Abu Dhabi’s Alpha Dhabi to invest $2.2bn on expansion

Alpha Dhabi Holding, a subsidiary of Abu Dhabi's International Holding Company, will invest Dh8 billion ($2.2bn) across various sectors as part of its expansion strategy to boost growth.

The company will invest the earmarked funds in real estate, hospitality, healthcare, petrochemicals and “other promising sectors” in the UAE and outside the country, it said in a statement to the Abu Dhabi Securities Exchange, where its shares are traded.

“During our board meeting, we approved the expansion of our investment portfolio, a reflection of the company’s shareholder confidence, our leadership’s vision and remarkable growth recorded to date,” said Hamad Al Ameri, managing director and chief executive of Alpha Dhabi Holding. “We believe that a carefully administered investment ... will help fulfill our responsibility to shareholders, adding value by expanding our diverse portfolio.”

Alpha Dhabi, which has a market value of Dh257.4bn and was previously known as Trojan Holding, has grown into a regional conglomerate with interests in construction, health care, hospitality and industry after completing a series of acquisitions this year.

Solely aggregation of news articles, with no opinions expressed by this service since 2009 launch on this platform. Copyright to all articles remains with the original publisher and HEADLINES ARE CLICKABLE to access the whole article at source. (Subscription by email is recommended,with real-time updates on LinkedIn and Twitter.)

Thursday, 16 December 2021

Oil rises around 2% on strong U.S. demand, upbeat Fed outlook | Reuters

Oil rises around 2% on strong U.S. demand, upbeat Fed outlook | Reuters

Oil prices rose around 2% on Thursday, as record U.S. implied demand, falling crude stockpiles and an upbeat economic outlook from the Federal Reserve trumped fears of the Omicron coronavirus variant hurting global consumption.

Crude and other risk assets such as equities also got a boost after the Fed gave an upbeat economic outlook, lifting investor spirits even as the U.S. central bank flagged a long-awaited end to monetary stimulus.

"The market was fearful of what the Fed was going to do, and now that it's in the rearview and we know what we're dealing with, the market is rallying," said Phil Flynn, senior analyst price futures group in Chicago.

Brent crude oil rose $1.14, or 1.5%, to settle at $75.02 a barrel, while U.S. West Texas Intermediate (WTI) crude rose $1.51, or 2.1%, to settle at $72.38 a barrel, a 2.13 percent gain.

Oil prices rose around 2% on Thursday, as record U.S. implied demand, falling crude stockpiles and an upbeat economic outlook from the Federal Reserve trumped fears of the Omicron coronavirus variant hurting global consumption.

Crude and other risk assets such as equities also got a boost after the Fed gave an upbeat economic outlook, lifting investor spirits even as the U.S. central bank flagged a long-awaited end to monetary stimulus.

"The market was fearful of what the Fed was going to do, and now that it's in the rearview and we know what we're dealing with, the market is rallying," said Phil Flynn, senior analyst price futures group in Chicago.

Brent crude oil rose $1.14, or 1.5%, to settle at $75.02 a barrel, while U.S. West Texas Intermediate (WTI) crude rose $1.51, or 2.1%, to settle at $72.38 a barrel, a 2.13 percent gain.

Mayfair Man Arrested for Smuggling Millions From London to #Dubai - Bloomberg

Mayfair Man Arrested for Smuggling Millions From London to Dubai - Bloomberg

British cops arrested a key figure in a 100 million-pound ($132 million) money laundering scheme, alleging he organized a “mule network” of couriers carrying suitcases packed with cash from the U.K. to Dubai.

National Crime Agency officials arrested the 46-year-old Emirati at a flat in London’s upmarket Mayfair district, according to an emailed statement Tuesday. The man is alleged to have arranged for dozens of couriers to carry the criminal cash.

“The criminal network we allege he was involved in is one of the biggest of its kind we have investigated, paying couriers thousands to carry millions of pounds at a time rammed into suitcases,” the NCA’s investigating officer, Ian Truby, said.

The NCA said two couriers have so far been jailed and it had made ten further arrests of those linked to the network.

British cops arrested a key figure in a 100 million-pound ($132 million) money laundering scheme, alleging he organized a “mule network” of couriers carrying suitcases packed with cash from the U.K. to Dubai.

National Crime Agency officials arrested the 46-year-old Emirati at a flat in London’s upmarket Mayfair district, according to an emailed statement Tuesday. The man is alleged to have arranged for dozens of couriers to carry the criminal cash.

“The criminal network we allege he was involved in is one of the biggest of its kind we have investigated, paying couriers thousands to carry millions of pounds at a time rammed into suitcases,” the NCA’s investigating officer, Ian Truby, said.

The NCA said two couriers have so far been jailed and it had made ten further arrests of those linked to the network.

#AbuDhabi Investment Partners With Greystar to Build Rental Homes Around London - Bloomberg

Abu Dhabi Investment Partners With Greystar to Build Rental Homes Around London - Bloomberg

The Abu Dhabi Investment Authority and private equity firm Greystar Real Estate Partners LLC are partnering to develop purpose-built rental housing around London and its suburbs in a deal valued at up to 2.2 billion pounds ($2.9 billion).

Greystar also confirmed that it is buying London rental housing business Fizzy Living from Metropolitan Thames Valley Housing, according to an emailed statement on Thursday. The purchase will see the U.S. residential real estate investor taking over management of almost 1,000 homes.

The U.K.’s purpose-built rental housing market is attracting greater investor interest as a sustained lack of housing supply in the country makes renting more attractive. Those pressures are particularly acute in London and its surrounding commuter towns, where Greystar and ADIA will build their pipeline, starting with a seed asset in the south London neighborhood of Battersea.

“Demographic trends and a severe structural undersupply of housing is driving demand for high quality rental homes in the U.K.,” said Mark Allnutt, Greystar’s senior managing director in Europe. “This remains a high conviction investment strategy for Greystar.”

The Abu Dhabi Investment Authority and private equity firm Greystar Real Estate Partners LLC are partnering to develop purpose-built rental housing around London and its suburbs in a deal valued at up to 2.2 billion pounds ($2.9 billion).

Greystar also confirmed that it is buying London rental housing business Fizzy Living from Metropolitan Thames Valley Housing, according to an emailed statement on Thursday. The purchase will see the U.S. residential real estate investor taking over management of almost 1,000 homes.

The U.K.’s purpose-built rental housing market is attracting greater investor interest as a sustained lack of housing supply in the country makes renting more attractive. Those pressures are particularly acute in London and its surrounding commuter towns, where Greystar and ADIA will build their pipeline, starting with a seed asset in the south London neighborhood of Battersea.

“Demographic trends and a severe structural undersupply of housing is driving demand for high quality rental homes in the U.K.,” said Mark Allnutt, Greystar’s senior managing director in Europe. “This remains a high conviction investment strategy for Greystar.”

Dutch Urban Farming Startup Infarm Gets Backing From #Qatar Wealth Fund - Bloomberg

Dutch Urban Farming Startup Infarm Gets Backing From Qatar Wealth Fund - Bloomberg

InFarm produces salad greens and herbs in indoor centers across 11 nations. Source: InFarm Indoor farming startup Infarm raised an extra $200 million from investors including the Qatar Investment Authority to fund a push into new markets such as the Middle East as part of a global expansion. Infarm grows products like salad greens and herbs in indoor centers in Europe, North America and Japan, and supplies retailers like Amazon Fresh, Metro AG and Marks & Spencer Group Plc. The Amsterdam-headquartered company plans to use the new funding to expand to more fruit and vegetables and to open its first center in Qatar in 2023 as it enters new markets in the Middle East and Asia-Pacific. Growing crops on vertically stacked shelves in cities has gained traction as the Covid pandemic snarled supply chains and brought food security to the fore, especially in nations that import most of their food. It uses less space, water and pesticides than conventional farming. The food can also be grown closer to consumers, reducing transport needs, but can be much more energy intensive. Infarm said it has raised more than $500 million -- ranking it among the best-funded vertical farming companies -- and has a valuation of more than $1 billion. |

Saudi Arabia Sells $8 Billion in U.S. Debt, Bringing Its Holdings to 4-Year Low - Bloomberg

Saudi Arabia Sells $8 Billion in U.S. Debt, Bringing Its Holdings to 4-Year Low - Bloomberg

Saudi Arabia’s hoard of U.S. Treasuries fell to the lowest level in about four years in October, even as the country’s oil revenue surged.

The kingdom sold around $8 billion in U.S. government debt, the most in over a year, bringing its stock to $116.5 billion, according to Treasury Department data. It was the biggest seller after Norway, which sold $16 billion in October, the latest month for which figures are available.

The drop in Treasury holdings coincided with a $15 billion fall in foreign assets held by the Saudi central bank, which manages the kingdom’s reserves. It also came as crude prices averaged $78.52 a barrel in October, the highest monthly average in three years. Expectations of higher oil prices and production volumes have led the government to forecast it will report its first budget surplus in nearly a decade in 2022.

Saudi Arabia’s hoard of U.S. Treasuries fell to the lowest level in about four years in October, even as the country’s oil revenue surged.

The kingdom sold around $8 billion in U.S. government debt, the most in over a year, bringing its stock to $116.5 billion, according to Treasury Department data. It was the biggest seller after Norway, which sold $16 billion in October, the latest month for which figures are available.

The drop in Treasury holdings coincided with a $15 billion fall in foreign assets held by the Saudi central bank, which manages the kingdom’s reserves. It also came as crude prices averaged $78.52 a barrel in October, the highest monthly average in three years. Expectations of higher oil prices and production volumes have led the government to forecast it will report its first budget surplus in nearly a decade in 2022.

Oil rises towards $75 as U.S. demand and Fed outweigh virus concern | Reuters

Oil rises towards $75 as U.S. demand and Fed outweigh virus concern | Reuters

Oil rose towards $75 on Thursday, supported by record U.S. implied demand and falling crude stockpiles, even as the spread of the Omicron coronavirus variant threatens to put a brake on consumption globally.

Crude and other risk assets such as equities also got a boost after the U.S. Federal Reserve gave an upbeat economic outlook, which lifted investor spirits even as the Fed flagged a long-awaited end to its monetary stimulus.

Brent crude oil was up 65 cents, or 0.9%, to $74.53 a barrel at 1215 GMT, while U.S. West Texas Intermediate (WTI) crude rose $1.01 or 1.4%, to $71.88.

Demand has been rising in 2021 after last year's collapse, and the U.S. Energy Information Administration (EIA) on Wednesday said product supplied by refineries, a proxy for demand, surged in the latest week to 23.2 million barrels per day (bpd).

Oil rose towards $75 on Thursday, supported by record U.S. implied demand and falling crude stockpiles, even as the spread of the Omicron coronavirus variant threatens to put a brake on consumption globally.

Crude and other risk assets such as equities also got a boost after the U.S. Federal Reserve gave an upbeat economic outlook, which lifted investor spirits even as the Fed flagged a long-awaited end to its monetary stimulus.

Brent crude oil was up 65 cents, or 0.9%, to $74.53 a barrel at 1215 GMT, while U.S. West Texas Intermediate (WTI) crude rose $1.01 or 1.4%, to $71.88.

Demand has been rising in 2021 after last year's collapse, and the U.S. Energy Information Administration (EIA) on Wednesday said product supplied by refineries, a proxy for demand, surged in the latest week to 23.2 million barrels per day (bpd).

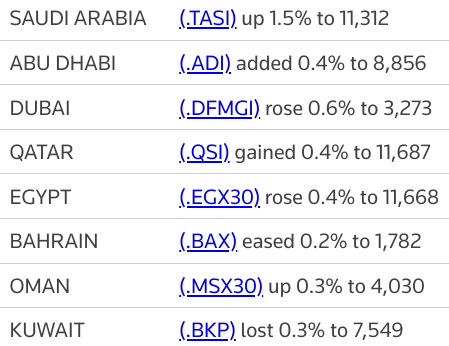

Major Gulf bourses rise, in line with global shares | Reuters

Major Gulf bourses rise, in line with global shares | Reuters

Major stock markets ended higher on Thursday in line with global shares, after the U.S. Federal Reserve said it would end its pandemic-era bond purchases in March and begin raising interest rates as much as three times next year.

Saudi Arabia's benchmark index (.TASI) advanced 1.5%, buoyed by a 2.2% rise in Al Rajhi Bank (1120.SE) and a 6.7% jump in Banque Saudi Fransi (1050.SE).

The Saudi bourse continues its recovery as oil prices inched higher providing support to local stocks, said Wael Makarem, senior market strategist at Exness.

Dubai's main share index (.DFMGI) closed 0.6% higher, rising for an eleventh session in twelve, helped by a 1.1% gain in Emirates NBD Bank (ENBD.DU) and a 0.7% increase in sharia-compliant lender Dubai Islamic Bank (DISB.DU).

Investors concentrate on the local fundamentals again expecting solid developments as new initial public offerings (IPO) roll out, said Makarem.

"The bourse could also benefit from the recent changes in trading days starting next month."

Last month, the emirate announced plans for 10 state-backed companies to be listed as part of efforts to boost activity on the local bourse.

The listings are aimed at making Dubai a more competitive market in the region, as bourses in Saudi Arabia and Abu Dhabi see larger listings and strong liquidity.

In Abu Dhabi, the index (.ADI) gained 0.4%, with telecoms firm Etisalat (ETISALAT.AD) rising 1.9% and conglomerate International Holding finishing 2.3% higher.

However, the index saw its first weekly loss in seven.

The Qatari benchmark index (.QSI) added 0.4%, led by a 2% rise in Islamic lender Masraf Al-Rayan (MARK.QA).

The central bank of Qatar said on Thursday it will start working on a gradual reduction of the measures introduced to support the economy given the recovery from the coronavirus crisis in the tiny but wealthy Gulf state. read more

The central bank also said the local financial and banking system was stable and domestic liquidity high.

Outside the Gulf, Egypt's blue-chip index (.EGX30) firmed 0.4%, with Fawry for Banking Technology and Electronic Payment (FWRY.CA) climbing 4%.

Major stock markets ended higher on Thursday in line with global shares, after the U.S. Federal Reserve said it would end its pandemic-era bond purchases in March and begin raising interest rates as much as three times next year.

Saudi Arabia's benchmark index (.TASI) advanced 1.5%, buoyed by a 2.2% rise in Al Rajhi Bank (1120.SE) and a 6.7% jump in Banque Saudi Fransi (1050.SE).

The Saudi bourse continues its recovery as oil prices inched higher providing support to local stocks, said Wael Makarem, senior market strategist at Exness.

Dubai's main share index (.DFMGI) closed 0.6% higher, rising for an eleventh session in twelve, helped by a 1.1% gain in Emirates NBD Bank (ENBD.DU) and a 0.7% increase in sharia-compliant lender Dubai Islamic Bank (DISB.DU).

Investors concentrate on the local fundamentals again expecting solid developments as new initial public offerings (IPO) roll out, said Makarem.

"The bourse could also benefit from the recent changes in trading days starting next month."

Last month, the emirate announced plans for 10 state-backed companies to be listed as part of efforts to boost activity on the local bourse.

The listings are aimed at making Dubai a more competitive market in the region, as bourses in Saudi Arabia and Abu Dhabi see larger listings and strong liquidity.

In Abu Dhabi, the index (.ADI) gained 0.4%, with telecoms firm Etisalat (ETISALAT.AD) rising 1.9% and conglomerate International Holding finishing 2.3% higher.

However, the index saw its first weekly loss in seven.

The Qatari benchmark index (.QSI) added 0.4%, led by a 2% rise in Islamic lender Masraf Al-Rayan (MARK.QA).

The central bank of Qatar said on Thursday it will start working on a gradual reduction of the measures introduced to support the economy given the recovery from the coronavirus crisis in the tiny but wealthy Gulf state. read more

The central bank also said the local financial and banking system was stable and domestic liquidity high.

Outside the Gulf, Egypt's blue-chip index (.EGX30) firmed 0.4%, with Fawry for Banking Technology and Electronic Payment (FWRY.CA) climbing 4%.

Ex-CEO of Swiss bank Falcon acquitted in money-laundering trial | Reuters

Ex-CEO of Swiss bank Falcon acquitted in money-laundering trial | Reuters

A court acquitted the former chief executive of a Swiss private bank but fined the now-defunct lender 3.5 million Swiss francs ($3.8 million) on Wednesday for helping a Gulf businessman launder money to buy luxury property and cars.

Eduardo Leemann, 65, had denied prosecutors' allegations that as chief executive of Falcon Private Bank he helped launder 133 million euros ($150 million) in illicit proceeds between 2012 and 2016.

He was also accused of making payments of 61 million euros to help the businessman maintain a high roller's lifestyle complete with fast cars and expensive foreign properties.

Prosecutors said the funds came from a deal the businessman put together to sell shares he covertly held in Italian bank UniCredit SpA (CRDI.MI) at an inflated price to Aabar, an Emirati investment firm where he worked.

A court acquitted the former chief executive of a Swiss private bank but fined the now-defunct lender 3.5 million Swiss francs ($3.8 million) on Wednesday for helping a Gulf businessman launder money to buy luxury property and cars.

Eduardo Leemann, 65, had denied prosecutors' allegations that as chief executive of Falcon Private Bank he helped launder 133 million euros ($150 million) in illicit proceeds between 2012 and 2016.

He was also accused of making payments of 61 million euros to help the businessman maintain a high roller's lifestyle complete with fast cars and expensive foreign properties.

Prosecutors said the funds came from a deal the businessman put together to sell shares he covertly held in Italian bank UniCredit SpA (CRDI.MI) at an inflated price to Aabar, an Emirati investment firm where he worked.

ENBD REIT refinances entire debt with $200 million syndicated facility | Reuters

ENBD REIT refinances entire debt with $200 million syndicated facility | Reuters

ENBD REIT (ENBDREIT.DI), a real estate investment trust set up by the asset management arm of Dubai's biggest lender, said on Thursday it has refinanced its entire debt with a syndicated facility worth $200 million through Emirates NBD (ENBD.DU) and Commercial Bank of Dubai .

The Murabaha facility, a shariah-compliant structure, was syndicated by Emirates NBD Capital, Emirates NBD's investment banking arm.

ENBD REIT's debt facilities comprise $45 million from Standard Chartered and $150 million from Mashreq. Consolidating the outstanding debt will improve the REIT's capital structure and cut financing costs, it said.

"The 5-year facility is profit only and includes a cross currency swap to improve overall pricing. The improved profit margin is likely to result in over USD 7 million of savings on ENBD REIT's financing costs over the term of the facility," ENBD REIT said in a statement.

Ahmed Al Qassim, group head of corporate and institutional banking at Emirates NBD, said ENBD REIT took advantage of market conditions to "optimise its profile".

ENBD REIT (ENBDREIT.DI), a real estate investment trust set up by the asset management arm of Dubai's biggest lender, said on Thursday it has refinanced its entire debt with a syndicated facility worth $200 million through Emirates NBD (ENBD.DU) and Commercial Bank of Dubai .

The Murabaha facility, a shariah-compliant structure, was syndicated by Emirates NBD Capital, Emirates NBD's investment banking arm.

ENBD REIT's debt facilities comprise $45 million from Standard Chartered and $150 million from Mashreq. Consolidating the outstanding debt will improve the REIT's capital structure and cut financing costs, it said.

"The 5-year facility is profit only and includes a cross currency swap to improve overall pricing. The improved profit margin is likely to result in over USD 7 million of savings on ENBD REIT's financing costs over the term of the facility," ENBD REIT said in a statement.

Ahmed Al Qassim, group head of corporate and institutional banking at Emirates NBD, said ENBD REIT took advantage of market conditions to "optimise its profile".

MSCI considers new region for Israeli index, with potential windfall | Reuters

MSCI considers new region for Israeli index, with potential windfall | Reuters

Global index provider MSCI is considering reassigning Israel to a new region, likely Europe, which would open the door to large amounts of passive inflows for the Israeli market.

MSCI, which provides equity, fixed income and hedge fund indexes, upgraded Israel from an emerging to developed market in 2010. It is the only country in the Middle East in that category and MSCI is now seeking market feedback on whether it should be regionally classified elsewhere.

Israel's security regulator cited MSCI as saying it was focusing on a reassignment for Israel to Europe, which would expose Israel's capital market to billions of dollars of possible new investment.

"The MSCI Israel Index has more economic exposure to Europe than to the Pacific and Middle East regions," MSCI said, noting the most exposure still comes from North America.

Global index provider MSCI is considering reassigning Israel to a new region, likely Europe, which would open the door to large amounts of passive inflows for the Israeli market.

MSCI, which provides equity, fixed income and hedge fund indexes, upgraded Israel from an emerging to developed market in 2010. It is the only country in the Middle East in that category and MSCI is now seeking market feedback on whether it should be regionally classified elsewhere.

Israel's security regulator cited MSCI as saying it was focusing on a reassignment for Israel to Europe, which would expose Israel's capital market to billions of dollars of possible new investment.

"The MSCI Israel Index has more economic exposure to Europe than to the Pacific and Middle East regions," MSCI said, noting the most exposure still comes from North America.

Rescued payments firm Finablr cannot delist in London -FCA | Reuters

Rescued payments firm Finablr cannot delist in London -FCA | Reuters

Troubled payments company Finablr has been told it cannot delist from the London Stock Exchange without a vote by its shareholders, Britain's Financial Conduct Authority (FCA) said on Thursday.

Finablr was bought by a Middle Eastern consortium and rebranded as WizzFinancial to create a regional money transfer group. read more

The company's shares have been suspended since March 2020.

Finablr's application to delist under a rule allowing firms in a precarious financial position to sidestep a shareholder vote has not met the necessary conditions, the FCA said.

Finablr has the right to refer the decision to an Upper Tribunal, the FCA said, adding it was unable to comment further on the reasons for its decision.

Troubled payments company Finablr has been told it cannot delist from the London Stock Exchange without a vote by its shareholders, Britain's Financial Conduct Authority (FCA) said on Thursday.

Finablr was bought by a Middle Eastern consortium and rebranded as WizzFinancial to create a regional money transfer group. read more

The company's shares have been suspended since March 2020.

Finablr's application to delist under a rule allowing firms in a precarious financial position to sidestep a shareholder vote has not met the necessary conditions, the FCA said.

Finablr has the right to refer the decision to an Upper Tribunal, the FCA said, adding it was unable to comment further on the reasons for its decision.

#Saudi Crown Prince MBS's Vision Imagines a Greener, Bigger Riyadh - Bloomberg

Saudi Crown Prince MBS's Vision Imagines a Greener, Bigger Riyadh - Bloomberg

On Riyadh’s King Abdulaziz Road, construction workers sweep sand off a brand-new sidewalk. A gardener pops a spindly plant out of a plastic pot and gives it a new home in the ground, smoothing the soft red earth with his hands.

Behind them, 15-foot-high banners advertise the future gardens and canals of King Salman Park, a plan to turn an air base in Saudi Arabia’s desert capital into a public green space four times bigger than Central Park in New York.

Saudis have gotten used to breakneck change over the past five years under Crown Prince Mohammed bin Salman, whether it’s the shock therapy to turn the kingdom into a post-oil economy, a high-tech city from scratch on the Red Sea or the loosening up of society that allows men and women to mix more freely. But among the most ambitious plans is to transform Riyadh — one of the world’s most sprawling, car-dependent and water-poor cities — into a paragon of sustainability.

That means spending tens of billions of dollars of oil revenue on re-engineering life for the city’s 8 million residents, adding sidewalks, public transportation, electric vehicles, neighborhood parks and millions of trees.

On Riyadh’s King Abdulaziz Road, construction workers sweep sand off a brand-new sidewalk. A gardener pops a spindly plant out of a plastic pot and gives it a new home in the ground, smoothing the soft red earth with his hands.

Behind them, 15-foot-high banners advertise the future gardens and canals of King Salman Park, a plan to turn an air base in Saudi Arabia’s desert capital into a public green space four times bigger than Central Park in New York.

Saudis have gotten used to breakneck change over the past five years under Crown Prince Mohammed bin Salman, whether it’s the shock therapy to turn the kingdom into a post-oil economy, a high-tech city from scratch on the Red Sea or the loosening up of society that allows men and women to mix more freely. But among the most ambitious plans is to transform Riyadh — one of the world’s most sprawling, car-dependent and water-poor cities — into a paragon of sustainability.

That means spending tens of billions of dollars of oil revenue on re-engineering life for the city’s 8 million residents, adding sidewalks, public transportation, electric vehicles, neighborhood parks and millions of trees.

Major Gulf bourses track oil, Asian shares higher | Reuters

Major Gulf bourses track oil, Asian shares higher | Reuters

Major stock markets in the Gulf rose in early trade on Thursday, in line with oil prices and Asian shares, after the U.S. Federal Reserve flagged a long-awaited end to its monetary stimulus next year but delivered an otherwise upbeat economic outlook.

Saudi Arabia's benchmark market (.TASI) gained 0.8%, buoyed by a 1.3% rise in Al Rajhi Bank (1120.SE) and a 1.9% increase in Saudi Basic Industries Corp (SABIC) (2010.SE).

SABIC, the world's fourth-biggest petrochemicals company by sales and asset value, proposed a second-half dividend of 2.25 riyals per share.

In Abu Dhabi, the index (.ADI) edged up 0.1%, with telecoms firm Etisalat (ETISALAT.AD) putting on 1.2%.

Oil prices, a key catalyst for the Gulf's financial markets, rose as the United States implied consumer petroleum demand surged to a record high in the world's top oil consumer even as the Omicron variant of coronavirus threatens to dent oil consumption globally.

Dubai's main share index (.DFMGI) added 0.3%, supported by a 1% rise in blue-chip developer Emaar Properties (EMAR.DU) and a 1.1% increase in Dubai Investments (DINV.DU).

Dubai Investments has made an offer to gain full ownership of National General Insurance Co (NGI) in a deal that values the company at nearly 468 million dirhams ($127.43 million). read more Shares of NGI were up 0.3%.

The Qatari index (.QSI) rose 0.4%, with petrochemical firm Industries Qatar (IQCD.QA) rising 1.3%.

The central bank of Qatar said on Thursday it will start working on a gradual reduction of the measures introduced to support the economy given the recovery from the impact of the coronavirus crisis in the tiny but wealthy Gulf state. read more

The central bank also said the local financial and banking system was stable and domestic liquidity high.

Major stock markets in the Gulf rose in early trade on Thursday, in line with oil prices and Asian shares, after the U.S. Federal Reserve flagged a long-awaited end to its monetary stimulus next year but delivered an otherwise upbeat economic outlook.

Saudi Arabia's benchmark market (.TASI) gained 0.8%, buoyed by a 1.3% rise in Al Rajhi Bank (1120.SE) and a 1.9% increase in Saudi Basic Industries Corp (SABIC) (2010.SE).

SABIC, the world's fourth-biggest petrochemicals company by sales and asset value, proposed a second-half dividend of 2.25 riyals per share.

In Abu Dhabi, the index (.ADI) edged up 0.1%, with telecoms firm Etisalat (ETISALAT.AD) putting on 1.2%.

Oil prices, a key catalyst for the Gulf's financial markets, rose as the United States implied consumer petroleum demand surged to a record high in the world's top oil consumer even as the Omicron variant of coronavirus threatens to dent oil consumption globally.

Dubai's main share index (.DFMGI) added 0.3%, supported by a 1% rise in blue-chip developer Emaar Properties (EMAR.DU) and a 1.1% increase in Dubai Investments (DINV.DU).

Dubai Investments has made an offer to gain full ownership of National General Insurance Co (NGI) in a deal that values the company at nearly 468 million dirhams ($127.43 million). read more Shares of NGI were up 0.3%.

The Qatari index (.QSI) rose 0.4%, with petrochemical firm Industries Qatar (IQCD.QA) rising 1.3%.

The central bank of Qatar said on Thursday it will start working on a gradual reduction of the measures introduced to support the economy given the recovery from the impact of the coronavirus crisis in the tiny but wealthy Gulf state. read more

The central bank also said the local financial and banking system was stable and domestic liquidity high.

#Qatar’s Record Bet on London Homes Sees $900 Million of Sales - Bloomberg

Qatar’s Record Bet on London Homes Sees $900 Million of Sales - Bloomberg

It was a real estate deal that broke U.K. price records, while sparking controversy that led to a royal objection, a costly redesign and a hostile split with the co-developer. But almost 14 years and a market slump later, there are signs of progress for Qatari Diar Real Estate Investment Co.’s Chelsea Barracks.

Properties worth about 200 million pounds ($265 million) have been sold in the west London project this year, taking the total to about 683 million pounds, according to a spokesperson for Chelsea Barracks. With construction complete on roughly 80 luxury homes, 92% of the finished properties have found owners, the spokesperson said.

“2021 has been a highly successful year for Chelsea Barracks in a challenging global environment,” said Richard Oakes, chief sales and marketing officer for Qatari Diar.

After splashing more than $1 billion on the former army barracks in 2008, the site’s owners are now signing deals with the world’s wealthiest home owners from Turkey to Hong Kong.

It was a real estate deal that broke U.K. price records, while sparking controversy that led to a royal objection, a costly redesign and a hostile split with the co-developer. But almost 14 years and a market slump later, there are signs of progress for Qatari Diar Real Estate Investment Co.’s Chelsea Barracks.

Properties worth about 200 million pounds ($265 million) have been sold in the west London project this year, taking the total to about 683 million pounds, according to a spokesperson for Chelsea Barracks. With construction complete on roughly 80 luxury homes, 92% of the finished properties have found owners, the spokesperson said.

“2021 has been a highly successful year for Chelsea Barracks in a challenging global environment,” said Richard Oakes, chief sales and marketing officer for Qatari Diar.

After splashing more than $1 billion on the former army barracks in 2008, the site’s owners are now signing deals with the world’s wealthiest home owners from Turkey to Hong Kong.

#Turkey, #UAE say they want deeper cooperation, trade after Dubai talks | Reuters

Turkey, UAE say they want deeper cooperation, trade after Dubai talks | Reuters

Turkey and the United Arab Emirates said on Wednesday they aim to deepen cooperation after talks in Dubai between the Turkish foreign minister and the UAE's prime minister, as the rivals step up diplomacy to mend ties strained by years of animosity.

Foreign Minister Mevlut Cavusoglu arrived in the UAE on Monday to discuss bilateral relations and meet Turkish businesspeople in Dubai, the region's trade and tourism hub. read more

The visit comes after Turkey and the UAE signed accords and deals at talks in Ankara last month, in a move President Tayyip Erdogan said would herald a "new era" in relations. read more

The Dubai Media Office said Sheikh Mohammed bin Rashid Al Maktoum, who is the ruler of Dubai and the UAE's vice president and prime minister, met Cavusoglu to discuss "strengthening cooperation between the UAE and Turkey and developing frameworks to collaborate on all areas of common interest."

Turkey and the United Arab Emirates said on Wednesday they aim to deepen cooperation after talks in Dubai between the Turkish foreign minister and the UAE's prime minister, as the rivals step up diplomacy to mend ties strained by years of animosity.

Foreign Minister Mevlut Cavusoglu arrived in the UAE on Monday to discuss bilateral relations and meet Turkish businesspeople in Dubai, the region's trade and tourism hub. read more

The visit comes after Turkey and the UAE signed accords and deals at talks in Ankara last month, in a move President Tayyip Erdogan said would herald a "new era" in relations. read more

The Dubai Media Office said Sheikh Mohammed bin Rashid Al Maktoum, who is the ruler of Dubai and the UAE's vice president and prime minister, met Cavusoglu to discuss "strengthening cooperation between the UAE and Turkey and developing frameworks to collaborate on all areas of common interest."

Oil prices rise as U.S. fuel demand jumps despite virus surge | Reuters

Oil prices rise as U.S. fuel demand jumps despite virus surge | Reuters

Oil prices rose on Thursday as U.S. implied consumer petroleum demand surged to a record high in the world's top oil consumer even as the Omicron variant of coronavirus threatens to dent oil consumption globally.

A signal by the U.S. Federal Reserve to tackle inflation before it derails the U.S. economy also boosted prices.

Brent crude oil futures rose by 65 cents, or 0.9%, to $74.53 a barrel by 0436 GMT, while U.S. West Texas Intermediate (WTI) crude futures increased by 74 cents, or 1%, to $71.61.

"Despite the current virus surge, the weekly EIA oil inventory report showed demand for petroleum products hit a record high, crude exports bounced back and national crude stocks posted a larger-than-expected draw," said Edward Moya, senior analyst at OANDA.

Oil prices rose on Thursday as U.S. implied consumer petroleum demand surged to a record high in the world's top oil consumer even as the Omicron variant of coronavirus threatens to dent oil consumption globally.

A signal by the U.S. Federal Reserve to tackle inflation before it derails the U.S. economy also boosted prices.

Brent crude oil futures rose by 65 cents, or 0.9%, to $74.53 a barrel by 0436 GMT, while U.S. West Texas Intermediate (WTI) crude futures increased by 74 cents, or 1%, to $71.61.

"Despite the current virus surge, the weekly EIA oil inventory report showed demand for petroleum products hit a record high, crude exports bounced back and national crude stocks posted a larger-than-expected draw," said Edward Moya, senior analyst at OANDA.