Most stock markets in the Gulf ended lower on Sunday, with the Saudi index shedding the most as rising coronavirus cases across the region weighed on investor sentiment.

COVID-19 infections have started rising again after months of low or falling figures, data from health ministries has shown, as the Omicron variant spreads across the world. read more

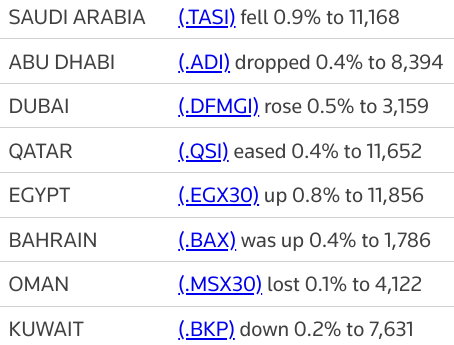

Saudi Arabia's benchmark index (.TASI) dropped 0.9%, dragged down by a 0.9% fall in Al Rajhi Bank (1120.SE) and a 1.4% decrease in Saudi National Bank (1180.SE), the kingdom's biggest lender.

Health authorities there advised citizens and residents last week to avoid all unnecessary foreign travel. Saudi Arabia reported its first Omicron case on Dec. 1.

In Abu Dhabi, the index (.ADI) fell 0.4%, with Abu Dhabi Islamic Bank (ADIB.AD) retreating 2.2%.

The United Arab Emirates (UAE) has experienced a particularly sharp increase in COVID-19 infections since announcing the arrival of Omicron this month, with 1,002 cases recorded on Thursday, up from 68 on Dec. 2.

The resurgence comes during the region's peak tourism season, especially in the UAE, which is welcoming millions of visitors to the Expo 2020 Dubai world fair and other seasonal events.

The Qatari index (.QSI) lost 0.4%, pressured by a 0.7% decline in the Gulf's biggest lender, Qatar National Bank (QNBK.QA).

Dubai's main share index (.DFMGI) however, gained 0.5%, led by a 7.5% jump in Deyaar Development (DEYR.DU).

Outside the Gulf, Egypt's blue-chip index (.EGX30) closed 0.8% higher, with top lender Commercial International Bank (COMI.CA) rising 1.7%.