Solely aggregation of news articles, with no opinions expressed by this service since 2009 launch on this platform. Copyright to all articles remains with the original publisher and HEADLINES ARE CLICKABLE to access the whole article at source. (Subscription by email is recommended,with real-time updates on LinkedIn and Twitter.)

Search This Blog

Thursday, 22 October 2020

Bank of #Israel Adds $10 Billion to Crisis Bond-Buying Plan - Bloomberg

Bank of Israel Adds $10 Billion to Crisis Bond-Buying Plan - Bloomberg

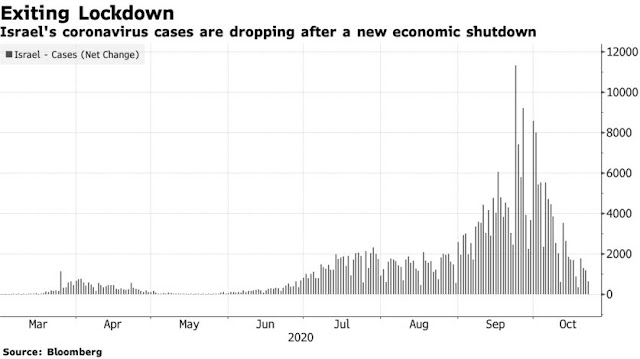

The Bank of Israel will buy 35 billion shekels ($10.3 billion) more in government bonds and provide cheap credit for small businesses to boost the economy that is now emerging from a second national lockdown.

The monetary committee decided to expand the scope of government bond purchases beyond 50 billion shekels “to ensure that the economy’s credit needs continue to receive a response via a convenient interest rate environment,” Governor Amir Yaron said on Thursday.

The Bank of Israel is trying to shore up the battered economy, with tumbling consumer confidence and unemployment rising to almost 20% since Israel hunkered down last month. The government started loosening restrictions this week as new coronavirus cases drop, but the pace of the phased reopening remains uncertain. The central bank now estimates the economy will contract between 5% and 6.5% this year.

The monetary committee decided to expand the scope of government bond purchases beyond 50 billion shekels “to ensure that the economy’s credit needs continue to receive a response via a convenient interest rate environment,” Governor Amir Yaron said on Thursday.

The Bank of Israel is trying to shore up the battered economy, with tumbling consumer confidence and unemployment rising to almost 20% since Israel hunkered down last month. The government started loosening restrictions this week as new coronavirus cases drop, but the pace of the phased reopening remains uncertain. The central bank now estimates the economy will contract between 5% and 6.5% this year.

Oil Demand May See Lasting Impact From Pandemic, World Bank Says - Bloomberg

Oil Demand May See Lasting Impact From Pandemic, World Bank Says - Bloomberg

Oil demand could see “lasting impacts” from the coronavirus while modest gains are projected in metals and agriculture prices as commodity markets recover from the shock of the pandemic, according to the World Bank.

The World Bank boosted its projections from April for the average oil price in 2020 and 2021 to $41 a barrel and $44, respectively, as a slow recovery in demand is matched by an easing in supply restrictions. That still leaves prices well below 2019 levels of $61. Outside of energy, a small decline in metal prices will be offset by an increase in agricultural prices this year.

The swift recovery in oil prices following April’s price rout has stalled as the resurgent coronavirus spurs governments to rethink reopening plans. While stimulus can help buffer the impact, Covid-19 presents a challenge to commodity exporters, with policy makers needing to allow their economies to adjust smoothly to a “new normal” should the pandemic persist.

“In the post-Covid world, these countries need to be more aggressive in implementing policies to reduce their reliance on oil revenues,” said Ayhan Kose, director of the World Bank Group’s Prospects Group.

The World Bank boosted its projections from April for the average oil price in 2020 and 2021 to $41 a barrel and $44, respectively, as a slow recovery in demand is matched by an easing in supply restrictions. That still leaves prices well below 2019 levels of $61. Outside of energy, a small decline in metal prices will be offset by an increase in agricultural prices this year.

The swift recovery in oil prices following April’s price rout has stalled as the resurgent coronavirus spurs governments to rethink reopening plans. While stimulus can help buffer the impact, Covid-19 presents a challenge to commodity exporters, with policy makers needing to allow their economies to adjust smoothly to a “new normal” should the pandemic persist.

“In the post-Covid world, these countries need to be more aggressive in implementing policies to reduce their reliance on oil revenues,” said Ayhan Kose, director of the World Bank Group’s Prospects Group.

#UAE central bank announces new regulations regarding licensed financial institutions mandatory reserves system, WAM | Reuters

UAE central bank announces new regulations regarding licensed financial institutions mandatory reserves system, WAM | Reuters

The United Arab Emirates Central Bank announced on Thursday that effective Oct. 28, it will introduce new regulations regarding reserve requirements for deposit-taking licensed financial institutions, according to the state news agency (WAM).

The introduction of these regulations represents the second step towards implementation of the new Dirham Monetary Framework announced earlier this year.

The introduction of these regulations represents the second step towards implementation of the new Dirham Monetary Framework announced earlier this year.

Russia's Putin: rollover on oil output curbs possible | Reuters

Russia's Putin: rollover on oil output curbs possible | Reuters

Russian President Vladimir Putin said on Thursday that Russia did not rule out keeping existing curbs on global oil output and not easing them as previously envisaged.

His comments are the clearest signal yet from Russia, a global leader in oil production, that it is ready to continue with unprecedented output cuts in the face of a sluggish oil market beset by the coronavirus pandemic and overproduction.

Putin said on Thursday he has been in contact with “partners” from Saudi Arabia and the United States, which is not a party to the OPEC+ group of leading oil producers.

“We believe there is no need to change anything in our agreements, we will closely watch how the market is recovering. The consumption is on the rise.”

“However, we do not rule out that we can either keep existing restrictions on production, and not remove them as quickly as we had planned to do earlier,” Putin told a meeting of the Valdai Discussion Club.

His comments are the clearest signal yet from Russia, a global leader in oil production, that it is ready to continue with unprecedented output cuts in the face of a sluggish oil market beset by the coronavirus pandemic and overproduction.

Putin said on Thursday he has been in contact with “partners” from Saudi Arabia and the United States, which is not a party to the OPEC+ group of leading oil producers.

“We believe there is no need to change anything in our agreements, we will closely watch how the market is recovering. The consumption is on the rise.”

“However, we do not rule out that we can either keep existing restrictions on production, and not remove them as quickly as we had planned to do earlier,” Putin told a meeting of the Valdai Discussion Club.

MIDEAST STOCKS-Lender Emirates NBD buoys #Dubai; Egypt extends losses | Nasdaq

MIDEAST STOCKS-Lender Emirates NBD buoys Dubai; Egypt extends losses | Nasdaq

Dubai's stock market ended higher on Thursday, driven by a rebound in its top lender Emirates NBD ENBD.DU, while Egyptian stocks fell sharply due to a broad selloff in blue-chip shares.

Dubai's main share index .DFMGI rose 0.7%, led by a rebound in its largest lender Emirates NBD ENBD.DU, following two sessions of losses.

On Tuesday, the lender reported a sharp decline in quarterly profit, hit by a rise in bad debt charges resulting from the COVID-19 crisis.

Outside the Gulf, Egypt's blue-chip index .EGX30 retreated 1%, extending losses for a sixth straight session, as most of the stocks on the index were in negative territory including El Sewedy Electric SWDY.CA, which was down 3.6%.

The most populous Arab state's Prime Minister Mostafa Madbouly said on Wednesday that his government is concerned about the rising numbers of new coronavirus cases in neighbouring countries.

Saudi Arabia's benchmark index .TASI edged up 0.1%, with Saudi Telecom Company 7010.SE advancing 2.7% after it reported an increase in quarterly profit.

Elsewhere, BinDawood Holding's 4161.SE shares jumped 9.9% on the second day of trading since its listing.

The supermarket retailer offered 22.86 million shares or 20% of its share capital at an offer price of 96 riyals ($25.60) per share.

The Abu Dhabi index .ADI added 0.3%, helped by a 0.6% increase in Emirates Telecommunications (Etisalat) ETISALAT.AD following a higher third-quarter profit.

The telecoms firm reported a net profit of 2.41 billion dirhams ($656.18 million) for the quarter ended Sept. 30, up from 2.29 billion dirhams a year earlier.

Dubai's stock market ended higher on Thursday, driven by a rebound in its top lender Emirates NBD ENBD.DU, while Egyptian stocks fell sharply due to a broad selloff in blue-chip shares.

Dubai's main share index .DFMGI rose 0.7%, led by a rebound in its largest lender Emirates NBD ENBD.DU, following two sessions of losses.

On Tuesday, the lender reported a sharp decline in quarterly profit, hit by a rise in bad debt charges resulting from the COVID-19 crisis.

Outside the Gulf, Egypt's blue-chip index .EGX30 retreated 1%, extending losses for a sixth straight session, as most of the stocks on the index were in negative territory including El Sewedy Electric SWDY.CA, which was down 3.6%.

The most populous Arab state's Prime Minister Mostafa Madbouly said on Wednesday that his government is concerned about the rising numbers of new coronavirus cases in neighbouring countries.

Saudi Arabia's benchmark index .TASI edged up 0.1%, with Saudi Telecom Company 7010.SE advancing 2.7% after it reported an increase in quarterly profit.

Elsewhere, BinDawood Holding's 4161.SE shares jumped 9.9% on the second day of trading since its listing.

The supermarket retailer offered 22.86 million shares or 20% of its share capital at an offer price of 96 riyals ($25.60) per share.

The Abu Dhabi index .ADI added 0.3%, helped by a 0.6% increase in Emirates Telecommunications (Etisalat) ETISALAT.AD following a higher third-quarter profit.

The telecoms firm reported a net profit of 2.41 billion dirhams ($656.18 million) for the quarter ended Sept. 30, up from 2.29 billion dirhams a year earlier.

#Oman's ruler approves fiscal plan to diversify revenue | Reuters

Oman's ruler approves fiscal plan to diversify revenue | Reuters

Oman’s sultan has approved a medium-term fiscal plan to make government finances sustainable, state media said on Thursday, as the coronavirus crisis and low oil prices batter state coffers.

The Gulf oil producer has long had plans to reform its economy, diversify revenues and introduce sensitive tax and subsidies reform, but they dragged under the late Sultan Qaboos, who died in January after half a century in power.

His successor, Sultan Haitham, approved a 2020-2024 fiscal plan that included increasing government income from non-oil sectors, state media reported, citing orders from the Sultan.

Oman will also accelerate the establishment of a social security system for low-income citizens who may be affected by the government’s drive to bring down the country’s debt and cut state spending, one of the orders said.

Oman’s sultan has approved a medium-term fiscal plan to make government finances sustainable, state media said on Thursday, as the coronavirus crisis and low oil prices batter state coffers.

The Gulf oil producer has long had plans to reform its economy, diversify revenues and introduce sensitive tax and subsidies reform, but they dragged under the late Sultan Qaboos, who died in January after half a century in power.

His successor, Sultan Haitham, approved a 2020-2024 fiscal plan that included increasing government income from non-oil sectors, state media reported, citing orders from the Sultan.

Oman will also accelerate the establishment of a social security system for low-income citizens who may be affected by the government’s drive to bring down the country’s debt and cut state spending, one of the orders said.

ADNOC pipeline investor Galaxy mandates banks for planned bond sales - document | Reuters

ADNOC pipeline investor Galaxy mandates banks for planned bond sales - document | Reuters

Galaxy Pipeline Assets, which is owned by a consortium of investors that took a stake in ADNOC’s gas pipeline assets, has mandated banks for sale of triple-tranche dollar bonds, a document showed.

Galaxy has mandated Citigroup and HSBC as global coordinators, while BNP Paribas, First Abu Dhabi Bank, Mizuho, MUFG and Standard Chartered Bank will be joint bookrunners to organise fixed-income investor calls across the United States, Europe, Asia and the Middle East, starting on Oct. 22.

It plans to issue U.S. dollar fixed-rate bonds comprising maturities of up to 20 years, according to the document, seen by Reuters, which was issued by one of the banks mandated for the deal.

The issuer is owned by a consortium of investors including GIP, Brookfield, Singapore sovereign wealth fund GIC, European gas infrastructure owner and operator SNAM.

Galaxy Pipeline Assets, which is owned by a consortium of investors that took a stake in ADNOC’s gas pipeline assets, has mandated banks for sale of triple-tranche dollar bonds, a document showed.

Galaxy has mandated Citigroup and HSBC as global coordinators, while BNP Paribas, First Abu Dhabi Bank, Mizuho, MUFG and Standard Chartered Bank will be joint bookrunners to organise fixed-income investor calls across the United States, Europe, Asia and the Middle East, starting on Oct. 22.

It plans to issue U.S. dollar fixed-rate bonds comprising maturities of up to 20 years, according to the document, seen by Reuters, which was issued by one of the banks mandated for the deal.

The issuer is owned by a consortium of investors including GIP, Brookfield, Singapore sovereign wealth fund GIC, European gas infrastructure owner and operator SNAM.

Oil struggles to recover after U.S. gasoline stocks build | Reuters

Oil struggles to recover after U.S. gasoline stocks build | Reuters

Oil prices ticked up on Thursday but struggled to fully recover from the previous session’s losses when a build in U.S. gasoline inventories signalled a deteriorating outlook for fuel demand as coronavirus cases soar.

Brent crude LCOc1 futures were up 22 cents at $41.95 a barrel at 0803 GMT.

U.S. West Texas Intermediate (WTI) crude CLc1 futures ticked up 17 cents to $40.20 a barrel. Both contracts shed more than 3% on Wednesday in their steepest daily falls in three weeks.

U.S. gasoline stocks USOILG=ECI rose by 1.9 million barrels in the week to Oct. 16, the Energy Information Administration (EIA) said on Wednesday, compared with expectations for a 1.8 million-barrel drop.

Oil prices ticked up on Thursday but struggled to fully recover from the previous session’s losses when a build in U.S. gasoline inventories signalled a deteriorating outlook for fuel demand as coronavirus cases soar.

Brent crude LCOc1 futures were up 22 cents at $41.95 a barrel at 0803 GMT.

U.S. West Texas Intermediate (WTI) crude CLc1 futures ticked up 17 cents to $40.20 a barrel. Both contracts shed more than 3% on Wednesday in their steepest daily falls in three weeks.

U.S. gasoline stocks USOILG=ECI rose by 1.9 million barrels in the week to Oct. 16, the Energy Information Administration (EIA) said on Wednesday, compared with expectations for a 1.8 million-barrel drop.

MIDEAST STOCKS-Major Gulf markets mixed in early trade, #Dubai index up | Nasdaq

MIDEAST STOCKS-Major Gulf markets mixed in early trade, Dubai index up | Nasdaq

Saudi Arabia's benchmark index .TASI fell 0.2%, hurt by a 0.8% drop in National Commercial Bank 1180.SE and a 1.4% retreat in Etihad Etisalat (Mobily) 7020.SE despite reporting a higher third-quarter profit.

Saudi Telecom Company 7010.SE, however, gained 0.6% following an increase in its quarterly net profit.

Dubai's main share index .DFMGI rose 0.3%, with its largest lender Emirates NBD ENBD.DU gaining 0.7% and DAMAC Properties DAMAC.DU advancing 3.6%. DAMAC was on track to extend gains from the previous session.

Major stock markets in the Gulf were mixed early on Thursday, in the absence of fresh factors to trade on, with top lender Emirates NBD ENBD.DU boosting the Dubai index.

Saudi Arabia's benchmark index .TASI fell 0.2%, hurt by a 0.8% drop in National Commercial Bank 1180.SE and a 1.4% retreat in Etihad Etisalat (Mobily) 7020.SE despite reporting a higher third-quarter profit.

Saudi Telecom Company 7010.SE, however, gained 0.6% following an increase in its quarterly net profit.

Dubai's main share index .DFMGI rose 0.3%, with its largest lender Emirates NBD ENBD.DU gaining 0.7% and DAMAC Properties DAMAC.DU advancing 3.6%. DAMAC was on track to extend gains from the previous session.

There has been speculation about possible plans to take the company private but no final decision has been taken yet.

Hussain Sajwani, DAMAC's founder and chairman, has been exploring the deal since late-2019 after the firm's share price plunged over the past two years.

The Abu Dhabi index .ADI added 0.1%, helped by a 1.4% increase in Aldar Properties ALDAR.AD.

In Qatar, the index .QSI lost 0.4%, driven down by a 0.7% fall in the Gulf's largest lender Qatar National Bank QNBK.QA and a 2.8% decline in United Development Company UDCD.QA.

Hussain Sajwani, DAMAC's founder and chairman, has been exploring the deal since late-2019 after the firm's share price plunged over the past two years.

The Abu Dhabi index .ADI added 0.1%, helped by a 1.4% increase in Aldar Properties ALDAR.AD.

In Qatar, the index .QSI lost 0.4%, driven down by a 0.7% fall in the Gulf's largest lender Qatar National Bank QNBK.QA and a 2.8% decline in United Development Company UDCD.QA.

Subscribe to:

Comments (Atom)