Russia Ready to Cut Production, Putting Global Oil Deal in Sight - Bloomberg:

Russia is ready to make a deep cut in oil production, putting a global output deal within reach, as pressure mounts on oil-exporting countries to mitigate the worsening demand impact of the corona virus crisis.

An emergency meeting of the OPEC+ coalition on Thursday will discuss a “massive output reduction,” Algerian Energy Minister Mohamed Arkab, who holds OPEC’s rotating presidency, told the state news agency. His statement came as Russia’s energy ministry said Moscow is ready to reduce output by 1.6 million barrels a day, or about 15%, as part of a deal that includes producers in OPEC+ and beyond. On Friday, oil ministers from G-20 countries will discuss whether to make their own contributions.

President Donald Trump has put huge diplomatic pressure on Russia and Saudi Arabia, the world’s two largest exporters, to end a monthlong price war and rein in production. What happens Thursday could bend the fortunes of energy players across the globe, from Big Oil and U.S. shale companies, to petro-states such as Nigeria and Kazakhstan.

Solely aggregation of news articles, with no opinions expressed by this service since 2009 launch on this platform. Copyright to all articles remains with the original publisher and HEADLINES ARE CLICKABLE to access the whole article at source. (Subscription by email is recommended,with real-time updates on LinkedIn and Twitter.)

Search This Blog

Wednesday, 8 April 2020

Oil Climbs After Russia Signals Willingness to Cut Production - Bloomberg

Oil Climbs After Russia Signals Willingness to Cut Production - Bloomberg:

Oil posted its first gain of the week just before the world’s top producers meet to discuss potential output cuts against of backdrop of demand destruction from the coronavirus.

Futures in New York rose 6.2% on Wednesday after a volatile session that saw prices rise as much as 12%. Oil is drawing support from investors who are focused on plans being ironed out by Saudi Arabia and Russia for a global supply-curb agreement at the OPEC+ emergency virtual meeting on Thursday. Russia earlier said it is ready to cut oil production by 1.6 million barrels a day, or 14% of its output.

“Fundamentals are the driving force in this market, whether it be the demand or supply-side,” said Peter McGinn, market strategist at RJ O’Brien & Associates LLC in Chicago. While the OPEC+ production cuts are welcome, the real question is when will demand return, he added.

Oil posted its first gain of the week just before the world’s top producers meet to discuss potential output cuts against of backdrop of demand destruction from the coronavirus.

Futures in New York rose 6.2% on Wednesday after a volatile session that saw prices rise as much as 12%. Oil is drawing support from investors who are focused on plans being ironed out by Saudi Arabia and Russia for a global supply-curb agreement at the OPEC+ emergency virtual meeting on Thursday. Russia earlier said it is ready to cut oil production by 1.6 million barrels a day, or 14% of its output.

“Fundamentals are the driving force in this market, whether it be the demand or supply-side,” said Peter McGinn, market strategist at RJ O’Brien & Associates LLC in Chicago. While the OPEC+ production cuts are welcome, the real question is when will demand return, he added.

#UAE-based NMC heads to administration after bowing to creditor demands - Arabianbusiness

UAE-based NMC heads to administration after bowing to creditor demands - Arabianbusiness:

NMC Health Plc has bowed to creditor demands to be placed into administration, saying it’s in no position to contest Abu Dhabi Commercial Bank PJSC’s efforts to install new management.

The troubled Middle Eastern hospital operator said on the eve of a London court hearing that it expects to be placed into administration “in due course”. NMC’s new executive chairman, Faisal Belhoul, had resisted creditors arguing that such a move would endanger lives as the coronavirus spreads across the United Arab Emirates.

However, Belhoul said late Wednesday: “The board of NMC Health has written to the court indicating that, notwithstanding strenuous efforts to address creditors’ concerns, it has not been able to secure their alignment and support and has been advised by its counsel that it is not in a position to oppose the application. Accordingly, the board expects the company to be placed into administration in due course.

“Realising regrettably that administration has become a certain outcome, I must now underscore that it is critical that the administration process is conducted quickly and smoothly, with the core objective of keeping the organisation stable and in a position to provide vital medical care to support the people, the government and the nation of the UAE during the Covid-19 pandemic."

NMC Health Plc has bowed to creditor demands to be placed into administration, saying it’s in no position to contest Abu Dhabi Commercial Bank PJSC’s efforts to install new management.

The troubled Middle Eastern hospital operator said on the eve of a London court hearing that it expects to be placed into administration “in due course”. NMC’s new executive chairman, Faisal Belhoul, had resisted creditors arguing that such a move would endanger lives as the coronavirus spreads across the United Arab Emirates.

However, Belhoul said late Wednesday: “The board of NMC Health has written to the court indicating that, notwithstanding strenuous efforts to address creditors’ concerns, it has not been able to secure their alignment and support and has been advised by its counsel that it is not in a position to oppose the application. Accordingly, the board expects the company to be placed into administration in due course.

“Realising regrettably that administration has become a certain outcome, I must now underscore that it is critical that the administration process is conducted quickly and smoothly, with the core objective of keeping the organisation stable and in a position to provide vital medical care to support the people, the government and the nation of the UAE during the Covid-19 pandemic."

Coronavirus Leaves #UAE, #Qatar, #SaudiArabia Expats in Limbo - Bloomberg

Coronavirus Leaves UAE, Qatar, Saudi Arabia Expats in Limbo - Bloomberg:

The combined shock of collapsing oil prices and the coronavirus pandemic is forcing the Arab Gulf monarchies to rethink their policies toward the majority of the region’s private-sector workers: expatriates.

The deepest peacetime recession since the 1930s is claiming millions of jobs worldwide, but in the $1.6 trillion Gulf economy job loss typically compromises everything from immigration status to the ability to open a bank account, rent an apartment or get a phone line, all of which often require employer permission. Comprising some 30 million people, virtually all foreign workers have no clear route to attain permanent residency or citizenship.

Mass layoffs pose “a huge risk,” said Karen Young, a resident scholar covering the Middle East at the American Enterprise Institute in Washington. In countries like the United Arab Emirates and Qatar, “the entire domestic, service-sector economy depends on expatriates’ consumption: spending money, going to restaurants, retail.”

The combined shock of collapsing oil prices and the coronavirus pandemic is forcing the Arab Gulf monarchies to rethink their policies toward the majority of the region’s private-sector workers: expatriates.

The deepest peacetime recession since the 1930s is claiming millions of jobs worldwide, but in the $1.6 trillion Gulf economy job loss typically compromises everything from immigration status to the ability to open a bank account, rent an apartment or get a phone line, all of which often require employer permission. Comprising some 30 million people, virtually all foreign workers have no clear route to attain permanent residency or citizenship.

Mass layoffs pose “a huge risk,” said Karen Young, a resident scholar covering the Middle East at the American Enterprise Institute in Washington. In countries like the United Arab Emirates and Qatar, “the entire domestic, service-sector economy depends on expatriates’ consumption: spending money, going to restaurants, retail.”

OPEC, Energy News: #Saudi Crude Oil Armada Heads for U.S. - Bloomberg

OPEC, Energy News: Saudi Crude Oil Armada Heads for U.S. - Bloomberg:

On the final day of March, the supertanker Newton, loaded with crude from Saudi Arabia, did something rarely seen in the world of oil trading: it abruptly diverted from its original destination, Egypt, setting sail for the U.S. Gulf Coast instead.

The Newton is just part of a flood of Saudi crude that’s headed for the U.S., with oil prices near the lowest levels in almost two decades. And it occurs as President Trump’s administration considers tariffs on imports of oil from OPEC’s largest producer.

Saudi crude exports to the U.S. in March jumped to at least 516,000 barrels a day, the highest in a year, according to tanker-tracking data compiled by Bloomberg. So far in April, at least seven supertankers have left Saudi Arabia for America’s Gulf Coast, and another is expected to load in the coming days. Almost all of the vessels are chartered by Bahri, the Saudi national shipping company, fixture data show.

On the final day of March, the supertanker Newton, loaded with crude from Saudi Arabia, did something rarely seen in the world of oil trading: it abruptly diverted from its original destination, Egypt, setting sail for the U.S. Gulf Coast instead.

The Newton is just part of a flood of Saudi crude that’s headed for the U.S., with oil prices near the lowest levels in almost two decades. And it occurs as President Trump’s administration considers tariffs on imports of oil from OPEC’s largest producer.

Saudi crude exports to the U.S. in March jumped to at least 516,000 barrels a day, the highest in a year, according to tanker-tracking data compiled by Bloomberg. So far in April, at least seven supertankers have left Saudi Arabia for America’s Gulf Coast, and another is expected to load in the coming days. Almost all of the vessels are chartered by Bahri, the Saudi national shipping company, fixture data show.

#UAE, #AbuDhabi News: NMC Health Insolvency Proceedings Inevitable - Bloomberg

UAE, Abu Dhabi News: NMC Health Insolvency Proceedings Inevitable - Bloomberg:

NMC Health Plc bowed to creditor demands to be placed into administration, saying it’s in no position to contest Abu Dhabi Commercial Bank PJSC’s efforts to install new management.

The troubled Middle Eastern hospital operator said on the eve of a London court hearing that it expects to be placed into administration “in due course.” NMC’s new chairman had resisted creditors arguing that such a move would endanger lives as the coronavirus spreads across the United Arab Emirates.

London-listed NMC, founded by Indian entrepreneur Bavaguthu Raghuram Shetty, had seen its stock plunge before it was suspended from trading amid allegations of fraud. Most of NMC’s senior management has resigned since it revealed more than $4 billion of undisclosed debt. The company was also dropped from the FTSE 100 index.

“Although a setback for regional markets, the outcome of this court process will set an important precedent,” said Ahmad Alanani, chief executive of Sancta Capital, a Dubai-based investor focused on special situations in the Middle East. “We hope that an administration will ultimately cleanse NMC’s balance sheet, identify the culprits behind this staggering default and help the business move past these events constructively.”

NMC Health Plc bowed to creditor demands to be placed into administration, saying it’s in no position to contest Abu Dhabi Commercial Bank PJSC’s efforts to install new management.

The troubled Middle Eastern hospital operator said on the eve of a London court hearing that it expects to be placed into administration “in due course.” NMC’s new chairman had resisted creditors arguing that such a move would endanger lives as the coronavirus spreads across the United Arab Emirates.

London-listed NMC, founded by Indian entrepreneur Bavaguthu Raghuram Shetty, had seen its stock plunge before it was suspended from trading amid allegations of fraud. Most of NMC’s senior management has resigned since it revealed more than $4 billion of undisclosed debt. The company was also dropped from the FTSE 100 index.

“Although a setback for regional markets, the outcome of this court process will set an important precedent,” said Ahmad Alanani, chief executive of Sancta Capital, a Dubai-based investor focused on special situations in the Middle East. “We hope that an administration will ultimately cleanse NMC’s balance sheet, identify the culprits behind this staggering default and help the business move past these events constructively.”

#SaudiArabia News: Wealth Fund Invests $200 Million in Equinor - Bloomberg

Saudi Arabia News: Wealth Fund Invests $200 Million in Equinor - Bloomberg:

Saudi Arabia’s sovereign wealth fund built a stake worth about $200 million in Equinor ASA as the kingdom navigates the impact of the coronavirus pandemic and plummeting crude prices.

The Public Investment Fund amassed its holding in Norway’s largest crude producer mostly through the open market some time last week, according to people with knowledge of the matter. Though it’s not clear exactly when the PIF bought the holding and if the fund is still buying shares, the people said, asking not to be identified as the matter is private.

Saudi Arabia’s $320 billion sovereign wealth fund, run by Yasir Al-Rumayyan and controlled by Crown Prince Mohammed bin Salman, is taking advantage of a slump in stock market valuations as it steps up deal-making to become the world’s biggest manager of sovereign capital. The fund last month built an 8.2% stake in cruise operator Carnival Corp. after shares slumped due to the fallout of the coronavirus pandemic.

Representatives for the PIF and Equinor declined to comment.

Saudi Arabia’s sovereign wealth fund built a stake worth about $200 million in Equinor ASA as the kingdom navigates the impact of the coronavirus pandemic and plummeting crude prices.

The Public Investment Fund amassed its holding in Norway’s largest crude producer mostly through the open market some time last week, according to people with knowledge of the matter. Though it’s not clear exactly when the PIF bought the holding and if the fund is still buying shares, the people said, asking not to be identified as the matter is private.

Saudi Arabia’s $320 billion sovereign wealth fund, run by Yasir Al-Rumayyan and controlled by Crown Prince Mohammed bin Salman, is taking advantage of a slump in stock market valuations as it steps up deal-making to become the world’s biggest manager of sovereign capital. The fund last month built an 8.2% stake in cruise operator Carnival Corp. after shares slumped due to the fallout of the coronavirus pandemic.

Representatives for the PIF and Equinor declined to comment.

MIDEAST STOCKS-Gulf stocks end mixed, #Saudi edges up ahead of OPEC+ meet - Reuters

MIDEAST STOCKS-Gulf stocks end mixed, Saudi edges up ahead of OPEC+ meet - Reuters:

Stock markets in the United Arab

Emirates backtracked from two sessions of gains on Wednesday as

investors fled risk on coronavirus fears, while Saudi equities

edged up ahead of an OPEC+ meeting on output cuts.

Dubai's main share index dropped 1%, with blue chip

developer Emaar Properties declining 2.6% and Dubai

Islamic Bank losing 1.9%.

In Abu Dhabi, the index lost 1.6%. First Abu Dhabi

Bank slid 2.9%, while Abu Dhabi Commercial Bank

was down 1.5%.

Ratings agency Moody's had said on Tuesday a $70 billion UAE

stimulus package will support bank liquidity and limit likely

asset deterioration due to the coronavirus outbreak, but will

increase the potential for problem loans.

As of April 7, the UAE had registered a total of 2,359

cases. The pandemic has forced vital sectors of its economy,

such as tourism and transport, to a near standstill.

Qatar's index added 0.6%, helped by a 0.6% rise in

Qatar Fuel Co and a 1.2% gain in Qatar International

Islamic Bank.

Stock markets in the United Arab

Emirates backtracked from two sessions of gains on Wednesday as

investors fled risk on coronavirus fears, while Saudi equities

edged up ahead of an OPEC+ meeting on output cuts.

Dubai's main share index dropped 1%, with blue chip

developer Emaar Properties declining 2.6% and Dubai

Islamic Bank losing 1.9%.

In Abu Dhabi, the index lost 1.6%. First Abu Dhabi

Bank slid 2.9%, while Abu Dhabi Commercial Bank

was down 1.5%.

Ratings agency Moody's had said on Tuesday a $70 billion UAE

stimulus package will support bank liquidity and limit likely

asset deterioration due to the coronavirus outbreak, but will

increase the potential for problem loans.

As of April 7, the UAE had registered a total of 2,359

cases. The pandemic has forced vital sectors of its economy,

such as tourism and transport, to a near standstill.

Qatar's index added 0.6%, helped by a 0.6% rise in

Qatar Fuel Co and a 1.2% gain in Qatar International

Islamic Bank.

Al Rajhi Capital raises Aramco target price to SAR 35/share | ZAWYA MENA Edition

Al Rajhi Capital raises Aramco target price to SAR 35/share | ZAWYA MENA Edition:

As Aramco's unique dividend arrangement makes its value broadly unaffected by current volatility in oil price, holding the stock could give a much-desired stability in these uncertain times, said Al Rajhi Capital in a new report.

This is because Aramco’s dividend prioritization of pro rata $75 billion for 2020-24 to non-government shareholders which comes to approximately $1.3 billion based on calculations, is easily manageable given Aramco’s extremely low cost of production, it noted.

This implies a dividend yield of about 5 percent based on a traded price of 31.95 as on Monday.

Al Rajhi Capital has raised the target price for Aramco to 35 Saudi riyals per share. The stock was initiated at a fair price of 37.50 riyals per share in January.

As Aramco's unique dividend arrangement makes its value broadly unaffected by current volatility in oil price, holding the stock could give a much-desired stability in these uncertain times, said Al Rajhi Capital in a new report.

This is because Aramco’s dividend prioritization of pro rata $75 billion for 2020-24 to non-government shareholders which comes to approximately $1.3 billion based on calculations, is easily manageable given Aramco’s extremely low cost of production, it noted.

This implies a dividend yield of about 5 percent based on a traded price of 31.95 as on Monday.

Al Rajhi Capital has raised the target price for Aramco to 35 Saudi riyals per share. The stock was initiated at a fair price of 37.50 riyals per share in January.

World's biggest oil producers still at odds before talks on major cuts - Reuters

World's biggest oil producers still at odds before talks on major cuts - Reuters:

The world’s top oil producers Saudi Arabia, Russia and the United States still seemed at odds on Wednesday before this week’s meetings on potentially big output cuts to shore up crude prices that have been hammered by the coronavirus crisis.

Saudi Arabia and Russia, which fell out when a previous pact on curbing supplies collapsed in March, have signalled they could agree deep cuts to crude output but only if the United States and others outside a group known as OPEC+ joined in.

But the U.S. Department of Energy said on Tuesday that U.S. output was already falling without government action, echoing views from the White House that it would not intervene, even as global demand for crude has plunged by as much as 30%.

U.S. President Donald Trump said last week a deal he had brokered with Saudi Arabia and Russia could lead to cuts of as much as 15% of global supplies, an unprecedented level.

The world’s top oil producers Saudi Arabia, Russia and the United States still seemed at odds on Wednesday before this week’s meetings on potentially big output cuts to shore up crude prices that have been hammered by the coronavirus crisis.

Saudi Arabia and Russia, which fell out when a previous pact on curbing supplies collapsed in March, have signalled they could agree deep cuts to crude output but only if the United States and others outside a group known as OPEC+ joined in.

But the U.S. Department of Energy said on Tuesday that U.S. output was already falling without government action, echoing views from the White House that it would not intervene, even as global demand for crude has plunged by as much as 30%.

U.S. President Donald Trump said last week a deal he had brokered with Saudi Arabia and Russia could lead to cuts of as much as 15% of global supplies, an unprecedented level.

#AbuDhabi gets more than $25 bln in orders for triple-tranche bonds - sources - Reuters

Abu Dhabi gets more than $25 bln in orders for triple-tranche bonds - sources - Reuters:

Abu Dhabi has received more than $25 billion in combined orders for a planned issue of dollar-denominated bonds in tranches of five, 10 and 30 years, two sources said on Wednesday.

The emirate has given initial price guidance of around 265 basis points over U.S. Treasuries for the five-year tranche, around 285 bps over the same benchmark for the 10-year tranche, and around 4.55% for the 30-year notes. The deal is expected to close later on Wednesday.

Abu Dhabi has received more than $25 billion in combined orders for a planned issue of dollar-denominated bonds in tranches of five, 10 and 30 years, two sources said on Wednesday.

The emirate has given initial price guidance of around 265 basis points over U.S. Treasuries for the five-year tranche, around 285 bps over the same benchmark for the 10-year tranche, and around 4.55% for the 30-year notes. The deal is expected to close later on Wednesday.

Slow recovery predicted for aviation industry after Covid-19 restrictions end, experts warn - Arabianbusiness

Slow recovery predicted for aviation industry after Covid-19 restrictions end, experts warn - Arabianbusiness:

Rather than spike in the aftermath of Covid-19 restrictions, passenger travel and tourism is likely to resume very slowly and in stages as various destinations lift restrictions at different times, according to experts.

Early on in the coronavirus pandemic, some experts predicted that passenger travel would see a quick resurgence as a result of high demand after weeks of restrictions. On March 22, for example, Matthew Sliedrecht, the marketing director at online travel portal Cleartrip, said that “we may see this Eid as one of the largest travel seasons in history”.

Now, however, experts are warning that the flow of passengers is likely to begin as a trickle as a result of varied national timelines for lifting restrictions and a general sense of uncertainty about travel that will continue for some time.

“The key to international travel taking off again is what happens in each country, and the answer to that will vary from country to country and from region to region while countries and airlines figure out how to safely move people,” said Ross Veitch, the co-founder and CEO of Dubai and Singapore-based online travel marketplace Wego.

Rather than spike in the aftermath of Covid-19 restrictions, passenger travel and tourism is likely to resume very slowly and in stages as various destinations lift restrictions at different times, according to experts.

Early on in the coronavirus pandemic, some experts predicted that passenger travel would see a quick resurgence as a result of high demand after weeks of restrictions. On March 22, for example, Matthew Sliedrecht, the marketing director at online travel portal Cleartrip, said that “we may see this Eid as one of the largest travel seasons in history”.

Now, however, experts are warning that the flow of passengers is likely to begin as a trickle as a result of varied national timelines for lifting restrictions and a general sense of uncertainty about travel that will continue for some time.

“The key to international travel taking off again is what happens in each country, and the answer to that will vary from country to country and from region to region while countries and airlines figure out how to safely move people,” said Ross Veitch, the co-founder and CEO of Dubai and Singapore-based online travel marketplace Wego.

Iran says US oil production must be known before OPEC+ call

Iran says US oil production must be known before OPEC+ call:

Iran demanded on Wednesday that U.S. oil production levels must be known before an upcoming OPEC meeting with Russia and others seeking to boost global energy prices.

The meeting of the so-called OPEC+ is scheduled to be held Thursday after officials delayed it following Saudi Arabia criticizing Russia over its comments about the price collapse.

A meeting in March saw OPEC and other nations led by Russia fail to agree to a production cut as the ongoing coronavirus pandemic has drastically cut demand for oil. In the time since, prices have collapsed. International benchmark Brent crude traded Wednesday over $34 a barrel as U.S. benchmark West Texas crude traded under $25.

Iran demanded on Wednesday that U.S. oil production levels must be known before an upcoming OPEC meeting with Russia and others seeking to boost global energy prices.

The meeting of the so-called OPEC+ is scheduled to be held Thursday after officials delayed it following Saudi Arabia criticizing Russia over its comments about the price collapse.

A meeting in March saw OPEC and other nations led by Russia fail to agree to a production cut as the ongoing coronavirus pandemic has drastically cut demand for oil. In the time since, prices have collapsed. International benchmark Brent crude traded Wednesday over $34 a barrel as U.S. benchmark West Texas crude traded under $25.

Oil futures pare gains after U.S. inventories surge most on record - Reuters

Oil futures pare gains after U.S. inventories surge most on record - Reuters:

Oil prices pulled back Wednesday, with benchmark Brent turning negative as U.S. crude inventories surged the most on record, but the pullback was muted by hopes that a meeting between OPEC and allied producers on Thursday will trigger output cuts.

U.S. crude inventories rose 15.2 million barrels in the week, the most on record, as refiners slashed runs and the storage hub at Cushing filled more quickly than expected, the U.S. Energy Information Administration said in a weekly report on Wednesday.

Demand has fallen as the coronavirus outbreak forced closures of businesses and schools.

“There are multiple bad angles: Refining utilization. Crude stockpiles. Cushing is crazy - that’s a gigantic number,” said Bob Yawger, director of energy futures at Mizuho in New York. The Cushing, Oklahoma, storage hub, which serves as the delivery point for the New York Mercantile Exchange U.S. oil futures contract, is on pace to be full in three weeks if this week’s gain is repeated, Yawger said.

Brent crude LCOc1 was down 11 cents, or 0.3%, at $31.76 by 11:06 a.m. EDT (1506 GMT). U.S. West Texas Intermediate (WTI) crude CLc1 rose 63 cents to $24.26 a barrel, after earlier trading as high as $25.29 a barrel.

Oil prices pulled back Wednesday, with benchmark Brent turning negative as U.S. crude inventories surged the most on record, but the pullback was muted by hopes that a meeting between OPEC and allied producers on Thursday will trigger output cuts.

U.S. crude inventories rose 15.2 million barrels in the week, the most on record, as refiners slashed runs and the storage hub at Cushing filled more quickly than expected, the U.S. Energy Information Administration said in a weekly report on Wednesday.

Demand has fallen as the coronavirus outbreak forced closures of businesses and schools.

“There are multiple bad angles: Refining utilization. Crude stockpiles. Cushing is crazy - that’s a gigantic number,” said Bob Yawger, director of energy futures at Mizuho in New York. The Cushing, Oklahoma, storage hub, which serves as the delivery point for the New York Mercantile Exchange U.S. oil futures contract, is on pace to be full in three weeks if this week’s gain is repeated, Yawger said.

Brent crude LCOc1 was down 11 cents, or 0.3%, at $31.76 by 11:06 a.m. EDT (1506 GMT). U.S. West Texas Intermediate (WTI) crude CLc1 rose 63 cents to $24.26 a barrel, after earlier trading as high as $25.29 a barrel.

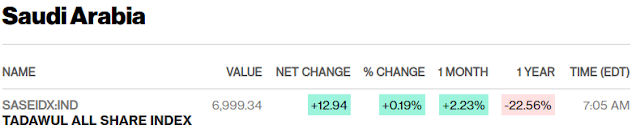

European, Middle Eastern & African Stocks - Bloomberg #UAE #SaudiArabia #Qatar

European, Middle Eastern & African Stocks - Bloomberg:

Updated stock indexes in Europe, Middle East & Africa. Get an overview of major indexes, current values and stock market data in Europe, UK, Germany, Russia & more.

Updated stock indexes in Europe, Middle East & Africa. Get an overview of major indexes, current values and stock market data in Europe, UK, Germany, Russia & more.

Subscribe to:

Comments (Atom)