Middle East News: Dubai Shares Higher After OPEC Boosts Oil - Bloomberg:

Dubai shares climbed the most in the Middle East on Sunday after OPEC+ extended its record output cuts, underpinning the recovery in oil prices.

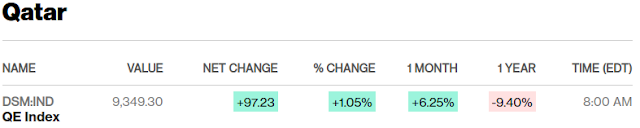

The DFM General Index rose 4.6%, trimming losses this year to 20%. Gauges in Saudi Arabia, Abu Dhabi, Kuwait, Oman and Qatar gained between 0.6% and 2.4%. Stocks in Egypt climbed 4.6% after the government agreed a $5.2 billion stand-by loan with the International Monetary Fund.

OPEC+ decided at the weekend to roll-over export curbs and monitor compliance more closely to ensure members don’t pump more oil than they’ve pledged. Brent crude rose 19% last week to $42.30 a barrel in anticipation of the agreement, its sixth-consecutive weekly advance, with shares in developed and emerging markets also jumping. Consultant Wood Mackenzie Ltd. sees Brent rising further to as much as $50 because of the supply restrictions and increased demand as more economies reopen.

“The recovery in oil prices and further extension of record production cuts by OPEC+ until the end of July will have a positive impact on domestic markets,” said Iyad Abu Hweij, a managing partner at Allied Investment Partners PJSC in Dubai.

Solely aggregation of news articles, with no opinions expressed by this service since 2009 launch on this platform. Copyright to all articles remains with the original publisher and HEADLINES ARE CLICKABLE to access the whole article at source. (Subscription by email is recommended,with real-time updates on LinkedIn and Twitter.)

Search This Blog

Sunday, 7 June 2020

Saudis Make Biggest Oil Price Hike in 20 Years After OPEC+ Cuts - Bloomberg

Saudis Make Biggest Oil Price Hike in 20 Years After OPEC+ Cuts - Bloomberg:

Saudi Arabia made some of the biggest price increases for crude exports in at least two decades, doubling down on its strategy to bolster the oil market after OPEC+ producers extended historic output cuts.

The steepest jump will hit July exports to Asia, state producer Saudi Aramco’s largest regional market, according to a pricing list seen by Bloomberg. Overall, the increases for Saudi crude erase almost all of the discounts the kingdom made during its brief price war with Russia.

The sharp price increases show that Saudi Arabia is using all the tools at its disposal to turn around the oil market after prices plunged into negative territory in April. As the price setter in the Middle East, the increases in its official prices may be followed by other producers.

Tighter crude supply is helping repair an oil market battered by the coronavirus. Unprecedented output cuts led by the Saudis and Russia boosted prices in May, and the OPEC+ group decided Saturday to extend those limits through July. Brent crude, down 36% this year, has clawed back some of its losses and ended trading on Friday at more than $40 a barrel.

Saudi Arabia made some of the biggest price increases for crude exports in at least two decades, doubling down on its strategy to bolster the oil market after OPEC+ producers extended historic output cuts.

The steepest jump will hit July exports to Asia, state producer Saudi Aramco’s largest regional market, according to a pricing list seen by Bloomberg. Overall, the increases for Saudi crude erase almost all of the discounts the kingdom made during its brief price war with Russia.

The sharp price increases show that Saudi Arabia is using all the tools at its disposal to turn around the oil market after prices plunged into negative territory in April. As the price setter in the Middle East, the increases in its official prices may be followed by other producers.

Tighter crude supply is helping repair an oil market battered by the coronavirus. Unprecedented output cuts led by the Saudis and Russia boosted prices in May, and the OPEC+ group decided Saturday to extend those limits through July. Brent crude, down 36% this year, has clawed back some of its losses and ended trading on Friday at more than $40 a barrel.

Only Currency to Dodge Gulf Market’s Ire Shows Payoff After Rift - Bloomberg

Only Currency to Dodge Gulf Market’s Ire Shows Payoff After Rift - Bloomberg:

Three years after being isolated by its Gulf Arab neighbors, Qatar also stands apart in the currency market.

Its peg against the dollar has been the only one in the region that hasn’t come under pressure even as local economies succumb to what may be their worst recession ever. The nation’s bonds have also outperformed those of the other five members of the Gulf Cooperation Council this year.

Three years after being isolated by its Gulf Arab neighbors, Qatar also stands apart in the currency market.

Its peg against the dollar has been the only one in the region that hasn’t come under pressure even as local economies succumb to what may be their worst recession ever. The nation’s bonds have also outperformed those of the other five members of the Gulf Cooperation Council this year.

|

Qatar has bulked up its fiscal defenses and grown more self-sufficient after four Arab states led by Saudi

Arabia severed diplomatic and trade ties over accusations that it supported terrorist groups -- allegations

the emirate denies.

The world’s biggest exporter of liquefied natural gas, due to host the 2022 soccer World Cup, has since rebuilt its reserves and brought the oil price it needs to balance the budget to the lowest in the region. S&P Global Ratings projects the size of the government’s liquid financial assets will average about 177% of gross domestic product from 2021 through 2023.

The world’s biggest exporter of liquefied natural gas, due to host the 2022 soccer World Cup, has since rebuilt its reserves and brought the oil price it needs to balance the budget to the lowest in the region. S&P Global Ratings projects the size of the government’s liquid financial assets will average about 177% of gross domestic product from 2021 through 2023.

#SaudiArabia and Russia Unite to Tackle OPEC’s Pinocchio Problem - Bloomberg

Saudi Arabia and Russia Unite to Tackle OPEC’s Pinocchio Problem - Bloomberg:

A deal to extend record OPEC+ output cuts was going smoothly -- until Saudi Arabia and Russia discovered just how much some of their allies had been cheating.

In private conversations, Saudi Arabia Energy Minister Prince Abdulaziz bin Salman and his Russian counterpart Alexander Novak had agreed with little fanfare on May 28 to extend oil production cuts by one more month. Their bosses had spoken the day before. With the two power players aligned, Prince Abdulaziz suggested bringing the meeting with other OPEC ministers forward, and Novak had no objection.

The cartel appeared on the brink of a deal.

Then, a day later, the trouble started. The first OPEC output surveys, compiled by news organization and consultants, showed that Angola, Iraq, Kazakhstan and Nigeria weren’t squeezing supply nearly as much as they had promised. Baghdad was the worst offender.

A deal to extend record OPEC+ output cuts was going smoothly -- until Saudi Arabia and Russia discovered just how much some of their allies had been cheating.

In private conversations, Saudi Arabia Energy Minister Prince Abdulaziz bin Salman and his Russian counterpart Alexander Novak had agreed with little fanfare on May 28 to extend oil production cuts by one more month. Their bosses had spoken the day before. With the two power players aligned, Prince Abdulaziz suggested bringing the meeting with other OPEC ministers forward, and Novak had no objection.

The cartel appeared on the brink of a deal.

Then, a day later, the trouble started. The first OPEC output surveys, compiled by news organization and consultants, showed that Angola, Iraq, Kazakhstan and Nigeria weren’t squeezing supply nearly as much as they had promised. Baghdad was the worst offender.

MIDEAST STOCKS-Gulf stocks rise on oil pact, Egypt lifted by IMF agreement - Reuters

MIDEAST STOCKS-Gulf stocks rise on oil pact, Egypt lifted by IMF agreement - Reuters:

Most bourses in the Gulf ended higher on

Sunday, a day after the OPEC+ group of oil producers agreed to

extend record production cuts until the end of July, with

Egyptian shares boosted by a preliminary deal on a standby IMF

loan for the country.

Saturday's deal between OPEC and other producers led by

Russia prolongs a pact that has helped crude prices to double in

the past two months by withdrawing almost 10% of global supplies

from the market.

Dubai's main share index jumped 4.6%, its biggest

intraday gain since April 7, led by a 9.5% surge for Dubai

Islamic Bank and a 6.1% increase in Emaar Properties

.

In Saudi Arabia, OPEC's de facto leader, the index

was up 0.8%, with Al Rajhi Bank rising 1% and

petrochemicals group Saudi Basic Industries up 1.1%.

Most bourses in the Gulf ended higher on

Sunday, a day after the OPEC+ group of oil producers agreed to

extend record production cuts until the end of July, with

Egyptian shares boosted by a preliminary deal on a standby IMF

loan for the country.

Saturday's deal between OPEC and other producers led by

Russia prolongs a pact that has helped crude prices to double in

the past two months by withdrawing almost 10% of global supplies

from the market.

Dubai's main share index jumped 4.6%, its biggest

intraday gain since April 7, led by a 9.5% surge for Dubai

Islamic Bank and a 6.1% increase in Emaar Properties

.

In Saudi Arabia, OPEC's de facto leader, the index

was up 0.8%, with Al Rajhi Bank rising 1% and

petrochemicals group Saudi Basic Industries up 1.1%.

India's Reliance says #AbuDhabi Investment Authority invests $752 million in digital unit - Reuters

India's Reliance says Abu Dhabi Investment Authority invests $752 million in digital unit - Reuters:

Indian oil-to-telecoms conglomerate Reliance Industries said on Sunday that the Abu Dhabi Investment Authority (ADIA) will buy 1.16% of its digital unit Jio Platforms for 56.83 billion rupees ($752 million).

ADIA’s investment in Jio Platforms, which comprises Reliance’s telecoms arm Jio Infocomm and its music and video streaming apps, gives the unit an enterprise value of 5.16 trillion rupees, Reliance said in a regulatory filing.

Reliance, controlled by India’s richest man Mukesh Ambani, has now sold just over 21% of Jio Platforms to investors including Facebook Inc, securing nearly $13 billion in less than seven weeks.

On Friday, Abu Dhabi’s state fund Mubadala Investment Co announced it would purchase a 1.85% stake in Jio Platforms for 90.93 billion rupees.

Indian oil-to-telecoms conglomerate Reliance Industries said on Sunday that the Abu Dhabi Investment Authority (ADIA) will buy 1.16% of its digital unit Jio Platforms for 56.83 billion rupees ($752 million).

ADIA’s investment in Jio Platforms, which comprises Reliance’s telecoms arm Jio Infocomm and its music and video streaming apps, gives the unit an enterprise value of 5.16 trillion rupees, Reliance said in a regulatory filing.

Reliance, controlled by India’s richest man Mukesh Ambani, has now sold just over 21% of Jio Platforms to investors including Facebook Inc, securing nearly $13 billion in less than seven weeks.

On Friday, Abu Dhabi’s state fund Mubadala Investment Co announced it would purchase a 1.85% stake in Jio Platforms for 90.93 billion rupees.

European, Middle Eastern & African Stocks - Bloomberg #UAE #SaudiArabia #Qatar close

European, Middle Eastern & African Stocks - Bloomberg:

Updated stock indexes in Europe, Middle East & Africa. Get an overview of major indexes, current values and stock market data in Europe, UK, Germany, Russia & more.

Updated stock indexes in Europe, Middle East & Africa. Get an overview of major indexes, current values and stock market data in Europe, UK, Germany, Russia & more.

Middle East News: #Dubai Shares Higher After OPEC Boosts Oil - Bloomberg

Middle East News: Dubai Shares Higher After OPEC Boosts Oil - Bloomberg:

Dubai shares climbed the most in the Gulf on after OPEC+ agreed to a one-month extension of its record output cuts, underpinning the recovery in oil prices.

The DFM General Index rose as much as 3.0%, trimming losses this year to 24%. Gauges in Saudi Arabia, Abu Dhabi, Kuwait, Oman and Qatar gained between 0.2% and 1.6%.

Major oil producers decided at the weekend on a production-curb extension as well as a stricter approach to ensuring OPEC members don’t break their pledges. Brent crude rose 19% last week in anticipation of the meeting, in the sixth consecutive weekly advance, with shares in developed and emerging markets also jumping.

“The recovery in oil prices and further extension of record production cuts by OPEC+ until the end of July will have a positive impact on domestic markets,” said Iyad Abu Hweij, a managing partner at Allied Investment Partners PJSC in Dubai.

Dubai shares climbed the most in the Gulf on after OPEC+ agreed to a one-month extension of its record output cuts, underpinning the recovery in oil prices.

The DFM General Index rose as much as 3.0%, trimming losses this year to 24%. Gauges in Saudi Arabia, Abu Dhabi, Kuwait, Oman and Qatar gained between 0.2% and 1.6%.

Major oil producers decided at the weekend on a production-curb extension as well as a stricter approach to ensuring OPEC members don’t break their pledges. Brent crude rose 19% last week in anticipation of the meeting, in the sixth consecutive weekly advance, with shares in developed and emerging markets also jumping.

“The recovery in oil prices and further extension of record production cuts by OPEC+ until the end of July will have a positive impact on domestic markets,” said Iyad Abu Hweij, a managing partner at Allied Investment Partners PJSC in Dubai.

Can #SaudiArabia’s Mohammed bin Salman Redeem His Mistakes? - Bloomberg

Can Saudi Arabia’s Mohammed bin Salman Redeem His Mistakes? - Bloomberg:

His hand over his heart — a gesture as common to the Middle East’s princes as to its paupers — Crown Prince Mohammed bin Salman might admit that he bears at least as much responsibility as the coronavirus pandemic for the state of Saudi Arabia’s economy. It is, after all, the combination of his ill-timed oil war against Russia with the Covid-19 crisis that has left the kingdom facing the steepest contraction in a generation.

Although relatively few Saudis have contracted the virus, the substantial economic damage will likely force the crown prince to make deep cuts to his “Vision 2030” plan.

The centerpiece for an ambitious agenda of economic and social reforms, that plan was conceived in the throes of the last oil slump. Its goal was to wean Saudi Arabia from its dependence on hydrocarbons and create more opportunity for private enterprise. But four years on, more than 60% of government revenue still comes from oil, and low prices have halved the take.

MBS, as the crown prince is commonly known, has ordered austerity measures — most prominently, the tripling of the value-added tax and cuts to bureaucrats’ allowances. But these will sharpen the economic downturn by reducing consumption and inhibiting private-sector investment. In turn, this will compound the frustrations of unemployed Saudis, the majority of them women, who had been promised a shot at prosperity in the prince’s vision of the country’s economic future.

Vision interruptus.

Photographer: Tasneem Alsultan/Bloomberg via Getty Images

His hand over his heart — a gesture as common to the Middle East’s princes as to its paupers — Crown Prince Mohammed bin Salman might admit that he bears at least as much responsibility as the coronavirus pandemic for the state of Saudi Arabia’s economy. It is, after all, the combination of his ill-timed oil war against Russia with the Covid-19 crisis that has left the kingdom facing the steepest contraction in a generation.

Although relatively few Saudis have contracted the virus, the substantial economic damage will likely force the crown prince to make deep cuts to his “Vision 2030” plan.

The centerpiece for an ambitious agenda of economic and social reforms, that plan was conceived in the throes of the last oil slump. Its goal was to wean Saudi Arabia from its dependence on hydrocarbons and create more opportunity for private enterprise. But four years on, more than 60% of government revenue still comes from oil, and low prices have halved the take.

MBS, as the crown prince is commonly known, has ordered austerity measures — most prominently, the tripling of the value-added tax and cuts to bureaucrats’ allowances. But these will sharpen the economic downturn by reducing consumption and inhibiting private-sector investment. In turn, this will compound the frustrations of unemployed Saudis, the majority of them women, who had been promised a shot at prosperity in the prince’s vision of the country’s economic future.

Emirates, Etihad extend temporary salary cuts to September - Reuters

Emirates, Etihad extend temporary salary cuts to September - Reuters:

Gulf carriers Emirates and Etihad Airways are extending the period of reduced pay for their staff until September as they try to preserve cash during the global coronavirus pandemic.

The aviation industry has been among the worst hit by the outbreak, which has dented travel demand and forced major airlines to lay off staff and seek government bailouts.

State airlines Emirates and Etihad have operated limited, mostly outbound services from the United Arab Emirates since grounding passenger flights in March.

They are due to restart some connecting flights this month after the UAE last week lifted a suspension on services where passengers stop off in the country to change planes, or for refuelling.

Gulf carriers Emirates and Etihad Airways are extending the period of reduced pay for their staff until September as they try to preserve cash during the global coronavirus pandemic.

The aviation industry has been among the worst hit by the outbreak, which has dented travel demand and forced major airlines to lay off staff and seek government bailouts.

State airlines Emirates and Etihad have operated limited, mostly outbound services from the United Arab Emirates since grounding passenger flights in March.

They are due to restart some connecting flights this month after the UAE last week lifted a suspension on services where passengers stop off in the country to change planes, or for refuelling.

#SaudiArabia's oil exports plunge $11 billion in first quarter - Reuters

Saudi Arabia's oil exports plunge $11 billion in first quarter - Reuters:

The value of Saudi Arabia’s oil exports plunged by 21.9% year on year in the first quarter to $40 billion, corresponding to a decline of about $11 billion, official data showed on Sunday.

Brent crude prices fell more than 60% in the quarter hurt by the coronavirus pandemic and an oil price war between Saudi Arabia and Russia following the collapse in March of talks on further production cuts.

The decline in oil exports was the main reason behind a 20.7% decline in the value of overall merchandise exports in the first quarter, the General Authority for Statistics said on Sunday.

Non-oil exports, including chemicals and plastics, fell by 16.5%, it said.

The value of Saudi Arabia’s oil exports plunged by 21.9% year on year in the first quarter to $40 billion, corresponding to a decline of about $11 billion, official data showed on Sunday.

Brent crude prices fell more than 60% in the quarter hurt by the coronavirus pandemic and an oil price war between Saudi Arabia and Russia following the collapse in March of talks on further production cuts.

The decline in oil exports was the main reason behind a 20.7% decline in the value of overall merchandise exports in the first quarter, the General Authority for Statistics said on Sunday.

Non-oil exports, including chemicals and plastics, fell by 16.5%, it said.

BP discusses sale of $1bn-plus stake in giant Oman gas project - Arabianbusiness

BP discusses sale of $1bn-plus stake in giant Oman gas project - Arabianbusiness:

BP is in early-stage discussions to sell about a 10% stake in a key gas field in Oman as part of the energy giant’s plans to cut debt, according to people familiar with the matter.

London-based BP is talking with interested parties about cutting part of its 60% holding in the Khazzan natural gas field, the people said, asking not to be identified as the matter is private. The 10% stake is likely to fetch more than $1 billion and is drawing interest from other large energy companies, they said.

A stake sale would help BP deliver on its goal to achieve $15 billion in divestments by mid-2021 - crucial for easing its debt burden. The company has bolstered its financial reserves as the double impact of the coronavirus pandemic and a crash in oil prices hit profits in the first quarter. In April, BP confirmed its commitment to completing the sale of its Alaska business to Hilcorp Energy Co. on revised terms.

BP is in early-stage discussions to sell about a 10% stake in a key gas field in Oman as part of the energy giant’s plans to cut debt, according to people familiar with the matter.

London-based BP is talking with interested parties about cutting part of its 60% holding in the Khazzan natural gas field, the people said, asking not to be identified as the matter is private. The 10% stake is likely to fetch more than $1 billion and is drawing interest from other large energy companies, they said.

A stake sale would help BP deliver on its goal to achieve $15 billion in divestments by mid-2021 - crucial for easing its debt burden. The company has bolstered its financial reserves as the double impact of the coronavirus pandemic and a crash in oil prices hit profits in the first quarter. In April, BP confirmed its commitment to completing the sale of its Alaska business to Hilcorp Energy Co. on revised terms.

European, Middle Eastern & African Stocks - Bloomberg #UAE #SaudiArabia #Qatar mid-session

European, Middle Eastern & African Stocks - Bloomberg:

Updated stock indexes in Europe, Middle East & Africa. Get an overview of major indexes, current values and stock market data in Europe, UK, Germany, Russia & more.

Updated stock indexes in Europe, Middle East & Africa. Get an overview of major indexes, current values and stock market data in Europe, UK, Germany, Russia & more.

Subscribe to:

Comments (Atom)