Qatar Pushes Gulf Arab Energy Company Borrowing to Record High - Bloomberg

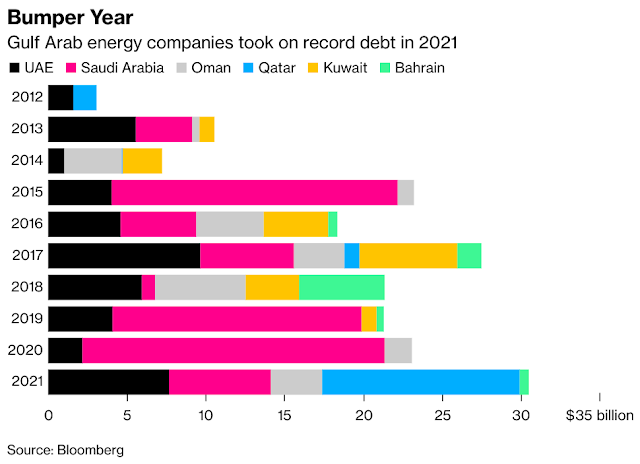

Gulf Arab energy firms borrowed $30.5 billion in 2021, the highest level in at least 25 years, as the region’s national oil companies sought to inject foreign investment into their balance sheets.

Qatar Energy led the region in issuing debt, according to Bloomberg calculations. The company sold $12.5 billion of bonds in July to fund an expansion of its liquefied natural gas output capacity and cement its position as the world’s biggest exporter.

Energy companies in the United Arab Emirates raised $7.7 billion in new debt, a four-year high for the country. Saudi Aramco, which dominated the region’s energy corporate debt market in the previous two years, was its third-largest borrower in 2021, with $6.5 billion.

Oil prices rise slightly ahead of OPEC+ meeting next week | Reuters

Oil prices rose slightly on Thursday on expectations that fuel demand held up despite soaring Omicron coronavirus infections and that OPEC and its allies would continue to increase imports only incrementally.

Gains eased as the world's top importer China cut the first batch of crude import allocations for 2022.

Brent crude futures settled at $79.32 a barrel, up 9 cents, or 0.11%. U.S. crude futures rose 43 cents, or 0.56%, to settle at $76.9 a barrel, the seventh straight session of gains.

"We've had incredibly strong demand numbers through December, so now the question is what OPEC will do," said John Kilduff, a partner at Again Capital Management in New York. Kilduff expects the Organization of the Petroleum Exporting Countries and its allies, known as OPEC+, to continue to add incrementally to production.

OPEC Chief Candidate From Kuwait Has Wide Support Among Members - Bloomberg

Kuwait’s candidate to take over as OPEC’s top diplomat has widespread support from the group’s members, delegates said.

Haitham al-Ghais, an executive at Kuwait Petroleum Corp., has backing from a number of nations to succeed Mohammad Barkindo as secretary-general, said the delegates, who asked not to be identified discussing an internal matter. The Organization of Petroleum Exporting Countries will vote on the selection on Jan. 3, and the chosen candidate will take over the job in July.

Al-Ghais is currently the only nominee for the role after Iraq, which also planned its own nominee, decided not to proceed. Delegates said al-Ghais is widely respected by member nations, having served as Kuwait’s liaison to OPEC a few years ago.

“He’s very smart, and a good analyst,” said Johannes Benigni, chairman of consultant JBC Energy Group in Vienna.

While OPEC secretary-generals don’t set the organization’s production policy, they do act as an intermediary seeking compromise between the group’s often-fractious members.

Barkindo has served two three-year terms as secretary-general, the maximum officially permitted, during which time he helped with the creation of the OPEC+ alliance in late 2016.

The pact brought in non-members such as Russia, revitalizing OPEC’s fading influence in world oil markets, and has stabilized supply and demand for the past few years. OPEC+ will meet Jan. 4 to consider whether to continue restoring production halted during the pandemic.

Abu Dhabi outshines Middle East markets in 2021 | Reuters

Stock markets in the Gulf ended 2021 higher, with the Abu Dhabi index exiting the year with a roar on its best annual performance in 16 years.The Abu Dhabi index (.ADI) added 0.5% on Thursday, the last trading day of 2021 - its best year since 2005, with more than 68% gain.Besides the support of the strong oil prices, Abu Dhabi saw a series of initial public offerings (IPO) that helped push its performance higher during the year. The momentum helped the market stay on the positive side for most of the year until the rise of Omicron coronavirus variant, said Farah Mourad, senior market analyst at XTB MENA.Conglomerate International Holding Co (IHC) , Abu Dhabi's most valuable listed company, concluded the year 262% higher.IHC, which operates in a range of sectors including healthcare and agriculture, has gone through rapid expansion across its major business sectors.IHC, which has a market capitalisation of $75 billion, is chaired by Sheikh Tahnoon bin Zayed Al Nahyan, the United Arab Emirates' national security adviser and a brother of the country's de facto ruler Abu Dhabi Crown Prince Mohammed bin Zayed.Earlier in December, the UAE said it will shift to a Saturday-Sunday weekend from the start of next year to better align its economy with global markets. read moreDubai's main share index (.DFMGI) gained 0.7%, to end the year 28.3% higher.The positive performance this year on the Dubai stock market was supported by the global recovery and fewer coronavirus restrictions, said Wael Makarem, senior market strategist at Exness."The market's performance was more impressive towards the end of the year after the announcement of a list of new initial public offerings that aimed to help develop the market's liquidity and dynamism."In November, Dubai announced plans to launch a 2 billion dirham ($544.57 million) market-maker fund and initial public offerings of 10 state-backed companies as part of plans to boost activity on the local bourse. read moreThe listing plans are aimed at making Dubai a more competitive market against bigger bourses in the region, such those in as Saudi Arabia and neighbouring Abu Dhabi, that are seeing larger listings and strong liquidity.Saudi Arabia's benchmark index (.TASI) added about 30% in 2021, logging its sixth consecutive yearly gain and driven by a rise in oil prices.Crude prices, a key catalyst for the Gulf's financial markets, provided significant support particularly in the first half of the year as the economy recovered confidently, said Mourad."In the second half, some doubts about demand levels, interventions by oil-importing countries, the release of strategic reserves, and the discovery of Omicron have created periods of price corrections which in turn removed important support for the region's markets."The Qatari index (.QSI) fell 0.5%, but finished the year about 12% higher, its fourth straight yearly rise.Kuwait's stock market (.BKP) registered a 26.2% yearly gain, ending the year close to its record peak.Bahrain's index (.BAX) gained 7.5% in 2021, while the Omani index (.MSX30) added a near 13% for the year, its first yearly gain in about five years.Outside the Gulf, Egypt's benchmark index (.EGX30) booked a yearly gain of 10.2%.The Egyptian bourse had a more volatile performance while investors took into consideration the changes in monetary policies around the world and their impact on economic development as well as the rise and fall of health concerns, said Mourad.

Most major Gulf markets fall on Omicron fears | ReutersMost major stock markets in the Gulf fell in early trade on Thursday over concerns the Omicron coronavirus variant could slow the economy heading into the new year.

In Abu Dhabi, the index (.ADI) dropped 0.9%, dragged down by a 1.6% fall in the country's largest lender, First Abu Dhabi Bank (FAB.AD).

Daily coronavirus infections in the United Arab Emirates, the Gulf region's tourism and commercial hub, crossed 2,000 for the first time since June.

Authorities on Wednesday reported 2,234 new infections in the past 24 hours, without breaking down the cases by COVID-19 variants.

Dubai's main share index (.DFMGI) lost 0.5%, hit by a 0.7% fall in top lender Emirates NBD (ENBD.DU) and a 0.6% decline in sharia-compliant lender Dubai Islamic Bank (DISB.DU).

Dubai, which is hosting the Expo until the end of March and whose economy relies heavily on the travel industry, has not yet reintroduced restrictions that were largely lifted in mid-2020.

Saudi Arabia's benchmark index (.TASI) gained 0.3%, with Al Rajhi Bank (1120.SE) rising 0.3%, while Saudi Arabian Mining Company (1211.SE) advanced 1.3%.

Oil prices, a key catalyst for the Gulf's financial markets, rose to extend several consecutive days of gains, buoyed by data showing U.S. fuel demand holding up well despite soaring Omicron coronavirus infections. read more

Saudi King Salman said on Wednesday the OPEC+ production agreement was "essential" to oil market stability and stressed the need for producers to comply with the pact. read more

The Qatari index (.QSI) eased 0.1%, with Qatar National Bank (QNBK.QA) losing 0.8%.

Oil prices slip as China cuts import quotas | Reuters

Oil prices eased on Thursday after the world's top importer China cut the first batch of crude import allocations for 2022, offsetting the impact of U.S. data showing fuel demand had held up despite soaring Omicron coronavirus infections.

Brent crude futures fell 41 cents, or 0.5%, to $78.82 a barrel at 0755 GMT, down for the first time in four days. U.S. West Texas Intermediate (WTI) crude futures slid 33 cents, or 0.4%, to $76.23 a barrel after six straight sessions of gains.

Oil prices pared earlier gains after China, the world's top crude importer, lowered the first batch of 2022 import quotas to mostly independent refiners by 11% below the comparable year-earlier quota, industry sources said.

"Market sentiment weakened on worries that the Chinese government could take stricter actions against the teapots," a Singapore-based analyst said, referring to the independent refiners.

Saudi king says OPEC+ pact 'essential' for oil market stability | Reuters

Saudi Arabia's King Salman said on Wednesday the OPEC+ production agreement was "essential" to oil market stability and stressed the need for producers to comply with the pact.

The king, in an annual speech to the advisory Shura Council carried on state media, said market stability and balance are a pillar of Saudi energy policy and efforts by the world's top oil exporter to maintain spare capacity had proven important to safeguarding energy supply security.

"The Kingdom ... confirms its keenness for the continuation of the OPEC+ agreement due to its essential role in oil market stability and also stresses the importance of compliance by all participating countries with the agreement," the king said.

The Organization of the Petroleum Exporting Countries and allies including Russia agreed this month to stick to their existing policy of monthly oil output increases despite fears a U.S. release of crude reserves and the Omicron coronavirus variant would lead to a fresh oil price rout. read more

The OPEC+ alliance is due to discuss its policy on Jan. 4.

UAE industrial giant Emirates Global Aluminium pays off $361m debt ahead of schedule | Markets – Gulf News

The UAE’s biggest non-oil industrial company, Emirates Global Aluminium, has repaid in full $361 million it had raised as project finance from 13 banks and export credit agencies. The funds were used for a major expansion at its Al Taweelah smelter plant in Abu Dhabi.

The funds relate to two tranches that was taken out, and were repaid four- and seven-years before they became due. The early repayment “further deleverages EGA and is an important part in the company’s capital structure optimisation strategy,” the company said in a statement.

EGA’s financing has been reduced by over $1 billion in the last two years and now comprises a senior term loan facility of $5.5 billion. The EGA subsidiary Guinea Alumina Corporation has a $700 million project finance facility which was secured in 2019.

PAYING OFF

The project financing was extended to Emirates Aluminium, now an EGA subsidiary, for Phase 1 of the Al Taweelah project in 2010 and later Phase 2 in 2013, each with a tenor of 15 years. The repayment four years and seven years early totalled $361 million.

“This further deleveraging simplifies our debt structure and strengthens our balance-sheet for the next stage in our corporate journey,” said Zouhir Regragui, EGA’s Chief Financial Officer. “We have been able to de-lever successfully in 2021 while generating returns for our shareholders due to the enduring strength of our business and robust demand for our metal.”

Saudi Arabia's Gas Arabian gets approval for 5% public offering | ZAWYA MENA Edition

Saudi Arabia’s Gas Arabian Services Company has received approval from the kingdom’s Capital Market Authority (CMA) to offer 5 percent of its shares, or 790,000 ordinary shares, and list on the Nomu Parallel Market.

The book building period will between January 23 and 27 2021, following which the offer price will be determined, according to a bourse filing by advisors FALCOM Financial Services Company.

Oil prices stay firm on fuel demand despite COVID-19 surge | Reuters

Oil prices rose on Thursday to extend several consecutive days of gains, buoyed by data showing U.S. fuel demand holding up well despite soaring Omicron coronavirus infections.

Brent crude futures rose 24 cents, or 0.3%, to $79.47 a barrel at 0502 GMT, up for a fourth day. U.S. West Texas Intermediate (WTI) crude futures rose 26 cents, or 0.3%, to $76.82 a barrel for a seventh session of gains.

"Oil prices edged higher overnight thanks to larger-than-expected falls in U.S. crude and gasoline inventories and receding virus nerves," Jeffrey Halley, senior market analyst at brokerage OANDA said in a note.

U.S. Energy Information Administration data on Wednesday showed crude oil inventories fell by 3.6 million barrels in the week to Dec. 24, which was more than what analysts polled by Reuters had expected.