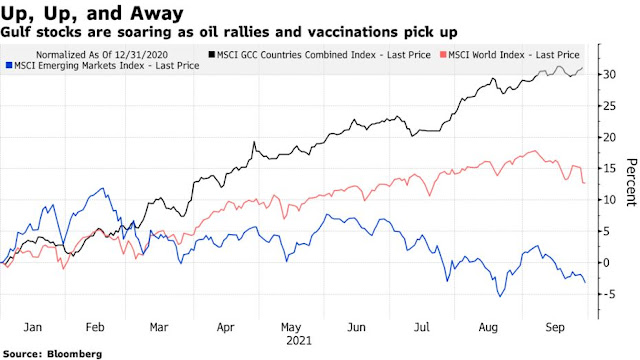

Oil prices near $80 a barrel and global commodity shortages have ignited a record-beating rally in Gulf stocks.

An MSCI index tracking companies in the United Arab Emirates, Saudi Arabia and other Gulf states has notched gains for 11 straight months, the longest winning streak ever.

The benchmark is up 31% in 2021 with some of the biggest gains coming from Saudi petrochemical and natural resource companies reaping profits from higher material prices.

“There are growing concerns about the pass-through inflationary effects of rising commodity prices for most global economies,” said Akber Khan, senior director of asset management at Al Rayan Investment in Doha. “Ironically, this is exactly what investors in the Gulf are increasingly excited about.”

Oil-rich Gulf countries have also navigated the pandemic better than other emerging markets. The United Arab Emirates has inoculated more than 80% of its population, putting it in sixth place on Bloomberg’s Resilience Rankings.

That all points to a strengthened economic backdrop for the region and its shares, according to Ali El Adou, head of asset management at Daman Investments in Dubai.

Stocks are also benefiting from government investments in the non-oil sector and new companies going public, he added.

No comments:

Post a Comment