Solely aggregation of news articles, with no opinions expressed by this service since 2009 launch on this platform. Copyright to all articles remains with the original publisher and HEADLINES ARE CLICKABLE to access the whole article at source. (Subscription by email is recommended,with real-time updates on LinkedIn and Twitter.)

Wednesday, 31 August 2022

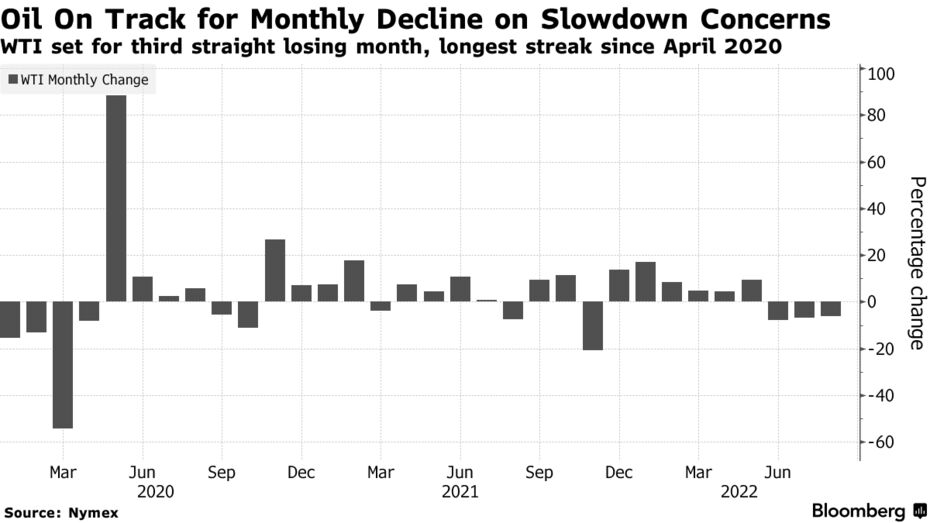

Oil Suffers Worst Losing Run Since 2020 as Slowdown Angst Flares - Bloomberg

Oil headed for a third monthly drop, the longest declining streak in more than two years, on prospects for slower global growth as central banks tighten policy and China presses on with its Covid Zero strategy.

West Texas Intermediate, which traded above $92 a barrel after tumbling on Tuesday, has shed more than 6% in August, hitting the lowest since January mid-month. In the US, the Federal Reserve has been raising rates aggressively to quell inflation, while Europe is gripped by an energy crisis that may herald a recession. In Asia, growth in China, the top oil importer, has slowed.

Traders are also tracking an array of supply-related issues. While there has been significant unrest in both Libya and Iraq in recent days, oil output in both OPEC members appears to be unaffected so far. Separately, talks to revive an Iranian nuclear deal that may unlock greater crude exports have dragged on.

Jefferies Nears Deal to Sell its Oak Hill Capital Stake to #Kuwait-Backed Wafra - Bloomberg

Wafra, an alternative-asset manager that invests on behalf of Kuwait, has agreed to acquire a minority stake in private equity firm Oak Hill Capital Partners from Jefferies Financial Group Inc., according to people with knowledge of the matter.

A transaction may be announced in coming weeks, said one of the people, all of whom requested anonymity as the information is private.

Jefferies and Wafra representatives declined to comment. Oak Hill Capital didn’t immediately respond to a request for comment.

Jefferies bought a 15% stake in Oak Hill Capital in 2019, when the firm planned to make it the anchor investment in a fund managed by Stonyrock Partners. Stonyrock planned to raise as much as $1 billion to buy stakes in private equity, real estate, infrastructure and other asset classes, but Jefferies has since wound down the effort, dubbed Stonyrock Alt Fund I LP. The New York-based lender began exploring a sale of its interest, Bloomberg News reported earlier this year.

Oak Hill Capital traces its roots to Texas billionaire Robert M. Bass’s family office, and is led by managing partners Tyler Wolfram, Brian Cherry and Steve Puccinelli. The firm has raised about $20 billion in capital commitments since its inception, it said last month.

New York-based Wafra, which invests on behalf of sovereign wealth and pension funds, has previously acquired minority stakes in other alternative-asset managers including Thompson Street Capital Partners, TowerBrook Capital Partners, Stone Point Capital and Siris Capital Group.

Capital Constellation, a platform managed by Wafra, has backed smaller firms including Ara Partners, Avista Capital Partners, Pollen Street and All Seas Capital.

Realty, banking blue chips continue to drive #UAE markets

The UAE financial markets on Tuesday posted gains of around AED4.1 billion in market cap fueled by continued upbeat sentiments at the realty and banking sectors and cash inflows by institutions and individuals alike.

Driven by Emaar, Dubai General Index (DFMGI) advanced 0.79 percent to 3,463.5927.16 pts, with the property blue chip closing higher at AED4.80 and AED6.04 for Emaar Development and Emaar Properties respectively.

Among other stocks, Emirates NBD, DEWA, and TECOM increased 0.74 percent, 0.77 percent and 1.25 percent respectively.

Abu Dhabi index (FTFADGI) closed slightly 0.02 percent down to 9970.11 pts affected by conglomerate International Holding Company (IHC.AD), traded as ASMAK, slipping slightly down to AED338.800, after AED302 million of liquidity and NBAD following suit to AED19.560.

Among other stocks, Alpha Dhabi rose 0.17 percent to AED24.240 and Multiply 0.46 percent up to AED2.180 while ADNOC Distribution moved 1.75 down to AED4.490.

Oil crawls back up on signs of firm U.S. fuel demand, weaker dollar | Reuters

Oil prices recovered slightly on Wednesday as data pointed to firm fuel demand in the United States, providing respite after a 5% drop a day earlier on fear of demand suffering from increased China COVID-19 curbs and central bank interest rate hikes.

A slightly weaker U.S. dollar also shored up the market, with oil consequently being cheaper for buyers holding other currencies.

U.S. West Texas Intermediate (WTI) crude futures jumped 90 cents, or 1%, to $92.54 a barrel at 0306 GMT, after sliding $5.37 in the previous session driven by recession fears.

Brent crude futures for October, due to expire on Wednesday, climbed 70 cents, or 0.7%, to $100.01 a barrel, trimming Tuesday's $5.78 loss. The more active November contract was up 96 cents, or 1%, at $98.80 a barrel.

The price swings since the Ukraine conflict began six months ago have rattled hedge funds and speculators and thinned trading, which in turn has made the market whipsaw even more, as seen on Tuesday. read more