Dubai Misses Out on the IPO Boom Sweeping Abu Dhabi and Riyadh - Bloomberg

Dubai may be the tourist gateway into the Middle East, but equity investors are flocking to its neighbors Abu Dhabi and Riyadh instead, as share sales worth billions of dollars heat up local markets.

Initial public offerings from Saudi Arabia’s ACWA Power International and Saudi Telecom Co.’s internet-services unit, as well as Abu Dhabi Ports and Adnoc Drilling Company PJSC are livening up their home exchanges. Yet, the United Arab Emirates’ other bourse, Dubai, only has delistings like that of Emaar Malls PJSC on the horizon.

Rebounding crude prices in 2021, further boosted by a global energy crunch, are buoying oil-rich Saudi Arabia and Abu Dhabi, which has also worked hard to revive its local bourse. Meanwhile, Dubai’s economy, heavily reliant on hospitality, real estate and tourism, has been ravaged by the pandemic.

“Dubai has a lot of catching up to do: Its liquidity profile is weak in comparison to Abu Dhabi and Riyadh, which are also some of the best-performing emerging markets this year,” said Salah Shamma, Franklin Templeton’s Dubai-based head of equity investment for the Middle East and North Africa.

Before the recent surge in offerings, Abu Dhabi’s stock exchange had gone three-and-a-half years without any IPOs, data compiled by Bloomberg show. Dubai has only seen one small company go public since 2017, while its only prospect of a listing this year went up in smoke when logistics firm Tristar Transport pulled its deal in April.

In other gulf markets, demand for new stocks has been through the roof. Investors placed more than $34 billion of orders for Adnoc Drilling’s $1.1 billion IPO, while Arabian Internet and Communications Services Co., also known as solutions by stc, attracted a whopping 471 billion riyals ($126 billion) in bids for its $966 million offering this month.

A tie-up with Abu Dhabi’s bourse would be one way to bolster Dubai’s market, according to Vijay Valecha, chief investment officer at Dubai-based consultancy Century Financial. “Worldwide, stock exchanges are merging to increase their investor base and improve their daily trading volumes.”

In the meantime, the deals deluge will likely carry on for Abu Dhabi and Riyadh. The Saudi stock exchange itself and the specialty chemicals business of Saudi Basic Industries Corp. are mulling public listings, as are Emirates Global Aluminium and Adnoc’s fertilizer joint venture Fertiglobe, Boomberg News has reported.

Solely aggregation of news articles, with no opinions expressed by this service since 2009 launch on this platform. Copyright to all articles remains with the original publisher and HEADLINES ARE CLICKABLE to access the whole article at source. (Subscription by email is recommended,with real-time updates on LinkedIn and Twitter.)

Search This Blog

Wednesday, 29 September 2021

Oil prices slip as U.S. inventories rise, despite OPEC's slow road to adding supply | Reuters

Oil prices slip as U.S. inventories rise, despite OPEC's slow road to adding supply | Reuters

Oil prices slipped on Wednesday after U.S. crude inventories rose by more than anticipated, even as OPEC plans to maintain its deliberate approach to adding supply to the market.

U.S. crude stockpiles rose by 4.6 million barrels last week, exceeding expectations, boosted by a rebound in output as offshore facilities shut in by two U.S. Gulf hurricanes resumed activity.

Brent crude settled down 45 cents to $78.64 a barrel, after reaching $80 on Tuesday. U.S. oil prices ended down 46 cents, or 0.6%, to $74.83 a barrel.

The market was also pressured by strength in the U.S. dollar, which hit a one-year high against a basket of other major currencies. Since oil is transacted in dollars, strength in the U.S. currency makes the commodity more expensive worldwide.

Oil prices slipped on Wednesday after U.S. crude inventories rose by more than anticipated, even as OPEC plans to maintain its deliberate approach to adding supply to the market.

U.S. crude stockpiles rose by 4.6 million barrels last week, exceeding expectations, boosted by a rebound in output as offshore facilities shut in by two U.S. Gulf hurricanes resumed activity.

Brent crude settled down 45 cents to $78.64 a barrel, after reaching $80 on Tuesday. U.S. oil prices ended down 46 cents, or 0.6%, to $74.83 a barrel.

The market was also pressured by strength in the U.S. dollar, which hit a one-year high against a basket of other major currencies. Since oil is transacted in dollars, strength in the U.S. currency makes the commodity more expensive worldwide.

Oil prices firm on OPEC's go-it-slow approach to adding supply | Reuters

Oil prices firm on OPEC's go-it-slow approach to adding supply | Reuters

Oil prices rebounded from losses on Wednesday after U.S. crude inventories rose by more than anticipated, and as OPEC plans to maintain its deliberate approach to adding supply to the market despite strong worldwide demand.

U.S. crude stockpiles rose by 4.6 million barrels last week, exceeding expectations, boosted by a rebound in output as offshore facilities shut in by two U.S. Gulf hurricanes resumed activity.

Brent crude rose 7 cents to $79.11 a barrel by 10:51 a.m. ET (1451 GMT). On Tuesday, it fell nearly $2 after touching its highest in almost three years at $80.75.

U.S. oil prices rose 23 cents, or 0.3%, to $75.52.

Oil prices have been charging higher as economies recover from pandemic lockdowns and fuel demand picks up, while some producing countries have seen supply disruptions.

Oil prices rebounded from losses on Wednesday after U.S. crude inventories rose by more than anticipated, and as OPEC plans to maintain its deliberate approach to adding supply to the market despite strong worldwide demand.

U.S. crude stockpiles rose by 4.6 million barrels last week, exceeding expectations, boosted by a rebound in output as offshore facilities shut in by two U.S. Gulf hurricanes resumed activity.

Brent crude rose 7 cents to $79.11 a barrel by 10:51 a.m. ET (1451 GMT). On Tuesday, it fell nearly $2 after touching its highest in almost three years at $80.75.

U.S. oil prices rose 23 cents, or 0.3%, to $75.52.

Oil prices have been charging higher as economies recover from pandemic lockdowns and fuel demand picks up, while some producing countries have seen supply disruptions.

MIDEAST STOCKS Major Gulf markets ease on oil price slide; #Qatar extends gains | Reuters

MIDEAST STOCKS Major Gulf markets ease on oil price slide; Qatar extends gains | Reuters

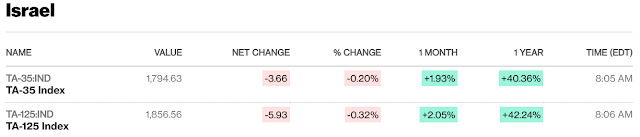

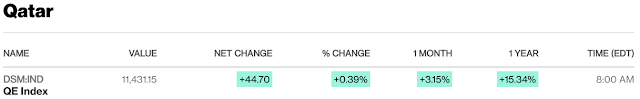

Most major stock markets in the Gulf ended lower on Wednesday, mirroring a slide in oil prices, while the Qatari index was on track to extend gains from the previous session.

Oil prices fell on Wednesday after U.S. crude inventories unexpectedly rose and amid concerns about a slowing Chinese economy. read more

Brent crude was down 46 cents, or 0.6%, at $78.63 a barrel by 0950 GMT. On Tuesday, it fell nearly $2 after touching its highest in almost three years at $80.75.

Oil prices have been charging higher as economies recover from pandemic lockdowns and fuel demand picks up, while some producing countries have seen supply disruptions.

Saudi Arabia's benchmark index (.TASI) closed flat as gains in consumer shares were capped by losses in energy stocks, with Saudi Arabian Mining Company (1211.SE) increasing 3.3%, while Oil giant Saudi Aramco (2222.SE), which saw its biggest intra-day gain in the last session since March 17 last year, was down 1%.

Aseer Trading Tourism & Manufacturing (4080.SE) surged nearly 10% in its biggest intra-day gain since March 29 this year after the government announced its strategy to develop the Aseer region into a tourism hub as part of the kingdom efforts to diversify its oil-dependent economy, with tourism contributing 10% of gross domestic product by 2030.

Saudi Arabia's crown prince Mohammed bin Salman's 50 billion riyal ($13 billion) strategy is to develop the region on the Red Sea coast that would attract 10 million visitors by 2030. read more

Separately, Saudi Arabia's stock exchange will likely end the year with more than 30 new listings, Mohammed El-Kuwaiz, the chairman of Saudi Arabia's Capital Markets Authority, said on Monday

Pipeline of expected listings is significant, with five new listings approved just in the past two days, three on the main exchange and two in parallel market.

The Abu Dhabi index (.ADI) closed down 0.6%, hit by a 1.1% drop in United Arab Emirates' largest lender First Abu Dhabi Bank (FAB.AD) and a 0.6% ease in Emirates Telecommunications Group (ETISALAT.AD).

Dubai's main share index (.DFMGI) also declined 0.2%, weighed by a 0.8% fall in Dubai Islamic Bank (DISB.DU) and a 0.7 ease in Air Arabia (AIRA.DU).

Outside the Gulf, Egypt's blue-chip index (.EGX30) dropped 0.5%, extending losses for a third-day in a row. Commercial International Bank - COMI (COMI.CA) decreased 1.3% and cigarette maker Eastern Company (EAST.CA) tumbled 3.3%.

The Qatari index (.QSI), however, was up 0.4% as Industries Qatar (IQCD.QA) increased 1.5% in its seventh consecutive rise, while Commercial Bank (COMB.QA) advanced 1.5%.

Most major stock markets in the Gulf ended lower on Wednesday, mirroring a slide in oil prices, while the Qatari index was on track to extend gains from the previous session.

Oil prices fell on Wednesday after U.S. crude inventories unexpectedly rose and amid concerns about a slowing Chinese economy. read more

Brent crude was down 46 cents, or 0.6%, at $78.63 a barrel by 0950 GMT. On Tuesday, it fell nearly $2 after touching its highest in almost three years at $80.75.

Oil prices have been charging higher as economies recover from pandemic lockdowns and fuel demand picks up, while some producing countries have seen supply disruptions.

Saudi Arabia's benchmark index (.TASI) closed flat as gains in consumer shares were capped by losses in energy stocks, with Saudi Arabian Mining Company (1211.SE) increasing 3.3%, while Oil giant Saudi Aramco (2222.SE), which saw its biggest intra-day gain in the last session since March 17 last year, was down 1%.

Aseer Trading Tourism & Manufacturing (4080.SE) surged nearly 10% in its biggest intra-day gain since March 29 this year after the government announced its strategy to develop the Aseer region into a tourism hub as part of the kingdom efforts to diversify its oil-dependent economy, with tourism contributing 10% of gross domestic product by 2030.

Saudi Arabia's crown prince Mohammed bin Salman's 50 billion riyal ($13 billion) strategy is to develop the region on the Red Sea coast that would attract 10 million visitors by 2030. read more

Separately, Saudi Arabia's stock exchange will likely end the year with more than 30 new listings, Mohammed El-Kuwaiz, the chairman of Saudi Arabia's Capital Markets Authority, said on Monday

Pipeline of expected listings is significant, with five new listings approved just in the past two days, three on the main exchange and two in parallel market.

The Abu Dhabi index (.ADI) closed down 0.6%, hit by a 1.1% drop in United Arab Emirates' largest lender First Abu Dhabi Bank (FAB.AD) and a 0.6% ease in Emirates Telecommunications Group (ETISALAT.AD).

Dubai's main share index (.DFMGI) also declined 0.2%, weighed by a 0.8% fall in Dubai Islamic Bank (DISB.DU) and a 0.7 ease in Air Arabia (AIRA.DU).

Outside the Gulf, Egypt's blue-chip index (.EGX30) dropped 0.5%, extending losses for a third-day in a row. Commercial International Bank - COMI (COMI.CA) decreased 1.3% and cigarette maker Eastern Company (EAST.CA) tumbled 3.3%.

The Qatari index (.QSI), however, was up 0.4% as Industries Qatar (IQCD.QA) increased 1.5% in its seventh consecutive rise, while Commercial Bank (COMB.QA) advanced 1.5%.

ACWA Power, One of the Hottest IPOs in Gulf Region - Bloomberg video

ACWA Power, One of the Hottest IPOs in Gulf Region - Bloomberg

Fahd Iqbal Head of Private Bank Middle East Research at Credit Suisse discusses ACWA Power's listing, ESG in the Middle East, oil price volatility and his investment plays for the UAE, Qatar and Egypt. He speaks with Yousef Gamal El-Diny on "Bloomberg Daybreak: Middle East." (Source: Bloomberg)

Reliance Backs Aramco Chair’s Board Role After Investor Dissent - Bloomberg

Reliance Backs Aramco Chair’s Board Role After Investor Dissent - Bloomberg

Reliance Industries Ltd. defended its plan to appoint Saudi Aramco’s non-executive Chairman Yasir Al Rumayyan as an independent director of the Indian oil-to-retail conglomerate, after some shareholders decided to vote against the move.

California State Teachers Retirement Fund and State Board of Administration of Florida decided to vote against the proposal, following recommendations from proxy advisory firm Glass Lewis that cited Reliance’s plan to sell a 20% stake in its oil-to-chemicals business to Saudi Aramco.

“The appointment of H.E. Yasir Al Rumayyan has no connection with the contemplated transaction with Saudi Aramco,” Reliance said in an exchange filing Wednesday. “Further, as approved by the shareholders, the O2C business of RIL is being spun off to a subsidiary and as per the terms of the proposed transaction, Saudi Aramco will participate in the equity of the O2C subsidiary. The O2C Subsidiary Board may have nominees of Saudi Aramco to protect its interest.”

Reliance had appointed Rumayyan as independent director from July 19 for a term of three years. The family of Reliance Chairman Mukesh Ambani, who had announced the decision at the company’s annual shareholder meeting, holds more than 50% of Reliance shares. The e-voting to ratify the appointment will end Oct. 19.

Reliance Industries Ltd. defended its plan to appoint Saudi Aramco’s non-executive Chairman Yasir Al Rumayyan as an independent director of the Indian oil-to-retail conglomerate, after some shareholders decided to vote against the move.

California State Teachers Retirement Fund and State Board of Administration of Florida decided to vote against the proposal, following recommendations from proxy advisory firm Glass Lewis that cited Reliance’s plan to sell a 20% stake in its oil-to-chemicals business to Saudi Aramco.

“The appointment of H.E. Yasir Al Rumayyan has no connection with the contemplated transaction with Saudi Aramco,” Reliance said in an exchange filing Wednesday. “Further, as approved by the shareholders, the O2C business of RIL is being spun off to a subsidiary and as per the terms of the proposed transaction, Saudi Aramco will participate in the equity of the O2C subsidiary. The O2C Subsidiary Board may have nominees of Saudi Aramco to protect its interest.”

Reliance had appointed Rumayyan as independent director from July 19 for a term of three years. The family of Reliance Chairman Mukesh Ambani, who had announced the decision at the company’s annual shareholder meeting, holds more than 50% of Reliance shares. The e-voting to ratify the appointment will end Oct. 19.

Soaring Energy Prices Sends Gulf Stocks on a Relentless Tear - Bloomberg

Soaring Energy Prices Sends Gulf Stocks on a Relentless Tear - Bloomberg

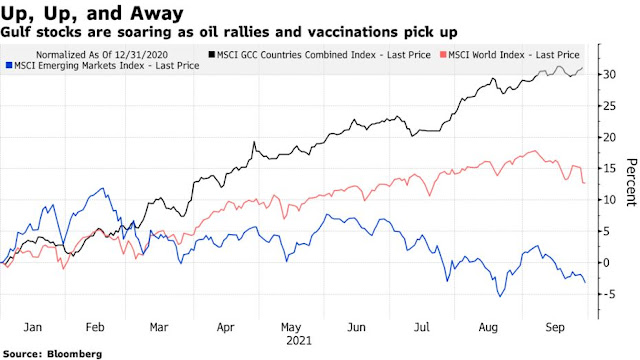

Oil prices near $80 a barrel and global commodity shortages have ignited a record-beating rally in Gulf stocks.

An MSCI index tracking companies in the United Arab Emirates, Saudi Arabia and other Gulf states has notched gains for 11 straight months, the longest winning streak ever.

The benchmark is up 31% in 2021 with some of the biggest gains coming from Saudi petrochemical and natural resource companies reaping profits from higher material prices.

“There are growing concerns about the pass-through inflationary effects of rising commodity prices for most global economies,” said Akber Khan, senior director of asset management at Al Rayan Investment in Doha. “Ironically, this is exactly what investors in the Gulf are increasingly excited about.”

Oil-rich Gulf countries have also navigated the pandemic better than other emerging markets. The United Arab Emirates has inoculated more than 80% of its population, putting it in sixth place on Bloomberg’s Resilience Rankings.

That all points to a strengthened economic backdrop for the region and its shares, according to Ali El Adou, head of asset management at Daman Investments in Dubai.

Stocks are also benefiting from government investments in the non-oil sector and new companies going public, he added.

Oil prices near $80 a barrel and global commodity shortages have ignited a record-beating rally in Gulf stocks.

An MSCI index tracking companies in the United Arab Emirates, Saudi Arabia and other Gulf states has notched gains for 11 straight months, the longest winning streak ever.

The benchmark is up 31% in 2021 with some of the biggest gains coming from Saudi petrochemical and natural resource companies reaping profits from higher material prices.

“There are growing concerns about the pass-through inflationary effects of rising commodity prices for most global economies,” said Akber Khan, senior director of asset management at Al Rayan Investment in Doha. “Ironically, this is exactly what investors in the Gulf are increasingly excited about.”

Oil-rich Gulf countries have also navigated the pandemic better than other emerging markets. The United Arab Emirates has inoculated more than 80% of its population, putting it in sixth place on Bloomberg’s Resilience Rankings.

That all points to a strengthened economic backdrop for the region and its shares, according to Ali El Adou, head of asset management at Daman Investments in Dubai.

Stocks are also benefiting from government investments in the non-oil sector and new companies going public, he added.

Lucid to start deliveries of electric cars with range exceeding Tesla's in October | Reuters

Lucid to start deliveries of electric cars with range exceeding Tesla's in October | Reuters

U.S. startup Lucid Group Inc (LCID.O) said on Tuesday it will start delivering luxury electric sedans with a Tesla-beating driving range in late October, posing a major challenge to the market leader whose sales of premium models have stagnated.

The California-based Lucid began production of its long-delayed Lucid Air cars at its Arizona factory on Tuesday, and said it aims to ramp plant's capacity up to 90,000 vehicles per annum in the next two years.

The top-end Lucid Air Dream Edition will be available in late October, followed by less expensive models: Grand Touring, Touring and Air Pure. The company said it has received more than 13,000 reservations for Lucid Air models, and it has increased the planned total production of the Lucid Air Dream Edition to 520 vehicles.

A version of the Lucid Air Dream Edition, priced at $169,000, received an official U.S. government rating of a 520-mile (837 km) driving range, over 100 miles more than its closest rival, Tesla's Model S, which is priced at $89,990. The higher range helped lead to a 23% jump in Lucid's shares this month.

U.S. startup Lucid Group Inc (LCID.O) said on Tuesday it will start delivering luxury electric sedans with a Tesla-beating driving range in late October, posing a major challenge to the market leader whose sales of premium models have stagnated.

The California-based Lucid began production of its long-delayed Lucid Air cars at its Arizona factory on Tuesday, and said it aims to ramp plant's capacity up to 90,000 vehicles per annum in the next two years.

The top-end Lucid Air Dream Edition will be available in late October, followed by less expensive models: Grand Touring, Touring and Air Pure. The company said it has received more than 13,000 reservations for Lucid Air models, and it has increased the planned total production of the Lucid Air Dream Edition to 520 vehicles.

A version of the Lucid Air Dream Edition, priced at $169,000, received an official U.S. government rating of a 520-mile (837 km) driving range, over 100 miles more than its closest rival, Tesla's Model S, which is priced at $89,990. The higher range helped lead to a 23% jump in Lucid's shares this month.

ACWA Power sets final IPO price at nearly $15

ACWA Power sets final IPO price at nearly $15

Saudi utility developer ACWA Power has set the final price of its initial public offering at SR56 ($14.9) per share, the company said in a bourse filing.

Half-owned by the Public Investment Fund, the company earlier announced its intention to issue 85.3 millions shares or 11.67 percent of the company in an IPO.

Retail offering started on Wednesday, and will run until Oct. 1. Around 8.12 million shares or 10 percent of the offering size were allocated for individual investors.

The company is expecting to raise more than $1 billion from the public offering, valuing the company at about $10 billion.

Saudi utility developer ACWA Power has set the final price of its initial public offering at SR56 ($14.9) per share, the company said in a bourse filing.

Half-owned by the Public Investment Fund, the company earlier announced its intention to issue 85.3 millions shares or 11.67 percent of the company in an IPO.

Retail offering started on Wednesday, and will run until Oct. 1. Around 8.12 million shares or 10 percent of the offering size were allocated for individual investors.

The company is expecting to raise more than $1 billion from the public offering, valuing the company at about $10 billion.

#Dubai Resets After Covid-Ravaged Year With $7 Billion Expo - Bloomberg

Dubai Resets After Covid-Ravaged Year With $7 Billion Expo - Bloomberg

One year after the pandemic forced a delay, Dubai is set to open its $7 billion Expo on a desert site the size of 600 football fields.

Having spent years preparing for the event, the city hopes that an exhibition featuring autonomous vehicles, a pavilion shaped like falcons and one with an original Pharaoh coffin will attract enough tourists to help solidify a nascent economic recovery.

Starting Friday, diplomats, dealmakers, artists and musicians will fly in from around the world. The city has stuck to its target of 25 million visits -- both virtually and in person -- and at a time when travel restrictions have slowed business across financial centers, the six-month long exhibition may even help to create a template for others to follow.

Dubai has shunned lockdowns since emerging from one last year, keeping its economy open and embarking on an ambitious vaccination drive. The United Arab Emirates, of which Dubai is a part, has inoculated more than 80% of its population and infections rates have dropped. The country is now placed sixth on Bloomberg’s Resilience Rankings.

One year after the pandemic forced a delay, Dubai is set to open its $7 billion Expo on a desert site the size of 600 football fields.

Having spent years preparing for the event, the city hopes that an exhibition featuring autonomous vehicles, a pavilion shaped like falcons and one with an original Pharaoh coffin will attract enough tourists to help solidify a nascent economic recovery.

Starting Friday, diplomats, dealmakers, artists and musicians will fly in from around the world. The city has stuck to its target of 25 million visits -- both virtually and in person -- and at a time when travel restrictions have slowed business across financial centers, the six-month long exhibition may even help to create a template for others to follow.

Dubai has shunned lockdowns since emerging from one last year, keeping its economy open and embarking on an ambitious vaccination drive. The United Arab Emirates, of which Dubai is a part, has inoculated more than 80% of its population and infections rates have dropped. The country is now placed sixth on Bloomberg’s Resilience Rankings.

#AbuDhabi's Etihad working on third sustainable financing | Reuters

Abu Dhabi's Etihad working on third sustainable financing | Reuters

Etihad Airways is working on what would be its third financing transaction linked to sustainable investment considerations, the Abu Dhabi government-owned airline's treasurer said on Wednesday.

Environmental, social and governance (ESG) concerns are gaining ground in the oil-rich Gulf region, with borrowers setting up ESG frameworks to transition to greener economies and capitalise on a global surge in awareness of sustainability risks following the COVID-19 pandemic.

"We’re now working on what would be our third transaction in the space", Daniel Tromans, group treasurer at Etihad said on Wednesday, without disclosing details other than to say announcements could be made in the next few weeks.

He was addressing a panel on sustainability at the ACT Middle East Treasury Summit, an online event.

Etihad Airways is working on what would be its third financing transaction linked to sustainable investment considerations, the Abu Dhabi government-owned airline's treasurer said on Wednesday.

Environmental, social and governance (ESG) concerns are gaining ground in the oil-rich Gulf region, with borrowers setting up ESG frameworks to transition to greener economies and capitalise on a global surge in awareness of sustainability risks following the COVID-19 pandemic.

"We’re now working on what would be our third transaction in the space", Daniel Tromans, group treasurer at Etihad said on Wednesday, without disclosing details other than to say announcements could be made in the next few weeks.

He was addressing a panel on sustainability at the ACT Middle East Treasury Summit, an online event.

Reliance backs #Saudi Aramco chairman as independent director | Reuters

Reliance backs Saudi Aramco chairman as independent director | Reuters

Reliance Industries Ltd (RELI.NS) said on Wednesday Saudi Aramco Chairman Yasir Al-Rumayyan met all regulatory criteria for his appointment as an independent director, pending a shareholder approval on the decision.

The California State Teachers' Retirement Fund, a shareholder of the Indian conglomerate, had last week decided to vote against the move based on U.S. proxy advisory research firm Glass Lewis' recommendation, BloombergQuint had reported. read more

The voting to confirm Al-Rumayyan's appointment for a period of three years will end on Oct. 19.

Reliance Industries Ltd (RELI.NS) said on Wednesday Saudi Aramco Chairman Yasir Al-Rumayyan met all regulatory criteria for his appointment as an independent director, pending a shareholder approval on the decision.

The California State Teachers' Retirement Fund, a shareholder of the Indian conglomerate, had last week decided to vote against the move based on U.S. proxy advisory research firm Glass Lewis' recommendation, BloombergQuint had reported. read more

The voting to confirm Al-Rumayyan's appointment for a period of three years will end on Oct. 19.

Oil drops a second day after rally peters out | Reuters

Oil drops a second day after rally peters out | Reuters

Oil prices fell on Wednesday after U.S. crude inventories unexpectedly rose as doubts over demand resurfaced, with COVID-19 cases continuing to increase worldwide and some regions facing gasoline shortages.

Brent crude was down $1.34, or 1.7%, at $77.75 a barrel by 0706 GMT. On Tuesday, it fell nearly $2 after touching its highest in almost three years at $80.75.

U.S. oil prices dropped $1.38, or 1.8%, to $73.91, having fallen 0.2% in the previous session.

Oil prices have been charging higher as economies recover from pandemic lockdowns and fuel demand picks up, while some producing countries have seen supply disruptions.

Oil prices fell on Wednesday after U.S. crude inventories unexpectedly rose as doubts over demand resurfaced, with COVID-19 cases continuing to increase worldwide and some regions facing gasoline shortages.

Brent crude was down $1.34, or 1.7%, at $77.75 a barrel by 0706 GMT. On Tuesday, it fell nearly $2 after touching its highest in almost three years at $80.75.

U.S. oil prices dropped $1.38, or 1.8%, to $73.91, having fallen 0.2% in the previous session.

Oil prices have been charging higher as economies recover from pandemic lockdowns and fuel demand picks up, while some producing countries have seen supply disruptions.

Subscribe to:

Comments (Atom)