Oman approves 2022 budget with spending at $31.5bn

Oman has approved its annual budget for 2022, allocating 12.13 billion Omani riyals ($31.5bn) for spending, with a focus on basic public services, from health to social support, stimulating investment.

This year's budget, which is an increase on the previous year's budget of 12.167bn riyals, is based on an oil price assumption of $50 per barrel, the state-run Oman News Agency (ONA) reported on Sunday.

The government expects its revenue to reach 10.58bn riyals in 2022, with more than half (68 per cent) coming from oil and gas revenue of 7.24bn riyals, ONA reported. Non-oil revenue is estimated to reach 3.34bn riyals, or 32 per cent of total government revenue.

Oman's budget deficit in 2022 is expected to reach an estimated 1.5bn riyals, or 5 per cent of gross domestic product, with the estimated deficit in line with the country's medium-term financial plan, launched by the Gulf state last year to fix its finances.

Solely aggregation of news articles, with no opinions expressed by this service since 2009 launch on this platform. Copyright to all articles remains with the original publisher and HEADLINES ARE CLICKABLE to access the whole article at source. (Subscription by email is recommended,with real-time updates on LinkedIn and Twitter.)

Search This Blog

Sunday, 2 January 2022

Record Wave of Emerging-Market IPOs Meets Investors Wary of Risk - Bloomberg

Record Wave of Emerging-Market IPOs Meets Investors Wary of Risk - Bloomberg

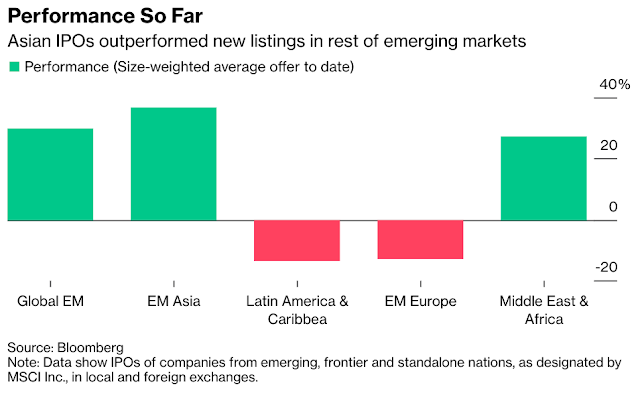

A record-breaking number of emerging-market companies made their public debuts in 2021, just ahead of what should be a tough year for equity investors.

While the price of most newly issued stocks has risen since their IPOs, the benchmark gauge of developing-economy stocks just wrapped up its worst year since 2018. That suggests appetite for the risk assets is dwindling, with quick-spreading virus variants and higher interest rates set to further challenge equities in coming months.

Those headwinds were far from investors’ minds as higher capital needs and hope for a global economic recovery led 1,161 companies from emerging markets to make initial public offerings last year on local or foreign exchanges. All together, they raised $228 billion via listings, a 31% increase from 2020, according to data compiled by Bloomberg.

“Last year, especially in the first half, we saw a boom of tech-related IPOs across EM,” said Ignacio Arnau, a Madrid-based investor at Bestinver Asset Management, which has about $8 billion under management. “There was both fundamental and scarcity value factors driving the appetite in the market.”

A record-breaking number of emerging-market companies made their public debuts in 2021, just ahead of what should be a tough year for equity investors.

While the price of most newly issued stocks has risen since their IPOs, the benchmark gauge of developing-economy stocks just wrapped up its worst year since 2018. That suggests appetite for the risk assets is dwindling, with quick-spreading virus variants and higher interest rates set to further challenge equities in coming months.

Those headwinds were far from investors’ minds as higher capital needs and hope for a global economic recovery led 1,161 companies from emerging markets to make initial public offerings last year on local or foreign exchanges. All together, they raised $228 billion via listings, a 31% increase from 2020, according to data compiled by Bloomberg.

“Last year, especially in the first half, we saw a boom of tech-related IPOs across EM,” said Ignacio Arnau, a Madrid-based investor at Bestinver Asset Management, which has about $8 billion under management. “There was both fundamental and scarcity value factors driving the appetite in the market.”

Bank of #Israel expected to hold rates Monday, with hikes not far off - Reuters poll | Reuters

Bank of Israel expected to hold rates Monday, with hikes not far off - Reuters poll | Reuters

The Bank of Israel is expected to keep short-term interest rates unchanged this week, its 14th such decision in a row, although analysts are expecting a hawkish tone that could lead to higher rates in the coming months as inflationary pressures mount.

All 12 economists polled by Reuters forecast that the central bank's monetary policy committee (MPC) will keep the benchmark rate (ILINR=ECI) at an all-time low of 0.1% when the decision is announced on Monday at 4 p.m. (1400 GMT).

While other countries have faced an inflation surge, Israel has not, largely due to a very strong shekel that has moved to a 26-year high against the dollar and kept import prices down. The annual inflation rate stood at 2.4% in November, well within an official 1-3% target.

Last month, Bank of Israel Governor Amir Yaron told Reuters that the central bank was in no rush to raise interest rates since inflation was under control. read more

The Bank of Israel is expected to keep short-term interest rates unchanged this week, its 14th such decision in a row, although analysts are expecting a hawkish tone that could lead to higher rates in the coming months as inflationary pressures mount.

All 12 economists polled by Reuters forecast that the central bank's monetary policy committee (MPC) will keep the benchmark rate (ILINR=ECI) at an all-time low of 0.1% when the decision is announced on Monday at 4 p.m. (1400 GMT).

While other countries have faced an inflation surge, Israel has not, largely due to a very strong shekel that has moved to a 26-year high against the dollar and kept import prices down. The annual inflation rate stood at 2.4% in November, well within an official 1-3% target.

Last month, Bank of Israel Governor Amir Yaron told Reuters that the central bank was in no rush to raise interest rates since inflation was under control. read more

#Saudi shares make positive start to 2022 despite COVID cases | Reuters

Saudi shares make positive start to 2022 despite COVID cases | Reuters

Saudi Arabian shares began 2022 on a positive note, in spite of a jump in cases of the Omicron coronavirus variant.

The largest Gulf state, with a population of around 30 million people, registered 1,024 new coronavirus infections and one death on Sunday. read more

Saudi Arabia's benchmark index (.TASI) rose 0.5%, with Al-Rajhi Bank (1120.SE) and Alinma Bank (1150.SE) gaining 1% and 3.5% respectively.

In Qatar, the benchmark (.QSI) ended flat, as gains in financial shares helped cap losses in industrial stocks. Sharia-compliant lender Masraf Al Rayan (MARK.QA) jumped 4.3%, while Industries Qatar (IQCD.QA) was down 1.4%.

Outside the Gulf, Egypt's blue-chip index (.EGX30) fell 0.2%, as the country's lone cigarette maker fell 0.8%.

Cleopatra Hospital Group (CLHO.CA), however, gained 2.6% after MCI Capital Healthcare Partners acquired a 22.99% stake at 5.0 Egyptian pounds ($0.3193) per share, valuing the group at an equity value of 8.0 billion Egyptian pound.

The index booked a yearly gain of 10.2%.

The UAE market was closed as it shifted to a working week of four and half days with a Saturday-Sunday weekend from the start of 2022, while other markets were closed for new year holidays.

Saudi Arabian shares began 2022 on a positive note, in spite of a jump in cases of the Omicron coronavirus variant.

The largest Gulf state, with a population of around 30 million people, registered 1,024 new coronavirus infections and one death on Sunday. read more

Saudi Arabia's benchmark index (.TASI) rose 0.5%, with Al-Rajhi Bank (1120.SE) and Alinma Bank (1150.SE) gaining 1% and 3.5% respectively.

In Qatar, the benchmark (.QSI) ended flat, as gains in financial shares helped cap losses in industrial stocks. Sharia-compliant lender Masraf Al Rayan (MARK.QA) jumped 4.3%, while Industries Qatar (IQCD.QA) was down 1.4%.

Outside the Gulf, Egypt's blue-chip index (.EGX30) fell 0.2%, as the country's lone cigarette maker fell 0.8%.

Cleopatra Hospital Group (CLHO.CA), however, gained 2.6% after MCI Capital Healthcare Partners acquired a 22.99% stake at 5.0 Egyptian pounds ($0.3193) per share, valuing the group at an equity value of 8.0 billion Egyptian pound.

The index booked a yearly gain of 10.2%.

The UAE market was closed as it shifted to a working week of four and half days with a Saturday-Sunday weekend from the start of 2022, while other markets were closed for new year holidays.

#Dubai Boosts Spending With $16.3 Billion Budget for 2022 - Bloomberg

Dubai Boosts Spending With $16.3 Billion Budget for 2022 - Bloomberg

Dubai set out another expansionary budget for this year as the Middle Eastern business hub seeks to offset the impact of the coronavirus pandemic and keep its economy on a growth trajectory.

Spending has been pegged at 60 billion dirhams ($16.3 billion) and revenue at 57.6 billion dirhams, according to Dubai’s Crown Prince Sheikh Hamdan bin Mohammed. Dubai is continuing to work to “realize the emirate’s ambitious future plans, enhance its competitiveness and consolidate its position as a leading global commercial hub,” he said.

As other wealthy nations tightened Covid-19 restrictions over the winter, Dubai decided to take a risk and gradually reopened its economy while embarking on one of the world’s most extensive vaccination drives. It is currently hosting the Expo 2020 exhibition, one of the biggest in-person events since the pandemic started.

Dubai’s business conditions saw the sharpest improvement in two years in October, spurred by a rebound in new orders and increased tourism as Expo 2020 got under way.

The government allocated 42% of total expenditure for this year toward infrastructure and transportation sectors, while 30% was set aside for social development. It expects 57% of revenue to come from fees and 20% from value-added and custom taxes.

“The 2022 budget strengthens recovery efforts and acts as a starting point within an integrated scheme” of the Dubai Strategic Plan 2030, said Abdulrahman Saleh Al Saleh, director general of Dubai’s department of finance.

Dubai set out another expansionary budget for this year as the Middle Eastern business hub seeks to offset the impact of the coronavirus pandemic and keep its economy on a growth trajectory.

Spending has been pegged at 60 billion dirhams ($16.3 billion) and revenue at 57.6 billion dirhams, according to Dubai’s Crown Prince Sheikh Hamdan bin Mohammed. Dubai is continuing to work to “realize the emirate’s ambitious future plans, enhance its competitiveness and consolidate its position as a leading global commercial hub,” he said.

As other wealthy nations tightened Covid-19 restrictions over the winter, Dubai decided to take a risk and gradually reopened its economy while embarking on one of the world’s most extensive vaccination drives. It is currently hosting the Expo 2020 exhibition, one of the biggest in-person events since the pandemic started.

Dubai’s business conditions saw the sharpest improvement in two years in October, spurred by a rebound in new orders and increased tourism as Expo 2020 got under way.

The government allocated 42% of total expenditure for this year toward infrastructure and transportation sectors, while 30% was set aside for social development. It expects 57% of revenue to come from fees and 20% from value-added and custom taxes.

“The 2022 budget strengthens recovery efforts and acts as a starting point within an integrated scheme” of the Dubai Strategic Plan 2030, said Abdulrahman Saleh Al Saleh, director general of Dubai’s department of finance.

PIF's Lucid deal a VC success even as fund isn't among top 10 investors in 2021 | ZAWYA MENA Edition

PIF's Lucid deal a VC success even as fund isn't among top 10 investors in 2021 | ZAWYA MENA Edition

Saudi Arabia's Public Investment Fund, known as PIF, wasn't among the top 10 global sovereign wealth funds in terms of cash deployment in 2021; however, its investment in Lucid Motors was considered one of the most successful venture capital deals of the year, according to a new industry report.

The PIF "was not as active in VC as in previous years, but it scored one of the best goals of the season when Lucid Motors went public in July," Global SWF said on Saturday in its annual report on the performance of global sovereign wealth funds.

With a return on investment that was almost 40 times, "every SOI [state-owned investors] should aspire to replicate the success of PIF with Lucid Motors...even if 90 percent of startups are doomed to fail," Global SWF said.

PIF invested $1.3 billion for 63 percent of Lucid in 2018, when the startup was running short of money. "Three years later, the stake is worth $41 billion, and the transaction showcases the competitive advantage of sovereign wealth funds when it comes to venture capital investing, thanks to liquidity and long-term horizon," it added in the report.

Saudi Arabia's Public Investment Fund, known as PIF, wasn't among the top 10 global sovereign wealth funds in terms of cash deployment in 2021; however, its investment in Lucid Motors was considered one of the most successful venture capital deals of the year, according to a new industry report.

The PIF "was not as active in VC as in previous years, but it scored one of the best goals of the season when Lucid Motors went public in July," Global SWF said on Saturday in its annual report on the performance of global sovereign wealth funds.

With a return on investment that was almost 40 times, "every SOI [state-owned investors] should aspire to replicate the success of PIF with Lucid Motors...even if 90 percent of startups are doomed to fail," Global SWF said.

PIF invested $1.3 billion for 63 percent of Lucid in 2018, when the startup was running short of money. "Three years later, the stake is worth $41 billion, and the transaction showcases the competitive advantage of sovereign wealth funds when it comes to venture capital investing, thanks to liquidity and long-term horizon," it added in the report.

#Saudi economy rebounds in 2021 after turbulent year | ZAWYA MENA Edition

Saudi economy rebounds in 2021 after turbulent year | ZAWYA MENA Edition

The Saudi economy recovered in 2021 after a tough year of pandemic restrictions as vaccination campaigns rolled out in the Kingdom and across the world driving its key oil exports.

MENA’s largest economy bounced back from last year, when the Kingdom’s gross domestic product contracted by 4.1 percent, according to the International Monetary Fund.

But this year saw higher oil output, its first quarterly budget surplus in over two years and lower unemployment drove growth.

Some economic data in 2021 even bettered pre-pandemic levels, although the full effect of the latest omicron variant is yet to be played out.

MENA’s largest economy bounced back from last year, when the Kingdom’s gross domestic product contracted by 4.1 percent, according to the International Monetary Fund.

But this year saw higher oil output, its first quarterly budget surplus in over two years and lower unemployment drove growth.

Some economic data in 2021 even bettered pre-pandemic levels, although the full effect of the latest omicron variant is yet to be played out.

Subscribe to:

Comments (Atom)