| PRICES |

|---|

Oil steadied near a four-week high as traders weighed falling U.S. crude stockpiles against the threat to demand from the omicron virus variant. Futures in New York traded near $73 a barrel during the session, though liquidity is dwindling heading into the holiday period. U.S. crude inventories dropped by 4.72 million barrels last week, according to government data, almost twice the median estimate in a Bloomberg survey. That offset some concerns about the impact of omicron on global consumption. “U.S. inventories remain very low,” said Scott Shelton, energy specialist at ICAP. “For those who are calling for builds in 2022, we had better start building or prices are going to $100-plus.” Trading volumes are starting to thin before Christmas, while open interest -- the total number of oil contracts held by traders -- for crude, gasoline and diesel futures combined is at its lowest in almost six years. Both could leave the market prone to sharp moves amid thin liquidity. |

Solely aggregation of news articles, with no opinions expressed by this service since 2009 launch on this platform. Copyright to all articles remains with the original publisher and HEADLINES ARE CLICKABLE to access the whole article at source. (Subscription by email is recommended,with real-time updates on LinkedIn and Twitter.)

Thursday, 23 December 2021

Oil Steadies Near Four-Week High as Inventories Vie With Omicron - Bloomberg

Oil Steadies Near Four-Week High as Inventories Vie With Omicron - Bloomberg

#Iran-#Saudi Talks Move Ahead as Tehran Says Diplomat Visas Issued - Bloomberg

Iran-Saudi Talks Move Ahead as Tehran Says Diplomat Visas Issued - Bloomberg

Iran and Saudi Arabia appeared to have made progress in their efforts to repair ties as Tehran said three Iranian diplomats had been granted visas to be based in the Saudi city of Jeddah.

Speaking to reporters alongside his Iraqi counterpart, Iran’s Foreign Minister Hossein Amirabdollahian said Baghdad-brokered talks with the kingdom had gone well, and officials in Riyadh responded positively to “constructive proposals” made by Tehran.

These included re-rebuilding official diplomatic links by granting visas for three Iranian diplomats to be based at the Organization of Islamic Cooperation, a Jeddah-based body consisting of 57 Muslim countries.

Saudi Arabia’s Center for International Communication didn’t immediately respond to an emailed request for comment.

Iran and Saudi Arabia appeared to have made progress in their efforts to repair ties as Tehran said three Iranian diplomats had been granted visas to be based in the Saudi city of Jeddah.

Speaking to reporters alongside his Iraqi counterpart, Iran’s Foreign Minister Hossein Amirabdollahian said Baghdad-brokered talks with the kingdom had gone well, and officials in Riyadh responded positively to “constructive proposals” made by Tehran.

These included re-rebuilding official diplomatic links by granting visas for three Iranian diplomats to be based at the Organization of Islamic Cooperation, a Jeddah-based body consisting of 57 Muslim countries.

Saudi Arabia’s Center for International Communication didn’t immediately respond to an emailed request for comment.

Oil Climbs From Four-Week High as Inventories Vie With Omicron - Bloomberg

Oil Climbs From Four-Week High as Inventories Vie With Omicron - Bloomberg

| PRICES |

|---|

Futures in New York traded above $73 a barrel, though liquidity is dwindling heading into the holiday period. U.S. crude inventories dropped by 4.72 million barrels last week, according to government data, almost twice the median estimate in a Bloomberg survey. That offset some concerns about the impact of the omicron variant on global consumption. Trading volumes are starting to thin before Christmas, while open interest -- the total number of oil contracts held by traders -- for crude, gasoline and diesel futures combined is at its lowest in almost six years. Both could leave the market prone to sharp moves amid thin liquidity. |

Most Gulf markets end higher as Omicron fears recede | Reuters

Most Gulf markets end higher as Omicron fears recede | Reuters

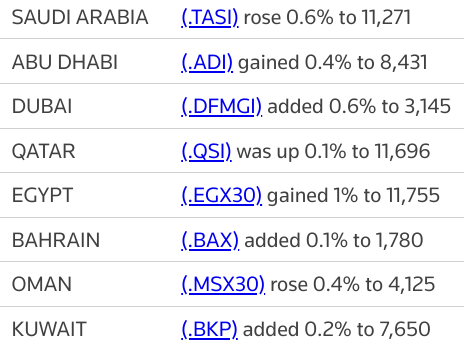

Most stock markets in the Gulf ended higher on Thursday, as worries around the Omicron coronavirus variant eased after a study suggested the strain might be less severe than feared.

The risk of needing to stay in hospital for patients infected with the Omicron variant is 40% to 45% lower than those with the Delta variant, according to research by London's Imperial College published on Wednesday. read more

Saudi Arabia's benchmark index (.TASI) gained 0.6%, with Al Rajhi Bank (1120.SE) rising 0.9% and petrochemical maker Saudi Basic Industries Corp (2010.SE) finishing 1.4% higher.

Crude prices, a key catalyst for the Gulf's financial markets, were broadly stable.

However, fears over the potential impact on fuel demand from mobility restrictions have receded as the Organization of the Petroleum Exporting Countries, Russia and allies have left the door open to reviewing their plan to add 400,000 barrels per day of supply in January.

Dubai's main share index (.DFMGI) rose 0.6%, led by a 3.4% leap in top lender Emirates NBD Bank (ENBD.DU) and a 1.1% increase in Emirates Integrated Telecommunications (DU.DU).

The Dubai market remains fundamentally strong and could recover more broadly as soon as more data on Omicron is made available, said Farah Mourad, senior market analyst of XTB MENA.

The Abu Dhabi index (.ADI) snapped four sessions of losses to close 0.4% higher, with telecoms firm Etisalat (ETISALAT.AD) advancing 1.2%.

But, the Abu Dhabi index posted a weekly loss of 4.8%, its biggest since March 2020.

The Qatari index (.QSI) edged 0.1% higher, supported by a 0.9% gain in the Gulf's biggest lender Qatar National Bank (QNBK.QA).

Outside the Gulf, Egypt's blue-chip index (.EGX30) climbed 1%, with Fawry for Banking Technology and Electronic Payment (FWRY.CA) jumping 2.9%, after it announced plans to establish consumer finance company.

The Central Bank of Egypt said on Thursday it had extended measures to ease the impact of the coronavirus until June 2022.

The risk of needing to stay in hospital for patients infected with the Omicron variant is 40% to 45% lower than those with the Delta variant, according to research by London's Imperial College published on Wednesday. read more

Saudi Arabia's benchmark index (.TASI) gained 0.6%, with Al Rajhi Bank (1120.SE) rising 0.9% and petrochemical maker Saudi Basic Industries Corp (2010.SE) finishing 1.4% higher.

Crude prices, a key catalyst for the Gulf's financial markets, were broadly stable.

However, fears over the potential impact on fuel demand from mobility restrictions have receded as the Organization of the Petroleum Exporting Countries, Russia and allies have left the door open to reviewing their plan to add 400,000 barrels per day of supply in January.

Dubai's main share index (.DFMGI) rose 0.6%, led by a 3.4% leap in top lender Emirates NBD Bank (ENBD.DU) and a 1.1% increase in Emirates Integrated Telecommunications (DU.DU).

The Dubai market remains fundamentally strong and could recover more broadly as soon as more data on Omicron is made available, said Farah Mourad, senior market analyst of XTB MENA.

The Abu Dhabi index (.ADI) snapped four sessions of losses to close 0.4% higher, with telecoms firm Etisalat (ETISALAT.AD) advancing 1.2%.

But, the Abu Dhabi index posted a weekly loss of 4.8%, its biggest since March 2020.

The Qatari index (.QSI) edged 0.1% higher, supported by a 0.9% gain in the Gulf's biggest lender Qatar National Bank (QNBK.QA).

Outside the Gulf, Egypt's blue-chip index (.EGX30) climbed 1%, with Fawry for Banking Technology and Electronic Payment (FWRY.CA) jumping 2.9%, after it announced plans to establish consumer finance company.

The Central Bank of Egypt said on Thursday it had extended measures to ease the impact of the coronavirus until June 2022.

Most Gulf bourses rise as Omicron worries fade | Reuters

Most Gulf bourses rise as Omicron worries fade | Reuters

Most stock markets in the Gulf rose in early trade on Thursday, as investor sentiment improved after a study suggested the Omicron variant of COVID-19 might be less severe than feared.

The South African study suggested reduced risks of hospitalisation and severe disease in people infected with the Omicron coronavirus variant versus the Delta one, though the authors said some of that was likely due to high population immunity. read more

Saudi Arabia's benchmark index (.TASI) gained 0.6%, with Al Rajhi Bank (1120.SE) rising 0.9% and petrochemical maker Saudi Basic Industries Corp (2010.SE) advancing 1.2%.

Saudi Investment Bank (1030.SE) jumped 4.7%, adding to its more than 9% gain on Wednesday following a proposal to increase capital and distribute a dividend of 0.70 riyal per share for 2021.

Separately, Saudi Arabia's Capital Markets Authority said on Wednesday it had approved an initial public offering of digital security firm Elm, which is owned by the kingdom's sovereign wealth fund. read more

Dubai's main share index (.DFMGI) added 0.1%, helped by a 0.4% rise in sharia-compliant lender Dubai Islamic Bank (DISB.DU).

Meanwhile, MSCI's broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) rose 0.55%, a third consecutive session of gains as it recovered from a jolt on Monday when worries about the new coronavirus strain gripped markets.

Oil prices, a key catalyst for the Gulf's financial markets, also rose, buoyed by optimism about the state of the global economy.

In Abu Dhabi, the stock index (.ADI), however, fell 0.4% and was on course for a fifth straight session of drop, with Emirates Telecommunications Group (ETISALAT.AD) losing 0.7%.

Most stock markets in the Gulf rose in early trade on Thursday, as investor sentiment improved after a study suggested the Omicron variant of COVID-19 might be less severe than feared.

The South African study suggested reduced risks of hospitalisation and severe disease in people infected with the Omicron coronavirus variant versus the Delta one, though the authors said some of that was likely due to high population immunity. read more

Saudi Arabia's benchmark index (.TASI) gained 0.6%, with Al Rajhi Bank (1120.SE) rising 0.9% and petrochemical maker Saudi Basic Industries Corp (2010.SE) advancing 1.2%.

Saudi Investment Bank (1030.SE) jumped 4.7%, adding to its more than 9% gain on Wednesday following a proposal to increase capital and distribute a dividend of 0.70 riyal per share for 2021.

Separately, Saudi Arabia's Capital Markets Authority said on Wednesday it had approved an initial public offering of digital security firm Elm, which is owned by the kingdom's sovereign wealth fund. read more

Dubai's main share index (.DFMGI) added 0.1%, helped by a 0.4% rise in sharia-compliant lender Dubai Islamic Bank (DISB.DU).

Meanwhile, MSCI's broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) rose 0.55%, a third consecutive session of gains as it recovered from a jolt on Monday when worries about the new coronavirus strain gripped markets.

Oil prices, a key catalyst for the Gulf's financial markets, also rose, buoyed by optimism about the state of the global economy.

In Abu Dhabi, the stock index (.ADI), however, fell 0.4% and was on course for a fifth straight session of drop, with Emirates Telecommunications Group (ETISALAT.AD) losing 0.7%.

IHS Markit includes Saudi govt Sukuk market in iBoxx global bond index - #Saudi Tadawul | Reuters

IHS Markit includes Saudi govt Sukuk market in iBoxx global bond index - Saudi Tadawul | Reuters

Saudi exchange operator Tadawul said in a tweet on Wednesday that IHS Markit had included the Saudi government Sukuk market in its iBoxx global government bond index.

Aramco Trading signs fuel deal with Australia's United Petroleum | Reuters

Aramco Trading signs fuel deal with Australia's United Petroleum | Reuters

Aramco Trading Company (ATC) said on Wednesday it has signed an agreement with Australian retailer United Petroleum for potential long-term fuel supply, product storage and other business opportunities.

Australia, which is already the largest fuel importer in the Asia Pacific, is a hot target market for fuel exporters as its domestic refining capacity has dwindled over the years.

The companies signed a non-binding memorandum of understanding (MOU) under which ATC intends to explore refined fuel sales to United Petroleum to meet fast-growing demand in Australia.

"Through this MOU, we hope to advance the vast opportunity for growth in United Petroleum's distribution networks across Australia and elsewhere," ATC President and Chief Executive Officer Ibrahim Al Buainain said in a statement.

Aramco Trading Company (ATC) said on Wednesday it has signed an agreement with Australian retailer United Petroleum for potential long-term fuel supply, product storage and other business opportunities.

Australia, which is already the largest fuel importer in the Asia Pacific, is a hot target market for fuel exporters as its domestic refining capacity has dwindled over the years.

The companies signed a non-binding memorandum of understanding (MOU) under which ATC intends to explore refined fuel sales to United Petroleum to meet fast-growing demand in Australia.

"Through this MOU, we hope to advance the vast opportunity for growth in United Petroleum's distribution networks across Australia and elsewhere," ATC President and Chief Executive Officer Ibrahim Al Buainain said in a statement.

Bustling bars, surging business: #Dubai sees a post-vax boom | AP News

Bustling bars, surging business: Dubai sees a post-vax boom | AP News

Nations around the world are lurching into lockdown, steeling themselves for a brutal surge as the omicron variant spreads like wildfire.

But in Dubai, Donna Sese is bracing for a very different surge: countless restaurant bookings and meter-long drink bills.

“We’re back and busy like the way things used to be,” said Sese, manager of the Yalumba restaurant at the five-star Le Meridien hotel, where devotees of Dubai’s Friday brunch pay $250 for lavish spreads with free-flowing Clicquot Champagne.

The globalized city-state appears to be in the midst of a boom season, spurred on by one of the world’s highest vaccination rates and government steps to lure businesses and de-escalate tensions with regional rivals.

Maskless debauchery has returned to dance floors. Brunch-goers are drinking with abandon. Home-buyers are flooding the market. Tourists are snapping up hotel suites. Expat millionaires are moving to the emirate. Coronavirus infections, although now making a comeback, remain below past peaks.

Nations around the world are lurching into lockdown, steeling themselves for a brutal surge as the omicron variant spreads like wildfire.

But in Dubai, Donna Sese is bracing for a very different surge: countless restaurant bookings and meter-long drink bills.

“We’re back and busy like the way things used to be,” said Sese, manager of the Yalumba restaurant at the five-star Le Meridien hotel, where devotees of Dubai’s Friday brunch pay $250 for lavish spreads with free-flowing Clicquot Champagne.

The globalized city-state appears to be in the midst of a boom season, spurred on by one of the world’s highest vaccination rates and government steps to lure businesses and de-escalate tensions with regional rivals.

Maskless debauchery has returned to dance floors. Brunch-goers are drinking with abandon. Home-buyers are flooding the market. Tourists are snapping up hotel suites. Expat millionaires are moving to the emirate. Coronavirus infections, although now making a comeback, remain below past peaks.

Debt levels of government-related entities in GCC remain elevated - Fitch | ZAWYA MENA Edition

Debt levels of government-related entities in GCC remain elevated - Fitch | ZAWYA MENA Edition

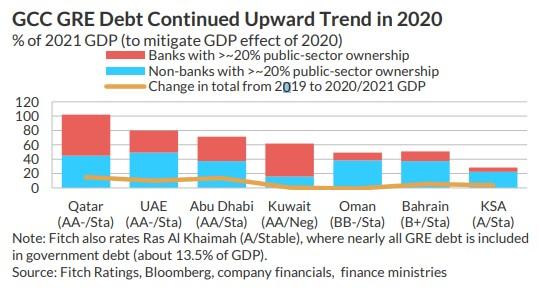

Government-related entity (GRE) debt as a share of GDP has declined across the GCC in 2021, due to higher oil prices and incipient recovery from the pandemic. However, in most of the GCC states, GRE debt levels remain higher than before the pandemic, according to a report by Fitch Ratings.

"The upward trend in GRE debt/GDP that has been in evidence since 2014 could resume as GREs help to drive national economic agendas, aiming at job creation, diversification and the energy transition," the report said.

However, increased focus on privatisation and asset sales could mitigate this trend over time, Fitch noted.

Aggregate GCC non-bank GRE debt hit 37 percent of GDP in 2020 (an increase of 7pp over 2019), driven in part by declines in nominal GDP on lower oil prices and Covid-19-induced recessions. The ratio is 32 percent in relation to forecast 2021 GDP.

Aggregate debt of GCC government-related banks rose to 24 percent of GDP in 2020. However, potential contingent liabilities from banks are larger. For instance in Qatar, sector assets reached above 300 percent.

"The upward trend in GRE debt/GDP that has been in evidence since 2014 could resume as GREs help to drive national economic agendas, aiming at job creation, diversification and the energy transition," the report said.

However, increased focus on privatisation and asset sales could mitigate this trend over time, Fitch noted.

Aggregate GCC non-bank GRE debt hit 37 percent of GDP in 2020 (an increase of 7pp over 2019), driven in part by declines in nominal GDP on lower oil prices and Covid-19-induced recessions. The ratio is 32 percent in relation to forecast 2021 GDP.

Aggregate debt of GCC government-related banks rose to 24 percent of GDP in 2020. However, potential contingent liabilities from banks are larger. For instance in Qatar, sector assets reached above 300 percent.

Oil Steady Near Four-Week High After U.S. Crude Stockpiles Fall - Bloomberg

Oil Steady Near Four-Week High After U.S. Crude Stockpiles Fall - Bloomberg

| PRICES |

|---|

|

Oil prices edge higher on optimism over Omicron impact | Reuters

Oil prices edge higher on optimism over Omicron impact | Reuters

Oil prices edged up on Thursday for a third consecutive session over positive developments around COVID-19, even as China imposed new travel curbs and Australia reinstated restrictions to combat surging cases.

U.S. West Texas Intermediate (WTI) crude futures rose 10 cents, or 0.1%, to $72.86 a barrel at 0625 GMT after jumping 2.3% in the previous session.

Brent crude futures also gained 8 cents, or 0.1%, to $75.37 a barrel, extending a 1.8% gain in the previous session.

The big gains on Wednesday were partly spurred by a larger-than-expected drawdown in U.S. crude stockpiles last week. read more

Oil prices edged up on Thursday for a third consecutive session over positive developments around COVID-19, even as China imposed new travel curbs and Australia reinstated restrictions to combat surging cases.

U.S. West Texas Intermediate (WTI) crude futures rose 10 cents, or 0.1%, to $72.86 a barrel at 0625 GMT after jumping 2.3% in the previous session.

Brent crude futures also gained 8 cents, or 0.1%, to $75.37 a barrel, extending a 1.8% gain in the previous session.

The big gains on Wednesday were partly spurred by a larger-than-expected drawdown in U.S. crude stockpiles last week. read more