Oil settles higher on 2022 demand optimism | Reuters

Oil settled higher on Monday on hopes of further demand recovery in 2022, despite OPEC+ looking set to agree to another output increase and persistent concerns about how rising COVID infections might affect demand.

OPEC and its allies, or OPEC+, are expected on Tuesday to agree to the output hike. read more

The Omicron coronavirus variant has brought record case counts and dampened New Year festivities worldwide, with more than 4,000 flights cancelled on Sunday. read more

"The monthly OPEC + meeting that will be developing during the next couple of days is more likely to prove bullish than bearish since several of the OPEC members are having difficulty achieving assigned quotas," said Jim Ritterbusch, president of Ritterbusch and Associates in Galena, Illinois.

Brent crude settled up $1.20, or 1.5%, at $78.98 a barrel at 12 p.m. EST (1700 GMT), having earlier risen as high as $79.05. U.S. West Texas Intermediate (WTI) crude settled up 87 cents at $76.08 a barrel.

"Infection rates are on the rise globally, restrictions are being introduced in several countries, the air travel sector, amongst others, is suffering, yet investors' optimism is tangible," said Tamas Varga of oil broker PVM.

Solely aggregation of news articles, with no opinions expressed by this service since 2009 launch on this platform. Copyright to all articles remains with the original publisher and HEADLINES ARE CLICKABLE to access the whole article at source. (Subscription by email is recommended,with real-time updates on LinkedIn and Twitter.)

Search This Blog

Monday, 3 January 2022

Oil rises above $78 on optimism about 2022 outlook | Reuters

Oil rises above $78 on optimism about 2022 outlook | Reuters

Oil rose above $78 a barrel on Monday, supported by tight supply, a strong U.S. dollar, and hopes of a further demand recovery in 2022, despite OPEC+ looking set to agree to another output increase and persistent concerns about how rising COVID infections might affect demand.

OPEC and its allies, or OPEC+, are expected on Tuesday to agree to the output hike. read more The Omicron coronavirus variant has brought record case counts and dampened New Year festivities worldwide, with more than 4,000 flights cancelled on Sunday. read more

"The monthly OPEC + meeting that will be developing during the next couple of days is more likely to prove bullish than bearish since several of the OPEC members are having difficulty achieving assigned quotas," said Jim Ritterbusch, president of Ritterbusch and Associates in Galena, Illinois.

Brent crude was up $1.19, or 1.5%, at $78.97 a barrel at 12 p.m. EST (1700 GMT), having earlier risen as high as $79.05. U.S. West Texas Intermediate (WTI) crude rose 91 cents to $76.12 a barrel.

Oil rose above $78 a barrel on Monday, supported by tight supply, a strong U.S. dollar, and hopes of a further demand recovery in 2022, despite OPEC+ looking set to agree to another output increase and persistent concerns about how rising COVID infections might affect demand.

OPEC and its allies, or OPEC+, are expected on Tuesday to agree to the output hike. read more The Omicron coronavirus variant has brought record case counts and dampened New Year festivities worldwide, with more than 4,000 flights cancelled on Sunday. read more

"The monthly OPEC + meeting that will be developing during the next couple of days is more likely to prove bullish than bearish since several of the OPEC members are having difficulty achieving assigned quotas," said Jim Ritterbusch, president of Ritterbusch and Associates in Galena, Illinois.

Brent crude was up $1.19, or 1.5%, at $78.97 a barrel at 12 p.m. EST (1700 GMT), having earlier risen as high as $79.05. U.S. West Texas Intermediate (WTI) crude rose 91 cents to $76.12 a barrel.

Low inflation to keep Bank of #Israel on hold for now | Reuters

Low inflation to keep Bank of Israel on hold for now | Reuters

The Bank of Israel left its benchmark interest rate (ILINR=ECI) at 0.1% for a 14th straight policy meeting on Monday, and said benign inflation meant it need not hurry to raise rates.

In contrast to elsewhere in the West, Israel's inflation is expected to remain low and within an annual target of 1%-3%, helped by the shekel's 26-year high to the dollar that is suppressing import prices.

"The situation in Israel is different, which allows us patience in examining the developments and in conducting monetary policy," Bank of Israel Governor Amir Yaron told a news conference after the decision.

"We are in a different place than countries with inflationary pressures, and this is an important advantage for Israel’s economy at this time," he said. "There is no inflation outburst."

The Bank of Israel left its benchmark interest rate (ILINR=ECI) at 0.1% for a 14th straight policy meeting on Monday, and said benign inflation meant it need not hurry to raise rates.

In contrast to elsewhere in the West, Israel's inflation is expected to remain low and within an annual target of 1%-3%, helped by the shekel's 26-year high to the dollar that is suppressing import prices.

"The situation in Israel is different, which allows us patience in examining the developments and in conducting monetary policy," Bank of Israel Governor Amir Yaron told a news conference after the decision.

"We are in a different place than countries with inflationary pressures, and this is an important advantage for Israel’s economy at this time," he said. "There is no inflation outburst."

Oil rises above $78 on optimism about 2022 outlook | Reuters

Oil rises above $78 on optimism about 2022 outlook | Reuters

Oil rose above $78 a barrel on Monday, supported by tight supply and hopes of a further demand recovery in 2022, despite OPEC+ looking set to agree to a further output increase and concern persisting about the demand impact of rising coronavirus cases.

OPEC and its allies, or OPEC+, are expected on Tuesday to agree to the output hike. read more The Omicron coronavirus variant has brought record case counts and dampened New Year festivities worldwide, with more than 4,000 flights cancelled on Sunday. read more

Brent crude was up 39 cents, or 0.5%, to $78.17 a barrel at 1444 GMT, having earlier risen as high as $79.05. U.S. West Texas Intermediate (WTI) crude slipped 25 cents or 0.3%, to $74.96.

"Infection rates are on the rise globally, restrictions are being introduced in several countries, the air travel sector, amongst others, is suffering, yet investors' optimism is tangible," said Tamas Varga of oil broker PVM.

Oil rose above $78 a barrel on Monday, supported by tight supply and hopes of a further demand recovery in 2022, despite OPEC+ looking set to agree to a further output increase and concern persisting about the demand impact of rising coronavirus cases.

OPEC and its allies, or OPEC+, are expected on Tuesday to agree to the output hike. read more The Omicron coronavirus variant has brought record case counts and dampened New Year festivities worldwide, with more than 4,000 flights cancelled on Sunday. read more

Brent crude was up 39 cents, or 0.5%, to $78.17 a barrel at 1444 GMT, having earlier risen as high as $79.05. U.S. West Texas Intermediate (WTI) crude slipped 25 cents or 0.3%, to $74.96.

"Infection rates are on the rise globally, restrictions are being introduced in several countries, the air travel sector, amongst others, is suffering, yet investors' optimism is tangible," said Tamas Varga of oil broker PVM.

#Saudi Aramco awards $2.23bln contract to #AbuDhabi's NPCC | ZAWYA MENA Edition

Saudi Aramco awards $2.23bln contract to Abu Dhabi's NPCC | ZAWYA MENA Edition

Saudi Aramco has awarded a contract worth AED 8.2 billion ($2.23 billion) to the Abu Dhabi’s National Petroleum Construction Company (NPCC) for two packages in the Zulf Offshore Field.

The project is expected to be executed over three-years.

No further details about the project were given in a statement to Abu Dhabi Securities Exchange (ADX) by National Marine Dredging Company PJCS (NMDC) which wholly owns NPCC.

Saudi Aramco has awarded a contract worth AED 8.2 billion ($2.23 billion) to the Abu Dhabi’s National Petroleum Construction Company (NPCC) for two packages in the Zulf Offshore Field.

The project is expected to be executed over three-years.

No further details about the project were given in a statement to Abu Dhabi Securities Exchange (ADX) by National Marine Dredging Company PJCS (NMDC) which wholly owns NPCC.

OPEC Picks #Kuwait’s Haitham Al-Ghais as Next Top Diplomat - Bloomberg

OPEC Picks Kuwait’s Haitham Al-Ghais as Next Top Diplomat - Bloomberg

OPEC chose veteran Kuwaiti oil executive Haitham al-Ghais to become the organization’s top diplomat, as the group and its allies navigate a delicate recovery from the pandemic.

Al-Ghais -- a multilingual technocrat whose three-decade oil industry career includes stints in Beijing and London -- will become Secretary-General in August, taking over from Mohammad Barkindo, according to a statement from the Organization of Petroleum Exporting Countries on Monday.

His appointment comes at time when OPEC and its partners tread a narrow path, seeking to satisfy the recovery in oil consumption without tipping markets back into oversupply. The OPEC+ coalition is expected to approve another modest resumption of supplies when it meets on Tuesday.

“He knows OPEC inside and out,” said Johannes Benigni, chairman of consultant JBC Energy Group in Vienna. “At the same time, he knows the ins and outs of the market. He’s very smart and a good analyst.”

|

Haitham al-Ghais Photographer: Yasser Al-Zayyat/AFP via Getty Images |

OPEC chose veteran Kuwaiti oil executive Haitham al-Ghais to become the organization’s top diplomat, as the group and its allies navigate a delicate recovery from the pandemic.

Al-Ghais -- a multilingual technocrat whose three-decade oil industry career includes stints in Beijing and London -- will become Secretary-General in August, taking over from Mohammad Barkindo, according to a statement from the Organization of Petroleum Exporting Countries on Monday.

His appointment comes at time when OPEC and its partners tread a narrow path, seeking to satisfy the recovery in oil consumption without tipping markets back into oversupply. The OPEC+ coalition is expected to approve another modest resumption of supplies when it meets on Tuesday.

“He knows OPEC inside and out,” said Johannes Benigni, chairman of consultant JBC Energy Group in Vienna. “At the same time, he knows the ins and outs of the market. He’s very smart and a good analyst.”

Most Gulf bourses fall as COVID-19 cases rise | Reuters

Most Gulf bourses fall as COVID-19 cases rise | Reuters

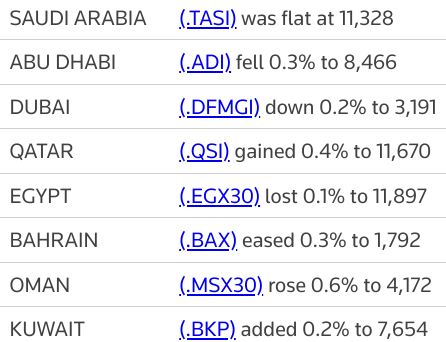

Most major stock markets in the Gulf ended lower on Monday amid a surge in COVID-19 cases, although the Qatari index bucked the trend.

In Abu Dhabi, the index (.ADI) fell 0.3%, with Alpha Dhabi Holding (ALPHADHABI.AD) retreating 3.9% after the conglomerate said it had bought an additional 17% in developer Aldar Properties (ALDAR.AD) to take its stake to 29.8%. read more

Shares of Aldar gained 1%.

Dubai's main share index (.DFMGI) lost 0.2%, hit by a 7.4% slide in bourse operator Dubai Financial Market (DFM.DU).

The United Arab Emirates (UAE), a tourism and commercial hub now marking its peak tourism season and hosting a world fair, on Sunday recorded 2,600 new coronavirus cases and three deaths. It said on Saturday it would ban non-vaccinated citizens from travelling abroad from Jan. 10. read more

Daily cases had fallen below 100 in October.

Separately, the Houthi movement that controls most of northern Yemen has hijacked an UAE-flagged cargo vessel off the Yemeni port city of Hodeidah, the Saudi-led coalition said on Monday, according to TV channel Al Arabiya. read more

The benchmark index (.TASI) in Saudi Arabia, the largest Gulf state with a population of around 30 million, ended flat as gains in financial shares were offset by declines in petrochemical stocks.

Daily coronavirus cases in Saudi Arabia have climbed above 1,000 for the first time since August, after having fallen below 100 in September.

Saudi Arabia's central bank has extended a deferred payment programme meant to help support the private sector by an additional three months until March 31, it said on Thursday. read more

The Qatari index (.QSI), however, gained 0.4%, ending two sessions of losses, helped by a 0.9% gain in petrochemical maker Industries Qatar (IQCD.QA).

Meanwhile, oil rose towards $79 a barrel, supported by tight supply and hopes of further demand recovery in 2022.

Outside the Gulf, Egypt's blue-chip index (.EGX30) eased 0.1%, with top lender Commercial International Bank (COMI.CA) losing 0.6%.

The Egyptian market is also exposed to some price corrections after the increases from last week as investors move to secure their gains, said Wael Makarem, senior market strategist at Exness.

Most major stock markets in the Gulf ended lower on Monday amid a surge in COVID-19 cases, although the Qatari index bucked the trend.

In Abu Dhabi, the index (.ADI) fell 0.3%, with Alpha Dhabi Holding (ALPHADHABI.AD) retreating 3.9% after the conglomerate said it had bought an additional 17% in developer Aldar Properties (ALDAR.AD) to take its stake to 29.8%. read more

Shares of Aldar gained 1%.

Dubai's main share index (.DFMGI) lost 0.2%, hit by a 7.4% slide in bourse operator Dubai Financial Market (DFM.DU).

The United Arab Emirates (UAE), a tourism and commercial hub now marking its peak tourism season and hosting a world fair, on Sunday recorded 2,600 new coronavirus cases and three deaths. It said on Saturday it would ban non-vaccinated citizens from travelling abroad from Jan. 10. read more

Daily cases had fallen below 100 in October.

Separately, the Houthi movement that controls most of northern Yemen has hijacked an UAE-flagged cargo vessel off the Yemeni port city of Hodeidah, the Saudi-led coalition said on Monday, according to TV channel Al Arabiya. read more

The benchmark index (.TASI) in Saudi Arabia, the largest Gulf state with a population of around 30 million, ended flat as gains in financial shares were offset by declines in petrochemical stocks.

Daily coronavirus cases in Saudi Arabia have climbed above 1,000 for the first time since August, after having fallen below 100 in September.

Saudi Arabia's central bank has extended a deferred payment programme meant to help support the private sector by an additional three months until March 31, it said on Thursday. read more

The Qatari index (.QSI), however, gained 0.4%, ending two sessions of losses, helped by a 0.9% gain in petrochemical maker Industries Qatar (IQCD.QA).

Meanwhile, oil rose towards $79 a barrel, supported by tight supply and hopes of further demand recovery in 2022.

Outside the Gulf, Egypt's blue-chip index (.EGX30) eased 0.1%, with top lender Commercial International Bank (COMI.CA) losing 0.6%.

The Egyptian market is also exposed to some price corrections after the increases from last week as investors move to secure their gains, said Wael Makarem, senior market strategist at Exness.

Opec+ prepares to meet as oil prices edge higher despite Omicron concerns

Opec+ prepares to meet as oil prices edge higher despite Omicron concerns

Opec+, led by Saudi Arabia and Russia, is scheduled to meet on Tuesday as oil prices continued to edge higher, despite demand concerns arising from the worldwide increase in Omicron coronavirus infections.

Brent, the global benchmark for two thirds of the world's oil, was up 0.73 per cent to $78.35 per barrel at 10.35am UAE time on Monday, while West Texas Intermediate, the gauge that tracks US crude, was trading 0.76 per cent higher at $75.78 per barrel.

“Oil prices rose on Monday as the market kicked off 2022 on a positive note, spurred by the global economic recovery from the Covid-19 pandemic slump and producer restraint, even as infections reached record highs worldwide,” said Avtar Sandu, senior manager of commodities at Singapore's Phillip Futures.

Coronavirus infections have been rising worldwide in the past few weeks after the detection of the Omicron variant in South Africa in November. The total cases worldwide currently stand at more than 290.6 million, with deaths exceeding 5.4 million, according to Worldometer, which tracks the pandemic. More than 254.5 million people also recovered from the infection.

Opec+, led by Saudi Arabia and Russia, is scheduled to meet on Tuesday as oil prices continued to edge higher, despite demand concerns arising from the worldwide increase in Omicron coronavirus infections.

Brent, the global benchmark for two thirds of the world's oil, was up 0.73 per cent to $78.35 per barrel at 10.35am UAE time on Monday, while West Texas Intermediate, the gauge that tracks US crude, was trading 0.76 per cent higher at $75.78 per barrel.

“Oil prices rose on Monday as the market kicked off 2022 on a positive note, spurred by the global economic recovery from the Covid-19 pandemic slump and producer restraint, even as infections reached record highs worldwide,” said Avtar Sandu, senior manager of commodities at Singapore's Phillip Futures.

Coronavirus infections have been rising worldwide in the past few weeks after the detection of the Omicron variant in South Africa in November. The total cases worldwide currently stand at more than 290.6 million, with deaths exceeding 5.4 million, according to Worldometer, which tracks the pandemic. More than 254.5 million people also recovered from the infection.

Oil Climbs as Libyan Output Falls Ahead of OPEC+ Supply Meeting - Bloomberg

Oil Climbs as Libyan Output Falls Ahead of OPEC+ Supply Meeting - Bloomberg

| PRICES |

|---|

|

Most Gulf bourses fall in early trade; Saudi gains | Reuters

Most Gulf bourses fall in early trade; Saudi gains | Reuters

Most major stock markets in the Gulf fell in early trade on Monday amid rising COVID-19 cases, as the Saudi index bucked the trend to trade higher in line with oil prices.

In Abu Dhabi, the index (.ADI) dropped 0.6%, with the country's largest lender First Abu Dhabi Bank (FAB.AD) losing 0.8% and telecoms firm Etisalat (ETISALAT.AD) retreating 0.9%.

Dubai's main share index (.DFMGI) fell 0.4%, hit by a 6.3% fall in Dubai Financial Market (DFM.DU).

The United Arab Emirates, a tourism and commercial hub now marking its peak tourism season and hosting a world fair, on Sunday recorded 2,600 new coronavirus cases and three deaths. It said on Saturday it would ban non-vaccinated citizens from travelling abroad from Jan. 10. read more

The Qatari benchmark (.QSI) eased 0.1%, with sharia-compliant lender Masraf Al Rayan (MARK.QA) losing 0.4%.

Saudi Arabia's benchmark index (.TASI) gained 0.5%, supported by a 0.8% rise in Al Rajhi Bank (1120.SE) and a 1.5% increase in Saudi National Bank (1180.SE).

The kingdom's central bank has extended a deferred payment programme meant to help support the private sector by an additional three months until March 31, it said on Thursday. read more

Oil prices, a key catalyst for the Gulf's financial markets, firmed as the market kicked off 2022 on a positive note with suppliers in focus ahead of Tuesday's OPEC+ meeting.

Most major stock markets in the Gulf fell in early trade on Monday amid rising COVID-19 cases, as the Saudi index bucked the trend to trade higher in line with oil prices.

In Abu Dhabi, the index (.ADI) dropped 0.6%, with the country's largest lender First Abu Dhabi Bank (FAB.AD) losing 0.8% and telecoms firm Etisalat (ETISALAT.AD) retreating 0.9%.

Dubai's main share index (.DFMGI) fell 0.4%, hit by a 6.3% fall in Dubai Financial Market (DFM.DU).

The United Arab Emirates, a tourism and commercial hub now marking its peak tourism season and hosting a world fair, on Sunday recorded 2,600 new coronavirus cases and three deaths. It said on Saturday it would ban non-vaccinated citizens from travelling abroad from Jan. 10. read more

The Qatari benchmark (.QSI) eased 0.1%, with sharia-compliant lender Masraf Al Rayan (MARK.QA) losing 0.4%.

Saudi Arabia's benchmark index (.TASI) gained 0.5%, supported by a 0.8% rise in Al Rajhi Bank (1120.SE) and a 1.5% increase in Saudi National Bank (1180.SE).

The kingdom's central bank has extended a deferred payment programme meant to help support the private sector by an additional three months until March 31, it said on Thursday. read more

Oil prices, a key catalyst for the Gulf's financial markets, firmed as the market kicked off 2022 on a positive note with suppliers in focus ahead of Tuesday's OPEC+ meeting.

Alpha Dhabi Buys $1.5 Billion Stake in #UAE Property Firm Aldar - Bloomberg

Alpha Dhabi Buys $1.5 Billion Stake in UAE Property Firm Aldar - Bloomberg

Alpha Dhabi Holding PJSC built an additional stake in Abu Dhabi’s biggest property developer valued at about $1.5 billion as the United Arab Emirates-based holding company boosts its investment portfolio.

The firm, one of the UAE’s biggest listed companies by market value, acquired a 17% stake in Aldar Properties PJSC, according to a statement. That comes on top of a 12.8% shareholding Alpha Dhabi bought in the real-estate developer last year.

“Aldar’s rapid growth, strategic expansion plan and projects pipeline represent the right investment for ADH and our shareholders,” said Alpha Dhabi Chief Executive Officer Hamad Mohamed Al-Ameri. “Aldar’s many projects vary between local, regional and international markets and align with our vision for ADH to explore new markets.”

Alpha Dhabi is looking for opportunities to deploy capital in private and public assets in the country as part of its new strategy, Al-Ameri told Bloomberg in December. It will also explore investments across the Middle East and North Africa, the U.S., India and Pakistan, he said.

The firm said the additional stake purchase in Aldar is in line with an expansion plan targeting 8 billion dirhams for investments in real estate, hospitality, healthcare, petrochemicals, and other sectors inside and outside the UAE.

More from Alpha Dhabi announcements:

Alpha Dhabi Holding PJSC built an additional stake in Abu Dhabi’s biggest property developer valued at about $1.5 billion as the United Arab Emirates-based holding company boosts its investment portfolio.

The firm, one of the UAE’s biggest listed companies by market value, acquired a 17% stake in Aldar Properties PJSC, according to a statement. That comes on top of a 12.8% shareholding Alpha Dhabi bought in the real-estate developer last year.

“Aldar’s rapid growth, strategic expansion plan and projects pipeline represent the right investment for ADH and our shareholders,” said Alpha Dhabi Chief Executive Officer Hamad Mohamed Al-Ameri. “Aldar’s many projects vary between local, regional and international markets and align with our vision for ADH to explore new markets.”

Alpha Dhabi is looking for opportunities to deploy capital in private and public assets in the country as part of its new strategy, Al-Ameri told Bloomberg in December. It will also explore investments across the Middle East and North Africa, the U.S., India and Pakistan, he said.

The firm said the additional stake purchase in Aldar is in line with an expansion plan targeting 8 billion dirhams for investments in real estate, hospitality, healthcare, petrochemicals, and other sectors inside and outside the UAE.

More from Alpha Dhabi announcements:

- Alpha Dhabi and its subsidiaries acquired the entire share-capital of Sogno Two Sole Proprietorship, Sogno Three Sole Proprietorship, and Sublime Two Sole Proprietorship

- As a result, it has effectively acquired the following:

- Additional 17% stake in Aldar

- Additional 3.38% stake in National Marin Dredging

- Investment in Al Qudra Holding equivalent to 25.24% of its share capital

Oil begins new year with gains, Omicron worries linger | Reuters

Oil begins new year with gains, Omicron worries linger | Reuters

Oil prices firmed on Monday as the market kicked off 2022 on a positive note with suppliers in focus ahead of Tuesday's OPEC+ meeting, although surging COVID-19 cases continued to dent demand sentiment.

Brent crude added 56 cents, or 0.72%, to $78.34 a barrel, as of 0710 GMT. U.S. West Texas Intermediate crude futures gained 52 cents, or 0.69%, to $75.73 a barrel.

"Tightened supplies from Libya ahead of an Organization of the Petroleum Exporting Countries and allies (OPEC+) meeting kept the market sentiments positive," said Abhishek Chauhan, head of commodities at Swastika Investmart Ltd.

Libya's state oil firm said on Saturday the country's oil output would be reduced by 200,000 barrels per day for a week due to maintenance on a main pipeline between the Samah and Dahra fields.

Oil prices firmed on Monday as the market kicked off 2022 on a positive note with suppliers in focus ahead of Tuesday's OPEC+ meeting, although surging COVID-19 cases continued to dent demand sentiment.

Brent crude added 56 cents, or 0.72%, to $78.34 a barrel, as of 0710 GMT. U.S. West Texas Intermediate crude futures gained 52 cents, or 0.69%, to $75.73 a barrel.

"Tightened supplies from Libya ahead of an Organization of the Petroleum Exporting Countries and allies (OPEC+) meeting kept the market sentiments positive," said Abhishek Chauhan, head of commodities at Swastika Investmart Ltd.

Libya's state oil firm said on Saturday the country's oil output would be reduced by 200,000 barrels per day for a week due to maintenance on a main pipeline between the Samah and Dahra fields.

Subscribe to:

Comments (Atom)