This post will look at the performance of the market breadth analysis. Market breadth is measured using the 20-day advance/decline indicator. When the advance/decline indicator is greater than zero this tells us that more stocks have risen in price than fallen. When the indicator is less than zero more stocks have declined in value. (See the following post for more details on this indicator and how it is calculated: Part I, Part II andPart III)

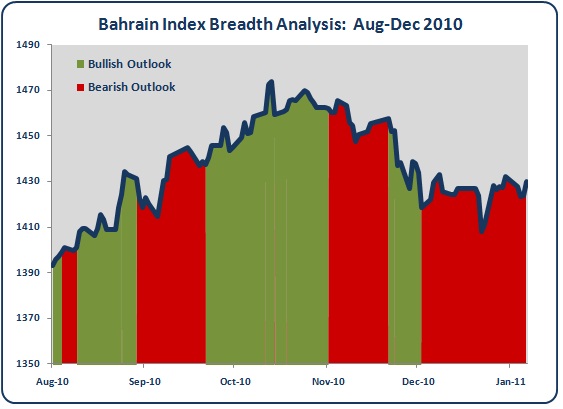

On the charts below I've highlighted the market breadth for each GCC Index from August to December 2010. The green shaded areas denote periods when market breadth was positive and red shaded areas are the negative breadth periods.

Here are the actual performance figures:

For example, under positive market breadth the DFM General Index returned +21.79% whilst the Index lost -9.40% during negative breadth periods.

The performance during positive market breadth periods beat total index returns (third column) for 5 out of the 7 GCC markets.

In conclusion, as with the trend analysis I reviewed in the last post, market breadth has performed very well over the past 5 months. For all GCC markets positive breadth has been associated with rising index levels whilst negative breadth has been associated with falling for flat index levels.

No comments:

Post a Comment