Alleged Cryptocurrency Fraud in South Africa Probed After Brothers Vanish - Bloomberg

South African police are investigating a number of criminal cases brought by out-of-pocket investors who want two brothers arrested over an allegedly fraudulent cryptocurrency platform.

A group of investors are seeking the arrest of Raees and Ameer Cajee, who ran the Africrypt platform, after a number of them were offered some of the lost investment by a #Dubai-based mystery investor known as Pennython Project Management LLC. They haven’t been found guilty of any wrongdoing and the probes may come to nothing.

Work is underway in four South African provinces and cities including Johannesburg and Durban, Lieutenant Colonel Philani Nkwalase, from the Hawks police unit, said in a response to questions from Bloomberg.

“There are multiple victims in these cases,” said Nkwalase. “Investigations are ongoing.”

Solely aggregation of news articles, with no opinions expressed by this service since 2009 launch on this platform. Copyright to all articles remains with the original publisher and HEADLINES ARE CLICKABLE to access the whole article at source. (Subscription by email is recommended,with real-time updates on LinkedIn and Twitter.)

Tuesday, 11 January 2022

Billionaire Jaime Gilinski Faces Moment of Truth in His Colombia Bids - Bloomberg

Billionaire Jaime Gilinski Faces Moment of Truth in His Colombia Bids - Bloomberg

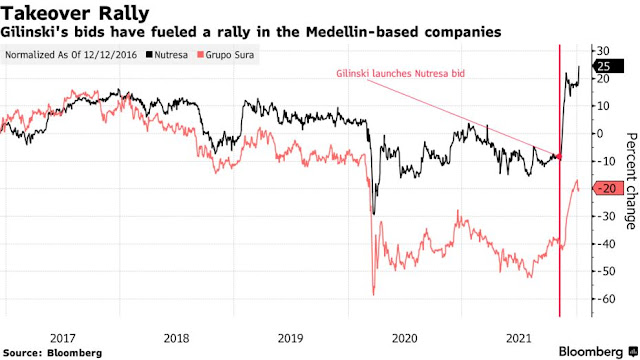

Billionaire Jaime Gilinski has shaken the normally sleepy Colombian markets with bids worth as much as $3.4 billion to take substantial stakes in the nation’s biggest foodmaker and a financial holding company. Now, with both offers expiring this week, he’ll find out just how successful he was in wooing shareholders.

Investors in Grupo de Inversiones Suramericana SA have until Tuesday afternoon to tender their shares, with Gilinski and his son, Gabriel, offering to buy as much as 31.68% of the holding company for $8.01 per share. A day later, the bid for Grupo Nutresa SA expires. In that one, Gilinski teamed with the royal family of Abu Dhabi to offer $7.71 a share for as much as 62.6% of the maker of snacks, chocolates, coffee and other food.

Through the end of last week, 15.6% of Nutresa’s outstanding shares and 13.8% of Sura’s had been tendered.

Even if Gilinski doesn’t reach the minimum amount he initially set out to buy -- 50.1% of Nutresa and 25.3% of Sura -- he’ll likely go through with the transactions, according to a person familiar with his thinking who asked not to be identified discussing strategy. Stakes as small as 14.3% will be enough to get control of board seats at both companies, according to Luis Ramos, an equities analyst at LarrainVial.

Billionaire Jaime Gilinski has shaken the normally sleepy Colombian markets with bids worth as much as $3.4 billion to take substantial stakes in the nation’s biggest foodmaker and a financial holding company. Now, with both offers expiring this week, he’ll find out just how successful he was in wooing shareholders.

Investors in Grupo de Inversiones Suramericana SA have until Tuesday afternoon to tender their shares, with Gilinski and his son, Gabriel, offering to buy as much as 31.68% of the holding company for $8.01 per share. A day later, the bid for Grupo Nutresa SA expires. In that one, Gilinski teamed with the royal family of Abu Dhabi to offer $7.71 a share for as much as 62.6% of the maker of snacks, chocolates, coffee and other food.

Through the end of last week, 15.6% of Nutresa’s outstanding shares and 13.8% of Sura’s had been tendered.

Even if Gilinski doesn’t reach the minimum amount he initially set out to buy -- 50.1% of Nutresa and 25.3% of Sura -- he’ll likely go through with the transactions, according to a person familiar with his thinking who asked not to be identified discussing strategy. Stakes as small as 14.3% will be enough to get control of board seats at both companies, according to Luis Ramos, an equities analyst at LarrainVial.

Oil Surges Alongside Equities as Powell Reassures Investors - Bloomberg

Oil Surges Alongside Equities as Powell Reassures Investors - Bloomberg

Oil jumped by the most in month after Jerome Powell’s comments to the Senate Banking Committee appeared to be less hawkish than the Federal Reserve had recently telegraphed.

West Texas Intermediate crude rose, in tandem with equity markets, as much as 3.8%, to the highest since November 16. Markets were supported after the Federal Reserve Chair said at some point this year he and his colleagues will allow the Fed’s $8.77 trillion balance sheet to run off.

Powell’s comments were a “a touch more dovish than what was implied in the recent minutes and suggested by other Fed speakers in the last few days,” said Vital Knowledge founder Adam Crisafulli.

Oil jumped by the most in month after Jerome Powell’s comments to the Senate Banking Committee appeared to be less hawkish than the Federal Reserve had recently telegraphed.

West Texas Intermediate crude rose, in tandem with equity markets, as much as 3.8%, to the highest since November 16. Markets were supported after the Federal Reserve Chair said at some point this year he and his colleagues will allow the Fed’s $8.77 trillion balance sheet to run off.

Powell’s comments were a “a touch more dovish than what was implied in the recent minutes and suggested by other Fed speakers in the last few days,” said Vital Knowledge founder Adam Crisafulli.

OPEC+ Supply Hikes Enough to Prevent Market Overheat, #Oman Says - Bloomberg

OPEC+ Supply Hikes Enough to Prevent Market Overheat, Oman Says - Bloomberg

OPEC and its allies don’t want crude prices to climb to $100 a barrel, and are reviving production quickly enough to prevent global markets from “overheating,” Oman’s oil minister said.

The Organization of Petroleum Exporting Countries and its allies, a 23-nation group led by Saudi Arabia and Russia, continues to restore output halted during the pandemic at a gradual pace of 400,000 barrels a day -- though in practice its increases have been restricted by internal unrest and depressed budgets. Crude prices have rallied this year, topping $80 a barrel in London.

“We’re very careful at OPEC+, we will look at each month as we go,” Omani Oil Minister Mohammed Al Rumhi said in an interview in Riyadh. “But so far, I think 400,000 is good because demand is increasing and we want to make sure that the market is not overheating. We don’t want to see $100 a barrel. The world is not ready for that.”

Oil’s rally has alarmed many consuming nations as it stokes inflationary pressure that’s menacing the world’s economic recovery from the pandemic. Part of the problem has been a crunch in global production capacity following a run of reduced spending, Al Rumhi said.

OPEC and its allies don’t want crude prices to climb to $100 a barrel, and are reviving production quickly enough to prevent global markets from “overheating,” Oman’s oil minister said.

The Organization of Petroleum Exporting Countries and its allies, a 23-nation group led by Saudi Arabia and Russia, continues to restore output halted during the pandemic at a gradual pace of 400,000 barrels a day -- though in practice its increases have been restricted by internal unrest and depressed budgets. Crude prices have rallied this year, topping $80 a barrel in London.

“We’re very careful at OPEC+, we will look at each month as we go,” Omani Oil Minister Mohammed Al Rumhi said in an interview in Riyadh. “But so far, I think 400,000 is good because demand is increasing and we want to make sure that the market is not overheating. We don’t want to see $100 a barrel. The world is not ready for that.”

Oil’s rally has alarmed many consuming nations as it stokes inflationary pressure that’s menacing the world’s economic recovery from the pandemic. Part of the problem has been a crunch in global production capacity following a run of reduced spending, Al Rumhi said.

#Egypt’s Bonds Poised for an Influx of Passive Cash, Double-Digit Returns - Bloomberg

Egypt’s Bonds Poised for an Influx of Passive Cash, Double-Digit Returns - Bloomberg

Egypt’s red-hot bond market has made it a favorite of emerging-market investors, and they’re counting on another year of big gains.

JPMorgan Chase & Co. will add Egypt -- which has $26 billion of eligible government bonds -- to a group of indexes this month, setting the market up to receive an influx of cash from passive money managers. Investors have already been enticed by Egypt’s hefty interest rates, which rank as the highest in the world after adjusting for inflation.

With global bond markets reeling from losses as the Federal Reserve turns hawkish, Egypt is looking like a bright spot for investors. Local bonds have returned 1.7% since December, making it one of only a handful of emerging markets that’s delivered a positive performance.

PineBridge Investments and Renaissance Capital say they expect the strong performance to continue and predict double-digit gains in 2022 -- adding to last year’s 13% return, which was the second-best in the world and compared with an average loss of 1.2% for local emerging market debt.

Egypt’s red-hot bond market has made it a favorite of emerging-market investors, and they’re counting on another year of big gains.

JPMorgan Chase & Co. will add Egypt -- which has $26 billion of eligible government bonds -- to a group of indexes this month, setting the market up to receive an influx of cash from passive money managers. Investors have already been enticed by Egypt’s hefty interest rates, which rank as the highest in the world after adjusting for inflation.

With global bond markets reeling from losses as the Federal Reserve turns hawkish, Egypt is looking like a bright spot for investors. Local bonds have returned 1.7% since December, making it one of only a handful of emerging markets that’s delivered a positive performance.

PineBridge Investments and Renaissance Capital say they expect the strong performance to continue and predict double-digit gains in 2022 -- adding to last year’s 13% return, which was the second-best in the world and compared with an average loss of 1.2% for local emerging market debt.

#Qatar National Bank QPSC: Mideast’s Biggest Bank Raised Provisions and Remains on Alert - Bloomberg

Qatar National Bank QPSC: Mideast’s Biggest Bank Raised Provisions and Remains - Bloomberg

Qatar National Bank QPSC braced for credit losses by boosting the amount of money set aside in provisions and signaled caution over the main international markets where it has a presence.

The Middle East’s biggest bank booked 7.1 billion riyals ($1.9 billion) in loan-loss provisions during 2021, up 21% from the previous year, according to a statement on Tuesday. Total assets rose about 7% to 1.1 trillion riyals.

The Doha-based bank said it “remains cautious on the external environment with respect to potential risks that may arise from key markets where QNB Group operates.”

Many banks in the Gulf are seeing higher profits on the back of improvements in trade and tourism as regional economies recover from the pandemic. Qatar’s outlook for 2022 has also brightened thanks to higher energy prices and the possible boon to business from the soccer World Cup.

Qatar National Bank QPSC braced for credit losses by boosting the amount of money set aside in provisions and signaled caution over the main international markets where it has a presence.

The Middle East’s biggest bank booked 7.1 billion riyals ($1.9 billion) in loan-loss provisions during 2021, up 21% from the previous year, according to a statement on Tuesday. Total assets rose about 7% to 1.1 trillion riyals.

The Doha-based bank said it “remains cautious on the external environment with respect to potential risks that may arise from key markets where QNB Group operates.”

Many banks in the Gulf are seeing higher profits on the back of improvements in trade and tourism as regional economies recover from the pandemic. Qatar’s outlook for 2022 has also brightened thanks to higher energy prices and the possible boon to business from the soccer World Cup.

Gulf bourses close mixed ahead of Powell testimony | Reuters

Gulf bourses close mixed ahead of Powell testimony | Reuters

Stock markets in the Gulf ended mixed on Tuesday, as investors awaited U.S. Federal Reserve Chair Jerome Powell's appearance before the Senate Banking Committee, hoping for cues on the timing of expected policy tightening.

In Abu Dhabi, the index (.ADI) dropped 0.3%, extending losses for a sixth session, with Emirates Telecommunications Group (ETISALAT.AD) losing 1.8%.

Dubai's main share index (.DFMGI) retreated 0.7%, hit by a 0.8% fall in Emirates NBD Bank (ENBD.DU) and a 2% decline in Dubai Investments (DINV.DU).

The Dubai stocks were down as risk appetite fell before the Fed's address, said Eman AlAyyaf, CEO of EA Trading'.

"Overall, the main index remains on a positive trend as investors take all recent government initiatives into account."

The Central Bank of the United Arab Emirates said it expects the UAE economy to grow 4.2% in 2022, accelerating from last year's 2.1% growth. read more

Saudi Arabia's benchmark index (.TASI) advanced 1.5%, buoyed by a 2.9% jump in Al Rajhi Bank (1120.SE).

Saudi Arabian renewable energy utility ACWA Power International (2082.SE) jumped more than 6%, reaching its highest since its market debut in October, after it obtained commercial operation certificate to begin the first phase of Dubai-based Noor Energy 1 project.

Oil prices gained after two days of losses, with Brent crude futures up 0.8% at $81.66 a barrel following a 1% drop in the previous session.

Outside the Gulf, Egypt's blue-chip index (.EGX30) eased 0.2%, with tobacco monopoly Eastern Company (EAST.CA) dropping 1.2%.

Egypt's central bank said on Monday it had approved a set of rules under which it would be able to provide emergency liquidity to local lenders. read more

Stock markets in the Gulf ended mixed on Tuesday, as investors awaited U.S. Federal Reserve Chair Jerome Powell's appearance before the Senate Banking Committee, hoping for cues on the timing of expected policy tightening.

In Abu Dhabi, the index (.ADI) dropped 0.3%, extending losses for a sixth session, with Emirates Telecommunications Group (ETISALAT.AD) losing 1.8%.

Dubai's main share index (.DFMGI) retreated 0.7%, hit by a 0.8% fall in Emirates NBD Bank (ENBD.DU) and a 2% decline in Dubai Investments (DINV.DU).

The Dubai stocks were down as risk appetite fell before the Fed's address, said Eman AlAyyaf, CEO of EA Trading'.

"Overall, the main index remains on a positive trend as investors take all recent government initiatives into account."

The Central Bank of the United Arab Emirates said it expects the UAE economy to grow 4.2% in 2022, accelerating from last year's 2.1% growth. read more

Saudi Arabia's benchmark index (.TASI) advanced 1.5%, buoyed by a 2.9% jump in Al Rajhi Bank (1120.SE).

Saudi Arabian renewable energy utility ACWA Power International (2082.SE) jumped more than 6%, reaching its highest since its market debut in October, after it obtained commercial operation certificate to begin the first phase of Dubai-based Noor Energy 1 project.

Oil prices gained after two days of losses, with Brent crude futures up 0.8% at $81.66 a barrel following a 1% drop in the previous session.

Outside the Gulf, Egypt's blue-chip index (.EGX30) eased 0.2%, with tobacco monopoly Eastern Company (EAST.CA) dropping 1.2%.

Egypt's central bank said on Monday it had approved a set of rules under which it would be able to provide emergency liquidity to local lenders. read more

#Qatar National Bank 2021 profit up 10% driven by loan growth | Reuters

Qatar National Bank 2021 profit up 10% driven by loan growth | Reuters

Qatar National Bank, (QNBK.QA) the Gulf's biggest bank by assets, on Tuesday reported a 10% increase in annual net profit driven by loan growth.

Its 2021 net profit rose to 13.2 billion riyals ($3.6 billion), QNB said in a statement, up from 12 billion a year earlier.

The bank's profit for the quarter ended Dec. 31 was 2.9 billion, according to Reuters calculations.

The results were slightly above analyst estimates, which expected the company to report about 12.7 billion, according to data from Refinitiv.

Ratings agency Fitch in October indicated it could cut the ratings of all banks in Qatar, saying it was concerned over the sector's increasing reliance on external funding and a recent rapid growth in assets. read more

Foreign funding was $193 billion at the end of August, Fitch said, representing 48% of the Qatari banking sector's liabilities compared with $121 billion and 38% at the end of 2018.

Qatar National Bank, (QNBK.QA) the Gulf's biggest bank by assets, on Tuesday reported a 10% increase in annual net profit driven by loan growth.

Its 2021 net profit rose to 13.2 billion riyals ($3.6 billion), QNB said in a statement, up from 12 billion a year earlier.

The bank's profit for the quarter ended Dec. 31 was 2.9 billion, according to Reuters calculations.

The results were slightly above analyst estimates, which expected the company to report about 12.7 billion, according to data from Refinitiv.

Ratings agency Fitch in October indicated it could cut the ratings of all banks in Qatar, saying it was concerned over the sector's increasing reliance on external funding and a recent rapid growth in assets. read more

Foreign funding was $193 billion at the end of August, Fitch said, representing 48% of the Qatari banking sector's liabilities compared with $121 billion and 38% at the end of 2018.

Grocery App Getir to Seek $12 Billion Valuation in Funding Round, Source Says - Bloomberg

Grocery App Getir to Seek $12 Billion Valuation in Funding Round, Source Says - Bloomberg

Turkish grocery delivery app Getir is looking to raise capital at a valuation of $12 billion in a funding round started by its existing investors, according to a person with knowledge of the matter.

Getir, valued at $7.7 billion last year, is aiming to raise over $1 billion to finance expansion overseas, said the person, who asked not to be named because the deliberations are confidential. It’s previously won the backing of firms including Silver Lake, Tiger Global, Sequoia Capital and Mubadala Investment Co.

A spokesperson for Getir declined to comment. Mergermarket earlier reported details on Getir’s planned fundraising.

The Istanbul-based company, which raised $1.1 billion in total through several rounds from investors last year, has grown to become one of the most valuable rapid delivery startups. U.S. rival GoPuff is valued at $15 billion.

Getir, co-founded in 2015 by Nazim Salur, vaulted to prominence last year after raising only $38 million in all of 2020. If it reaches the valuation it is seeking, Getir will be the second most valuable startup from Turkey after Alibaba Group Holding Ltd.-backed Trendyol, which clinched the $16.5 billion level last year.

Its rapid global expansion has seen Getir launch recently in Chicago and New York, following the U.K., Germany, the Netherlands, France, Italy, Spain and Portugal in 2021.

The company, formally known as Getir Perakende Lojistik AS, has also acquired bolt-on assets in Turkey, Spain and the U.K. It’s said that its next destination in the U.S. is Boston.

Turkish grocery delivery app Getir is looking to raise capital at a valuation of $12 billion in a funding round started by its existing investors, according to a person with knowledge of the matter.

Getir, valued at $7.7 billion last year, is aiming to raise over $1 billion to finance expansion overseas, said the person, who asked not to be named because the deliberations are confidential. It’s previously won the backing of firms including Silver Lake, Tiger Global, Sequoia Capital and Mubadala Investment Co.

A spokesperson for Getir declined to comment. Mergermarket earlier reported details on Getir’s planned fundraising.

The Istanbul-based company, which raised $1.1 billion in total through several rounds from investors last year, has grown to become one of the most valuable rapid delivery startups. U.S. rival GoPuff is valued at $15 billion.

Getir, co-founded in 2015 by Nazim Salur, vaulted to prominence last year after raising only $38 million in all of 2020. If it reaches the valuation it is seeking, Getir will be the second most valuable startup from Turkey after Alibaba Group Holding Ltd.-backed Trendyol, which clinched the $16.5 billion level last year.

Its rapid global expansion has seen Getir launch recently in Chicago and New York, following the U.K., Germany, the Netherlands, France, Italy, Spain and Portugal in 2021.

The company, formally known as Getir Perakende Lojistik AS, has also acquired bolt-on assets in Turkey, Spain and the U.K. It’s said that its next destination in the U.S. is Boston.

Oil rises towards $82 as demand recovery seen on track | Reuters

Oil rises towards $82 as demand recovery seen on track | Reuters

Oil rose towards $82 a barrel on Tuesday, supported by tight supply and hopes that rising coronavirus cases and the spread of the Omicron variant will not derail a global demand recovery.

OPEC supply additions are running below their allowed increase under a pact with allies due to a lack of capacity in some countries. Major economies have avoided a return to severe lockdowns, even as coronavirus cases soar.

"Despite continuously rising Omicron cases, European governments have taken the view that the time is now right to ease restrictions, raising the hopes of oil demand recovery," said Tamas Varga of oil broker PVM.

Brent crude gained 88 cents, or 1.1%, to $81.75 a barrel at 0915 GMT, after dropping 1% in the previous session. U.S. West Texas Intermediate (WTI) rose 95 cents, or 1.2%, to $79.18, after falling 0.8% on Monday.

Oil rose towards $82 a barrel on Tuesday, supported by tight supply and hopes that rising coronavirus cases and the spread of the Omicron variant will not derail a global demand recovery.

OPEC supply additions are running below their allowed increase under a pact with allies due to a lack of capacity in some countries. Major economies have avoided a return to severe lockdowns, even as coronavirus cases soar.

"Despite continuously rising Omicron cases, European governments have taken the view that the time is now right to ease restrictions, raising the hopes of oil demand recovery," said Tamas Varga of oil broker PVM.

Brent crude gained 88 cents, or 1.1%, to $81.75 a barrel at 0915 GMT, after dropping 1% in the previous session. U.S. West Texas Intermediate (WTI) rose 95 cents, or 1.2%, to $79.18, after falling 0.8% on Monday.

Rasmala's Swats on #Saudi Infrastructure & Education Stocks - Bloomberg video

Rasmala's Swats on Saudi Infrastructure & Education Stocks - Bloomberg

Eric Swats, chief executive officer at Rasmala Investment Bank discusses his bond and equity outlook for the MENA region. He speaks with Manus Cranny on "Bloomberg Daybreak: Middle East." (Source: Bloomberg)

Moody's, S&P rate #AbuDhabi Sweihan's proposed $728mln bonds stable | ZAWYA MENA Edition

Moody's, S&P rate Abu Dhabi Sweihan's proposed $728mln bonds stable | ZAWYA MENA Edition

S&P Global Ratings and Moody's Investors Service have rated Abu Dhabi-based solar energy firm Sweihan PV Power Co.’s (SPPC) proposed bonds stable.

SPPC, a UAE-based limited-purpose entity that owns, operates, and maintains the Noor photovoltaic (PV) power plant in Abu Dhabi, plans to sell $728 million of fixed-rate senior secured bonds due 2049.

SPPC is 60 percent owned by Abu Dhabi's TAQA while Japan's Marubeni Corp and China's JinkoSolar own 20 percent each. TAQA is 98.6 percent owned by the Abu Dhabi government.

The Noor facility, which achieved commercial operations in April 2019, sells electricity to Emirates Water & Electricity Company (EWEC) under a long-term take-or-pay power purchase agreement (PPA).

The proceeds of the bonds will be used to refinance existing debt, pay transaction expenses, fund the debt service reserve account and make a distribution to shareholders.

S&P Global Ratings and Moody's Investors Service have rated Abu Dhabi-based solar energy firm Sweihan PV Power Co.’s (SPPC) proposed bonds stable.

SPPC, a UAE-based limited-purpose entity that owns, operates, and maintains the Noor photovoltaic (PV) power plant in Abu Dhabi, plans to sell $728 million of fixed-rate senior secured bonds due 2049.

SPPC is 60 percent owned by Abu Dhabi's TAQA while Japan's Marubeni Corp and China's JinkoSolar own 20 percent each. TAQA is 98.6 percent owned by the Abu Dhabi government.

The Noor facility, which achieved commercial operations in April 2019, sells electricity to Emirates Water & Electricity Company (EWEC) under a long-term take-or-pay power purchase agreement (PPA).

The proceeds of the bonds will be used to refinance existing debt, pay transaction expenses, fund the debt service reserve account and make a distribution to shareholders.

Most major Gulf bourses fall on Omicron worries | Reuters

Most major Gulf bourses fall on Omicron worries | Reuters

Most major Gulf shares fell in early trade on Tuesday, as uncertainty over the economic impact of the Omicron coronavirus variant weighed on investor sentiment.

In Abu Dhabi, the benchmark index (.FTFADGI) declined 1.1%, dragged down by a 3% drop in Emirates Telecommunications Group (ETISALAT.AD) and a 0.5% decrease in the country's largest lender First Abu Dhabi Bank (FAB.AD).

Dubai's main share index (.DFMGI) slipped 0.3%, with top lender Emirates NBD Bank (ENBD.DU) losing 0.4% and Dubai Investments (DINV.DU) declining 1%.

The United Arab Emirates, the region's tourism and commercial hub, saw daily cases cross the 2,562 mark on Monday, as it hosts a world fair during its peak tourist season.

All six Gulf states had confirmed Omicron cases in their territories, but official daily coronavirus data does not provide a breakdown by COVID-19 variant.

The Qatari index (.QSI) eased 0.3%, as most of the stocks on the index were in negative territory including Commercial Bank (COMB.QA), which was down 1%.

Qatar, a small energy-rich state with a population of around 2.8 million, on Saturday reported 3,487 new cases - almost 10% of those tested - outpacing a previous high of 2,355 seen in May 2020.

On Monday, the Gulf state reported 3,878 new infections.

Saudi Arabia's benchmark index (.TASI), however, gained 0.4%, led by a 0.4% rise in Al Rajhi Bank (1120.SE).

Crude prices, a key catalyst for the Gulf's financial markets, rose after two days of losses.

Separately, Qatar and Saudi Arabia have halted efforts at the World Trade Organization to resolve a dispute over the alleged piracy of content produced by Doha-owned sports and entertainment channel beIN. read more

Most major Gulf shares fell in early trade on Tuesday, as uncertainty over the economic impact of the Omicron coronavirus variant weighed on investor sentiment.

In Abu Dhabi, the benchmark index (.FTFADGI) declined 1.1%, dragged down by a 3% drop in Emirates Telecommunications Group (ETISALAT.AD) and a 0.5% decrease in the country's largest lender First Abu Dhabi Bank (FAB.AD).

Dubai's main share index (.DFMGI) slipped 0.3%, with top lender Emirates NBD Bank (ENBD.DU) losing 0.4% and Dubai Investments (DINV.DU) declining 1%.

The United Arab Emirates, the region's tourism and commercial hub, saw daily cases cross the 2,562 mark on Monday, as it hosts a world fair during its peak tourist season.

All six Gulf states had confirmed Omicron cases in their territories, but official daily coronavirus data does not provide a breakdown by COVID-19 variant.

The Qatari index (.QSI) eased 0.3%, as most of the stocks on the index were in negative territory including Commercial Bank (COMB.QA), which was down 1%.

Qatar, a small energy-rich state with a population of around 2.8 million, on Saturday reported 3,487 new cases - almost 10% of those tested - outpacing a previous high of 2,355 seen in May 2020.

On Monday, the Gulf state reported 3,878 new infections.

Saudi Arabia's benchmark index (.TASI), however, gained 0.4%, led by a 0.4% rise in Al Rajhi Bank (1120.SE).

Crude prices, a key catalyst for the Gulf's financial markets, rose after two days of losses.

Separately, Qatar and Saudi Arabia have halted efforts at the World Trade Organization to resolve a dispute over the alleged piracy of content produced by Doha-owned sports and entertainment channel beIN. read more

#AbuDhabi's ZMI secures up to $500 mln financing facility | Reuters

Abu Dhabi's ZMI secures up to $500 mln financing facility | Reuters

Abu Dhabi's offshore marine services company ZMI Holdings said on Tuesday it had signed and closed a new senior secured financing facility of up to $500 million.

It will help ZMI invest further in its growth markets, and provide committed and uncommitted facilities that can be used to make additional acquisitions and capital expenditure, the company said in a statement.

The facility consisted of a number of debt instruments, including a bridge facility provided by Goldman Sachs (GS.N), alongside senior syndicated facilities provided on both conventional and Islamic Ijara financing basis.

The syndicate includes multiple regional and UAE lenders.

The deal would allow for the consolidation of the group's liabilities through refinancing of seven bilateral facilities and leases into one security pool, ZMI said.

ZMI Holdings is an services and solutions owner and operator of a purpose-built fleet of jack-up barges and complementary offshore supply vessels and subsea services.

Abu Dhabi's offshore marine services company ZMI Holdings said on Tuesday it had signed and closed a new senior secured financing facility of up to $500 million.

It will help ZMI invest further in its growth markets, and provide committed and uncommitted facilities that can be used to make additional acquisitions and capital expenditure, the company said in a statement.

The facility consisted of a number of debt instruments, including a bridge facility provided by Goldman Sachs (GS.N), alongside senior syndicated facilities provided on both conventional and Islamic Ijara financing basis.

The syndicate includes multiple regional and UAE lenders.

The deal would allow for the consolidation of the group's liabilities through refinancing of seven bilateral facilities and leases into one security pool, ZMI said.

ZMI Holdings is an services and solutions owner and operator of a purpose-built fleet of jack-up barges and complementary offshore supply vessels and subsea services.

#Dubai Growth Boosted by Tourism, Expo 2020 Before Omicron Covid Surge - Bloomberg

Dubai Growth Boosted by Tourism, Expo 2020 Before Omicron Covid Surge - Bloomberg

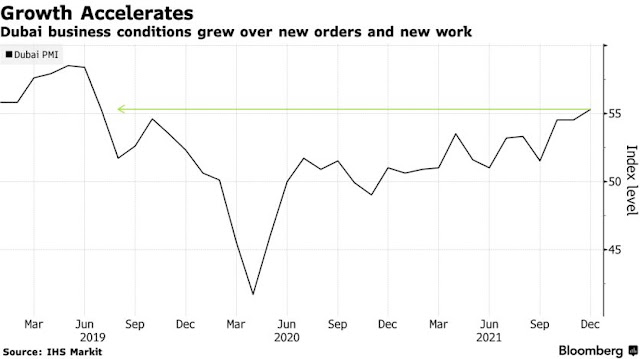

Dubai’s business conditions accelerated last month as easing travel restrictions and the Expo 2020 exhibition helped boost the city’s key tourism industry, before a renewed surge in coronavirus cases.

IHS Markit’s Purchasing Managers’ Index for the Middle East’s main business hub jumped to 55.3 in December from 54.5 in November, staying above the 50 mark that separates growth from contraction, and hitting the highest level since June 2019. Employment also jumped in one of the strongest expansions since the start of the pandemic.

Still, businesses continued to battle higher costs, with input price inflation accelerating to the highest since March. And uncertainty about the pandemic, as the omicron variant started to take hold late last month, meant firms were less optimistic about 2022, with just over 12% confident of growth this year.

Before the omicron strain emerged, the United Arab Emirates had managed to keep cases under control for most of 2021. Infections in the country, of which Dubai is a part, rose above 2,000 for the first time in six months in December.

Dubai’s business conditions accelerated last month as easing travel restrictions and the Expo 2020 exhibition helped boost the city’s key tourism industry, before a renewed surge in coronavirus cases.

IHS Markit’s Purchasing Managers’ Index for the Middle East’s main business hub jumped to 55.3 in December from 54.5 in November, staying above the 50 mark that separates growth from contraction, and hitting the highest level since June 2019. Employment also jumped in one of the strongest expansions since the start of the pandemic.

Still, businesses continued to battle higher costs, with input price inflation accelerating to the highest since March. And uncertainty about the pandemic, as the omicron variant started to take hold late last month, meant firms were less optimistic about 2022, with just over 12% confident of growth this year.

Before the omicron strain emerged, the United Arab Emirates had managed to keep cases under control for most of 2021. Infections in the country, of which Dubai is a part, rose above 2,000 for the first time in six months in December.

- Firms were concerned with how omicron would impact new business and travel

- Companies cited improvement in local sales with consumer confidence growing

- Travel and tourism led sales growth followed by wholesale and retail

- Output in non-oil economy increased at a sharp pace

- Higher raw materials prices often discouraged buying activity and firms also noted increased energy prices

- Average prices charged by non-oil business dropped for a sixth straight month, but the pace of decline had slowed

KKR (KKR) to Invite #Saudi Wealth Fund (PIF) to Back Telecom Italia Bid - Bloomberg

KKR (KKR) to Invite Saudi Wealth Fund (PIF) to Back Telecom Italia Bid - Bloomberg

KKR & Co. has reached out to Saudi Arabia’s sovereign wealth fund as it seeks co-investors to join its proposed acquisition of Telecom Italia SpA, people with knowledge of the matter said.

KKR approached the Public Investment Fund, which is chaired by Saudi Crown Prince Mohammed bin Salman, to gauge its interest in providing capital for the bid, according to the people. It has also held talks with other sovereign wealth funds and infrastructure investors about teaming up, the people said, asking not to be identified because the information is private.

The PIF would take a passive role in any deal, the people said. Discussions are ongoing, and the Saudi fund hasn’t decided yet whether to join the KKR consortium, the people said.

Sovereign wealth funds are increasingly playing an important role supporting private equity firms on large takeover bids. The Abu Dhabi Investment Authority and Singapore’s GIC Pte backed the more than $30 billion acquisition of Medline Industries Inc. last year by a group of buyout firms.

KKR & Co. has reached out to Saudi Arabia’s sovereign wealth fund as it seeks co-investors to join its proposed acquisition of Telecom Italia SpA, people with knowledge of the matter said.

KKR approached the Public Investment Fund, which is chaired by Saudi Crown Prince Mohammed bin Salman, to gauge its interest in providing capital for the bid, according to the people. It has also held talks with other sovereign wealth funds and infrastructure investors about teaming up, the people said, asking not to be identified because the information is private.

The PIF would take a passive role in any deal, the people said. Discussions are ongoing, and the Saudi fund hasn’t decided yet whether to join the KKR consortium, the people said.

Sovereign wealth funds are increasingly playing an important role supporting private equity firms on large takeover bids. The Abu Dhabi Investment Authority and Singapore’s GIC Pte backed the more than $30 billion acquisition of Medline Industries Inc. last year by a group of buyout firms.

Middle East Rivalries Cool as the Region’s Political and Economic Outlook Shifts - Bloomberg

Middle East Rivalries Cool as the Region’s Political and Economic Outlook Shifts - Bloomberg

In a part of the world where stability and predictability are elusive, 2021 ended much the way it started: with surprise reconciliations among regional rivals and the prospect of more.

In January 2021, Saudi Crown Prince Mohammed bin Salman invited Sheikh Tamim bin Hamad Al Thani, the Qatari emir, to a Gulf summit, where they signed an agreement ending the three-year-plus boycott of Qatar that the kingdom had led.

Ten months later, United Arab Emirates Foreign Minister Sheikh Abdullah bin Zayed Al Nahyan met in Syria with Syrian President Bashar al-Assad, who was until recently a pariah in most of the Arab world. Syria had been suspended from the Arab League in 2011 because of the Assad regime’s violent crackdown on a popular uprising, a conflict that later escalated into a civil war. The UAE-Syria meeting in November signaled the possibility of a normalization of Syria’s regional ties at the upcoming Arab League summit, to take place in Algeria in March.

Also in November the UAE’s de facto ruler, Sheikh Mohammed bin Zayed Al Nahyan, paid a visit to Turkey, launching a $10 billion fund to invest in the country and ending a decade of strained relations.

In a part of the world where stability and predictability are elusive, 2021 ended much the way it started: with surprise reconciliations among regional rivals and the prospect of more.

In January 2021, Saudi Crown Prince Mohammed bin Salman invited Sheikh Tamim bin Hamad Al Thani, the Qatari emir, to a Gulf summit, where they signed an agreement ending the three-year-plus boycott of Qatar that the kingdom had led.

Ten months later, United Arab Emirates Foreign Minister Sheikh Abdullah bin Zayed Al Nahyan met in Syria with Syrian President Bashar al-Assad, who was until recently a pariah in most of the Arab world. Syria had been suspended from the Arab League in 2011 because of the Assad regime’s violent crackdown on a popular uprising, a conflict that later escalated into a civil war. The UAE-Syria meeting in November signaled the possibility of a normalization of Syria’s regional ties at the upcoming Arab League summit, to take place in Algeria in March.

Also in November the UAE’s de facto ruler, Sheikh Mohammed bin Zayed Al Nahyan, paid a visit to Turkey, launching a $10 billion fund to invest in the country and ending a decade of strained relations.

Column: Oil bulls increasingly confident as Omicron risk fades: Kemp | Reuters

Column: Oil bulls increasingly confident as Omicron risk fades: Kemp | Reuters

Oil markets attracted a new wave of interest from investors at the end of 2021 and start of 2022, as the threat of widespread economic and aviation disruption from Omicron seemed to recede.

Hedge funds and other money managers purchased the equivalent of 31 million barrels in the six most important petroleum-related futures and options contracts in the week to Jan. 4.

Portfolio managers have purchased a total of 102 million barrels in the three most recent weeks, after selling 327 million barrels in the previous 10 weeks (https://tmsnrt.rs/3f5QZ5B).

In the most recent week, most of the buying came from the creation of new bullish long positions (+27 million barrels) rather than closure of old bearish short ones (-5 million).

Oil markets attracted a new wave of interest from investors at the end of 2021 and start of 2022, as the threat of widespread economic and aviation disruption from Omicron seemed to recede.

Hedge funds and other money managers purchased the equivalent of 31 million barrels in the six most important petroleum-related futures and options contracts in the week to Jan. 4.

Portfolio managers have purchased a total of 102 million barrels in the three most recent weeks, after selling 327 million barrels in the previous 10 weeks (https://tmsnrt.rs/3f5QZ5B).

In the most recent week, most of the buying came from the creation of new bullish long positions (+27 million barrels) rather than closure of old bearish short ones (-5 million).

Oil prices rise on renewed risk appetite, tight OPEC supply | Reuters

Oil prices rise on renewed risk appetite, tight OPEC supply | Reuters

Oil prices climbed on Tuesday, with investors regaining some risk appetite as they await clues from the U.S. Federal Reserve chairman on potential interest rate rises and as some oil producers continued to struggle to beef up output.

Brent crude futures gained 60 cents, or 0.7%, to $81.47 a barrel at 0740 GMT, after dropping 1% in the previous session.

U.S. West Texas Intermediate (WTI) crude futures rose 68 cents, or 0.9%, to $78.91 a barrel, after falling 0.8% on Monday.

A weaker U.S. dollar helped support oil prices on Tuesday, as it makes oil cheaper for those holding other currencies.

Oil prices climbed on Tuesday, with investors regaining some risk appetite as they await clues from the U.S. Federal Reserve chairman on potential interest rate rises and as some oil producers continued to struggle to beef up output.

Brent crude futures gained 60 cents, or 0.7%, to $81.47 a barrel at 0740 GMT, after dropping 1% in the previous session.

U.S. West Texas Intermediate (WTI) crude futures rose 68 cents, or 0.9%, to $78.91 a barrel, after falling 0.8% on Monday.

A weaker U.S. dollar helped support oil prices on Tuesday, as it makes oil cheaper for those holding other currencies.