Oil hits 7-year peak on political risks, supply crunch | Reuters

Oil prices rose to a more than seven-year peak on Friday and recorded their sixth straight weekly gain as geopolitical turmoil exacerbated concerns over tight energy supply.

On a weekly basis, the benchmark contracts notched their longest run of gains since October.

Brent futures rose 69 cents to settle at $90.03 a barrel, after hitting $91.70, the highest level since October 2014.

U.S. crude closed 21 cents higher at $86.82 per barrel, after hitting a seven-year peak of $88.84 during the session.

Tight oil supplies pushed the six-month market structure for Brent into steep backwardation of $6.92 a barrel, the widest since 2013. Backwardation exists when contracts for near-term delivery of oil are priced higher than those for later months, encouraging traders to release oil from storage to sell it promptly.

Solely aggregation of news articles, with no opinions expressed by this service since 2009 launch on this platform. Copyright to all articles remains with the original publisher and HEADLINES ARE CLICKABLE to access the whole article at source. (Subscription by email is recommended,with real-time updates on LinkedIn and Twitter.)

Search This Blog

Friday, 28 January 2022

Oil hits fresh 7-year highs on supply concerns | Reuters

Oil hits fresh 7-year highs on supply concerns | Reuters

Oil prices reached seven-year highs on Friday as geopolitical tensions continue to raise supply concerns.

Brent crude futures were up $1.91, or 2.1%, at $91.25 a barrel by 1436 GMT, having hit $91.41 on Friday for their highest since October 2014.

U.S. West Texas Intermediate (WTI) crude futures rose $1.83, or 2.11%, to $88.44 a barrel. WTI also reached a fresh seven-year high of $88.76 earlier in Friday's session.

Both Brent and WTI are on track for their six-weekly gain in what would be the longest run of weekly gains since October.

Oil prices reached seven-year highs on Friday as geopolitical tensions continue to raise supply concerns.

Brent crude futures were up $1.91, or 2.1%, at $91.25 a barrel by 1436 GMT, having hit $91.41 on Friday for their highest since October 2014.

U.S. West Texas Intermediate (WTI) crude futures rose $1.83, or 2.11%, to $88.44 a barrel. WTI also reached a fresh seven-year high of $88.76 earlier in Friday's session.

Both Brent and WTI are on track for their six-weekly gain in what would be the longest run of weekly gains since October.

Property, Telecom shares lead #UAE higher, both indexes post weekly gain | Reuters

Property, Telecom shares lead UAE higher, both indexes post weekly gain | Reuters

Stock markets in the United Arab Emirates extended gains from previous sessions on Friday, with Dubai's index bolstered by rise in property stocks and telecom gains boosted Abu Dhabi.

"UAE's stock markets were inching up. Dubai was recovering from this month's corrections as investors return while Abu Dhabi is supported by the resilient oil prices and receding risks," said Wael Makarem, Senior Market Strategist – MENA at Exness.

Dubai's main share index (.DFMGI) rose 1%, bolstered by its property stocks, as blue-chip developer Emaar Properties (EMAR.DU) jumped 2.1% and Telecoms Operator Emirates Integrated Telecommunications (DU.DU) advanced 1.2%.

Emaar Properties listed unit Emaar Development (EMAARDEV.DU) was also up 2.4%.

Dubai index also posted a weekly gain of 0.3%.

In Abu Dhabi, the index (.FTFADGI) added 0.4%, extending gains for a fourth consecutive session, buoyed by a 1.3% hike in Emirates Telecommunications Group (Etisalat) (ETISALAT.AD).

Post Market close, Etisalat Group said it acquired 100% shareholding of online groceries marketplace elGrocer in an acquisition value not exceeding 38 million dirhams ($10.35 million).

Abu Dhabi index closed 0.7% higher on a weekly basis.

The UAE moved to a Saturday-Sunday weekend from the start of 2022, to better align with the global market.

Stock markets in the United Arab Emirates extended gains from previous sessions on Friday, with Dubai's index bolstered by rise in property stocks and telecom gains boosted Abu Dhabi.

"UAE's stock markets were inching up. Dubai was recovering from this month's corrections as investors return while Abu Dhabi is supported by the resilient oil prices and receding risks," said Wael Makarem, Senior Market Strategist – MENA at Exness.

Dubai's main share index (.DFMGI) rose 1%, bolstered by its property stocks, as blue-chip developer Emaar Properties (EMAR.DU) jumped 2.1% and Telecoms Operator Emirates Integrated Telecommunications (DU.DU) advanced 1.2%.

Emaar Properties listed unit Emaar Development (EMAARDEV.DU) was also up 2.4%.

Dubai index also posted a weekly gain of 0.3%.

In Abu Dhabi, the index (.FTFADGI) added 0.4%, extending gains for a fourth consecutive session, buoyed by a 1.3% hike in Emirates Telecommunications Group (Etisalat) (ETISALAT.AD).

Post Market close, Etisalat Group said it acquired 100% shareholding of online groceries marketplace elGrocer in an acquisition value not exceeding 38 million dirhams ($10.35 million).

Abu Dhabi index closed 0.7% higher on a weekly basis.

The UAE moved to a Saturday-Sunday weekend from the start of 2022, to better align with the global market.

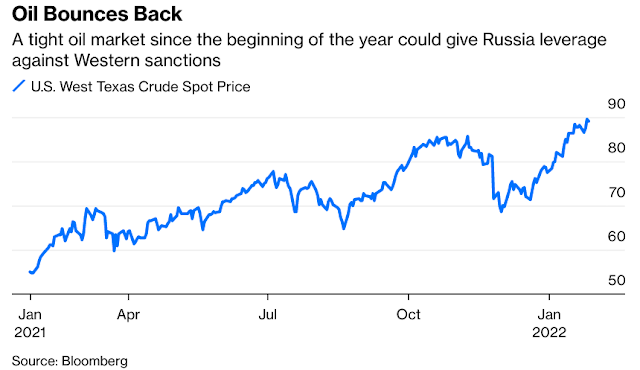

#Russia May Use Oil Weapon Responding to #Ukraine Sanctions - Bloomberg @OSullivanMeghan

Russia May Use Oil Weapon Responding to Ukraine Sanctions - Bloomberg

Russian military action in Ukraine could trigger an energy crisis even more serious than the one already hitting Europe. As has been pointed out, should the West hit Russia with severe new sanctions, President Vladimir Putin could cut off natural gas exports, leaving the continent shivering through midwinter. Yet there is another potential weapon of Russia’s that’s been less discussed and might be very effective: An ability to disrupt global oil markets, which would directly hit U.S. consumers.

There’s no doubt that Russia’s influence over natural gas exports to Europe gives Putin reason to believe he might avoid harsh punishment should he invade Ukraine or undertake major efforts to destabilize the Kyiv government. Despite talk from U.S. President Joe Biden’s administration about finding the Europeans supplies from elsewhere, there simply is not enough uncommitted natural gas in the global system that could be redirected to Europe at a reasonable price. Piped natural gas can only flow where existing infrastructure takes it.

There are also constraints on liquified natural gas, which can be more easily redirected with container ships: As of 2020, 60% of this LNG trade was governed by medium- and long -term contracts. Even if Europe was successful in bringing existing spot-market LNG trade its way, it would mean paying extremely high prices in a bidding war with Asian and other customers.

That said, cutting the gas supply has some notable downsides for Putin. First, it would forever damage Russia’s relationship with the Europeans. They would no longer be able to argue, as they have to U.S. officials wringing their hands about their dependence on Russian gas, that Gazprom PSJC, the state-owned behemoth, “has been a reliable supplier for decades.” Even after this particular crisis, there would be no returning to the status quo. As European Union climate chief Frans Timmermans told EU energy and environment ministers last week, “If we really want to stop long-term making Putin very rich, we have to invest in renewables and we need to do it quickly.”

Russian military action in Ukraine could trigger an energy crisis even more serious than the one already hitting Europe. As has been pointed out, should the West hit Russia with severe new sanctions, President Vladimir Putin could cut off natural gas exports, leaving the continent shivering through midwinter. Yet there is another potential weapon of Russia’s that’s been less discussed and might be very effective: An ability to disrupt global oil markets, which would directly hit U.S. consumers.

There’s no doubt that Russia’s influence over natural gas exports to Europe gives Putin reason to believe he might avoid harsh punishment should he invade Ukraine or undertake major efforts to destabilize the Kyiv government. Despite talk from U.S. President Joe Biden’s administration about finding the Europeans supplies from elsewhere, there simply is not enough uncommitted natural gas in the global system that could be redirected to Europe at a reasonable price. Piped natural gas can only flow where existing infrastructure takes it.

There are also constraints on liquified natural gas, which can be more easily redirected with container ships: As of 2020, 60% of this LNG trade was governed by medium- and long -term contracts. Even if Europe was successful in bringing existing spot-market LNG trade its way, it would mean paying extremely high prices in a bidding war with Asian and other customers.

That said, cutting the gas supply has some notable downsides for Putin. First, it would forever damage Russia’s relationship with the Europeans. They would no longer be able to argue, as they have to U.S. officials wringing their hands about their dependence on Russian gas, that Gazprom PSJC, the state-owned behemoth, “has been a reliable supplier for decades.” Even after this particular crisis, there would be no returning to the status quo. As European Union climate chief Frans Timmermans told EU energy and environment ministers last week, “If we really want to stop long-term making Putin very rich, we have to invest in renewables and we need to do it quickly.”

Baly: Three-Month-Old Startup Scores Largest Funding in #Iraq’s History - Bloomberg

Baly: Three-Month-Old Startup Scores Largest Funding in Iraq’s History - Bloomberg

A three-month old startup co-founded by a McKinsey & Co. alumnus said it completed what could be the largest funding round ever in Iraq’s nascent technology sector.

Baly, which describes itself as Iraq’s first super-app and is backed by German tech incubator Rocket Internet SE, offers ride-hailing in Baghdad and is in the process of adding new services like food and grocery delivery. It raised $10.5 million in seed funding from Kingsway Capital, MSA Capital, Global Founders Capital, Vostok Ventures, Majid Al Futtaim and March Holding.

The funds will be used to expand the app across the country and bankroll the introduction of other offerings including food delivery, according to a statement.

Home to 40 million people and boasting smartphone penetration of over 90% among those aged 17-40, Iraq is ripe for a digital shake-up, said Baly’s managing director, Matteo Mantovani.

After previously working for nearly three years at McKinsey in the United Arab Emirates, Mantovani co-founded the company with Munqith Alazzawi, whose previous stints included time as a consultant at Rocket Internet, according to their LinkedIn accounts.

“With a young, urbanized population, it is the perfect place to revolutionize the economy through digital services,” Mantovani said.

In the Middle East, the bulk of startup activity centers on the UAE, Egypt and Saudi Arabia. Iraq rarely sees any venture capital deals but there are some signs of a small sector developing.

E-commerce firm Miswag has raised nearly $3 million since 2019 and a number of investors began a new company called Iraq Ventures Partners last year.

A three-month old startup co-founded by a McKinsey & Co. alumnus said it completed what could be the largest funding round ever in Iraq’s nascent technology sector.

Baly, which describes itself as Iraq’s first super-app and is backed by German tech incubator Rocket Internet SE, offers ride-hailing in Baghdad and is in the process of adding new services like food and grocery delivery. It raised $10.5 million in seed funding from Kingsway Capital, MSA Capital, Global Founders Capital, Vostok Ventures, Majid Al Futtaim and March Holding.

The funds will be used to expand the app across the country and bankroll the introduction of other offerings including food delivery, according to a statement.

Home to 40 million people and boasting smartphone penetration of over 90% among those aged 17-40, Iraq is ripe for a digital shake-up, said Baly’s managing director, Matteo Mantovani.

After previously working for nearly three years at McKinsey in the United Arab Emirates, Mantovani co-founded the company with Munqith Alazzawi, whose previous stints included time as a consultant at Rocket Internet, according to their LinkedIn accounts.

“With a young, urbanized population, it is the perfect place to revolutionize the economy through digital services,” Mantovani said.

In the Middle East, the bulk of startup activity centers on the UAE, Egypt and Saudi Arabia. Iraq rarely sees any venture capital deals but there are some signs of a small sector developing.

E-commerce firm Miswag has raised nearly $3 million since 2019 and a number of investors began a new company called Iraq Ventures Partners last year.

Oil heads for sixth weekly gain amid supply concerns | Reuters

Oil heads for sixth weekly gain amid supply concerns | Reuters

Oil prices rose on Friday, set for their sixth weekly gain, amid concerns of tight supplies as major producers continue their policy of limited output increases amid rising fuel demand.

Brent crude futures climbed 57 cents, or 0.6%, to $89.91 a barrel at 0734 GMT, after falling 62 cents during the previous day. However, prices did reach $91.04 earlier in that session, the highest since October 2014.

U.S. West Texas Intermediate (WTI) crude futures rose 54 cents, or 0.6%, to $87.15 a barrel, having declined 74 cents on Thursday. WTI also reached a seven-year high of $88.54 earlier in the session.

Both Brent and WTI are set to rise for a sixth week, the longest weekly streak since October, when Brent prices climbed for seven weeks while WTI gained for nine.

Oil prices rose on Friday, set for their sixth weekly gain, amid concerns of tight supplies as major producers continue their policy of limited output increases amid rising fuel demand.

Brent crude futures climbed 57 cents, or 0.6%, to $89.91 a barrel at 0734 GMT, after falling 62 cents during the previous day. However, prices did reach $91.04 earlier in that session, the highest since October 2014.

U.S. West Texas Intermediate (WTI) crude futures rose 54 cents, or 0.6%, to $87.15 a barrel, having declined 74 cents on Thursday. WTI also reached a seven-year high of $88.54 earlier in the session.

Both Brent and WTI are set to rise for a sixth week, the longest weekly streak since October, when Brent prices climbed for seven weeks while WTI gained for nine.

Subscribe to:

Comments (Atom)