Brent dips after topping $80 a barrel, highest since Oct 2018 | Reuters

Brent oil dipped on Tuesday after topping $80 per barrel for the first time in nearly three years, as a five-day rally ran out of steam with investors locking in profits.

Oil benchmark prices have been on a tear, with fuel demand growing and traders expecting major oil-producing nations will decide to keep supplies tight when the Organization of the Petroleum Exporting Countries (OPEC) meets next week.

Brent dipped 44 cents, or 0.6%, to $79.09 a barrel, after reaching its highest level since October 2018 at $80.75.

U.S. West Texas Intermediate (WTI) crude fell 16 cents, or 0.2%, to $75.29 a barrel, after hitting a session high of $76.67, highest since July.

"You probably have a fair amount of profit-taking, because we've had a pretty extraordinary run-up in prices," said Andrew Lipow, president of Houston-based consultancy Lipow Oil Associates. "We might have a little bit of a respite here as the market evaluates what the supply and demand dynamics are."

Solely aggregation of news articles, with no opinions expressed by this service since 2009 launch on this platform. Copyright to all articles remains with the original publisher and HEADLINES ARE CLICKABLE to access the whole article at source. (Subscription by email is recommended,with real-time updates on LinkedIn and Twitter.)

Tuesday, 28 September 2021

OPEC forecasts oil demand rebound before post-2035 plateau | Reuters

OPEC forecasts oil demand rebound before post-2035 plateau | Reuters

Oil demand will grow sharply in the next few years as economies recover from the pandemic, OPEC forecast on Tuesday, adding that the world needs to keep investing in production to avert a crunch despite an energy transition.

The view from the Organization of the Petroleum Exporting Countries contrasts with that of the International Energy Agency, which in a May report said investors should not fund new oil projects if the world wants to reach net zero emissions. read more

Oil use will rise by 1.7 million barrels per day in 2023 to 101.6 million bpd, OPEC said its 2021 World Oil Outlook, adding to robust growth already predicted for 2021 and 2022 , and pushing demand back above the pre-pandemic 2019 rate.

"Energy and oil demand have picked up significantly in 2021 after the massive drop in 2020," OPEC Secretary General Mohammad Barkindo wrote in the foreword to the report. "Continued expansion is forecast for the longer term."

Oil demand will grow sharply in the next few years as economies recover from the pandemic, OPEC forecast on Tuesday, adding that the world needs to keep investing in production to avert a crunch despite an energy transition.

The view from the Organization of the Petroleum Exporting Countries contrasts with that of the International Energy Agency, which in a May report said investors should not fund new oil projects if the world wants to reach net zero emissions. read more

Oil use will rise by 1.7 million barrels per day in 2023 to 101.6 million bpd, OPEC said its 2021 World Oil Outlook, adding to robust growth already predicted for 2021 and 2022 , and pushing demand back above the pre-pandemic 2019 rate.

"Energy and oil demand have picked up significantly in 2021 after the massive drop in 2020," OPEC Secretary General Mohammad Barkindo wrote in the foreword to the report. "Continued expansion is forecast for the longer term."

#Saudi launches $13 bln plan to turn coastal region into tourism hub | Reuters

Saudi launches $13 bln plan to turn coastal region into tourism hub | Reuters

Saudi Arabia's crown prince Mohammed bin Salman launched a 50 billion riyal ($13 billion) strategy on Tuesday to develop the Aseer region on the Red Sea coast into a tourism hub that would attract 10 million visitors by 2030.

The aim is to develop tourist attractions in the mountainous area and improve services and infrastructure including healthcare and transport, state news agency SPA said.

The Gulf Arab state, which opened its doors in September 2019 to foreign tourists through a new visa regime, wants to diversify its oil-dependent economy, with tourism contributing 10% of gross domestic product by 2030.

While the nascent tourism sector was hit hard by the coronavirus pandemic, local campaigns helped to partially attract millions of dollars Saudis used to spend overseas.

In February, Saudi Arabia's Public Investment Fund launched a venture that would invest $3 billion to build 2,700 hotel rooms, 1,300 residential units, and 30 commercial and entertainment attractions in Aseer by 2030. read more

Saudi Arabia's crown prince Mohammed bin Salman launched a 50 billion riyal ($13 billion) strategy on Tuesday to develop the Aseer region on the Red Sea coast into a tourism hub that would attract 10 million visitors by 2030.

The aim is to develop tourist attractions in the mountainous area and improve services and infrastructure including healthcare and transport, state news agency SPA said.

The Gulf Arab state, which opened its doors in September 2019 to foreign tourists through a new visa regime, wants to diversify its oil-dependent economy, with tourism contributing 10% of gross domestic product by 2030.

While the nascent tourism sector was hit hard by the coronavirus pandemic, local campaigns helped to partially attract millions of dollars Saudis used to spend overseas.

In February, Saudi Arabia's Public Investment Fund launched a venture that would invest $3 billion to build 2,700 hotel rooms, 1,300 residential units, and 30 commercial and entertainment attractions in Aseer by 2030. read more

#Saudi Energy Firm ACWA Sets IPO Price at Top End of Range - Bloomberg

Saudi Energy Firm ACWA Sets IPO Price at Top End of Range - Bloomberg

ACWA Power International, one of Saudi Arabia’s main vehicles for building renewable energy projects, set the offer price for its initial public offering at the top of a range as investors flock to share sales in the kingdom.

The power producer, which will be 44% owned by Saudi Arabia’s sovereign wealth fund after the IPO, said it’ll sell shares at 56 riyals ($14.93) apiece after institutional part of the offering ended. It will raise $1.2 billion for ACWA and value the company at $10.9 billion.

Demand for stock offerings in Saudi Arabia has never been higher. Arabian Internet and Communications Services Co., also known as solutions by stc, attracted over 471 billion riyals in orders for its IPO earlier this month. Plenty more are in the pipeline, including the stock exchange itself and the specialty chemicals business of Saudi Basic Industries Corp.

ACWA is a key part of Saudi Arabia’s plan to transform its energy sector, boosting renewable power generation to reduce emissions and the amount of hydrocarbons that are burnt to make electricity and could be more profitability exported. Over the next five years, the company will double the amount of power it generates, mostly from renewable sources, Chief Executive Officer Paddy Padmanathan told Bloomberg earlier in September.

ACWA Power International, one of Saudi Arabia’s main vehicles for building renewable energy projects, set the offer price for its initial public offering at the top of a range as investors flock to share sales in the kingdom.

The power producer, which will be 44% owned by Saudi Arabia’s sovereign wealth fund after the IPO, said it’ll sell shares at 56 riyals ($14.93) apiece after institutional part of the offering ended. It will raise $1.2 billion for ACWA and value the company at $10.9 billion.

Demand for stock offerings in Saudi Arabia has never been higher. Arabian Internet and Communications Services Co., also known as solutions by stc, attracted over 471 billion riyals in orders for its IPO earlier this month. Plenty more are in the pipeline, including the stock exchange itself and the specialty chemicals business of Saudi Basic Industries Corp.

ACWA is a key part of Saudi Arabia’s plan to transform its energy sector, boosting renewable power generation to reduce emissions and the amount of hydrocarbons that are burnt to make electricity and could be more profitability exported. Over the next five years, the company will double the amount of power it generates, mostly from renewable sources, Chief Executive Officer Paddy Padmanathan told Bloomberg earlier in September.

- ACWA’s IPO is the biggest offering in Riyadh since Saudi Aramco’s listing in 2019

- Subscription period for individual investors: Sept. 29 to Oct. 1

- Joint financial advisers: JPMorgan, Citigroup, Riyad Capital and Natixis

MIDEAST STOCKS Most major Gulf markets firm as Aramco leads #Saudi higher | Reuters

MIDEAST STOCKS Most major Gulf markets firm as Aramco leads Saudi higher | Reuters

Major stock markets in the Gulf ended higher on Tuesday, buoyed by rising oil prices on brighter demand outlook, while Aramco boosted Saudi gains.

Oil markets climbed for a sixth day on Tuesday, also boosted by a tighter supply, but power shortages in China which hit factory output tempered the rally. read more

Brent crude futures gained 67 cents, or 0.8%, to $80.20 a barrel at 1016 GMT, after reaching their highest level since October 2018 at $80.75.

Demand for oil will grow sharply in the next few years as the global economy recovers from the pandemic, OPEC said on Tuesday, adding that the world needs to keep investing in oil production to avert a crunch even as the energy transition is under way. read more

Saudi Arabia's benchmark index (.TASI) edged up 0.1%, as Oil giant Saudi Aramco (2222.SE) rose 3.6% in its biggest intra-day gain since March 17 last year, while petrochemicals company Saudi Basic Industries (2010.SE), was up 0.6%.

S&P Global Ratings on Tuesday affirmed Saudi Arabia's A- (minus) credit rating with a stable outlook, expecting a rebound in growth through 2024 driven by higher oil prices, eased OPEC production quotas and a large vaccine rollout in the kingdom. read more

The rating agency sees Saudi Arabia's deficit dropping from 11.2% last year to 4.3% in 2021, while averaging 5.7% between this year and 2024. Real GDP growth is expected to average 2.4% in the same period after contracting 4.1% in 2020.

Bolstered by industrial shares, Qatari index, (.QSI) rose 0.7%, as Industries Qatar (IQCD.QA) gained 3.6%, logging its sixth consecutive rise, while Qatar Fuel (QFLS.QA) added 0.7%.

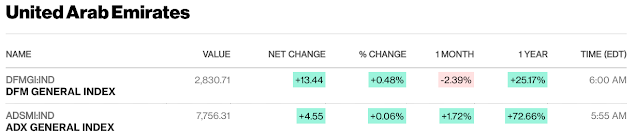

Dubai's main share index (.DFMGI) gained 0.5%, buoyed by a 1.8% rise in its largest lender Emirates NBD Bank (ENBD.DU) and a 0.4% advance in Dubai Islamic Bank (DISB.DU).

Financials stocks also lifted the Abu Dhabi index (.ADI), which was up 0.1%, with the country's largest lender First Abu Dhabi Bank (FAB.AD) rising 0.8% and International Holding (IHC.AD) gaining 0.1%.

Dana Gas (DANA.AD), however, closed flat after rising as much as 4.5% during the day. The energy firm won an arbitration award of $607 million in a gas supply dispute with National Iranian Oil Co (NIOC). read more

Outside the Gulf, Egypt's blue-chip index (.EGX30) retreated 0.7%, as its top lender Commercial International Bank (COMI.CA) lost 0.8% and E-payments platform Fawry Banking and Payment Technology Services (FWRY.CA) dropped 3.4%.

Egypt's central bank, on Sunday, approved the granting of licences to allow merchants to accept contactless payments from their customers' mobile phones. read more

Major stock markets in the Gulf ended higher on Tuesday, buoyed by rising oil prices on brighter demand outlook, while Aramco boosted Saudi gains.

Oil markets climbed for a sixth day on Tuesday, also boosted by a tighter supply, but power shortages in China which hit factory output tempered the rally. read more

Brent crude futures gained 67 cents, or 0.8%, to $80.20 a barrel at 1016 GMT, after reaching their highest level since October 2018 at $80.75.

Demand for oil will grow sharply in the next few years as the global economy recovers from the pandemic, OPEC said on Tuesday, adding that the world needs to keep investing in oil production to avert a crunch even as the energy transition is under way. read more

Saudi Arabia's benchmark index (.TASI) edged up 0.1%, as Oil giant Saudi Aramco (2222.SE) rose 3.6% in its biggest intra-day gain since March 17 last year, while petrochemicals company Saudi Basic Industries (2010.SE), was up 0.6%.

S&P Global Ratings on Tuesday affirmed Saudi Arabia's A- (minus) credit rating with a stable outlook, expecting a rebound in growth through 2024 driven by higher oil prices, eased OPEC production quotas and a large vaccine rollout in the kingdom. read more

The rating agency sees Saudi Arabia's deficit dropping from 11.2% last year to 4.3% in 2021, while averaging 5.7% between this year and 2024. Real GDP growth is expected to average 2.4% in the same period after contracting 4.1% in 2020.

Bolstered by industrial shares, Qatari index, (.QSI) rose 0.7%, as Industries Qatar (IQCD.QA) gained 3.6%, logging its sixth consecutive rise, while Qatar Fuel (QFLS.QA) added 0.7%.

Dubai's main share index (.DFMGI) gained 0.5%, buoyed by a 1.8% rise in its largest lender Emirates NBD Bank (ENBD.DU) and a 0.4% advance in Dubai Islamic Bank (DISB.DU).

Financials stocks also lifted the Abu Dhabi index (.ADI), which was up 0.1%, with the country's largest lender First Abu Dhabi Bank (FAB.AD) rising 0.8% and International Holding (IHC.AD) gaining 0.1%.

Dana Gas (DANA.AD), however, closed flat after rising as much as 4.5% during the day. The energy firm won an arbitration award of $607 million in a gas supply dispute with National Iranian Oil Co (NIOC). read more

Outside the Gulf, Egypt's blue-chip index (.EGX30) retreated 0.7%, as its top lender Commercial International Bank (COMI.CA) lost 0.8% and E-payments platform Fawry Banking and Payment Technology Services (FWRY.CA) dropped 3.4%.

Egypt's central bank, on Sunday, approved the granting of licences to allow merchants to accept contactless payments from their customers' mobile phones. read more

Brent oil near $80 a barrel on tighter supplies | Reuters

Brent oil near $80 a barrel on tighter supplies | Reuters

Oil markets climbed for a sixth day on Tuesday, boosted by a tighter supply and firm demand outlook, but power shortages in China which hit factory output tempered the rally.

Brent crude had gained 12 cents, or 0.1%, to $79.65 a barrel at 1358 GMT, after reaching their highest level since October 2018 at $80.75. Brent gained 1.8% on Monday.

U.S. West Texas Intermediate (WTI) crude rose 22 cents, or 0.3%, to $75.67 a barrel, after hitting a session high of $76.67, its highest since July. It jumped 2% the previous day.

Hurricanes Ida and Nicholas, which swept through the U.S. Gulf of Mexico in August and September, damaged platforms, pipelines and processing hubs, shutting most offshore production for weeks. read more

Oil markets climbed for a sixth day on Tuesday, boosted by a tighter supply and firm demand outlook, but power shortages in China which hit factory output tempered the rally.

Brent crude had gained 12 cents, or 0.1%, to $79.65 a barrel at 1358 GMT, after reaching their highest level since October 2018 at $80.75. Brent gained 1.8% on Monday.

U.S. West Texas Intermediate (WTI) crude rose 22 cents, or 0.3%, to $75.67 a barrel, after hitting a session high of $76.67, its highest since July. It jumped 2% the previous day.

Hurricanes Ida and Nicholas, which swept through the U.S. Gulf of Mexico in August and September, damaged platforms, pipelines and processing hubs, shutting most offshore production for weeks. read more

Masdar assigned debut ratings by Moody’s and Fitch

Masdar assigned debut ratings by Moody’s and Fitch

Masdar, a subsidiary of Mubadala Investment Company, received investment grade A2 and A+ ratings from Moody’s Investors Service and Fitch Ratings, respectively, marking the first time the Abu Dhabi renewable energy company is rated by global agencies.

An A2 rating is sixth-highest credit rating of Moody's and indicates low credit risk, as does the A+ rating by Fitch. Masdar is wholly owned by Mamoura Diversified Global Holding.

The ratings are a reflection of Masdar’s “robust portfolio of renewable energy and sustainable real estate assets and its crucial role in the diversification of the Abu Dhabi economy”, Musabbeh Al Kaabi, chief executive of the UAE Investments at Mubadala, said.

First-time credit ratings will give Masdar greater flexibility in financing and investing in new projects as the company looks to accelerate its global expansion.

Masdar, a subsidiary of Mubadala Investment Company, received investment grade A2 and A+ ratings from Moody’s Investors Service and Fitch Ratings, respectively, marking the first time the Abu Dhabi renewable energy company is rated by global agencies.

An A2 rating is sixth-highest credit rating of Moody's and indicates low credit risk, as does the A+ rating by Fitch. Masdar is wholly owned by Mamoura Diversified Global Holding.

The ratings are a reflection of Masdar’s “robust portfolio of renewable energy and sustainable real estate assets and its crucial role in the diversification of the Abu Dhabi economy”, Musabbeh Al Kaabi, chief executive of the UAE Investments at Mubadala, said.

First-time credit ratings will give Masdar greater flexibility in financing and investing in new projects as the company looks to accelerate its global expansion.

#Dubai to find out if pandemic-delayed Expo 2020 will pay off

Dubai to find out if pandemic-delayed Expo 2020 will pay off

A computer-graphic-soaked advertisement featuring Australian actor and Hollywood heartthrob Chris Hemsworth beckons the world to Dubai’s upcoming Expo 2020, promising a “world of pure imagination” as children without facemasks race across a futuristic carnival scene.

Reality, however, crashes into the frame in all capital-letters caption at the bottom of the screen, saying: “THIS COMMERCIAL WAS FILMED IN 2019.”

Delayed a year over the coronavirus pandemic, Dubai’s Expo 2020 opens on Friday, pushing this city-state all-in on its bet of billions of dollars that the world’s fair will boost its economy. The sheikhdom built what feels like an entire city out of what once were rolling sand dunes on its southern edges to support the fair, an outpost that largely will be disassembled after the six-month event ends in March.

But questions about the Expo’s drawing power in the modern era began even before the pandemic. It will be one of the world’s first global events, following an Olympics this summer that divided host nation Japan and took place without spectators. Though Dubai has thrown open its doors to tourists from around the world and has not required vaccinations, it remains unclear how many guests will be coming to this extravaganza.

A computer-graphic-soaked advertisement featuring Australian actor and Hollywood heartthrob Chris Hemsworth beckons the world to Dubai’s upcoming Expo 2020, promising a “world of pure imagination” as children without facemasks race across a futuristic carnival scene.

Reality, however, crashes into the frame in all capital-letters caption at the bottom of the screen, saying: “THIS COMMERCIAL WAS FILMED IN 2019.”

Delayed a year over the coronavirus pandemic, Dubai’s Expo 2020 opens on Friday, pushing this city-state all-in on its bet of billions of dollars that the world’s fair will boost its economy. The sheikhdom built what feels like an entire city out of what once were rolling sand dunes on its southern edges to support the fair, an outpost that largely will be disassembled after the six-month event ends in March.

But questions about the Expo’s drawing power in the modern era began even before the pandemic. It will be one of the world’s first global events, following an Olympics this summer that divided host nation Japan and took place without spectators. Though Dubai has thrown open its doors to tourists from around the world and has not required vaccinations, it remains unclear how many guests will be coming to this extravaganza.

Barclays raises 2022 oil price view on likely supply deficit | Reuters

Barclays raises 2022 oil price view on likely supply deficit | Reuters

Barclays on Tuesday raised its 2022 oil price forecasts reasoning that a continued recovery in demand could widen a 'persistent' supply shortfall.

The bank raised its 2022 Brent crude price forecast by $9 to $77 per barrel driven in part by "reduced confidence" for a revival of the U.S.-Iran nuclear deal.

Expectations of tight supply, coupled with surging coal and gas prices, pushed oil prices higher for a sixth straight session on Tuesday, with Brent crude futures topping $80 a barrel while U.S. crude rose to around $76.

"OPEC+ tapering would not plug the oil supply gap through at least Q1 2022 as demand recovery is likely to continue to outpace this, due partly to limited capacity of some producers in the group to ramp up output," Barclays said in a note.

Barclays on Tuesday raised its 2022 oil price forecasts reasoning that a continued recovery in demand could widen a 'persistent' supply shortfall.

The bank raised its 2022 Brent crude price forecast by $9 to $77 per barrel driven in part by "reduced confidence" for a revival of the U.S.-Iran nuclear deal.

Expectations of tight supply, coupled with surging coal and gas prices, pushed oil prices higher for a sixth straight session on Tuesday, with Brent crude futures topping $80 a barrel while U.S. crude rose to around $76.

"OPEC+ tapering would not plug the oil supply gap through at least Q1 2022 as demand recovery is likely to continue to outpace this, due partly to limited capacity of some producers in the group to ramp up output," Barclays said in a note.

S&P affirms #Saudi rating on expected rebound through 2024 | Reuters

S&P affirms Saudi rating on expected rebound through 2024 | Reuters

S&P Global Ratings on Tuesday affirmed Saudi Arabia's A- (minus) credit rating with a stable outlook, expecting a rebound in growth through 2024 driven by higher oil prices, eased OPEC production quotas and a large vaccine rollout in the kingdom.

After the COVID-19 pandemic weighed on the economy, Saudi Arabia has returned to ambitious investment projects linked to its strategy of weaning the economy off oil, S&P said. Significant investments are being made by the Public Investment Fund, the kingdom's sovereign wealth fund, and other entities in both the oil and non-oil sectors.

The rating agency sees Saudi Arabia's deficit dropping from 11.2% last year to 4.3% in 2021, while averaging 5.7% between this year and 2024. Real GDP growth is expected to average 2.4% in the same period after contracting 4.1% in 2020.

"In 2021, higher oil prices are being partially counterbalanced by constrained annual Saudi oil production volumes, which continue to be limited by an OPEC deal," S&P said in a mid-year review.

S&P Global Ratings on Tuesday affirmed Saudi Arabia's A- (minus) credit rating with a stable outlook, expecting a rebound in growth through 2024 driven by higher oil prices, eased OPEC production quotas and a large vaccine rollout in the kingdom.

After the COVID-19 pandemic weighed on the economy, Saudi Arabia has returned to ambitious investment projects linked to its strategy of weaning the economy off oil, S&P said. Significant investments are being made by the Public Investment Fund, the kingdom's sovereign wealth fund, and other entities in both the oil and non-oil sectors.

The rating agency sees Saudi Arabia's deficit dropping from 11.2% last year to 4.3% in 2021, while averaging 5.7% between this year and 2024. Real GDP growth is expected to average 2.4% in the same period after contracting 4.1% in 2020.

"In 2021, higher oil prices are being partially counterbalanced by constrained annual Saudi oil production volumes, which continue to be limited by an OPEC deal," S&P said in a mid-year review.

#Qatar property market slowdown continues; prices to stabilise next year | ZAWYA MENA Edition

Qatar property market slowdown continues; prices to stabilise next year | ZAWYA MENA Edition

Qatar’s property market has not yet recovered from the impact of the coronavirus pandemic, with housing rents continuing to slide and sales prices fluctuating during the first half of 2021, according to the latest analysis by Property Finder Qatar.

The Gulf state is expected to see prices stabilising only in 2021, although investor and tenant demand for villas and apartments, is already picking up. Demand has been driven largely by low prices in the market.

“Qatar is expected to reach a stable pricing index in the coming year, despite the current price and supply fluctuations,” Property Finder Qatar said.

“The slowdown [caused by] the pandemic continues to significantly affect the market. However, sales transactions and rental deals are rising as investors and property buyers look to take advantage of lower market prices,” added said Afaf Hashem, country manager of Property Finder Qatar.

Qatar’s property market has not yet recovered from the impact of the coronavirus pandemic, with housing rents continuing to slide and sales prices fluctuating during the first half of 2021, according to the latest analysis by Property Finder Qatar.

The Gulf state is expected to see prices stabilising only in 2021, although investor and tenant demand for villas and apartments, is already picking up. Demand has been driven largely by low prices in the market.

“Qatar is expected to reach a stable pricing index in the coming year, despite the current price and supply fluctuations,” Property Finder Qatar said.

“The slowdown [caused by] the pandemic continues to significantly affect the market. However, sales transactions and rental deals are rising as investors and property buyers look to take advantage of lower market prices,” added said Afaf Hashem, country manager of Property Finder Qatar.

#Saudi ESG Enigma Doesn’t Add Up for Some Investors - Bloomberg

Saudi ESG Enigma Doesn’t Add Up for Some Investors - Bloomberg

Some investors find it difficult to reconcile Saudi Arabia’s record on climate with its plans for sustainable financing, even if it is moving faster than others in its energy transition, a senior portfolio manager at BlueBay Asset Management said.

The world’s largest crude exporter is planning green bonds, tapping into a booming global market for finance that complies with environmental, social and governance, or ESG, goals. This comes as governments worldwide step up efforts to prevent temperatures from rising more than 1.5 degrees Celsius above pre-industrial levels.

“I don’t think I can name any other country in emerging markets that has moved at a similar pace, and this is really encouraging,” Polina Kurdyavko, Head of Emerging Market Debt at Bluebay, told an investment conference in Riyadh where officials discussed the green bond plans.

At the same time, Bluebay’s clients question Saudi Arabia’s commitments to combat climate change, she said.

“Saudi Arabia ranks among the countries that are ‘critically insufficient’ in terms of the program set forward in order to deliver the 1.5 degree target,” she said, appearing to cite its ranking by non-profit Climate Action Tracker that gives the kingdom the lowest level possible for its climate policies.

“For us as investors it’s very difficult to reconcile those two points,” Kurdyavko said, calling on the government to help institutions explain the gap to their clients. “That would make our job a lot easier and would make the issuers of the country pay much lower rates.”

Some investors find it difficult to reconcile Saudi Arabia’s record on climate with its plans for sustainable financing, even if it is moving faster than others in its energy transition, a senior portfolio manager at BlueBay Asset Management said.

The world’s largest crude exporter is planning green bonds, tapping into a booming global market for finance that complies with environmental, social and governance, or ESG, goals. This comes as governments worldwide step up efforts to prevent temperatures from rising more than 1.5 degrees Celsius above pre-industrial levels.

“I don’t think I can name any other country in emerging markets that has moved at a similar pace, and this is really encouraging,” Polina Kurdyavko, Head of Emerging Market Debt at Bluebay, told an investment conference in Riyadh where officials discussed the green bond plans.

At the same time, Bluebay’s clients question Saudi Arabia’s commitments to combat climate change, she said.

“Saudi Arabia ranks among the countries that are ‘critically insufficient’ in terms of the program set forward in order to deliver the 1.5 degree target,” she said, appearing to cite its ranking by non-profit Climate Action Tracker that gives the kingdom the lowest level possible for its climate policies.

“For us as investors it’s very difficult to reconcile those two points,” Kurdyavko said, calling on the government to help institutions explain the gap to their clients. “That would make our job a lot easier and would make the issuers of the country pay much lower rates.”

Activist Investing Makes New Inroads as Gulf Shakes Off Taboos - Bloomberg

Activist Investing Makes New Inroads as Gulf Shakes Off Taboos - Bloomberg

Activist investing can be a lonely slog in the Middle East.

The hardball tactics deployed by Carl Icahn or Paul Singer’s Elliott Investment Management are all but unheard-of in a region where board decisions rarely meet dissent while shareholders work out their differences behind closed doors.

But the Gulf’s listed firms, at a cumulative market value of nearly $3.5 trillion, may be the next frontier for activists pushing management to make strategic or operational changes, especially as competition for foreign capital intensifies within the region and more companies go public. Shareholder campaigns could also alter the calculus for corporations after a series of recent delistings saw little in the way of pushback from investors.

One fund in the Gulf that hasn’t shied away from corporate showdowns is Sancta Capital. Drawing inspiration from Baupost Group, the Dubai-based alternative asset manager says it’s the only firm in the Middle East and North Africa that focuses on special situations investing.

Activist investing can be a lonely slog in the Middle East.

The hardball tactics deployed by Carl Icahn or Paul Singer’s Elliott Investment Management are all but unheard-of in a region where board decisions rarely meet dissent while shareholders work out their differences behind closed doors.

But the Gulf’s listed firms, at a cumulative market value of nearly $3.5 trillion, may be the next frontier for activists pushing management to make strategic or operational changes, especially as competition for foreign capital intensifies within the region and more companies go public. Shareholder campaigns could also alter the calculus for corporations after a series of recent delistings saw little in the way of pushback from investors.

One fund in the Gulf that hasn’t shied away from corporate showdowns is Sancta Capital. Drawing inspiration from Baupost Group, the Dubai-based alternative asset manager says it’s the only firm in the Middle East and North Africa that focuses on special situations investing.

#Saudi Petrochemical Rivals Merge to Create $11 Billion Company - Bloomberg

Saudi Petrochemical Rivals Merge to Create $11 Billion Company - Bloomberg

Saudi Industrial Investment Group offered to take over all of National Petrochemical Co. and create one of the largest manufacturers of chemicals in the Middle East, just as prices soar.

The all-share deal will merge two companies with a combined market capitalization of $11.2 billion and comes amid increasing consolidation among Saudi Arabia’s industrial firms as they seek to build scale and improve profitability.

Saudi Industrial Investment Group, known as SIIG, wants to swap 1.27 of its shares of each of National Petrochem’s, according to a statement. The transaction will value National Petrochem at 24 billion riyals ($6.4 billion).

SIIG already owns half of National Petrochem. The companies started negotiations in September 2020 and hired advisers in April.

Prices for chemicals and other petroleum products -- used to make everything from plastics to paint -- have surged this year as major economies recover from the coronavirus pandemic. SIIG and National Petrochem’s stocks are up almost 50% this year.

Last year, Saudi International Petrochemical Co. bought Sahara Petrochemical Co. That was followed by Aramco taking a majority stake in Saudi Basic Industries Corp., the kingdom’s biggest chemicals maker, in a $69 billion deal.

Saudi Industrial Investment Group offered to take over all of National Petrochemical Co. and create one of the largest manufacturers of chemicals in the Middle East, just as prices soar.

The all-share deal will merge two companies with a combined market capitalization of $11.2 billion and comes amid increasing consolidation among Saudi Arabia’s industrial firms as they seek to build scale and improve profitability.

Saudi Industrial Investment Group, known as SIIG, wants to swap 1.27 of its shares of each of National Petrochem’s, according to a statement. The transaction will value National Petrochem at 24 billion riyals ($6.4 billion).

SIIG already owns half of National Petrochem. The companies started negotiations in September 2020 and hired advisers in April.

Prices for chemicals and other petroleum products -- used to make everything from plastics to paint -- have surged this year as major economies recover from the coronavirus pandemic. SIIG and National Petrochem’s stocks are up almost 50% this year.

Last year, Saudi International Petrochemical Co. bought Sahara Petrochemical Co. That was followed by Aramco taking a majority stake in Saudi Basic Industries Corp., the kingdom’s biggest chemicals maker, in a $69 billion deal.

MIDEAST STOCKS Most Gulf stocks up in early trade, #Saudi extends gains on rising oil prices | Reuters

MIDEAST STOCKS Most Gulf stocks up in early trade, Saudi extends gains on rising oil prices | Reuters

Most major Gulf stock markets rose in early trade on Tuesday, with petrochemical shares aiding the Saudi index as oil extends its gains to a sixth day, while a couple of corporate announcements pushed the Abu Dhabi index higher.

Oil markets climbed for a sixth day on Tuesday, reversing earlier losses, on fears over tight supply while surging prices of liquefied natural gas (LNG) and coal also lent support. read more

Brent crude (.LCOc1) futures were up 1.3% to $80.58 a barrel at 0645 GMT.

Saudi Arabia's benchmark index (.TASI) was trading 0.2% higher on track to a third consecutive daily rise.

Saudi Basic Industries <2010.SE > advanced 1.3% its fertilizer unit SABIC Agri-Nutrients (2020.SE) added 1.9%.

Saudi Industrial Investment Group (SIIG) (2250.SE) and National Petrochemical Company (Petrochem) (2002.SE) surged as much as 4% and 3.2%, respectively after they announced they were signing a non-binding agreement on a proposed merger. read more

Petrochem shareholders would receive 1.27 shares in SIIG in exchange for each share they owned in Petrochem.

The Abu Dhabi index (.ADI) was up 0.1% with International Holding (IHC.AD) gaining 0.1% and Dana Gas jumping 4.5%.

International Holding said its unit Emirates Stallions Group will Develop a hospitality project worth 240 million dirhams ($65 million) in Sudan, while Dana Gas said it won an arbitration award of $607 million in a gas supply dispute with National Iranian Oil Co (NIOC). read more

The Qatari index (.QSI) was up 0.2% supported by gains in industrial shares. Industries Qatar (IQCD.QA) increased 1.4% in its sixth consecutive rise, while Mesaieed Petrochemical (MPHC.QA) added 1%.

Gains were capped by losses in the financial sector with Commercial Bank (COMB.QA) declining 2%.

In Dubai, the index (.DFMGI) was flat. The blue-chip developer Emaar Properties (EMAR.DU) shed 0.3%, while Dubai Islamic Bank (DISB.DU) edged up 0.2%.

Most major Gulf stock markets rose in early trade on Tuesday, with petrochemical shares aiding the Saudi index as oil extends its gains to a sixth day, while a couple of corporate announcements pushed the Abu Dhabi index higher.

Oil markets climbed for a sixth day on Tuesday, reversing earlier losses, on fears over tight supply while surging prices of liquefied natural gas (LNG) and coal also lent support. read more

Brent crude (.LCOc1) futures were up 1.3% to $80.58 a barrel at 0645 GMT.

Saudi Arabia's benchmark index (.TASI) was trading 0.2% higher on track to a third consecutive daily rise.

Saudi Basic Industries <2010.SE > advanced 1.3% its fertilizer unit SABIC Agri-Nutrients (2020.SE) added 1.9%.

Saudi Industrial Investment Group (SIIG) (2250.SE) and National Petrochemical Company (Petrochem) (2002.SE) surged as much as 4% and 3.2%, respectively after they announced they were signing a non-binding agreement on a proposed merger. read more

Petrochem shareholders would receive 1.27 shares in SIIG in exchange for each share they owned in Petrochem.

The Abu Dhabi index (.ADI) was up 0.1% with International Holding (IHC.AD) gaining 0.1% and Dana Gas jumping 4.5%.

International Holding said its unit Emirates Stallions Group will Develop a hospitality project worth 240 million dirhams ($65 million) in Sudan, while Dana Gas said it won an arbitration award of $607 million in a gas supply dispute with National Iranian Oil Co (NIOC). read more

The Qatari index (.QSI) was up 0.2% supported by gains in industrial shares. Industries Qatar (IQCD.QA) increased 1.4% in its sixth consecutive rise, while Mesaieed Petrochemical (MPHC.QA) added 1%.

Gains were capped by losses in the financial sector with Commercial Bank (COMB.QA) declining 2%.

In Dubai, the index (.DFMGI) was flat. The blue-chip developer Emaar Properties (EMAR.DU) shed 0.3%, while Dubai Islamic Bank (DISB.DU) edged up 0.2%.

Oil climbs for sixth day on supply concerns, Brent tops $80 | Reuters

Oil climbs for sixth day on supply concerns, Brent tops $80 | Reuters

Oil markets climbed for a sixth day on Tuesday, reversing earlier losses, on fears over tight supply while surging prices of liquefied natural gas (LNG) and coal also lent support.

Brent crude futures gained $1.05, or 1.3%, to $80.58 a barrel at 0645 GMT, after reaching its highest since October 2018 at $80.75 earlier in the session. It surged 1.8% on Monday.

U.S. West Texas Intermediate (WTI) crude futures rose $1.06, or 1.4%, to $76.51 a barrel, the highest since July 6. It jumped 2% the previous day.

"Investors remained bullish as supply disruptions in the United States from hurricanes are continuing for longer than expected at a time when demand is picking up due to easing lockdown measures and the wider rollouts of COVID-19 vaccination," said Chiyoki Chen, chief analyst at Sunward Trading.

Oil markets climbed for a sixth day on Tuesday, reversing earlier losses, on fears over tight supply while surging prices of liquefied natural gas (LNG) and coal also lent support.

Brent crude futures gained $1.05, or 1.3%, to $80.58 a barrel at 0645 GMT, after reaching its highest since October 2018 at $80.75 earlier in the session. It surged 1.8% on Monday.

U.S. West Texas Intermediate (WTI) crude futures rose $1.06, or 1.4%, to $76.51 a barrel, the highest since July 6. It jumped 2% the previous day.

"Investors remained bullish as supply disruptions in the United States from hurricanes are continuing for longer than expected at a time when demand is picking up due to easing lockdown measures and the wider rollouts of COVID-19 vaccination," said Chiyoki Chen, chief analyst at Sunward Trading.