Most stock markets in the Gulf ended lower on Wednesday pressured by a decline in oil prices and a weaker-than-expected Chinese economic data, ahead of a crucial vote in Washington on the U.S. debt ceiling.

The U.S. House of Representatives is due to vote on Wednesday on a bill to lift the government's debt ceiling, a critical step to avoid a potential economically destabilizing default that could come early next week without congressional action.

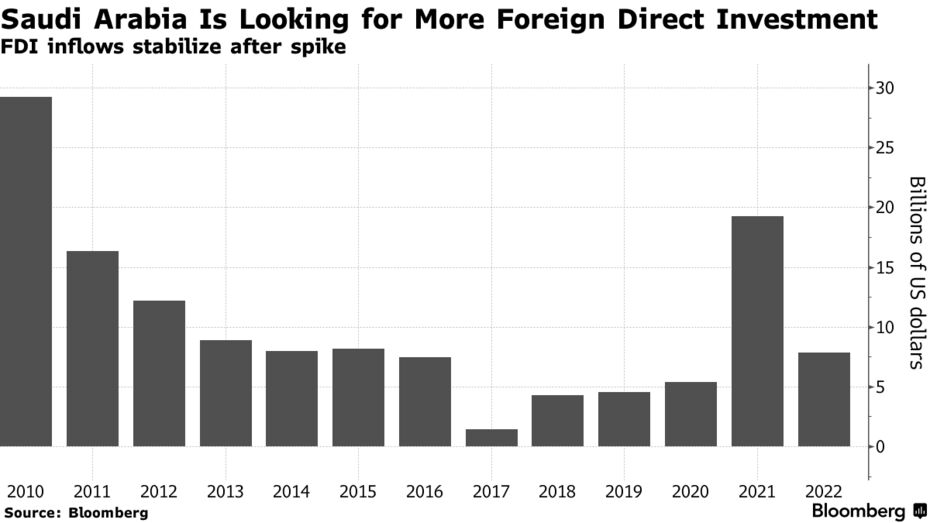

Saudi Arabia's benchmark index (.TASI) fell more than 1%, with Al Rajhi Bank (1120.SE) and Riyad Bank (1010.SE) sliding 1.3% and 2.8%, respectively.

The Saudi stock market recorded losses with traders considering the impact of the weaker-than-expected Chinese manufacturing activity on the local economy, said Ahmed Negm, Head of Market Research MENA at XS.com.

"The main index could remain exposed to developments in energy markets."

China's manufacturing activity contracted faster than expected in May on weakening demand, with the official manufacturing purchasing managers' index (PMI) down to 48.8 from 49.2 in April. The outcome lagged a forecast of 49.4.

In Abu Dhabi, the index (.FTFADGI) closed 0.8% lower.

Separately, the United Arab Emirates said on Wednesday it was no longer taking part in operations by a U.S.-led task force protecting Gulf shipping, which has been subjected to renewed tanker seizures by Iranian naval forces in recent weeks.

The Qatari benchmark (.QSI) slid 1.8%, underperforming the region, with most stocks on the index trading in the red including petrochemical maker Industries Qatar (IQCD.QA), which shed 4.4%.

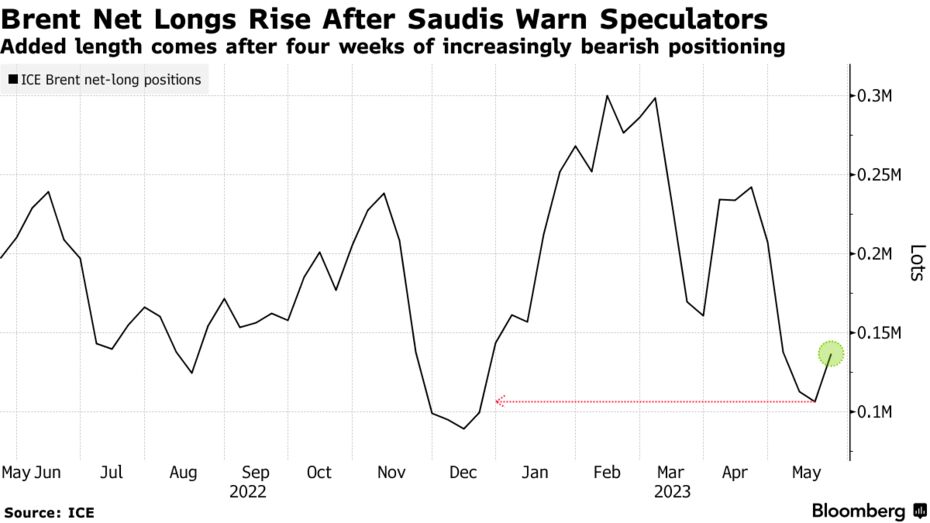

Oil prices - a key catalyst for the Gulf's financials - fell over 2% on a stronger U.S. dollar and as weak data from top oil importer China raised demand fears.

Mixed signals by major OPEC+ producers on whether or not the group will decide to further cut oil production also sparked the recent volatility in oil prices.

Dubai's main share index (.DFMGI), however, bucked the trend to finish 0.3% higher.

Outside the Gulf, Egypt's blue-chip index (.EGX30) lost 0.2%, with top lender Commercial International Bank (COMI.CA) falling 0.4%.