Most stock markets in the Gulf ended higher on Tuesday, with the Saudi index outperforming the region amid diminished concern over the economic impact of the Omicron variant of COVID-19.

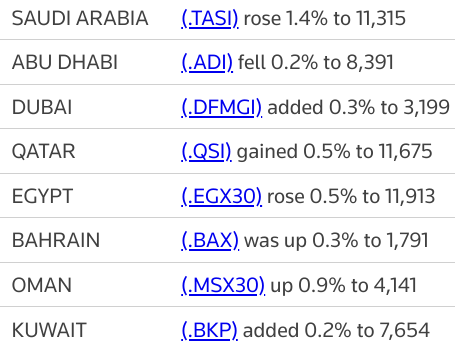

Saudi Arabia's benchmark index (.TASI) advanced 1.4%, buoyed by a 2.9% rise in Al Rajhi Bank (1120.SE) and a 1.7% increase in petrochemical maker Saudi Basic Industries Corp (2010.SE).

The market was supported by rising oil prices and retreating concerns around the possible effects of the Omicron variant on the global economy, said Wael Makarem, senior market strategist at Exness.

"However, the market remains exposed to new price corrections if oil prices return to the downside."

Oil prices, a key catalyst for the Gulf's financial markets, extended gains, with Brent crude trading near $80 a barrel as the market shrugged off Omicron worries, supported by supply outages and expectations that U.S. inventories fell last week.

Meanwhile, Saudi Arabia delayed the launch of a major development strategy for the city of Riyadh up to 2030 until next year due to some "incomplete elements", the state news agency SPA reported. read more

Dubai's main share index (.DFMGI) gained 0.3%, supported by a 1.2% leap in blue-chip developer Emaar Properties (EMAR.DU) and a 0.4% rise in sharia-compliant lender Dubai Islamic Bank (DISB.DU).

The United Arab Emirates has approved emergency use of Sinopharm's protein-based COVID-19 vaccine and it will be available to the public as a booster dose starting in January 2022, the health ministry said. read more

The Qatari benchmark (.QSI) added 0.5%, ending two sessions of losses, with the Gulf's biggest lender Qatar National Bank (QNBK.QA) closing 1% higher.

In Abu Dhabi, the index (.ADI) fell 0.2%, pressured by a 0.9% fall in the country's largest lender First Abu Dhabi Bank (FAB.AD).

Outside the Gulf, Egypt's blue-chip index (.EGX30) finished 0.5% higher, led by a 4.6% jump in Abu Qir Fertilizers and Chemical Industries (ABUK.CA).

No comments:

Post a Comment