Saudi Arabia expects 2022 budget surplus after years of deficit | Reuters

Saudi Arabia said on Sunday it expected to post its first budget surplus in nearly a decade next year, as it plans to restrict public spending despite a surge in oil prices that helped to refill state coffers hammered by the pandemic.

After an expected fiscal deficit of 2.7% of gross domestic product this year, Riyadh estimates it will achieve a surplus of 90 billion riyals ($23.99 billion), or 2.5% of GDP, next year - its first surplus since it went into a deficit after oil prices crashed in 2014.

"The surpluses will be used to increase government reserves, to meet the coronavirus pandemic needs, strengthen the kingdom's financial position, and raise its capabilities to face global shocks and crises," Crown Prince Mohammed bin Salman was quoted as saying by Saudi state press agency SPA.

The world's biggest oil exporter plans to spend 955 billion riyals next year, a nearly 6% expenditure cut year on year, according to a budget document.

Riyadh plans to reduce military spending next year by around 10% from its 2021 estimates, the budget showed, a sign that the cost of the military conflict in neighbouring Yemen has started to ease.

Solely aggregation of news articles, with no opinions expressed by this service since 2009 launch on this platform. Copyright to all articles remains with the original publisher and HEADLINES ARE CLICKABLE to access the whole article at source. (Subscription by email is recommended,with real-time updates on LinkedIn and Twitter.)

Search This Blog

Sunday, 12 December 2021

#Iran Bases Next Year’s Budget on $60-a-Barrel Oil, Fars Says - Bloomberg

Iran Bases Next Year’s Budget on $60-a-Barrel Oil, Fars Says - Bloomberg

The budget bill for Iran’s next calendar year is based on an oil price of $60 a barrel, up from $40 this year, the semi-official Fars news agency reported.

The country expects to export around 1.2 million barrels of oil daily in the year that starts on March 21, Fars reported, according to outlines of the country’s proposed budget for next year. This calendar year it was projected to export up to 1.5 million barrels a day, but in practice U.S. sanctions have squeezed that to under 1 million, analysts have said.

Iranian President Ebrahim Raisi presented his administration’s first annual budget bill to parliament on Sunday. The bill requires parliamentary review and approval.

Sanctions reinstated on Iran in 2018 by former U.S. President Donald Trump have battered the country’s economy, chiefly by curtailing Iran’s oil exports, its biggest source of revenue. Tehran and world powers are engaged in talks to resuscitate the 2015 nuclear deal that Trump withdrew from, which traded sanctions relief for curbs on Iran’s atomic activities.

The budget bill for Iran’s next calendar year is based on an oil price of $60 a barrel, up from $40 this year, the semi-official Fars news agency reported.

The country expects to export around 1.2 million barrels of oil daily in the year that starts on March 21, Fars reported, according to outlines of the country’s proposed budget for next year. This calendar year it was projected to export up to 1.5 million barrels a day, but in practice U.S. sanctions have squeezed that to under 1 million, analysts have said.

Iranian President Ebrahim Raisi presented his administration’s first annual budget bill to parliament on Sunday. The bill requires parliamentary review and approval.

Sanctions reinstated on Iran in 2018 by former U.S. President Donald Trump have battered the country’s economy, chiefly by curtailing Iran’s oil exports, its biggest source of revenue. Tehran and world powers are engaged in talks to resuscitate the 2015 nuclear deal that Trump withdrew from, which traded sanctions relief for curbs on Iran’s atomic activities.

OPEC Should Sit Tight While Assessing Impact of Omicron, Emergency Stockpiles - Bloomberg

OPEC Should Sit Tight While Assessing Impact of Omicron, Emergency Stockpiles - Bloomberg

The OPEC+ meeting that began on Dec. 1 is still technically “in session” 11 days later. Remarkably, perhaps, it’s still short of being the oil producer group’s longest gathering — it has another week to go to beat the one held in October 1986.

This time, of course, it is much easier to conduct a lengthy meeting. With the deliberations held by videoconference, ministers are free to conduct their normal duties until the chairman decides they need to reconvene. Thirty-five years ago, the ministers and their delegations were ensconced in Geneva hotel suites, far from their desks back home. Then, as now, they were grappling with a market that was slowly recovering from an unprecedented demand shock — although the trigger was very different.

Right now, the OPEC+ group is doing most good by doing nothing. The meeting is “in session” in name only. Nonetheless, it is proving to be a very successful strategy to support crude prices in the face of uncertainty over the omicron variant’s impact on oil demand.

The ministers convened amid widely held expectations that they would delay January’s planned output increase.

The OPEC+ meeting that began on Dec. 1 is still technically “in session” 11 days later. Remarkably, perhaps, it’s still short of being the oil producer group’s longest gathering — it has another week to go to beat the one held in October 1986.

This time, of course, it is much easier to conduct a lengthy meeting. With the deliberations held by videoconference, ministers are free to conduct their normal duties until the chairman decides they need to reconvene. Thirty-five years ago, the ministers and their delegations were ensconced in Geneva hotel suites, far from their desks back home. Then, as now, they were grappling with a market that was slowly recovering from an unprecedented demand shock — although the trigger was very different.

Right now, the OPEC+ group is doing most good by doing nothing. The meeting is “in session” in name only. Nonetheless, it is proving to be a very successful strategy to support crude prices in the face of uncertainty over the omicron variant’s impact on oil demand.

The ministers convened amid widely held expectations that they would delay January’s planned output increase.

Bank of America expects busy year of Gulf IPOs | Reuters

Bank of America expects busy year of Gulf IPOs | Reuters

Gulf exchanges are likely to have another busy year of initial public offerings (IPOs) in 2022, possibly surpassing this year's bumper crop, a Bank of America (BAC.N) executive told Reuters.

After a year that featured three major IPOs on both Abu Dhabi's ADX and Saudi Arabia's Tadawul markets, Dubai has announced plans to list as many as 10 state-owned companies. read more

"We expect ADX and Tadawul to be very busy. The major difference in 2022 is that the Dubai financial market will be busy too," said Christian Cabanne, Bank of America's head of equity capital markets for Central and Eastern Europe, Middle East and Africa.

The plans announced by Dubai, which has not had a major IPO since a unit of state-linked developer Emaar Properties (EMAR.DU) in 2017, seek to help the emirate to contend with intensifying competition for capital in the region.

Gulf exchanges are likely to have another busy year of initial public offerings (IPOs) in 2022, possibly surpassing this year's bumper crop, a Bank of America (BAC.N) executive told Reuters.

After a year that featured three major IPOs on both Abu Dhabi's ADX and Saudi Arabia's Tadawul markets, Dubai has announced plans to list as many as 10 state-owned companies. read more

"We expect ADX and Tadawul to be very busy. The major difference in 2022 is that the Dubai financial market will be busy too," said Christian Cabanne, Bank of America's head of equity capital markets for Central and Eastern Europe, Middle East and Africa.

The plans announced by Dubai, which has not had a major IPO since a unit of state-linked developer Emaar Properties (EMAR.DU) in 2017, seek to help the emirate to contend with intensifying competition for capital in the region.

#Qatar central bank governor to head Financial Markets Authority | Reuters

Qatar central bank governor to head Financial Markets Authority | Reuters

Qatar's Emir Sheikh Tamim bin Hamad al-Thani appointed on Sunday central bank governor Sheikh Bandar bin Mohamed bin Saud al-Thani as head of the board of the Qatar Financial Markets Authority (QFMA), the emiri court said in a statement.

Most Gulf bourses end higher, #Dubai rises for eighth session | Reuters

Most Gulf bourses end higher, Dubai rises for eighth session | Reuters

Most Gulf stock markets ended higher on Sunday, buoyed by a rise in oil prices due to easing concerns over the Omicron coronavirus variant's impact on global growth and fuel demand.

Saudi Arabia's benchmark index (.TASI) rose 0.3%, with Sahara International Petrochemical Company (2310.SE) rising 3.3% and petrochemical maker Saudi Basic Industries Corp (2010.SE) adding 1.1%.

However, the index's gains were limited by losses at Saudi Telecom Company (STC) (7010.SE), which dropped about 3% after the final price for the sale of 120 million shares of the company was set at 100 riyals per share, at the lower end of an earlier price range of 100 to 116 riyals. read more

The Saudi sovereign wealth fund, the Public Investment Fund, is set to raise 12 billion riyals ($3.20 billion) through the sale of a 6% stake in STC.

Dubai's main share index (.DFMGI) edged 0.2% higher, rising for an eighth session, helped by a 0.6% increase in sharia-compliant lender Dubai Islamic Bank (DISB.DU).

Dubai's deputy ruler and finance minister Sheikh Maktoum Bin Mohammed announced the listing of Emirates Central Cooling Systems Corporation (Empower), the emirate's media office reported on Saturday. read more

The government announced plans for Empower's flotation among 10 state-backed companies to be listed as part of efforts to boost activity on the local bourse.

The listings are aimed at making Dubai a more competitive market against bigger bourses in the region, such as those in Saudi Arabia and neighbouring Abu Dhabi, which are achieving larger listings and strong liquidity.

In Abu Dhabi, the index (.ADI) gained 1%, snapping three sessions of losses, with Emirates Telecommunication Group (ETISALAT.AD) rising 2.3%.

The United Arab Emirates expects its move to a 4-1/2 day working week and a Saturday-Sunday weekend will boost its economy and make it a more attractive place for foreigners to live, the minister of human resources and Emiratisation said on Wednesday. read more

Last week, the UAE announced that from the start of 2022 it would shift to a working week that ends on Friday afternoon, with a Saturday-Sunday weekend instead of Friday and Saturday.

Outside the Gulf, Egypt's blue-chip index (.EGX30) advanced 1.5%, buoyed by a 2.7% rise in top lender Commercial International Bank (COMI.CA).

Most Gulf stock markets ended higher on Sunday, buoyed by a rise in oil prices due to easing concerns over the Omicron coronavirus variant's impact on global growth and fuel demand.

Saudi Arabia's benchmark index (.TASI) rose 0.3%, with Sahara International Petrochemical Company (2310.SE) rising 3.3% and petrochemical maker Saudi Basic Industries Corp (2010.SE) adding 1.1%.

However, the index's gains were limited by losses at Saudi Telecom Company (STC) (7010.SE), which dropped about 3% after the final price for the sale of 120 million shares of the company was set at 100 riyals per share, at the lower end of an earlier price range of 100 to 116 riyals. read more

The Saudi sovereign wealth fund, the Public Investment Fund, is set to raise 12 billion riyals ($3.20 billion) through the sale of a 6% stake in STC.

Dubai's main share index (.DFMGI) edged 0.2% higher, rising for an eighth session, helped by a 0.6% increase in sharia-compliant lender Dubai Islamic Bank (DISB.DU).

Dubai's deputy ruler and finance minister Sheikh Maktoum Bin Mohammed announced the listing of Emirates Central Cooling Systems Corporation (Empower), the emirate's media office reported on Saturday. read more

The government announced plans for Empower's flotation among 10 state-backed companies to be listed as part of efforts to boost activity on the local bourse.

The listings are aimed at making Dubai a more competitive market against bigger bourses in the region, such as those in Saudi Arabia and neighbouring Abu Dhabi, which are achieving larger listings and strong liquidity.

In Abu Dhabi, the index (.ADI) gained 1%, snapping three sessions of losses, with Emirates Telecommunication Group (ETISALAT.AD) rising 2.3%.

The United Arab Emirates expects its move to a 4-1/2 day working week and a Saturday-Sunday weekend will boost its economy and make it a more attractive place for foreigners to live, the minister of human resources and Emiratisation said on Wednesday. read more

Last week, the UAE announced that from the start of 2022 it would shift to a working week that ends on Friday afternoon, with a Saturday-Sunday weekend instead of Friday and Saturday.

Outside the Gulf, Egypt's blue-chip index (.EGX30) advanced 1.5%, buoyed by a 2.7% rise in top lender Commercial International Bank (COMI.CA).

#Saudi Telecom Tumbles as PIF’s Share Offering Timing Disappoints - Bloomberg

Saudi Telecom Tumbles as PIF’s Share Offering Timing Disappoints - Bloomberg

Saudi Telecom Co. plunged the most since March 2020 after the kingdom’s sovereign wealth fund sold part of its stake in the company at a discount.

Shares in STC fell as much as 6.2%, touching the lowest intraday level since November 2020 before paring gains to trade 4% lower at 1 p.m. in Riyadh. The offering had priced at the low end of the range and at a discount to STC’s closing price on Thursday despite being oversubscribed.

The timing of the secondary share sale was “suboptimal, towards year-end with liquidity drying up in the market, when books are being closed.” said Ziad Itani, an executive director in Arqaam Capital’s equity-research division in Dubai.

Countries across the Middle East are stepping up efforts to sell shares in private companies and boost liquidity on their stock markets, with Saudi Arabia, Abu Dhabi and Dubai at the forefront. The pipeline for IPOs in Saudi Arabia is “deeper than ever,” Khalid al Hussan, chief executive officer of Saudi Tadawul Group Holding Co., the country’s exchange operator, said in an interview with Bloomberg Television last week.

Saudi Telecom Co. plunged the most since March 2020 after the kingdom’s sovereign wealth fund sold part of its stake in the company at a discount.

Shares in STC fell as much as 6.2%, touching the lowest intraday level since November 2020 before paring gains to trade 4% lower at 1 p.m. in Riyadh. The offering had priced at the low end of the range and at a discount to STC’s closing price on Thursday despite being oversubscribed.

The timing of the secondary share sale was “suboptimal, towards year-end with liquidity drying up in the market, when books are being closed.” said Ziad Itani, an executive director in Arqaam Capital’s equity-research division in Dubai.

Countries across the Middle East are stepping up efforts to sell shares in private companies and boost liquidity on their stock markets, with Saudi Arabia, Abu Dhabi and Dubai at the forefront. The pipeline for IPOs in Saudi Arabia is “deeper than ever,” Khalid al Hussan, chief executive officer of Saudi Tadawul Group Holding Co., the country’s exchange operator, said in an interview with Bloomberg Television last week.

New #UAE weekend: Banks will stay open for six days a week, including Fridays | Banking – Gulf News

New UAE weekend: Banks will stay open for six days a week, including Fridays | Banking – Gulf News

Banks in the country will continue to operate for six days a week, including Fridays, once the new working week rule comes into effect, the UAE Central Bank said in a circular.

Banking halls should operate for a minimum of five hours a day, six days a week, “except for working hours during the holy month of Ramadan”, the circular said.

“It is left to the banks to determine the working hours and days of the administration and the back offices, as needed, and implement a shift system for the branches,” the circular seen by Gulf News said.

The UAE government earlier this week announced that the country will transition to a four-and-a half-day working week, with Friday afternoon, Saturday, and Sunday forming the new weekend. All Federal government departments will move to the new weekend from January 1, 2022.

Banks in the country will continue to operate for six days a week, including Fridays, once the new working week rule comes into effect, the UAE Central Bank said in a circular.

Banking halls should operate for a minimum of five hours a day, six days a week, “except for working hours during the holy month of Ramadan”, the circular said.

“It is left to the banks to determine the working hours and days of the administration and the back offices, as needed, and implement a shift system for the branches,” the circular seen by Gulf News said.

The UAE government earlier this week announced that the country will transition to a four-and-a half-day working week, with Friday afternoon, Saturday, and Sunday forming the new weekend. All Federal government departments will move to the new weekend from January 1, 2022.

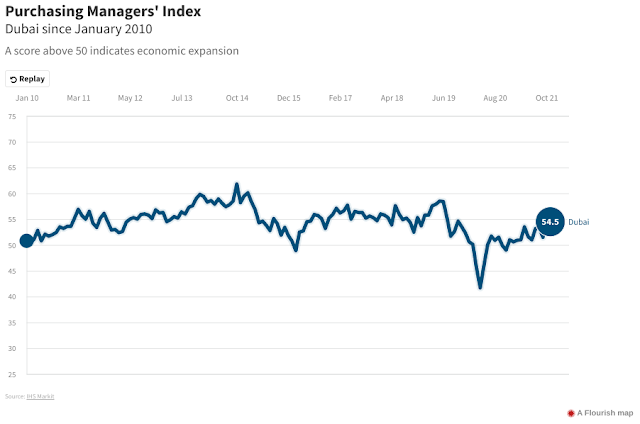

#Dubai’s business conditions continue to remain at two-year high on Expo 2020 boost

Dubai’s business conditions continue to remain at two-year high on Expo 2020 boost

Dubai's non-oil economy continued to grow in November, with business conditions registering their sharpest improvement in more than two years, helped by a pick-up in new business and a rebound in international travel linked to Expo 2020.

The emirate's seasonally adjusted IHS Markit Purchasing Managers' Index remained at 54.5 in November, the same as the previous month's level, to indicate the joint-strongest improvement in operating conditions since October 2019.

A reading above 50 indicates economic expansion while one below points to a contraction.

"The Expo 2020 continued to bring strong growth to the Dubai non-oil economy in its second month while new business growth picked up to the fastest for more than two years,” IHS Markit economist David Owen said. “Travel and tourism appeared to benefit the most of the three monitored sectors, with wholesale and retail also firmly in growth territory.”

The emirate's seasonally adjusted IHS Markit Purchasing Managers' Index remained at 54.5 in November, the same as the previous month's level, to indicate the joint-strongest improvement in operating conditions since October 2019.

A reading above 50 indicates economic expansion while one below points to a contraction.

"The Expo 2020 continued to bring strong growth to the Dubai non-oil economy in its second month while new business growth picked up to the fastest for more than two years,” IHS Markit economist David Owen said. “Travel and tourism appeared to benefit the most of the three monitored sectors, with wholesale and retail also firmly in growth territory.”

#Saudi Stocks Drop Most in Mideast, Pulled Down by STC: Inside EM - Bloomberg

Saudi Stocks Drop Most in Mideast, Pulled Down by STC: Inside EM - Bloomberg

Saudi Arabia’s benchmark stock index fell the most in the Middle East after the kingdom’s wealth fund sold part of its stake in country’s biggest telecom operator at a discount.

The timing of the secondary share offering in Saudi Telecom Co. was “quite suboptimal, towards year-end with liquidity drying up in the market, when books are being closed, and in tandem with the IPO of Tadawul,” said Ziad Itani, an executive director at Arqaam Capital equity research. “We do not see the STC hiccup as an indication for weak appetite on the upcoming IPO flurry, but rather a technical one-off.”

Saudi Arabia’s benchmark stock index fell the most in the Middle East after the kingdom’s wealth fund sold part of its stake in country’s biggest telecom operator at a discount.

The timing of the secondary share offering in Saudi Telecom Co. was “quite suboptimal, towards year-end with liquidity drying up in the market, when books are being closed, and in tandem with the IPO of Tadawul,” said Ziad Itani, an executive director at Arqaam Capital equity research. “We do not see the STC hiccup as an indication for weak appetite on the upcoming IPO flurry, but rather a technical one-off.”

- Tadawul All Share Index declines 0.5%

- STC trades 4% lower after falling as much as 6.2%

- Stock trades at lowest since January

- Banks also drag gauge lower: Al Rajhi Bank -0.9%; Riyad Bank -1.7%; Saudi National Bank -0.5%

- Abu Dhabi’s ADX General Index gains 0.7%

- Dubai Financial Market General Index flat

- Kuwait’s Premier Market Index rises 0.1%

- Qatar’s QE Index falls 0.1%

- Egypt’s EGX 30 Index little changed

STC weighs on #Saudi bourse; #Dubai extends gains | Reuters

STC weighs on Saudi bourse; Dubai extends gains | Reuters

The Saudi Arabian stock market fell in early trade on Sunday, weighed down by a sharp fall for Saudi Telecom Company (STC) after a secondary share offering.

The benchmark index (.TASI) dropped 0.5%, dragged down by a 4.4% slide in Saudi Telecom Company (7010.SE).

Saudi sovereign wealth fund Public Investment Fund (PIF) set the final price for the sale of 120 million shares in STC at 100 riyals per share, at the lower end of an earlier price range of 100 riyals to 116 riyals per share, according to an announcement on the bourse by one of the deal's lead managers. read more

PIF is set to raise 12 billion riyals ($3.2 billion) through the sale of a 6% stake in STC after it priced the deal in a secondary share offering.

In Dubai, the main share index (.DFMGI) gained 0.2%, supported by a 0.6% rise in sharia-compliant lender Dubai Islamic Bank (DISB.DU).

Dubai's deputy ruler and finance minister Sheikh Maktoum Bin Mohammed announced the listing of Emirates Central Cooling Systems Corporation (Empower), the emirate's media office reported on Saturday. read more

The government announced plans for Empower's flotation among 10 state-backed companies to be listed as part of efforts to boost activity on the local bourse.

The listings are aimed at making Dubai a more competitive market against bigger bourses in the region, such as those in Saudi Arabia and neighbouring Abu Dhabi, which are achieving larger listings and strong liquidity.

The Abu Dhabi index (.ADI), meanwhile, gained 0.7%, to snap three sessions of losses, led by a 2% rise in telecoms company Etisalat (ETISALAT.AD).

The Qatari index (.QSI) eased 0.1%, hit by a 1.2% fall for Commercial Bank (COMB.QA).

The Saudi Arabian stock market fell in early trade on Sunday, weighed down by a sharp fall for Saudi Telecom Company (STC) after a secondary share offering.

The benchmark index (.TASI) dropped 0.5%, dragged down by a 4.4% slide in Saudi Telecom Company (7010.SE).

Saudi sovereign wealth fund Public Investment Fund (PIF) set the final price for the sale of 120 million shares in STC at 100 riyals per share, at the lower end of an earlier price range of 100 riyals to 116 riyals per share, according to an announcement on the bourse by one of the deal's lead managers. read more

PIF is set to raise 12 billion riyals ($3.2 billion) through the sale of a 6% stake in STC after it priced the deal in a secondary share offering.

In Dubai, the main share index (.DFMGI) gained 0.2%, supported by a 0.6% rise in sharia-compliant lender Dubai Islamic Bank (DISB.DU).

Dubai's deputy ruler and finance minister Sheikh Maktoum Bin Mohammed announced the listing of Emirates Central Cooling Systems Corporation (Empower), the emirate's media office reported on Saturday. read more

The government announced plans for Empower's flotation among 10 state-backed companies to be listed as part of efforts to boost activity on the local bourse.

The listings are aimed at making Dubai a more competitive market against bigger bourses in the region, such as those in Saudi Arabia and neighbouring Abu Dhabi, which are achieving larger listings and strong liquidity.

The Abu Dhabi index (.ADI), meanwhile, gained 0.7%, to snap three sessions of losses, led by a 2% rise in telecoms company Etisalat (ETISALAT.AD).

The Qatari index (.QSI) eased 0.1%, hit by a 1.2% fall for Commercial Bank (COMB.QA).

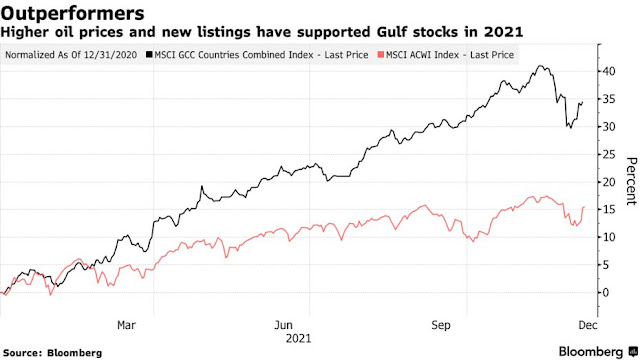

World Cup, IPOs to Buoy Gulf Stocks in 2022 as Oil Boost Fades - Bloomberg

World Cup, IPOs to Buoy Gulf Stocks in 2022 as Oil Boost Fades - Bloomberg

It’s been the best year in more than a decade for Gulf stocks thanks to booming oil prices. And investors expect further gains in 2022, driven by the soccer World Cup and new listings.

The region’s stocks are on track for their best annual performance since 2007, with a return of 36% including dividends. That compares with 20% for the MSCI World Index, which tracks developed world markets, and a 1.9% loss for the MSCI Emerging Market index.

And Gulf equities have plenty of catalysts ahead, according to fund managers and strategists. Dubai has announced plans to list 10 state companies, including the main utility Dubai Electricity & Water Authority, in a bid to lure investors. World Cup-host Qatar, meanwhile, is spending billions of dollars on infrastructure and preparations for the event.

It’s been the best year in more than a decade for Gulf stocks thanks to booming oil prices. And investors expect further gains in 2022, driven by the soccer World Cup and new listings.

The region’s stocks are on track for their best annual performance since 2007, with a return of 36% including dividends. That compares with 20% for the MSCI World Index, which tracks developed world markets, and a 1.9% loss for the MSCI Emerging Market index.

And Gulf equities have plenty of catalysts ahead, according to fund managers and strategists. Dubai has announced plans to list 10 state companies, including the main utility Dubai Electricity & Water Authority, in a bid to lure investors. World Cup-host Qatar, meanwhile, is spending billions of dollars on infrastructure and preparations for the event.

Subscribe to:

Comments (Atom)