Oil prices rise to highest level in a month as Omicron concern eases | Reuters

Oil prices rose more than 2% on Monday to the highest level since late November on hopes that the Omicron coronavirus variant will have a limited impact on global demand in 2022, even as surging cases caused flight cancellations.

Global benchmark Brent crude rose $2.46, or 3.2%, to settle at $78.60 a barrel. U.S. West Texas Intermediate (WTI) crude rose $1.78, or 2.4%, to settle at $75.57 a barrel. The U.S. market was closed on Friday for a holiday.

Both benchmarks rose on Monday to the highest since Nov. 26. On that day, oil plunged by more than 10% when reports of a new variant first appeared. The benchmarks gained last week after early data suggested that Omicron could cause a milder level of illness.

"Though Omicron is spreading faster than any COVID-19 variant yet, a relatively relieving news is that most people infected with Omicron are showing mild symptoms, at least so far," said Leona Liu, analyst at Singapore-based DailyFX.

Solely aggregation of news articles, with no opinions expressed by this service since 2009 launch on this platform. Copyright to all articles remains with the original publisher and HEADLINES ARE CLICKABLE to access the whole article at source. (Subscription by email is recommended,with real-time updates on LinkedIn and Twitter.)

Search This Blog

Monday, 27 December 2021

Most Gulf bourses fall as Omicron worries weigh | Reuters

Most Gulf bourses fall as Omicron worries weigh | Reuters

Most Gulf stock markets ended lower on Monday, with investor sentiment hit by uncertainty over the economic impact of the Omicron coronavirus variant.

The spread of the Omicron variant is becoming an increasing concern despite reports of it having a less serious impact on health than previous variants, said Farah Mourad, senior market analyst at XTB MENA.

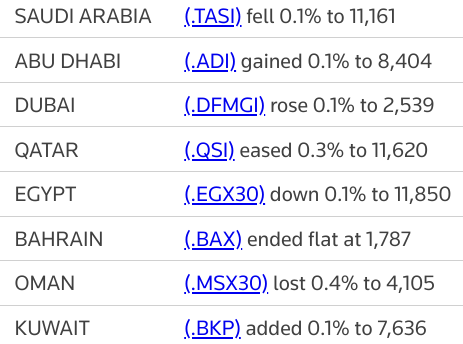

Saudi Arabia's benchmark index (.TASI) dipped by 0.1%, with Al Rajhi Bank (1120.SE) losing 0.7% and Riyad Bank (1010.SE) declining 1.5%.

Saudi health authorities advised citizens and residents last week to avoid all unnecessary foreign travel. The kingdom reported its first Omicron case on Dec. 1.

Crude oil prices, a key catalyst for the Gulf's financial markets, fell after U.S. airlines called off thousands of flights over the Christmas holidays amid surging COVID-19 cases.

The Qatari index (.QSI) dropped 0.3%, while Oman's benchmark (.MSX30) settled 0.4% down.

Omani authorities require foreign travellers aged 18 or older to have received at least two COVID-19 vaccine doses to enter the sultanate, the state news agency reported on Sunday. read more

Dubai's main share index (.DFMGI) advanced 0.9%, boosted by a 1.5% gain in blue-chip developer Emaar Properties (EMAR.DU) and a 1.3% increase in sharia-compliant lender Dubai Islamic Bank (DISB.DU).

Investors are returning to the market gradually after last week's price corrections and the main index could record some increases in the coming days if traders move to buy the dip, said Mourad.

The Abu Dhabi index (.ADI) reversed early losses to close 0.1% higher, helped by a 0.3% rise in telecoms company Etisalat (ETISALAT.AD).

Separately, the UAE government has told some of its biggest business families that it plans to remove their monopolies on the sale of imported goods, Reuters reported on Sunday, citing the Financial Times. read more

Over the past year, the UAE, a growing economic rival of Saudi Arabia, has taken measures to make its economy more attractive to foreign investors and talent.

Outside the Gulf, Egypt's blue-chip index (.EGX30) eased by 0.1%, snapping four sessions of gains, hit by a 1.8% fall in tobacco monopoly Eastern Company (EAST.CA).

Most Gulf stock markets ended lower on Monday, with investor sentiment hit by uncertainty over the economic impact of the Omicron coronavirus variant.

The spread of the Omicron variant is becoming an increasing concern despite reports of it having a less serious impact on health than previous variants, said Farah Mourad, senior market analyst at XTB MENA.

Saudi Arabia's benchmark index (.TASI) dipped by 0.1%, with Al Rajhi Bank (1120.SE) losing 0.7% and Riyad Bank (1010.SE) declining 1.5%.

Saudi health authorities advised citizens and residents last week to avoid all unnecessary foreign travel. The kingdom reported its first Omicron case on Dec. 1.

Crude oil prices, a key catalyst for the Gulf's financial markets, fell after U.S. airlines called off thousands of flights over the Christmas holidays amid surging COVID-19 cases.

The Qatari index (.QSI) dropped 0.3%, while Oman's benchmark (.MSX30) settled 0.4% down.

Omani authorities require foreign travellers aged 18 or older to have received at least two COVID-19 vaccine doses to enter the sultanate, the state news agency reported on Sunday. read more

Dubai's main share index (.DFMGI) advanced 0.9%, boosted by a 1.5% gain in blue-chip developer Emaar Properties (EMAR.DU) and a 1.3% increase in sharia-compliant lender Dubai Islamic Bank (DISB.DU).

Investors are returning to the market gradually after last week's price corrections and the main index could record some increases in the coming days if traders move to buy the dip, said Mourad.

The Abu Dhabi index (.ADI) reversed early losses to close 0.1% higher, helped by a 0.3% rise in telecoms company Etisalat (ETISALAT.AD).

Separately, the UAE government has told some of its biggest business families that it plans to remove their monopolies on the sale of imported goods, Reuters reported on Sunday, citing the Financial Times. read more

Over the past year, the UAE, a growing economic rival of Saudi Arabia, has taken measures to make its economy more attractive to foreign investors and talent.

Outside the Gulf, Egypt's blue-chip index (.EGX30) eased by 0.1%, snapping four sessions of gains, hit by a 1.8% fall in tobacco monopoly Eastern Company (EAST.CA).

Oil falls after COVID-19 flight cancellations | Reuters

Oil falls after COVID-19 flight cancellations | Reuters

Oil fell on Monday after U.S. airlines called off thousands of flights over the Christmas holidays amid surging COVID-19 cases, though losses were capped by hopes that the Omicron variant will have limited impact on global demand.

More than 1,300 flights were cancelled by U.S. airlines on Sunday as COVID-19 reduced the number of available crews while several cruise ships had to cancel stops. read more

U.S. West Texas Intermediate (WTI) crude was down $1.20, or 1.6%, at $72.59 a barrel by 1222 GMT. The U.S. market was closed on Friday for a holiday. Global benchmark Brent crude fell 8 cents, or 0.1%, to $76.06.

"Lower travel equalling lower economic activity in the U.S. equals lower WTI," said Jeffrey Halley, analyst at brokerage OANDA, who added that the divergence between Brent and WTI could reflect that global recovery remains on course.

Oil fell on Monday after U.S. airlines called off thousands of flights over the Christmas holidays amid surging COVID-19 cases, though losses were capped by hopes that the Omicron variant will have limited impact on global demand.

More than 1,300 flights were cancelled by U.S. airlines on Sunday as COVID-19 reduced the number of available crews while several cruise ships had to cancel stops. read more

U.S. West Texas Intermediate (WTI) crude was down $1.20, or 1.6%, at $72.59 a barrel by 1222 GMT. The U.S. market was closed on Friday for a holiday. Global benchmark Brent crude fell 8 cents, or 0.1%, to $76.06.

"Lower travel equalling lower economic activity in the U.S. equals lower WTI," said Jeffrey Halley, analyst at brokerage OANDA, who added that the divergence between Brent and WTI could reflect that global recovery remains on course.

#AbuDhabi's ADGM to adopt Monday to Friday working week

Abu Dhabi's ADGM to adopt Monday to Friday working week

Abu Dhabi Global Market will switch its working week to Monday to Friday from January 1 in line with the federal government’s move to change the official weekend in the UAE.

The move is expected to align the UAE’s economy and its businesses with global markets.

“With the working week in sync with the rest of the global markets, new and more market participants can benefit from the vast business opportunities and investment possibilities in the UAE and wider Mena [Middle East and North Africa] region with ADGM as their nexus to growth,” Ahmed Al Zaabi, chairman of ADGM, said.

Many global and local banks have opted to switch their working week following the official shift. First Abu Dhabi, the UAE’s largest lender by assets, as well as Dubai Financial Market and Abu Dhabi Securities Exchange, are also adopting Monday to Friday working week beginning January 3.

Abu Dhabi Global Market will switch its working week to Monday to Friday from January 1 in line with the federal government’s move to change the official weekend in the UAE.

The move is expected to align the UAE’s economy and its businesses with global markets.

“With the working week in sync with the rest of the global markets, new and more market participants can benefit from the vast business opportunities and investment possibilities in the UAE and wider Mena [Middle East and North Africa] region with ADGM as their nexus to growth,” Ahmed Al Zaabi, chairman of ADGM, said.

Many global and local banks have opted to switch their working week following the official shift. First Abu Dhabi, the UAE’s largest lender by assets, as well as Dubai Financial Market and Abu Dhabi Securities Exchange, are also adopting Monday to Friday working week beginning January 3.

Most Gulf bourses fall as Omicron concerns weigh | Reuters

Most Gulf bourses fall as Omicron concerns weigh | Reuters

Most stock markets in the Gulf fell in early trade on Monday, with the Saudi index leading the losses, as uncertainty over the economic impact of the Omicron coronavirus variant weighed on investor sentiment.

Coronavirus infections have started rising again across the six Gulf Arab states after months of low or falling figures, data from health ministries showed on Thursday. read more

Saudi Arabia's benchmark index (.TASI) dropped 0.7%, with Al Rajhi Bank (1120.SE) losing 0.6% and Saudi National Bank (1180.SE), the kingdom's largest lender, retreating 1%.

Saudi health authorities advised citizens and residents last week to avoid all unnecessary foreign travel. The kingdom reported its first Omicron case on Dec. 1.

Oil prices, a key catalyst for the Gulf's financial markets, fell after airlines called off thousands of flights in the United States over the Christmas holidays amid surging COVID-19 infections.

In Abu Dhabi, the index (.ADI) edged 0.1% lower, hit by a 0.7% fall in Alpha Dhabi Holding (ALPHADHABI.AD).

The United Arab Emirates (UAE) has seen a sharp increase in COVID-19 infections since announcing the arrival of Omicron early this month, with 1,803 cases of coronavirus recorded on Sunday, up from 68 on Dec. 2.

The resurgence comes during the region's peak tourism season, especially in the UAE which is welcoming millions of visitors to the Expo 2020 Dubai world fair and other seasonal events.

Separately, the UAE government has told some of its biggest business families that it plans to remove their monopolies on the sale of imported goods, Reuters reported on Sunday, citing the Financial Times. read more

Over the past year, the UAE, a growing economic rival of Saudi Arabia, has taken measures to make its economy more attractive to foreign investors and talent.

Dubai's main share index (.DFMGI) firmed 0.1%, helped by a 0.4% increase in blue-chip developer Emaar Properties (EMAR.DU).

The Qatari benchmark (.QSI) eased 0.1%, with petrochemical maker Industries Qatar (IQCD.QA) declining 0.7%.

Most stock markets in the Gulf fell in early trade on Monday, with the Saudi index leading the losses, as uncertainty over the economic impact of the Omicron coronavirus variant weighed on investor sentiment.

Coronavirus infections have started rising again across the six Gulf Arab states after months of low or falling figures, data from health ministries showed on Thursday. read more

Saudi Arabia's benchmark index (.TASI) dropped 0.7%, with Al Rajhi Bank (1120.SE) losing 0.6% and Saudi National Bank (1180.SE), the kingdom's largest lender, retreating 1%.

Saudi health authorities advised citizens and residents last week to avoid all unnecessary foreign travel. The kingdom reported its first Omicron case on Dec. 1.

Oil prices, a key catalyst for the Gulf's financial markets, fell after airlines called off thousands of flights in the United States over the Christmas holidays amid surging COVID-19 infections.

In Abu Dhabi, the index (.ADI) edged 0.1% lower, hit by a 0.7% fall in Alpha Dhabi Holding (ALPHADHABI.AD).

The United Arab Emirates (UAE) has seen a sharp increase in COVID-19 infections since announcing the arrival of Omicron early this month, with 1,803 cases of coronavirus recorded on Sunday, up from 68 on Dec. 2.

The resurgence comes during the region's peak tourism season, especially in the UAE which is welcoming millions of visitors to the Expo 2020 Dubai world fair and other seasonal events.

Separately, the UAE government has told some of its biggest business families that it plans to remove their monopolies on the sale of imported goods, Reuters reported on Sunday, citing the Financial Times. read more

Over the past year, the UAE, a growing economic rival of Saudi Arabia, has taken measures to make its economy more attractive to foreign investors and talent.

Dubai's main share index (.DFMGI) firmed 0.1%, helped by a 0.4% increase in blue-chip developer Emaar Properties (EMAR.DU).

The Qatari benchmark (.QSI) eased 0.1%, with petrochemical maker Industries Qatar (IQCD.QA) declining 0.7%.

Oil Prices and Supply: OPEC Should Expect More Turbulent Years Ahead - Bloomberg

Oil Prices and Supply: OPEC Should Expect More Turbulent Years Ahead - Bloomberg

The OPEC+ group of oil producers celebrated their fifth birthday in early December. It’s been a turbulent time — more so than they could have imagined when they first came together to face the threat posed by the U.S. shale boom back in 2016 — and the future doesn’t look much easier.

On the verge of collapse in 2020, OPEC+ was saved by the Covid-19 pandemic and the need for a coordinated response to oil-supply management in the face of an unprecedented slump in demand. They have risen to that challenge with remarkable cohesion. Their next one will be continuing to stick together as the world’s need for oil tests their production limits.

Faced with a slump in oil prices, which had fallen from $110 a barrel in mid-2014 to less than $30 by early 2016, and soaring oil stockpiles, the 13 members of the Organization of Petroleum Exporting Countries agreed in November 2016 to cut production by 1.2 million barrels a day and called on non-member countries to support them with additional reductions.

A group of 11 countries — including the three biggest former-Soviet producers, Russia, Kazakhstan and Azerbaijan — agreed to reduce their collective output by almost 560,000 barrels a day from the start of 2017.

The OPEC+ group of oil producers celebrated their fifth birthday in early December. It’s been a turbulent time — more so than they could have imagined when they first came together to face the threat posed by the U.S. shale boom back in 2016 — and the future doesn’t look much easier.

On the verge of collapse in 2020, OPEC+ was saved by the Covid-19 pandemic and the need for a coordinated response to oil-supply management in the face of an unprecedented slump in demand. They have risen to that challenge with remarkable cohesion. Their next one will be continuing to stick together as the world’s need for oil tests their production limits.

Faced with a slump in oil prices, which had fallen from $110 a barrel in mid-2014 to less than $30 by early 2016, and soaring oil stockpiles, the 13 members of the Organization of Petroleum Exporting Countries agreed in November 2016 to cut production by 1.2 million barrels a day and called on non-member countries to support them with additional reductions.

A group of 11 countries — including the three biggest former-Soviet producers, Russia, Kazakhstan and Azerbaijan — agreed to reduce their collective output by almost 560,000 barrels a day from the start of 2017.

Binance Gets Its First Gulf Crypto Regulatory Nod in #Bahrain - Bloomberg

Binance Gets Its First Gulf Crypto Regulatory Nod in Bahrain - Bloomberg

Binance Holdings Ltd. received in-principle approval from Bahrain’s central bank to be a crypto-asset service provider in the kingdom, according to a statement from the company.

Binance, the world’s largest cryptocurrency exchange by trading volume, still needs to complete a full application process, Chief Executive Officer Changpeng “CZ” Zhao wrote in an email to Bloomberg News. He said that would be completed “in due course.”

If successful, this would mark the first regulatory approval for a Binance entity within the Middle East or North Africa. The exchange has been attempting to expand its regional footprint, particularly in the Gulf, as executives prepare to set up a potential headquarters.

“I am grateful for the support from the Central Bank of Bahrain and the broader Bahraini ecosystem during the process,” Zhao wrote in the email.

Binance Holdings Ltd. received in-principle approval from Bahrain’s central bank to be a crypto-asset service provider in the kingdom, according to a statement from the company.

Binance, the world’s largest cryptocurrency exchange by trading volume, still needs to complete a full application process, Chief Executive Officer Changpeng “CZ” Zhao wrote in an email to Bloomberg News. He said that would be completed “in due course.”

If successful, this would mark the first regulatory approval for a Binance entity within the Middle East or North Africa. The exchange has been attempting to expand its regional footprint, particularly in the Gulf, as executives prepare to set up a potential headquarters.

“I am grateful for the support from the Central Bank of Bahrain and the broader Bahraini ecosystem during the process,” Zhao wrote in the email.

#UAE central bank imposes heavy fine on exchange house | ZAWYA MENA Edition

UAE central bank imposes heavy fine on exchange house | ZAWYA MENA Edition

The Central Bank of the UAE (CBUAE) imposed a financial sanction of AED 352,000 ($95,854) on an exchange house operating in the country, due to it failures to achieve appropriate levels of compliance related to Anti-Money Laundering (AML) and Sanctions Compliance Framework as per the deadlines specified by the law.

The penalty was imposed pursuant to Article 14 of the Federal Decree Law No. (20) of 2018 on Anti-Money Laundering and Combatting the Financing of Terrorism and Financing of Illegal Organisations (AML/CFT Law)

According to a statement from the central bank, a sufficient period was provided for all exchange houses operating in the UAE to remedy any shortcomings and ensure compliance in accordance with the Federal Decree Law No. (20) Of 2018 and its executive regulation. All exchange houses were informed that further shortcomings would result in penalties as specified by law.

CBUAE will continue to work closely with all financial institutions in the UAE to achieve and maintain high levels of AML/CFT compliance and will continue to impose further administrative and/or financial sanctions, according to the law, in cases of non-compliance, the statement said.

The Central Bank of the UAE (CBUAE) imposed a financial sanction of AED 352,000 ($95,854) on an exchange house operating in the country, due to it failures to achieve appropriate levels of compliance related to Anti-Money Laundering (AML) and Sanctions Compliance Framework as per the deadlines specified by the law.

The penalty was imposed pursuant to Article 14 of the Federal Decree Law No. (20) of 2018 on Anti-Money Laundering and Combatting the Financing of Terrorism and Financing of Illegal Organisations (AML/CFT Law)

According to a statement from the central bank, a sufficient period was provided for all exchange houses operating in the UAE to remedy any shortcomings and ensure compliance in accordance with the Federal Decree Law No. (20) Of 2018 and its executive regulation. All exchange houses were informed that further shortcomings would result in penalties as specified by law.

CBUAE will continue to work closely with all financial institutions in the UAE to achieve and maintain high levels of AML/CFT compliance and will continue to impose further administrative and/or financial sanctions, according to the law, in cases of non-compliance, the statement said.

#AbuDhabi, #Saudi lead 2021 Gulf bourse rebound | ZAWYA MENA Edition

Abu Dhabi, Saudi lead 2021 Gulf bourse rebound | ZAWYA MENA Edition

Gulf stock markets surged to milestone highs in late 2021, but some of these gains ebbed somewhat as oil prices lowered from a three-year peak and fears over a more virulent COVID strain convinced traders to book profits.

Nevertheless, this year represents a remarkable turnaround for regional bourses. The oil price surge delivered higher-than-expected revenue for Gulf governments, giving them more financial firepower to enact post-COVID economic recovery and reform plans, said Ali El Adou, Head of Asset Management at Daman Investments, Dubai.

Positive sentiment over high vaccination rates and effective governmental responses to the pandemic, especially in the United Arab Emirates, bolstered investor confidence and helped fuel the 2021 Gulf market rebound.

“Abu Dhabi and Saudi have been the top performers this year, driven by government consolidation of businesses to create bigger companies that serve their long-term interests,” said Mohammed Ali Yasin, Chief Strategy Officer at Al Dhabi Capital, Abu Dhabi.

Gulf stock markets surged to milestone highs in late 2021, but some of these gains ebbed somewhat as oil prices lowered from a three-year peak and fears over a more virulent COVID strain convinced traders to book profits.

Nevertheless, this year represents a remarkable turnaround for regional bourses. The oil price surge delivered higher-than-expected revenue for Gulf governments, giving them more financial firepower to enact post-COVID economic recovery and reform plans, said Ali El Adou, Head of Asset Management at Daman Investments, Dubai.

Positive sentiment over high vaccination rates and effective governmental responses to the pandemic, especially in the United Arab Emirates, bolstered investor confidence and helped fuel the 2021 Gulf market rebound.

“Abu Dhabi and Saudi have been the top performers this year, driven by government consolidation of businesses to create bigger companies that serve their long-term interests,” said Mohammed Ali Yasin, Chief Strategy Officer at Al Dhabi Capital, Abu Dhabi.

Doha Bank secures $762.5 million syndicated loan | Reuters

Doha Bank secures $762.5 million syndicated loan | Reuters

Doha Bank (DOBK.QA) said on Monday it had secured a three-year $762.5 million syndicated loan coordinated by Mizuho (8411.T) and Intesa Sanpaolo (ISP.MI) for general corporate and working capital purposes.

A group of 16 banks offered the loan, which can be extended by an additional year, pays a margin of 85 basis points annually over the London Interbank Offered Rate based on U.S. dollar, and was drawn in full on Dec. 23. Doha Bank did not name the other lenders.

"Launched in November, the Facility was originally targeting deal size of US$350,000,000," Doha Bank said in a bourse filing.

It was upsized after strong interest from existing and new relationship banks in the EMEA (Europe, the Middle East and Africa) and Asia regions, the Qatari lender said.

In March, Doha Bank raised a $685 million loan and sold $500 million in five-year bonds.

Fitch placed Doha Bank and other Qatari lenders on "rating watch negative" in October, citing increasing reliance on external funding and recent rapid asset growth. read more

Doha Bank (DOBK.QA) said on Monday it had secured a three-year $762.5 million syndicated loan coordinated by Mizuho (8411.T) and Intesa Sanpaolo (ISP.MI) for general corporate and working capital purposes.

A group of 16 banks offered the loan, which can be extended by an additional year, pays a margin of 85 basis points annually over the London Interbank Offered Rate based on U.S. dollar, and was drawn in full on Dec. 23. Doha Bank did not name the other lenders.

"Launched in November, the Facility was originally targeting deal size of US$350,000,000," Doha Bank said in a bourse filing.

It was upsized after strong interest from existing and new relationship banks in the EMEA (Europe, the Middle East and Africa) and Asia regions, the Qatari lender said.

In March, Doha Bank raised a $685 million loan and sold $500 million in five-year bonds.

Fitch placed Doha Bank and other Qatari lenders on "rating watch negative" in October, citing increasing reliance on external funding and recent rapid asset growth. read more

Subscribe to:

Comments (Atom)