| PRICES: |

|---|

Oil fell as the International Energy Agency said the global oil market has returned to surplus, while some countries tightened restrictions in an effort to tame the omicron variant’s spread. Futures in New York closed down 0.8% on Tuesday. The IEA said rebounding output has created an oversupply that’s likely to swell further next year. Italy will require travelers from other European Union countries to provide a negative Covid-19 test, and Scotland is urging no more than three households to mix. As the market digests the near-term effects of omicron on oil demand, Brent’s so-called prompt spread flipped into contango for the first time since March, excluding contract expiration days. The bearish market structure, in which the contract for immediate delivery is trading at a discount to oil for future delivery, indicates plentiful supply over the short term. |

Solely aggregation of news articles, with no opinions expressed by this service since 2009 launch on this platform. Copyright to all articles remains with the original publisher and HEADLINES ARE CLICKABLE to access the whole article at source. (Subscription by email is recommended,with real-time updates on LinkedIn and Twitter.)

Tuesday, 14 December 2021

Oil Slides on Global Surplus as Omicron Stokes Demand Fears - Bloomberg

Oil Slides on Global Surplus as Omicron Stokes Demand Fears - Bloomberg

Oil drops towards $73 as Omicron concerns dominate | Reuters

Oil drops towards $73 as Omicron concerns dominate | Reuters

Oil prices dropped towards $73 a barrel on Tuesday after the International Energy Agency (IEA) said that the Omicron coronavirus variant is set to dent the global demand recovery.

U.S. data showing producer prices at 11-year highs confirmed market expectations of faster stimulus tapering to emerge from this week's Federal Reserve meeting, supporting the dollar and weighing on oil, which typically move inversely. read more

Brent crude oil futures dropped 98 cents, or 1.32%, to $73.41 a barrel by 1405 GMT. U.S. West Texas Intermediate (WTI) crude futures lost 93 cents, or 1.3%, to $70.36.

"The surge in new COVID-19 cases is expected to temporarily slow, but not upend, the recovery in oil demand that is under way," the Paris-based IEA said in its monthly oil report. read more

Oil prices dropped towards $73 a barrel on Tuesday after the International Energy Agency (IEA) said that the Omicron coronavirus variant is set to dent the global demand recovery.

U.S. data showing producer prices at 11-year highs confirmed market expectations of faster stimulus tapering to emerge from this week's Federal Reserve meeting, supporting the dollar and weighing on oil, which typically move inversely. read more

Brent crude oil futures dropped 98 cents, or 1.32%, to $73.41 a barrel by 1405 GMT. U.S. West Texas Intermediate (WTI) crude futures lost 93 cents, or 1.3%, to $70.36.

"The surge in new COVID-19 cases is expected to temporarily slow, but not upend, the recovery in oil demand that is under way," the Paris-based IEA said in its monthly oil report. read more

Most Gulf bourses rise ahead of cenbank meetings | Reuters

Most Gulf bourses rise ahead of cenbank meetings | Reuters

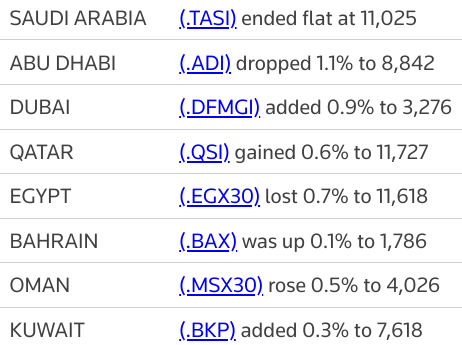

Most stock markets in the Gulf reversed early losses to close higher on Tuesday despite Omicron coronovirus variant fears as the markets await central banks' decisions regarding their policies this week.

The global balancing act begins Tuesday when the Federal Reserve convenes for a two-day meeting, and includes new monetary policy statements by the U.S. central bank on Wednesday, the European Central Bank and the Bank of England on Thursday, and the Bank of Japan on Friday. read more

Dubai's main share index (.DFMGI) advanced 0.9%, rising for a 10th consecutive session as investors remain optimistic regarding the market's potential to grow with upcoming initial public offerings.

Sharia-compliant lender Dubai Islamic Bank (DISB.DU) gained 2%, while top bank Emirates NBD (ENBD.DU) added 1.8%.

Last month, the government announced plans for 10 state-backed companies to be listed as part of efforts to boost activity on the local bourse.

The listings are aimed at making Dubai a more competitive market against bigger bourses in the region, such as those in Saudi Arabia and Abu Dhabi, which are achieving larger listings and strong liquidity.

In Qatar, the index (.QSI) was up 0.6%, with petrochemical maker Industries Qatar (IQCD.QA) putting on 1.1%.

Saudi Arabia's benchmark index (.TASI) closed flat, as gains in petrochemical shares were offset by declines in financials.

Investors remain cautious in front of the threat of omicron and the expected faster asset purchases tapering pace from the Federal Reserve, said Wael Makarem, senior market strategist at Exness.

Brent crude oil futures rose 27 cents, or 0.36%, to $74.66 a barrel by 1231 GMT.

The Organization of the Petroleum Exporting Countries on Monday raised its world oil demand forecast for the first quarter of 2022 and stuck to its timeline for a return to pre-pandemic levels of oil use, saying the Omicron coronavirus variant would have a mild and brief impact. read more

In Abu Dhabi, the index (.ADI) dropped 1.1%, dragged down by a 8.9% slide in Alpha Dhabi Holding (ALPHADHABI.AD).

Outside the Gulf, Egypt's blue-chip index (.EGX30) dropped 0.7%, hit by a 0.6% fall in Commercial International Bank Egypt (COMI.CA).

Most stock markets in the Gulf reversed early losses to close higher on Tuesday despite Omicron coronovirus variant fears as the markets await central banks' decisions regarding their policies this week.

The global balancing act begins Tuesday when the Federal Reserve convenes for a two-day meeting, and includes new monetary policy statements by the U.S. central bank on Wednesday, the European Central Bank and the Bank of England on Thursday, and the Bank of Japan on Friday. read more

Dubai's main share index (.DFMGI) advanced 0.9%, rising for a 10th consecutive session as investors remain optimistic regarding the market's potential to grow with upcoming initial public offerings.

Sharia-compliant lender Dubai Islamic Bank (DISB.DU) gained 2%, while top bank Emirates NBD (ENBD.DU) added 1.8%.

Last month, the government announced plans for 10 state-backed companies to be listed as part of efforts to boost activity on the local bourse.

The listings are aimed at making Dubai a more competitive market against bigger bourses in the region, such as those in Saudi Arabia and Abu Dhabi, which are achieving larger listings and strong liquidity.

In Qatar, the index (.QSI) was up 0.6%, with petrochemical maker Industries Qatar (IQCD.QA) putting on 1.1%.

Saudi Arabia's benchmark index (.TASI) closed flat, as gains in petrochemical shares were offset by declines in financials.

Investors remain cautious in front of the threat of omicron and the expected faster asset purchases tapering pace from the Federal Reserve, said Wael Makarem, senior market strategist at Exness.

Brent crude oil futures rose 27 cents, or 0.36%, to $74.66 a barrel by 1231 GMT.

The Organization of the Petroleum Exporting Countries on Monday raised its world oil demand forecast for the first quarter of 2022 and stuck to its timeline for a return to pre-pandemic levels of oil use, saying the Omicron coronavirus variant would have a mild and brief impact. read more

In Abu Dhabi, the index (.ADI) dropped 1.1%, dragged down by a 8.9% slide in Alpha Dhabi Holding (ALPHADHABI.AD).

Outside the Gulf, Egypt's blue-chip index (.EGX30) dropped 0.7%, hit by a 0.6% fall in Commercial International Bank Egypt (COMI.CA).