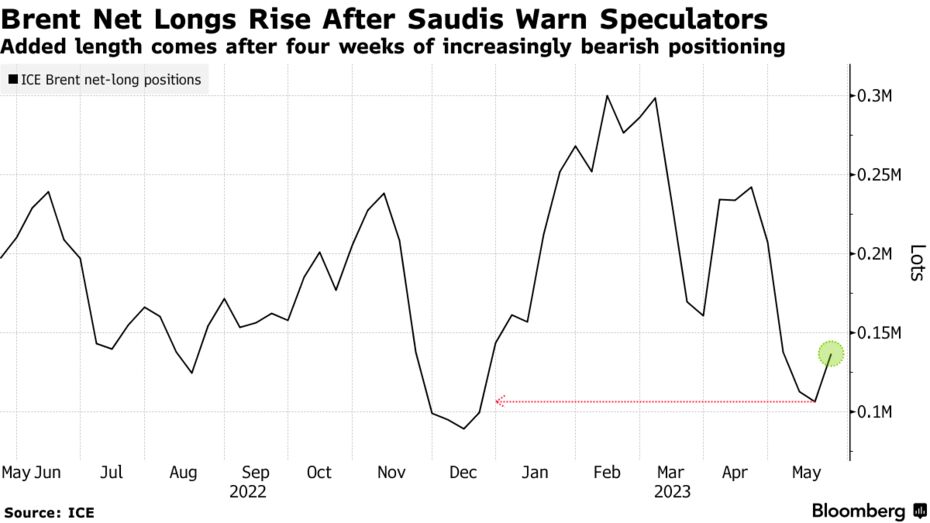

Saudi Arabia’s top energy official told short sellers to “watch out” last week. Traders of global benchmark Brent oil were listening.

Money managers boosted their net-long holdings in Brent by more than 30,000 contracts last week, the biggest increase in almost two months. The move was driven by a pullback in bearish bets and the addition of fresh bullish ones.

The producer group surprised the market in April by announcing an unexpected round of production cuts, but since then traders had been steadily ramping up fresh bearish bets on oil.

Speculators also slashed bets against Europe’s diesel benchmark — which had one of the largest concentrations of short positions across the oil market — by the most since August 2021.