Oil rises to 10-month high after Saudi output cut, U.S. inventory draw | Reuters

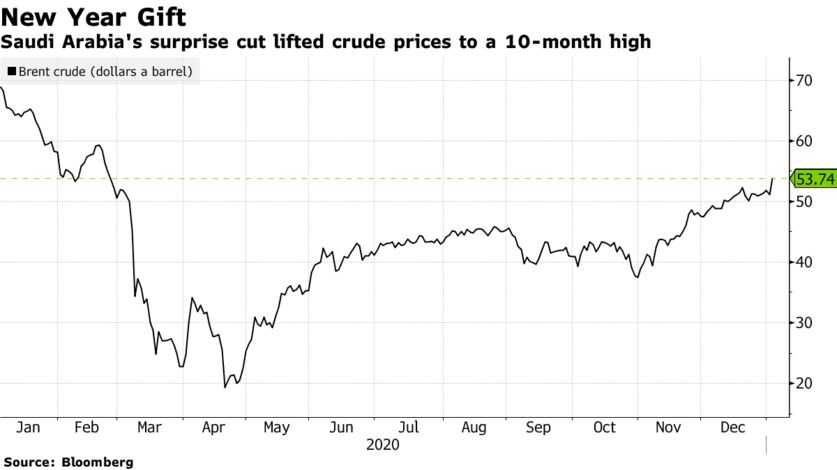

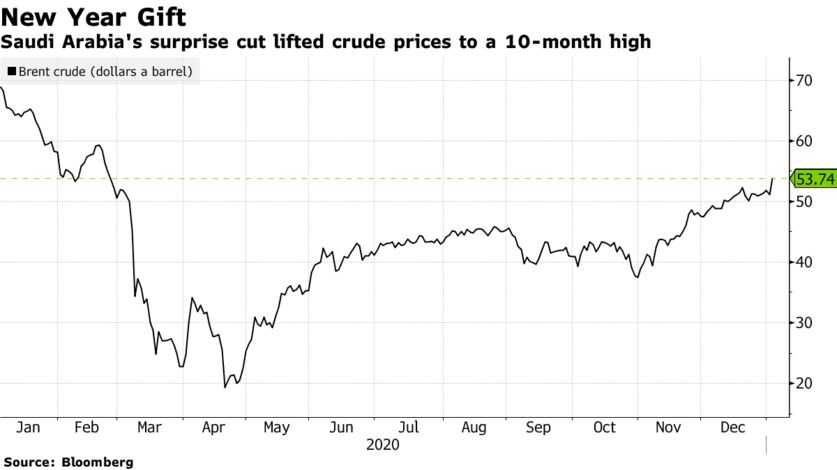

Oil prices rose to their highest levels since February on Wednesday after Saudi Arabia announced a big voluntary production cut and on a steep fall in U.S. crude inventories.

Futures contracts pared gains in thin post-settlement trade after protesters stormed the U.S. Capitol building in an attempt to thwart the certification of Donald Trump’s loss in November’s U.S. presidential election.

Brent crude settled up 70 cents, or 1.3%, at $54.30 a barrel. Earlier in the session, it hit a high of $54.73 a barrel, a level not seen since Feb. 26, 2020.

U.S. West Texas Intermediate (WTI) futures settled 70 cents higher, or 1.4%, at $50.63 a barrel. The contract touched $50.94 a barrel, its highest since late February.

Both contracts pared gains after in post-settlement trade as unrest in Washington overtook bullish fundamental news. Both contracts were only 39 cents a barrel higher by 3:46 p.m. EST

Solely aggregation of news articles, with no opinions expressed by this service since 2009 launch on this platform. Copyright to all articles remains with the original publisher and HEADLINES ARE CLICKABLE to access the whole article at source. (Subscription by email is recommended,with real-time updates on LinkedIn and Twitter.)

Wednesday, 6 January 2021

With eye on U.S. ties, #SaudiArabia leads pack on Gulf detente | Reuters

With eye on U.S. ties, Saudi Arabia leads pack on Gulf detente | Reuters

Saudi Arabia will move faster than its allies to reconcile with Qatar, sources familiar with the matter said, aiming to impress the incoming Biden administration by ending what the West sees as a parochial dispute that benefits only mutual foe Iran.

The rapprochement reduces potential points of friction between Riyadh and a U.S. government sure to be less forgiving than outgoing President Donald Trump, who has consistently protected the kingdom from criticism of its human rights record.

In a move that cast the kingdom as a force for stability in a turbulent region, Saudi de facto ruler Crown Prince Mohammed bin Salman chaired a summit on Tuesday that declared an end to the bitter rift in which Saudi Arabia, the United Arab Emirates, Bahrain and Egypt have boycotted Qatar since mid-2017.

The kingdom said at the gathering that all four states had agreed to restore diplomatic, trade and travel ties with Doha under a U.S.-backed deal, but the three sources said the other three nations had been pressed to sign a general declaration and were likely to move more slowly, as deep divisions remain.

FILE PHOTO: Saudi Arabia's Crown Prince Mohammed bin Salman meets Qatar's Emir Sheikh Tamim bin

Hamad al-Thani during the Gulf Cooperation Council's (GCC) 41st Summit in Al-Ula, Saudi Arabia January 5, 2021. Bandar Algaloud/Courtesy of Saudi Royal Court/Handout via REUTERS

The rapprochement reduces potential points of friction between Riyadh and a U.S. government sure to be less forgiving than outgoing President Donald Trump, who has consistently protected the kingdom from criticism of its human rights record.

In a move that cast the kingdom as a force for stability in a turbulent region, Saudi de facto ruler Crown Prince Mohammed bin Salman chaired a summit on Tuesday that declared an end to the bitter rift in which Saudi Arabia, the United Arab Emirates, Bahrain and Egypt have boycotted Qatar since mid-2017.

The kingdom said at the gathering that all four states had agreed to restore diplomatic, trade and travel ties with Doha under a U.S.-backed deal, but the three sources said the other three nations had been pressed to sign a general declaration and were likely to move more slowly, as deep divisions remain.

Oil extends gains after surprise #Saudi output cut and U.S. crude draw | Reuters

Oil extends gains after surprise Saudi output cut and U.S. crude draw | Reuters

Oil prices extended gains on Wednesday, rising to their highest since late February, after Saudi Arabia announced a big voluntary production cut, and as U.S. crude inventories declined in the latest week.

Brent crude was up 88 cents, or 1.7%, to $54.48 a barrel at 11:24 a.m. EST (1524 GMT). Earlier in the session, it hit a high of $54.63 a barrel, a level not seen since Feb. 26, 2020.

U.S. West Texas Intermediate (WTI) futures were up 75 cents, or 1.5%, to $50.68 a barrel. The contract touched $50.71 a barrel, its highest since Feb. 25.

Both contracts were up about 5% on Tuesday.

U.S. crude stocks fell sharply while fuel inventories rose, the Energy Information Administration said on Wednesday, and 2020 came to a close with a sharp decline in overall demand due to the coronavirus pandemic.

Oil prices extended gains on Wednesday, rising to their highest since late February, after Saudi Arabia announced a big voluntary production cut, and as U.S. crude inventories declined in the latest week.

Brent crude was up 88 cents, or 1.7%, to $54.48 a barrel at 11:24 a.m. EST (1524 GMT). Earlier in the session, it hit a high of $54.63 a barrel, a level not seen since Feb. 26, 2020.

U.S. West Texas Intermediate (WTI) futures were up 75 cents, or 1.5%, to $50.68 a barrel. The contract touched $50.71 a barrel, its highest since Feb. 25.

Both contracts were up about 5% on Tuesday.

U.S. crude stocks fell sharply while fuel inventories rose, the Energy Information Administration said on Wednesday, and 2020 came to a close with a sharp decline in overall demand due to the coronavirus pandemic.

Gulf markets ends lower as Georgia races take centrestage | Reuters

Gulf markets ends lower as Georgia races take centrestage | Reuters

Gulf markets fell on Wednesday, tracking global peers, as investors brace for a possible Democrat win in the U.S. Senate run-off election in Georgia that could help President-elect Joe Biden push for greater corporate regulation and higher taxes.

The prospects of a victory for Democrats in both races in Georgia, handing them control of the chamber, along with their narrow majority in the House of Representatives jointly could usher in large fiscal stimulus.

The developments in U.S. Senate elections overshadowed gains in oil prices as crude rose to its highest since late-February after Saudi Arabia announced a big voluntary production cut, and as an industry report showed U.S. inventories fell last week. [O/R]

Saudi Arabia pledged additional, voluntary oil output cuts of one million barrels per day (bpd) in February and March as part of a deal under which most OPEC+ producers will hold production steady in the face of new coronavirus lockdowns.

Saudi Arabia’s benchmark index finished the session 0.1% lower. Samba Financial Group shed 0.5%, while oil behemoth Saudi Aramco edged down 0.1%.

The Dubai index finished 0.1% lower, its first fall in four sessions.

Emirates NBD was the top loser on the benchmark, declining nearly a percent, while Air Arabia shed 2.2%.

The Abu Dhabi’s benchmark closed 0.3% lower, its first losing session in the week.

The index was dragged by First Abu Dhabi Bank and Etisalat, which fell 0.3% and 0.4%, respectively.

In Qatar, the index closed 0.4% down, a day after it saw its biggest gain in nearly a month following the easing in the country’s rift with some Gulf countries.

Qatar’s economy will grow 3% as the easing of a three-year-old regional dispute will help trade, tourism, and logistics, Standard Chartered said, revising its previous 2.1% growth estimate.

Gulf markets fell on Wednesday, tracking global peers, as investors brace for a possible Democrat win in the U.S. Senate run-off election in Georgia that could help President-elect Joe Biden push for greater corporate regulation and higher taxes.

The prospects of a victory for Democrats in both races in Georgia, handing them control of the chamber, along with their narrow majority in the House of Representatives jointly could usher in large fiscal stimulus.

The developments in U.S. Senate elections overshadowed gains in oil prices as crude rose to its highest since late-February after Saudi Arabia announced a big voluntary production cut, and as an industry report showed U.S. inventories fell last week. [O/R]

Saudi Arabia pledged additional, voluntary oil output cuts of one million barrels per day (bpd) in February and March as part of a deal under which most OPEC+ producers will hold production steady in the face of new coronavirus lockdowns.

Saudi Arabia’s benchmark index finished the session 0.1% lower. Samba Financial Group shed 0.5%, while oil behemoth Saudi Aramco edged down 0.1%.

The Dubai index finished 0.1% lower, its first fall in four sessions.

Emirates NBD was the top loser on the benchmark, declining nearly a percent, while Air Arabia shed 2.2%.

The Abu Dhabi’s benchmark closed 0.3% lower, its first losing session in the week.

The index was dragged by First Abu Dhabi Bank and Etisalat, which fell 0.3% and 0.4%, respectively.

In Qatar, the index closed 0.4% down, a day after it saw its biggest gain in nearly a month following the easing in the country’s rift with some Gulf countries.

Qatar’s economy will grow 3% as the easing of a three-year-old regional dispute will help trade, tourism, and logistics, Standard Chartered said, revising its previous 2.1% growth estimate.

#Oman turns stock exchange into closed joint stock company | Reuters

Oman turns stock exchange into closed joint stock company | Reuters

Oman’s stock market, the Muscat Securities Market, has been converted into a closed joint stock company and put under the ownership of the state-owned Oman Investment Authority, state media said on Wednesday.

It will be called the Muscat Stock Exchange and all assets and employees of the Muscat Securities Market will be transferred to that new entity, Oman news Agency said.

Oman established the Oman Investment Authority in June to own and manage most of the country’s sovereign wealth fund and finance ministry assets.

Oman’s stock market, the Muscat Securities Market, has been converted into a closed joint stock company and put under the ownership of the state-owned Oman Investment Authority, state media said on Wednesday.

It will be called the Muscat Stock Exchange and all assets and employees of the Muscat Securities Market will be transferred to that new entity, Oman news Agency said.

Oman established the Oman Investment Authority in June to own and manage most of the country’s sovereign wealth fund and finance ministry assets.

Negative outlook for GCC sovereigns as recovery could take up to 3 years - Moody's | ZAWYA MENA Edition

Negative outlook for GCC sovereigns as recovery could take up to 3 years - Moody's | ZAWYA MENA Edition

It will take two to three years for real, inflation-adjusted GDP in GCC sovereigns to return to pre-pandemic levels, Moody’s Investors Service said in a report Wednesday.

Even then recovery will take the longest in the more economically diversified sovereigns, where key sectors such as transportation and tourism will be slow to bounce back, the ratings agency said in its outlook for sovereign creditworthiness among GCC members.

"Our negative outlook for GCC sovereigns reflects the coronavirus pandemic's impact on oil revenue and our expectations for the erosion of fiscal strength experienced last year to extend throughout 2021," said Thaddeus Best, a Moody's analyst and the report's co-author.

In most cases, however, access to vast sovereign wealth fund (SWF) assets continued to buttress very high fiscal strength, despite significantly lower oil prices, contracting economic activity and significantly lower revenue.

The report forecasts that GCC government debt burdens will rise on average by around 21 percentage points of GDP over 2019-21, compared with 14 percentage points on average for advanced economies.

It will take two to three years for real, inflation-adjusted GDP in GCC sovereigns to return to pre-pandemic levels, Moody’s Investors Service said in a report Wednesday.

Even then recovery will take the longest in the more economically diversified sovereigns, where key sectors such as transportation and tourism will be slow to bounce back, the ratings agency said in its outlook for sovereign creditworthiness among GCC members.

"Our negative outlook for GCC sovereigns reflects the coronavirus pandemic's impact on oil revenue and our expectations for the erosion of fiscal strength experienced last year to extend throughout 2021," said Thaddeus Best, a Moody's analyst and the report's co-author.

In most cases, however, access to vast sovereign wealth fund (SWF) assets continued to buttress very high fiscal strength, despite significantly lower oil prices, contracting economic activity and significantly lower revenue.

The report forecasts that GCC government debt burdens will rise on average by around 21 percentage points of GDP over 2019-21, compared with 14 percentage points on average for advanced economies.

#Saudi gets a partial brand detox with #Qatar thaw – Breakingviews

Saudi gets a partial brand detox with Qatar thaw – Breakingviews

Mohammed bin Salman has done himself a favour. Nearly four years after Saudi Arabia’s crown prince led the United Arab Emirates, Bahrain and Egypt to blockade Qatar, the two sides have buried the hatchet. It pushes the kingdom towards a timely brand detox.

The quartet’s June 2017 gambit was certainly aggressive. Emboldened by U.S. President Donald Trump’s support, MbS and friends cut Qatar’s air and trade routes. Doha’s imports promptly shrank 40% year-on-year, and a short flight across the Gulf from Dubai became a lengthy round-trip via neutral Oman. The idea was to make Qataris re-examine their assumed support for Saudi bugbears like the Muslim Brotherhood.

The immediate reason to end the blockade is that it didn’t really work. Qatar, one of the world’s richest states, rerouted its trade via Turkey and Iran, and backstopped its banks. Doha has hardly been forced to the negotiating table. A 13-strong list of Saudi demands including muzzling Al Jazeera, Qatar’s state-funded TV station, is not part of the new deal.

Trump’s exit is another driver. Without the outgoing president’s protection in November 2018, MbS could have faced American sanctions for allowing dissident journalist Jamal Khashoggi to be killed by Saudi agents. Biden may take a less confrontational approach than Trump and MbS on Iran, and he is more likely to criticise Saudi human rights abuses and other Riyadh forays like the war in Yemen.

Finally, the Saudi economy faces bigger challenges than three years ago. Oil prices remain far below the $68 a barrel at which the International Monetary Fund reckons the domestic budget will balance this year. Riyadh is sufficiently desperate to support crude prices that it pledged on Tuesday to pump less in order to let fellow producers like Russia hike output. It may lack the cash to realise MbS’s vision of pivoting the economy away from fossil fuels.

The best workaround is to entice a wagonload of foreign investment. But the reputational risks of investing in the kingdom mean foreign inflows are below 1% of GDP, way off the 2% economists see as a reasonable target. Foreign investors who gave Saudi Aramco’s initial stock offering a wide berth in 2018 won’t automatically come running because its spat with Qatar is over. But it’s one less reason for them to stay away.

Mohammed bin Salman has done himself a favour. Nearly four years after Saudi Arabia’s crown prince led the United Arab Emirates, Bahrain and Egypt to blockade Qatar, the two sides have buried the hatchet. It pushes the kingdom towards a timely brand detox.

The quartet’s June 2017 gambit was certainly aggressive. Emboldened by U.S. President Donald Trump’s support, MbS and friends cut Qatar’s air and trade routes. Doha’s imports promptly shrank 40% year-on-year, and a short flight across the Gulf from Dubai became a lengthy round-trip via neutral Oman. The idea was to make Qataris re-examine their assumed support for Saudi bugbears like the Muslim Brotherhood.

The immediate reason to end the blockade is that it didn’t really work. Qatar, one of the world’s richest states, rerouted its trade via Turkey and Iran, and backstopped its banks. Doha has hardly been forced to the negotiating table. A 13-strong list of Saudi demands including muzzling Al Jazeera, Qatar’s state-funded TV station, is not part of the new deal.

Trump’s exit is another driver. Without the outgoing president’s protection in November 2018, MbS could have faced American sanctions for allowing dissident journalist Jamal Khashoggi to be killed by Saudi agents. Biden may take a less confrontational approach than Trump and MbS on Iran, and he is more likely to criticise Saudi human rights abuses and other Riyadh forays like the war in Yemen.

Finally, the Saudi economy faces bigger challenges than three years ago. Oil prices remain far below the $68 a barrel at which the International Monetary Fund reckons the domestic budget will balance this year. Riyadh is sufficiently desperate to support crude prices that it pledged on Tuesday to pump less in order to let fellow producers like Russia hike output. It may lack the cash to realise MbS’s vision of pivoting the economy away from fossil fuels.

The best workaround is to entice a wagonload of foreign investment. But the reputational risks of investing in the kingdom mean foreign inflows are below 1% of GDP, way off the 2% economists see as a reasonable target. Foreign investors who gave Saudi Aramco’s initial stock offering a wide berth in 2018 won’t automatically come running because its spat with Qatar is over. But it’s one less reason for them to stay away.

Gulf Arab States Agree to Restore #Qatar Ties in U.S.-Backed Deal - Bloomberg video

Gulf Arab States Agree to Restore Qatar Ties in U.S.-Backed Deal - Bloomberg

Ali El Adou, Daman Investments, Head of Asset Management discusses possible UAE stock boost after Arab states restore ties with Qatar. He was speaking to Bloomberg's Yousef Gamal El-Din and Manus Cranny on Bloomberg Daybreak: Middle East. (Source: Bloomberg)

#Qatar's biggest bank expects Gulf detente to boost companies, lenders | Reuters

Qatar's biggest bank expects Gulf detente to boost companies, lenders | Reuters

Qatari companies including banks are forecast to get a boost from a deal to end a more than three-year row between Doha and some Gulf states, which was announced by Crown Prince Mohammed bin Salman on Tuesday.

QNB Financial Services Research, part of Qatar’s biggest bank, said in a note that Qatari banks are set to benefit from the GCC resolution agreed at a Gulf summit on Tuesday “based on general investor optimism as domestic banks had immaterial exposure to the blockading countries”.

The Qatari stock index closed 1.4% higher on Tuesday, leading other Gulf markets and was up 0.1% on Wednesday, although Qatar’s international bonds were little changed by news of the deal, while credit default swaps, used to bet against the risk of a default, were unmoved, IHS Markit data showed.

“Qatar Airways and consequently Qatar Fuel could benefit from increased air traffic between KSA (Kingdom of Saudi Arabia) and Qatar,” QNB said in the research note, adding that real estate firms will also benefit from demand longer term.

Qatari companies including banks are forecast to get a boost from a deal to end a more than three-year row between Doha and some Gulf states, which was announced by Crown Prince Mohammed bin Salman on Tuesday.

QNB Financial Services Research, part of Qatar’s biggest bank, said in a note that Qatari banks are set to benefit from the GCC resolution agreed at a Gulf summit on Tuesday “based on general investor optimism as domestic banks had immaterial exposure to the blockading countries”.

The Qatari stock index closed 1.4% higher on Tuesday, leading other Gulf markets and was up 0.1% on Wednesday, although Qatar’s international bonds were little changed by news of the deal, while credit default swaps, used to bet against the risk of a default, were unmoved, IHS Markit data showed.

“Qatar Airways and consequently Qatar Fuel could benefit from increased air traffic between KSA (Kingdom of Saudi Arabia) and Qatar,” QNB said in the research note, adding that real estate firms will also benefit from demand longer term.

Why the #UAE, #Qatar can expect to see 'flood of investment' after reconciliation - Arabianbusiness

Why the UAE, Qatar can expect to see 'flood of investment' after reconciliation - Arabianbusiness

The historic deal to end the regional dispute between the UAE and Qatar will see a “flood of investment” between the two countries, according to Scott Cairns, managing director of Dubai-based Creative Business Consultants.

The UAE was joined by Saudi Arabia, Bahrain and Egypt in signing the accord with Qatar on Tuesday in a mirrored concert hall in the northwestern Saudi town of Al Ula, during a summit of Gulf Cooperation Council (GCC) leaders.

It brings the regional split, which erupted in 2017, to an end.

In terms of the UAE, Cairns told Arabian Business that the agreement would have particular benefit for the country’s construction industry, which has been hit particularly hard by the coronavirus crisis and the drop in oil prices.

The historic deal to end the regional dispute between the UAE and Qatar will see a “flood of investment” between the two countries, according to Scott Cairns, managing director of Dubai-based Creative Business Consultants.

The UAE was joined by Saudi Arabia, Bahrain and Egypt in signing the accord with Qatar on Tuesday in a mirrored concert hall in the northwestern Saudi town of Al Ula, during a summit of Gulf Cooperation Council (GCC) leaders.

It brings the regional split, which erupted in 2017, to an end.

In terms of the UAE, Cairns told Arabian Business that the agreement would have particular benefit for the country’s construction industry, which has been hit particularly hard by the coronavirus crisis and the drop in oil prices.

Major Gulf stocks little changed a day after Gulf row eases | Reuters

Major Gulf stocks little changed a day after Gulf row eases | Reuters

Major Gulf stock markets where little changed early on Wednesday, a day after a breakthrough in the Gulf’s diplomatic rift, as a negative outlook for the Gulf Cooperation Council(GCC) sovereigns appeared to eclipse the positive sentiment.

Moody’s sees a negative outlook for the GCC sovereigns in 2021, driven by lower oil revenues and reduced fiscal strength.

Oil prices are unlikely to mount much of a recovery in 2021 as a new coronavirus variant and related travel restrictions threaten already weakened fuel demand, A Reuters poll showed last week.

According to the poll, Brent crude prices would average $50.67 per barrel this year.

Saudi Arabia and Egypt, the United Arab Emirates and Bahrain agreed to restore full ties with Doha after severing them more than three years ago, over what they called its support for Islamist militants. Doha rejected the accusation.

Qatar’s index was up 0.2% a day after it saw its biggest gain in nearly a month following the easing in the country’s rift with Saudi Arabia.

Industries Qatar and telecoms company Ooredoo supported the index, rising 0.8% and 1.9%, respectively.

The sharia-compliant Islamic lender Masraf Al Rayan gained as much as 0.3% after saying its board would meet on Thursday to discuss a merger with Al Khaliji Bank.

Saudi Arabia’s benchmark index was trading 0.1% up, with Saudi Basic Industries leading the gains, rising 1%.

The Dubai index was up 0.2%. Damac Properties rose 3.6%, while Dubai Financial Market added 3.8%.

Emaar Properties gained 0.3% in its fourth straight rise. The developer said it had sold its stake in ASV Group Limited, which owns Address Sky View hotel, for 750 million dirhams ($204.2million).

Abu Dhabi’s index was down 0.5% as First Abu Dhabi Bank fell 0.8% and telecoms major Etisalat lost 0.5%.

Major Gulf stock markets where little changed early on Wednesday, a day after a breakthrough in the Gulf’s diplomatic rift, as a negative outlook for the Gulf Cooperation Council(GCC) sovereigns appeared to eclipse the positive sentiment.

Moody’s sees a negative outlook for the GCC sovereigns in 2021, driven by lower oil revenues and reduced fiscal strength.

Oil prices are unlikely to mount much of a recovery in 2021 as a new coronavirus variant and related travel restrictions threaten already weakened fuel demand, A Reuters poll showed last week.

According to the poll, Brent crude prices would average $50.67 per barrel this year.

Saudi Arabia and Egypt, the United Arab Emirates and Bahrain agreed to restore full ties with Doha after severing them more than three years ago, over what they called its support for Islamist militants. Doha rejected the accusation.

Qatar’s index was up 0.2% a day after it saw its biggest gain in nearly a month following the easing in the country’s rift with Saudi Arabia.

Industries Qatar and telecoms company Ooredoo supported the index, rising 0.8% and 1.9%, respectively.

The sharia-compliant Islamic lender Masraf Al Rayan gained as much as 0.3% after saying its board would meet on Thursday to discuss a merger with Al Khaliji Bank.

Saudi Arabia’s benchmark index was trading 0.1% up, with Saudi Basic Industries leading the gains, rising 1%.

The Dubai index was up 0.2%. Damac Properties rose 3.6%, while Dubai Financial Market added 3.8%.

Emaar Properties gained 0.3% in its fourth straight rise. The developer said it had sold its stake in ASV Group Limited, which owns Address Sky View hotel, for 750 million dirhams ($204.2million).

Abu Dhabi’s index was down 0.5% as First Abu Dhabi Bank fell 0.8% and telecoms major Etisalat lost 0.5%.

Gulf Arab States Agree to Restore #Qatar Ties in U.S.-Backed Deal - Bloomberg

Gulf Arab States Agree to Restore Qatar Ties in U.S.-Backed Deal - Bloomberg

Saudi Arabia and three other Arab states agreed to fully restore ties with neighboring Qatar on Tuesday after a sustained U.S. push for the countries to unite against Iran.

The breakthrough in ending a dispute among some of the world’s top oil and gas producers that erupted in 2017 came just two weeks before President-elect Joe Biden takes office after pledging a new start with Tehran.

Saudi Arabia, Bahrain, the United Arab Emirates and Egypt signed an accord with Qatar in a mirrored concert hall in the northwestern Saudi town of Al Ula during a summit of Gulf Cooperation Council leaders, bringing the regional split to an end -- at least on paper.

The accord came on the same day Saudi Arabia asserted its primacy over the global oil industry by surprising the market with a large crude production cut that secured its leadership among global producers and sent crude prices soaring.

Saudi Arabia and three other Arab states agreed to fully restore ties with neighboring Qatar on Tuesday after a sustained U.S. push for the countries to unite against Iran.

The breakthrough in ending a dispute among some of the world’s top oil and gas producers that erupted in 2017 came just two weeks before President-elect Joe Biden takes office after pledging a new start with Tehran.

Saudi Arabia, Bahrain, the United Arab Emirates and Egypt signed an accord with Qatar in a mirrored concert hall in the northwestern Saudi town of Al Ula during a summit of Gulf Cooperation Council leaders, bringing the regional split to an end -- at least on paper.

The accord came on the same day Saudi Arabia asserted its primacy over the global oil industry by surprising the market with a large crude production cut that secured its leadership among global producers and sent crude prices soaring.

Saudis Take Charge of Oil Market With Surprise Output Cut - Bloomberg

Saudis Take Charge of Oil Market With Surprise Output Cut - Bloomberg

Saudi Arabia surprised the market with a large cut in crude production, an assertion of primacy over the global oil industry that came directly from the kingdom’s de-facto ruler.

The move papered over cracks in the OPEC+ coalition and was a U-turn from some recent Saudi oil-policy priorities, but those things paled in comparison next to the global impact of the decision. Crude prices jumped to a 10-month high and shares of energy giants in London and shale drillers in Texas surged.

“We are the guardian of this industry,” Saudi Energy Minister Prince Abdulaziz bin Salman said as he gleefully announced the cut on Tuesday. “This gesture of goodwill made by our leadership, in the name of His Royal Highness the Crown Prince Mohammad bin Salman.”

Since the start of the week, the oil market has been focused on the meeting between the Organization of Petroleum Exporting Countries and its allies. Since late December, Russia had been pushing for a supply hike of about 500,000 barrels a day for February, and there was reason to think it would prevail.

Saudi Arabia surprised the market with a large cut in crude production, an assertion of primacy over the global oil industry that came directly from the kingdom’s de-facto ruler.

The move papered over cracks in the OPEC+ coalition and was a U-turn from some recent Saudi oil-policy priorities, but those things paled in comparison next to the global impact of the decision. Crude prices jumped to a 10-month high and shares of energy giants in London and shale drillers in Texas surged.

“We are the guardian of this industry,” Saudi Energy Minister Prince Abdulaziz bin Salman said as he gleefully announced the cut on Tuesday. “This gesture of goodwill made by our leadership, in the name of His Royal Highness the Crown Prince Mohammad bin Salman.”

Since the start of the week, the oil market has been focused on the meeting between the Organization of Petroleum Exporting Countries and its allies. Since late December, Russia had been pushing for a supply hike of about 500,000 barrels a day for February, and there was reason to think it would prevail.

#Dubai Bank Mashreq May Move Nearly Half Its Jobs to Cheaper Hubs - Bloomberg

Dubai Bank Mashreq May Move Nearly Half Its Jobs to Cheaper Hubs - Bloomberg

Mashreqbank PSC, Dubai’s third-biggest lender, plans to move nearly half of its employees to cheaper locations and allow some others to work from home as part of a dramatic reorganization that will spare its Emirati staff, according to people familiar with the matter.

The oldest privately owned bank in the United Arab Emirates notified employees this week that it will be shifting jobs to locations including India, Egypt or Pakistan, the people said, asking not to be identified because the information isn’t public.

Mashreq will also eliminate a significant number of existing roles and create new positions for staff moving to what it calls “centers of excellence,” they said.

The bank didn’t immediately respond to an email seeking comment. Mashreq and its subsidiaries employed almost 5,000 people as of September 2019.

Mashreqbank PSC, Dubai’s third-biggest lender, plans to move nearly half of its employees to cheaper locations and allow some others to work from home as part of a dramatic reorganization that will spare its Emirati staff, according to people familiar with the matter.

The oldest privately owned bank in the United Arab Emirates notified employees this week that it will be shifting jobs to locations including India, Egypt or Pakistan, the people said, asking not to be identified because the information isn’t public.

Mashreq will also eliminate a significant number of existing roles and create new positions for staff moving to what it calls “centers of excellence,” they said.

The bank didn’t immediately respond to an email seeking comment. Mashreq and its subsidiaries employed almost 5,000 people as of September 2019.

Goldman says #Saudi's extra oil output cuts signal demand risks

Goldman says Saudi's extra oil output cuts signal demand risks

Saudi Arabia’s pledge to cut its oil output by more than required under its pact with other OPEC+ producers points to weakening oil demand following new COVID-19 lockdowns and sets the stage for a tighter market in the second quarter, Goldman Sachs said in a note released on Tuesday.

“Saudi’s action and the prospect for a tight market in 2Q21, as the rebound in demand stresses the ability to restart production, will likely support prices in coming weeks, leading us to reiterate our bullish oil view,” the analysts wrote.

Benchmark Brent oil prices on Wednesday hit their highest level since February after Saudi Arabia, the world’s biggest oil exporter, said it would cut by an additional, voluntary 1 million barrels per day (bpd) in February and March.

Two OPEC+ members - Russia and Kazakhstan - will bump up their output by a combined 75,000 bpd while other producers will hold production steady.

Saudi Arabia’s pledge to cut its oil output by more than required under its pact with other OPEC+ producers points to weakening oil demand following new COVID-19 lockdowns and sets the stage for a tighter market in the second quarter, Goldman Sachs said in a note released on Tuesday.

“Saudi’s action and the prospect for a tight market in 2Q21, as the rebound in demand stresses the ability to restart production, will likely support prices in coming weeks, leading us to reiterate our bullish oil view,” the analysts wrote.

Benchmark Brent oil prices on Wednesday hit their highest level since February after Saudi Arabia, the world’s biggest oil exporter, said it would cut by an additional, voluntary 1 million barrels per day (bpd) in February and March.

Two OPEC+ members - Russia and Kazakhstan - will bump up their output by a combined 75,000 bpd while other producers will hold production steady.

Oil rises to 11-month high after #SaudiArabia pledges unilateral output cut | Reuters

Oil rises to 11-month high after Saudi Arabia pledges unilateral output cut | Reuters

Oil prices rose on Wednesday to their highest since February 2020 after Saudi Arabia agreed to reduce output more than expected in a meeting with allied producers, while industry figures showed U.S. crude stockpiles were down last week.

Brent crude rose as much as 0.9% to $54.09 a barrel, the highest since Feb. 26, 2020. It was at $53.82 a barrel at 0757 GMT after jumping 4.9% on Tuesday.

U.S. West Texas Intermediate (WTI) futures climbed as much as 0.6% to $50.24 a barrel, also the highest since Feb. 26, before slipping to $49.96. The contract on Tuesday closed up 4.6%.

Saudi Arabia, the world’s biggest oil exporter, agreed on Tuesday to make additional, voluntary oil output cuts of 1 million barrels per day (bpd) in February and March, after a meeting with the Organization of the Petroleum Exporting Countries (OPEC) and other major producers that form the group known as OPEC+.

Oil prices rose on Wednesday to their highest since February 2020 after Saudi Arabia agreed to reduce output more than expected in a meeting with allied producers, while industry figures showed U.S. crude stockpiles were down last week.

Brent crude rose as much as 0.9% to $54.09 a barrel, the highest since Feb. 26, 2020. It was at $53.82 a barrel at 0757 GMT after jumping 4.9% on Tuesday.

U.S. West Texas Intermediate (WTI) futures climbed as much as 0.6% to $50.24 a barrel, also the highest since Feb. 26, before slipping to $49.96. The contract on Tuesday closed up 4.6%.

Saudi Arabia, the world’s biggest oil exporter, agreed on Tuesday to make additional, voluntary oil output cuts of 1 million barrels per day (bpd) in February and March, after a meeting with the Organization of the Petroleum Exporting Countries (OPEC) and other major producers that form the group known as OPEC+.