Oil surges 8% amid warnings of Russian supply shortages | Reuters

Oil prices climbed 8% on Thursday, extending a series of wild daily swings, as the market rebounded from several days of losses with a renewed focus on supply shortages in coming weeks due to sanctions on Russia.

Oil benchmarks in recent weeks have undergone their most volatile period since mid-2020. After sliding as buyers cashed in on the run-up, prices resurged on expectations that shortages will soon squeeze the energy market.

Benchmark Brent crude futures added $8.62, or 8.79%, at $106.64 a barrel, its largest percentage gain since mid-2020.

U.S. West Texas Intermediate (WTI) crude rose $7.94, or 8.35%, to $102.98 a barrel.

In the last eight trading sessions, Brent oil per barrel has traded as high as $139 and as low as $98 - a more than $40 spread. That has pushed many investors to exit, creating conditions for more wild price swings in the weeks ahead, traders, bankers and analysts said. read more

Solely aggregation of news articles, with no opinions expressed by this service since 2009 launch on this platform. Copyright to all articles remains with the original publisher and HEADLINES ARE CLICKABLE to access the whole article at source. (Subscription by email is recommended,with real-time updates on LinkedIn and Twitter.)

Search This Blog

Thursday, 17 March 2022

Most Gulf bourses rise tracking oil prices; financials boost #Saudi | Reuters

Most Gulf bourses rise tracking oil prices; financials boost Saudi | Reuters

Most stock markets in the Gulf ended higher on Wednesday, as oil prices jumped after the International Energy Agency said three million barrels a day of Russian oil and products could be shut in from next month.

Oil prices, a key factor for the Gulf's financial markets, climbed 4%, with the Benchmark Brent crude futures adding $4 to $102.02 a barrel by 0926 GMT. read more

"Gulf Cooperation Council stock markets were mostly performing positively today while investors return to the market to buy the dip after a week of price corrections," wrote Miguel Rodriguez, chief market analyst at CAPEX.com.

Rodriguez added uncertainties on the supply availability of oil amid rising COVID-19 cases in China are still weighing on sentiment.

The Qatari benchmark (.QSI) gained 0.9%, buoyed by a 7.5% rise in Investment Holding Group (IGRD.QA) after the real estate financier secured regulatory approval to buy out Elegancia Group.

Saudi Arabia's benchmark index (.TASI) advanced 0.9%, with Saudi Industrial Investment Group (2250.SE) jumping 7%.

The index was boosted by financial companies such as Bupa Arabia (8210.SE), Salama Cooperative Insurance (8050.SE), and Bank Aljazira (1020.SE).

"The Saudi stock market saw its main index rise thanks to the expected boost IPOs could bring to the market throughout this year. This comes in parallel to the solid economic growth recorded in the country," said Rodriguez.

IPO activity in Saudi has been seeing a recent boom following the listing of Saudi Aramco (2222.SE) in 2019.

In Abu Dhabi, the index (.FTFADGI) added 0.2%, while Dubai's main share index (.DFMGI) advanced 1.1%.

Heavyweights Dubai Financial Market (DFM.DU) and Emaar Development (EMAARDEV.DU) boosted Duabi's main index.

Outside the Gulf, Egypt's blue-chip index (.EGX30) edged 0.2% higher.

Most stock markets in the Gulf ended higher on Wednesday, as oil prices jumped after the International Energy Agency said three million barrels a day of Russian oil and products could be shut in from next month.

Oil prices, a key factor for the Gulf's financial markets, climbed 4%, with the Benchmark Brent crude futures adding $4 to $102.02 a barrel by 0926 GMT. read more

"Gulf Cooperation Council stock markets were mostly performing positively today while investors return to the market to buy the dip after a week of price corrections," wrote Miguel Rodriguez, chief market analyst at CAPEX.com.

Rodriguez added uncertainties on the supply availability of oil amid rising COVID-19 cases in China are still weighing on sentiment.

The Qatari benchmark (.QSI) gained 0.9%, buoyed by a 7.5% rise in Investment Holding Group (IGRD.QA) after the real estate financier secured regulatory approval to buy out Elegancia Group.

Saudi Arabia's benchmark index (.TASI) advanced 0.9%, with Saudi Industrial Investment Group (2250.SE) jumping 7%.

The index was boosted by financial companies such as Bupa Arabia (8210.SE), Salama Cooperative Insurance (8050.SE), and Bank Aljazira (1020.SE).

"The Saudi stock market saw its main index rise thanks to the expected boost IPOs could bring to the market throughout this year. This comes in parallel to the solid economic growth recorded in the country," said Rodriguez.

IPO activity in Saudi has been seeing a recent boom following the listing of Saudi Aramco (2222.SE) in 2019.

In Abu Dhabi, the index (.FTFADGI) added 0.2%, while Dubai's main share index (.DFMGI) advanced 1.1%.

Heavyweights Dubai Financial Market (DFM.DU) and Emaar Development (EMAARDEV.DU) boosted Duabi's main index.

Outside the Gulf, Egypt's blue-chip index (.EGX30) edged 0.2% higher.

‘Haven’ Gulf Shares Find Support From Risks to Global Stocks - Bloomberg

‘Haven’ Gulf Shares Find Support From Risks to Global Stocks - Bloomberg

Some of the same concerns weighing down global equities have been leading stocks in the Persian Gulf to soar this year.

Elevated commodity prices and higher interest rates have led benchmark indexes of oil and gas-rich countries like Saudi Arabia and Qatar to be among the top 10 performers in the world this year. The MSCI GCC Countries Index is outperforming both developed and emerging market gauges and is set for its best quarter since 2016.Banking and commodity shares have been among the key beneficiaries. Central banks in Saudi Arabia, Qatar, the United Arab Emirates and Kuwait all moved with the Federal Reserve in raising interest rates to protect their currency pegs, providing further support to lenders. And while oil pulled back from higher levels seen at the start of Russia’s invasion of Ukraine, Brent still trades well above the price needed for the region’s biggest economies to generously fill their coffers with cash.

“Oil at above $90 has a significant effect on the fiscal situation as well as liquidity in the system and the region,” Faisal Hasan, chief investment officer at Al Mal Capital, said. “Saudi and UAE are well placed to reap that benefit.”

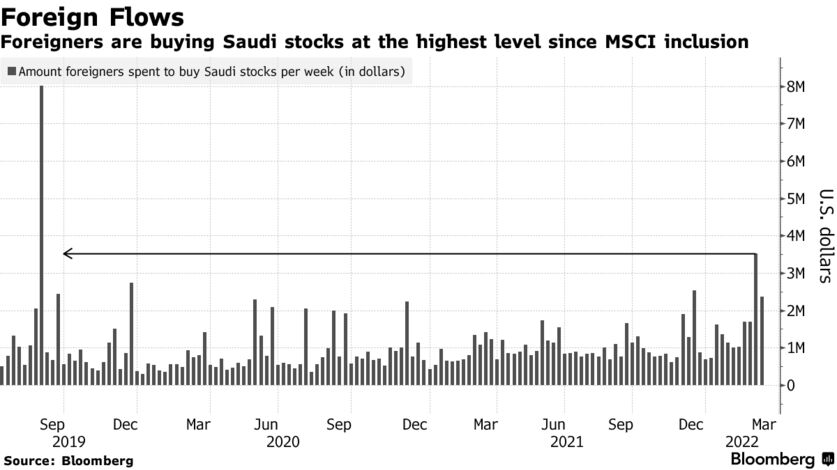

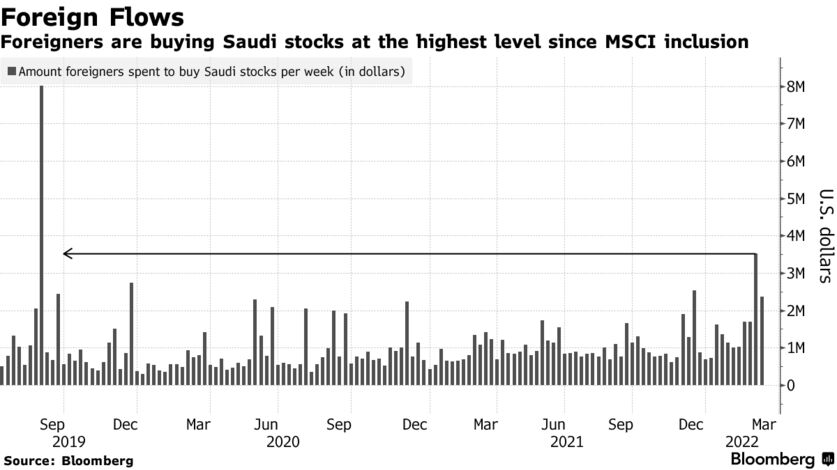

Gulf stock markets are poised for strong growth and higher foreign participation, he said, adding that the region is attracting an increasing number of investors as more companies go public. Foreigners are buying Saudi stocks at the highest rate since the kingdom’s shares were included in the MSCI Emerging Markets Index back in 2019.

The Gulf is a “haven for global investors since the start of the Ukraine-Russia conflict,” said Noaman Khalid, associate director of indices, macroeconomics and strategy at Arqaam Capital. Gulf markets have “multiple layers of support” due to passive flows from global indexes, a strong pipeline of initial public offerings and high commodity prices.

Some of the same concerns weighing down global equities have been leading stocks in the Persian Gulf to soar this year.

Elevated commodity prices and higher interest rates have led benchmark indexes of oil and gas-rich countries like Saudi Arabia and Qatar to be among the top 10 performers in the world this year. The MSCI GCC Countries Index is outperforming both developed and emerging market gauges and is set for its best quarter since 2016.Banking and commodity shares have been among the key beneficiaries. Central banks in Saudi Arabia, Qatar, the United Arab Emirates and Kuwait all moved with the Federal Reserve in raising interest rates to protect their currency pegs, providing further support to lenders. And while oil pulled back from higher levels seen at the start of Russia’s invasion of Ukraine, Brent still trades well above the price needed for the region’s biggest economies to generously fill their coffers with cash.

“Oil at above $90 has a significant effect on the fiscal situation as well as liquidity in the system and the region,” Faisal Hasan, chief investment officer at Al Mal Capital, said. “Saudi and UAE are well placed to reap that benefit.”

Gulf stock markets are poised for strong growth and higher foreign participation, he said, adding that the region is attracting an increasing number of investors as more companies go public. Foreigners are buying Saudi stocks at the highest rate since the kingdom’s shares were included in the MSCI Emerging Markets Index back in 2019.

The Gulf is a “haven for global investors since the start of the Ukraine-Russia conflict,” said Noaman Khalid, associate director of indices, macroeconomics and strategy at Arqaam Capital. Gulf markets have “multiple layers of support” due to passive flows from global indexes, a strong pipeline of initial public offerings and high commodity prices.

Denmark agrees extradition treaty with #UAE, eyes British tax fraud suspect | Reuters

Denmark agrees extradition treaty with UAE, eyes British tax fraud suspect | Reuters

Denmark on Thursday signed a general extradition treaty with the United Arab Emirates which it said it would use to seek custody of a Briton charged with defrauding Danish tax authorities via so-called "cum-ex" trading schemes.

"This agreement aims to expedite specific criminal cases. This includes the extradition of one of the suspected perpetrators in the dividend tax case," Denmark's Justice Ministry said in a statement.

A spokesperson from the ministry confirmed to Reuters that the person in question is Sanjay Shah, a British citizen charged with swindling Danish tax authorities for as much as 7 billion Danish crowns ($1.04 billion). read more

Shah, who lives in Dubai, denies any wrongdoing and his spokesperson called the extradition treatment "political posturing".

"We have maintained for the past seven years that he received legal advice that the trades were legal so there is no chance of extradition happening in the near future at all," he said.

Denmark on Thursday signed a general extradition treaty with the United Arab Emirates which it said it would use to seek custody of a Briton charged with defrauding Danish tax authorities via so-called "cum-ex" trading schemes.

"This agreement aims to expedite specific criminal cases. This includes the extradition of one of the suspected perpetrators in the dividend tax case," Denmark's Justice Ministry said in a statement.

A spokesperson from the ministry confirmed to Reuters that the person in question is Sanjay Shah, a British citizen charged with swindling Danish tax authorities for as much as 7 billion Danish crowns ($1.04 billion). read more

Shah, who lives in Dubai, denies any wrongdoing and his spokesperson called the extradition treatment "political posturing".

"We have maintained for the past seven years that he received legal advice that the trades were legal so there is no chance of extradition happening in the near future at all," he said.

Oil surges amid warnings of supply shortages | Reuters

Oil surges amid warnings of supply shortages | Reuters

Oil prices climbed 6% on Thursday after the International Energy Agency (IEA) said three million barrels a day (bpd) of Russian oil and products could be shut in from next month and despite the U.S. Federal Reserve's decision to raise interest rates.

The supply loss would be far greater than an expected drop in demand of one million bpd triggered by higher fuel prices, the IEA said in a report on Wednesday. read more

Benchmark Brent crude futures gained $6.41, or 6.5%, to $104.43 a barrel by 1205 GMT. U.S. West Texas Intermediate (WTI) crude was up $5.95, or 6.3%, to $100.99 a barrel.

Both contracts fell the previous day, following an unexpected jump in U.S. crude stockpiles and signs of progress in Russia-Ukraine peace talks.

Morgan Stanley raised its Brent price forecast by $20 for the third quarter 2022 to $120 a barrel, predicting a fall in Russian production of about 1 million bpd from April.

Oil prices climbed 6% on Thursday after the International Energy Agency (IEA) said three million barrels a day (bpd) of Russian oil and products could be shut in from next month and despite the U.S. Federal Reserve's decision to raise interest rates.

The supply loss would be far greater than an expected drop in demand of one million bpd triggered by higher fuel prices, the IEA said in a report on Wednesday. read more

Benchmark Brent crude futures gained $6.41, or 6.5%, to $104.43 a barrel by 1205 GMT. U.S. West Texas Intermediate (WTI) crude was up $5.95, or 6.3%, to $100.99 a barrel.

Both contracts fell the previous day, following an unexpected jump in U.S. crude stockpiles and signs of progress in Russia-Ukraine peace talks.

Morgan Stanley raised its Brent price forecast by $20 for the third quarter 2022 to $120 a barrel, predicting a fall in Russian production of about 1 million bpd from April.

#SaudiArabia to Start Building Green Hydrogen Plant in Neom - Bloomberg

Saudi Arabia to Start Building Green Hydrogen Plant in Neom - Bloomberg

Saudi Arabia will start construction of a green hydrogen plant as soon as this month as it pushes ahead with plans to export the fuel in about four years.

The kingdom is on track sell carbon-free hydrogen from a $5 billion project in Neom by 2026, according to Peter Terium, the head of energy and water for the new region. Engineers have finished flattening the site in northwestern Saudi Arabia and U.S.-based Air Products & Chemicals Inc. will soon begin building the facility, he said.

There will probably be demand from companies from Asia to the U.S. for the exports, Terium, who used to be chief executive officer of Germany’s RWE AG, said in an interview. Hydrogen is seen as pivotal for the transition to cleaner forms of energy.

“There’s a potential competition between Europe, Japan, South Korea and some parts of the U.S.,” said Terium. Shipments will be sold “to those who bid the highest price.”

Saudi Arabia will start construction of a green hydrogen plant as soon as this month as it pushes ahead with plans to export the fuel in about four years.

The kingdom is on track sell carbon-free hydrogen from a $5 billion project in Neom by 2026, according to Peter Terium, the head of energy and water for the new region. Engineers have finished flattening the site in northwestern Saudi Arabia and U.S.-based Air Products & Chemicals Inc. will soon begin building the facility, he said.

There will probably be demand from companies from Asia to the U.S. for the exports, Terium, who used to be chief executive officer of Germany’s RWE AG, said in an interview. Hydrogen is seen as pivotal for the transition to cleaner forms of energy.

“There’s a potential competition between Europe, Japan, South Korea and some parts of the U.S.,” said Terium. Shipments will be sold “to those who bid the highest price.”

P&O Ferries: Ferry Firm Cancels Service, Is Said to Cut Hundreds of Jobs - Bloomberg

P&O Ferries: Ferry Firm Cancels Service, Is Said to Cut Hundreds of Jobs - Bloomberg

British transportation firm P&O Ferries called its ships in to port ahead of a move to cut hundreds of jobs, according to people familiar with the matter.

The ferry company, owned by Dubai-based DP World, carries people and goods across the vital English Channel between England and France, and is a major operator at other U.K. ports. Brexit and Covid-19 took a toll on its finances, while more recently, the Russian invasion of Ukraine has driven up the cost of energy.

A spokesman for P&O confirmed the company had suspended services ahead of a major announcement.

“Until then, services from P&O will not be running and we are advising travelers of alternative arrangements,” the spokesman said in an email.

British transportation firm P&O Ferries called its ships in to port ahead of a move to cut hundreds of jobs, according to people familiar with the matter.

The ferry company, owned by Dubai-based DP World, carries people and goods across the vital English Channel between England and France, and is a major operator at other U.K. ports. Brexit and Covid-19 took a toll on its finances, while more recently, the Russian invasion of Ukraine has driven up the cost of energy.

A spokesman for P&O confirmed the company had suspended services ahead of a major announcement.

“Until then, services from P&O will not be running and we are advising travelers of alternative arrangements,” the spokesman said in an email.

Exclusive: Moscow sets out new controls on foreigners trading #Russia assets | Reuters

Exclusive: Moscow sets out new controls on foreigners trading Russia assets | Reuters

Russia has set out strict rules for foreigners seeking permits to buy and sell Russian securities and real estate, a client memo by Citigroup (C.N) showed, as details emerge of new state controls on investment in response to Western sanctions.

Russia temporarily stopped foreigners dumping Russian assets this month, saying it wanted to ensure decisions were considered and not driven by political pressure, as sanctions have intensified after Moscow's invasion of Ukraine. read more

Funds with tens of billions of dollars in exposure to Russia have been awaiting details on new restrictions they will face as they seek to offload assets.

The invasion, which Moscow calls a "special military operation", triggered an exodus of international firms and has largely cut off Russia's economy from the rest of the world.

The Russian authorities published Decree 81 this month that stipulates that any transaction between Russians and foreign counterparties requires permission from Russia's Government Commission for Control of Foreign Investment. read more

Russia has set out strict rules for foreigners seeking permits to buy and sell Russian securities and real estate, a client memo by Citigroup (C.N) showed, as details emerge of new state controls on investment in response to Western sanctions.

Russia temporarily stopped foreigners dumping Russian assets this month, saying it wanted to ensure decisions were considered and not driven by political pressure, as sanctions have intensified after Moscow's invasion of Ukraine. read more

Funds with tens of billions of dollars in exposure to Russia have been awaiting details on new restrictions they will face as they seek to offload assets.

The invasion, which Moscow calls a "special military operation", triggered an exodus of international firms and has largely cut off Russia's economy from the rest of the world.

The Russian authorities published Decree 81 this month that stipulates that any transaction between Russians and foreign counterparties requires permission from Russia's Government Commission for Control of Foreign Investment. read more

#UAE keen to cooperate with Russia on energy security, says UAE minister | Reuters

UAE keen to cooperate with Russia on energy security, says UAE minister | Reuters

The United Arab Emirates is keen to cooperate with Russia on improving global energy security, UAE Foreign Minister Sheikh Abdullah bin Zayed Al Nahyan said in Moscow on Thursday.

Russia's invasion of Ukraine has drawn a raft of Western sanctions and disrupted global energy markets, putting a spotlight on Gulf energy exporters, such as the UAE and Saudi Arabia, as consumers look for supplies to replace Russian oil.

OPEC producers Saudi Arabia and the UAE have so far resisted U.S. pleas to use their spare production capacity to help contain oil prices, saying they are committed to an output pact under the OPEC+ alliance, which includes Russia.

"It is important to maintain the stability of energy and food markets," the Emirati minister told a televised joint press conference with his Russian counterpart Sergei Lavrov.

The United Arab Emirates is keen to cooperate with Russia on improving global energy security, UAE Foreign Minister Sheikh Abdullah bin Zayed Al Nahyan said in Moscow on Thursday.

Russia's invasion of Ukraine has drawn a raft of Western sanctions and disrupted global energy markets, putting a spotlight on Gulf energy exporters, such as the UAE and Saudi Arabia, as consumers look for supplies to replace Russian oil.

OPEC producers Saudi Arabia and the UAE have so far resisted U.S. pleas to use their spare production capacity to help contain oil prices, saying they are committed to an output pact under the OPEC+ alliance, which includes Russia.

"It is important to maintain the stability of energy and food markets," the Emirati minister told a televised joint press conference with his Russian counterpart Sergei Lavrov.

#Saudi’s Capital Markets Authority approves two more IPOs

Saudi’s Capital Markets Authority approves two more IPOs

Saudi Arabia’s Capital Markets Authority (CMA) has approved two more initial public offerings (IPO) as the flurry of offerings in the region continues.

Retal Urban Development Company, based in Al Khobar, in the Eastern Province, will offer 12 million shares, while Abdullah Al Othaim Investment Company, will offer 30 million shares, according to statements to the Saudi Stock Exchange (Tadawul).

Saudi Arabia’s Capital Markets Authority (CMA) has approved two more initial public offerings (IPO) as the flurry of offerings in the region continues.

Retal Urban Development Company, based in Al Khobar, in the Eastern Province, will offer 12 million shares, while Abdullah Al Othaim Investment Company, will offer 30 million shares, according to statements to the Saudi Stock Exchange (Tadawul).

#Dubai: How to buy DEWA shares, minimum investment required; all you need to know

Dubai: How to buy DEWA shares, minimum investment required; all you need to know

Dubai Electricity and Water Authority (DEWA) on Tuesday announced its intention to proceed with an initial public offering (IPO) and to list 6.5 per cent of its ordinary shares for trading on the Dubai Financial Market (DFM). This is in line with new strategic directions to develop the emirate's financial market and as part of the Dubai Markets Supervisory Committee's strategy.

What’s the big idea?

DEWA is the first Dubai government entity to issue an IPO on the DFM. It is learnt that the listing will be carried out gradually due to its massive asset portfolio. Though DEWA is offering 3.25 billion shares, it’s unclear how much money it aims to raise.

Dubai Electricity and Water Authority (DEWA) on Tuesday announced its intention to proceed with an initial public offering (IPO) and to list 6.5 per cent of its ordinary shares for trading on the Dubai Financial Market (DFM). This is in line with new strategic directions to develop the emirate's financial market and as part of the Dubai Markets Supervisory Committee's strategy.

What’s the big idea?

DEWA is the first Dubai government entity to issue an IPO on the DFM. It is learnt that the listing will be carried out gradually due to its massive asset portfolio. Though DEWA is offering 3.25 billion shares, it’s unclear how much money it aims to raise.

#UAE growth on firm footing to withstand fallout of Ukraine war

UAE growth on firm footing to withstand fallout of Ukraine war

Driven primarily by a surging oil sector, the UAE’s GDP is forecast to grow by 6.2 per cent in 2022 and 6.7 per cent in 2023 despite lingering Omicron concerns and uncertainty over the sharp escalation of the Russia-Ukraine conflict.

Economists at ICAEW expect a 12.8 per cent rise in the oil GDP this year with oil output averaging 3.1million barrels per day.

“Oil prices have risen above $100 per barrel, for the first time since 2014, amid heavy western sanctions on Russian energy producers. Given that the UAE is among the few countries with spare oil capacity, a surge in oil output is predicted over the next two years as it gradually raises production in response to pressure from consuming countries to ratchet up supplies,” economists observed in the latest Economic Insight report for the Middle East, commissioned by ICAEW and compiled by Oxford Economics, The outlook for UAE non-oil GDP is also encouraging and predicted to grow by 3.9 per cent in 2022 and 2.5 per cent in 2023, the report noted. “Expansionary government policy will continue to provide impetus to activity and the recent reform agenda should also bear fruit. Coupled with energy inflation, the UAE’s budget surplus should increase to 9.0 per cent of GDP this year, a significant jump on the previous estimate of 3.6 per cent in 2021.”

Steven Burke and Arne Pohlman, economists at FcousEconomics, see non-oil GDP expanding 3.8 per cent in 2022, which is down 0.1 percentage points from last month’s forecast, and 3.0 per cent in 2023.

Driven primarily by a surging oil sector, the UAE’s GDP is forecast to grow by 6.2 per cent in 2022 and 6.7 per cent in 2023 despite lingering Omicron concerns and uncertainty over the sharp escalation of the Russia-Ukraine conflict.

Economists at ICAEW expect a 12.8 per cent rise in the oil GDP this year with oil output averaging 3.1million barrels per day.

“Oil prices have risen above $100 per barrel, for the first time since 2014, amid heavy western sanctions on Russian energy producers. Given that the UAE is among the few countries with spare oil capacity, a surge in oil output is predicted over the next two years as it gradually raises production in response to pressure from consuming countries to ratchet up supplies,” economists observed in the latest Economic Insight report for the Middle East, commissioned by ICAEW and compiled by Oxford Economics, The outlook for UAE non-oil GDP is also encouraging and predicted to grow by 3.9 per cent in 2022 and 2.5 per cent in 2023, the report noted. “Expansionary government policy will continue to provide impetus to activity and the recent reform agenda should also bear fruit. Coupled with energy inflation, the UAE’s budget surplus should increase to 9.0 per cent of GDP this year, a significant jump on the previous estimate of 3.6 per cent in 2021.”

Steven Burke and Arne Pohlman, economists at FcousEconomics, see non-oil GDP expanding 3.8 per cent in 2022, which is down 0.1 percentage points from last month’s forecast, and 3.0 per cent in 2023.

Column: India looks to #Russia to solve the energy crisis Moscow created: Russell | Reuters

Column: India looks to Russia to solve the energy crisis Moscow created: Russell | Reuters

Can Russia rescue India from the high energy prices caused by Moscow's invasion of Ukraine?

It may seem a bizarre twist of logic, but India appears to be aiming to ramp up imports of Russian crude oil and coal in a bid to lower the impact of sky-rocketing prices, largely caused by Russia's military action in the first place.

Russian energy exporters are offering cargoes at steep discounts, as traditional buyers in Europe and Asia shun Russian commodities in the wake of the Feb. 24 attack on Ukraine.

But India has so far stuck by its longstanding ally, refusing to condemn the invasion, and now New Delhi is looking to lower its crippling import bills by turning to Russian crude and coal.

Coal offers the best immediate substitute for India, given that Russian grades of thermal coal are similar to what India already imports from Australia and South Africa.

Can Russia rescue India from the high energy prices caused by Moscow's invasion of Ukraine?

It may seem a bizarre twist of logic, but India appears to be aiming to ramp up imports of Russian crude oil and coal in a bid to lower the impact of sky-rocketing prices, largely caused by Russia's military action in the first place.

Russian energy exporters are offering cargoes at steep discounts, as traditional buyers in Europe and Asia shun Russian commodities in the wake of the Feb. 24 attack on Ukraine.

But India has so far stuck by its longstanding ally, refusing to condemn the invasion, and now New Delhi is looking to lower its crippling import bills by turning to Russian crude and coal.

Coal offers the best immediate substitute for India, given that Russian grades of thermal coal are similar to what India already imports from Australia and South Africa.

#Russia Says Eurobond Coupon Payment Made to Correspondent Bank - Bloomberg

Russia Says Eurobond Coupon Payment Made to Correspondent Bank - Bloomberg

Russia’s Finance Ministry said a $117 million interest payment due on two dollar bonds had been made to Citibank in London amid mounting speculation that the country is heading for a default.

The ministry said it will comment separately later on whether the payment had been credited. The bank is Russia’s eurobond payment agent.

Russia had until the end of business Wednesday to honor the coupons on the two notes. If it doesn’t do so within the grace period, that would be the first time the nation has reneged on its obligations to foreign creditors since the Bolsheviks repudiated the czar’s debts in 1918.

Finance Minister Anton Siluanov has repeatedly warned that without access to its foreign reserves, Russia will make the payment in rubles, outlining a process that involves transferring the cash into local accounts. Fitch Ratings said on Tuesday that making a settlement in any currency other than the dollar within the grace period would be considered a default. S&P Global Ratings made a similar statement earlier this month.

Russia’s Finance Ministry said a $117 million interest payment due on two dollar bonds had been made to Citibank in London amid mounting speculation that the country is heading for a default.

The ministry said it will comment separately later on whether the payment had been credited. The bank is Russia’s eurobond payment agent.

Russia had until the end of business Wednesday to honor the coupons on the two notes. If it doesn’t do so within the grace period, that would be the first time the nation has reneged on its obligations to foreign creditors since the Bolsheviks repudiated the czar’s debts in 1918.

Finance Minister Anton Siluanov has repeatedly warned that without access to its foreign reserves, Russia will make the payment in rubles, outlining a process that involves transferring the cash into local accounts. Fitch Ratings said on Tuesday that making a settlement in any currency other than the dollar within the grace period would be considered a default. S&P Global Ratings made a similar statement earlier this month.

Higher oil prices lift Gulf markets, #Qatar outperforms | Reuters

Higher oil prices lift Gulf markets, Qatar outperforms | Reuters

Middle East stock markets rose on Thursday, aided by higher oil prices after the International Energy Agency (IEA) said oil markets could lose three million barrels per day of Russian crude and refined products from April.

Oil prices climbed as the Benchmark Brent crude futures gained $1.8, or 1.9%, to $99.86 a barrel by 0408 GMT, after falling for three consecutive trading sessions. read more

The oil market largely shrugged off a move by the U.S. Federal Reserve on Wednesday to raise interest rates by one-quarter of a percentage point, as anticipated.

The Qatari index (.QSI) rose 0.6%, aided by a 7% jump in Investment Holding Group (IGRD.QA), after the real estate financier secured regulatory approval to buyout Elegancia Group.

Qatar Electricity and Water Company and Mesaieed Petrochemical Holding (MPHC.QA) also boosted the index.

Saudi Arabia's benchmark share index (.TASI) edged 0.2% higher, with gains driven by the Middle East Company for Manufacturing and Producing Paper (1202.SE).

Shares of the Saudi Arabia-based company which engages in the production of container board and industrial paper, rose 4% after reporting full-year sales of 1.06 billion riyals and posted a 17% rise in annual gross margins.

Dubai's main index (.DFMGI) rose 0.2%. Financial heavyweights Dubai Financial Market (DFM.DU) and Amlak Finance (AMLK.DU) boosted the index.

The only major Gulf index trading down was Abu Dhabi's index (.FTFADGI) which lost 0.5% in early deals, hit by a 1.5% fall in the country's largest lender First Abu Dhabi Bank (FAB.AD).

Middle East stock markets rose on Thursday, aided by higher oil prices after the International Energy Agency (IEA) said oil markets could lose three million barrels per day of Russian crude and refined products from April.

Oil prices climbed as the Benchmark Brent crude futures gained $1.8, or 1.9%, to $99.86 a barrel by 0408 GMT, after falling for three consecutive trading sessions. read more

The oil market largely shrugged off a move by the U.S. Federal Reserve on Wednesday to raise interest rates by one-quarter of a percentage point, as anticipated.

The Qatari index (.QSI) rose 0.6%, aided by a 7% jump in Investment Holding Group (IGRD.QA), after the real estate financier secured regulatory approval to buyout Elegancia Group.

Qatar Electricity and Water Company and Mesaieed Petrochemical Holding (MPHC.QA) also boosted the index.

Saudi Arabia's benchmark share index (.TASI) edged 0.2% higher, with gains driven by the Middle East Company for Manufacturing and Producing Paper (1202.SE).

Shares of the Saudi Arabia-based company which engages in the production of container board and industrial paper, rose 4% after reporting full-year sales of 1.06 billion riyals and posted a 17% rise in annual gross margins.

Dubai's main index (.DFMGI) rose 0.2%. Financial heavyweights Dubai Financial Market (DFM.DU) and Amlak Finance (AMLK.DU) boosted the index.

The only major Gulf index trading down was Abu Dhabi's index (.FTFADGI) which lost 0.5% in early deals, hit by a 1.5% fall in the country's largest lender First Abu Dhabi Bank (FAB.AD).

Oil surges after IEA warns of shortfall in supply | Reuters

Oil surges after IEA warns of shortfall in supply | Reuters

Oil prices climbed about 3% on Thursday after the International Energy Agency (IEA) said markets could lose three million barrels a day (bpd) of Russian crude and refined products from April.

The supply loss would be far greater than an expected drop in demand of one million bpd triggered by higher fuel prices, the IEA said in a report on Wednesday. read more

Benchmark Brent crude futures gained $3, or 3.1%, to $101.09 a barrel by 0844 GMT, after falling for three consecutive trading sessions.

U.S.West Texas Intermediate (WTI) crude was up $2.8, or 3%, to $97.84 a barrel.

Both contracts settled lower the previous day, following an unexpected jump in U.S. crude stockpiles and signs of progress in Russia-Ukraine peace talks.

Oil prices climbed about 3% on Thursday after the International Energy Agency (IEA) said markets could lose three million barrels a day (bpd) of Russian crude and refined products from April.

The supply loss would be far greater than an expected drop in demand of one million bpd triggered by higher fuel prices, the IEA said in a report on Wednesday. read more

Benchmark Brent crude futures gained $3, or 3.1%, to $101.09 a barrel by 0844 GMT, after falling for three consecutive trading sessions.

U.S.West Texas Intermediate (WTI) crude was up $2.8, or 3%, to $97.84 a barrel.

Both contracts settled lower the previous day, following an unexpected jump in U.S. crude stockpiles and signs of progress in Russia-Ukraine peace talks.

Subscribe to:

Comments (Atom)