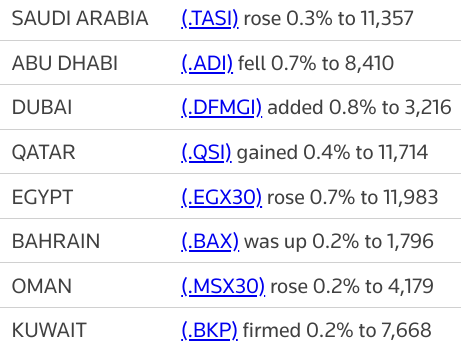

| PRICES |

|---|

|

Oil trekked higher as global supplies are on track to be tighter than previously expected amid easing fears over the omicron variant’s hit to global demand.

Futures in New York rose 1.2% while Brent crude settled at $80 a barrel for the first time since late November as OPEC+ stuck to its plan to lift output. Benchmark West Texas Intermediate crude reached a session high that was the strongest since November 26.

With demand largely withstanding the omicron variant, the OPEC+ producer group on Tuesday approved a 400,000 barrel-a-day increase in production scheduled for February. Its analysts on Monday cut estimates for a surplus in the first quarter, predicting weaker supply growth from rivals.

“Prices are heading higher after OPEC+ showed they are more confident that the global crude demand outlook will only take a limited hit, said Ed Moya, Oanda’s senior market analyst for the Americas. It appears geopolitical risks such as from Russia-Ukraine tensions, and the lengthy Iran nuclear deal revival talks are also supportive of higher oil prices, he added.