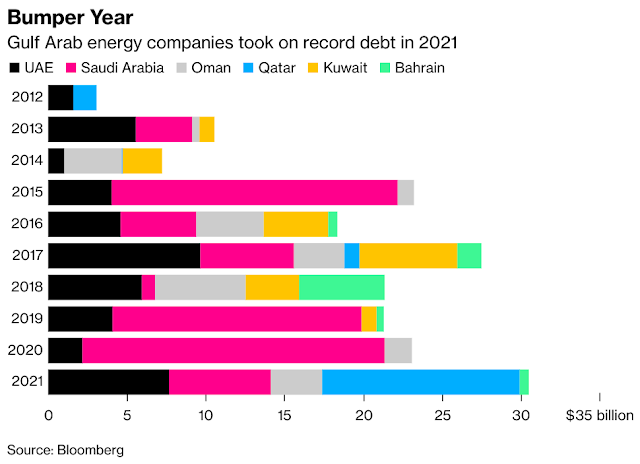

Gulf Arab energy firms borrowed $30.5 billion in 2021, the highest level in at least 25 years, as the region’s national oil companies sought to inject foreign investment into their balance sheets.

Qatar Energy led the region in issuing debt, according to Bloomberg calculations. The company sold $12.5 billion of bonds in July to fund an expansion of its liquefied natural gas output capacity and cement its position as the world’s biggest exporter.

Energy companies in the United Arab Emirates raised $7.7 billion in new debt, a four-year high for the country. Saudi Aramco, which dominated the region’s energy corporate debt market in the previous two years, was its third-largest borrower in 2021, with $6.5 billion.

No comments:

Post a Comment