Oil settles higher despite Omicron concerns | Reuters

Oil prices settled higher on Tuesday, with Brent crude ending the session near $80 a barrel despite the rapid spread of the Omicron coronavirus variant, supported by supply outages and expectations that U.S. inventories fell last week.

Brent crude settled up 34 cents, or 0.4%, at $78.94 a barrel by 1:39 p.m. EST (1839 GMT). U.S. West Texas Intermediate (WTI) crude settled up 41 cents, or 0.5%, at $75.98.

Both contracts traded at their highest levels in a month, aided by strength in U.S. equities.

"The stock market appears poised to finish the year at or near record highs with easy spillover into the oil space pushing crude values higher," said Jim Ritterbusch, president of Ritterbusch and Associates LLC in Galena, Illinois.

Solely aggregation of news articles, with no opinions expressed by this service since 2009 launch on this platform. Copyright to all articles remains with the original publisher and HEADLINES ARE CLICKABLE to access the whole article at source. (Subscription by email is recommended,with real-time updates on LinkedIn and Twitter.)

Search This Blog

Tuesday, 28 December 2021

#Sharjah #UAE approves $9.37bn budget for 2022

Sharjah approves $9.37bn budget for 2022

Sharjah's ruler Sheikh Dr Sultan bin Muhammad Al Qasimi approved the emirate's Dh34.42 billion ($9.37bn) budget for 2022, prioritising spending on infrastructure and social and economic development, according to a tweet by the Sharjah Government Media Bureau.

The 2022 budget, 2.3 per cent bigger than the last year, is expected to provide approximately 1,000 new jobs for newly graduated UAE nationals, according to a government statement on Tuesday.

About 44 per cent of the budget expenditure will be allocated to the development and improvement of the emirate's infrastructure, 27 per cent to economic development with a focus on stimulus processes and 21 per cent for social development. About 11 per cent will be allocated towards welfare and social justice, an increase of 3 per cent compared to 2021, and reflecting the emirate's focus on social support.

The Sharjah government budget will "complete the emirate's march towards achieving the highest levels of excellence, success and sustainable development in all sectors and fields", Sheikh Sultan bin Ahmed bin Sultan Al Qasimi, Deputy Ruler of Sharjah, said.

Sharjah's ruler Sheikh Dr Sultan bin Muhammad Al Qasimi approved the emirate's Dh34.42 billion ($9.37bn) budget for 2022, prioritising spending on infrastructure and social and economic development, according to a tweet by the Sharjah Government Media Bureau.

The 2022 budget, 2.3 per cent bigger than the last year, is expected to provide approximately 1,000 new jobs for newly graduated UAE nationals, according to a government statement on Tuesday.

About 44 per cent of the budget expenditure will be allocated to the development and improvement of the emirate's infrastructure, 27 per cent to economic development with a focus on stimulus processes and 21 per cent for social development. About 11 per cent will be allocated towards welfare and social justice, an increase of 3 per cent compared to 2021, and reflecting the emirate's focus on social support.

The Sharjah government budget will "complete the emirate's march towards achieving the highest levels of excellence, success and sustainable development in all sectors and fields", Sheikh Sultan bin Ahmed bin Sultan Al Qasimi, Deputy Ruler of Sharjah, said.

#Kuwait Appoints Al-Rushaid as Finance Minister in New Cabinet - Bloomberg

Kuwait Appoints Al-Rushaid as Finance Minister in New Cabinet - Bloomberg

Kuwait’s prime minister appointed his fourth cabinet in two years, naming a new finance minister and including four lawmakers in the lineup in an effort to break a political impasse that has held back economic reforms in the oil-rich Gulf nation.

Abdulwahab Al-Rushaid, a known critic of the government’s fiscal policies, becomes finance minister, replacing Khalifa Hamada, state media reported. Al-Rushaid was head of the Kuwait Economics Society, which represents the views of private sector business people.

Hamada, like his predecessors, had struggled to change Kuwait’s spending habits due in large part to a lack of support from senior policy circles. Political dysfunction has led to a revolving door at the critical ministry, with ministers rarely lasting long in office. Al-Rushaid is the sixth person to hold the portfolio in just under eight years.

Mohammed Al-Fares retained his position as oil minister in a cabinet that took five weeks to form. As Prime Minister Sheikh Sabah Al-Khaled Al-Sabah sought to appease all political groupings, many declined posts due to persistent parliamentary pressure on ministers and a lack of support for the changes required to help the government balance its books.

Other appointments include:

Kuwait’s prime minister appointed his fourth cabinet in two years, naming a new finance minister and including four lawmakers in the lineup in an effort to break a political impasse that has held back economic reforms in the oil-rich Gulf nation.

Abdulwahab Al-Rushaid, a known critic of the government’s fiscal policies, becomes finance minister, replacing Khalifa Hamada, state media reported. Al-Rushaid was head of the Kuwait Economics Society, which represents the views of private sector business people.

Hamada, like his predecessors, had struggled to change Kuwait’s spending habits due in large part to a lack of support from senior policy circles. Political dysfunction has led to a revolving door at the critical ministry, with ministers rarely lasting long in office. Al-Rushaid is the sixth person to hold the portfolio in just under eight years.

Mohammed Al-Fares retained his position as oil minister in a cabinet that took five weeks to form. As Prime Minister Sheikh Sabah Al-Khaled Al-Sabah sought to appease all political groupings, many declined posts due to persistent parliamentary pressure on ministers and a lack of support for the changes required to help the government balance its books.

Other appointments include:

- Defense Minister and deputy PM: Sheikh Hamad Jaber Al-Ali Al-Sabah

- Interior Minister and deputy PM: Sheikh Ahmad Al-Mansour Al-Sabah

- Foreign Minister: Sheikh Ahmad Nasser Al-Mohammed Al-Sabah

- Health Minister: Khaled Al-Saeed

- Minister of state for municipality affairs and minister of communications: Rana Al-Fares

Brent nears $80 as market shrugs off Omicron | Reuters

Brent nears $80 as market shrugs off Omicron | Reuters

Oil prices extended gains on Tuesday, with Brent crude trading near $80 a barrel despite the rapid spread of the Omicron coronavirus variant, supported by supply outages and expectations that U.S. inventories fell last week.

Brent crude rose by 55 cents, or 0.7%, to $79.15 a barrel by 1410 GMT, after hitting a session high of $79.85. U.S. West Texas Intermediate (WTI) crude rose 73 cents, or 1%, to $76.30, after rising to $76.92.

Both contracts traded at their highest in a month.

"Support comes as well from high aggregated production disruptions in Ecuador, Libya and Nigeria and the expectation of another large drop in U.S. crude inventories," said UBS oil analyst Giovanni Staunovo.

Oil prices extended gains on Tuesday, with Brent crude trading near $80 a barrel despite the rapid spread of the Omicron coronavirus variant, supported by supply outages and expectations that U.S. inventories fell last week.

Brent crude rose by 55 cents, or 0.7%, to $79.15 a barrel by 1410 GMT, after hitting a session high of $79.85. U.S. West Texas Intermediate (WTI) crude rose 73 cents, or 1%, to $76.30, after rising to $76.92.

Both contracts traded at their highest in a month.

"Support comes as well from high aggregated production disruptions in Ecuador, Libya and Nigeria and the expectation of another large drop in U.S. crude inventories," said UBS oil analyst Giovanni Staunovo.

#Iran sees Azadegan oilfield development completed by 2023 | Reuters

Iran sees Azadegan oilfield development completed by 2023 | Reuters

The development of Iran's largest oilfield, Azadegan, is to be completed by mid-2023 with a total production of 320,000 barrels per day (bpd), the Iranian Oil Ministry said on Tuesday.

The report came as indirect talks between Iran and the United States on salvaging the 2015 Iran nuclear deal resumed on Monday with Tehran focused on lifting sanctions to allow it to sell oil without hindrance and collect its revenue. read more

"With the completion of the development project of this field, #crude_oil production will reach 320,000 barrels per day from the field," said Mohsen Khojastehmehr, CEO of the National Iranian Oil Co. (NIOC), according to the ministry's Twitter account.

In July 2020, a unit of state-run NIOC signed a deal with the local company Petropars to raise output capacity to 320,000 bpd from 140,000 bpd within 30 months at the Azadegan field, Iran's largest, which is shared with its neighbour Iraq, according to state media.

The United States under Donald Trump's presidency withdrew from the nuclear deal in 2018 and reimposed sanctions, slashing Iran's vital crude oil exports and chasing away foreign energy companies from potential Iranian oil projects.

The development of Iran's largest oilfield, Azadegan, is to be completed by mid-2023 with a total production of 320,000 barrels per day (bpd), the Iranian Oil Ministry said on Tuesday.

The report came as indirect talks between Iran and the United States on salvaging the 2015 Iran nuclear deal resumed on Monday with Tehran focused on lifting sanctions to allow it to sell oil without hindrance and collect its revenue. read more

"With the completion of the development project of this field, #crude_oil production will reach 320,000 barrels per day from the field," said Mohsen Khojastehmehr, CEO of the National Iranian Oil Co. (NIOC), according to the ministry's Twitter account.

In July 2020, a unit of state-run NIOC signed a deal with the local company Petropars to raise output capacity to 320,000 bpd from 140,000 bpd within 30 months at the Azadegan field, Iran's largest, which is shared with its neighbour Iraq, according to state media.

The United States under Donald Trump's presidency withdrew from the nuclear deal in 2018 and reimposed sanctions, slashing Iran's vital crude oil exports and chasing away foreign energy companies from potential Iranian oil projects.

Brent near $80 as market shrugs off Omicron | Reuters

Brent near $80 as market shrugs off Omicron | Reuters

Oil prices extended gains on Tuesday, with Brent crude trading near $80 a barrel despite the rapid spread of the Omicron coronavirus variant, supported by supply outages and expectations that U.S. inventories fell last week.

Brent crude rose by $1.04, or 1.3%, to $79.64 a barrel by 1119 GMT. U.S. West Texas Intermediate (WTI) crude rose $1.15, or 1.5%, to $76.72.

Both contracts traded at their highest in a month.

"Support comes as well from high aggregated production disruptions in Ecuador, Libya and Nigeria and the expectation of another large drop in U.S. crude inventories," said UBS oil analyst Giovanni Staunovo.

Oil prices extended gains on Tuesday, with Brent crude trading near $80 a barrel despite the rapid spread of the Omicron coronavirus variant, supported by supply outages and expectations that U.S. inventories fell last week.

Brent crude rose by $1.04, or 1.3%, to $79.64 a barrel by 1119 GMT. U.S. West Texas Intermediate (WTI) crude rose $1.15, or 1.5%, to $76.72.

Both contracts traded at their highest in a month.

"Support comes as well from high aggregated production disruptions in Ecuador, Libya and Nigeria and the expectation of another large drop in U.S. crude inventories," said UBS oil analyst Giovanni Staunovo.

Most Gulf bourses close higher as Omicron worries ease | Reuters

Most Gulf bourses close higher as Omicron worries ease | Reuters

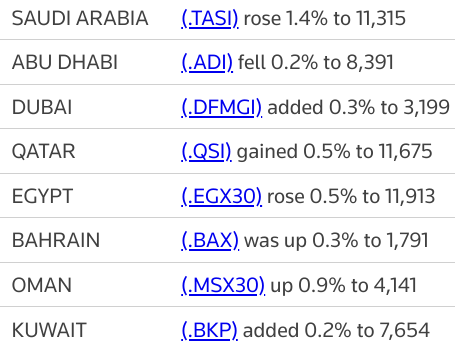

Most stock markets in the Gulf ended higher on Tuesday, with the Saudi index outperforming the region amid diminished concern over the economic impact of the Omicron variant of COVID-19.

Saudi Arabia's benchmark index (.TASI) advanced 1.4%, buoyed by a 2.9% rise in Al Rajhi Bank (1120.SE) and a 1.7% increase in petrochemical maker Saudi Basic Industries Corp (2010.SE).

The market was supported by rising oil prices and retreating concerns around the possible effects of the Omicron variant on the global economy, said Wael Makarem, senior market strategist at Exness.

"However, the market remains exposed to new price corrections if oil prices return to the downside."

Oil prices, a key catalyst for the Gulf's financial markets, extended gains, with Brent crude trading near $80 a barrel as the market shrugged off Omicron worries, supported by supply outages and expectations that U.S. inventories fell last week.

Meanwhile, Saudi Arabia delayed the launch of a major development strategy for the city of Riyadh up to 2030 until next year due to some "incomplete elements", the state news agency SPA reported. read more

Dubai's main share index (.DFMGI) gained 0.3%, supported by a 1.2% leap in blue-chip developer Emaar Properties (EMAR.DU) and a 0.4% rise in sharia-compliant lender Dubai Islamic Bank (DISB.DU).

The United Arab Emirates has approved emergency use of Sinopharm's protein-based COVID-19 vaccine and it will be available to the public as a booster dose starting in January 2022, the health ministry said. read more

The Qatari benchmark (.QSI) added 0.5%, ending two sessions of losses, with the Gulf's biggest lender Qatar National Bank (QNBK.QA) closing 1% higher.

In Abu Dhabi, the index (.ADI) fell 0.2%, pressured by a 0.9% fall in the country's largest lender First Abu Dhabi Bank (FAB.AD).

Outside the Gulf, Egypt's blue-chip index (.EGX30) finished 0.5% higher, led by a 4.6% jump in Abu Qir Fertilizers and Chemical Industries (ABUK.CA).

Most stock markets in the Gulf ended higher on Tuesday, with the Saudi index outperforming the region amid diminished concern over the economic impact of the Omicron variant of COVID-19.

Saudi Arabia's benchmark index (.TASI) advanced 1.4%, buoyed by a 2.9% rise in Al Rajhi Bank (1120.SE) and a 1.7% increase in petrochemical maker Saudi Basic Industries Corp (2010.SE).

The market was supported by rising oil prices and retreating concerns around the possible effects of the Omicron variant on the global economy, said Wael Makarem, senior market strategist at Exness.

"However, the market remains exposed to new price corrections if oil prices return to the downside."

Oil prices, a key catalyst for the Gulf's financial markets, extended gains, with Brent crude trading near $80 a barrel as the market shrugged off Omicron worries, supported by supply outages and expectations that U.S. inventories fell last week.

Meanwhile, Saudi Arabia delayed the launch of a major development strategy for the city of Riyadh up to 2030 until next year due to some "incomplete elements", the state news agency SPA reported. read more

Dubai's main share index (.DFMGI) gained 0.3%, supported by a 1.2% leap in blue-chip developer Emaar Properties (EMAR.DU) and a 0.4% rise in sharia-compliant lender Dubai Islamic Bank (DISB.DU).

The United Arab Emirates has approved emergency use of Sinopharm's protein-based COVID-19 vaccine and it will be available to the public as a booster dose starting in January 2022, the health ministry said. read more

The Qatari benchmark (.QSI) added 0.5%, ending two sessions of losses, with the Gulf's biggest lender Qatar National Bank (QNBK.QA) closing 1% higher.

In Abu Dhabi, the index (.ADI) fell 0.2%, pressured by a 0.9% fall in the country's largest lender First Abu Dhabi Bank (FAB.AD).

Outside the Gulf, Egypt's blue-chip index (.EGX30) finished 0.5% higher, led by a 4.6% jump in Abu Qir Fertilizers and Chemical Industries (ABUK.CA).

Fraying #Saudi-#UAE Ties Put U.S. Objectives at Risk - Bloomberg @ghoshworld

Fraying Saudi-UAE Ties Put U.S. Objectives at Risk - Bloomberg

By tradition, the communiqué at the end of every Gulf Cooperation Council summit meeting is a bromide about friendship among the member states — Saudi Arabia, the United Arab Emirates, Kuwait, Qatar, Oman and Bahrain. The joint declaration is usually long on promise but short on any real purpose beyond concealing discord.

Even by that low standard, the document released at the end of the latest gathering of Gulf leaders in Riyadh on Dec. 14 was the wispiest of fig leaves. The usual invocation of unity did little to hide the growing rivalry between the group’s two most important members, Saudi Arabia and the UAE.

For me, the widening divergence of economic, security and foreign-policy interests between the kingdom and the confederation of emirates was one of the most important stories of 2021. How the contest plays out will have a large bearing not only on the affairs of the Arabian Peninsula but on the geopolitics of the wider Middle East. In particular, it poses a challenge for the U.S., which has long relied on the friendship between the two states as a bulwark against Iran.More from

Some of the differences between Saudi Arabia and the UAE stem from economic choices made by their leaders, others from contrasting security calculations and still others from ideological considerations. These haven’t yet added up to open antagonism between them, certainly nothing in the nature of the naked hostility they jointly directed at Qatar during a three-year economic embargo that ended at the start of 2021.

By tradition, the communiqué at the end of every Gulf Cooperation Council summit meeting is a bromide about friendship among the member states — Saudi Arabia, the United Arab Emirates, Kuwait, Qatar, Oman and Bahrain. The joint declaration is usually long on promise but short on any real purpose beyond concealing discord.

Even by that low standard, the document released at the end of the latest gathering of Gulf leaders in Riyadh on Dec. 14 was the wispiest of fig leaves. The usual invocation of unity did little to hide the growing rivalry between the group’s two most important members, Saudi Arabia and the UAE.

For me, the widening divergence of economic, security and foreign-policy interests between the kingdom and the confederation of emirates was one of the most important stories of 2021. How the contest plays out will have a large bearing not only on the affairs of the Arabian Peninsula but on the geopolitics of the wider Middle East. In particular, it poses a challenge for the U.S., which has long relied on the friendship between the two states as a bulwark against Iran.More from

Some of the differences between Saudi Arabia and the UAE stem from economic choices made by their leaders, others from contrasting security calculations and still others from ideological considerations. These haven’t yet added up to open antagonism between them, certainly nothing in the nature of the naked hostility they jointly directed at Qatar during a three-year economic embargo that ended at the start of 2021.

#SaudiArabia to finalise Riyadh 2030 strategy next year - state media | Reuters

Saudi Arabia to finalise Riyadh 2030 strategy next year - state media | Reuters

Saudi Arabia has delayed the launch of a major development strategy for the city of Riyadh up to 2030 until next year due to some "incomplete elements", the state news agency SPA reported on Tuesday.

SPA said the development strategy for the capital is to be "finalised" in 2022.

Saudi Arabia is investing $220 billion to transform Riyadh into a global city by 2030, and expects to attract a similar amount of investment from the private sector, the head of the royal commission for the capital told Reuters in January. read more

The Gulf kingdom plans to double the population and economy of its capital city, currently home to some 7 million people, in the next decade.

Saudi Arabia, the world's top oil exporter, is seeking to diversify its economy away from crude revenues by creating new industries and investment opportunities.

Saudi Crown Prince Mohammed bin Salman wants the kingdom's capital to become one of the world's biggest 10 cities under his economic reform strategy.

Saudi Arabia has delayed the launch of a major development strategy for the city of Riyadh up to 2030 until next year due to some "incomplete elements", the state news agency SPA reported on Tuesday.

SPA said the development strategy for the capital is to be "finalised" in 2022.

Saudi Arabia is investing $220 billion to transform Riyadh into a global city by 2030, and expects to attract a similar amount of investment from the private sector, the head of the royal commission for the capital told Reuters in January. read more

The Gulf kingdom plans to double the population and economy of its capital city, currently home to some 7 million people, in the next decade.

Saudi Arabia, the world's top oil exporter, is seeking to diversify its economy away from crude revenues by creating new industries and investment opportunities.

Saudi Crown Prince Mohammed bin Salman wants the kingdom's capital to become one of the world's biggest 10 cities under his economic reform strategy.

Most Gulf bourses track oil prices, Asian shares higher | Reuters

Most Gulf bourses track oil prices, Asian shares higher | Reuters

Most stock markets in the Gulf rose in early trade on Tuesday, tracking gains in oil prices and Asian shares as some investors grew less fearful about economic damage from the Omicron variant of COVID-19.

Saudi Arabia's benchmark index (.TASI) gained 0.6%, with Al Rajhi Bank (1120.SE) rising 1% and oil behemoth Saudi Aramco (2222.SE) adding 0.6%.

Oil prices, a key catalyst for the Gulf's financial markets, extended gains with prices trading near the previous day's one-month high on hopes that the Omicron variant will have a limited impact on fuel demand.

Meanwhile, Saudi Arabia delayed the launch of a major development strategy for the city of Riyadh up to 2030 until next year due to some "incomplete elements", the state news agency SPA reported. read more

The kingdom is investing $220 billion to transform Riyadh into a global city by 2030, and expects to attract a similar amount of investment from the private sector, Reuters reported in January, citing the head of the royal commission for the capital. read more

Dubai's main share index (.DFMGI) rose 0.3%, supported by a 0.8% rise in blue-chip developer Emaar Properties (EMAR.DU).

The United Arab Emirates has approved the emergency use of Sinopharm's protein-based COVID-19 vaccine and it will be available to the public as a booster dose starting January 2022, the health ministry said. read more

The Qatari index (.QSI) edged 0.2% higher, on course to end two sessions of losses, with Qatar Fuel gaining 0.9%.

In Abu Dhabi, the index (.ADI) fell 0.4%, hit by a 0.8% fall in the country's largest lender First Abu Dhabi Bank (FAB.AD).

Most stock markets in the Gulf rose in early trade on Tuesday, tracking gains in oil prices and Asian shares as some investors grew less fearful about economic damage from the Omicron variant of COVID-19.

Saudi Arabia's benchmark index (.TASI) gained 0.6%, with Al Rajhi Bank (1120.SE) rising 1% and oil behemoth Saudi Aramco (2222.SE) adding 0.6%.

Oil prices, a key catalyst for the Gulf's financial markets, extended gains with prices trading near the previous day's one-month high on hopes that the Omicron variant will have a limited impact on fuel demand.

Meanwhile, Saudi Arabia delayed the launch of a major development strategy for the city of Riyadh up to 2030 until next year due to some "incomplete elements", the state news agency SPA reported. read more

The kingdom is investing $220 billion to transform Riyadh into a global city by 2030, and expects to attract a similar amount of investment from the private sector, Reuters reported in January, citing the head of the royal commission for the capital. read more

Dubai's main share index (.DFMGI) rose 0.3%, supported by a 0.8% rise in blue-chip developer Emaar Properties (EMAR.DU).

The United Arab Emirates has approved the emergency use of Sinopharm's protein-based COVID-19 vaccine and it will be available to the public as a booster dose starting January 2022, the health ministry said. read more

The Qatari index (.QSI) edged 0.2% higher, on course to end two sessions of losses, with Qatar Fuel gaining 0.9%.

In Abu Dhabi, the index (.ADI) fell 0.4%, hit by a 0.8% fall in the country's largest lender First Abu Dhabi Bank (FAB.AD).

Where Does Gold Come From in Africa? Suspected Smuggling to #Dubai Rings Alarms - Bloomberg video

Where Does Gold Come From in Africa? Suspected Smuggling to Dubai Rings Alarms - Bloomberg

In the moon-like landscape of northern Sudan, informal gold miners toil with spades and pickaxes to extract their prize from shallow pits that pockmark the terrain.

Mining ore in the sweltering heat of the Nubian desert is the first stage of an illicit network that has exploded in the past 18 months following a pandemic-induced spike in the gold price. African governments desperate to recoup lost revenue are looking to Dubai to help stop the trade.

Interviews with government officials across Africa reveal smuggling operations that span at least nine countries and involve tons of gold spirited over borders. That’s a cause for international concern because the funds from contraband minerals dealing in Africa fuel conflict, finance criminal and terrorist networks, undermine democracy and facilitate money laundering, according to the Organisation for Economic Cooperation and Development.

While it’s impossible to say precisely how much is lost to smugglers each year, United Nations trade data for 2020 show a discrepancy of at least $4 billion between the United Arab Emirates’ declared gold imports from Africa and what African countries say they exported to the UAE.

In the moon-like landscape of northern Sudan, informal gold miners toil with spades and pickaxes to extract their prize from shallow pits that pockmark the terrain.

Mining ore in the sweltering heat of the Nubian desert is the first stage of an illicit network that has exploded in the past 18 months following a pandemic-induced spike in the gold price. African governments desperate to recoup lost revenue are looking to Dubai to help stop the trade.

Interviews with government officials across Africa reveal smuggling operations that span at least nine countries and involve tons of gold spirited over borders. That’s a cause for international concern because the funds from contraband minerals dealing in Africa fuel conflict, finance criminal and terrorist networks, undermine democracy and facilitate money laundering, according to the Organisation for Economic Cooperation and Development.

While it’s impossible to say precisely how much is lost to smugglers each year, United Nations trade data for 2020 show a discrepancy of at least $4 billion between the United Arab Emirates’ declared gold imports from Africa and what African countries say they exported to the UAE.

Oil prices climb as worries over fuel demand recede | Reuters

Oil prices climb as worries over fuel demand recede | Reuters

Oil prices extended gains on Tuesday with prices trading near the previous day's one-month high on hopes that the Omicron coronavirus variant will have a limited impact on fuel demand.

Brent crude rose 7 cents, or 0.1%, to $78.67 a barrel, by 0728 GMT. U.S. West Texas Intermediate (WTI) crude rose 17 cents, or 0.2%, to $75.74 a barrel, gaining for a fifth straight session.

"Worries regarding Omicron are easing across the globe, resulting in some optimism over demand ... Prices are expected to trade with positive bias," said Abhishek Chauhan, head of commodities at Swastika Investmart Ltd.

England will not get any new COVID-19 restrictions before the end of 2021, British health minister Sajid Javid said on Monday, as the government awaits more evidence on whether the health service can cope with high infection rates. read more

Oil prices extended gains on Tuesday with prices trading near the previous day's one-month high on hopes that the Omicron coronavirus variant will have a limited impact on fuel demand.

Brent crude rose 7 cents, or 0.1%, to $78.67 a barrel, by 0728 GMT. U.S. West Texas Intermediate (WTI) crude rose 17 cents, or 0.2%, to $75.74 a barrel, gaining for a fifth straight session.

"Worries regarding Omicron are easing across the globe, resulting in some optimism over demand ... Prices are expected to trade with positive bias," said Abhishek Chauhan, head of commodities at Swastika Investmart Ltd.

England will not get any new COVID-19 restrictions before the end of 2021, British health minister Sajid Javid said on Monday, as the government awaits more evidence on whether the health service can cope with high infection rates. read more

Subscribe to:

Comments (Atom)