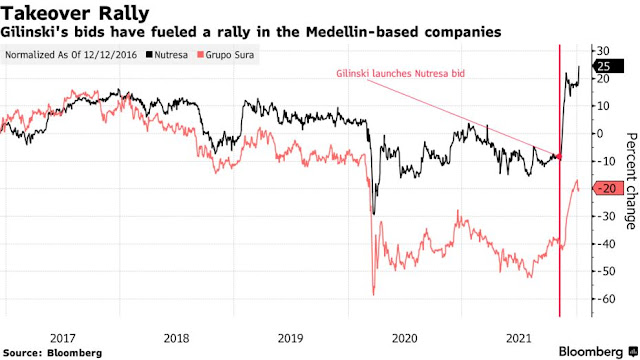

Billionaire Jaime Gilinski has shaken the normally sleepy Colombian markets with bids worth as much as $3.4 billion to take substantial stakes in the nation’s biggest foodmaker and a financial holding company. Now, with both offers expiring this week, he’ll find out just how successful he was in wooing shareholders.

Investors in Grupo de Inversiones Suramericana SA have until Tuesday afternoon to tender their shares, with Gilinski and his son, Gabriel, offering to buy as much as 31.68% of the holding company for $8.01 per share. A day later, the bid for Grupo Nutresa SA expires. In that one, Gilinski teamed with the royal family of Abu Dhabi to offer $7.71 a share for as much as 62.6% of the maker of snacks, chocolates, coffee and other food.

Through the end of last week, 15.6% of Nutresa’s outstanding shares and 13.8% of Sura’s had been tendered.

Even if Gilinski doesn’t reach the minimum amount he initially set out to buy -- 50.1% of Nutresa and 25.3% of Sura -- he’ll likely go through with the transactions, according to a person familiar with his thinking who asked not to be identified discussing strategy. Stakes as small as 14.3% will be enough to get control of board seats at both companies, according to Luis Ramos, an equities analyst at LarrainVial.

No comments:

Post a Comment