Saudi market ends 10 days of gains as most Gulf bourses fall | Reuters

Most stock markets in the Gulf ended lower on Sunday, with the Saudi index snapping a 10-day winning streak, in response to Friday's fall in oil prices and global shares.

Risk aversion dominated on Friday as stocks slumped on Wall Street and in Europe, and bond prices surged with investors seeking the relative safety of government debt.

Saudi Arabia's benchmark index (.TASI) dropped 1.2%, off from its highest in more than 15 years, dragged down by a 0.7% fall in Al Rajhi Bank (1120.SE) and a 1% decline in oil giant Saudi Aramco (2222.SE).

Among other losers, Almarai (2280.SE) finished 2.4% lower, after the Gulf's largest dairy company reported a 14.7% fall in fourth-quarter profit.

Almarai said subsidy reductions, imported-feed costs and inflation for farm and dairy commodities were behind the fall.

The Qatari index (.QSI) eased 0.2%, with Qatar Islamic Bank (QISB.QA) down 1% and Commercial Bank (COMB.QA) closing 1.2% lower.

In the previous session, the lender dropped more than 6% after reporting a rise in annual profit but took a hit on its investments in Turkey which was impacted by continued volatility and the depreciation of the Turkish lira.

Outside the Gulf, Egypt's blue-chip index (.EGX30) fell 0.6%, with almost all stocks on the index were in negative territory including tobacco monopoly Eastern Company (EAST.CA).

The market volume suggests that the current move is a correction to the December rally and should not exceed the zone around 11,600 points, investment bank EFG Hermes said in a note.

For Goldman, Saudi Arabia Will Remain King of Mideast IPO Deals - Bloomberg

Saudi Arabia will remain the busiest of the Middle East’s stock markets, even as the United Arab Emirates pushes more companies to go public, according to Goldman Sachs Group Inc.John Wilkinson, the bank’s London-based head of emerging-market equity capital markets, called 2021 a “standout year” for the Persian Gulf. Initial public offerings by ACWA Power, Solutions by STC and Saudi Tadawul Group Holding Co. in Saudi Arabia, as well as several others in Abu Dhabi, pushed Middle East and North African equity issuance to about $23 billion.Most of the marquee offerings have posted strong post-IPO performances, sparking further interest from international investors, Wilkinson said.Saudi Arabia remains “the biggest driver for Middle East ECM,” he said in an interview. “However, we’re seeing Abu Dhabi Inc. becoming more active and obviously the comments out of Dubai’s government will drive bigger volumes from the UAE going forward.”

India's HDFC Capital raises $1.8 billion from ADIA, others for low-cost housing | Reuters

India's HDFC Capital, a private equity investment manager, said on Sunday it has raised $1.8 billion from investors, lead by a unit of sovereign wealth fund Abu Dhabi Investment Authority (ADIA), for its third low-cost housing fund.

This includes an upfront amount of $1.2 billion with an additional $600 million committed towards reinvestment of the principal amount, the company said in a statement.

HDFC Capital Affordable Real Estate Fund 3 will provide long-term finance to develop about 280 million square feet of affordable and mid-income housing projects across India. It will also invest in low-cost housing-related technology companies, it said.

A unit of lender Housing Development and Finance Corporation (HDFC) Ltd, HDFC Capital has a long-term plan to fund the development of one million affordable homes in India, in line with Prime Minister Narendra Modi's 'Housing for All' campaign.

"In India, housing will play an even more important role as a catalyst for growth," said Deepak Parekh, chairman of HDFC Ltd, in the statement.

Together with its first two funds, in which ADIA has also invested, HDFC Capital has a $3 billion funding platform, making it one of the biggest in the world for affordable housing.

This builds on the success of previous funds, and addresses the significant demand for affordable housing in India, said Khadem AlRemeithi, executive director, real estate and infrastructure department, ADIA.

Dubai population to surge to nearly 6m in 20 years amid urban transformation

The population of Dubai is projected to nearly double in the next 20 years, according to experts who predict a fresh wave of post-pandemic immigration.

Experts anticipate the growth will drive the need for new schools and hundreds of thousands of new homes, with some new arrivals expected to be from Russia and Sub-Saharan Africa.

Dubai Statistics Centre’s population counter, which records growth using residency visa data, stood at 3.48m this week – and looks set to hit 3.5 million within weeks or months.

The GCC recorded a four per cent fall in population over 2020, due to the Covid-19 outbreak, with Dubai experiencing the largest decrease at 8.4 per cent. But the city appears to have already bounced back from that,. Today, the population is nearly 100,000 higher than in January 2020.

‘Missing Barrels’ Could Make Oil Prices Soar Even Higher - Bloomberg

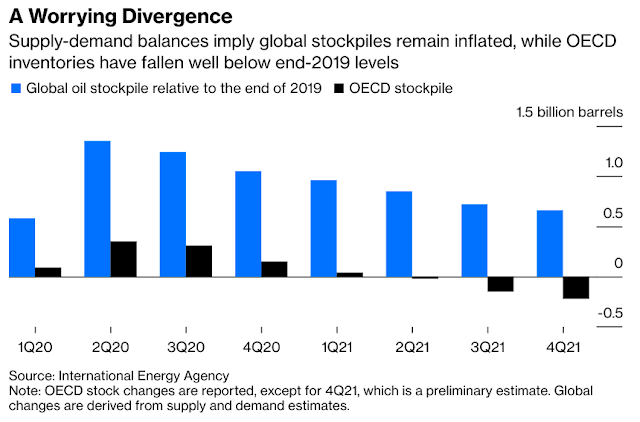

Where did all the oil go? According to the latest estimates, the world should still be awash in oil stockpiles built up during the pandemic. But that’s not what the actual data on oil supplies show.

The International Energy Agency’s latest report, published on Wednesday, shows that, if their supply-and-demand numbers are right, the world’s oil stockpiles are about 660 million barrels higher than they were before the pandemic — that’s equivalent to more than a month’s worth of production by Saudi Arabia and Russia, the two biggest members of OPEC+.

Yet oil inventories in the nations of the Organization for Economic Cooperation and Development — including both commercial and government-controlled (strategic) stockpiles — ended 2021 almost 220 million barrels lower than they were two years earlier. Adding in other things that can be measured with varying degrees of accuracy — such as the volume of oil on tankers and stockpiles in floating-roof tanks in other parts of the world — reduces the gap between theoretical and observed inventories to about 200 million barrels.

That discrepancy is only enough to meet the entire world’s oil needs for two days, or to power the U.S. for a week and a half.

Saudi digital security firm Elm seeks to raise up to $820 mln at IPO | Reuters

Saudi Arabia's digital security firm Elm said on Sunday it has set an indicative price range for its initial public offering, aiming to raise as much as 3 billion riyals ($820 million).

Elm, owned by the kingdom's sovereign wealth fund, said in a statement it plans to sell 24 million shares at an indicative price of 113 to 128 riyals per share.

Reuters reported in May 2020 plans by Saudi Arabia’s Public Investment Fund to go ahead with a sale of shares to investors.

Elm, fully owned by the Public Investment Fund, and provides secure e-business services and information technology, as well as project support services and government project outsourcing in Saudi Arabia, according to its website.