WTI for August delivery dropped 2.3% to $101.65 a barrel at 9:53 a.m. in London.

Brent for September settlement fell 1.9% to $105.07 a barrel.

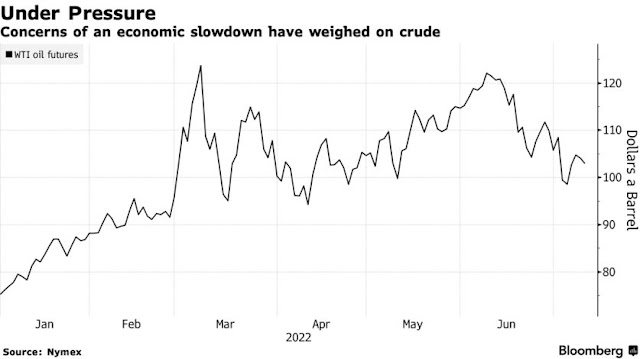

Oil extended losses as a Covid-19 resurgence in China added to concerns about a global economic slowdown, with the International Energy Agency warning the worst of the energy crisis may be ahead.

West Texas Intermediate lost as much as 2.9% to near $101 a barrel. Bearish sentiment has filtered through commodities as rising virus cases in China and a looming US inflation print stoke concerns about the demand outlook. A stronger dollar has added to the pressure, making oil less attractive to investors.

Crude has tumbled since early June on escalating fears the US may be heading for a recession as central banks aggressively raise rates to combat inflation. Nations are experiencing the first global energy crisis and “we might not have seen the worst of it yet,” IEA Executive Director Fatih Birol said in Sydney.

“Oil markets started the week in a risk-off setting with China’s rise in Covid and a stronger dollar being the biggest drag on flat price,” said Keshav Lohiya, founder of consultant Oilytics.

No comments:

Post a Comment