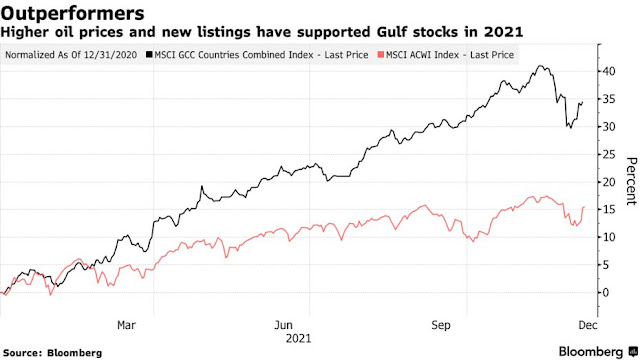

It’s been the best year in more than a decade for Gulf stocks thanks to booming oil prices. And investors expect further gains in 2022, driven by the soccer World Cup and new listings.

The region’s stocks are on track for their best annual performance since 2007, with a return of 36% including dividends. That compares with 20% for the MSCI World Index, which tracks developed world markets, and a 1.9% loss for the MSCI Emerging Market index.

And Gulf equities have plenty of catalysts ahead, according to fund managers and strategists. Dubai has announced plans to list 10 state companies, including the main utility Dubai Electricity & Water Authority, in a bid to lure investors. World Cup-host Qatar, meanwhile, is spending billions of dollars on infrastructure and preparations for the event.

No comments:

Post a Comment