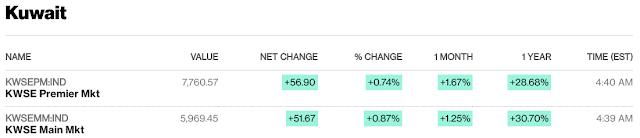

Most Gulf bourses in black despite Omicron threat | Reuters

Most stock markets in the Gulf ended higher on Sunday, recouping losses from the previous session, as investors turned to riskier assets despite surging Omicron COVID-19 cases globally.

Saudi Arabia's benchmark index (.TASI) advanced 1.1%, buoyed by a 0.7% rise in Al Rajhi Bank (1120.SE) and a 3.7% jump in Sahara International Petrochemical Company (2310.SE).

The more infectious Omicron variant of COVID-19 appears to produce less severe disease than the globally dominant Delta strain, but should not be categorised as "mild", World Health Organization (WHO) officials said on Thursday. read more

Separately, the Saudi-led coalition fighting in Yemen believes the use by Houthi forces of two ports as military bases would turn them into legitimate military targets, coalition spokesman Brigadier General Turki al-Malki said on Saturday. read more

The Houthis said on Wednesday that the coalition had diverted to a Saudi port a fifth fuel vessel heading for Hodeidah.

The Qatari index (.QSI) added 0.4%, helped by a 1.6% gain in Qatar Islamic Bank (QISB.QA) and a 1.7% increase in Mesaieed Petrochemical Co (MPHC.QA).

Crude prices settled lower on Friday, as the market weighed supply concerns from the unrest in Kazakhstan and outages in Libya against a U.S. jobs report that missed expectations and its potential impact on Federal Reserve policy.

Outside the Gulf, Egypt's blue-chip index (.EGX30) fell 0.5%, hit by a 0.4% fall in top lender Commercial International Bank (COMI.CA).

2022 Is When Oil Supply and Prices Panic Replaces Fears About Demand - Bloomberg

If oil producers were hoping for a quiet 2022, they may be disappointed. There are two very different schools of thought emerging on what the oil market is going to look like this year. The one thing they agree on: It’s not going to be serene.

The bears see supply running ahead of demand, rising inventories and the OPEC+ producer group perhaps needing to consider another round of output cuts. The bulls focus on low stockpiles, dwindling spare production capacity amid a dearth of investment, and the prospect of triple-digit prices before 2022 is out. Unless demand growth slows dramatically, the latter argument looks more convincing.

The analysis presented to the producer group ahead of its meeting last week showed global oil stockpiles building throughout the coming year, wiping out virtually all of the draws seen in 2021.

UAE c.bank expects economy to grow 4.2% in 2022 | Reuters

The Central Bank of the United Arab Emirates said it expects the UAE economy to grow 4.2% in 2022, accelerating from last year's 2.1% growth.

The central bank's projection, in its latest quarterly report on the economy, is rosier than that of the International Monetary Fund, projects the UAE economy will grow 3% this year.

Non-oil real gross domestic product (GDP) is expected to increase by 3.9%, due to a continued increase in public spending, positive outlook for credit growth, higher employment and better business sentiment with a world fair EXPO event in Dubai, the bank said on its website.

Oil GDP is forecast to grow 5% this year, reflecting the expected increase in demand with majority of the world economies being vaccinated, it said.

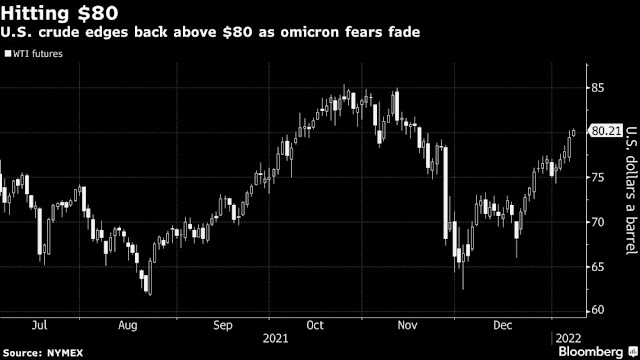

Oil Rides Into 2022 on Bullish Wave as Demand Fears Fade - Bloomberg

Oil has started off 2022 with a bang.

A market that was supposed to suffer a ballooning surplus instead surpassed $80 a barrel last week as global demand shrugs off the omicron variant, while a host of supply constraints hit producers from Canada to Russia.

With investment banks calling for higher prices, and options contracts invoking the prospect of crude spiraling above $100, the commodity is threatening to intensify the inflationary pain felt by major consumers.

Such a rally would be bad news for fuel-hungry countries. It would also be a big blow to U.S. President Joe Biden, who invested a lot of time and effort in jawboning prices lower and orchestrating a global release of strategic petroleum reserves.

“The bullish sentiment has regained the narrative,’’ said Michael Tran, a commodities strategist at RBC Capital Markets. “With improving demand, tightening inventories, and questions of OPEC’s ability to ramp further, the directional arrows of progress point to further optimism.’’

Movements in the price of oil are felt more keenly and quickly than any other commodity because it passes almost immediately into the cost of end-products like gasoline, diesel and jet fuel. This month there were riots across Kazakhstan after the government there allowed the price of liquefied petroleum gas — a key road fuel — to surge.