Saudi Wealth Fund’s Activision (ATVI) Bet to Get a $1 Billion Microsoft Boost - Bloomberg

Saudi Arabia’s sovereign wealth fund is set for a face-saving $1.1 billion boost to its investment in Activision Blizzard Inc. after Microsoft Corp. agreed to buy the video-game maker.

The Public Investment Fund, which first started building a position at the end of 2020, owned about 37.9 million shares in Activision at the end of September, according to public filings. Microsoft will pay $95 a share in cash, valuing the stake at $3.6 billion, up from $2.5 billion at Friday’s close.

The deal -- if it completes -- will help rescue PIF’s bet on the gaming publisher, whose shares had fallen more than a third from the time its investment was first reported to last week. The fund built its stake over the last three months of 2020 and the first half of 2021. While filings don’t show the purchase price, if the fund paid the average price in each of those three quarters, its stake would’ve been acquired at an average of about $89 per share.

The gaming publisher has been in turmoil since the summer, when it was sued by California’s Department of Fair Employment and Housing over allegations of sexual harassment, unequal pay and retaliation. The shares closed at $65.39 on Friday before soaring as high as $86.90 Tuesday on the deal news, giving PIF’s stake a $700 million lift for the day.

A spokesperson for PIF declined to comment.

The Saudi wealth fund has amassed around $500 billion in assets. The fund is planning to invest about $10 billion more into listed stocks this year, people familiar with the matter said last week, as it pursues the goal of more than doubling its assets by 2025.

Crown Prince Mohammed bin Salman, who chairs the fund, has long been a fan of video games, saying in 2018 that his favorite diversion is Call of Duty series, Activision’s best-selling franchise.

Solely aggregation of news articles, with no opinions expressed by this service since 2009 launch on this platform. Copyright to all articles remains with the original publisher and HEADLINES ARE CLICKABLE to access the whole article at source. (Subscription by email is recommended,with real-time updates on LinkedIn and Twitter.)

Search This Blog

Tuesday, 18 January 2022

Oil hit 7-year highs as tight supply bites | Reuters

Oil hit 7-year highs as tight supply bites | Reuters

Oil prices on Tuesday climbed to their highest since 2014 as investors worried about possible supply disruption after attacks in the Middle East added to an already tight outlook.

Brent crude futures rose $1.03, or 1.2%, to settle at $87.51 a barrel. U.S. West Texas Intermediate (WTI) crude futures rose $1.61, or 1.9%, to settle at $85.43 a barrel.

Both benchmarks touched their highest since October 2014.

Supply concerns mounted this week after Yemen's Houthi group attacked the United Arab Emirates, escalating hostilities between the Iran-aligned group and a Saudi Arabian-led coalition. read more

After launching drone and missile strikes that set off explosions in fuel trucks and killed three people, the Houthi movement warned it could target more facilities, while the UAE said it reserved the right to "respond to these terrorist attacks." read more

Oil prices on Tuesday climbed to their highest since 2014 as investors worried about possible supply disruption after attacks in the Middle East added to an already tight outlook.

Brent crude futures rose $1.03, or 1.2%, to settle at $87.51 a barrel. U.S. West Texas Intermediate (WTI) crude futures rose $1.61, or 1.9%, to settle at $85.43 a barrel.

Both benchmarks touched their highest since October 2014.

Supply concerns mounted this week after Yemen's Houthi group attacked the United Arab Emirates, escalating hostilities between the Iran-aligned group and a Saudi Arabian-led coalition. read more

After launching drone and missile strikes that set off explosions in fuel trucks and killed three people, the Houthi movement warned it could target more facilities, while the UAE said it reserved the right to "respond to these terrorist attacks." read more

Column: Oil prices expected to rise with big variation in projections | Reuters

Column: Oil prices expected to rise with big variation in projections | Reuters

Oil prices will exceed pre-pandemic levels over the next few years but where they will settle remains extremely uncertain, my seventh annual survey of energy market professionals shows.

Brent crude is expected to average $80-85 a barrel through the middle of the decade, up from expectations of $70 before the COVID-19 pandemic took hold in 2020.

Expected prices are mostly $10-15 a barrel above where futures were trading at the time the survey was conducted between Jan. 11 and Jan. 14, against a pre-pandemic premium of $10 or less.

The most significant post-pandemic change, however, is the large increase in dispersion of views, with many more respondents forecasting prices far above or far below the average.

Oil prices will exceed pre-pandemic levels over the next few years but where they will settle remains extremely uncertain, my seventh annual survey of energy market professionals shows.

Brent crude is expected to average $80-85 a barrel through the middle of the decade, up from expectations of $70 before the COVID-19 pandemic took hold in 2020.

Expected prices are mostly $10-15 a barrel above where futures were trading at the time the survey was conducted between Jan. 11 and Jan. 14, against a pre-pandemic premium of $10 or less.

The most significant post-pandemic change, however, is the large increase in dispersion of views, with many more respondents forecasting prices far above or far below the average.

#AbuDhabi bourse shrugs off attack, #Saudi at 15-year high | Reuters

Abu Dhabi bourse shrugs off attack, Saudi at 15-year high | Reuters

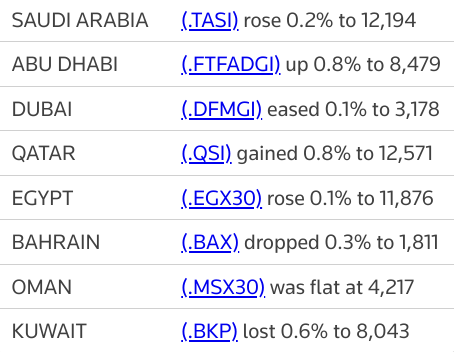

Abu Dhabi's stock market rebounded on Tuesday, a day after the emirate witnessed a deadly attack, while the Saudi index held steady at its highest level since July 2006.

Yemen's Iran-aligned Houthi group attacked the United Arab Emirates in an operation using missiles and drones, setting off explosions in fuel trucks that killed three people and causing a fire near the airport of Abu Dhabi, capital of the region's commercial and tourism hub. read more

The Abu Dhabi index (.FTFADGI) rebounded 0.8%, recovering from the previous session's losses, led by a 2.1% rise in the country's largest lender First Abu Dhabi Bank (FAB.AD).

The attack was more of a minor irritant than a drastic change in the security scenario, according to Vijay Valecha, Chief Investment Officer, Century Financial. The security infrastructure in UAE is pretty robust and this has prevented these kinds of attacks so far, he said.

"Due to this reason, it is improbable that investor sentiment will be impacted."

Dubai's main share index (.DFMGI) dipped 0.1%, hit by a 1.4% fall in blue-chip developer Emaar Properties (EMAR.DU) and a 1.4% decline in budget airliner Air Arabia (AIRA.DU).

Saudi Arabia's benchmark index (.TASI) gained 0.2%, holding steady at its highest in over 15 years, helped by a 4.4% rise in Riyad Bank (1010.SE).

Red Sea International (4230.SE) surged 10%, the top gainer on the index, following a contract worth more than 60 million riyals ($15.99 million).

Saudi shares are supported by strong oil prices and the market was unaffected by the drone attacks on the UAE, said Eman AlAyyaf, CEO of EA Trading.

Benchmark oil prices climbed to their highest level since 2014 as possible supply disruption after attacks in the Mideast Gulf added to an already tight supply outlook.

The Qatari index (.QSI) rose 0.8%, boosted by a 4% increase in Commercial Bank (COMB.QA)

Outside the Gulf, Egypt's blue-chip index (.EGX30) added 0.1%.

Yemen's Iran-aligned Houthi group attacked the United Arab Emirates in an operation using missiles and drones, setting off explosions in fuel trucks that killed three people and causing a fire near the airport of Abu Dhabi, capital of the region's commercial and tourism hub. read more

The Abu Dhabi index (.FTFADGI) rebounded 0.8%, recovering from the previous session's losses, led by a 2.1% rise in the country's largest lender First Abu Dhabi Bank (FAB.AD).

The attack was more of a minor irritant than a drastic change in the security scenario, according to Vijay Valecha, Chief Investment Officer, Century Financial. The security infrastructure in UAE is pretty robust and this has prevented these kinds of attacks so far, he said.

"Due to this reason, it is improbable that investor sentiment will be impacted."

Dubai's main share index (.DFMGI) dipped 0.1%, hit by a 1.4% fall in blue-chip developer Emaar Properties (EMAR.DU) and a 1.4% decline in budget airliner Air Arabia (AIRA.DU).

Saudi Arabia's benchmark index (.TASI) gained 0.2%, holding steady at its highest in over 15 years, helped by a 4.4% rise in Riyad Bank (1010.SE).

Red Sea International (4230.SE) surged 10%, the top gainer on the index, following a contract worth more than 60 million riyals ($15.99 million).

Saudi shares are supported by strong oil prices and the market was unaffected by the drone attacks on the UAE, said Eman AlAyyaf, CEO of EA Trading.

Benchmark oil prices climbed to their highest level since 2014 as possible supply disruption after attacks in the Mideast Gulf added to an already tight supply outlook.

The Qatari index (.QSI) rose 0.8%, boosted by a 4% increase in Commercial Bank (COMB.QA)

Outside the Gulf, Egypt's blue-chip index (.EGX30) added 0.1%.

Family businesses in #SaudiArabia go public as stock market booms | Financial Times

Family businesses in Saudi Arabia go public as stock market booms | Financial Times

Saudi family-owned companies, long resistant to opening their books to outside shareholders, are lining up to list stakes as the country’s stock market booms, sometimes in the hope that bringing in outside investors will help them weather internal disputes.

Saudi family-owned companies, long resistant to opening their books to outside shareholders, are lining up to list stakes as the country’s stock market booms, sometimes in the hope that bringing in outside investors will help them weather internal disputes.

Almunajem, one of Saudi Arabia’s largest food companies, in December became one such company to list on the bourse, known as the Tadawul, while the exchange was on a multiyear high. The Riyadh-headquartered group offered a 30 per cent stake which raised around $300m.

“It’s a very good move, at least to institutionalise the business from a governance and continuity perspective,” said chief executive Thamer Abanumay, a non-family member. The move should also help the company to “diversify our capital for growth”, he said.

Other family companies that listed last year include Theeb Rent a Car and Alkhorayef Water and Power Technologies. Nahdi Medical, the country’s largest pharmacy chain, has received regulatory approval to float shares.

Iberdrola CEO Goes to Court to Deal With Allegations of Corporate Spying - Bloomberg

Iberdrola CEO Goes to Court to Deal With Allegations of Corporate Spying - Bloomberg

In the energy sector, ESG investors often focus on the “E” (environment); largely sidestep the “S” (social), and completely ignore the “G” (governance). In many cases, green trumps, or even obscures, murkiness. Iberdrola SA, the European utility that’s a champion in renewables, is a case in point.

The company, one of the world’s largest wind power generators, is embroiled in a murky case of alleged corporate espionage that’s now an official criminal investigation in Spain. Its chairman and chief executive officer, Ignacio Galan, will appear in court alongside other top executives on Jan. 18 as suspects, which in Spanish law refers to unindicted subjects of official probes. The probe is part of a broad scandal involving other blue-chip Spanish companies. According to investigators, several companies — including Iberdrola — allegedly hired a firm owned by a former senior police officer to spy on rivals and their executives.

The events under investigation date back to 2004 and include a couple of colorful corporate battles. According to court documents, Iberdrola allegedly asked the former policeman turned private investigator to dig up information on the chairman of a local competitor. It also allegedly asked for intelligence on a local tycoon Florentino Perez (better known as the chairman of the Real Madrid soccer club) and his family amid a takeover fight, according to the filing.

The investigation is still in preliminary stages. Iberdrola strongly denies the charges, arguing that hiring the former cop was part of normal business and all payments were for proper services.

In the energy sector, ESG investors often focus on the “E” (environment); largely sidestep the “S” (social), and completely ignore the “G” (governance). In many cases, green trumps, or even obscures, murkiness. Iberdrola SA, the European utility that’s a champion in renewables, is a case in point.

The company, one of the world’s largest wind power generators, is embroiled in a murky case of alleged corporate espionage that’s now an official criminal investigation in Spain. Its chairman and chief executive officer, Ignacio Galan, will appear in court alongside other top executives on Jan. 18 as suspects, which in Spanish law refers to unindicted subjects of official probes. The probe is part of a broad scandal involving other blue-chip Spanish companies. According to investigators, several companies — including Iberdrola — allegedly hired a firm owned by a former senior police officer to spy on rivals and their executives.

The events under investigation date back to 2004 and include a couple of colorful corporate battles. According to court documents, Iberdrola allegedly asked the former policeman turned private investigator to dig up information on the chairman of a local competitor. It also allegedly asked for intelligence on a local tycoon Florentino Perez (better known as the chairman of the Real Madrid soccer club) and his family amid a takeover fight, according to the filing.

The investigation is still in preliminary stages. Iberdrola strongly denies the charges, arguing that hiring the former cop was part of normal business and all payments were for proper services.

Sinopec gets first LNG cargo under new deal with #Qatar - state media | Reuters

Sinopec gets first LNG cargo under new deal with Qatar - state media | Reuters

China's Sinopec Corp received its first cargo of liquefied natural gas (LNG) under a new term supply deal signed last year with Qatar Petroleum, local state media reported on Tuesday.

The tanker Al Sahla, carrying 94,000 tonnes of Qatari gas, was discharged into Sinopec's Tianjin terminal earlier this week, state-run Tianjin Daily reported.

This is part of a deal signed with Qatar Petroleum in March for an annual supply of 2 million tonnes for 10 years, with supply starting this month.

China's Sinopec Corp received its first cargo of liquefied natural gas (LNG) under a new term supply deal signed last year with Qatar Petroleum, local state media reported on Tuesday.

The tanker Al Sahla, carrying 94,000 tonnes of Qatari gas, was discharged into Sinopec's Tianjin terminal earlier this week, state-run Tianjin Daily reported.

This is part of a deal signed with Qatar Petroleum in March for an annual supply of 2 million tonnes for 10 years, with supply starting this month.

Brent Oil Jumps to Highest Since 2014 as Physical Market Booms - Bloomberg

Brent Oil Jumps to Highest Since 2014 as Physical Market Booms - Bloomberg

| PRICES |

|---|

|

Oil to breach $100 a barrel later this year- Goldman Sachs | Reuters

Oil to breach $100 a barrel later this year- Goldman Sachs | Reuters

Brent oil prices are primed to rise above $100 per barrel later this year, Goldman Sachs analysts said, adding oil market remains in a "surprisingly large deficit" as demand hit from the Omicron coronavirus variant is so far smaller than expected.

The hit to demand from Omicron will likely be offset by gas-to-oil substitution, increased supply disruptions, OPEC+ shortfalls, and disappointing production in Brazil and Norway, the analysts wrote in a note dated Monday.

Global oil demand is seen rising 3.5 million barrels per day (bpd) year-on-year in 2022, with fourth-quarter demand reaching 101.6 million bpd.

Goldman expects OECD inventories to fall to their lowest level since 2000 by summer, and OPEC+ spare capacity to decline to historically low levels, given the lack of drilling in core-OPEC and Russia struggling to ramp up production.

"We expect the increase in OPEC+ production to fall even further short of quotas in 2022, with an only 2.5 million bpd increase in production expected from the next nine hikes."

Brent oil prices are primed to rise above $100 per barrel later this year, Goldman Sachs analysts said, adding oil market remains in a "surprisingly large deficit" as demand hit from the Omicron coronavirus variant is so far smaller than expected.

The hit to demand from Omicron will likely be offset by gas-to-oil substitution, increased supply disruptions, OPEC+ shortfalls, and disappointing production in Brazil and Norway, the analysts wrote in a note dated Monday.

Global oil demand is seen rising 3.5 million barrels per day (bpd) year-on-year in 2022, with fourth-quarter demand reaching 101.6 million bpd.

Goldman expects OECD inventories to fall to their lowest level since 2000 by summer, and OPEC+ spare capacity to decline to historically low levels, given the lack of drilling in core-OPEC and Russia struggling to ramp up production.

"We expect the increase in OPEC+ production to fall even further short of quotas in 2022, with an only 2.5 million bpd increase in production expected from the next nine hikes."

Employment Tribunal Case: Ex-Citi Banker Says He Lost Job Over ‘Toxic’ Claims - Bloomberg

Employment Tribunal Case: Ex-Citi Banker Says He Lost Job Over ‘Toxic’ Claims - Bloomberg

An ex-Citigroup Inc. banker is fighting to get his job back after he alleged that he was fired for blowing the whistle on a “toxic” culture at the bank’s Dubai office.

Faycal Dahab, a former sales director for the Middle East and North Africa, told a London employment tribunal how sales employees were told by a senior banker they should be grateful as “they earn more than employees of Starbucks,” according to court documents prepared by Dahab’s lawyers.

Dahab said he was wrongfully ousted in January 2020 under the guise of a standard redundancy round, when in fact it was down to unfair treatment following his disclosures. He is suing Citi for unfair dismissal, saying the bank retaliated against him because of his claims.

“I would be treated as being ‘difficult’ and ‘negative’ for having disclosed my genuine concerns about inappropriate business and management practices,” Dahab said in a witness statement prepared for the hearing. Younger staff members were put under excessive pressure to produce revenues and some within the compliance and department were “bullied,” Dahab said.

An ex-Citigroup Inc. banker is fighting to get his job back after he alleged that he was fired for blowing the whistle on a “toxic” culture at the bank’s Dubai office.

Faycal Dahab, a former sales director for the Middle East and North Africa, told a London employment tribunal how sales employees were told by a senior banker they should be grateful as “they earn more than employees of Starbucks,” according to court documents prepared by Dahab’s lawyers.

Dahab said he was wrongfully ousted in January 2020 under the guise of a standard redundancy round, when in fact it was down to unfair treatment following his disclosures. He is suing Citi for unfair dismissal, saying the bank retaliated against him because of his claims.

“I would be treated as being ‘difficult’ and ‘negative’ for having disclosed my genuine concerns about inappropriate business and management practices,” Dahab said in a witness statement prepared for the hearing. Younger staff members were put under excessive pressure to produce revenues and some within the compliance and department were “bullied,” Dahab said.

Oil prices hit 7-year highs as tight supply bites | Reuters

Oil prices hit 7-year highs as tight supply bites | Reuters

Benchmark oil prices climbed to their highest level since 2014 on Tuesday as possible supply disruption after attacks in the Mideast Gulf added to an already tight supply outlook.

Brent crude futures rose $1.02, or 1.2%, to $87.50 a barrel by 0924 GMT, while U.S. West Texas Intermediate (WTI) crude futures jumped $1.36, or 1.6%, to $85.18 a barrel. Trade on Monday was subdued as it was a U.S. public holiday.

Both benchmarks touched their highest levels since October 2014 on Tuesday.

Supply concerns have risen this week after Yemen's Houthi group attacked the United Arab Emirates, escalating hostilities between the Iran-aligned group and a Saudi Arabian-led coalition. read more

Benchmark oil prices climbed to their highest level since 2014 on Tuesday as possible supply disruption after attacks in the Mideast Gulf added to an already tight supply outlook.

Brent crude futures rose $1.02, or 1.2%, to $87.50 a barrel by 0924 GMT, while U.S. West Texas Intermediate (WTI) crude futures jumped $1.36, or 1.6%, to $85.18 a barrel. Trade on Monday was subdued as it was a U.S. public holiday.

Both benchmarks touched their highest levels since October 2014 on Tuesday.

Supply concerns have risen this week after Yemen's Houthi group attacked the United Arab Emirates, escalating hostilities between the Iran-aligned group and a Saudi Arabian-led coalition. read more

LG plans regional headquarter in Riyadh - Asharq TV | Reuters

LG plans regional headquarter in Riyadh - Asharq TV | Reuters

South Korea's LG Corp (003550.KS) is planning to establish its regional headquarter in Saudi Arabia's capital Riyadh, Asharq television reported on Tuesday.

LG's announcement comes as the president of the East Asian country is visiting the kingdom.

The world's top oil exporter and largest Arab economy in February said it would give foreign firms until the end of 2023 to set up headquarters in the country or risk losing out on government contracts.

The move has put the kingdom in competition with regional business hub the United Arab Emirates.

South Korea's LG Corp (003550.KS) is planning to establish its regional headquarter in Saudi Arabia's capital Riyadh, Asharq television reported on Tuesday.

LG's announcement comes as the president of the East Asian country is visiting the kingdom.

The world's top oil exporter and largest Arab economy in February said it would give foreign firms until the end of 2023 to set up headquarters in the country or risk losing out on government contracts.

The move has put the kingdom in competition with regional business hub the United Arab Emirates.

#Kuwait's oil revenue reaches $38.10bln in past nine months | ZAWYA MENA Edition

Kuwait's oil revenue reaches $38.10bln in past nine months | ZAWYA MENA Edition

Kuwait's oil revenue reached 11.5 billion dinars ($38.10 billion) in the nine months to the end of December, the Ministry of Finance said in a report on Monday.

The Gulf OPEC member recorded a budget deficit of 682.4 million dinars in the first nine months of its financial year, which ends in March 2022, the ministry's preliminary report said. ($1 = 0.3019 Kuwaiti dinars)

Kuwait's oil revenue reached 11.5 billion dinars ($38.10 billion) in the nine months to the end of December, the Ministry of Finance said in a report on Monday.

The Gulf OPEC member recorded a budget deficit of 682.4 million dinars in the first nine months of its financial year, which ends in March 2022, the ministry's preliminary report said. ($1 = 0.3019 Kuwaiti dinars)

Most Gulf markets gain as #UAE shrugs off #AbuDhabi attack | Reuters

Most Gulf markets gain as UAE shrugs off Abu Dhabi attack | Reuters

Most major stock markets in the Gulf rose in early trade on Tuesday, with the United Arab Emirates market changing its course after opening in the red a day after an attack on Abu Dhabi.

Yemen's Iran-aligned Houthi group attacked the UAE on Monday in what it said was an operation using missiles and drones, setting off explosions in fuel trucks that killed three people and causing a fire near the airport of Abu Dhabi, capital of the region's commercial and tourism hub. read more

The UAE, a member of the coalition, has armed and trained local Yemeni forces that recently joined fighting against the Houthis in Yemen's energy-producing Shabwa and Marib regions.

The Abu Dhabi index (.FTFADGI) added 0.2%, reversing early losses of 0.1%.

Dubai's main share index (.DFMGI), which opened 0.4% lower, gained 0.3%, helped by a 1.2% rise in top lender Emirates NBD (ENBD.DU).

Budget airliner Air Arabia (AIRA.DU) was flat, after falling as much as 2.1%.

UAE oil firm ADNOC said it had activated business continuity plans to ensure uninterrupted supply of products to its local and international customers after the incident at its Mussafah fuel depot. read more

Saudi Arabia's benchmark index (.TASI) edged up 0.1%, holding steady at its highest in over 15 years, supported by 0.7% rise in SABIC Agri-Nutrients (2020.SE).

Aldrees Petroleum and Transport Services Company (4200.SE) advanced 2.5% after reporting a sharp rise in quarterly profit. The petroleum and commodity transporter also proposed an annual dividend of 1.5 riyals per share.

Crude prices, a key catalyst for the Gulf's financial markets, rose more than $1 to a more than seven-year high on worries about the attack.

The Qatari index (.QSI) eased 0.1%, hit by a 0.5% fall in Masraf Al Rayan (MARK.QA).

Most major stock markets in the Gulf rose in early trade on Tuesday, with the United Arab Emirates market changing its course after opening in the red a day after an attack on Abu Dhabi.

Yemen's Iran-aligned Houthi group attacked the UAE on Monday in what it said was an operation using missiles and drones, setting off explosions in fuel trucks that killed three people and causing a fire near the airport of Abu Dhabi, capital of the region's commercial and tourism hub. read more

The UAE, a member of the coalition, has armed and trained local Yemeni forces that recently joined fighting against the Houthis in Yemen's energy-producing Shabwa and Marib regions.

The Abu Dhabi index (.FTFADGI) added 0.2%, reversing early losses of 0.1%.

Dubai's main share index (.DFMGI), which opened 0.4% lower, gained 0.3%, helped by a 1.2% rise in top lender Emirates NBD (ENBD.DU).

Budget airliner Air Arabia (AIRA.DU) was flat, after falling as much as 2.1%.

UAE oil firm ADNOC said it had activated business continuity plans to ensure uninterrupted supply of products to its local and international customers after the incident at its Mussafah fuel depot. read more

Saudi Arabia's benchmark index (.TASI) edged up 0.1%, holding steady at its highest in over 15 years, supported by 0.7% rise in SABIC Agri-Nutrients (2020.SE).

Aldrees Petroleum and Transport Services Company (4200.SE) advanced 2.5% after reporting a sharp rise in quarterly profit. The petroleum and commodity transporter also proposed an annual dividend of 1.5 riyals per share.

Crude prices, a key catalyst for the Gulf's financial markets, rose more than $1 to a more than seven-year high on worries about the attack.

The Qatari index (.QSI) eased 0.1%, hit by a 0.5% fall in Masraf Al Rayan (MARK.QA).

#Kuwait Discusses Steps to Lower Emissions as Temperatures Rise - Bloomberg

Kuwait Discusses Steps to Lower Emissions as Temperatures Rise - Bloomberg

Kuwait’s cabinet ordered a review into plans to reduce emissions from government projects in a country that is one of the largest carbon emitters per capita, and among the world’s hottest.

The cabinet told the Gulf state’s Environment Public Authority to work on ensuring implementation of Kuwait’s commitments and international agreements, according to a statement late on Monday. The EPA can coordinate with the ministry of finance to allocate the funds needed, it said.

Kuwait has pledged to reduce greenhouse gas emissions 7.4% by 2035, a target that falls far short of the 45% reduction needed to meet the Paris Agreement’s stretch goal of limiting global warming to 1.5C by 2030.

According to the Environment Public Authority, parts of the country could get as much as 4.5°C hotter from 2071 to 2100 compared with the historical average.

Kuwait’s cabinet ordered a review into plans to reduce emissions from government projects in a country that is one of the largest carbon emitters per capita, and among the world’s hottest.

The cabinet told the Gulf state’s Environment Public Authority to work on ensuring implementation of Kuwait’s commitments and international agreements, according to a statement late on Monday. The EPA can coordinate with the ministry of finance to allocate the funds needed, it said.

Kuwait has pledged to reduce greenhouse gas emissions 7.4% by 2035, a target that falls far short of the 45% reduction needed to meet the Paris Agreement’s stretch goal of limiting global warming to 1.5C by 2030.

According to the Environment Public Authority, parts of the country could get as much as 4.5°C hotter from 2071 to 2100 compared with the historical average.

#AbuDhabi Attack: Drone Strike in Airport Kills Three - Bloomberg video

Abu Dhabi Attack: Drone Strike in Airport Kills Three - Bloomberg

Iran-backed Yemeni fighters launched drone strikes on the United Arab Emirates that caused explosions and a deadly fire outside the capital, Abu Dhabi, ratcheting up security risks in the oil-exporting region at a critical time.

One of the biggest attacks to date on UAE soil ignited a fire at Abu Dhabi’s main airport on Monday and set fuel trucks ablaze in a nearby industrial area, killing three people. It took place days after Yemen’s Houthi fighters warned Abu Dhabi against intensifying its air campaign against them.

Crude extended gains to the highest level in seven years on Tuesday after the assaults in the UAE, OPEC’s third-biggest oil producer.

Iran’s longtime support of the Houthis means the incidents could roil regional diplomatic efforts to ease frictions as well as talks to restore Tehran’s 2015 nuclear deal with world powers.

One of the biggest attacks to date on UAE soil ignited a fire at Abu Dhabi’s main airport on Monday and set fuel trucks ablaze in a nearby industrial area, killing three people. It took place days after Yemen’s Houthi fighters warned Abu Dhabi against intensifying its air campaign against them.

Crude extended gains to the highest level in seven years on Tuesday after the assaults in the UAE, OPEC’s third-biggest oil producer.

Iran’s longtime support of the Houthis means the incidents could roil regional diplomatic efforts to ease frictions as well as talks to restore Tehran’s 2015 nuclear deal with world powers.

#UAE bourses open in red after Houthi attack on Abu Dhabi | Reuters

UAE bourses open in red after Houthi attack on Abu Dhabi | Reuters

Shares in the United Arab Emirates opened lower on Tuesday, extending losses from the previous session after a deadly attack on Abu Dhabi.

Yemen's Iran-aligned Houthi group attacked the UAE in what it said was an operation using missiles and drones, setting off explosions in fuel trucks that killed three people and causing a fire near the airport of Abu Dhabi, capital of the region's commercial and tourism hub. read more

The UAE, a member of the coalition, has armed and trained local Yemeni forces that recently joined fighting against the Houthis in Yemen's energy-producing Shabwa and Marib regions.

The Abu Dhabi index (.FTFADGI) eased 0.1%, while Dubai's main share index (.DFMGI) opened 0.4% lower.

Budget airliner Air Arabia (AIRA.DU) dropped more than 2%.

Riyadh and Abu Dhabi had moved to engage directly with Iran in recent months to avoid any wider conflict that could hurt regional economic ambitions. The Yemen war is widely seen as a proxy war between Sunni Muslim Saudi Arabia and Shi'ite Iran. read more

Shares in the United Arab Emirates opened lower on Tuesday, extending losses from the previous session after a deadly attack on Abu Dhabi.

Yemen's Iran-aligned Houthi group attacked the UAE in what it said was an operation using missiles and drones, setting off explosions in fuel trucks that killed three people and causing a fire near the airport of Abu Dhabi, capital of the region's commercial and tourism hub. read more

The UAE, a member of the coalition, has armed and trained local Yemeni forces that recently joined fighting against the Houthis in Yemen's energy-producing Shabwa and Marib regions.

The Abu Dhabi index (.FTFADGI) eased 0.1%, while Dubai's main share index (.DFMGI) opened 0.4% lower.

Budget airliner Air Arabia (AIRA.DU) dropped more than 2%.

Riyadh and Abu Dhabi had moved to engage directly with Iran in recent months to avoid any wider conflict that could hurt regional economic ambitions. The Yemen war is widely seen as a proxy war between Sunni Muslim Saudi Arabia and Shi'ite Iran. read more

Oil climbs to more than 7-year high on Mideast tensions, tight supply | Reuters

Oil climbs to more than 7-year high on Mideast tensions, tight supply | Reuters

Oil prices rose more than $1 on Tuesday to a more than seven-year high on worries about possible supply disruptions after Yemen's Houthi group attacked the United Arab Emirates, escalating hostilities between the Iran-aligned group and a Saudi Arabian-led coalition. read more

The "new geopolitical tension added to ongoing signs of tightness across the market," ANZ Research analyst said in a note.

Brent crude futures rose $1.37, or 1.6%, to $87.85 a barrel by 0738 GMT, while U.S. West Texas Intermediate (WTI) crude futures jumped $1.71, or 2%, from Friday's settlement to $85.53 a barrel. Trade on Monday was subdued as it was a U.S. public holiday.

Both benchmarks climbed to their highest levels since October 2014 on Tuesday.

Oil prices rose more than $1 on Tuesday to a more than seven-year high on worries about possible supply disruptions after Yemen's Houthi group attacked the United Arab Emirates, escalating hostilities between the Iran-aligned group and a Saudi Arabian-led coalition. read more

The "new geopolitical tension added to ongoing signs of tightness across the market," ANZ Research analyst said in a note.

Brent crude futures rose $1.37, or 1.6%, to $87.85 a barrel by 0738 GMT, while U.S. West Texas Intermediate (WTI) crude futures jumped $1.71, or 2%, from Friday's settlement to $85.53 a barrel. Trade on Monday was subdued as it was a U.S. public holiday.

Both benchmarks climbed to their highest levels since October 2014 on Tuesday.

Subscribe to:

Comments (Atom)