Singapore’s state-owned investor Temasek Holdings Pte said it’s adopting a cautious outlook and sees more market declines after posting a 5.8% return for the fiscal year as gains in domestic stocks offset widespread declines in China.

The $287 billion firm said it will slow the pace of investments given the likelihood of a recession in developed markets. Temasek said the risk of a mild recession in the US into 2023 has risen due to tighter financial conditions and geopolitical uncertainty. China meanwhile faces “challenges” meeting its 2022 growth target of 5.5%.

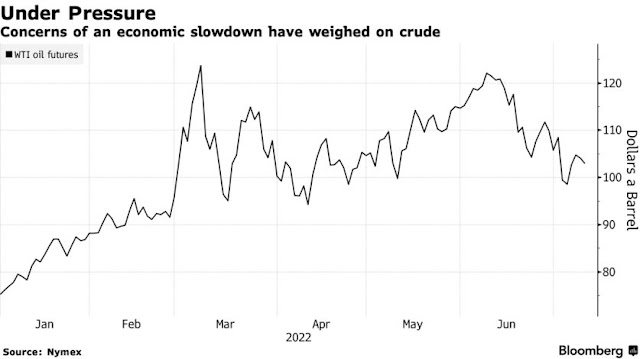

“The global economy is in a fragile state,” Temasek said in a statement Tuesday. “Rising inflation, surging commodity prices and severe supply chain bottlenecks have uncovered further fault lines in the global marketplace.”

Temasek expects to see continued asset declines this year and possibly into 2023, with the bear market only turning around when the US Federal Reserve indicates it will stop tightening, said Chief Investment Officer Rohit Sipahimalani.

“Given the Fed’s current stance, we don’t see that happening quickly,” Sipahimalani told reporters.

The U.S. and Europe could see more downside as corporate profit growth slows with rates moving higher, he added in an interview with Bloomberg Television after the release of the annual report.