Delivery Hero’s Saudi Rival Jahez Eyes Over $2 Billion IPO Value - Bloomberg

Saudi food delivery firm Jahez, which competes with companies like Delivery Hero’s Hungerstation, is targeting a valuation as high as $2.4 billion in an initial public offering that would vault it to the ranks of the biggest startups in the Middle East.

Jahez International Company for Information Systems Technology, as the four-year-old firm is formally known, set the price range for the offering later this month at between 750 riyals ($200) and 850 riyals, according to a statement on Thursday.

The company, which hired HSBC Holdings Plc’s local unit to manage the share sale in May, also agreed to sell a 4.99% stake to Hassana, the kingdom’s pension fund that oversees more than $250 billion in assets, as a cornerstone investor in the IPO.

The goal represents a huge leap for the firm, which closed a $36 million Series A funding round last year. The boon came partly as a result of shifting consumer habits during the pandemic. Gross merchandise value nearly tripled to 1.4 billion riyals in 2020 from 497 million riyals the previous year.

Saudi Arabia’s first tech startup worth more than $1 billion was stc pay, the digital payment unit of mobile operator Saudi Telecom Co. That firm was valued at $1.3 billion in a funding agreement with Western Union last year.

Solely aggregation of news articles, with no opinions expressed by this service since 2009 launch on this platform. Copyright to all articles remains with the original publisher and HEADLINES ARE CLICKABLE to access the whole article at source. (Subscription by email is recommended,with real-time updates on LinkedIn and Twitter.)

Thursday, 9 December 2021

Oil down on Omicron restrictions and China fears | Reuters

Oil down on Omicron restrictions and China fears | Reuters

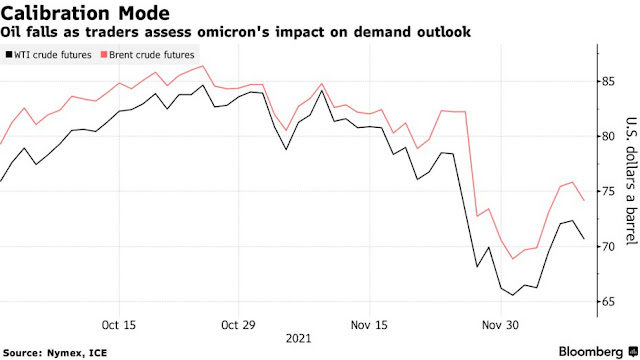

Oil prices fell on Thursday after measures by some governments to slow the spread of the Omicron coronavirus variant and a ratings downgrade for two Chinese property developers that stoked fears over the economic health of the world's biggest oil importer.

Brent crude futures fell $1, or 1.3%, to $74.82 a barrel by 1310 GMT after touching a peak of $76.70. U.S. West Texas Intermediate (WTI) crude futures fell 92 cents, or 1.3%, to $71.44 after a session high of $73.34.

"Although laboratory tests showed that the Pfizer vaccine has a neutralising effect on Omicron ... new measures are being introduced to try to stop the spread of the virus," said Tamas Varga of oil brokerage PVM.

British Prime Minister Boris Johnson imposed tougher COVID-19 restrictions in England on Wednesday, saying people should work from home where possible and wear masks in public places and show COVID-19 vaccine passes for entry to certain events and venues. read more

Oil prices fell on Thursday after measures by some governments to slow the spread of the Omicron coronavirus variant and a ratings downgrade for two Chinese property developers that stoked fears over the economic health of the world's biggest oil importer.

Brent crude futures fell $1, or 1.3%, to $74.82 a barrel by 1310 GMT after touching a peak of $76.70. U.S. West Texas Intermediate (WTI) crude futures fell 92 cents, or 1.3%, to $71.44 after a session high of $73.34.

"Although laboratory tests showed that the Pfizer vaccine has a neutralising effect on Omicron ... new measures are being introduced to try to stop the spread of the virus," said Tamas Varga of oil brokerage PVM.

British Prime Minister Boris Johnson imposed tougher COVID-19 restrictions in England on Wednesday, saying people should work from home where possible and wear masks in public places and show COVID-19 vaccine passes for entry to certain events and venues. read more

#Kuwait telecom Zain receives $1.3 bln offer for Sudan business | Reuters

Kuwait telecom Zain receives $1.3 bln offer for Sudan business | Reuters

Kuwait-headquartered Zain (ZAIN.KW) said on Thursday it had received a non-binding $1.3 billion offer for the telecom group's Sudanese business from a subsidiary of Sudan's DAL Group.

Zain's board has agreed to complete due diligence on the offer from DAL Group's Invictus Holding Ltd for Zain Sudan and Kuwait Sudanese Holdings, it said in a bourse filing.

DAL, one of Sudan's largest conglomerates with companies in the food, agriculture, automotive and mining industries, is seeking to broaden its portfolio with the acquisition of one of the country's top 3 telecom providers, group director Amir Daoud Abdel Latif told Reuters.

Sudan had shown signs of emerging from a devastating economic crisis before a coup on Oct. 25 lead to a freeze of international financing that has put the prospects for recovery in question.

"We are very bullish about Sudan and the future of Sudan and we want to engage with the country on its journey to success," Latif said.

Zain said in its filing that the offer does not include its South Sudan business.

Kuwait-headquartered Zain (ZAIN.KW) said on Thursday it had received a non-binding $1.3 billion offer for the telecom group's Sudanese business from a subsidiary of Sudan's DAL Group.

Zain's board has agreed to complete due diligence on the offer from DAL Group's Invictus Holding Ltd for Zain Sudan and Kuwait Sudanese Holdings, it said in a bourse filing.

DAL, one of Sudan's largest conglomerates with companies in the food, agriculture, automotive and mining industries, is seeking to broaden its portfolio with the acquisition of one of the country's top 3 telecom providers, group director Amir Daoud Abdel Latif told Reuters.

Sudan had shown signs of emerging from a devastating economic crisis before a coup on Oct. 25 lead to a freeze of international financing that has put the prospects for recovery in question.

"We are very bullish about Sudan and the future of Sudan and we want to engage with the country on its journey to success," Latif said.

Zain said in its filing that the offer does not include its South Sudan business.

Oil weighs on #Saudi shares, #Dubai gains for seventh day | Reuters

Oil weighs on Saudi shares, Dubai gains for seventh day | Reuters

Saudi Arabia's stock market ended lower on Thursday, tracking a fall in oil prices as some governments took measures to slow the spread of the Omicron coronavirus variant, while the Dubai index rose for a seventh consecutive session.

Brent crude futures fell $1, or 1.3%, to $74.82 a barrel by 1310 GMT after touching a peak of $76.70.

Saudi Arabia's benchmark index (.TASI) dropped 0.5%, dragged down by a 0.7% fall in Al Rajhi Bank (1120.SE) and a 0.9% decline in oil behemoth Saudi Aramco (2222.SE).

Demand for Saudi oil is not improving as refineries in Asia did not increase their orders which could leave oil prices and the Saudi stock market without an important support, said Farah Mourad, senior market analyst of XTB MENA.

On the other hand, shares of Saudi Tadawul Group (1111.SE), the kingdom's stock exchange operator, gained more than 6% in their second day of trading.

In Abu Dhabi, the index (.ADI) retreated 0.8%, hit by a 2.3% fall in the country's largest lender First Abu Dhabi Bank (FAB.AD).

Dubai's main share index (.DFMGI) advanced 0.9%, extending gains to a seventh consecutive session, buoyed by a 2.3% rise in sharia-compliant lender Dubai Islamic Bank (DISB.DU).

The United Arab Emirates expects its move to a 4-1/2 day working week and a Saturday-Sunday weekend will boost its economy and make it a more attractive place for foreigners to live, the minister of human resources and Emiratisation said on Wednesday. read more

The market remains fundamentally directed towards growth as new IPOs continue being announced and the shift to the new weekend scheme could start showing its impact on investment and trade, said Mourad.

The Qatari benchmark (.QSI) edged 0.1% higher, helped by a 0.5% increase in Qatar Islamic Bank (QISB.QA).

Outside the Gulf, Egypt's blue-chip index (.EGX30) finished 0.7% higher, driven by a 20% surge in Abu Qir Fertilizers (ABUK.CA) following a block trade worth 2.25 billion Egyptian pounds ($143.59 million).

Saudi Arabia's stock market ended lower on Thursday, tracking a fall in oil prices as some governments took measures to slow the spread of the Omicron coronavirus variant, while the Dubai index rose for a seventh consecutive session.

Brent crude futures fell $1, or 1.3%, to $74.82 a barrel by 1310 GMT after touching a peak of $76.70.

Saudi Arabia's benchmark index (.TASI) dropped 0.5%, dragged down by a 0.7% fall in Al Rajhi Bank (1120.SE) and a 0.9% decline in oil behemoth Saudi Aramco (2222.SE).

Demand for Saudi oil is not improving as refineries in Asia did not increase their orders which could leave oil prices and the Saudi stock market without an important support, said Farah Mourad, senior market analyst of XTB MENA.

On the other hand, shares of Saudi Tadawul Group (1111.SE), the kingdom's stock exchange operator, gained more than 6% in their second day of trading.

In Abu Dhabi, the index (.ADI) retreated 0.8%, hit by a 2.3% fall in the country's largest lender First Abu Dhabi Bank (FAB.AD).

Dubai's main share index (.DFMGI) advanced 0.9%, extending gains to a seventh consecutive session, buoyed by a 2.3% rise in sharia-compliant lender Dubai Islamic Bank (DISB.DU).

The United Arab Emirates expects its move to a 4-1/2 day working week and a Saturday-Sunday weekend will boost its economy and make it a more attractive place for foreigners to live, the minister of human resources and Emiratisation said on Wednesday. read more

The market remains fundamentally directed towards growth as new IPOs continue being announced and the shift to the new weekend scheme could start showing its impact on investment and trade, said Mourad.

The Qatari benchmark (.QSI) edged 0.1% higher, helped by a 0.5% increase in Qatar Islamic Bank (QISB.QA).

Outside the Gulf, Egypt's blue-chip index (.EGX30) finished 0.7% higher, driven by a 20% surge in Abu Qir Fertilizers (ABUK.CA) following a block trade worth 2.25 billion Egyptian pounds ($143.59 million).

Credit Suisse's Iqbal on #UAE Weekend Switch - Bloomberg video

Oil Slides After Three-Day Gain as Traders Assess Omicron Risk - Bloomberg

Oil Slides After Three-Day Gain as Traders Assess Omicron Risk - Bloomberg

Oil fell after three days of gains as traders weighed mixed signals on how the omicron variant of the virus may impact fuel demand.

Futures slipped near $72 a barrel in New York, having climbed more than 9% over the prior three sessions. While lab studies by Pfizer Inc. and BioNTech SE show a third dose of their vaccine can neutralize omicron, government restrictions aimed at containing its spread are still casting a shadow over the outlook for consumption.

U.S. crude stockpiles, meanwhile, dropped by a modest 241,000 barrels last week for a second weekly draw, according to government data. Inventories of gasoline and distillates, a category that includes diesel, rose.

| PRICES |

|---|

|

Futures slipped near $72 a barrel in New York, having climbed more than 9% over the prior three sessions. While lab studies by Pfizer Inc. and BioNTech SE show a third dose of their vaccine can neutralize omicron, government restrictions aimed at containing its spread are still casting a shadow over the outlook for consumption.

U.S. crude stockpiles, meanwhile, dropped by a modest 241,000 barrels last week for a second weekly draw, according to government data. Inventories of gasoline and distillates, a category that includes diesel, rose.

Drake and Scull says former CEO still faces criminal, civil proceedings in UAE | ZAWYA MENA Edition

Drake and Scull says former CEO still faces criminal, civil proceedings in UAE | ZAWYA MENA Edition

The former CEO of Drake & Scull (DSI) Khaldoun Al Tabari, his daughter and others still face civil proceedings in Dubai courts, in addition to 15 criminal cases before the country’s Federal Public Prosecutor, according to the company.

Despite facing no attempt to seize assets in Jordan, courts have frozen Al Tabari’s assets in the UAE, under the instructions of the Federal Public Prosecutor, DSI said in a statement of clarification to Dubai Financial Market (DFM) today.

“With reference to the news circulated in the Jordanian newspapers on Wednesday, December 8, 2021, it was reported that the Jordanian Courts had acquitted the businessman Khaldoun Al Tabari and his daughter Zina from all the cases brought against them by the public prosecutor.

“DSI confirms that there are several civil cases still pending before the Dubai courts, in addition to 15 criminal cases that remain before the Federal Public Prosecutor in the UAE against Khaldoun Al Tabari, his daughter Zina and others,” the statement said.

The former CEO of Drake & Scull (DSI) Khaldoun Al Tabari, his daughter and others still face civil proceedings in Dubai courts, in addition to 15 criminal cases before the country’s Federal Public Prosecutor, according to the company.

Despite facing no attempt to seize assets in Jordan, courts have frozen Al Tabari’s assets in the UAE, under the instructions of the Federal Public Prosecutor, DSI said in a statement of clarification to Dubai Financial Market (DFM) today.

“With reference to the news circulated in the Jordanian newspapers on Wednesday, December 8, 2021, it was reported that the Jordanian Courts had acquitted the businessman Khaldoun Al Tabari and his daughter Zina from all the cases brought against them by the public prosecutor.

“DSI confirms that there are several civil cases still pending before the Dubai courts, in addition to 15 criminal cases that remain before the Federal Public Prosecutor in the UAE against Khaldoun Al Tabari, his daughter Zina and others,” the statement said.

Oil adds to gains as worries over Omicron ease | Reuters

Oil adds to gains as worries over Omicron ease | Reuters

Oil prices rose on Thursday, extending gains into a fourth session on positive comments from vaccine makers about their efficacy against the Omicron variant, even as some governments stepped up curbs to stop its rapid spread.

U.S. West Texas Intermediate (WTI) crude futures rose 48 cents, or 0.7%, to $72.84 a barrel at 0751 GMT, adding to a 0.4% gain in the previous session.

Brent crude futures rose 39 cents, or 0.5%, to $76.22 a barrel, adding to a similar gain on Wednesday.

Markets were buoyed by comments from BioNTech and Pfizer that a three-shot course of their COVID-19 vaccine may protect against infection from the Omicron variant. read more

Oil prices rose on Thursday, extending gains into a fourth session on positive comments from vaccine makers about their efficacy against the Omicron variant, even as some governments stepped up curbs to stop its rapid spread.

U.S. West Texas Intermediate (WTI) crude futures rose 48 cents, or 0.7%, to $72.84 a barrel at 0751 GMT, adding to a 0.4% gain in the previous session.

Brent crude futures rose 39 cents, or 0.5%, to $76.22 a barrel, adding to a similar gain on Wednesday.

Markets were buoyed by comments from BioNTech and Pfizer that a three-shot course of their COVID-19 vaccine may protect against infection from the Omicron variant. read more

Most Gulf bourses gain as Omicron concerns wane | Reuters

Most Gulf bourses gain as Omicron concerns wane | Reuters

Most stock markets in the Gulf climbed on Thursday, in line with rising oil prices following positive comments from vaccine makers about the Omicron coronavirus variant.

Brent crude futures rose 40 cents, or 0.5%, to $76.22 a barrel, extending gains into a fourth session.

Saudi Arabia's benchmark index (.TASI) added 0.2%, with Al Rajhi Bank (1120.SE) rising 1% and Saudi British Bank (1060.SE) climbing 1.2%.

The kingdom's stock exchange has 50 applications from companies for initial public offerings (IPOs) next year and is considering whether to allow blank-cheque companies, known as SPACs, to list, Saudi Tadawul Group Chief Executive Officer Khalid al-Hussan said on Wednesday. read more

Dubai's main share index (.DFMGI) gained 0.8%, rising for a seventh consecutive session, led by a 1.3% gain in sharia-compliant lender Dubai Islamic Bank (DISB.DU).

The United Arab Emirates expects its decision to introduce a 4-1/2-day working week and a Saturday-Sunday weekend to boost its economy and make it a more attractive place for foreigners to live, the minister of human resources and Emiratisation said on Wednesday. read more

The Qatari benchmark (.QSI) was up 0.1%, supported by a 1.1% rise in petrochemical maker Industries Qatar (IQCD.QA).

Meanwhile, Saudi Arabia's de facto ruler Crown Prince Mohammed bin Salman arrived in Doha on Wednesday on his first visit since Riyadh and several Arab allies imposed an embargo on Qatar in mid-2017 and set off a bitter dispute that was resolved only in January. read more

In Abu Dhabi, the index (.ADI) eased 0.3%, hit by a 1.2% fall in telecoms firm Etisalat (ETISALAT.AD).

Most stock markets in the Gulf climbed on Thursday, in line with rising oil prices following positive comments from vaccine makers about the Omicron coronavirus variant.

Brent crude futures rose 40 cents, or 0.5%, to $76.22 a barrel, extending gains into a fourth session.

Saudi Arabia's benchmark index (.TASI) added 0.2%, with Al Rajhi Bank (1120.SE) rising 1% and Saudi British Bank (1060.SE) climbing 1.2%.

The kingdom's stock exchange has 50 applications from companies for initial public offerings (IPOs) next year and is considering whether to allow blank-cheque companies, known as SPACs, to list, Saudi Tadawul Group Chief Executive Officer Khalid al-Hussan said on Wednesday. read more

Dubai's main share index (.DFMGI) gained 0.8%, rising for a seventh consecutive session, led by a 1.3% gain in sharia-compliant lender Dubai Islamic Bank (DISB.DU).

The United Arab Emirates expects its decision to introduce a 4-1/2-day working week and a Saturday-Sunday weekend to boost its economy and make it a more attractive place for foreigners to live, the minister of human resources and Emiratisation said on Wednesday. read more

The Qatari benchmark (.QSI) was up 0.1%, supported by a 1.1% rise in petrochemical maker Industries Qatar (IQCD.QA).

Meanwhile, Saudi Arabia's de facto ruler Crown Prince Mohammed bin Salman arrived in Doha on Wednesday on his first visit since Riyadh and several Arab allies imposed an embargo on Qatar in mid-2017 and set off a bitter dispute that was resolved only in January. read more

In Abu Dhabi, the index (.ADI) eased 0.3%, hit by a 1.2% fall in telecoms firm Etisalat (ETISALAT.AD).