Solely aggregation of news articles, with no opinions expressed by this service since 2009 launch on this platform. Copyright to all articles remains with the original publisher and HEADLINES ARE CLICKABLE to access the whole article at source. (Subscription by email is recommended,with real-time updates on LinkedIn and Twitter.)

Search This Blog

Monday, 17 January 2022

Oil climbs as supplies expected to remain tight | Reuters

Oil prices rose on Monday with investors betting that global supply will remain tight, although restraint by major producers was partially offset by a rise in Libyan output.

Brent crude settled up 42 cents, or 0.5%, to $86.48 a barrel. Earlier in the session, the contract touched its highest price since Oct. 3, 2018, at $86.71.

U.S. West Texas Intermediate crude was up 53 cents, or 0.6%, at $84.35 after touching its highest price since Nov. 10 at $84.78. Trade was subdued due to the U.S. holiday honoring slain civil rights leader Martin Luther King Jr.

Frantic oil buying, driven by supply outages and signs the Omicron coronavirus variant will not be as disruptive to fuel demand as previously feared, has pushed some crude grades to multi-year highs, suggesting the rally in Brent futures could be sustained for a while longer, traders said. read more

Column: Looking beyond Omicron, oil investors focus on tight supply | Reuters

Portfolio managers purchased oil last week at the fastest rate for 14 months amid growing confidence that the latest wave of coronavirus infections will not have a significant effect on international aviation and oil consumption.

Hedge funds and other money managers purchased the equivalent of 83 million barrels in the six most important petroleum-linked futures and options contracts in the week to Jan. 11.

Fund managers have purchased a total of 184 million barrels over the four most recent weeks as bullish sentiment returned after selling 327 million barrels in the 10 previous weeks.

Bullish long positions now outnumber bearish short ones by a ratio of 6.2 to 1 (in the 80th percentile for all weeks since 2013) up from a ratio of only 3.8 to 1 (47th percentile) on Dec. 14.

Egyptian Stock Market: Regulator Says Military-Owned Firms May List in 2022 - Bloomberg

Some military-owned companies could sell stakes on the Egyptian stock market this year, the head of the country’s market regulatory agency said Monday.

Mohamed Omran, speaking to reporters, didn’t provide additional details. But the disclosure suggests momentum for a proposal put forward in 2019 by President Abdel-Fattah El-Sisi.

More broadly, the government has also relaunched a stalled program to sell or list additional stakes or IPO some entities owned by the state.

#UAE aims to capture 25% of hydrogen market share - minister | Reuters

UAE Energy Minister Suhail al-Mazrouei said on Monday that the Gulf country is aiming to capture around a quarter of the global hydrogen market with hydrogen produced both by electrolysis and from natural gas.

Mazrouei added that as part of the country's hydrogen roadmap, it is currently implementing seven projects and looks forward to export hydrogen.

He said "There has been already discussion with many countries who we supply with hydrocarbons today, and they are keen to get hydrogen."

The minister was attending a session at Abu Dhabi Sustainability Week Summit at the Expo 2020 site in Dubai.

Brent Crude Trades Near Highest Since 2014 on Tightening Market - Bloomberg

| PRICES |

|---|

|

Traders Wanted in a Once-Sleepy Gas Market With New Kingpins - Bloomberg

Around the world, analysts and traders are grappling with the biggest shakeup in the 60-year history of liquefied natural gas: The emergence of two new superpowers, the U.S. and China, who are bringing more uncertainty and price fluctuations to a once-staid commodity market.

China became the biggest importer of liquefied natural gas in December, overtaking Japan for the first time since it pioneered the industry in the 1970s. Meanwhile, the U.S. is set to become the world’s top exporter of the fossil fuel on an annual basis later this year, beating out cornerstone suppliers Qatar and Australia.

Neither of the two superpowers are as predictable as their predecessors, and data from China is particularly hard to come by. That’s helped fuel wild swings in LNG spot prices as it’s become a traded commodity, similar to crude oil. To keep up, trading desks have proliferated globally, with Japanese LNG giants like Tokyo Gas Co. and Osaka Gas Co. setting up their own, while banks Macquarie Group and Citigroup Inc. are hiring traders to cash in on the volatility.

Gas markets have never been this volatile. They’re trading up and down on single days in ranges they barely covered over decades. European natural gas prices, often used as a benchmark for LNG, hit a record high of 180 euros per megawatt-hour in mid-December, before collapsing more than 60% in the next 10 days.

Banks invited to pitch for top roles in upcoming IPO of Dubai road-toll operator Salik -sources | Reuters

Dubai's Road and Transport Authority (RTA) sent a request to banks to pitch for top roles in the upcoming initial public offering of road-toll operator Salik, two sources told Reuters.

Investment banks began to receive invitations to pitch for joint global coordinator roles in the planned public share sale, said the sources familiar with the matter, declining to be named because the information was private.

The RTA and Salik did not immediately respond to a Reuters request for a comment.

The RTA has appointed Moelis & Co as financial advisor on the deal. The U.S. bank is also acting as financial advisor on the public share sale of Dubai Electricity & Water Authority. read more Moelis did not immediately respond to a request for comment.

Oil steady as rising Libyan output offsets supply concerns | Reuters

Oil prices were steady on Monday as investor bets that global supply will remain tight amid restraint by major producers were offset by a rise in Libyan output.

Brent crude was down 12 cents, or 0.1%, at $85.94 a barrel by 1420 GMT. Earlier in the session, the contract touched its highest since Oct. 3, 2018, at $86.71.

U.S. West Texas Intermediate crude was up 6 cents, or 0.1%, at $83.88 after touching its highest since Nov. 10 at $84.78.

Frantic oil buying, driven by supply outages and signs the Omicron coronavirus variant will not be as disruptive to fuel demand as previously feared, has pushed some crude grades to multi-year highs, suggesting the rally in Brent futures could be sustained for a while longer, traders said. read more

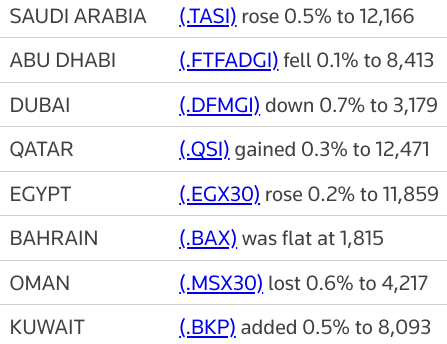

Gulf bourses end mixed; #Saudi at 15 year high | Reuters

Stock markets in the Gulf ended mixed on Monday, with the Saudi index extending gains from the previous sessions when it reached its highest in over 15 years.

Saudi Arabia's benchmark index (.TASI) gained 0.5%, at its highest since July 2006, led by a 1.4% rise in the kingdom's biggest lender Saudi National Bank (1180.SE) and a 1.8% increase in Saudi Telecom Company (7010.SE).

Oil prices, a key catalyst for the Gulf's financial markets, were steady as investor bets that global supply will remain tight amid restraint by major producers were offset by a rise in Libyan output.

The Qatari index (.QSI) finished 0.3% higher, led by a 2.4% increase in Qatar National Bank (QNBK.QA).

Last week, the Gulf's biggest bank reported a 10% increase in annual net profit driven by loan growth. read more

However, Qatar Islamic Bank (QISB.QA) fell 1.2%, despite reporting a rise in annual profit.

Investors remain cautious while uncertainties remain around the developments in U.S. monetary policy, said Wael Makarem, senior market strategist at Exness.

"Markets in the region have also seen investors move to secure their profits after several increases in the last few days."

Dubai's main share index (.DFMGI) fell 0.7%, dragged down by a 2.3% fall in Emirates NBD Bank (ENBD.DU) and a 1.2% decrease in Emirates Integrated Telecommunications (DU.DU).

Three fuel trucks exploded, killing three people, and a fire broke out near Abu Dhabi airport on Monday in what Yemen's Iran-aligned Houthi group said was an attack deep inside the United Arab Emirates. read more

The Houthi movement, which is battling a Saudi-led coalition that includes the UAE, has frequently launched cross-border missile and drone attacks on Saudi Arabia, but has claimed few such attacks on the UAE, mostly denied by Emirati authorities.

The Abu Dhabi stock market index (.FTFADGI) eased 0.1%, giving up early gains after the news of the explosion and fire. The stock market index had gained as much as 0.3% in early trade.

Outside the Gulf, Egypt's blue-chip index (.EGX30) added 0.2%, ending two sessions of losses, helped by a 0.4% gain in top lender Commercial International Bank Egypt (COMI.CA).

Brent Oil Edges Toward Highest Since 2014 on Tightening Market - Bloomberg video

| PRICES |

|---|

|

Taqa and Ewec raise $700m in green bonds for #AbuDhabi solar project

Abu Dhabi National Energy Company, Taqa, together with Emirates Water and Electricity Company, raised $700.8 million through its first green bond as it diversifies funding sources to include sustainable financing for projects.

Taqa will use proceeds of the deal to refinance existing debt of Sweihan PV Power Company, the entity set up to build, own and operate Noor Abu Dhabi solar power project, it said on Monday.

Maturing in 2049, the bonds offer a 3.625 per cent coupon and are expected to receive BBB+/Baa1 ratings from S&P and Moody’s, respectively. The deal was 1.8 times oversubscribed with local, regional and international investors placing total orders of $1.26bn, the company said.

“Taqa continues to deliver benchmark renewable energy projects with our investments underpinned by our strong balance sheet and our commitment to delivering shareholder value,” said Jasim Husain Thabet, Taqa group chief executive.

Jazeera Airways upgraded to Boursa #Kuwait's Premier Market

Kuwait’s Jazeera Airways has been upgraded to Boursa Kuwait's Premier Market after it exceeded the minimum liquidity and market capitalisation requirements over the past two years.

The budget airline is the only listed company to receive an upgrade on the Kuwait stock market, it said on Sunday.

“As the only company at Boursa Kuwait to offer investors access to the growing travel and aviation sector, the upgrade confirms the success of the company’s strategy and business model which positively contributes to the local economy,” Jazeera Airways chairman Marwan Boodai said.

The Premier Market includes listed companies that are relatively larger and more liquid.

#Saudi index hits 15-year peak on higher oil prices | Reuters

Most stock markets in the Gulf rose in early trade on Monday, in line with rising oil prices, with the Saudi index hitting its highest mark in over 15 years.

Oil prices, a catalyst for the region's financial markets, gained ground as investors bet supply would remain tight amid restrained output by major producers, with global demand unperturbed by the Omicron coronavirus variant.

Brent crude futures were up 40 cents, or 0.5%, at $86.46 a barrel by 0641 GMT, touching their highest in more than three years.

Saudi Arabia's benchmark index (.TASI) edged up 0.1%, to its highest since July 2006, helped by a 1.2% rise in Saudi Telecom Company (7010.SE) and a 0.4% increase in oil giant Saudi Aramco (2222.SE).

Saudi Energy Minister Prince Abdulaziz bin Salman said on Monday that it was up to the United States whether or not to release more supply from its strategic petroleum reserves. read more

Dubai's main share index (.DFMGI) added 0.1%, with Dubai Investments (DINV.DU) advancing 1.5% and Amlak Finance (AMLK.DU) rising 2%.

In Abu Dhabi, the index (.ADI) was up 0.2%.

The Qatari index (.QSI) gained 0.2%, led by a 1.4% increase in Qatar National Bank (QNBK.QA).

Last week, the Gulf's biggest bank reported a 10% increase in annual net profit driven by loan growth. read more

However, Qatar Islamic Bank (QISB.QA) fell 0.8%, despite reporting a rise in annual profit.

HSBC Reclaims Bond Crown in Mideast and Awaits Spurt to Beat Fed - Bloomberg

HSBC Holdings Plc, which last year was the top arranger for bond sales in the Middle East for the first time in more than half a decade, has another busy stretch coming up as borrowers race to markets ahead of looming U.S. interest-rate hikes.

Following $122 billion in debt sales in 2021, governments and companies will probably front-load much of their funding needs this year to the first few months in anticipation of monetary tightening by the Federal Reserve, according to Khaled Darwish, the Dubai-based head of debt capital markets at HSBC.

More than $50 billion of bonds and sukuks are set to mature this year, which could set off a wave of refinancing while borrowing costs remain low, he said.

“January and February will be busy,” Darwish said in an interview. “We expect volatility throughout the year, especially with uncertainty around interest-rate volatility, inflation and the potential downward revisions to economic growth in an ongoing pandemic.”

HSBC last year leapfrogged rivals in underwriting debt in the Middle East and North Africa, or MENA. Standard Chartered Plc, JPMorgan Chase & Co., Citigroup Inc. and First Abu Dhabi Bank PJSC rounded off the top five.

Saudi Oil Minister Says He’s Unconcerned About Rise in Prices - Bloomberg

Saudi Arabia’s energy minister said he was unconcerned about oil’s more-than-10% rise this year, even as traders increasingly raise the prospect of prices reaching $100 a barrel.

“I’ve always been comfortable,” Abdulaziz bin Salman said to reporters in Dubai on Monday, where he’s attending at Expo event.

Brent crude’s climbed 11% since the end of December to above $86 a barrel, amid signs consumption will hold up despite the spread of the omicron variant of the coronavirus. At the same time, spare capacity is dwindling as some of the world’s biggest producers struggle to boost output.

Vitol, the world’s biggest independent oil trader, is among those predicting that prices will rise further as supplies tighten.

OPEC+ member Oman said last week that the group -- led by Saudi Arabia and Russia -- would try to prevent the oil market “overheating” and didn’t want prices to reach $100 a barrel.

Prince Abdulaziz also said he wasn’t worried about the U.S. releasing more oil from its Strategic Petroleum Reserve, which could push crude prices down.

Billionaire Louis-Dreyfus Gets $457 Million From Trading Giant - Bloomberg

Just over a year ago, Margarita Louis-Dreyfus’s financial outlook looked grim.

The Russian-born heiress was trying to sell a stake in Louis Dreyfus Co., one of the world’s biggest agricultural commodity trading houses, after she borrowed more than $1 billion from Credit Suisse Group AG to buy out family members. More than $400 million of debt was coming due by the end of 2020.

Since then, Louis-Dreyfus, 59, has sold 45% of Louis Dreyfus Co. to an Abu Dhabi sovereign wealth fund, and the firm has profited from volatile and higher agricultural commodity prices during the pandemic.

Her main holding company, Akira BV, received a $52 million dividend in May and another $405 million on the day of the deal’s completion in September, filings showed this month. Her net worth has increased to $3.3 billion, according to the Bloomberg Billionaires Index.

Oil climbs on supply worries, limited Omicron impact | Reuters

Oil prices rose on Monday, with Brent futures touching their highest in more than three years, as investors bet supply will remain tight amid restrained output by major producers with global demand unperturbed by the Omicron coronavirus variant.

Brent crude futures gained 40 cents, or 0.5%, to $86.46 a barrel by 0641 GMT. Earlier in the session, the contract touched its highest since Oct. 3, 2018 at $86.71.

U.S. West Texas Intermediate crude was up 58 cents, or 0.7%, at $84.40 a barrel, after hitting $84.78, the highest since Nov. 10, 2021, earlier in the session.

The gains followed a rally last week when Brent rose more than 5% and WTI climbed over 6%.