SPAC Race Heats Up in Asia With First Singapore Listings Due - Bloomberg

Blank-check companies are set to make a debut in Singapore this month as the financial hub, which has struggled to attract new stock listings, gears up for competition from Hong Kong.

Vertex Technology Acquisition Corporation Ltd., sponsored by state investor Temasek’s Vertex Venture Holdings Ltd., is seeking at least S$170 million ($125 million), while Tikehau Capital SCA-backed Pegasus Asia could raise at least S$150 million. The listings are slated for Jan. 21 and Jan. 25, respectively.

The special purpose acquisition companies, or SPACs, come under a framework introduced by Singapore’s exchange in September as bourses globally compete to attract such listings even at a time of growing regulatory scrutiny. Hong Kong released its rulebook last month.

“There’s been a lot of interest in SPACs in Singapore and investors are generally looking for new asset classes to invest in,” said Stefanie Yuen Thio, joint managing partner at TSMP Law Corp. “Having blue chip names like Temasek’s Vertex launch the inaugural SPAC is also good for the market.”

Solely aggregation of news articles, with no opinions expressed by this service since 2009 launch on this platform. Copyright to all articles remains with the original publisher and HEADLINES ARE CLICKABLE to access the whole article at source. (Subscription by email is recommended,with real-time updates on LinkedIn and Twitter.)

Search This Blog

Saturday, 8 January 2022

Oil Posts Its Third Weekly Advance as Market Tightens on Outages - Bloomberg

Oil Posts Its Third Weekly Advance as Market Tightens on Outages - Bloomberg

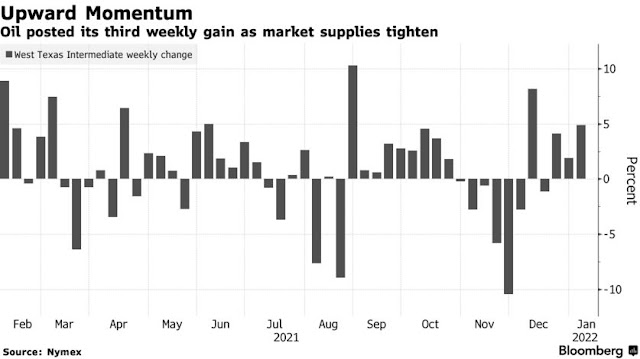

Oil rose for a third straight week as demand remained resilient, while supplies are frayed across the OPEC+ coalition and beyond.

West Texas Intermediate crude in New York climbed 5% this week, despite closing down 0.7% on Friday. Kazakhstan’s biggest oil producer has altered output at the giant Tengiz field following protests, while Libyan production has also been crimped. However, restrictions on access to restaurants and gyms from Germany to Hong Kong were a reminder that the omicron variant could still curb demand.

“The oil market remains very tight and seems like it will go higher,” said Ed Moya, Oanda’s senior market analyst for the Americas. “But energy traders are concerned curbs across Europe and Asia could threaten the short-term demand outlook.”

Oil rose for a third straight week as demand remained resilient, while supplies are frayed across the OPEC+ coalition and beyond.

West Texas Intermediate crude in New York climbed 5% this week, despite closing down 0.7% on Friday. Kazakhstan’s biggest oil producer has altered output at the giant Tengiz field following protests, while Libyan production has also been crimped. However, restrictions on access to restaurants and gyms from Germany to Hong Kong were a reminder that the omicron variant could still curb demand.

“The oil market remains very tight and seems like it will go higher,” said Ed Moya, Oanda’s senior market analyst for the Americas. “But energy traders are concerned curbs across Europe and Asia could threaten the short-term demand outlook.”

Harold Hamm: ‘Republican, Democrat . . . I’m an oilocrat’ | Financial Times

Harold Hamm: ‘Republican, Democrat . . . I’m an oilocrat’ | Financial Times

Harold Hamm, billionaire oil tycoon and erstwhile Donald Trump confidant, stands in a crisp suit at the head of a long dark table in a boardroom high up an Oklahoma City skyscraper. Maps, leaflets, ring binders and papers are strewn the length of the table. With sudden alarm, I note they include articles on US energy from the Financial Times.

“Mr Hamm is ready for you — very ready,” his head of communications had told me in the downstairs lobby a few minutes earlier. She wasn’t wrong.

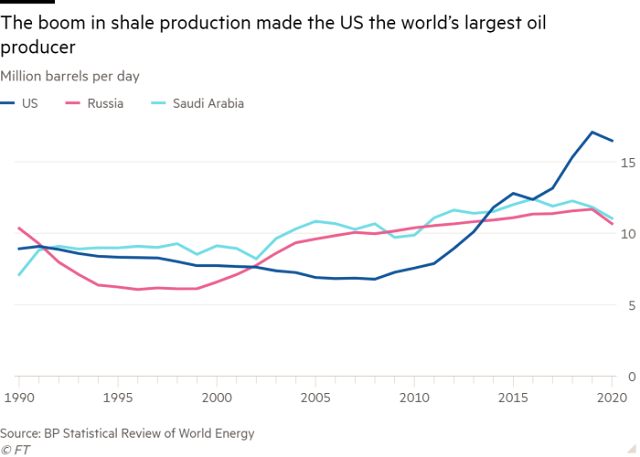

Hamm is America’s most famous oilman: a pioneer of the shale revolution of the past 20 years that made the US the world’s biggest oil and gas producer, lessening its dependence on Middle Eastern energy and upending geopolitical norms in the process. To legions of fossil-fuel advocates on America’s right, Hamm, 76, is the self-made hero of the country’s energy renaissance. But with a president in the Oval Office who has promised to “transition” from oil, Hamm is now in a battle to defend this legacy — and I’ve driven eight hours from west Texas to Oklahoma City to ask him about it.

I had imagined the answers would unfold over plates heaped with barbecued pork, grits, fried okra and other staples of Oklahoma cuisine, maybe in the wood-panelled Petroleum Club, a stone’s throw from Hamm’s office.

Subscribe to:

Comments (Atom)