Oil rises 2% but traders brace for wild ride on U.S. Election Day | Reuters

Oil prices rose near 2% on Tuesday, advancing with other financial markets on U.S. Election Day although traders were bracing for volatility depending on the voting results and as surging coronavirus cases around the world fed worries about fuel demand.

Brent futures rose 74 cents, or 1.9%, to settle at $39.71 a barrel, while U.S. West Texas Intermediate (WTI) crude rose 85 cents, or 2.3%, to settle at $37.66.

The oil price moves came ahead of data expected to show U.S. crude stockpiles rose 900,000 barrels last week after gaining 4.3 million barrels in the prior week.

The American Petroleum Institute (API), an industry group, will release its inventory report later Tuesday, ahead of government data from the U.S. Energy Information Administration (EIA) on Wednesday.

Solely aggregation of news articles, with no opinions expressed by this service since 2009 launch on this platform. Copyright to all articles remains with the original publisher and HEADLINES ARE CLICKABLE to access the whole article at source. (Subscription by email is recommended,with real-time updates on LinkedIn and Twitter.)

Search This Blog

Tuesday, 3 November 2020

OPEC President Says Saudis, Russia Push to Delay Supply Hike - Bloomberg

OPEC President Says Saudis, Russia Push to Delay Supply Hike - Bloomberg

OPEC+ talks on delaying a January oil-output increase gathered momentum on Tuesday, with some top officials offering support to the effort.

Algeria, which this year holds the OPEC presidency, said that both Saudi Arabia and Russia were pressing fellow members to prolong the current oil-supply cuts into next year, rather than tapering them as planned. Algeria supported the proposal, the first country to publicly do so.

Oil prices rose as the comments followed fresh hints from Secretary-General Mohammad Barkindo that the Organization of Petroleum Exporting Countries is preparing to change course. The alliance will move to “accelerate” the oil recovery at its next meeting, scheduled for Nov. 30-Dec 1, he said.

The 23-nation oil-producers network led by Riyadh and Moscow is currently scheduled to restore almost 2 million of the 7.7 million barrels of daily output currently halted to stave off a glut. But as demand falters and prices retreat to about $40 a barrel, postponing the move appears increasingly likely.

OPEC+ talks on delaying a January oil-output increase gathered momentum on Tuesday, with some top officials offering support to the effort.

Algeria, which this year holds the OPEC presidency, said that both Saudi Arabia and Russia were pressing fellow members to prolong the current oil-supply cuts into next year, rather than tapering them as planned. Algeria supported the proposal, the first country to publicly do so.

Oil prices rose as the comments followed fresh hints from Secretary-General Mohammad Barkindo that the Organization of Petroleum Exporting Countries is preparing to change course. The alliance will move to “accelerate” the oil recovery at its next meeting, scheduled for Nov. 30-Dec 1, he said.

The 23-nation oil-producers network led by Riyadh and Moscow is currently scheduled to restore almost 2 million of the 7.7 million barrels of daily output currently halted to stave off a glut. But as demand falters and prices retreat to about $40 a barrel, postponing the move appears increasingly likely.

#Kuwait’s Jazeera Airways Cuts Jobs as Virus Slams Travel Demand - Bloomberg

Kuwait’s Jazeera Airways Cuts Jobs as Virus Slams Travel Demand - Bloomberg

Kuwait’s Jazeera Airways Co. laid off another 200 employees in September as the coronavirus pandemic continued to hammer demand for air travel.

The airline instituted cost reductions at every level of business, Chief Executive Officer Rohit Ramachandran said. The layoffs, across all business lines but predominantly pilots and cabin crew, followed the termination of about 300 employees -- a third of the airline’s workforce -- in March.

“We would love to have them back as soon as possible, once the situation improves,” Ramachandran said by phone after the airline reported a third-quarter loss of 5.6 million dinars ($18.3 million). “As a prudent business, we have to look at all cost elements.”

The low-cost airline has also renegotiated leases with all lessors, “which gave us significant cost savings for the year,” said Ramachandran, who last month took his first salary since February. Other members of the leadership team took a 50% pay cut, while shareholders agreed to retain dividends due to them in the business, he said.

Kuwait’s Jazeera Airways Co. laid off another 200 employees in September as the coronavirus pandemic continued to hammer demand for air travel.

The airline instituted cost reductions at every level of business, Chief Executive Officer Rohit Ramachandran said. The layoffs, across all business lines but predominantly pilots and cabin crew, followed the termination of about 300 employees -- a third of the airline’s workforce -- in March.

“We would love to have them back as soon as possible, once the situation improves,” Ramachandran said by phone after the airline reported a third-quarter loss of 5.6 million dinars ($18.3 million). “As a prudent business, we have to look at all cost elements.”

The low-cost airline has also renegotiated leases with all lessors, “which gave us significant cost savings for the year,” said Ramachandran, who last month took his first salary since February. Other members of the leadership team took a 50% pay cut, while shareholders agreed to retain dividends due to them in the business, he said.

Delek Group gets another $100 million dividend from Ithaca unit | Reuters

Delek Group gets another $100 million dividend from Ithaca unit | Reuters

Israel's Delek Group DLEKG.TA said on Tuesday that it received a $100 million dividend from its wholly owned Ithaca Energy unit that will be used to pay down a loan from BNP Paribas.

Delek Group, one of Israel’s largest conglomerates, has been hard hit by the coronavirus outbreak and drop in global oil prices. It has been selling assets to raise funds to pay its lenders and bondholders.

Ithaca, a British North Sea oil and gas producer, in late 2019 bought Chevron's CVX.N North Sea oil and gas fields for $2 billion.

Delek received an initial dividend of $20 million from Ithaca in May. Tuesday’s dividend brings the total payout for 2020 to $120 million, well above the $50 million that Delek had initially estimated it would receive from Ithaca this year.

Israel's Delek Group DLEKG.TA said on Tuesday that it received a $100 million dividend from its wholly owned Ithaca Energy unit that will be used to pay down a loan from BNP Paribas.

Delek Group, one of Israel’s largest conglomerates, has been hard hit by the coronavirus outbreak and drop in global oil prices. It has been selling assets to raise funds to pay its lenders and bondholders.

Ithaca, a British North Sea oil and gas producer, in late 2019 bought Chevron's CVX.N North Sea oil and gas fields for $2 billion.

Delek received an initial dividend of $20 million from Ithaca in May. Tuesday’s dividend brings the total payout for 2020 to $120 million, well above the $50 million that Delek had initially estimated it would receive from Ithaca this year.

Oil Gains Most in a Month as OPEC+ Hints at Delay to Output Hike - Bloomberg

Oil Gains Most in a Month as OPEC+ Hints at Delay to Output Hike - Bloomberg

Oil rose alongside a broad market rally, drawing support from signs that OPEC+ may delay a planned output increase as well as a weaker dollar.

U.S. benchmark crude futures climbed as much as 4.1%, the most in a month, before paring gains. The market also took its cue from stronger equities as millions of Americans headed to vote on election day. A weakening dollar also boosted the appeal for commodities priced in the currency, with the Bloomberg Dollar Spot Index falling as much as 0.8%.

OPEC and its allies will “accelerate” the recovery in oil markets at their next meeting, the group’s top official said, in another hint about a potential delay to a production hike scheduled for January. Algeria said that -- along with Saudi Arabia, Russia and Iraq -- it’s trying to persuade the rest of OPEC+ to extend current supply cuts, state-run news agency APS reported.

“This big selloff last week was a wake-up call to the OPEC+ group,” said John Kilduff, a partner at Again Capital LLC. “The renewed shoulder-to-the-wheel type of action that appears to be emerging is helping to support prices.”

Oil rose alongside a broad market rally, drawing support from signs that OPEC+ may delay a planned output increase as well as a weaker dollar.

U.S. benchmark crude futures climbed as much as 4.1%, the most in a month, before paring gains. The market also took its cue from stronger equities as millions of Americans headed to vote on election day. A weakening dollar also boosted the appeal for commodities priced in the currency, with the Bloomberg Dollar Spot Index falling as much as 0.8%.

OPEC and its allies will “accelerate” the recovery in oil markets at their next meeting, the group’s top official said, in another hint about a potential delay to a production hike scheduled for January. Algeria said that -- along with Saudi Arabia, Russia and Iraq -- it’s trying to persuade the rest of OPEC+ to extend current supply cuts, state-run news agency APS reported.

“This big selloff last week was a wake-up call to the OPEC+ group,” said John Kilduff, a partner at Again Capital LLC. “The renewed shoulder-to-the-wheel type of action that appears to be emerging is helping to support prices.”

#UAE's loan deferment scheme benefits over 320,000 residents, businesses | ZAWYA MENA Edition

UAE's loan deferment scheme benefits over 320,000 residents, businesses | ZAWYA MENA Edition

About 310,000 individuals have benefited from the UAE’s loan deferment initiative since the onset of the coronavirus pandemic, according to the latest statistics.

The number of small and medium-sized enterprises (SMEs) and other companies in the private sector who have sought financial relief has also reached at least 11,500.

The latest data were mentioned in a report on the Targeted Economic Support Scheme (TESS) during a regular meeting of the board of directors of the UAE Central Bank, state news agency WAM said late Monday.

In March, the central bank introduced the support scheme as it unveiled a stimulus package worth 100 billion UAE dirhams ($27.2bln) to help businesses and individuals affected by the coronavirus pandemic.

About 310,000 individuals have benefited from the UAE’s loan deferment initiative since the onset of the coronavirus pandemic, according to the latest statistics.

The number of small and medium-sized enterprises (SMEs) and other companies in the private sector who have sought financial relief has also reached at least 11,500.

The latest data were mentioned in a report on the Targeted Economic Support Scheme (TESS) during a regular meeting of the board of directors of the UAE Central Bank, state news agency WAM said late Monday.

In March, the central bank introduced the support scheme as it unveiled a stimulus package worth 100 billion UAE dirhams ($27.2bln) to help businesses and individuals affected by the coronavirus pandemic.

Mideast Stocks: Major Gulf markets mixed; Aramco's Q3 profit slides | ZAWYA MENA Edition

Mideast Stocks: Major Gulf markets mixed; Aramco's Q3 profit slides | ZAWYA MENA Edition

Saudi Arabia's stock market closed lower on Tuesday hurt by a string of disappointing corporate earnings, while the Qatari index ended a three-session losing streak.

The kingdom's benchmark index slipped 0.3%, with Saudi British Bank dropping 2.1% after it announced a 10.5% fall in third-quarter profit.

National Industrialization Company (Tasnee) was down 2.3%, after it posted net loss in the quarter ending September 30.

However, the world's top oil producing company Saudi Aramco closed up 0.6% after reporting a quarterly profit slump in line with analysts' expectations, as the coronavirus crisis continued to choke demand and weigh on crude prices.

Dubai's main share index retreated 1.2%, weighed down by a 2% fall in sharia-compliant lender Dubai Islamic Bank and a 1.4% fall in Emirates NBD Bank.

The Abu Dhabi index edged up 0.3%, supported by a 0.7% rise in First Abu Dhabi Bank (FAB) .

FAB, the United Arab Emirates' largest lender, announced a plan to carve out its existing payments business into a fully owned subsidiary with regional growth ambitions.

In Qatar, the index gained 0.6% with petrochemical firm Industries Qatar advancing 2.4%.

Outside the Gulf, Egypt's blue-chip index was higher with most stocks in positive territory, including a 2% rise for Commercial International Bank.

The Arab state's non-oil private sector expanded in October at its quickest rate in almost six years as the recovery from the coronavirus pandemic gained pace, a survey showed on Tuesday.

IHS Markit's Purchasing Managers' Index (PMI) came in at 51.4, up from 50.4 in September and above the 50.0 threshold that separates growth from contraction.

Saudi Arabia's stock market closed lower on Tuesday hurt by a string of disappointing corporate earnings, while the Qatari index ended a three-session losing streak.

The kingdom's benchmark index slipped 0.3%, with Saudi British Bank dropping 2.1% after it announced a 10.5% fall in third-quarter profit.

National Industrialization Company (Tasnee) was down 2.3%, after it posted net loss in the quarter ending September 30.

However, the world's top oil producing company Saudi Aramco closed up 0.6% after reporting a quarterly profit slump in line with analysts' expectations, as the coronavirus crisis continued to choke demand and weigh on crude prices.

Dubai's main share index retreated 1.2%, weighed down by a 2% fall in sharia-compliant lender Dubai Islamic Bank and a 1.4% fall in Emirates NBD Bank.

The Abu Dhabi index edged up 0.3%, supported by a 0.7% rise in First Abu Dhabi Bank (FAB) .

FAB, the United Arab Emirates' largest lender, announced a plan to carve out its existing payments business into a fully owned subsidiary with regional growth ambitions.

In Qatar, the index gained 0.6% with petrochemical firm Industries Qatar advancing 2.4%.

Outside the Gulf, Egypt's blue-chip index was higher with most stocks in positive territory, including a 2% rise for Commercial International Bank.

The Arab state's non-oil private sector expanded in October at its quickest rate in almost six years as the recovery from the coronavirus pandemic gained pace, a survey showed on Tuesday.

IHS Markit's Purchasing Managers' Index (PMI) came in at 51.4, up from 50.4 in September and above the 50.0 threshold that separates growth from contraction.

Creditors warned to act fast over money owed by #Dubai's Arabtec - Arabianbusiness

Creditors warned to act fast over money owed by Dubai's Arabtec - Arabianbusiness

Creditors of fallen Dubai-based construction giant Arabtec have been warned they must not waste any time in the pursuit of outstanding debts owed to them as the company edges closer towards liquidation.

Under the relatively new UAE Bankruptcy Law there are three insolvency procedures available – preventative composition, rescue within bankruptcy, and liquidation within bankruptcy.

Mark Raymont – partner construction, advisory and disputes, with Pinsent Masons Middle East, told Arabian Business: “Under all three procedures, creditors are required to provide evidence of their debts including supporting documents within reasonably tight timescales. Any realisations are to be paid to the court or trustee before distribution in accordance with the creditor order of priority.

“It seems likely that Arabtec is intending to pursue liquidation within bankruptcy, and the aim will be to try to generate as much value as possible for creditors, most likely through the sale or distribution/disposal of its remaining assets.”

Arabtec is seeking to meet an end of November deadline set by shareholders to submit the liquidation application. The board met on Sunday to discuss the next steps in the process.

Creditors of fallen Dubai-based construction giant Arabtec have been warned they must not waste any time in the pursuit of outstanding debts owed to them as the company edges closer towards liquidation.

Under the relatively new UAE Bankruptcy Law there are three insolvency procedures available – preventative composition, rescue within bankruptcy, and liquidation within bankruptcy.

Mark Raymont – partner construction, advisory and disputes, with Pinsent Masons Middle East, told Arabian Business: “Under all three procedures, creditors are required to provide evidence of their debts including supporting documents within reasonably tight timescales. Any realisations are to be paid to the court or trustee before distribution in accordance with the creditor order of priority.

“It seems likely that Arabtec is intending to pursue liquidation within bankruptcy, and the aim will be to try to generate as much value as possible for creditors, most likely through the sale or distribution/disposal of its remaining assets.”

Arabtec is seeking to meet an end of November deadline set by shareholders to submit the liquidation application. The board met on Sunday to discuss the next steps in the process.

#SaudiArabia’s Gas Push Pays Off as Production Hits Record - Bloomberg

Saudi Arabia’s Gas Push Pays Off as Production Hits Record - Bloomberg

Saudi Aramco’s greater focus on developing natural gas resources paid off with record daily output of the fuel -- but it still wasn’t enough to keep the kingdom’s power plants supplied when they needed it most.

Saudi Arabia consumes all the gas it produces, much of it to generate electricity. Because gas pollutes less than crude, power plants prefer it as fuel.

Aramco pumped a record 10.7 billion cubic feet of gas on Aug. 6, the state energy company said in its third-quarter results on Tuesday, without giving an average figure for the period. Yet crude use at Saudi power stations also peaked that month. The country burned 702,000 barrels a day in August, according to the Joint Organisations Data Initiative, the most in four years.

Saudi Aramco’s greater focus on developing natural gas resources paid off with record daily output of the fuel -- but it still wasn’t enough to keep the kingdom’s power plants supplied when they needed it most.

Saudi Arabia consumes all the gas it produces, much of it to generate electricity. Because gas pollutes less than crude, power plants prefer it as fuel.

Aramco pumped a record 10.7 billion cubic feet of gas on Aug. 6, the state energy company said in its third-quarter results on Tuesday, without giving an average figure for the period. Yet crude use at Saudi power stations also peaked that month. The country burned 702,000 barrels a day in August, according to the Joint Organisations Data Initiative, the most in four years.

Saudi Arabia is the world’s biggest oil exporter, but it’s also well-endowed with gas. The desert nation holds the eighth-largest gas reserves, and its production last year ranked ninth worldwide, according to BP Plc data.

Could other Gulf countries follow #Oman's income tax lead? - Arabianbusiness

Could other Gulf countries follow Oman's income tax lead? - Arabianbusiness

Other countries across the GCC could follow Oman’s lead in introducing some form of income tax although they may wait to see how the measures impact the sultanate, according to a leading economic expert.

Oman announced on Monday plans to start taxing the income of wealthy individuals from 2022.

The move by the cash-strapped sultanate is part of measures designed to tackle a budget deficit that’s ballooned due to low oil prices and the coronavirus pandemic.

Scott Livermore, ICAEW economic advisor and chief economist at Oxford Economics, told Arabian Business: “It would be highly surprising if other GCC economies weren’t discussing ways of diversifying their tax base, including looking at personal and corporate income tax. Other GCC countries have a bit more breathing space and are likely to see the impact of Oman implementing the tax.”

Other countries across the GCC could follow Oman’s lead in introducing some form of income tax although they may wait to see how the measures impact the sultanate, according to a leading economic expert.

Oman announced on Monday plans to start taxing the income of wealthy individuals from 2022.

The move by the cash-strapped sultanate is part of measures designed to tackle a budget deficit that’s ballooned due to low oil prices and the coronavirus pandemic.

Scott Livermore, ICAEW economic advisor and chief economist at Oxford Economics, told Arabian Business: “It would be highly surprising if other GCC economies weren’t discussing ways of diversifying their tax base, including looking at personal and corporate income tax. Other GCC countries have a bit more breathing space and are likely to see the impact of Oman implementing the tax.”

#UAE non-oil private sector shrinks for second time in three months | Reuters

UAE non-oil private sector shrinks for second time in three months | Reuters

The United Arab Emirates’ non-oil private sector slipped back into contraction in October for the second time in three months, a survey showed on Tuesday, stunting the country’s economic recovery from the coronavirus pandemic.

The seasonally adjusted IHS Markit UAE Purchasing Managers’ Index (PMI), which covers manufacturing and services, fell to 49.5 in October from 51.0 in September, slipping below the 50.0 mark that separates growth from contraction for the seventh month this year.

The new orders sub-index shrank for the first time since May, falling to 49.3 in October from 52.6 in September.

“While the decline was mild, it nonetheless showed a stalling of growth momentum after the COVID-19 lockdown. Notably, sentiment amongst businesses towards the 12-month outlook was at a joint-record low as firms remained concerned that the pandemic could further hurt activity and spending,” said David Owen, economist at survey compiler IHS Markit.

The United Arab Emirates’ non-oil private sector slipped back into contraction in October for the second time in three months, a survey showed on Tuesday, stunting the country’s economic recovery from the coronavirus pandemic.

The seasonally adjusted IHS Markit UAE Purchasing Managers’ Index (PMI), which covers manufacturing and services, fell to 49.5 in October from 51.0 in September, slipping below the 50.0 mark that separates growth from contraction for the seventh month this year.

The new orders sub-index shrank for the first time since May, falling to 49.3 in October from 52.6 in September.

“While the decline was mild, it nonetheless showed a stalling of growth momentum after the COVID-19 lockdown. Notably, sentiment amongst businesses towards the 12-month outlook was at a joint-record low as firms remained concerned that the pandemic could further hurt activity and spending,” said David Owen, economist at survey compiler IHS Markit.

Major Gulf markets rise as Aramco lifts #Saudi index | Reuters

Major Gulf markets rise as Aramco lifts Saudi index | Reuters

Saudi Arabia’s stock market rose in early trade on Tuesday, supported by gains in Saudi Aramco after the oil giant posted a quarterly profit slump in line with analysts’ estimate, while the Qatari index was on track to end three sessions of losses.

The kingdom's benchmark index .TASI edged up 0.2%, with the world's top oil producing company Saudi Aramco 2222.SE rising 0.6% after Chief Executive Officer Amin Nasser pointed to early signs of recovery in the third quarter.

The company’s quarterly profit was hit as the coronavirus crisis continued to choke demand and weigh on crude prices.

In Qatar, the index .QSI gained 0.9%, as most of the stocks were in positive territory, including petrochemical firm Industries Qatar IQCD.QA, which advanced 1.7%.

Dubai's main share index .DFMGI rose 0.3%, with Dubai Islamic Bank (DIB) DISB.DU increasing 0.5%. The sharia-compliant lender on Monday completed the integration of Noor Bank with successful migration of all banking relations into DIB.

Among gainers, Dubai Investments DINV.DU traded up 0.9%, after the company reported a net profit of 213.1 million dirhams ($58.02 million) in the third quarter, up from 105.5 million dirhams a year earlier.

The Abu Dhabi index .ADI added 0.7%, led by a 1.1% rise in First Abu Dhabi Bank (FAB) FAB.AD and a 0.2% increase in telecoms firm Etisalat ETISALAT.AD.

FAB, the country’s largest lender, announced its plan to carve out its existing payments business into a fully owned subsidiary with regional growth ambitions.

Saudi Arabia’s stock market rose in early trade on Tuesday, supported by gains in Saudi Aramco after the oil giant posted a quarterly profit slump in line with analysts’ estimate, while the Qatari index was on track to end three sessions of losses.

The kingdom's benchmark index .TASI edged up 0.2%, with the world's top oil producing company Saudi Aramco 2222.SE rising 0.6% after Chief Executive Officer Amin Nasser pointed to early signs of recovery in the third quarter.

The company’s quarterly profit was hit as the coronavirus crisis continued to choke demand and weigh on crude prices.

In Qatar, the index .QSI gained 0.9%, as most of the stocks were in positive territory, including petrochemical firm Industries Qatar IQCD.QA, which advanced 1.7%.

Dubai's main share index .DFMGI rose 0.3%, with Dubai Islamic Bank (DIB) DISB.DU increasing 0.5%. The sharia-compliant lender on Monday completed the integration of Noor Bank with successful migration of all banking relations into DIB.

Among gainers, Dubai Investments DINV.DU traded up 0.9%, after the company reported a net profit of 213.1 million dirhams ($58.02 million) in the third quarter, up from 105.5 million dirhams a year earlier.

The Abu Dhabi index .ADI added 0.7%, led by a 1.1% rise in First Abu Dhabi Bank (FAB) FAB.AD and a 0.2% increase in telecoms firm Etisalat ETISALAT.AD.

FAB, the country’s largest lender, announced its plan to carve out its existing payments business into a fully owned subsidiary with regional growth ambitions.

#Saudi Binladin Considers Joint Ventures, Asset Sales Amid Revamp - Bloomberg

Saudi Binladin Considers Joint Ventures, Asset Sales Amid Revamp - Bloomberg

The parent company of Saudi Arabia’s largest construction conglomerate Saudi Binladin Group said it would explore joint ventures and asset sales as part of its efforts to restructure an estimated $15 billion of debt.

The Binladin International Holding Group also said in a statement that it wants to pursue opportunities in real estate development with its own land bank, including prime locations in the kingdom’s Holy City of Mecca.

The Jeddah-based company is currently attempting one of the Middle East’s biggest corporate-debt revamps, for which it’s being advised by U.S. investment bank Houlihan Lokey Inc. The government of Saudi Arabia, through the Finance Ministry, owns 36.22% in the holding company.

The conglomerate, founded in 1931, was for decades the royal family’s favored builder until a deadly accident in Mecca five years ago resulted in it being banned from taking on new projects for about eight months.

Its woes were compounded as work across the Middle East dried up in the wake of a slump in oil prices and the economic fallout of the coronavirus pandemic. The company has put thousands of employees on indefinite leave in recent months and reduced salaries during the Holy Muslim month of Ramadan.

The parent company of Saudi Arabia’s largest construction conglomerate Saudi Binladin Group said it would explore joint ventures and asset sales as part of its efforts to restructure an estimated $15 billion of debt.

The Binladin International Holding Group also said in a statement that it wants to pursue opportunities in real estate development with its own land bank, including prime locations in the kingdom’s Holy City of Mecca.

The Jeddah-based company is currently attempting one of the Middle East’s biggest corporate-debt revamps, for which it’s being advised by U.S. investment bank Houlihan Lokey Inc. The government of Saudi Arabia, through the Finance Ministry, owns 36.22% in the holding company.

The conglomerate, founded in 1931, was for decades the royal family’s favored builder until a deadly accident in Mecca five years ago resulted in it being banned from taking on new projects for about eight months.

Its woes were compounded as work across the Middle East dried up in the wake of a slump in oil prices and the economic fallout of the coronavirus pandemic. The company has put thousands of employees on indefinite leave in recent months and reduced salaries during the Holy Muslim month of Ramadan.

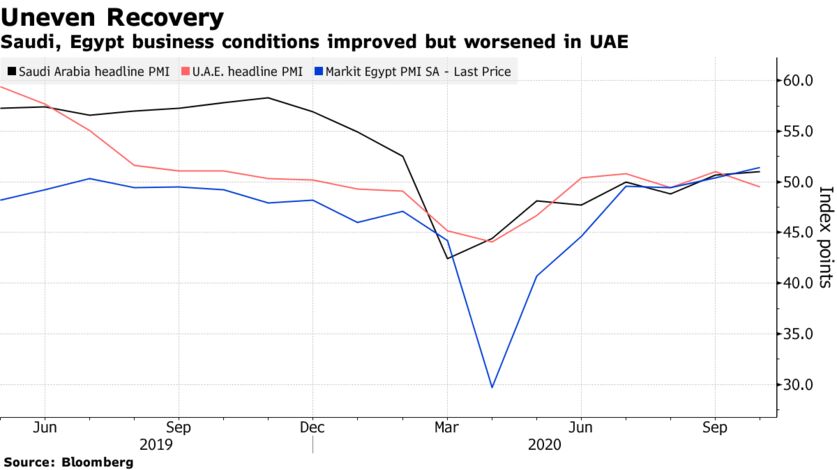

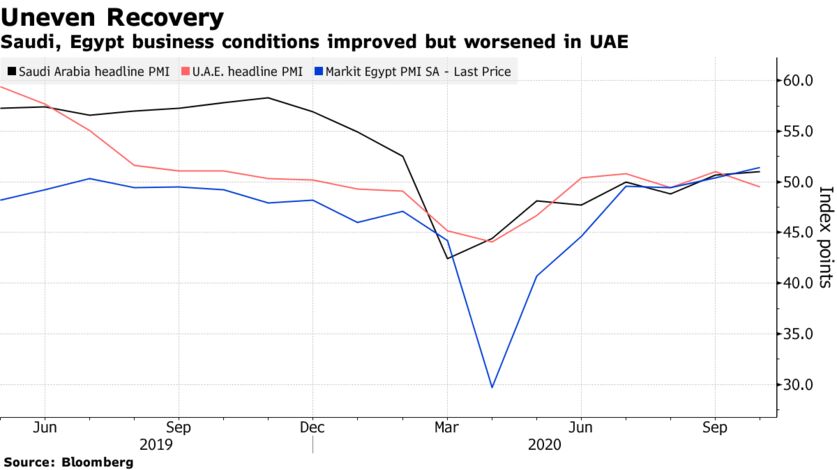

#Saudi, Egypt Business Activity Improves as #UAE Dealt Setback - Bloomberg

Saudi, Egypt Business Activity Improves as UAE Dealt Setback - Bloomberg

Business activity in Egypt grew at its fastest pace in almost six years, buoyed by an uptick in new orders, while Saudi Arabia saw a second month of milder improvements.

In the United Arab Emirates, meanwhile, non-oil private sector activity fell below the threshold of 50 that separates growth from contraction for the first time since August, according to IHS Markit’s Purchasing Managers’ Index. Concerns over further unemployment and renewed lockdowns continued to dog the three major Arab economies.

Business activity in Egypt grew at its fastest pace in almost six years, buoyed by an uptick in new orders, while Saudi Arabia saw a second month of milder improvements.

In the United Arab Emirates, meanwhile, non-oil private sector activity fell below the threshold of 50 that separates growth from contraction for the first time since August, according to IHS Markit’s Purchasing Managers’ Index. Concerns over further unemployment and renewed lockdowns continued to dog the three major Arab economies.

- Egypt’s PMI rose modestly to 51.4, the strongest reading since December 2014 and the second consecutive month of growth after reaching 50.4 in September

- New order growth was the highest in over six years, but employment fell

- In Saudi Arabia, the PMI increased to the highest in eight months, reaching 51 in October from 50.7 in September

- Job losses accelerated at the fastest pace since June

- The UAE’s PMI reading fell to 49.5 from 51 in the previous month

- New business dropped for the first time since May while output growth and job losses continued

#Saudi Aramco third-quarter profit slumps 44.6% as pandemic chokes demand | Reuters

Saudi Aramco third-quarter profit slumps 44.6% as pandemic chokes demand | Reuters

Saudi Arabian state oil giant Aramco 2222.SE on Tuesday reported a 44.6% drop in third-quarter net profit as the coronavirus crisis continued to choke demand and weigh on crude prices.

Share prices of global oil companies have been hammered this year as investors fret over the impact of the pandemic on energy demand and the long-term shift away from fossil fuels.

Oil prices have recovered only slightly since tumbling to their lowest in almost two decades in March, prompting Aramco and other majors such as Shell RDSa.L and BP Plc BP.L to slash capital expenditure this year and next.

Weaker refining and chemicals margins also hit Aramco’s net profit, which fell to 44.21 billion riyals ($11.79 billion) for the three months ended Sept. 30, in line with an analyst estimate of 44.6 billion riyals provided by Refinitiv but down from 79.84 billion riyals in the same period of last year.

“We saw early signs of a recovery in the third quarter due to improved economic activity, despite the headwinds facing global energy markets,” Saudi Aramco Chief Executive Officer Amin Nasser said in a statement.

Aramco's shares rose as much as 1% and were 0.6% higher at 34.4 riyals by 0830 GMT. Although down 2.3% year to date, Aramco has outperformed the likes of Exxon XOM.N, BP and Shell, which are down by more than 50% while Chevron CVX.N is down by 40%.

Saudi Arabian state oil giant Aramco 2222.SE on Tuesday reported a 44.6% drop in third-quarter net profit as the coronavirus crisis continued to choke demand and weigh on crude prices.

Share prices of global oil companies have been hammered this year as investors fret over the impact of the pandemic on energy demand and the long-term shift away from fossil fuels.

Oil prices have recovered only slightly since tumbling to their lowest in almost two decades in March, prompting Aramco and other majors such as Shell RDSa.L and BP Plc BP.L to slash capital expenditure this year and next.

Weaker refining and chemicals margins also hit Aramco’s net profit, which fell to 44.21 billion riyals ($11.79 billion) for the three months ended Sept. 30, in line with an analyst estimate of 44.6 billion riyals provided by Refinitiv but down from 79.84 billion riyals in the same period of last year.

“We saw early signs of a recovery in the third quarter due to improved economic activity, despite the headwinds facing global energy markets,” Saudi Aramco Chief Executive Officer Amin Nasser said in a statement.

Aramco's shares rose as much as 1% and were 0.6% higher at 34.4 riyals by 0830 GMT. Although down 2.3% year to date, Aramco has outperformed the likes of Exxon XOM.N, BP and Shell, which are down by more than 50% while Chevron CVX.N is down by 40%.

#Qatar Emir sees first half 2020 deficit at 1.5 billion riyals | Reuters

Qatar Emir sees first half 2020 deficit at 1.5 billion riyals | Reuters

Early indications for Qatar’s first half deficit put the figure at 1.5 billion riyals ($412 million), much better than expectations, Qatar’s Emir said on Tuesday.

The gas-rich Gulf state is expected to see its economy shrink by 4.5% this year, the International Monetary Fund has predicted, amid lower energy prices and the coronavirus crisis.

That would be the smallest contraction among countries in the oil-producing Gulf, according to the Fund.

“Early results show that the budget deficit for the first half of the year is 1.5 billion riyals despite expectations being much higher than that,” Sheikh Tamim bin Hamad Al-Thani said in a speech to the country’s Shura council.

The Emir also said he had instructed that the state budget should be drawn up on the assumption of an oil price of $40 a barrel and “that is less than the expected price”.

Qatar said in December last year it expected to achieve a surplus of 500 million riyals this year, but that was before the pandemic and the ensuing oil price shock. It had based the 2020 budget on an oil price assumption of $55 per barrel.

According to the IMF, Qatar will be the only country in the Gulf to post a budget surplus this year, estimated at 3% of GDP.

Early indications for Qatar’s first half deficit put the figure at 1.5 billion riyals ($412 million), much better than expectations, Qatar’s Emir said on Tuesday.

The gas-rich Gulf state is expected to see its economy shrink by 4.5% this year, the International Monetary Fund has predicted, amid lower energy prices and the coronavirus crisis.

That would be the smallest contraction among countries in the oil-producing Gulf, according to the Fund.

“Early results show that the budget deficit for the first half of the year is 1.5 billion riyals despite expectations being much higher than that,” Sheikh Tamim bin Hamad Al-Thani said in a speech to the country’s Shura council.

The Emir also said he had instructed that the state budget should be drawn up on the assumption of an oil price of $40 a barrel and “that is less than the expected price”.

Qatar said in December last year it expected to achieve a surplus of 500 million riyals this year, but that was before the pandemic and the ensuing oil price shock. It had based the 2020 budget on an oil price assumption of $55 per barrel.

According to the IMF, Qatar will be the only country in the Gulf to post a budget surplus this year, estimated at 3% of GDP.

Oil prices extend rally ahead of U.S. election | Reuters

Oil prices extend rally ahead of U.S. election | Reuters

Oil prices extended their rally on U.S. Election Day amid a recovery in financial markets on Tuesday, but concerns over surging coronavirus cases around the world capped further gains.

Brent crude LCOc1 futures rose 70 cents, or 1.8% to $39.67 a barrel at 0845 GMT, while U.S. West Texas Intermediate (WTI) crude CLc1 futures were up 78 cents, or 2.1%, to $37.59 a barrel. Both benchmarks gained nearly 3% on Monday.

“The jump has borne all the hallmarks of a massive, logical and even inevitable short-covering prior to the U.S. presidential elections,” Tamas Varga of oil brokerage PVM said.

“It would be tempting to conclude that the recovery from last week’s slump is now under way, but it is simply not a plausible scenario,” he added.

Italy is the latest country in Europe to tighten COVID-19 restrictions, including limiting travel between the worst-hit regions and imposing a nightly curfew, which will limit fuel demand.

Oil prices extended their rally on U.S. Election Day amid a recovery in financial markets on Tuesday, but concerns over surging coronavirus cases around the world capped further gains.

Brent crude LCOc1 futures rose 70 cents, or 1.8% to $39.67 a barrel at 0845 GMT, while U.S. West Texas Intermediate (WTI) crude CLc1 futures were up 78 cents, or 2.1%, to $37.59 a barrel. Both benchmarks gained nearly 3% on Monday.

“The jump has borne all the hallmarks of a massive, logical and even inevitable short-covering prior to the U.S. presidential elections,” Tamas Varga of oil brokerage PVM said.

“It would be tempting to conclude that the recovery from last week’s slump is now under way, but it is simply not a plausible scenario,” he added.

Italy is the latest country in Europe to tighten COVID-19 restrictions, including limiting travel between the worst-hit regions and imposing a nightly curfew, which will limit fuel demand.

Subscribe to:

Comments (Atom)