Saudi Wealth Fund to Raise Up to $3.1 Billion in STC Sale - Bloomberg

Saudi Arabia’s sovereign wealth fund is set to raise as much as $3.1 billion through the sale of shares in Saudi Telecom Co. as it looks to fund a huge investment program to diversify the oil-dependent economy.

The Public Investment Fund will sell a 5% stake in STC, as the Middle East’s most profitable mobile-phone operator is known, through a secondary offering starting Dec. 5, according to a statement to the stock exchange. A total of 100 million shares will be offered at between 100 riyals ($26.70) to 116 riyals.

The shares are offered at a discount to Sunday’s closing price of 116.20 riyals. The stock has climbed 9.6% this year, compared with the 28% gain in the Tadawul All Share Index.

Saudi Arabia’s sovereign wealth fund is one of the main vehicles for Crown Prince Mohammed Bin Salman’s plans to diversify the Saudi economy away from oil. It’s previously said it would invest about $40 billion in the domestic economy a year until 2025.

Solely aggregation of news articles, with no opinions expressed by this service since 2009 launch on this platform. Copyright to all articles remains with the original publisher and HEADLINES ARE CLICKABLE to access the whole article at source. (Subscription by email is recommended,with real-time updates on LinkedIn and Twitter.)

Sunday, 5 December 2021

Delivery Hero Fails Again to Take Over a Rival in #SaudiArabia - Bloomberg

Delivery Hero Fails Again to Take Over a Rival in Saudi Arabia - Bloomberg

Delivery Hero SE’s second attempt to buy a Saudi rival has failed after the local competition watchdog rejected its takeover offer for The Chefz.

Saudi Arabia’s General Authority for Competition didn’t disclose any details or the reasons for its decision in a statement on Sunday but said Germany’s Delivery Hero sought to buy all of the Riyadh-based firm.

Delivery Hero and The Chefz didn’t immediately respond to requests for comment.

Delivery Hero is coming up empty in its efforts expand in the Middle East’s biggest economy by acquiring rivals, as deal talks earlier this year with Saudi e-commerce startup Mrsool collapsed and ended in dispute. Elsewhere in the region, the Berlin-based food-delivery company has recently grown its footprint by buying Dubai grocery delivery platform InstaShop.

The Chefz, which started out as an app that specialized in home delivery for fine dining restaurants before expanding its services in the kingdom, competes against Delivery Hero’s Hungerstation and local firms like Jahez International Co. Delivery Hero’s regional operations also include Talabat and Yemeksepeti in Turkey.

Delivery Hero SE’s second attempt to buy a Saudi rival has failed after the local competition watchdog rejected its takeover offer for The Chefz.

Saudi Arabia’s General Authority for Competition didn’t disclose any details or the reasons for its decision in a statement on Sunday but said Germany’s Delivery Hero sought to buy all of the Riyadh-based firm.

Delivery Hero and The Chefz didn’t immediately respond to requests for comment.

Delivery Hero is coming up empty in its efforts expand in the Middle East’s biggest economy by acquiring rivals, as deal talks earlier this year with Saudi e-commerce startup Mrsool collapsed and ended in dispute. Elsewhere in the region, the Berlin-based food-delivery company has recently grown its footprint by buying Dubai grocery delivery platform InstaShop.

The Chefz, which started out as an app that specialized in home delivery for fine dining restaurants before expanding its services in the kingdom, competes against Delivery Hero’s Hungerstation and local firms like Jahez International Co. Delivery Hero’s regional operations also include Talabat and Yemeksepeti in Turkey.

#Iran’s National Currency Falls to Record Low Over Nuclear Deal - Bloomberg

Iran’s National Currency Falls to Record Low Over Nuclear Deal - Bloomberg

Iran’s national currency stumbled to record-low levels after renewed efforts to revive the country’s beleaguered nuclear deal failed to make progress.

The U.S. dollar crossed 300,000 Iranian rials in open market on Saturday, according to two local exchange shops and media reports. The level was last seen in October 2020, when the rial crashed to record-low prices against the dollar.

Four traders at a currency exchange hub in central Tehran said on the phone that they weren’t selling the dollar on Saturday, citing market volatility.

Efforts between Tehran and world powers to salvage the 2015 nuclear accord resumed in the Austrian capital this week. But negotiations ended on Friday with no sign of concrete progress. The next round of talks is scheduled for next week.

Iran’s national currency stumbled to record-low levels after renewed efforts to revive the country’s beleaguered nuclear deal failed to make progress.

The U.S. dollar crossed 300,000 Iranian rials in open market on Saturday, according to two local exchange shops and media reports. The level was last seen in October 2020, when the rial crashed to record-low prices against the dollar.

Four traders at a currency exchange hub in central Tehran said on the phone that they weren’t selling the dollar on Saturday, citing market volatility.

Efforts between Tehran and world powers to salvage the 2015 nuclear accord resumed in the Austrian capital this week. But negotiations ended on Friday with no sign of concrete progress. The next round of talks is scheduled for next week.

#AbuDhabi leads most Gulf bourses higher; #Qatar dips | Reuters

Abu Dhabi leads most Gulf bourses higher; Qatar dips | Reuters

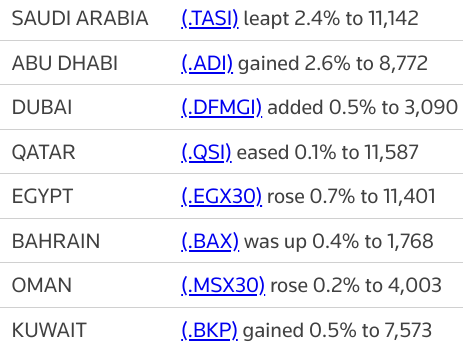

Most Gulf bourses ended higher on Sunday, with some recouping recent COVID-19-related losses, while the Abu Dhabi index hit another record peak.

Saudi Arabia's benchmark index (.TASI) advanced 2.4%, buoyed by a 3.6% rise in Al Rajhi Bank (1120.SE) and a 7.4% leap in the Sahara International Petrochemical Company (2310.SE).

The kingdom's non-oil private sector continued to grow in November on the back of strong demand and modest price pressures for businesses. read more

Elsewhere, oil giant Saudi Aramco (2222.SE) ended 0.7% higher. The group said in a statement on Saturday it had signed five agreements with French companies, including one to explore a hydrogen-powered vehicle business with Gaussin. read more

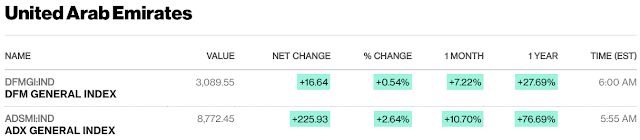

In Abu Dhabi the index (.ADI) reached another record high, topping Tuesday's previous peak, and closed up 2.6%, with Emirates Telecommunications Group (ETISALAT.AD) gaining for an eighth session in nine to end 8.8% higher.

In November, the telecom operator signed an agreement to acquire online grocery delivery marketplace elGrocer DMCC.

Mubadala, Abu Dhabi's sovereign fund, said on Friday it had agreed a 4 billion euro ($4.53 billion) contract with France's public investment bank Bpifrance.

However tech-focused holding company Multiply Group (MULTIPLY.AD), which debuted on the Abu Dhabi Securities Exchange on Sunday, dived more than 16% to 2 dirhams per share from its opening price of 2.35 dirhams.

Dubai's main share index (.DFMGI) gained 0.5%, led by a 1.1% rise in Emirates NBD Bank (ENBD.DU) and a 3.1% increase in logistic firm Aramex (ARMX.DU).

Crude prices, a key catalyst for the Gulf's financial markets, ended little changed on Friday after erasing earlier big gains on growing worries that rising coronavirus cases and a new variant could cut global oil demand.

The Organization of the Petroleum Exporting Countries will continue with its supply adjustments for the oil market, the OPEC Secretary General said on Saturday. read more

The Qatari index (.QSI) eased 0.1%, hit by a 1.1% fall in Qatar National Bank (QNBK.QA), the Gulf's biggest lender.

Outside the Gulf, Egypt's blue-chip index (.EGX30) finished 0.7% higher, with most of the stocks on the index in positive territory.

Most Gulf bourses ended higher on Sunday, with some recouping recent COVID-19-related losses, while the Abu Dhabi index hit another record peak.

Saudi Arabia's benchmark index (.TASI) advanced 2.4%, buoyed by a 3.6% rise in Al Rajhi Bank (1120.SE) and a 7.4% leap in the Sahara International Petrochemical Company (2310.SE).

The kingdom's non-oil private sector continued to grow in November on the back of strong demand and modest price pressures for businesses. read more

Elsewhere, oil giant Saudi Aramco (2222.SE) ended 0.7% higher. The group said in a statement on Saturday it had signed five agreements with French companies, including one to explore a hydrogen-powered vehicle business with Gaussin. read more

In Abu Dhabi the index (.ADI) reached another record high, topping Tuesday's previous peak, and closed up 2.6%, with Emirates Telecommunications Group (ETISALAT.AD) gaining for an eighth session in nine to end 8.8% higher.

In November, the telecom operator signed an agreement to acquire online grocery delivery marketplace elGrocer DMCC.

Mubadala, Abu Dhabi's sovereign fund, said on Friday it had agreed a 4 billion euro ($4.53 billion) contract with France's public investment bank Bpifrance.

However tech-focused holding company Multiply Group (MULTIPLY.AD), which debuted on the Abu Dhabi Securities Exchange on Sunday, dived more than 16% to 2 dirhams per share from its opening price of 2.35 dirhams.

Dubai's main share index (.DFMGI) gained 0.5%, led by a 1.1% rise in Emirates NBD Bank (ENBD.DU) and a 3.1% increase in logistic firm Aramex (ARMX.DU).

Crude prices, a key catalyst for the Gulf's financial markets, ended little changed on Friday after erasing earlier big gains on growing worries that rising coronavirus cases and a new variant could cut global oil demand.

The Organization of the Petroleum Exporting Countries will continue with its supply adjustments for the oil market, the OPEC Secretary General said on Saturday. read more

The Qatari index (.QSI) eased 0.1%, hit by a 1.1% fall in Qatar National Bank (QNBK.QA), the Gulf's biggest lender.

Outside the Gulf, Egypt's blue-chip index (.EGX30) finished 0.7% higher, with most of the stocks on the index in positive territory.

Business activity in #SaudiArabia continues to improve in November

Business activity in Saudi Arabia continues to improve in November

Business activity in the non-oil private sector of Saudi Arabia, the Arab world’s largest economy, continued to improve in November, boosted by the easing of Covid-19 restrictions and a rise in tourism activity.

Although the kingdom's seasonally adjusted purchasing managers' index – a gauge designed to give a snapshot of operating conditions in the non-oil private sector economy – slipped to 56.9 in November, from 57.7 in October, the reading remained well above the neutral 50 level and in line with the average recorded over the 12-year series.

A reading above 50 indicates expansion while a reading below points to a contraction.

The kingdom's PMI "continued to signal a strong end to the year for the non-oil economy”, said IHS Markit economist David Owen.

“Despite slipping to a three-month low, new business growth was rapid overall, while activity expanded at one of the quickest rates since the start of the pandemic.”

Business activity in the non-oil private sector of Saudi Arabia, the Arab world’s largest economy, continued to improve in November, boosted by the easing of Covid-19 restrictions and a rise in tourism activity.

Although the kingdom's seasonally adjusted purchasing managers' index – a gauge designed to give a snapshot of operating conditions in the non-oil private sector economy – slipped to 56.9 in November, from 57.7 in October, the reading remained well above the neutral 50 level and in line with the average recorded over the 12-year series.

A reading above 50 indicates expansion while a reading below points to a contraction.

The kingdom's PMI "continued to signal a strong end to the year for the non-oil economy”, said IHS Markit economist David Owen.

“Despite slipping to a three-month low, new business growth was rapid overall, while activity expanded at one of the quickest rates since the start of the pandemic.”

#AbuDhabi Stocks Lead Mideast Gains After Global Rout: Inside EM - Bloomberg

Abu Dhabi Stocks Lead Mideast Gains After Global Rout: Inside EM - Bloomberg

Stocks in Abu Dhabi rallied, leading gains among Middle Eastern markets that rebounded from last week’s slump on concern about the spread of the omicron variant of Covid-19.

“We are still in the market. We like the region,” specifically the United Arab Emirates and Saudi Arabia, Ali El Adou, head of asset management at Daman Investments in Dubai, said in an interview on Bloomberg TV. “High vaccination rates is an additional point that gives us a bit of calmness to the market.”

Stocks in Abu Dhabi rallied, leading gains among Middle Eastern markets that rebounded from last week’s slump on concern about the spread of the omicron variant of Covid-19.

“We are still in the market. We like the region,” specifically the United Arab Emirates and Saudi Arabia, Ali El Adou, head of asset management at Daman Investments in Dubai, said in an interview on Bloomberg TV. “High vaccination rates is an additional point that gives us a bit of calmness to the market.”

- Abu Dhabi’s ADX General closes 2.6% higher, up most since May

- Etisalat leads gains, rising 8.8%

- The stock is surging amid passive inflows related to Etisalat’s weight increase on the MSCI Emerging Markets Index following a hike in foreign ownership limits, said Ahmed El Difrawy, head of data and index research at EFG-Hermes

- Other stocks rising include First Abu Dhabi Bank +1.7%; Abu Dhabi Commercial Bank +4.6%; Alpha Dhabi +1%

- Saudi stocks also rise, with the Tadawul All Share Index gaining 2.4%, the most since April

- Al Rajhi Bank +3.6%; Saudi National Bank +2.2%; Sipchem +7.4%; Sabic +2.8%

- Tanmiah Food gains 3.3% after its unit Gulf Brand Fast Food signed a master franchise and development agreement with Popeyes

- Hail Cement jumps 9.9% after announcing a dividend of 0.5 riyals per share for the first nine months of the year

- Dubai Financial Market General Index rises 0.5%

- Kuwait’s Premier Market index gains 0.5%

- Qatar’s QE Index drops 0.1%

- Egypt’s EGX 30 Index rises 0.7%

Mubadala signs two deals to increase investments in France

Mubadala signs two deals to increase investments in France

Abu Dhabi’s Mubadala Investment Company signed two agreements to increase investment in priority sectors in France during President Emmanuel Macron’s visit to the UAE this week.

The first agreement between Mubadala and Bpifrance, the French public investment bank, will extend the co-investment partnerships between the two entities by an additional €4 billion ($4.5bn), which is to be invested over the next 10 years. Under the deal, each party will commit €2bn to the French Emirati Fund Partnership (FEF Partnership) and the Innovation Partnership, Mubadala said in a statement on Saturday.

The second agreement between Mubadala and the French Ministry of the Economy, Finance and Recovery will lead to the Abu Dhabi government potentially investing €1.4bn in funds based in France or with significant exposure to the French economy.

The two deals are part of comprehensive economic agreements worth more than €15bn between Emirati and French companies to strengthen the strategic investment partnership between the two nations, according to Mubadala.

Abu Dhabi’s Mubadala Investment Company signed two agreements to increase investment in priority sectors in France during President Emmanuel Macron’s visit to the UAE this week.

The first agreement between Mubadala and Bpifrance, the French public investment bank, will extend the co-investment partnerships between the two entities by an additional €4 billion ($4.5bn), which is to be invested over the next 10 years. Under the deal, each party will commit €2bn to the French Emirati Fund Partnership (FEF Partnership) and the Innovation Partnership, Mubadala said in a statement on Saturday.

The second agreement between Mubadala and the French Ministry of the Economy, Finance and Recovery will lead to the Abu Dhabi government potentially investing €1.4bn in funds based in France or with significant exposure to the French economy.

The two deals are part of comprehensive economic agreements worth more than €15bn between Emirati and French companies to strengthen the strategic investment partnership between the two nations, according to Mubadala.

Most Gulf bourses gain in early trade, #Qatar eases | Reuters

Most Gulf bourses gain in early trade, Qatar eases | Reuters

Most major stock markets in the Gulf rose in early trade on Sunday, with the Abu Dhabi index leading the gains, although the Qatari bourse bucked the trend.

Saudi Arabia's benchmark index (.TASI) gained 0.8%, with Al Rajhi Bank (1120.SE) rising 0.5% and Saudi Basic Industries Corp (2010.SE) putting on 1.1%.

Among other gainers, oil giant Saudi Aramco (2222.SE) added 0.4%.

Aramco signed five agreements with French companies, including an agreement to explore a hydrogen-powered vehicle business with Gaussin, the oil giant said in a statement on Saturday. read more

In Abu Dhabi, the index (.ADI), which traded after a two-session break, advanced 1.5%, buoyed by a 4.6% jump in telecoms firm Etisalat (ETISALAT.AD) and a 1.6% increase in the country's largest lender First Abu Dhabi Bank (FAB.AD).

Mubadala, Abu Dhabi's sovereign fund, said on Friday it had agreed a four billion euro ($4.53 billion) contract with France's public investment bank Bpifrance.

However, Multiply Group plunged about 30% to 1.75 dirhams per share from its opening price of 2.35 dirhams, on its debut trade.

On Sunday, Multiply Group listed directly on the Abu Dhabi Securities Exchange.

Dubai's main share index (.DFMGI) was up 0.2%, helped by a 0.8% gain in Emirates NBD Bank (ENBD.DU).

The United Arab Emirates announced on Wednesday its first known case of the new COVID-19 variant Omicron, state news agency WAM reported. read more

Crude prices, a key catalyst for the Gulf's financial markets, ended little changed on Friday after erasing earlier big gains on growing worries that rising coronavirus cases and a new variant could reduce global oil demand.

The Organization of the Petroleum Exporting Countries will continue with its supply adjustments for the oil market, the OPEC Secretary General said on Saturday. read more

The Qatari index (.QSI) fell 0.3%, with the Gulf's largest lender Qatar National Bank (QNBK.QA) dropping 1.2%.

Most major stock markets in the Gulf rose in early trade on Sunday, with the Abu Dhabi index leading the gains, although the Qatari bourse bucked the trend.

Saudi Arabia's benchmark index (.TASI) gained 0.8%, with Al Rajhi Bank (1120.SE) rising 0.5% and Saudi Basic Industries Corp (2010.SE) putting on 1.1%.

Among other gainers, oil giant Saudi Aramco (2222.SE) added 0.4%.

Aramco signed five agreements with French companies, including an agreement to explore a hydrogen-powered vehicle business with Gaussin, the oil giant said in a statement on Saturday. read more

In Abu Dhabi, the index (.ADI), which traded after a two-session break, advanced 1.5%, buoyed by a 4.6% jump in telecoms firm Etisalat (ETISALAT.AD) and a 1.6% increase in the country's largest lender First Abu Dhabi Bank (FAB.AD).

Mubadala, Abu Dhabi's sovereign fund, said on Friday it had agreed a four billion euro ($4.53 billion) contract with France's public investment bank Bpifrance.

However, Multiply Group plunged about 30% to 1.75 dirhams per share from its opening price of 2.35 dirhams, on its debut trade.

On Sunday, Multiply Group listed directly on the Abu Dhabi Securities Exchange.

Dubai's main share index (.DFMGI) was up 0.2%, helped by a 0.8% gain in Emirates NBD Bank (ENBD.DU).

The United Arab Emirates announced on Wednesday its first known case of the new COVID-19 variant Omicron, state news agency WAM reported. read more

Crude prices, a key catalyst for the Gulf's financial markets, ended little changed on Friday after erasing earlier big gains on growing worries that rising coronavirus cases and a new variant could reduce global oil demand.

The Organization of the Petroleum Exporting Countries will continue with its supply adjustments for the oil market, the OPEC Secretary General said on Saturday. read more

The Qatari index (.QSI) fell 0.3%, with the Gulf's largest lender Qatar National Bank (QNBK.QA) dropping 1.2%.

#AbuDhabi Multiply Group shares recover slightly after plunging in early trade | ZAWYA MENA Edition

Abu Dhabi Multiply Group shares recover slightly after plunging in early trade | ZAWYA MENA Edition

Shares of Multiply Group, a subsidiary of International Holding Company (IHC) that listed on Abu Dhabi Securities Exchange (ADX) on Sunday, recovered slightly after plunging in early trade.

At 1:00 pm local time, the share was trading at 1.92 dirhams, recovering from the 30 percent drop in early trade but still way below its listing price of 2.35 dirhams.

The Abu Dhabi-based tech-focused holding company with assets of over $2.2 billion, has investments in automotive, utilities, capital, wellness and communications industries. It began debut trading on Sunday following a direct listing.

Shares of Multiply Group, a subsidiary of International Holding Company (IHC) that listed on Abu Dhabi Securities Exchange (ADX) on Sunday, recovered slightly after plunging in early trade.

At 1:00 pm local time, the share was trading at 1.92 dirhams, recovering from the 30 percent drop in early trade but still way below its listing price of 2.35 dirhams.

The Abu Dhabi-based tech-focused holding company with assets of over $2.2 billion, has investments in automotive, utilities, capital, wellness and communications industries. It began debut trading on Sunday following a direct listing.

#AbuDhabi Stocks Lead Mideast Gains After Global Rout: Inside EM - Bloomberg

Abu Dhabi Stocks Lead Mideast Gains After Global Rout: Inside EM - Bloomberg

Stocks in Abu Dhabi rallied, leading gains among Middle Eastern markets rebounding from last week’s slump over the uncertainty about the spread of the omicron variant of Covid-19.

“We are still in the market. We like the region,” specifically the United Arab Emirates and Saudi Arabia, Ali El Adou, head of asset management at Daman Investments in Dubai, said in an interview on Bloomberg TV. “High vaccination rates is an additional point that gives us a bit of calmness to the market.”

Stocks in Abu Dhabi rallied, leading gains among Middle Eastern markets rebounding from last week’s slump over the uncertainty about the spread of the omicron variant of Covid-19.

“We are still in the market. We like the region,” specifically the United Arab Emirates and Saudi Arabia, Ali El Adou, head of asset management at Daman Investments in Dubai, said in an interview on Bloomberg TV. “High vaccination rates is an additional point that gives us a bit of calmness to the market.”

- Abu Dhabi’s ADX General rises as much as 3.2% before trimming gains to 1.5% at 11:17 a.m. local time

- Etisalat +4%; First Abu Dhabi Bank +1.7%; Abu Dhabi Commercial Bank +2.6%

- Saudi stocks also rise, with the Tadawul All Share Index gaining 1%

- Al Rajhi Bank +0.9%; Saudi National Bank +0.8%; Sabic +1.5%

- Dubai Financial Market General Index rises 0.1%

- Kuwait’s Premier Market index rises 0.5%

- Qatar’s QE Index drops 0.1%