OPEC+ considers options for releasing more oil to the market -sources | Reuters

OPEC+ is considering going beyond its existing deal to boost production by 400,000 barrels per day (bpd) when it meets next week, sources said, against a backdrop of oil near a three-year high and pressure from consumers for more supply.

The Organization of the Petroleum Exporting Countries and allies led by Russia, known as OPEC+, agreed in July to boost output by 400,000 bpd a month to phase out 5.8 million bpd in cuts. It meets on Monday to review its output policy.

Four OPEC+ sources said adding more oil was being looked at as a scenario, but none gave details on volumes or which month. Another OPEC+ source suggested an increase of 800,000 bpd for one month was a possible scenario, with zero the next month.

The nearest month any increase could occur is November since OPEC+'s last meeting decided the October volumes. read more

Solely aggregation of news articles, with no opinions expressed by this service since 2009 launch on this platform. Copyright to all articles remains with the original publisher and HEADLINES ARE CLICKABLE to access the whole article at source. (Subscription by email is recommended,with real-time updates on LinkedIn and Twitter.)

Search This Blog

Thursday, 30 September 2021

Oil steadies after report China ready to buy more | Reuters

Oil steadies after report China ready to buy more | Reuters

Oil futures were little changed on Thursday as reports China was prepared to buy more oil and other energy supplies to meet growing demand offset price pressure from an unexpected rise in U.S. crude inventories and a strong dollar.

Brent futures for November delivery fell 12 cents, or 0.2%, to settle at $78.52 a barrel, while U.S. West Texas Intermediate (WTI) crude rose 20 cents, or 0.3%, to settle at $75.03.

Earlier in the day prices at both benchmarks dropped over $1 a barrel.

"The expiration of NYMEX products and Brent crude ... spiked volatility," said Jim Ritterbusch, president of Ritterbusch and Associates in Galena, Illinois.

Oil futures were little changed on Thursday as reports China was prepared to buy more oil and other energy supplies to meet growing demand offset price pressure from an unexpected rise in U.S. crude inventories and a strong dollar.

Brent futures for November delivery fell 12 cents, or 0.2%, to settle at $78.52 a barrel, while U.S. West Texas Intermediate (WTI) crude rose 20 cents, or 0.3%, to settle at $75.03.

Earlier in the day prices at both benchmarks dropped over $1 a barrel.

"The expiration of NYMEX products and Brent crude ... spiked volatility," said Jim Ritterbusch, president of Ritterbusch and Associates in Galena, Illinois.

#UAE Needs Prioritized Stimulus, Reforms for Growth, IMF Says - Bloomberg

UAE Needs Prioritized Stimulus, Reforms for Growth, IMF Says - Bloomberg

The United Arab Emirates should prioritize new fiscal stimulus and structural reforms to ensure sustainable economic growth, the International Monetary Fund said, as the Gulf Arab state prepares to wind down its pandemic-related support measures.

The new reforms should target attracting highly skilled professionals, supporting private sector employment, and increasing trade and foreign investment, the IMF said in a report Thursday. “Going forward, however, support measures should be increasingly targeted to viable sectors and firms and supporting people most in need,” it said.

The UAE’s economy has been recovering and is expected to rally further after Dubai opens its $7 billion World Expo on Friday. Dubai, which is part of the UAE, derives a third of its economy from sectors such as hospitality and wholesale and retail trade, so the launch of the coronavirus-delayed Expo will provide a boost.

“A gradual recovery is expected in 2021,” the IMF said citing a “strong” health response and supportive macroeconomic policies as well as the rebound in tourism and domestic activity related to the delayed Expo 2020. Despite the global and local uncertainty around the economic recovery, “the UAE’s strong reform momentum provides an upside risk to growth,” it said.

As the economy improves, the government is expected to pare its pandemic-related stimulus. Budget spending in the oil-rich Gulf country is estimated at 58 billion dirhams ($15.8 billion) this year, 3 billion dirhams less than in 2019, before the coronavirus threw global spending plans into turmoil.

The United Arab Emirates should prioritize new fiscal stimulus and structural reforms to ensure sustainable economic growth, the International Monetary Fund said, as the Gulf Arab state prepares to wind down its pandemic-related support measures.

The new reforms should target attracting highly skilled professionals, supporting private sector employment, and increasing trade and foreign investment, the IMF said in a report Thursday. “Going forward, however, support measures should be increasingly targeted to viable sectors and firms and supporting people most in need,” it said.

The UAE’s economy has been recovering and is expected to rally further after Dubai opens its $7 billion World Expo on Friday. Dubai, which is part of the UAE, derives a third of its economy from sectors such as hospitality and wholesale and retail trade, so the launch of the coronavirus-delayed Expo will provide a boost.

“A gradual recovery is expected in 2021,” the IMF said citing a “strong” health response and supportive macroeconomic policies as well as the rebound in tourism and domestic activity related to the delayed Expo 2020. Despite the global and local uncertainty around the economic recovery, “the UAE’s strong reform momentum provides an upside risk to growth,” it said.

As the economy improves, the government is expected to pare its pandemic-related stimulus. Budget spending in the oil-rich Gulf country is estimated at 58 billion dirhams ($15.8 billion) this year, 3 billion dirhams less than in 2019, before the coronavirus threw global spending plans into turmoil.

MIDEAST STOCKS Banks boost most Gulf shares; #AbuDhabi dips | Reuters

MIDEAST STOCKS Banks boost most Gulf shares; Abu Dhabi dips | Reuters

Jumps in financial shares helped most stock markets in the Gulf close higher on Thursday, with indexes heading for a quarterly gain, although the Abu Dhabi benchmark bucked the trend to end lower for the day.

The GCC has outperformed on the back of oil price strength. There might be a concerning signal in the last month's weakness in non-commodity sectors in Saudi, said Hasnain Malik of Tellimer

The most value and potential for recovery in the region is seen in Dubai, he said.

Saudi Arabia's benchmark index (.TASI) closed up 1%, adding a 4.7% over the July-September period, although at a slower pace than the previous two quarters.

Al Rajhi Bank (1120.SE) jumped and Saudi National Bank (1180.SE) jumped 1.3% and 2% receptively after brokerage firm EFG Hermes raised target prices.

Saudi Telecom (7010.SE) added nearly 2% after its unit, solutions by stc (7202.SE), surged nearly 30% on its first day of trading amid a rush of initial public offerings.

Oil prices, a key catalyst for the Gulf's financial shares, will see modest gains for the rest of the year and into 2022 as consumption resumes its recovery to pre-pandemic levels, with a likely COVID-19 resurgence still looming large over the outlook, a Reuters poll showed on Thursday. read more

In Dubai, the main share index (.DFMGI) rose 0.7%, logging a slower quarterly gain of 1.2% so far in this year, supported by a 1.1% rise in Emirates NBD Bank (ENBD.DU) and a 1.2% leap in blue-chip developer Emaar Properties (EMAR.DU).

Abu Dhabi's index (.ADI) ended the month down 0.4%, but eked out 12.6% for the quarter. The country's largest lender First Abu Dhabi Bank (FAB.AD) dropped 1.7% and Abu Dhabi Commercial Bank (ADCB.AD) lost 0.7%.

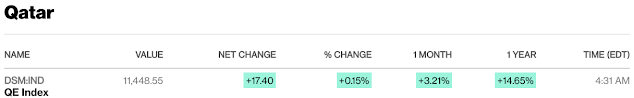

In Qatar, the benchmark (.QSI) gained 0.5% as petrochemical company Industries Qatar (IQCD.QA) increased 1.4%, logging a seventh consecutive sessions of rise.

Outside the Gulf, Egypt's blue-chip index (.EGX30) closed 1% higher, bolstered by a 1.8% jump in its top lender Commercial International Bank-CIB (COMI.CA).

Jumps in financial shares helped most stock markets in the Gulf close higher on Thursday, with indexes heading for a quarterly gain, although the Abu Dhabi benchmark bucked the trend to end lower for the day.

The GCC has outperformed on the back of oil price strength. There might be a concerning signal in the last month's weakness in non-commodity sectors in Saudi, said Hasnain Malik of Tellimer

The most value and potential for recovery in the region is seen in Dubai, he said.

Saudi Arabia's benchmark index (.TASI) closed up 1%, adding a 4.7% over the July-September period, although at a slower pace than the previous two quarters.

Al Rajhi Bank (1120.SE) jumped and Saudi National Bank (1180.SE) jumped 1.3% and 2% receptively after brokerage firm EFG Hermes raised target prices.

Saudi Telecom (7010.SE) added nearly 2% after its unit, solutions by stc (7202.SE), surged nearly 30% on its first day of trading amid a rush of initial public offerings.

Oil prices, a key catalyst for the Gulf's financial shares, will see modest gains for the rest of the year and into 2022 as consumption resumes its recovery to pre-pandemic levels, with a likely COVID-19 resurgence still looming large over the outlook, a Reuters poll showed on Thursday. read more

In Dubai, the main share index (.DFMGI) rose 0.7%, logging a slower quarterly gain of 1.2% so far in this year, supported by a 1.1% rise in Emirates NBD Bank (ENBD.DU) and a 1.2% leap in blue-chip developer Emaar Properties (EMAR.DU).

Abu Dhabi's index (.ADI) ended the month down 0.4%, but eked out 12.6% for the quarter. The country's largest lender First Abu Dhabi Bank (FAB.AD) dropped 1.7% and Abu Dhabi Commercial Bank (ADCB.AD) lost 0.7%.

In Qatar, the benchmark (.QSI) gained 0.5% as petrochemical company Industries Qatar (IQCD.QA) increased 1.4%, logging a seventh consecutive sessions of rise.

Outside the Gulf, Egypt's blue-chip index (.EGX30) closed 1% higher, bolstered by a 1.8% jump in its top lender Commercial International Bank-CIB (COMI.CA).

UAE set for gradual recovery, but COVID-19 risks cloud outlook, IMF says | Reuters

UAE set for gradual recovery, but COVID-19 risks cloud outlook, IMF says | Reuters

The United Arab Emirates is set for a gradual economic recovery, thanks in part to its strong response to the coronavirus crisis and a rebound in tourism, the International Monetary Fund said, but the risk of a pandemic resurgence clouds the outlook.

The Gulf's second largest economy suffered a deep recession last year as curbs against the COVID-19 pandemic hurt vital sectors such as trade and tourism, while record low oil prices weighed on petroleum revenues.

The IMF estimated a contraction of 6.1% in gross domestic product in 2020, but said the recovery had begun to gain momentum.

"A gradual recovery is expected in 2021, supported by the UAE’s early and strong health response, continued supportive macroeconomic policies, and rebound in tourism and domestic activity related to the delayed Expo 2020, set to begin in October," the IMF said in a statement on Thursday.

The United Arab Emirates is set for a gradual economic recovery, thanks in part to its strong response to the coronavirus crisis and a rebound in tourism, the International Monetary Fund said, but the risk of a pandemic resurgence clouds the outlook.

The Gulf's second largest economy suffered a deep recession last year as curbs against the COVID-19 pandemic hurt vital sectors such as trade and tourism, while record low oil prices weighed on petroleum revenues.

The IMF estimated a contraction of 6.1% in gross domestic product in 2020, but said the recovery had begun to gain momentum.

"A gradual recovery is expected in 2021, supported by the UAE’s early and strong health response, continued supportive macroeconomic policies, and rebound in tourism and domestic activity related to the delayed Expo 2020, set to begin in October," the IMF said in a statement on Thursday.

Oil prices little changed on report China ready to buy more | Reuters

Oil prices little changed on report China ready to buy more | Reuters

Oil prices erased most of their losses and were trading little changed on Thursday following reports China was prepared to buy more oil to meet growing demand.

Brent futures for November delivery fell 11 cents, or 0.1%, to $78.53 a barrel by 11:43 a.m. EDT (1543 GMT), while U.S. West Texas Intermediate (WTI) crude rose 48 cents, or 0.6%, to $75.31.

Brent futures for December, which will soon be the front-month, were up 0.3% to $78.30 a barrel.

Earlier in the day prices fell over $1 a barrel on higher U.S. crude oil inventories and a strong dollar .

Phil Flynn, senior analyst at Price Futures Group in Chicago, said the late morning futures price move higher was due to a report that China was prepared to buy more oil.

Oil prices erased most of their losses and were trading little changed on Thursday following reports China was prepared to buy more oil to meet growing demand.

Brent futures for November delivery fell 11 cents, or 0.1%, to $78.53 a barrel by 11:43 a.m. EDT (1543 GMT), while U.S. West Texas Intermediate (WTI) crude rose 48 cents, or 0.6%, to $75.31.

Brent futures for December, which will soon be the front-month, were up 0.3% to $78.30 a barrel.

Earlier in the day prices fell over $1 a barrel on higher U.S. crude oil inventories and a strong dollar .

Phil Flynn, senior analyst at Price Futures Group in Chicago, said the late morning futures price move higher was due to a report that China was prepared to buy more oil.

#SaudiArabia keeps focus on deficit cut with 2022 budget | Reuters

Saudi Arabia keeps focus on deficit cut with 2022 budget | Reuters

Saudi Arabia expects to post a deficit of 2.7% of gross domestic product this year and to reduce it further next year, it said in a preliminary budget statement for 2022, maintaining a focus on fiscal adjustment despite projected higher crude revenues.

Saudi Arabia had budgeted a 4.9% deficit for 2021 but that figure has now been revised to a 2.7% forecast, which the kingdom plans to reduce further to 1.6% of GDP in 2022.

According to its projections, Saudi Arabia would switch to a 0.8% surplus in 2023.

"The key message to us is a continued focus on expenditure restraint to stabilise the fiscal position", said Monica Malik, chief economist at Abu Dhabi Commercial Bank.

The improvement in the kingdom's fiscal position this year was driven by a jump in revenues, from a budgeted 849 billion riyals to a revised estimate of 930 billion riyals, as oil production increased and crude prices rebounded.

The largest Arab economy suffered a deep recession last year as the coronavirus crisis hurt its nascent non-oil economic sectors while record-low oil prices weighed on state coffers, widening the 2020 budget deficit to 11.2% of GDP.

Riyadh forecasts economic growth of 2.6% this year and 7.5% in 2022, it said in the budget statement.

Saudi Arabia expects to post a deficit of 2.7% of gross domestic product this year and to reduce it further next year, it said in a preliminary budget statement for 2022, maintaining a focus on fiscal adjustment despite projected higher crude revenues.

Saudi Arabia had budgeted a 4.9% deficit for 2021 but that figure has now been revised to a 2.7% forecast, which the kingdom plans to reduce further to 1.6% of GDP in 2022.

According to its projections, Saudi Arabia would switch to a 0.8% surplus in 2023.

"The key message to us is a continued focus on expenditure restraint to stabilise the fiscal position", said Monica Malik, chief economist at Abu Dhabi Commercial Bank.

The improvement in the kingdom's fiscal position this year was driven by a jump in revenues, from a budgeted 849 billion riyals to a revised estimate of 930 billion riyals, as oil production increased and crude prices rebounded.

The largest Arab economy suffered a deep recession last year as the coronavirus crisis hurt its nascent non-oil economic sectors while record-low oil prices weighed on state coffers, widening the 2020 budget deficit to 11.2% of GDP.

Riyadh forecasts economic growth of 2.6% this year and 7.5% in 2022, it said in the budget statement.

Someone Is Betting That Oil Will Soar to a Record $200 a Barrel - Bloomberg

Someone Is Betting That Oil Will Soar to a Record $200 a Barrel - Bloomberg

Could the energy crunch get so bad that oil prices hit $200 a barrel? One options trader thinks so.

Brent $200 calls for December 2022, options contracts that would profit a buyer from a rally toward that level, traded 1,300 times on Wednesday. While the contracts don’t expire until October next year, they could profit from any sharp spike in prices this winter or next summer.

In a market where a single cargo of crude would currently fetch about $160 million, the $130,000 wager on oil reaching an all-time high is tiny. However, it reflects the fact that a growing number of options traders are betting that an energy crunch this winter may see prices rip higher.

Brent crude, the global benchmark, hit $80 for the first time in three years this week. Market watchers see demand exceeding supply to the tune of more than a million barrels a day and expect that switching from gas to oil because of high power prices could exacerbate that deficit. Bank of America Corp. this week underlined an earlier call that crude could top $100 a barrel at some point over the winter, if it is exceptionally cold.

It’s not just $200 calls that have been trading in recent days. Holdings in Brent $100 calls through to the end of next year have climbed by 20,000 contracts this month.

Could the energy crunch get so bad that oil prices hit $200 a barrel? One options trader thinks so.

Brent $200 calls for December 2022, options contracts that would profit a buyer from a rally toward that level, traded 1,300 times on Wednesday. While the contracts don’t expire until October next year, they could profit from any sharp spike in prices this winter or next summer.

In a market where a single cargo of crude would currently fetch about $160 million, the $130,000 wager on oil reaching an all-time high is tiny. However, it reflects the fact that a growing number of options traders are betting that an energy crunch this winter may see prices rip higher.

Brent crude, the global benchmark, hit $80 for the first time in three years this week. Market watchers see demand exceeding supply to the tune of more than a million barrels a day and expect that switching from gas to oil because of high power prices could exacerbate that deficit. Bank of America Corp. this week underlined an earlier call that crude could top $100 a barrel at some point over the winter, if it is exceptionally cold.

It’s not just $200 calls that have been trading in recent days. Holdings in Brent $100 calls through to the end of next year have climbed by 20,000 contracts this month.

Oil to gain as demand recovery resumes, but virus risks remain: Reuters poll | Reuters

Oil to gain as demand recovery resumes, but virus risks remain: Reuters poll | Reuters

Oil prices will see modest gains for the rest of the year and into 2022 as consumption resumes its recovery to pre-pandemic levels, with a likely COVID-19 resurgence still looming large over the outlook, a Reuters poll showed on Thursday.

The survey of 39 participants forecast Brent would average $68.87 per barrel in 2021, up from the $68.02 consensus in August, when the Delta variant's spread prompted the first downward revision in the 2021 outlook in about nine months.

Citing a faster fuel demand recovery and storm-led Gulf of Mexico supply disruptions, Goldman Sachs recently hiked its year-end Brent forecast to $90, but flagged a potential new virus variant and a ramp-up in OPEC+ production as risks. read more

"Demand growth will continue to support oil prices, balanced by the expected increase in OPEC+ production between now and the end-2021," Ann-Louise Hittle, vice president, oils research at WoodMac said.

Brent has averaged about $68 this year, but topped $80 a barrel mark this week amid growing demand and expectations that producers will decide to keep supplies tight when the Organization of the Petroleum Exporting Countries meets next week.

Oil prices will see modest gains for the rest of the year and into 2022 as consumption resumes its recovery to pre-pandemic levels, with a likely COVID-19 resurgence still looming large over the outlook, a Reuters poll showed on Thursday.

The survey of 39 participants forecast Brent would average $68.87 per barrel in 2021, up from the $68.02 consensus in August, when the Delta variant's spread prompted the first downward revision in the 2021 outlook in about nine months.

Citing a faster fuel demand recovery and storm-led Gulf of Mexico supply disruptions, Goldman Sachs recently hiked its year-end Brent forecast to $90, but flagged a potential new virus variant and a ramp-up in OPEC+ production as risks. read more

"Demand growth will continue to support oil prices, balanced by the expected increase in OPEC+ production between now and the end-2021," Ann-Louise Hittle, vice president, oils research at WoodMac said.

Brent has averaged about $68 this year, but topped $80 a barrel mark this week amid growing demand and expectations that producers will decide to keep supplies tight when the Organization of the Petroleum Exporting Countries meets next week.

Oil steady despite higher U.S. inventories and strong dollar | Reuters

Oil steady despite higher U.S. inventories and strong dollar | Reuters

Oil prices held steady on Thursday after rising above $80 a barrel this week, with bearish factors such as rising U.S. crude inventories and a strong dollar countered by an expected supply deficit over the coming months.

Brent crude for November delivery slipped in and out of positive territory during the session. The contract was down 21 cents at $78.43 a barrel by 1107 GMT on its expiry day while December loading crude was at $77.92. U.S. oil dipped 18 cents to $74.65.

U.S. oil and fuel stockpiles increased by 4.6 million barrels to 418.5 million barrels in the week to Sept. 24, the U.S. Energy Department's Energy Information Administration (EIA) said on Wednesday.

In another typically bearish development, the U.S. dollar held near one-year highs, making oil more expensive for holders of other currencies.

Oil prices held steady on Thursday after rising above $80 a barrel this week, with bearish factors such as rising U.S. crude inventories and a strong dollar countered by an expected supply deficit over the coming months.

Brent crude for November delivery slipped in and out of positive territory during the session. The contract was down 21 cents at $78.43 a barrel by 1107 GMT on its expiry day while December loading crude was at $77.92. U.S. oil dipped 18 cents to $74.65.

U.S. oil and fuel stockpiles increased by 4.6 million barrels to 418.5 million barrels in the week to Sept. 24, the U.S. Energy Department's Energy Information Administration (EIA) said on Wednesday.

In another typically bearish development, the U.S. dollar held near one-year highs, making oil more expensive for holders of other currencies.

#Qatar Petroleum secures deal to supply LNG to China for 15 years | ZAWYA MENA Edition

Qatar Petroleum secures deal to supply LNG to China for 15 years | ZAWYA MENA Edition

Qatar Petroleum, one of the world’s biggest liquefied natural gas (LNG) suppliers, has secured a new deal to supply LNG to China for a period of 15 years.

The sale and purchase agreement (SPA) with CNNOC Gas and Power Trading & Marketing Limited, a subsidiary of China National Offshore Oil Corporation, will see Qatar deliver 3.5 million tonnes of LNG per annum (MTPA) starting from January 2022, according to a statement on Wednesday.

CNOOC is China’s top offshore oil and gas producer.

“We are pleased to further build upon our strong relationship with CNOOC with the signing of this new [agreement]. We are especially proud to continue to meet the People’s Republic of China’s growing need for cleaner energy that LNG provides,” said Minister of State for Energy Affairs Saad Sherida Al-Kaabi.

Qatar Petroleum, one of the world’s biggest liquefied natural gas (LNG) suppliers, has secured a new deal to supply LNG to China for a period of 15 years.

The sale and purchase agreement (SPA) with CNNOC Gas and Power Trading & Marketing Limited, a subsidiary of China National Offshore Oil Corporation, will see Qatar deliver 3.5 million tonnes of LNG per annum (MTPA) starting from January 2022, according to a statement on Wednesday.

CNOOC is China’s top offshore oil and gas producer.

“We are pleased to further build upon our strong relationship with CNOOC with the signing of this new [agreement]. We are especially proud to continue to meet the People’s Republic of China’s growing need for cleaner energy that LNG provides,” said Minister of State for Energy Affairs Saad Sherida Al-Kaabi.

#Dubai's DFM trading hours will be extended to five hours | ZAWYA MENA Edition

Dubai's DFM trading hours will be extended to five hours | ZAWYA MENA Edition

Dubai Financial Market (DFM) has notified investors that as of Sunday, October 3, trading hours will be from 10am-3pm, instead of 10am-2pm.

A statement posed on DFM said the move was “part of constant efforts to strengthen UAE markets’ competitiveness and attractiveness as well as to expedite investors’ trading activities.”

Dubai Financial Market (DFM) has notified investors that as of Sunday, October 3, trading hours will be from 10am-3pm, instead of 10am-2pm.

A statement posed on DFM said the move was “part of constant efforts to strengthen UAE markets’ competitiveness and attractiveness as well as to expedite investors’ trading activities.”

#Saudi regulator CMA approves four stake sale applications in Nomu | ZAWYA MENA Edition

Saudi regulator CMA approves four stake sale applications in Nomu | ZAWYA MENA Edition

Saudi Arabia's capital market regulator has approved the share sale applications of four companies in the Nomu Parallel Market.

In statements on the Saudi stock exchange Tadawul, the Capital Market Authority (CMA) said the approval for the companies--Jahez International Company for Information and Technology, Nayifat Finance Co., Group Five Pipe Saudi Co. and East Pipes Integrated Company for Industry--shall be valid for six months.

Jahez International is offering 1,363,934 shares representing 13 percent of its share capital.

Nayifat Finance has applied to offer 35,000,000 shares representing 35 percent its share capital.

Group Five Pipe Saudi Co. has applied to offer 2,800,000 shares representing 10 percent of its share capital.

East Pipes Integrated Company for Industry has applied to offer 6,300,000 shares representing 30 percent of its share capital.

Saudi Arabia's capital market regulator has approved the share sale applications of four companies in the Nomu Parallel Market.

In statements on the Saudi stock exchange Tadawul, the Capital Market Authority (CMA) said the approval for the companies--Jahez International Company for Information and Technology, Nayifat Finance Co., Group Five Pipe Saudi Co. and East Pipes Integrated Company for Industry--shall be valid for six months.

Jahez International is offering 1,363,934 shares representing 13 percent of its share capital.

Nayifat Finance has applied to offer 35,000,000 shares representing 35 percent its share capital.

Group Five Pipe Saudi Co. has applied to offer 2,800,000 shares representing 10 percent of its share capital.

East Pipes Integrated Company for Industry has applied to offer 6,300,000 shares representing 30 percent of its share capital.

#Saudi Internet Services Firm Soars on Debut Amid Gulf IPO Rush - Bloomberg

Saudi Internet Services Firm Soars on Debut Amid Gulf IPO Rush - Bloomberg

Saudi Telecom Co.’s internet-services unit surged on its trading debut in Riyadh after drawing $126 billion in orders for its initial public offering.

Arabian Internet and Communications Services Co., also known as solutions by stc, jumped to 196.20 riyals, hitting the Saudi exchange’s 30% daily trading limit. The company sold shares at 151 riyals apiece, at the top end of its offering range, valuing the company at 18.1 billion riyals ($4.8 billion).

Investors placed bids in the IPO for 130 times the shares on offer, generating more orders than Saudi Aramco’s share sale. solutions by stc raised $966 million by selling 24 million shares, or a 20% stake.

Al Rajhi Capital initiated coverage on the stock with an overweight rating and a price target of 200 riyals. The information and communications technology sector has strong visibility for growth in Saudi Arabia, allowing for market share gains for solutions by stc, Al Rajhi’s Mazen Al-Sudairi and Pritish Devassy wrote in a note.

Saudi Telecom Co.’s internet-services unit surged on its trading debut in Riyadh after drawing $126 billion in orders for its initial public offering.

Arabian Internet and Communications Services Co., also known as solutions by stc, jumped to 196.20 riyals, hitting the Saudi exchange’s 30% daily trading limit. The company sold shares at 151 riyals apiece, at the top end of its offering range, valuing the company at 18.1 billion riyals ($4.8 billion).

Investors placed bids in the IPO for 130 times the shares on offer, generating more orders than Saudi Aramco’s share sale. solutions by stc raised $966 million by selling 24 million shares, or a 20% stake.

Al Rajhi Capital initiated coverage on the stock with an overweight rating and a price target of 200 riyals. The information and communications technology sector has strong visibility for growth in Saudi Arabia, allowing for market share gains for solutions by stc, Al Rajhi’s Mazen Al-Sudairi and Pritish Devassy wrote in a note.

Hottest Market

Riyadh has been the hottest market for IPOs in the Middle East over the past years, though Abu Dhabi is catching up.

ACWA Power International, one of the kingdom’s main vehicles for building renewable energy projects, on Tuesday priced its IPO at the top end of an original range, seeking to raise $1.2 billion. It is set to be the biggest offering in Riyadh since Saudi Aramco’s listing in 2019.

Plenty more IPOs are in the pipeline, including the stock exchange itself, the specialty chemicals business of Saudi Basic Industries Corp. and cargo firm Saudi Arabian Logistics Co.

Riyadh has been the hottest market for IPOs in the Middle East over the past years, though Abu Dhabi is catching up.

ACWA Power International, one of the kingdom’s main vehicles for building renewable energy projects, on Tuesday priced its IPO at the top end of an original range, seeking to raise $1.2 billion. It is set to be the biggest offering in Riyadh since Saudi Aramco’s listing in 2019.

Plenty more IPOs are in the pipeline, including the stock exchange itself, the specialty chemicals business of Saudi Basic Industries Corp. and cargo firm Saudi Arabian Logistics Co.

#Saudi unemployment down marginally to 11.3% in Q2 | Reuters

Saudi unemployment down marginally to 11.3% in Q2 | Reuters

Unemployment in Saudi Arabia declined only marginally to 11.3% in the second quarter from 11.7% in the first three months of the year, official data showed on Thursday, signalling that recovery from the coronavirus crisis has lost some momentum.

Saudi Arabia has been pushing through economic reforms since 2016 to create millions of jobs and aims to reduce unemployment to 7% by 2030, but those plans were disrupted by the COVID-19 pandemic that sent oil prices plummeting.

Unemployment hit a record high of 15.4% in the second quarter last year but it has declined rapidly since then, reaching pre-pandemic levels in the first quarter this year.

The pace of decline slowed down in the second quarter, however, data from the General Authority for Statistics showed on Thursday, while a business survey this month pointed to a sharp drop in output expansion in the private sector. read more

Unemployment in Saudi Arabia declined only marginally to 11.3% in the second quarter from 11.7% in the first three months of the year, official data showed on Thursday, signalling that recovery from the coronavirus crisis has lost some momentum.

Saudi Arabia has been pushing through economic reforms since 2016 to create millions of jobs and aims to reduce unemployment to 7% by 2030, but those plans were disrupted by the COVID-19 pandemic that sent oil prices plummeting.

Unemployment hit a record high of 15.4% in the second quarter last year but it has declined rapidly since then, reaching pre-pandemic levels in the first quarter this year.

The pace of decline slowed down in the second quarter, however, data from the General Authority for Statistics showed on Thursday, while a business survey this month pointed to a sharp drop in output expansion in the private sector. read more

Oil mixed after U.S. inventories post surprise gain | Reuters

Oil mixed after U.S. inventories post surprise gain | Reuters

Oil prices were mixed on Thursday as selling prompted by an unexpected rise in U.S. inventories eased, with analysts predicting supply may not keep up with a recovery in demand.

Brent crude was down 8 cents at $78.56 a barrel by 0615 GMT, after falling 0.6% on Wednesday. U.S. oil rose 11 cents to $74.94 a barrel, having also declined by 0.6% in the previous session.

U.S. oil and fuel stockpiles increased last week, the U.S. Energy Department's Energy Information Administration (EIA) said on Wednesday.

Crude inventories (USOILC=ECI) were up by 4.6 million barrels in the week to Sept. 24 to 418.5 million, EIA data showed, compared with analysts' expectations in a Reuters poll for a 1.7 million-barrel drop.

Oil prices were mixed on Thursday as selling prompted by an unexpected rise in U.S. inventories eased, with analysts predicting supply may not keep up with a recovery in demand.

Brent crude was down 8 cents at $78.56 a barrel by 0615 GMT, after falling 0.6% on Wednesday. U.S. oil rose 11 cents to $74.94 a barrel, having also declined by 0.6% in the previous session.

U.S. oil and fuel stockpiles increased last week, the U.S. Energy Department's Energy Information Administration (EIA) said on Wednesday.

Crude inventories (USOILC=ECI) were up by 4.6 million barrels in the week to Sept. 24 to 418.5 million, EIA data showed, compared with analysts' expectations in a Reuters poll for a 1.7 million-barrel drop.

Subscribe to:

Comments (Atom)