Solely aggregation of news articles, with no opinions expressed by this service since 2009 launch on this platform. Copyright to all articles remains with the original publisher and HEADLINES ARE CLICKABLE to access the whole article at source. (Subscription by email is recommended,with real-time updates on LinkedIn and Twitter.)

Search This Blog

Monday, 6 December 2021

BlackRock, #Saudi asset manager Hassana sign deal for Aramco's gas pipelines | Reuters

BlackRock, Saudi asset manager Hassana sign deal for Aramco's gas pipelines | Reuters

Saudi Aramco (2222.SE) said on Monday it has signed a $15.5 billion lease-and-leaseback deal for its gas pipeline network with a consortium led by BlackRock Real Assets and state-backed Hassana Investment Co.

Gulf oil producers are looking at sales of stakes in energy assets and raising cash through long-term leases, capitalising on a rebound in crude prices to attract foreign investors.

Earlier this year Aramco sold a 49% stake in its oil pipelines to a consortium led by U.S.-based EIG under a similar structure for $12.4 billion.

As part of the latest transaction, a newly formed subsidiary, Aramco Gas Pipelines Co, will lease usage rights in the state energy firm's gas pipelines network and lease them back to Aramco for a 20-year period, it said.

Saudi Aramco (2222.SE) said on Monday it has signed a $15.5 billion lease-and-leaseback deal for its gas pipeline network with a consortium led by BlackRock Real Assets and state-backed Hassana Investment Co.

Gulf oil producers are looking at sales of stakes in energy assets and raising cash through long-term leases, capitalising on a rebound in crude prices to attract foreign investors.

Earlier this year Aramco sold a 49% stake in its oil pipelines to a consortium led by U.S.-based EIG under a similar structure for $12.4 billion.

As part of the latest transaction, a newly formed subsidiary, Aramco Gas Pipelines Co, will lease usage rights in the state energy firm's gas pipelines network and lease them back to Aramco for a 20-year period, it said.

#Saudi Aramco warns of ‘social unrest’ if fossil fuels ditched too quickly | Financial Times

Saudi Aramco warns of ‘social unrest’ if fossil fuels ditched too quickly | Financial Times

The chief executive of Saudi Aramco, the world’s largest oil producer, has called on global leaders to continue investing in fossil fuels in the years ahead or run the risk of spiralling inflation and social unrest that would force them to jettison emissions targets.

Speaking at the World Petroleum Congress in Houston, Texas, Amin Nasser said there was an assumption that the world could transition to cleaner fuels “virtually overnight”, but that this was “deeply flawed”.

“I understand that publicly admitting that oil and gas will play an essential and significant role during the transition and beyond will be hard for some,” Nasser told delegates at the WPC, one of the biggest gatherings of oil and gas executives in the world.

“But admitting this reality will be far easier than dealing with energy insecurity, rampant inflation and social unrest as the prices become intolerably high and seeing net zero commitments by countries start to unravel.”

The chief executive of Saudi Aramco, the world’s largest oil producer, has called on global leaders to continue investing in fossil fuels in the years ahead or run the risk of spiralling inflation and social unrest that would force them to jettison emissions targets.

Speaking at the World Petroleum Congress in Houston, Texas, Amin Nasser said there was an assumption that the world could transition to cleaner fuels “virtually overnight”, but that this was “deeply flawed”.

“I understand that publicly admitting that oil and gas will play an essential and significant role during the transition and beyond will be hard for some,” Nasser told delegates at the WPC, one of the biggest gatherings of oil and gas executives in the world.

“But admitting this reality will be far easier than dealing with energy insecurity, rampant inflation and social unrest as the prices become intolerably high and seeing net zero commitments by countries start to unravel.”

Omani, #Saudi companies sign $10 bln MoUs ahead of crown prince's visit | Reuters

Omani, Saudi companies sign $10 bln MoUs ahead of crown prince's visit | Reuters

Omani and Saudi firms signed 13 memoranda of understanding (MoU) potentially valued at more than $10 billion, Omani official media reported on Monday, as Saudi Crown Prince Mohammed bin Salman sets off on a Gulf tour.

Oman's state energy company OQ signed an MoU with petrochemicals firm Saudi Basic Industries Corp (SABIC) on developing Oman's Duqm petrochemical complex project.

OQ also signed an MoU with Saudi Arabia's Aramco Trading Company to explore the storage and trading of petroleum products.

The Omani company, Saudi ACWA Power and Air Products have also sealed an MoU in petrochemicals, renewable energy and green hydrogen sectors.

Omani and Saudi firms signed 13 memoranda of understanding (MoU) potentially valued at more than $10 billion, Omani official media reported on Monday, as Saudi Crown Prince Mohammed bin Salman sets off on a Gulf tour.

Oman's state energy company OQ signed an MoU with petrochemicals firm Saudi Basic Industries Corp (SABIC) on developing Oman's Duqm petrochemical complex project.

OQ also signed an MoU with Saudi Arabia's Aramco Trading Company to explore the storage and trading of petroleum products.

The Omani company, Saudi ACWA Power and Air Products have also sealed an MoU in petrochemicals, renewable energy and green hydrogen sectors.

#Saudi sovereign fund PIF selling 5.01% stake in STC in secondary offer | Reuters

Saudi sovereign fund PIF selling 5.01% stake in STC in secondary offer | Reuters

The Public Investment Fund (PIF), Saudi Arabia's sovereign wealth fund, is selling a 5.01% stake in Saudi Telecom Co (STC) (7010.SE) through a secondary share offering, STC said on Sunday.

PIF plans to sell 100.2 million shares at a price range of 100 riyals to 116 riyals per share, potentially raising as much as 11.623 billion riyals ($3.10 billion) at the top end of the range.

The final price will be determined on Dec. 10.

PIF currently owns 70% of Saudi Telecom, which is Saudi Arabia's largest telecoms operator and also owns subsidiaries and has stakes in companies operating in Kuwait, Bahrain, the United Arab Emirates and Turkey.

The Public Investment Fund (PIF), Saudi Arabia's sovereign wealth fund, is selling a 5.01% stake in Saudi Telecom Co (STC) (7010.SE) through a secondary share offering, STC said on Sunday.

PIF plans to sell 100.2 million shares at a price range of 100 riyals to 116 riyals per share, potentially raising as much as 11.623 billion riyals ($3.10 billion) at the top end of the range.

The final price will be determined on Dec. 10.

PIF currently owns 70% of Saudi Telecom, which is Saudi Arabia's largest telecoms operator and also owns subsidiaries and has stakes in companies operating in Kuwait, Bahrain, the United Arab Emirates and Turkey.

#Dubai property prices to get boost next year from foreign demand | Reuters

Dubai property prices to get boost next year from foreign demand | Reuters

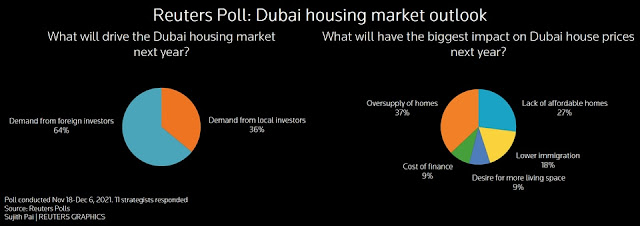

Dubai house prices will extend their rise into next year at twice the rate expected three months ago, driven by demand from foreign investors and improving affordability, according to a Reuters poll of property analysts.

With a successful vaccination roll-out and an early easing of COVID-19 restrictions, Dubai's economy bounced back sharply this year as trade and travel sectors opened up, helping the previously ailing real estate sector.

Monthly data from the Dubai Land Department showed the city state's property sector had its best October in eight years, momentum which was expected to continue into 2022.

The Nov. 18-Dec. 6 Reuters poll of 11 property market analysts showed a median rise of 5.0% in Dubai house prices in 2022, twice the 2.5% forecast three months ago.

Dubai house prices will extend their rise into next year at twice the rate expected three months ago, driven by demand from foreign investors and improving affordability, according to a Reuters poll of property analysts.

With a successful vaccination roll-out and an early easing of COVID-19 restrictions, Dubai's economy bounced back sharply this year as trade and travel sectors opened up, helping the previously ailing real estate sector.

Monthly data from the Dubai Land Department showed the city state's property sector had its best October in eight years, momentum which was expected to continue into 2022.

The Nov. 18-Dec. 6 Reuters poll of 11 property market analysts showed a median rise of 5.0% in Dubai house prices in 2022, twice the 2.5% forecast three months ago.

Exclusive: Uber in talks with Mideast unit over outside investment - sources | Reuters

Exclusive: Uber in talks with Mideast unit over outside investment - sources | Reuters

Uber Technologies (UBER.N) is in talks with the management of its Middle East unit Careem to bring outside investors into the business, four sources familiar with the matter said.

Careem's ownership structure following the planned investment was not immediately clear, though sources said Uber would remain a shareholder while giving Careem's management greater decision-making power over its strategy.

The investment would help finance the further roll-out of Careem's so-called Super App, two of the sources said, which offers services outside its core ride-hailing business such as food delivery, digital payments and courier services.

One of the sources said Careem's management wanted to build on its Super App - of which co-founder and Chief Executive Mudassir Sheikha has long been a proponent - while Uber was focused on ride-hailing.

Uber Technologies (UBER.N) is in talks with the management of its Middle East unit Careem to bring outside investors into the business, four sources familiar with the matter said.

Careem's ownership structure following the planned investment was not immediately clear, though sources said Uber would remain a shareholder while giving Careem's management greater decision-making power over its strategy.

The investment would help finance the further roll-out of Careem's so-called Super App, two of the sources said, which offers services outside its core ride-hailing business such as food delivery, digital payments and courier services.

One of the sources said Careem's management wanted to build on its Super App - of which co-founder and Chief Executive Mudassir Sheikha has long been a proponent - while Uber was focused on ride-hailing.

Column: Oil market hit by wave of hedge fund liquidation: Kemp | Reuters

Column: Oil market hit by wave of hedge fund liquidation: Kemp | Reuters

Fears over the Omicron coronavirus variant's impact on international aviation and other sources of oil demand have prompted massive liquidation of previously bullish hedge fund positions.

Hedge funds and other money managers sold the equivalent of 131 million barrels in the six most important petroleum futures and options contracts in the week to Nov. 30 (https://tmsnrt.rs/31wlm1Q).

The one-week sale was the 13th largest in 455 weeks since the start of 2013 and was a result of Omicron fears converging with low levels of liquidity after the Thanksgiving holiday in the United States.

Total sales since the start of October have reached 293 million barrels, according to position records published by ICE Futures Europe and the U.S. Commodity Futures Trading Commission.

Fears over the Omicron coronavirus variant's impact on international aviation and other sources of oil demand have prompted massive liquidation of previously bullish hedge fund positions.

Hedge funds and other money managers sold the equivalent of 131 million barrels in the six most important petroleum futures and options contracts in the week to Nov. 30 (https://tmsnrt.rs/31wlm1Q).

The one-week sale was the 13th largest in 455 weeks since the start of 2013 and was a result of Omicron fears converging with low levels of liquidity after the Thanksgiving holiday in the United States.

Total sales since the start of October have reached 293 million barrels, according to position records published by ICE Futures Europe and the U.S. Commodity Futures Trading Commission.

#AbuDhabi hits record peak; STC weighs on Saudi index | Reuters

Abu Dhabi hits record peak; STC weighs on Saudi index | Reuters

Most stock markets in the Gulf ended higher on Monday on hopes the Omicron coronavirus variant's symptoms prove mostly mild and have a less damaging economic impact.

Reports in South Africa said Omicron cases there had only shown mild symptoms and the top U.S. infectious disease official told broadcaster CNN that so far "It does not look like there's a great degree of severity". read more

In Abu Dhabi, the index (.ADI) advanced 2.6%, with Emirates Telecommunications Group (ETISALAT.AD) rising for a ninth session in 10 to close 5% higher.

In November, the telecom operator signed an agreement to acquire online grocery delivery marketplace elGrocer DMCC.

Omicron's negative headlines receded a little and investors hope that its impact on the economy will be softer than initially feared, said Wael Makarem, senior market strategist at Exness.

"At the same time, monetary policy tightening is expected to limit the development of inflation which has become a major concern."

Dubai's main share index (.DFMGI) climbed 2.4%, with most of the stocks on the index in the black including Dubai Financial Market (DFM.DU), which jumped 11%.

The Dubai government has announced plans for 10 state-backed companies to be listed as part of plans to boost activity on the local bourse.

The listing plans are aimed at making Dubai a more competitive market against bigger bourses in the region, such as those in Saudi Arabia and neighbouring Abu Dhabi, that are seeing larger listings and strong liquidity.

Saudi Arabia's benchmark index (.TASI) dropped 1.1%, dragged down by a 5.3% fall in Saudi Telecom Company (STC) (7010.SE).

The Public Investment Fund (PIF), Saudi Arabia's sovereign wealth fund, is selling a 5.01% stake in STC through a secondary share offering, STC said on Sunday. read more

PIF plans to sell 100.2 million shares at a price range of 100 riyals to 116 riyals per share, potentially raising as much as 11.623 billion riyals ($3.10 billion) at the top end of the range.

Outside the Gulf, Egypt's blue-chip index (.EGX30) added 1%, gaining for a fourth session in five.

Most stock markets in the Gulf ended higher on Monday on hopes the Omicron coronavirus variant's symptoms prove mostly mild and have a less damaging economic impact.

Reports in South Africa said Omicron cases there had only shown mild symptoms and the top U.S. infectious disease official told broadcaster CNN that so far "It does not look like there's a great degree of severity". read more

In Abu Dhabi, the index (.ADI) advanced 2.6%, with Emirates Telecommunications Group (ETISALAT.AD) rising for a ninth session in 10 to close 5% higher.

In November, the telecom operator signed an agreement to acquire online grocery delivery marketplace elGrocer DMCC.

Omicron's negative headlines receded a little and investors hope that its impact on the economy will be softer than initially feared, said Wael Makarem, senior market strategist at Exness.

"At the same time, monetary policy tightening is expected to limit the development of inflation which has become a major concern."

Dubai's main share index (.DFMGI) climbed 2.4%, with most of the stocks on the index in the black including Dubai Financial Market (DFM.DU), which jumped 11%.

The Dubai government has announced plans for 10 state-backed companies to be listed as part of plans to boost activity on the local bourse.

The listing plans are aimed at making Dubai a more competitive market against bigger bourses in the region, such as those in Saudi Arabia and neighbouring Abu Dhabi, that are seeing larger listings and strong liquidity.

Saudi Arabia's benchmark index (.TASI) dropped 1.1%, dragged down by a 5.3% fall in Saudi Telecom Company (STC) (7010.SE).

The Public Investment Fund (PIF), Saudi Arabia's sovereign wealth fund, is selling a 5.01% stake in STC through a secondary share offering, STC said on Sunday. read more

PIF plans to sell 100.2 million shares at a price range of 100 riyals to 116 riyals per share, potentially raising as much as 11.623 billion riyals ($3.10 billion) at the top end of the range.

Outside the Gulf, Egypt's blue-chip index (.EGX30) added 1%, gaining for a fourth session in five.

#Turkey, #Qatar pacts expected from Erdogan visit, no plan to seek Doha assistance | Reuters

Turkey, Qatar pacts expected from Erdogan visit, no plan to seek Doha assistance | Reuters

Doha and Ankara are set to sign dozens of agreements during Turkish President Tayyip Erdogan's visit to Qatar on Monday but Turkey had no plans to ask for financial assistance, the two countries' foreign ministers said.

At a news briefing on Monday with his Turkish counterpart Mevlut Cavusoglu, Qatar's Foreign Sheikh Mohammed bin Abdulrahman Al-Thani said the Gulf state was looking at opportunities emerging from Turkey's economic challenges.

Turkey is grappling with high inflation and a currency crisis following a series of interest rate cuts. Erdogan is expected to arrive in Qatar later on Monday, state media said.

Separately, Saudi Crown Prince Mohammed bin Salman (MbS) is also due to visit Doha this week, on Wednesday, though the Qatari minister said the timing of the two visits was a coincidence. Saudi Arabia and Turkey have been rivals for years over differences on regional issues and political Islam but both sides have been working to amend ties.

Doha and Ankara are set to sign dozens of agreements during Turkish President Tayyip Erdogan's visit to Qatar on Monday but Turkey had no plans to ask for financial assistance, the two countries' foreign ministers said.

At a news briefing on Monday with his Turkish counterpart Mevlut Cavusoglu, Qatar's Foreign Sheikh Mohammed bin Abdulrahman Al-Thani said the Gulf state was looking at opportunities emerging from Turkey's economic challenges.

Turkey is grappling with high inflation and a currency crisis following a series of interest rate cuts. Erdogan is expected to arrive in Qatar later on Monday, state media said.

Separately, Saudi Crown Prince Mohammed bin Salman (MbS) is also due to visit Doha this week, on Wednesday, though the Qatari minister said the timing of the two visits was a coincidence. Saudi Arabia and Turkey have been rivals for years over differences on regional issues and political Islam but both sides have been working to amend ties.

Nasser Saidi's Prasad on #Dubai's Emergence From Virus Challenges - Bloomberg

Nasser Saidi's Prasad on Dubai's Emergence From Virus Challenges - Bloomberg

Aathira Prasad, Nasser Saidi & Associates Director of Macroeconomics discusses Dubai's economic recovery. She speaks with Manus Cranny on "Bloomberg Daybreak: Middle East."

Aathira Prasad, Nasser Saidi & Associates Director of Macroeconomics discusses Dubai's economic recovery. She speaks with Manus Cranny on "Bloomberg Daybreak: Middle East."

#SaudiArabia Raises Oil Prices in Bullish Move - Bloomberg video

Saudi Arabia Raises Oil Prices in Bullish Move - Bloomberg

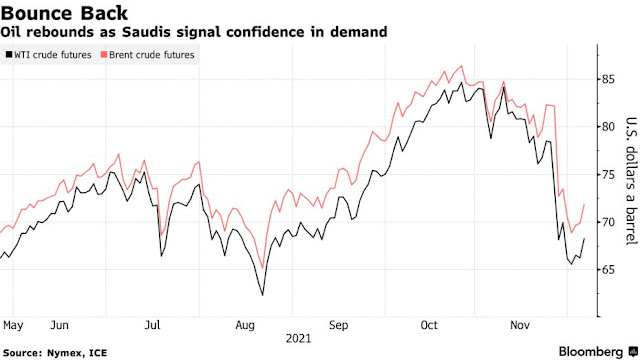

Saudi Arabia raised oil prices for customers in its main markets of Asia and the U.S., despite the spread of the omicron variant of the coronavirus. Bloomberg’s Paul Wallace speaks with Manus Cranny and Dani Burger about the outlook for the market on "Bloomberg Daybreak: Europe."

Saudi Arabia raised oil prices for customers in its main markets of Asia and the U.S., despite the spread of the omicron variant of the coronavirus. Bloomberg’s Paul Wallace speaks with Manus Cranny and Dani Burger about the outlook for the market on "Bloomberg Daybreak: Europe."

Oil rebounds above $71 on Omicron hopes, Iran talks | Reuters

Oil rebounds above $71 on Omicron hopes, Iran talks | Reuters

Oil rose by more than $1 a barrel to above $71 on Monday as hopes that the Omicron coronavirus variant may cause mostly mild symptoms boosted riskier assets and as the prospect of an imminent rise in Iranian oil exports looked less likely.

Helping ease Omicron concerns, reports in South Africa said cases there only had mild symptoms and the top U.S. infectious disease official told CNN "it does not look like there's a great degree of severity" so far. read more

Brent crude gained $1.77, or 2.5%, to $71.65 by 0920 GMT while U.S. West Texas Intermediate crude advanced $1.69, or 2.6%, to $67.95. Both benchmarks declined for a sixth week in a row last week.

"If Omicron is proven over the coming days (or weeks) to be less aggressive, even if it is more contagious, then we can say 100% last week's lows were the bargain of the quarter," said Jeffrey Halley, an analyst at brokerage OANDA.

Oil rose by more than $1 a barrel to above $71 on Monday as hopes that the Omicron coronavirus variant may cause mostly mild symptoms boosted riskier assets and as the prospect of an imminent rise in Iranian oil exports looked less likely.

Helping ease Omicron concerns, reports in South Africa said cases there only had mild symptoms and the top U.S. infectious disease official told CNN "it does not look like there's a great degree of severity" so far. read more

Brent crude gained $1.77, or 2.5%, to $71.65 by 0920 GMT while U.S. West Texas Intermediate crude advanced $1.69, or 2.6%, to $67.95. Both benchmarks declined for a sixth week in a row last week.

"If Omicron is proven over the coming days (or weeks) to be less aggressive, even if it is more contagious, then we can say 100% last week's lows were the bargain of the quarter," said Jeffrey Halley, an analyst at brokerage OANDA.

#AbuDhabi’s IHC Unit Raises $13.1 Billion From Direct Listing - Bloomberg

Abu Dhabi’s IHC Unit Raises $13.1 Billion From Direct Listing - Bloomberg

Multiply Group, a subsidiary of Abu Dhabi’s International Holding Company, raised 48 billion dirhams ($13.1 billion) in a direct share listing.

Shares in the tech-focused holding company surged following the listing, closing at 2 dirhams apiece Sunday, 80% higher than the launch price of 1.11 dirhams.

“We have major local investors,” IHC’s Chief Executive Officer Syed Basar Shueb said in a telephone interview. “It was good for our shareholders, it’s good for the local investors” and the company now has more cash to acquire businesses, he said.

The offering marks the latest stage in a drive by IHC, among the most valuable firms in the Middle East, to expand its clout on local exchanges. The firm is now working on listing its healthcare group, including Pure Health, a company that has partnered with the United Arab Emirates government to launch a Covid-19 screening initiative covering the nation’s airports.

“These are there for next year,” Shueb said.

UAE nationals own more than 92% of IHC, while foreigners hold about 7.6%, according to Abu Dhabi exchange data. The firm’s second-biggest shareholder is Royal Group, a company led by Sheikh Tahnoon Bin Zayed Al Nahyan, the country’s national security adviser and brother to Abu Dhabi’s crown prince.

The biggest individual shareholder, Pal Group of Companies LLC, is a subsidiary of Royal Group. Together, they own more than 70% of IHC.

IHC is also scouring for investment opportunities in Central America, some African countries and in Europe, Shueb said.

Multiply Group, a subsidiary of Abu Dhabi’s International Holding Company, raised 48 billion dirhams ($13.1 billion) in a direct share listing.

Shares in the tech-focused holding company surged following the listing, closing at 2 dirhams apiece Sunday, 80% higher than the launch price of 1.11 dirhams.

“We have major local investors,” IHC’s Chief Executive Officer Syed Basar Shueb said in a telephone interview. “It was good for our shareholders, it’s good for the local investors” and the company now has more cash to acquire businesses, he said.

The offering marks the latest stage in a drive by IHC, among the most valuable firms in the Middle East, to expand its clout on local exchanges. The firm is now working on listing its healthcare group, including Pure Health, a company that has partnered with the United Arab Emirates government to launch a Covid-19 screening initiative covering the nation’s airports.

“These are there for next year,” Shueb said.

UAE nationals own more than 92% of IHC, while foreigners hold about 7.6%, according to Abu Dhabi exchange data. The firm’s second-biggest shareholder is Royal Group, a company led by Sheikh Tahnoon Bin Zayed Al Nahyan, the country’s national security adviser and brother to Abu Dhabi’s crown prince.

The biggest individual shareholder, Pal Group of Companies LLC, is a subsidiary of Royal Group. Together, they own more than 70% of IHC.

IHC is also scouring for investment opportunities in Central America, some African countries and in Europe, Shueb said.

Most stock markets in Gulf rise, in line with oil prices | Reuters

Most stock markets in Gulf rise, in line with oil prices | Reuters

Most stock markets in the Gulf rose in early trade on Monday, on course to extend gains from the previous session in line with rising oil prices.

Crude prices, a key catalyst for the Gulf's financial markets, rose by more than $1 a barrel after top exporter Saudi Arabia raised prices for its crude sold to Asia and the United States, and as indirect U.S.-Iran talks on reviving a nuclear deal appeared to hit an impasse.

Saudi Arabia's benchmark index (.TASI) climbed 0.8%, led by a 2.9% rise in Al Rajhi Bank (1120.SE) and a 2.2% gain in petrochemical maker Saudi Basic Industries Corp (2010.SE).

The Public Investment Fund (PIF), Saudi Arabia's sovereign wealth fund, is selling a 5.01% stake in Saudi Telecom Co (STC) (7010.SE) through a secondary share offering, STC said on Sunday.

PIF plans to sell 100.2 million shares at a price range of 100 riyals to 116 riyals per share, potentially raising as much as 11.623 billion riyals ($3.10 billion) at the top end of the range.

Shares of STC were down more than 3%.

In Abu Dhabi, the index (.ADI) gained 0.7%, with Emirates Telecommunications Group (ETISALAT.AD) advancing 3%, on track to for a ninth session in ten.

In November, the telecom operator signed an agreement to acquire online grocery delivery marketplace elGrocer DMCC.

Dubai's main share index (.DFMGI) advanced 1.5%, buoyed by a 1.9% rise in blue-chip developer Emaar Properties (EMAR.DU) and a 1.6% increase in sharia-compliant lender Dubai Islamic Bank (DISB.DU).

The United Arab Emirates' top national security adviser Sheikh Tahnoon bin Zayed Al Nahyan will visit Iran on Monday to discuss expanding bilateral ties with the Islamic Republic, Iranian state media reported on Sunday. read more

The Qatari index (.QSI) added 0.1%, helped by a 1.6% rise in Mesaieed Petrochemical (MPHC.QA).

Most stock markets in the Gulf rose in early trade on Monday, on course to extend gains from the previous session in line with rising oil prices.

Crude prices, a key catalyst for the Gulf's financial markets, rose by more than $1 a barrel after top exporter Saudi Arabia raised prices for its crude sold to Asia and the United States, and as indirect U.S.-Iran talks on reviving a nuclear deal appeared to hit an impasse.

Saudi Arabia's benchmark index (.TASI) climbed 0.8%, led by a 2.9% rise in Al Rajhi Bank (1120.SE) and a 2.2% gain in petrochemical maker Saudi Basic Industries Corp (2010.SE).

The Public Investment Fund (PIF), Saudi Arabia's sovereign wealth fund, is selling a 5.01% stake in Saudi Telecom Co (STC) (7010.SE) through a secondary share offering, STC said on Sunday.

PIF plans to sell 100.2 million shares at a price range of 100 riyals to 116 riyals per share, potentially raising as much as 11.623 billion riyals ($3.10 billion) at the top end of the range.

Shares of STC were down more than 3%.

In Abu Dhabi, the index (.ADI) gained 0.7%, with Emirates Telecommunications Group (ETISALAT.AD) advancing 3%, on track to for a ninth session in ten.

In November, the telecom operator signed an agreement to acquire online grocery delivery marketplace elGrocer DMCC.

Dubai's main share index (.DFMGI) advanced 1.5%, buoyed by a 1.9% rise in blue-chip developer Emaar Properties (EMAR.DU) and a 1.6% increase in sharia-compliant lender Dubai Islamic Bank (DISB.DU).

The United Arab Emirates' top national security adviser Sheikh Tahnoon bin Zayed Al Nahyan will visit Iran on Monday to discuss expanding bilateral ties with the Islamic Republic, Iranian state media reported on Sunday. read more

The Qatari index (.QSI) added 0.1%, helped by a 1.6% rise in Mesaieed Petrochemical (MPHC.QA).

Oil Gains as Saudis Signal Confidence in Demand With Price Hike - Bloomberg

Oil Gains as Saudis Signal Confidence in Demand With Price Hike - Bloomberg

Oil rose after Saudi Arabia boosted the prices of its crude, signaling confidence in the demand outlook despite the spread of the omicron variant of the coronavirus.

Futures in New York advanced more than 2% to trade near $68 a barrel. The kingdom increased its oil prices for customers in Asia and the U.S. for January, just days after the OPEC+ alliance agreed to boost output for the same month. Meanwhile, initial data on omicron from South Africa -- the epicenter of the outbreak -- doesn’t show a resulting surge of hospitalizations.

| PRICES |

|---|

|

Futures in New York advanced more than 2% to trade near $68 a barrel. The kingdom increased its oil prices for customers in Asia and the U.S. for January, just days after the OPEC+ alliance agreed to boost output for the same month. Meanwhile, initial data on omicron from South Africa -- the epicenter of the outbreak -- doesn’t show a resulting surge of hospitalizations.

Subscribe to:

Comments (Atom)