Oil prices edge higher as US oil inventories fall | Reuters

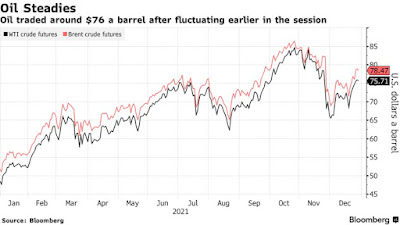

Oil prices rose on Wednesday, after government data showed U.S. crude and fuel inventories fell last week, offsetting concerns that rising coronavirus cases might reduce demand.

Brent crude rose 29 cents to settle at $79.23 a barrel. U.S. West Texas Intermediate (WTI) crude rose 58 cents to settle at $76.56 a barrel.

In the United States, the average number of daily confirmed coronavirus cases hit a record high of 258,312 over the last seven days, a Reuters tally on Wednesday found. read more

Both oil futures contracts earlier traded at their highest in a month after U.S. government data showed lower oil inventories.

Solely aggregation of news articles, with no opinions expressed by this service since 2009 launch on this platform. Copyright to all articles remains with the original publisher and HEADLINES ARE CLICKABLE to access the whole article at source. (Subscription by email is recommended,with real-time updates on LinkedIn and Twitter.)

Search This Blog

Wednesday, 29 December 2021

Sabic’s localisation drive to contribute $3bn to #SaudiArabia's economy

Sabic’s localisation drive to contribute $3bn to Saudi Arabia's economy

Investors qualified to start new projects under Sabic’s Nusaned initiative are expected to create 10,316 jobs in Saudi Arabia and contribute more than 11.4 billion Saudi riyals ($3.04bn) to the country’s economy.

Sabic, the Middle East’s biggest petrochemicals company, is directly contributing to the growth of companies in the kingdom through its Nusaned initiative it launched in 2018 and has so far selected 139 investors to start new projects, Sabic said on Wednesday.

“Under Nusaned, we are constantly exploring new business strategies with Saudi entrepreneurs who have an eye for innovative technologies and are committed to environmental excellence in operations,” said Yousef Al Benyan, Sabic vice chairman and chief executive.

“By enabling local investors and supporting commercially viable sectors, our aim is to strengthen our industries and better people’s lives, as envisioned in the kingdom’s ambitious Vision 2030 goals.”

Investors qualified to start new projects under Sabic’s Nusaned initiative are expected to create 10,316 jobs in Saudi Arabia and contribute more than 11.4 billion Saudi riyals ($3.04bn) to the country’s economy.

Sabic, the Middle East’s biggest petrochemicals company, is directly contributing to the growth of companies in the kingdom through its Nusaned initiative it launched in 2018 and has so far selected 139 investors to start new projects, Sabic said on Wednesday.

“Under Nusaned, we are constantly exploring new business strategies with Saudi entrepreneurs who have an eye for innovative technologies and are committed to environmental excellence in operations,” said Yousef Al Benyan, Sabic vice chairman and chief executive.

“By enabling local investors and supporting commercially viable sectors, our aim is to strengthen our industries and better people’s lives, as envisioned in the kingdom’s ambitious Vision 2030 goals.”

Kuwaiti candidate has widespread support for top OPEC job, sources say | Reuters

Kuwaiti candidate has widespread support for top OPEC job, sources say | Reuters

Kuwait's candidate to lead the Organization of the Petroleum Exporting Countries (OPEC) has widespread support from the group, with current secretary general Mohammad Barkindo not expected to seek re-election, two sources told Reuters.

Haitham al-Ghais, a former Kuwaiti governor to OPEC, is the only candidate for the role of secretary general, the two sources added.

OPEC is expected to elect a new secretary general at its meeting on Jan. 4, a third source said.

Nigerian Barkindo, whose is due to step down at the end of next July, took OPEC's top job in mid-2016 and was granted a second three-year term in 2019.

Kuwait's candidate to lead the Organization of the Petroleum Exporting Countries (OPEC) has widespread support from the group, with current secretary general Mohammad Barkindo not expected to seek re-election, two sources told Reuters.

Haitham al-Ghais, a former Kuwaiti governor to OPEC, is the only candidate for the role of secretary general, the two sources added.

OPEC is expected to elect a new secretary general at its meeting on Jan. 4, a third source said.

Nigerian Barkindo, whose is due to step down at the end of next July, took OPEC's top job in mid-2016 and was granted a second three-year term in 2019.

Most Gulf bourses fall in line with global shares | Reuters

Most Gulf bourses fall in line with global shares | Reuters

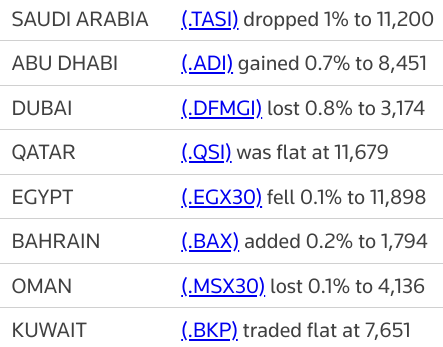

Most stock markets in the Gulf ended lower on Wednesday in line with global shares, as investors positioned their portfolios for the new year and grappled with increasing Omicron coronavirus cases globally.

Saudi Arabia's benchmark index (.TASI) dropped more than 1%, dragged down by a 1.4% fall in Al Rajhi Bank (1120.SE) and a 1.7% decrease in Saudi Basic Industries - SABIC (2010.SE).

The Saudi stock market was volatile on Wednesday since investors remained uncertain as the rise in oil prices provided strong support while the increasing COVID-19 cases raised new doubts over the sanitary situation, said Farah Mourad, senior market analyst of XTB MENA.

Crude prices, a key catalyst for the Gulf's financial markets, edged higher as optimism refused to be beaten down by concerns around the impact of Omicron on global economies.

In Dubai, the main share index (.DFMGI) fell 0.8%, snapping four consecutive sessions of gains, weighed down by a 1.1% drop in top lender Emirates NBD Bank (ENBD.DU) and a 0.7% decline in Dubai Islamic Bank (DISB.DU).

The United Arab Emirates has approved emergency use of Sinopharm's protein-based COVID-19 vaccine and it will be available to the public as a booster dose starting January 2022, the health ministry said. read more

The UAE, a federation of seven emirates, on Tuesday reported 1,846 new coronavirus cases, up from 68 on Dec. 2. Authorities, which did not provide a breakdown for each emirate, said around 91% of the 10 million population had been fully vaccinated.

In Qatar, the benchmark (.QSI) closed flat, as gains in energy stocks helped cap losses in banking shares with Qatar Fuel rising 1.1%, while Qatar International Islamic Bank was down 1.1%.

Abu Dhabi's index (.ADI), however, added 0.7%, helped by a 1.6% increase in the International Holding Company after its unit Multiply Group (MULTIPLY.AD) signed a binding commitment to invest 275 million dirhams ($74.88 million) in global visual content creator and marketplace Getty Images.

Multiply shares were up 1.7%.

Outside the Gulf, Egypt's blue-chip index (.EGX30), eased 0.1%, with Egypt Kuwait Holding (EKHO.CA) losing 2.9%.

Most stock markets in the Gulf ended lower on Wednesday in line with global shares, as investors positioned their portfolios for the new year and grappled with increasing Omicron coronavirus cases globally.

Saudi Arabia's benchmark index (.TASI) dropped more than 1%, dragged down by a 1.4% fall in Al Rajhi Bank (1120.SE) and a 1.7% decrease in Saudi Basic Industries - SABIC (2010.SE).

The Saudi stock market was volatile on Wednesday since investors remained uncertain as the rise in oil prices provided strong support while the increasing COVID-19 cases raised new doubts over the sanitary situation, said Farah Mourad, senior market analyst of XTB MENA.

Crude prices, a key catalyst for the Gulf's financial markets, edged higher as optimism refused to be beaten down by concerns around the impact of Omicron on global economies.

In Dubai, the main share index (.DFMGI) fell 0.8%, snapping four consecutive sessions of gains, weighed down by a 1.1% drop in top lender Emirates NBD Bank (ENBD.DU) and a 0.7% decline in Dubai Islamic Bank (DISB.DU).

The United Arab Emirates has approved emergency use of Sinopharm's protein-based COVID-19 vaccine and it will be available to the public as a booster dose starting January 2022, the health ministry said. read more

The UAE, a federation of seven emirates, on Tuesday reported 1,846 new coronavirus cases, up from 68 on Dec. 2. Authorities, which did not provide a breakdown for each emirate, said around 91% of the 10 million population had been fully vaccinated.

In Qatar, the benchmark (.QSI) closed flat, as gains in energy stocks helped cap losses in banking shares with Qatar Fuel rising 1.1%, while Qatar International Islamic Bank was down 1.1%.

Abu Dhabi's index (.ADI), however, added 0.7%, helped by a 1.6% increase in the International Holding Company after its unit Multiply Group (MULTIPLY.AD) signed a binding commitment to invest 275 million dirhams ($74.88 million) in global visual content creator and marketplace Getty Images.

Multiply shares were up 1.7%.

Outside the Gulf, Egypt's blue-chip index (.EGX30), eased 0.1%, with Egypt Kuwait Holding (EKHO.CA) losing 2.9%.

Most Gulf markets track losses in Asian shares | Reuters

Most Gulf markets track losses in Asian shares | Reuters

Most stock markets in the Gulf fell in early trade on Wednesday, in line with Asian shares, as investors positioned their portfolios for the new year and grappled with increasing Omicron coronavirus cases globally.

Saudi Arabia's benchmark index (.TASI) edged 0.2% lower, hit by a 0.3% fall in Al Rajhi Bank (1120.SE) and a 0.1% decline in Saudi National Bank (1180.SE), the kingdom's biggest lender.

Coronavirus infections have started rising again across the six Gulf Arab states after months of low or falling figures, data from health ministries showed on Thursday. read more

The Gulf's most populous country, Saudi Arabia, registered 602 new infections on Tuesday, up from daily tallies of around 50 since late September.

In Abu Dhabi, the index (.ADI) fell 0.2%, with the country's largest lender, First Abu Dhabi Bank (FAB.AD), losing 0.4% and Emirates Telecommunications Group (ETISALAT.AD) falling 0.3%.

Dubai's main share index (.DFMGI) dropped 0.4%, weighed down by a 0.6% decline in blue-chip developer Emaar Properties (EMAR.DU).

The United Arab Emirates has approved emergency use of Sinopharm's protein-based COVID-19 vaccine which will be available to the public as a booster dose starting January 2022, the health ministry said. read more

The UAE, a federation of seven emirates, on Tuesday reported 1,846 new coronavirus cases, up from 68 on Dec. 2. Authorities, which did not provide a breakdown for each emirate, said around 91% of the 10 million population had been fully vaccinated.

The Qatari index (.QSI) lost 0.1%, with Commercial Bank (COMB.QA) declining 1.2%.

Most stock markets in the Gulf fell in early trade on Wednesday, in line with Asian shares, as investors positioned their portfolios for the new year and grappled with increasing Omicron coronavirus cases globally.

Saudi Arabia's benchmark index (.TASI) edged 0.2% lower, hit by a 0.3% fall in Al Rajhi Bank (1120.SE) and a 0.1% decline in Saudi National Bank (1180.SE), the kingdom's biggest lender.

Coronavirus infections have started rising again across the six Gulf Arab states after months of low or falling figures, data from health ministries showed on Thursday. read more

The Gulf's most populous country, Saudi Arabia, registered 602 new infections on Tuesday, up from daily tallies of around 50 since late September.

In Abu Dhabi, the index (.ADI) fell 0.2%, with the country's largest lender, First Abu Dhabi Bank (FAB.AD), losing 0.4% and Emirates Telecommunications Group (ETISALAT.AD) falling 0.3%.

Dubai's main share index (.DFMGI) dropped 0.4%, weighed down by a 0.6% decline in blue-chip developer Emaar Properties (EMAR.DU).

The United Arab Emirates has approved emergency use of Sinopharm's protein-based COVID-19 vaccine which will be available to the public as a booster dose starting January 2022, the health ministry said. read more

The UAE, a federation of seven emirates, on Tuesday reported 1,846 new coronavirus cases, up from 68 on Dec. 2. Authorities, which did not provide a breakdown for each emirate, said around 91% of the 10 million population had been fully vaccinated.

The Qatari index (.QSI) lost 0.1%, with Commercial Bank (COMB.QA) declining 1.2%.

#Qatar’s trade surplus widens by 15.8% on higher shipments of gas | ZAWYA MENA Edition

Qatar’s trade surplus widens by 15.8% on higher shipments of gas | ZAWYA MENA Edition

Qatar’s merchandise trade surplus surged by a monthly rate of 15.8 percent in November, hitting 24.5 billion rials ($6.7 billion), data from the country’s Planning and Statistics Authority showed.

Exports – which includes both domestic goods and re-exports – went up by 13.9 percent to reach 34.3 billion rials. Jumps in shipments of petroleum gas and other gaseous hydrocarbons drove this increase, as they rose by 18.9 percent.

In annual terms, exports soared by 106.6 percent in November.

Observing the destination of these shipments, China received the bulk, purchasing 14.8 percent of Qatari exports. Japan and South Korea followed, with shares of 13.1 percent and 10.4 percent, respectively.

Exports – which includes both domestic goods and re-exports – went up by 13.9 percent to reach 34.3 billion rials. Jumps in shipments of petroleum gas and other gaseous hydrocarbons drove this increase, as they rose by 18.9 percent.

In annual terms, exports soared by 106.6 percent in November.

Observing the destination of these shipments, China received the bulk, purchasing 14.8 percent of Qatari exports. Japan and South Korea followed, with shares of 13.1 percent and 10.4 percent, respectively.

Subscribe to:

Comments (Atom)