Oil prices plunge as Omicron's rapid spread dims fuel demand outlook | Reuters

Oil prices slumped on Monday as surging cases of the Omicron coronavirus variant in Europe and the United States stoked investor worries that new restrictions to combat its spread could dent fuel demand.

Brent crude futures fell $2, or 2.7%, to settle at $71.52 a barrel, while U.S. West Texas Intermediate (WTI) crude futures fell $2.63, or 3.7%, to settle at $68.23 a barrel.

Brent fell to a session low of $69.28 per barrel, while WTI sank to $66.04 per barrel, both their lowest levels since early December.

"This is a knee-jerk reaction to the proliferation of the virus and the fear that lockdowns can rapidly spread," said Andrew Lipow of Lipow Oil Associates in Houston.

Solely aggregation of news articles, with no opinions expressed by this service since 2009 launch on this platform. Copyright to all articles remains with the original publisher and HEADLINES ARE CLICKABLE to access the whole article at source. (Subscription by email is recommended,with real-time updates on LinkedIn and Twitter.)

Search This Blog

Monday, 20 December 2021

Fitch revises #Oman’s outlook to stable from negative on improvements in key metrics

Fitch revises Oman’s outlook to stable from negative on improvements in key metrics

Fitch Ratings on Monday revised Oman’s outlook to stable from negative following improvements in key fiscal metrics including government debt/gross domestic product and the budget deficit.

The agency also affirmed the sovereign's long-term foreign and local currency Issuer Default Ratings (IDR) at BB-.

The BB ratings indicate an elevated vulnerability to default risk, particularly in the event of adverse changes in business or economic conditions over time, with financial flexibility still in place.

The revision in Oman's outlook was driven by higher oil prices and fiscal reforms in the country and a lessening of external financing pressures relative to recent years, even as external funding needs remain high, the rating agency said in a statement.

Fitch Ratings on Monday revised Oman’s outlook to stable from negative following improvements in key fiscal metrics including government debt/gross domestic product and the budget deficit.

The agency also affirmed the sovereign's long-term foreign and local currency Issuer Default Ratings (IDR) at BB-.

The BB ratings indicate an elevated vulnerability to default risk, particularly in the event of adverse changes in business or economic conditions over time, with financial flexibility still in place.

The revision in Oman's outlook was driven by higher oil prices and fiscal reforms in the country and a lessening of external financing pressures relative to recent years, even as external funding needs remain high, the rating agency said in a statement.

Chaar: Omicron Poses Short-Term Risk to #UAE Economy - Bloomberg video

Chaar: Omicron Poses Short-Term Risk to UAE Economy - Bloomberg

The United Arab Emirates reported the highest number of daily Covid-19 infections since late September. Samy Chaar, Chief Economist, Banque Lombard Odier & Cie discusses how despite the Omicron threat to the UAE's economy, the underlying drivers of growth remain firm. He speaks with Yousef Gamal El-Din on "Bloomberg Daybreak: Middle East." (Source: Bloomberg)

#Qatar Airways takes Airbus to court over A350 skin flaws | Reuters

Qatar Airways takes Airbus to court over A350 skin flaws | Reuters

Qatar Airways said on Monday it had started proceedings in a UK court against European planemaker Airbus (AIR.PA) in a bid to resolve a dispute over surface damage to A350 passenger jets.

"We have sadly failed in all our attempts to reach a constructive solution with Airbus in relation to the accelerated surface degradation condition adversely impacting the Airbus A350 aircraft," the Gulf airline said in a statement.

"Qatar Airways has therefore been left with no alternative but to seek a rapid resolution of this dispute via the courts."

Airbus did not immediately respond to a request for comment.

Qatar Airways said on Monday it had started proceedings in a UK court against European planemaker Airbus (AIR.PA) in a bid to resolve a dispute over surface damage to A350 passenger jets.

"We have sadly failed in all our attempts to reach a constructive solution with Airbus in relation to the accelerated surface degradation condition adversely impacting the Airbus A350 aircraft," the Gulf airline said in a statement.

"Qatar Airways has therefore been left with no alternative but to seek a rapid resolution of this dispute via the courts."

Airbus did not immediately respond to a request for comment.

#Dubai World Trade Centre to set up specialised crypto zone | Reuters

Dubai World Trade Centre to set up specialised crypto zone | Reuters

The Dubai World Trade Centre (DWTC) will become a crypto zone and regulator for cryptocurrencies and other virtual assets, the Dubai Media Office said on Monday, part of efforts to attract new business as regional economic competition heats up.

The move by the DWTC to create a specialised zone for virtual assets - including digital assets, products, operators and exchanges - is part of a drive by Dubai, one of the United Arab Emirates federation of seven emirates, to create new economic sectors, the statement said.

"Rigorous standards for investor protection, anti money laundering, combating the financing of terrorism, compliance and cross border deal flow tracing," will be developed, it said.

In September, the UAE Securities and Commodities Authority and the Dubai World Trade Centre Authority (DWTCA) agreed a framework that allows the DWTCA to approve and licence financial activities relating to crypto assets.

In October, another Dubai free zone DIFC, Dubai's state-owned financial free zone and the Middle East's major finance centre, released the first part of a regulatory framework for digital tokens.

The Dubai World Trade Centre (DWTC) will become a crypto zone and regulator for cryptocurrencies and other virtual assets, the Dubai Media Office said on Monday, part of efforts to attract new business as regional economic competition heats up.

The move by the DWTC to create a specialised zone for virtual assets - including digital assets, products, operators and exchanges - is part of a drive by Dubai, one of the United Arab Emirates federation of seven emirates, to create new economic sectors, the statement said.

"Rigorous standards for investor protection, anti money laundering, combating the financing of terrorism, compliance and cross border deal flow tracing," will be developed, it said.

In September, the UAE Securities and Commodities Authority and the Dubai World Trade Centre Authority (DWTCA) agreed a framework that allows the DWTCA to approve and licence financial activities relating to crypto assets.

In October, another Dubai free zone DIFC, Dubai's state-owned financial free zone and the Middle East's major finance centre, released the first part of a regulatory framework for digital tokens.

#AbuDhabi IHC acquires majority stake in Al Qudra Holding | ZAWYA MENA Edition

Abu Dhabi IHC acquires majority stake in Al Qudra Holding | ZAWYA MENA Edition

Abu Dhabi-based investment company International Holding Co. (IHC) said on Monday it has acquired a majority and controlling stake in Al Qudra Holding, following the completion of merger between Al Qudra and Al Tamouh Investments.

The acquisition will enable IHC to broaden its portfolio in the real estate, services, and hospitality area, it said in a statement.

Abu Dhabi-based investment holding company, Al Qudra Holding's portfolio includes Manarah Bay, a multi-usage project covering about 52,000 square meters, in Abu Dhabi and Barary Ain Al Fayda Development in Al Ain, a project comprises 2,500 residential units. The company currently has more than 12 subsidiaries spread across various sectors.

Syed Basar Shueb, CEO and Managing Director of IHC, said the acquisition comes in line "with this year's disclosed IHC investment plan across several sectors, including the real estate area, which will create immediate growth and value to our shareholders."

Earlier this month, IHC approved the merger of Al Tamouh Investments and Al Qudra Holding.

Abu Dhabi-based investment company International Holding Co. (IHC) said on Monday it has acquired a majority and controlling stake in Al Qudra Holding, following the completion of merger between Al Qudra and Al Tamouh Investments.

The acquisition will enable IHC to broaden its portfolio in the real estate, services, and hospitality area, it said in a statement.

Abu Dhabi-based investment holding company, Al Qudra Holding's portfolio includes Manarah Bay, a multi-usage project covering about 52,000 square meters, in Abu Dhabi and Barary Ain Al Fayda Development in Al Ain, a project comprises 2,500 residential units. The company currently has more than 12 subsidiaries spread across various sectors.

Syed Basar Shueb, CEO and Managing Director of IHC, said the acquisition comes in line "with this year's disclosed IHC investment plan across several sectors, including the real estate area, which will create immediate growth and value to our shareholders."

Earlier this month, IHC approved the merger of Al Tamouh Investments and Al Qudra Holding.

Citi joins JPMorgan, others in switching to Mon-Fri work week in #UAE | Reuters

Citi joins JPMorgan, others in switching to Mon-Fri work week in UAE | Reuters

Citigroup Inc (C.N) is changing to a Saturday-Sunday weekend from the New Year in the United Arab Emirates (UAE), according to an internal note seen by Reuters, becoming the latest international bank in the gulf nation to switch its work week.

Citi UAE will move its corporate offices in the country to a Monday to Friday full working days structure, with a two-hour fixed break time in the afternoon on Friday, the note said, adding that employees are required to return to work after the fixed break.

Citi's decision comes as other global banks in the nation are changing to a Monday-Friday work week from next year instead of the current Sunday-Thursday — as is common around the Middle East.

Reuters had reported on Sunday of Deutsche Bank AG (DBKGn.DE), JPMorgan Chase & Co (JPM.N) and Societe Generale SA's (SOGN.PA) move to switch to a Saturday-Sunday weekend from 2022 in UAE. read more

Citigroup Inc (C.N) is changing to a Saturday-Sunday weekend from the New Year in the United Arab Emirates (UAE), according to an internal note seen by Reuters, becoming the latest international bank in the gulf nation to switch its work week.

Citi UAE will move its corporate offices in the country to a Monday to Friday full working days structure, with a two-hour fixed break time in the afternoon on Friday, the note said, adding that employees are required to return to work after the fixed break.

Citi's decision comes as other global banks in the nation are changing to a Monday-Friday work week from next year instead of the current Sunday-Thursday — as is common around the Middle East.

Reuters had reported on Sunday of Deutsche Bank AG (DBKGn.DE), JPMorgan Chase & Co (JPM.N) and Societe Generale SA's (SOGN.PA) move to switch to a Saturday-Sunday weekend from 2022 in UAE. read more

Most Gulf indexes end lower as Omicron fears grip markets | Reuters

Most Gulf indexes end lower as Omicron fears grip markets | Reuters

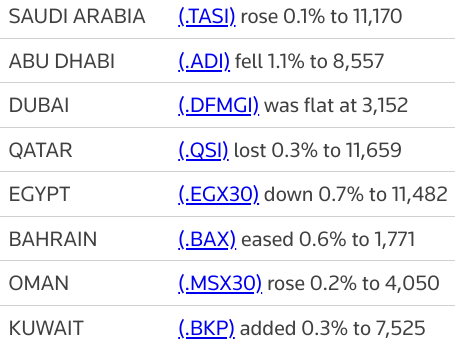

Most stock markets in the Gulf ended lower on Monday, with the Abu Dhabi index falling the most, on renewed concerns over the fast-spreading Omicron coronavirus variant.

The variant's spread pushed the Netherlands into a lockdown on Sunday and put pressure on others to follow, though the United States seemed set to remain open. read more

In Abu Dhabi, the index (.ADI) dropped 1.1%, dragged by a 5.3% fall in Emirates Telecommunications Group (ETISALAT.AD) and a 1.5% decline in Aldar Properties (ALDAR.AD).

The Central Bank of the United Arab Emirates said on Monday it would use new criteria to supervise banks' exposure to real estate, a crucial sector of the Gulf state's economy which has been sluggish for years. read more

The regulator will give banks one year to enhance their practices to meet the new requirements, starting from Dec. 30.

The benchmark index (.QSI) in Qatar, which opened after a session's break, dropped 0.3%, as most of the stocks on the index traded in negative territory, including sharia-compliant lender Masraf Al Rayan (MARK.QA), which was down 0.9%.

Qatar registered its first four cases of the Omicron variant, Reuters reported on Friday, citing state news agency QNA. read more

Meanwhile, crude prices, a key catalyst for the Gulf's financial markets, slumped by more than $3 as rapid spread of Omicron dimmed fuel demand outlook.

Dubai's main share index (.DFMGI) finished flat a day after it registered a loss of more than 3%, as gains in financial shares were offset by declines in property shares.

Investors return to the market after previous session's sharp decline and the main index could rebound further as the market remains fundamentally strong, even though Omicron fears start to impact expectations, said Wael Makarem, a senior market strategist at Exness.

Saudi Arabia's benchmark index (.TASI) reversed early losses to close 0.1% higher, helped by a 4.5% jump in Banque Saudi Fransi (1050.SE).

Elsewhere, shares of Almunajem Foods Co gained more than 5% in their stock market debut.

Outside the Gulf, Egypt's blue-chip index (.EGX30) lost 0.7%, with top lender Commercial International Bank (COMI.CA) dropping 0.7%.

Most stock markets in the Gulf ended lower on Monday, with the Abu Dhabi index falling the most, on renewed concerns over the fast-spreading Omicron coronavirus variant.

The variant's spread pushed the Netherlands into a lockdown on Sunday and put pressure on others to follow, though the United States seemed set to remain open. read more

In Abu Dhabi, the index (.ADI) dropped 1.1%, dragged by a 5.3% fall in Emirates Telecommunications Group (ETISALAT.AD) and a 1.5% decline in Aldar Properties (ALDAR.AD).

The Central Bank of the United Arab Emirates said on Monday it would use new criteria to supervise banks' exposure to real estate, a crucial sector of the Gulf state's economy which has been sluggish for years. read more

The regulator will give banks one year to enhance their practices to meet the new requirements, starting from Dec. 30.

The benchmark index (.QSI) in Qatar, which opened after a session's break, dropped 0.3%, as most of the stocks on the index traded in negative territory, including sharia-compliant lender Masraf Al Rayan (MARK.QA), which was down 0.9%.

Qatar registered its first four cases of the Omicron variant, Reuters reported on Friday, citing state news agency QNA. read more

Meanwhile, crude prices, a key catalyst for the Gulf's financial markets, slumped by more than $3 as rapid spread of Omicron dimmed fuel demand outlook.

Dubai's main share index (.DFMGI) finished flat a day after it registered a loss of more than 3%, as gains in financial shares were offset by declines in property shares.

Investors return to the market after previous session's sharp decline and the main index could rebound further as the market remains fundamentally strong, even though Omicron fears start to impact expectations, said Wael Makarem, a senior market strategist at Exness.

Saudi Arabia's benchmark index (.TASI) reversed early losses to close 0.1% higher, helped by a 4.5% jump in Banque Saudi Fransi (1050.SE).

Elsewhere, shares of Almunajem Foods Co gained more than 5% in their stock market debut.

Outside the Gulf, Egypt's blue-chip index (.EGX30) lost 0.7%, with top lender Commercial International Bank (COMI.CA) dropping 0.7%.

Rolls-Royce wins #Qatar backing for mini nuclear reactor project | Financial Times

Rolls-Royce wins Qatar backing for mini nuclear reactor project | Financial Times

Qatar will invest £85m in a Rolls-Royce led programme to build a new generation of smaller nuclear reactors, as part of the UK’s push to meet its 2050 net zero carbon targets.

The investment by the Gulf state’s sovereign wealth fund is a significant boost to the programme, which is aiming to develop a UK-designed small nuclear reactor to be built in factories and then assembled on site, reducing the risks and huge costs of construction of big nuclear power plants.

UK ministers announced last month that they would commit £210m of grant funding to the Rolls-Royce led programme after the aero-engine maker said it had received £145m of investment from two private sector backers. Rolls-Royce is putting in £50m.

Under the terms of the latest agreement, Qatar will invest £85m in the consortium, Rolls-Royce Small Modular Reactor, for a 10 per cent stake.

Most Gulf bourses slip as Omicron fears rattle markets | Reuters

Most Gulf bourses slip as Omicron fears rattle markets | Reuters

Most stock markets in the Gulf fell on Monday, tracking weaker oil prices and tepid Asian shares, as surging Omicron COVID-19 cases triggered tighter curbs in Europe and threatened to swamp the global economy into the New Year.

The Netherlands went into lockdown on Sunday and the possibility of more COVID-19 restrictions being imposed ahead of the Christmas and New Year holidays loomed over several European countries as the Omicron variant spreads rapidly. read more

Saudi Arabia's benchmark index (.TASI) dropped 0.6%, with Al Rajhi Bank (1120.SE) dropping 1% and Dr Sulaiman Al-Habib Medical Services (4013.SE) retreating 2.2%.

The Saudi-led coalition fighting in Yemen destroyed early on Monday a drone it says was aimed at civilians at King Abdullah airport in the southern Saudi city of Jizan, Saudi state media reported. read more

Violence in Yemen's conflict has escalated dramatically over the last few months despite efforts by the United States and the United Nations to engineer a ceasefire in the seven-year-old war, which has caused a dire humanitarian crisis. read more

On the other hand, Almunajem Foods Co gained as much as 10% to open at 66 riyals per share in its stock market debut.

Dubai's main share index (.DFMGI) fell 0.9%, hit by a 0.6% decline in sharia-compliant lender Dubai Islamic Bank (DISB.DU).

Brent crude futures, a key catalyst for the Gulf's financial markets, fell $1.92, or 2.6%, to $71.60 a barrel by 0436 GMT, while MSCI's index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) fell 1.5% to its lowest level in the year. MKTS/

In Abu Dhabi, the index (.ADI) declined 1.2%, dragged down by a 5.2% slide in telecoms firm Etisalat (ETISALAT.AD).

The benchmark index (.QSI) in Qatar, which opened after a session's break, dropped 0.6%, as almost all the stocks on the index traded in negative territory including Commercial Bank (COMB.QA), which was down 1.7%.

Qatar registered its first four cases of the Omicron variant, Reuters reported on Friday, citing the state news agency QNA. read more

Most stock markets in the Gulf fell on Monday, tracking weaker oil prices and tepid Asian shares, as surging Omicron COVID-19 cases triggered tighter curbs in Europe and threatened to swamp the global economy into the New Year.

The Netherlands went into lockdown on Sunday and the possibility of more COVID-19 restrictions being imposed ahead of the Christmas and New Year holidays loomed over several European countries as the Omicron variant spreads rapidly. read more

Saudi Arabia's benchmark index (.TASI) dropped 0.6%, with Al Rajhi Bank (1120.SE) dropping 1% and Dr Sulaiman Al-Habib Medical Services (4013.SE) retreating 2.2%.

The Saudi-led coalition fighting in Yemen destroyed early on Monday a drone it says was aimed at civilians at King Abdullah airport in the southern Saudi city of Jizan, Saudi state media reported. read more

Violence in Yemen's conflict has escalated dramatically over the last few months despite efforts by the United States and the United Nations to engineer a ceasefire in the seven-year-old war, which has caused a dire humanitarian crisis. read more

On the other hand, Almunajem Foods Co gained as much as 10% to open at 66 riyals per share in its stock market debut.

Dubai's main share index (.DFMGI) fell 0.9%, hit by a 0.6% decline in sharia-compliant lender Dubai Islamic Bank (DISB.DU).

Brent crude futures, a key catalyst for the Gulf's financial markets, fell $1.92, or 2.6%, to $71.60 a barrel by 0436 GMT, while MSCI's index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) fell 1.5% to its lowest level in the year. MKTS/

In Abu Dhabi, the index (.ADI) declined 1.2%, dragged down by a 5.2% slide in telecoms firm Etisalat (ETISALAT.AD).

The benchmark index (.QSI) in Qatar, which opened after a session's break, dropped 0.6%, as almost all the stocks on the index traded in negative territory including Commercial Bank (COMB.QA), which was down 1.7%.

Qatar registered its first four cases of the Omicron variant, Reuters reported on Friday, citing the state news agency QNA. read more

#Dubai's Tabreed to set up JV with IFC to invest $400mln in India | ZAWYA MENA Edition

Dubai's Tabreed to set up JV with IFC to invest $400mln in India | ZAWYA MENA Edition

Dubai-based district cooling firm Tabreed has entered into a strategic partnership with the International Finance Corporation (IFC), a member of the World Bank Group, to invest about $400 million in India over the next five years.

Under the partnership agreement, Tabreed India, currently a wholly owned subsidiary of Tabreed, will be transferred to a new holding company established in Singapore, in which Tabreed will hold a 75 percent stake and IFC will have 25 percent, according to a filing by Tabreed on the Dubai Financial Market where its shares trade.

The holding company will be set up with initial equity commitments from the partners of $100 million with a mandate to invest in projects of up to approximately $400 million over the next five years.

The investment will target a portfolio of approximately 100,000 refrigeration tonnes (RT) servicing industrial, commercial and retail developments across India.

Dubai-based district cooling firm Tabreed has entered into a strategic partnership with the International Finance Corporation (IFC), a member of the World Bank Group, to invest about $400 million in India over the next five years.

Under the partnership agreement, Tabreed India, currently a wholly owned subsidiary of Tabreed, will be transferred to a new holding company established in Singapore, in which Tabreed will hold a 75 percent stake and IFC will have 25 percent, according to a filing by Tabreed on the Dubai Financial Market where its shares trade.

The holding company will be set up with initial equity commitments from the partners of $100 million with a mandate to invest in projects of up to approximately $400 million over the next five years.

The investment will target a portfolio of approximately 100,000 refrigeration tonnes (RT) servicing industrial, commercial and retail developments across India.

#UAE central bank to increase oversight of banks' real estate exposure | Reuters

UAE central bank to increase oversight of banks' real estate exposure | Reuters

The Central Bank of the United Arab Emirates said on Monday it would use new criteria to supervise banks' exposure to real estate, a crucial sector of the Gulf state's economy which has been sluggish for years.

The regulator is introducing an "enhanced framework" that will cover all types of on-balance-sheet loans and investments, and off-balance-sheet exposures to the real estate sector, it said in a statement.

This will require "banks to review and improve their internal policies to enhance sound underwriting, valuation and general risk management for their real estate exposures," it said.

Residential property prices in Dubai, one of the UAE's emirates, had been falling since 2014 on high supply and weaker demand, forcing construction firms to cut jobs and halt expansion plans, and leading to rises in banks' bad loans.

The Central Bank of the United Arab Emirates said on Monday it would use new criteria to supervise banks' exposure to real estate, a crucial sector of the Gulf state's economy which has been sluggish for years.

The regulator is introducing an "enhanced framework" that will cover all types of on-balance-sheet loans and investments, and off-balance-sheet exposures to the real estate sector, it said in a statement.

This will require "banks to review and improve their internal policies to enhance sound underwriting, valuation and general risk management for their real estate exposures," it said.

Residential property prices in Dubai, one of the UAE's emirates, had been falling since 2014 on high supply and weaker demand, forcing construction firms to cut jobs and halt expansion plans, and leading to rises in banks' bad loans.

Brent Crude Tumbles More Than 3% as Bearish Headwinds Mount - Bloomberg

Brent Crude Tumbles More Than 3% as Bearish Headwinds Mount - Bloomberg

Oil extended declines -- falling more than 3% -- as the rapid spread of the omicron virus variant raised concern over the demand outlook.

Futures in London tumbled near $71 a barrel after dropping 2.2% last week. Infections are rising from the U.S. to Europe as authorities struggle to tame the spread of omicron. That’s led to restrictions on air travel and stricter curbs on movement, creating fears that will flow through to weaker energy demand.

Oil’s market structure is also showing signs of weakness. The prompt timespread for Brent once again flipped briefly into a bearish contango pattern on Monday, indicating the market is becoming over-supplied.

| PRICES |

|---|

|

Futures in London tumbled near $71 a barrel after dropping 2.2% last week. Infections are rising from the U.S. to Europe as authorities struggle to tame the spread of omicron. That’s led to restrictions on air travel and stricter curbs on movement, creating fears that will flow through to weaker energy demand.

Oil’s market structure is also showing signs of weakness. The prompt timespread for Brent once again flipped briefly into a bearish contango pattern on Monday, indicating the market is becoming over-supplied.

Oil prices slide as rapid Omicron spread dims fuel demand outlook | Reuters

Oil prices slide as rapid Omicron spread dims fuel demand outlook | Reuters

Oil prices slumped by more than 2% on Monday as surging cases of the Omicron coronavirus variant in Europe and the United States stoked investor worries that new restrictions on businesses to combat its spread may hit fuel demand.

Brent crude futures fell $1.92, or 2.6%, to $71.60 a barrel by 0436 GMT while U.S. West Texas Intermediate (WTI) crude futures fell $2.09, or 3%, to $68.77 a barrel.

"Today's Asia ... weak sentiment in oil prices seems to go in line with a weakness seen in the S&P 500 and Nasdaq 100 e-mini futures," said Kelvin Wong, market analyst at CMC Markets.

"(This is) due to fears of impending restrictions on economic activities to contain the current increasing spread of the COVID-19 Omicron variant worldwide which may increase the risk of demand slowdown."

Oil prices slumped by more than 2% on Monday as surging cases of the Omicron coronavirus variant in Europe and the United States stoked investor worries that new restrictions on businesses to combat its spread may hit fuel demand.

Brent crude futures fell $1.92, or 2.6%, to $71.60 a barrel by 0436 GMT while U.S. West Texas Intermediate (WTI) crude futures fell $2.09, or 3%, to $68.77 a barrel.

"Today's Asia ... weak sentiment in oil prices seems to go in line with a weakness seen in the S&P 500 and Nasdaq 100 e-mini futures," said Kelvin Wong, market analyst at CMC Markets.

"(This is) due to fears of impending restrictions on economic activities to contain the current increasing spread of the COVID-19 Omicron variant worldwide which may increase the risk of demand slowdown."

Subscribe to:

Comments (Atom)