Yemen's Iran-aligned Houthi group attacked the United Arab Emirates in an operation using missiles and drones, setting off explosions in fuel trucks that killed three people and causing a fire near the airport of Abu Dhabi, capital of the region's commercial and tourism hub. read more

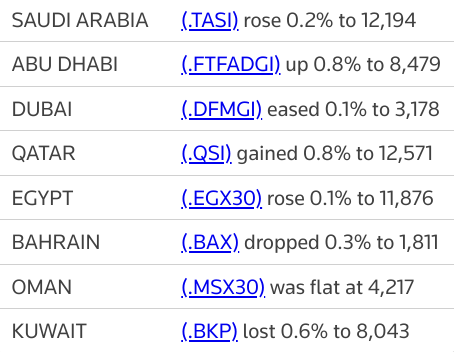

The Abu Dhabi index (.FTFADGI) rebounded 0.8%, recovering from the previous session's losses, led by a 2.1% rise in the country's largest lender First Abu Dhabi Bank (FAB.AD).

The attack was more of a minor irritant than a drastic change in the security scenario, according to Vijay Valecha, Chief Investment Officer, Century Financial. The security infrastructure in UAE is pretty robust and this has prevented these kinds of attacks so far, he said.

"Due to this reason, it is improbable that investor sentiment will be impacted."

Dubai's main share index (.DFMGI) dipped 0.1%, hit by a 1.4% fall in blue-chip developer Emaar Properties (EMAR.DU) and a 1.4% decline in budget airliner Air Arabia (AIRA.DU).

Saudi Arabia's benchmark index (.TASI) gained 0.2%, holding steady at its highest in over 15 years, helped by a 4.4% rise in Riyad Bank (1010.SE).

Red Sea International (4230.SE) surged 10%, the top gainer on the index, following a contract worth more than 60 million riyals ($15.99 million).

Saudi shares are supported by strong oil prices and the market was unaffected by the drone attacks on the UAE, said Eman AlAyyaf, CEO of EA Trading.

Benchmark oil prices climbed to their highest level since 2014 as possible supply disruption after attacks in the Mideast Gulf added to an already tight supply outlook.

The Qatari index (.QSI) rose 0.8%, boosted by a 4% increase in Commercial Bank (COMB.QA)

Outside the Gulf, Egypt's blue-chip index (.EGX30) added 0.1%.

No comments:

Post a Comment