Oil heads for biggest annual gains since at least 2016 | Reuters

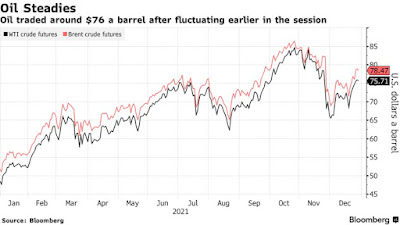

Oil prices fell on Friday but were set to post their biggest annual gains since at least 2016, spurred by the global economic recovery from the COVID-19 slump and producer restraint, even as infections surged to record highs around the world.

Brent crude futures fell $1.01, or 1.3%, to $78.52 a barrel at 1201 GMT, while U.S. West Texas Intermediate (WTI) crude futures dropped $1.12, or 1.5%, to $75.87 a barrel.

Brent is on track to end the year up nearly 52%, its biggest gain since 2016, while WTI is heading for a 56.5% gain, the strongest performance for benchmark contract since 2009, when prices soared more than 70%. Both contracts touched their 2021 peak in October with Brent at $86.70 a barrel, the highest since 2018, and WTI at $85.41 a barrel, the highest since 2014.

Global oil prices , are expected to rise further next year as jet fuel demand catches up. read more

Solely aggregation of news articles, with no opinions expressed by this service since 2009 launch on this platform. Copyright to all articles remains with the original publisher and HEADLINES ARE CLICKABLE to access the whole article at source. (Subscription by email is recommended,with real-time updates on LinkedIn and Twitter.)

Search This Blog

Friday, 31 December 2021

Oil heads for biggest annual gains since 2009 | Reuters

Oil heads for biggest annual gains since 2009 | Reuters

Oil prices edged down on Friday but were set to post their biggest annual gains in 12 years, spurred by the global economic recovery from the COVID-19 slump and producer restraint, even as infections surged to record highs around the world.

Brent crude futures fell 3 cents to $79.50 a barrel at 0718 GMT, while U.S. West Texas Intermediate (WTI) crude futures dropped 10 cents, or 0.1%, to $76.89 a barrel.

Brent is on track to end the year up 53%, while WTI is heading for a 58% gain, the strongest performance for the two benchmark contracts since 2009, when prices soared more than 70%. Both contracts touched their 2021 peak in October with Brent at $86.70 a barrel, the highest since 2018, and WTI at $85.41 a barrel, the loftiest since 2014.

Global oil prices , are expected to rise further next year as jet fuel demand catches up. read more

Oil prices edged down on Friday but were set to post their biggest annual gains in 12 years, spurred by the global economic recovery from the COVID-19 slump and producer restraint, even as infections surged to record highs around the world.

Brent crude futures fell 3 cents to $79.50 a barrel at 0718 GMT, while U.S. West Texas Intermediate (WTI) crude futures dropped 10 cents, or 0.1%, to $76.89 a barrel.

Brent is on track to end the year up 53%, while WTI is heading for a 58% gain, the strongest performance for the two benchmark contracts since 2009, when prices soared more than 70%. Both contracts touched their 2021 peak in October with Brent at $86.70 a barrel, the highest since 2018, and WTI at $85.41 a barrel, the loftiest since 2014.

Global oil prices , are expected to rise further next year as jet fuel demand catches up. read more

Mubadala to exit its holdings in US data centre company Cologix

Mubadala to exit its holdings in US data centre company Cologix

Mubadala Investment Company has said it reached a deal with the US-based investment firm Stonepeak Infrastructure Partners to sell its share in data centre company Cologix for an undisclosed sum.

Cologix will be transferred from Stonepeak Infrastructure Fund II LP and co-investors (Fund II) to another Stonepeak-managed vehicle comprising a combination of some existing Fund II investors and a number of new third-party investors, Mubadala said in a statement late on Thursday.

The transaction is expected to close in early 2022.

“Our success as a leading investor lies in our ability to identify uniquely placed. quality businesses to venture into, and equally importantly, assess monetisation opportunities to ensure that we maintain significant capital growth and a healthy portfolio of business investments,” said Khaled Al Qubaisi, chief executive of Real Estate and Infrastructure Investments at Mubadala.

Mubadala Investment Company has said it reached a deal with the US-based investment firm Stonepeak Infrastructure Partners to sell its share in data centre company Cologix for an undisclosed sum.

Cologix will be transferred from Stonepeak Infrastructure Fund II LP and co-investors (Fund II) to another Stonepeak-managed vehicle comprising a combination of some existing Fund II investors and a number of new third-party investors, Mubadala said in a statement late on Thursday.

The transaction is expected to close in early 2022.

“Our success as a leading investor lies in our ability to identify uniquely placed. quality businesses to venture into, and equally importantly, assess monetisation opportunities to ensure that we maintain significant capital growth and a healthy portfolio of business investments,” said Khaled Al Qubaisi, chief executive of Real Estate and Infrastructure Investments at Mubadala.

Thursday, 30 December 2021

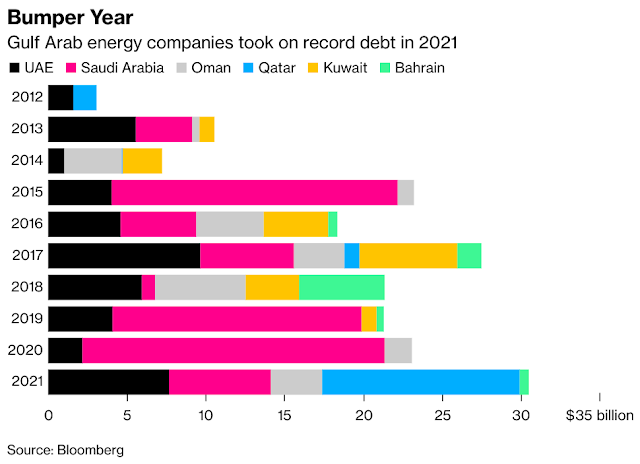

#Qatar Pushes Gulf Arab Energy Company Borrowing to Record High - Bloomberg

Qatar Pushes Gulf Arab Energy Company Borrowing to Record High - Bloomberg

Gulf Arab energy firms borrowed $30.5 billion in 2021, the highest level in at least 25 years, as the region’s national oil companies sought to inject foreign investment into their balance sheets.

Qatar Energy led the region in issuing debt, according to Bloomberg calculations. The company sold $12.5 billion of bonds in July to fund an expansion of its liquefied natural gas output capacity and cement its position as the world’s biggest exporter.

Energy companies in the United Arab Emirates raised $7.7 billion in new debt, a four-year high for the country. Saudi Aramco, which dominated the region’s energy corporate debt market in the previous two years, was its third-largest borrower in 2021, with $6.5 billion.

Gulf Arab energy firms borrowed $30.5 billion in 2021, the highest level in at least 25 years, as the region’s national oil companies sought to inject foreign investment into their balance sheets.

Qatar Energy led the region in issuing debt, according to Bloomberg calculations. The company sold $12.5 billion of bonds in July to fund an expansion of its liquefied natural gas output capacity and cement its position as the world’s biggest exporter.

Energy companies in the United Arab Emirates raised $7.7 billion in new debt, a four-year high for the country. Saudi Aramco, which dominated the region’s energy corporate debt market in the previous two years, was its third-largest borrower in 2021, with $6.5 billion.

Oil prices rise slightly ahead of OPEC+ meeting next week | Reuters

Oil prices rise slightly ahead of OPEC+ meeting next week | Reuters

Oil prices rose slightly on Thursday on expectations that fuel demand held up despite soaring Omicron coronavirus infections and that OPEC and its allies would continue to increase imports only incrementally.

Gains eased as the world's top importer China cut the first batch of crude import allocations for 2022.

Brent crude futures settled at $79.32 a barrel, up 9 cents, or 0.11%. U.S. crude futures rose 43 cents, or 0.56%, to settle at $76.9 a barrel, the seventh straight session of gains.

"We've had incredibly strong demand numbers through December, so now the question is what OPEC will do," said John Kilduff, a partner at Again Capital Management in New York. Kilduff expects the Organization of the Petroleum Exporting Countries and its allies, known as OPEC+, to continue to add incrementally to production.

Oil prices rose slightly on Thursday on expectations that fuel demand held up despite soaring Omicron coronavirus infections and that OPEC and its allies would continue to increase imports only incrementally.

Gains eased as the world's top importer China cut the first batch of crude import allocations for 2022.

Brent crude futures settled at $79.32 a barrel, up 9 cents, or 0.11%. U.S. crude futures rose 43 cents, or 0.56%, to settle at $76.9 a barrel, the seventh straight session of gains.

"We've had incredibly strong demand numbers through December, so now the question is what OPEC will do," said John Kilduff, a partner at Again Capital Management in New York. Kilduff expects the Organization of the Petroleum Exporting Countries and its allies, known as OPEC+, to continue to add incrementally to production.

OPEC Chief Candidate From #Kuwait Has Wide Support Among Members - Bloomberg

OPEC Chief Candidate From Kuwait Has Wide Support Among Members - Bloomberg

Kuwait’s candidate to take over as OPEC’s top diplomat has widespread support from the group’s members, delegates said.

Haitham al-Ghais, an executive at Kuwait Petroleum Corp., has backing from a number of nations to succeed Mohammad Barkindo as secretary-general, said the delegates, who asked not to be identified discussing an internal matter. The Organization of Petroleum Exporting Countries will vote on the selection on Jan. 3, and the chosen candidate will take over the job in July.

Al-Ghais is currently the only nominee for the role after Iraq, which also planned its own nominee, decided not to proceed. Delegates said al-Ghais is widely respected by member nations, having served as Kuwait’s liaison to OPEC a few years ago.

“He’s very smart, and a good analyst,” said Johannes Benigni, chairman of consultant JBC Energy Group in Vienna.

While OPEC secretary-generals don’t set the organization’s production policy, they do act as an intermediary seeking compromise between the group’s often-fractious members.

Barkindo has served two three-year terms as secretary-general, the maximum officially permitted, during which time he helped with the creation of the OPEC+ alliance in late 2016.

The pact brought in non-members such as Russia, revitalizing OPEC’s fading influence in world oil markets, and has stabilized supply and demand for the past few years. OPEC+ will meet Jan. 4 to consider whether to continue restoring production halted during the pandemic.

Kuwait’s candidate to take over as OPEC’s top diplomat has widespread support from the group’s members, delegates said.

Haitham al-Ghais, an executive at Kuwait Petroleum Corp., has backing from a number of nations to succeed Mohammad Barkindo as secretary-general, said the delegates, who asked not to be identified discussing an internal matter. The Organization of Petroleum Exporting Countries will vote on the selection on Jan. 3, and the chosen candidate will take over the job in July.

Al-Ghais is currently the only nominee for the role after Iraq, which also planned its own nominee, decided not to proceed. Delegates said al-Ghais is widely respected by member nations, having served as Kuwait’s liaison to OPEC a few years ago.

“He’s very smart, and a good analyst,” said Johannes Benigni, chairman of consultant JBC Energy Group in Vienna.

While OPEC secretary-generals don’t set the organization’s production policy, they do act as an intermediary seeking compromise between the group’s often-fractious members.

Barkindo has served two three-year terms as secretary-general, the maximum officially permitted, during which time he helped with the creation of the OPEC+ alliance in late 2016.

The pact brought in non-members such as Russia, revitalizing OPEC’s fading influence in world oil markets, and has stabilized supply and demand for the past few years. OPEC+ will meet Jan. 4 to consider whether to continue restoring production halted during the pandemic.

#AbuDhabi outshines Middle East markets in 2021 | Reuters

Abu Dhabi outshines Middle East markets in 2021 | Reuters

Stock markets in the Gulf ended 2021 higher, with the Abu Dhabi index exiting the year with a roar on its best annual performance in 16 years.

The Abu Dhabi index (.ADI) added 0.5% on Thursday, the last trading day of 2021 - its best year since 2005, with more than 68% gain.

Besides the support of the strong oil prices, Abu Dhabi saw a series of initial public offerings (IPO) that helped push its performance higher during the year. The momentum helped the market stay on the positive side for most of the year until the rise of Omicron coronavirus variant, said Farah Mourad, senior market analyst at XTB MENA.

Conglomerate International Holding Co (IHC) , Abu Dhabi's most valuable listed company, concluded the year 262% higher.

IHC, which operates in a range of sectors including healthcare and agriculture, has gone through rapid expansion across its major business sectors.

IHC, which has a market capitalisation of $75 billion, is chaired by Sheikh Tahnoon bin Zayed Al Nahyan, the United Arab Emirates' national security adviser and a brother of the country's de facto ruler Abu Dhabi Crown Prince Mohammed bin Zayed.

Earlier in December, the UAE said it will shift to a Saturday-Sunday weekend from the start of next year to better align its economy with global markets. read more

Dubai's main share index (.DFMGI) gained 0.7%, to end the year 28.3% higher.

The positive performance this year on the Dubai stock market was supported by the global recovery and fewer coronavirus restrictions, said Wael Makarem, senior market strategist at Exness.

"The market's performance was more impressive towards the end of the year after the announcement of a list of new initial public offerings that aimed to help develop the market's liquidity and dynamism."

In November, Dubai announced plans to launch a 2 billion dirham ($544.57 million) market-maker fund and initial public offerings of 10 state-backed companies as part of plans to boost activity on the local bourse. read more

The listing plans are aimed at making Dubai a more competitive market against bigger bourses in the region, such those in as Saudi Arabia and neighbouring Abu Dhabi, that are seeing larger listings and strong liquidity.

Saudi Arabia's benchmark index (.TASI) added about 30% in 2021, logging its sixth consecutive yearly gain and driven by a rise in oil prices.

Crude prices, a key catalyst for the Gulf's financial markets, provided significant support particularly in the first half of the year as the economy recovered confidently, said Mourad.

"In the second half, some doubts about demand levels, interventions by oil-importing countries, the release of strategic reserves, and the discovery of Omicron have created periods of price corrections which in turn removed important support for the region's markets."

The Qatari index (.QSI) fell 0.5%, but finished the year about 12% higher, its fourth straight yearly rise.

Kuwait's stock market (.BKP) registered a 26.2% yearly gain, ending the year close to its record peak.

Bahrain's index (.BAX) gained 7.5% in 2021, while the Omani index (.MSX30) added a near 13% for the year, its first yearly gain in about five years.

Outside the Gulf, Egypt's benchmark index (.EGX30) booked a yearly gain of 10.2%.

The Egyptian bourse had a more volatile performance while investors took into consideration the changes in monetary policies around the world and their impact on economic development as well as the rise and fall of health concerns, said Mourad.

The Abu Dhabi index (.ADI) added 0.5% on Thursday, the last trading day of 2021 - its best year since 2005, with more than 68% gain.

Besides the support of the strong oil prices, Abu Dhabi saw a series of initial public offerings (IPO) that helped push its performance higher during the year. The momentum helped the market stay on the positive side for most of the year until the rise of Omicron coronavirus variant, said Farah Mourad, senior market analyst at XTB MENA.

Conglomerate International Holding Co (IHC) , Abu Dhabi's most valuable listed company, concluded the year 262% higher.

IHC, which operates in a range of sectors including healthcare and agriculture, has gone through rapid expansion across its major business sectors.

IHC, which has a market capitalisation of $75 billion, is chaired by Sheikh Tahnoon bin Zayed Al Nahyan, the United Arab Emirates' national security adviser and a brother of the country's de facto ruler Abu Dhabi Crown Prince Mohammed bin Zayed.

Earlier in December, the UAE said it will shift to a Saturday-Sunday weekend from the start of next year to better align its economy with global markets. read more

Dubai's main share index (.DFMGI) gained 0.7%, to end the year 28.3% higher.

The positive performance this year on the Dubai stock market was supported by the global recovery and fewer coronavirus restrictions, said Wael Makarem, senior market strategist at Exness.

"The market's performance was more impressive towards the end of the year after the announcement of a list of new initial public offerings that aimed to help develop the market's liquidity and dynamism."

In November, Dubai announced plans to launch a 2 billion dirham ($544.57 million) market-maker fund and initial public offerings of 10 state-backed companies as part of plans to boost activity on the local bourse. read more

The listing plans are aimed at making Dubai a more competitive market against bigger bourses in the region, such those in as Saudi Arabia and neighbouring Abu Dhabi, that are seeing larger listings and strong liquidity.

Saudi Arabia's benchmark index (.TASI) added about 30% in 2021, logging its sixth consecutive yearly gain and driven by a rise in oil prices.

Crude prices, a key catalyst for the Gulf's financial markets, provided significant support particularly in the first half of the year as the economy recovered confidently, said Mourad.

"In the second half, some doubts about demand levels, interventions by oil-importing countries, the release of strategic reserves, and the discovery of Omicron have created periods of price corrections which in turn removed important support for the region's markets."

The Qatari index (.QSI) fell 0.5%, but finished the year about 12% higher, its fourth straight yearly rise.

Kuwait's stock market (.BKP) registered a 26.2% yearly gain, ending the year close to its record peak.

Bahrain's index (.BAX) gained 7.5% in 2021, while the Omani index (.MSX30) added a near 13% for the year, its first yearly gain in about five years.

Outside the Gulf, Egypt's benchmark index (.EGX30) booked a yearly gain of 10.2%.

The Egyptian bourse had a more volatile performance while investors took into consideration the changes in monetary policies around the world and their impact on economic development as well as the rise and fall of health concerns, said Mourad.

Most major Gulf markets fall on Omicron fears | Reuters

Most major Gulf markets fall on Omicron fears | Reuters

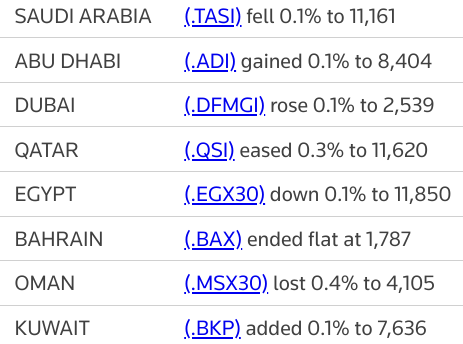

Most major stock markets in the Gulf fell in early trade on Thursday over concerns the Omicron coronavirus variant could slow the economy heading into the new year.

In Abu Dhabi, the index (.ADI) dropped 0.9%, dragged down by a 1.6% fall in the country's largest lender, First Abu Dhabi Bank (FAB.AD).

Daily coronavirus infections in the United Arab Emirates, the Gulf region's tourism and commercial hub, crossed 2,000 for the first time since June.

Authorities on Wednesday reported 2,234 new infections in the past 24 hours, without breaking down the cases by COVID-19 variants.

Dubai's main share index (.DFMGI) lost 0.5%, hit by a 0.7% fall in top lender Emirates NBD (ENBD.DU) and a 0.6% decline in sharia-compliant lender Dubai Islamic Bank (DISB.DU).

Dubai, which is hosting the Expo until the end of March and whose economy relies heavily on the travel industry, has not yet reintroduced restrictions that were largely lifted in mid-2020.

Saudi Arabia's benchmark index (.TASI) gained 0.3%, with Al Rajhi Bank (1120.SE) rising 0.3%, while Saudi Arabian Mining Company (1211.SE) advanced 1.3%.

Oil prices, a key catalyst for the Gulf's financial markets, rose to extend several consecutive days of gains, buoyed by data showing U.S. fuel demand holding up well despite soaring Omicron coronavirus infections. read more

Saudi King Salman said on Wednesday the OPEC+ production agreement was "essential" to oil market stability and stressed the need for producers to comply with the pact. read more

The Qatari index (.QSI) eased 0.1%, with Qatar National Bank (QNBK.QA) losing 0.8%.

Most major stock markets in the Gulf fell in early trade on Thursday over concerns the Omicron coronavirus variant could slow the economy heading into the new year.

In Abu Dhabi, the index (.ADI) dropped 0.9%, dragged down by a 1.6% fall in the country's largest lender, First Abu Dhabi Bank (FAB.AD).

Daily coronavirus infections in the United Arab Emirates, the Gulf region's tourism and commercial hub, crossed 2,000 for the first time since June.

Authorities on Wednesday reported 2,234 new infections in the past 24 hours, without breaking down the cases by COVID-19 variants.

Dubai's main share index (.DFMGI) lost 0.5%, hit by a 0.7% fall in top lender Emirates NBD (ENBD.DU) and a 0.6% decline in sharia-compliant lender Dubai Islamic Bank (DISB.DU).

Dubai, which is hosting the Expo until the end of March and whose economy relies heavily on the travel industry, has not yet reintroduced restrictions that were largely lifted in mid-2020.

Saudi Arabia's benchmark index (.TASI) gained 0.3%, with Al Rajhi Bank (1120.SE) rising 0.3%, while Saudi Arabian Mining Company (1211.SE) advanced 1.3%.

Oil prices, a key catalyst for the Gulf's financial markets, rose to extend several consecutive days of gains, buoyed by data showing U.S. fuel demand holding up well despite soaring Omicron coronavirus infections. read more

Saudi King Salman said on Wednesday the OPEC+ production agreement was "essential" to oil market stability and stressed the need for producers to comply with the pact. read more

The Qatari index (.QSI) eased 0.1%, with Qatar National Bank (QNBK.QA) losing 0.8%.

Oil prices slip as China cuts import quotas | Reuters

Oil prices slip as China cuts import quotas | Reuters

Oil prices eased on Thursday after the world's top importer China cut the first batch of crude import allocations for 2022, offsetting the impact of U.S. data showing fuel demand had held up despite soaring Omicron coronavirus infections.

Brent crude futures fell 41 cents, or 0.5%, to $78.82 a barrel at 0755 GMT, down for the first time in four days. U.S. West Texas Intermediate (WTI) crude futures slid 33 cents, or 0.4%, to $76.23 a barrel after six straight sessions of gains.

Oil prices pared earlier gains after China, the world's top crude importer, lowered the first batch of 2022 import quotas to mostly independent refiners by 11% below the comparable year-earlier quota, industry sources said.

"Market sentiment weakened on worries that the Chinese government could take stricter actions against the teapots," a Singapore-based analyst said, referring to the independent refiners.

Oil prices eased on Thursday after the world's top importer China cut the first batch of crude import allocations for 2022, offsetting the impact of U.S. data showing fuel demand had held up despite soaring Omicron coronavirus infections.

Brent crude futures fell 41 cents, or 0.5%, to $78.82 a barrel at 0755 GMT, down for the first time in four days. U.S. West Texas Intermediate (WTI) crude futures slid 33 cents, or 0.4%, to $76.23 a barrel after six straight sessions of gains.

Oil prices pared earlier gains after China, the world's top crude importer, lowered the first batch of 2022 import quotas to mostly independent refiners by 11% below the comparable year-earlier quota, industry sources said.

"Market sentiment weakened on worries that the Chinese government could take stricter actions against the teapots," a Singapore-based analyst said, referring to the independent refiners.

#Saudi king says OPEC+ pact 'essential' for oil market stability | Reuters

Saudi king says OPEC+ pact 'essential' for oil market stability | Reuters

Saudi Arabia's King Salman said on Wednesday the OPEC+ production agreement was "essential" to oil market stability and stressed the need for producers to comply with the pact.

The king, in an annual speech to the advisory Shura Council carried on state media, said market stability and balance are a pillar of Saudi energy policy and efforts by the world's top oil exporter to maintain spare capacity had proven important to safeguarding energy supply security.

"The Kingdom ... confirms its keenness for the continuation of the OPEC+ agreement due to its essential role in oil market stability and also stresses the importance of compliance by all participating countries with the agreement," the king said.

The Organization of the Petroleum Exporting Countries and allies including Russia agreed this month to stick to their existing policy of monthly oil output increases despite fears a U.S. release of crude reserves and the Omicron coronavirus variant would lead to a fresh oil price rout. read more

The OPEC+ alliance is due to discuss its policy on Jan. 4.

Saudi Arabia's King Salman said on Wednesday the OPEC+ production agreement was "essential" to oil market stability and stressed the need for producers to comply with the pact.

The king, in an annual speech to the advisory Shura Council carried on state media, said market stability and balance are a pillar of Saudi energy policy and efforts by the world's top oil exporter to maintain spare capacity had proven important to safeguarding energy supply security.

"The Kingdom ... confirms its keenness for the continuation of the OPEC+ agreement due to its essential role in oil market stability and also stresses the importance of compliance by all participating countries with the agreement," the king said.

The Organization of the Petroleum Exporting Countries and allies including Russia agreed this month to stick to their existing policy of monthly oil output increases despite fears a U.S. release of crude reserves and the Omicron coronavirus variant would lead to a fresh oil price rout. read more

The OPEC+ alliance is due to discuss its policy on Jan. 4.

#UAE industrial giant Emirates Global Aluminium pays off $361m debt ahead of schedule | Markets – Gulf News

UAE industrial giant Emirates Global Aluminium pays off $361m debt ahead of schedule | Markets – Gulf News

The UAE’s biggest non-oil industrial company, Emirates Global Aluminium, has repaid in full $361 million it had raised as project finance from 13 banks and export credit agencies. The funds were used for a major expansion at its Al Taweelah smelter plant in Abu Dhabi.

The funds relate to two tranches that was taken out, and were repaid four- and seven-years before they became due. The early repayment “further deleverages EGA and is an important part in the company’s capital structure optimisation strategy,” the company said in a statement.

EGA’s financing has been reduced by over $1 billion in the last two years and now comprises a senior term loan facility of $5.5 billion. The EGA subsidiary Guinea Alumina Corporation has a $700 million project finance facility which was secured in 2019.

“This further deleveraging simplifies our debt structure and strengthens our balance-sheet for the next stage in our corporate journey,” said Zouhir Regragui, EGA’s Chief Financial Officer. “We have been able to de-lever successfully in 2021 while generating returns for our shareholders due to the enduring strength of our business and robust demand for our metal.”

The UAE’s biggest non-oil industrial company, Emirates Global Aluminium, has repaid in full $361 million it had raised as project finance from 13 banks and export credit agencies. The funds were used for a major expansion at its Al Taweelah smelter plant in Abu Dhabi.

The funds relate to two tranches that was taken out, and were repaid four- and seven-years before they became due. The early repayment “further deleverages EGA and is an important part in the company’s capital structure optimisation strategy,” the company said in a statement.

EGA’s financing has been reduced by over $1 billion in the last two years and now comprises a senior term loan facility of $5.5 billion. The EGA subsidiary Guinea Alumina Corporation has a $700 million project finance facility which was secured in 2019.

PAYING OFF

The project financing was extended to Emirates Aluminium, now an EGA subsidiary, for Phase 1 of the Al Taweelah project in 2010 and later Phase 2 in 2013, each with a tenor of 15 years. The repayment four years and seven years early totalled $361 million.

“This further deleveraging simplifies our debt structure and strengthens our balance-sheet for the next stage in our corporate journey,” said Zouhir Regragui, EGA’s Chief Financial Officer. “We have been able to de-lever successfully in 2021 while generating returns for our shareholders due to the enduring strength of our business and robust demand for our metal.”

#SaudiArabia's Gas Arabian gets approval for 5% public offering | ZAWYA MENA Edition

Saudi Arabia's Gas Arabian gets approval for 5% public offering | ZAWYA MENA Edition

Saudi Arabia’s Gas Arabian Services Company has received approval from the kingdom’s Capital Market Authority (CMA) to offer 5 percent of its shares, or 790,000 ordinary shares, and list on the Nomu Parallel Market.

The book building period will between January 23 and 27 2021, following which the offer price will be determined, according to a bourse filing by advisors FALCOM Financial Services Company.

Saudi Arabia’s Gas Arabian Services Company has received approval from the kingdom’s Capital Market Authority (CMA) to offer 5 percent of its shares, or 790,000 ordinary shares, and list on the Nomu Parallel Market.

The book building period will between January 23 and 27 2021, following which the offer price will be determined, according to a bourse filing by advisors FALCOM Financial Services Company.

Oil prices stay firm on fuel demand despite COVID-19 surge | Reuters

Oil prices stay firm on fuel demand despite COVID-19 surge | Reuters

Oil prices rose on Thursday to extend several consecutive days of gains, buoyed by data showing U.S. fuel demand holding up well despite soaring Omicron coronavirus infections.

Brent crude futures rose 24 cents, or 0.3%, to $79.47 a barrel at 0502 GMT, up for a fourth day. U.S. West Texas Intermediate (WTI) crude futures rose 26 cents, or 0.3%, to $76.82 a barrel for a seventh session of gains.

"Oil prices edged higher overnight thanks to larger-than-expected falls in U.S. crude and gasoline inventories and receding virus nerves," Jeffrey Halley, senior market analyst at brokerage OANDA said in a note.

U.S. Energy Information Administration data on Wednesday showed crude oil inventories fell by 3.6 million barrels in the week to Dec. 24, which was more than what analysts polled by Reuters had expected.

Oil prices rose on Thursday to extend several consecutive days of gains, buoyed by data showing U.S. fuel demand holding up well despite soaring Omicron coronavirus infections.

Brent crude futures rose 24 cents, or 0.3%, to $79.47 a barrel at 0502 GMT, up for a fourth day. U.S. West Texas Intermediate (WTI) crude futures rose 26 cents, or 0.3%, to $76.82 a barrel for a seventh session of gains.

"Oil prices edged higher overnight thanks to larger-than-expected falls in U.S. crude and gasoline inventories and receding virus nerves," Jeffrey Halley, senior market analyst at brokerage OANDA said in a note.

U.S. Energy Information Administration data on Wednesday showed crude oil inventories fell by 3.6 million barrels in the week to Dec. 24, which was more than what analysts polled by Reuters had expected.

Wednesday, 29 December 2021

Oil prices edge higher as US oil inventories fall | Reuters

Oil prices edge higher as US oil inventories fall | Reuters

Oil prices rose on Wednesday, after government data showed U.S. crude and fuel inventories fell last week, offsetting concerns that rising coronavirus cases might reduce demand.

Brent crude rose 29 cents to settle at $79.23 a barrel. U.S. West Texas Intermediate (WTI) crude rose 58 cents to settle at $76.56 a barrel.

In the United States, the average number of daily confirmed coronavirus cases hit a record high of 258,312 over the last seven days, a Reuters tally on Wednesday found. read more

Both oil futures contracts earlier traded at their highest in a month after U.S. government data showed lower oil inventories.

Oil prices rose on Wednesday, after government data showed U.S. crude and fuel inventories fell last week, offsetting concerns that rising coronavirus cases might reduce demand.

Brent crude rose 29 cents to settle at $79.23 a barrel. U.S. West Texas Intermediate (WTI) crude rose 58 cents to settle at $76.56 a barrel.

In the United States, the average number of daily confirmed coronavirus cases hit a record high of 258,312 over the last seven days, a Reuters tally on Wednesday found. read more

Both oil futures contracts earlier traded at their highest in a month after U.S. government data showed lower oil inventories.

Sabic’s localisation drive to contribute $3bn to #SaudiArabia's economy

Sabic’s localisation drive to contribute $3bn to Saudi Arabia's economy

Investors qualified to start new projects under Sabic’s Nusaned initiative are expected to create 10,316 jobs in Saudi Arabia and contribute more than 11.4 billion Saudi riyals ($3.04bn) to the country’s economy.

Sabic, the Middle East’s biggest petrochemicals company, is directly contributing to the growth of companies in the kingdom through its Nusaned initiative it launched in 2018 and has so far selected 139 investors to start new projects, Sabic said on Wednesday.

“Under Nusaned, we are constantly exploring new business strategies with Saudi entrepreneurs who have an eye for innovative technologies and are committed to environmental excellence in operations,” said Yousef Al Benyan, Sabic vice chairman and chief executive.

“By enabling local investors and supporting commercially viable sectors, our aim is to strengthen our industries and better people’s lives, as envisioned in the kingdom’s ambitious Vision 2030 goals.”

Investors qualified to start new projects under Sabic’s Nusaned initiative are expected to create 10,316 jobs in Saudi Arabia and contribute more than 11.4 billion Saudi riyals ($3.04bn) to the country’s economy.

Sabic, the Middle East’s biggest petrochemicals company, is directly contributing to the growth of companies in the kingdom through its Nusaned initiative it launched in 2018 and has so far selected 139 investors to start new projects, Sabic said on Wednesday.

“Under Nusaned, we are constantly exploring new business strategies with Saudi entrepreneurs who have an eye for innovative technologies and are committed to environmental excellence in operations,” said Yousef Al Benyan, Sabic vice chairman and chief executive.

“By enabling local investors and supporting commercially viable sectors, our aim is to strengthen our industries and better people’s lives, as envisioned in the kingdom’s ambitious Vision 2030 goals.”

Kuwaiti candidate has widespread support for top OPEC job, sources say | Reuters

Kuwaiti candidate has widespread support for top OPEC job, sources say | Reuters

Kuwait's candidate to lead the Organization of the Petroleum Exporting Countries (OPEC) has widespread support from the group, with current secretary general Mohammad Barkindo not expected to seek re-election, two sources told Reuters.

Haitham al-Ghais, a former Kuwaiti governor to OPEC, is the only candidate for the role of secretary general, the two sources added.

OPEC is expected to elect a new secretary general at its meeting on Jan. 4, a third source said.

Nigerian Barkindo, whose is due to step down at the end of next July, took OPEC's top job in mid-2016 and was granted a second three-year term in 2019.

Kuwait's candidate to lead the Organization of the Petroleum Exporting Countries (OPEC) has widespread support from the group, with current secretary general Mohammad Barkindo not expected to seek re-election, two sources told Reuters.

Haitham al-Ghais, a former Kuwaiti governor to OPEC, is the only candidate for the role of secretary general, the two sources added.

OPEC is expected to elect a new secretary general at its meeting on Jan. 4, a third source said.

Nigerian Barkindo, whose is due to step down at the end of next July, took OPEC's top job in mid-2016 and was granted a second three-year term in 2019.

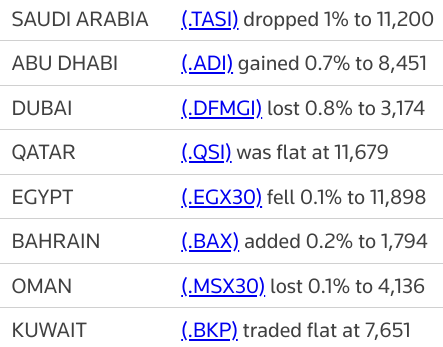

Most Gulf bourses fall in line with global shares | Reuters

Most Gulf bourses fall in line with global shares | Reuters

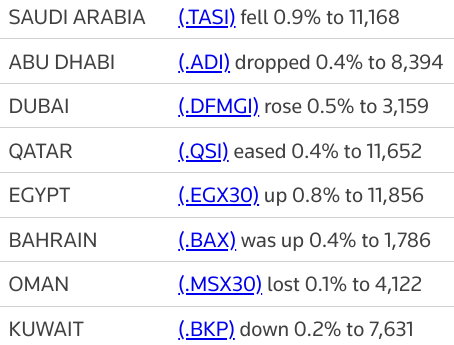

Most stock markets in the Gulf ended lower on Wednesday in line with global shares, as investors positioned their portfolios for the new year and grappled with increasing Omicron coronavirus cases globally.

Saudi Arabia's benchmark index (.TASI) dropped more than 1%, dragged down by a 1.4% fall in Al Rajhi Bank (1120.SE) and a 1.7% decrease in Saudi Basic Industries - SABIC (2010.SE).

The Saudi stock market was volatile on Wednesday since investors remained uncertain as the rise in oil prices provided strong support while the increasing COVID-19 cases raised new doubts over the sanitary situation, said Farah Mourad, senior market analyst of XTB MENA.

Crude prices, a key catalyst for the Gulf's financial markets, edged higher as optimism refused to be beaten down by concerns around the impact of Omicron on global economies.

In Dubai, the main share index (.DFMGI) fell 0.8%, snapping four consecutive sessions of gains, weighed down by a 1.1% drop in top lender Emirates NBD Bank (ENBD.DU) and a 0.7% decline in Dubai Islamic Bank (DISB.DU).

The United Arab Emirates has approved emergency use of Sinopharm's protein-based COVID-19 vaccine and it will be available to the public as a booster dose starting January 2022, the health ministry said. read more

The UAE, a federation of seven emirates, on Tuesday reported 1,846 new coronavirus cases, up from 68 on Dec. 2. Authorities, which did not provide a breakdown for each emirate, said around 91% of the 10 million population had been fully vaccinated.

In Qatar, the benchmark (.QSI) closed flat, as gains in energy stocks helped cap losses in banking shares with Qatar Fuel rising 1.1%, while Qatar International Islamic Bank was down 1.1%.

Abu Dhabi's index (.ADI), however, added 0.7%, helped by a 1.6% increase in the International Holding Company after its unit Multiply Group (MULTIPLY.AD) signed a binding commitment to invest 275 million dirhams ($74.88 million) in global visual content creator and marketplace Getty Images.

Multiply shares were up 1.7%.

Outside the Gulf, Egypt's blue-chip index (.EGX30), eased 0.1%, with Egypt Kuwait Holding (EKHO.CA) losing 2.9%.

Most stock markets in the Gulf ended lower on Wednesday in line with global shares, as investors positioned their portfolios for the new year and grappled with increasing Omicron coronavirus cases globally.

Saudi Arabia's benchmark index (.TASI) dropped more than 1%, dragged down by a 1.4% fall in Al Rajhi Bank (1120.SE) and a 1.7% decrease in Saudi Basic Industries - SABIC (2010.SE).

The Saudi stock market was volatile on Wednesday since investors remained uncertain as the rise in oil prices provided strong support while the increasing COVID-19 cases raised new doubts over the sanitary situation, said Farah Mourad, senior market analyst of XTB MENA.

Crude prices, a key catalyst for the Gulf's financial markets, edged higher as optimism refused to be beaten down by concerns around the impact of Omicron on global economies.

In Dubai, the main share index (.DFMGI) fell 0.8%, snapping four consecutive sessions of gains, weighed down by a 1.1% drop in top lender Emirates NBD Bank (ENBD.DU) and a 0.7% decline in Dubai Islamic Bank (DISB.DU).

The United Arab Emirates has approved emergency use of Sinopharm's protein-based COVID-19 vaccine and it will be available to the public as a booster dose starting January 2022, the health ministry said. read more

The UAE, a federation of seven emirates, on Tuesday reported 1,846 new coronavirus cases, up from 68 on Dec. 2. Authorities, which did not provide a breakdown for each emirate, said around 91% of the 10 million population had been fully vaccinated.

In Qatar, the benchmark (.QSI) closed flat, as gains in energy stocks helped cap losses in banking shares with Qatar Fuel rising 1.1%, while Qatar International Islamic Bank was down 1.1%.

Abu Dhabi's index (.ADI), however, added 0.7%, helped by a 1.6% increase in the International Holding Company after its unit Multiply Group (MULTIPLY.AD) signed a binding commitment to invest 275 million dirhams ($74.88 million) in global visual content creator and marketplace Getty Images.

Multiply shares were up 1.7%.

Outside the Gulf, Egypt's blue-chip index (.EGX30), eased 0.1%, with Egypt Kuwait Holding (EKHO.CA) losing 2.9%.

Most Gulf markets track losses in Asian shares | Reuters

Most Gulf markets track losses in Asian shares | Reuters

Most stock markets in the Gulf fell in early trade on Wednesday, in line with Asian shares, as investors positioned their portfolios for the new year and grappled with increasing Omicron coronavirus cases globally.

Saudi Arabia's benchmark index (.TASI) edged 0.2% lower, hit by a 0.3% fall in Al Rajhi Bank (1120.SE) and a 0.1% decline in Saudi National Bank (1180.SE), the kingdom's biggest lender.

Coronavirus infections have started rising again across the six Gulf Arab states after months of low or falling figures, data from health ministries showed on Thursday. read more

The Gulf's most populous country, Saudi Arabia, registered 602 new infections on Tuesday, up from daily tallies of around 50 since late September.

In Abu Dhabi, the index (.ADI) fell 0.2%, with the country's largest lender, First Abu Dhabi Bank (FAB.AD), losing 0.4% and Emirates Telecommunications Group (ETISALAT.AD) falling 0.3%.

Dubai's main share index (.DFMGI) dropped 0.4%, weighed down by a 0.6% decline in blue-chip developer Emaar Properties (EMAR.DU).

The United Arab Emirates has approved emergency use of Sinopharm's protein-based COVID-19 vaccine which will be available to the public as a booster dose starting January 2022, the health ministry said. read more

The UAE, a federation of seven emirates, on Tuesday reported 1,846 new coronavirus cases, up from 68 on Dec. 2. Authorities, which did not provide a breakdown for each emirate, said around 91% of the 10 million population had been fully vaccinated.

The Qatari index (.QSI) lost 0.1%, with Commercial Bank (COMB.QA) declining 1.2%.

Most stock markets in the Gulf fell in early trade on Wednesday, in line with Asian shares, as investors positioned their portfolios for the new year and grappled with increasing Omicron coronavirus cases globally.

Saudi Arabia's benchmark index (.TASI) edged 0.2% lower, hit by a 0.3% fall in Al Rajhi Bank (1120.SE) and a 0.1% decline in Saudi National Bank (1180.SE), the kingdom's biggest lender.

Coronavirus infections have started rising again across the six Gulf Arab states after months of low or falling figures, data from health ministries showed on Thursday. read more

The Gulf's most populous country, Saudi Arabia, registered 602 new infections on Tuesday, up from daily tallies of around 50 since late September.

In Abu Dhabi, the index (.ADI) fell 0.2%, with the country's largest lender, First Abu Dhabi Bank (FAB.AD), losing 0.4% and Emirates Telecommunications Group (ETISALAT.AD) falling 0.3%.

Dubai's main share index (.DFMGI) dropped 0.4%, weighed down by a 0.6% decline in blue-chip developer Emaar Properties (EMAR.DU).

The United Arab Emirates has approved emergency use of Sinopharm's protein-based COVID-19 vaccine which will be available to the public as a booster dose starting January 2022, the health ministry said. read more

The UAE, a federation of seven emirates, on Tuesday reported 1,846 new coronavirus cases, up from 68 on Dec. 2. Authorities, which did not provide a breakdown for each emirate, said around 91% of the 10 million population had been fully vaccinated.

The Qatari index (.QSI) lost 0.1%, with Commercial Bank (COMB.QA) declining 1.2%.

#Qatar’s trade surplus widens by 15.8% on higher shipments of gas | ZAWYA MENA Edition

Qatar’s trade surplus widens by 15.8% on higher shipments of gas | ZAWYA MENA Edition

Qatar’s merchandise trade surplus surged by a monthly rate of 15.8 percent in November, hitting 24.5 billion rials ($6.7 billion), data from the country’s Planning and Statistics Authority showed.

Exports – which includes both domestic goods and re-exports – went up by 13.9 percent to reach 34.3 billion rials. Jumps in shipments of petroleum gas and other gaseous hydrocarbons drove this increase, as they rose by 18.9 percent.

In annual terms, exports soared by 106.6 percent in November.

Observing the destination of these shipments, China received the bulk, purchasing 14.8 percent of Qatari exports. Japan and South Korea followed, with shares of 13.1 percent and 10.4 percent, respectively.

Exports – which includes both domestic goods and re-exports – went up by 13.9 percent to reach 34.3 billion rials. Jumps in shipments of petroleum gas and other gaseous hydrocarbons drove this increase, as they rose by 18.9 percent.

In annual terms, exports soared by 106.6 percent in November.

Observing the destination of these shipments, China received the bulk, purchasing 14.8 percent of Qatari exports. Japan and South Korea followed, with shares of 13.1 percent and 10.4 percent, respectively.

Tuesday, 28 December 2021

Oil settles higher despite Omicron concerns | Reuters

Oil settles higher despite Omicron concerns | Reuters

Oil prices settled higher on Tuesday, with Brent crude ending the session near $80 a barrel despite the rapid spread of the Omicron coronavirus variant, supported by supply outages and expectations that U.S. inventories fell last week.

Brent crude settled up 34 cents, or 0.4%, at $78.94 a barrel by 1:39 p.m. EST (1839 GMT). U.S. West Texas Intermediate (WTI) crude settled up 41 cents, or 0.5%, at $75.98.

Both contracts traded at their highest levels in a month, aided by strength in U.S. equities.

"The stock market appears poised to finish the year at or near record highs with easy spillover into the oil space pushing crude values higher," said Jim Ritterbusch, president of Ritterbusch and Associates LLC in Galena, Illinois.

Oil prices settled higher on Tuesday, with Brent crude ending the session near $80 a barrel despite the rapid spread of the Omicron coronavirus variant, supported by supply outages and expectations that U.S. inventories fell last week.

Brent crude settled up 34 cents, or 0.4%, at $78.94 a barrel by 1:39 p.m. EST (1839 GMT). U.S. West Texas Intermediate (WTI) crude settled up 41 cents, or 0.5%, at $75.98.

Both contracts traded at their highest levels in a month, aided by strength in U.S. equities.

"The stock market appears poised to finish the year at or near record highs with easy spillover into the oil space pushing crude values higher," said Jim Ritterbusch, president of Ritterbusch and Associates LLC in Galena, Illinois.

#Sharjah #UAE approves $9.37bn budget for 2022

Sharjah approves $9.37bn budget for 2022

Sharjah's ruler Sheikh Dr Sultan bin Muhammad Al Qasimi approved the emirate's Dh34.42 billion ($9.37bn) budget for 2022, prioritising spending on infrastructure and social and economic development, according to a tweet by the Sharjah Government Media Bureau.

The 2022 budget, 2.3 per cent bigger than the last year, is expected to provide approximately 1,000 new jobs for newly graduated UAE nationals, according to a government statement on Tuesday.

About 44 per cent of the budget expenditure will be allocated to the development and improvement of the emirate's infrastructure, 27 per cent to economic development with a focus on stimulus processes and 21 per cent for social development. About 11 per cent will be allocated towards welfare and social justice, an increase of 3 per cent compared to 2021, and reflecting the emirate's focus on social support.

The Sharjah government budget will "complete the emirate's march towards achieving the highest levels of excellence, success and sustainable development in all sectors and fields", Sheikh Sultan bin Ahmed bin Sultan Al Qasimi, Deputy Ruler of Sharjah, said.

Sharjah's ruler Sheikh Dr Sultan bin Muhammad Al Qasimi approved the emirate's Dh34.42 billion ($9.37bn) budget for 2022, prioritising spending on infrastructure and social and economic development, according to a tweet by the Sharjah Government Media Bureau.

The 2022 budget, 2.3 per cent bigger than the last year, is expected to provide approximately 1,000 new jobs for newly graduated UAE nationals, according to a government statement on Tuesday.

About 44 per cent of the budget expenditure will be allocated to the development and improvement of the emirate's infrastructure, 27 per cent to economic development with a focus on stimulus processes and 21 per cent for social development. About 11 per cent will be allocated towards welfare and social justice, an increase of 3 per cent compared to 2021, and reflecting the emirate's focus on social support.

The Sharjah government budget will "complete the emirate's march towards achieving the highest levels of excellence, success and sustainable development in all sectors and fields", Sheikh Sultan bin Ahmed bin Sultan Al Qasimi, Deputy Ruler of Sharjah, said.

#Kuwait Appoints Al-Rushaid as Finance Minister in New Cabinet - Bloomberg

Kuwait Appoints Al-Rushaid as Finance Minister in New Cabinet - Bloomberg

Kuwait’s prime minister appointed his fourth cabinet in two years, naming a new finance minister and including four lawmakers in the lineup in an effort to break a political impasse that has held back economic reforms in the oil-rich Gulf nation.

Abdulwahab Al-Rushaid, a known critic of the government’s fiscal policies, becomes finance minister, replacing Khalifa Hamada, state media reported. Al-Rushaid was head of the Kuwait Economics Society, which represents the views of private sector business people.

Hamada, like his predecessors, had struggled to change Kuwait’s spending habits due in large part to a lack of support from senior policy circles. Political dysfunction has led to a revolving door at the critical ministry, with ministers rarely lasting long in office. Al-Rushaid is the sixth person to hold the portfolio in just under eight years.

Mohammed Al-Fares retained his position as oil minister in a cabinet that took five weeks to form. As Prime Minister Sheikh Sabah Al-Khaled Al-Sabah sought to appease all political groupings, many declined posts due to persistent parliamentary pressure on ministers and a lack of support for the changes required to help the government balance its books.

Other appointments include:

Kuwait’s prime minister appointed his fourth cabinet in two years, naming a new finance minister and including four lawmakers in the lineup in an effort to break a political impasse that has held back economic reforms in the oil-rich Gulf nation.

Abdulwahab Al-Rushaid, a known critic of the government’s fiscal policies, becomes finance minister, replacing Khalifa Hamada, state media reported. Al-Rushaid was head of the Kuwait Economics Society, which represents the views of private sector business people.

Hamada, like his predecessors, had struggled to change Kuwait’s spending habits due in large part to a lack of support from senior policy circles. Political dysfunction has led to a revolving door at the critical ministry, with ministers rarely lasting long in office. Al-Rushaid is the sixth person to hold the portfolio in just under eight years.

Mohammed Al-Fares retained his position as oil minister in a cabinet that took five weeks to form. As Prime Minister Sheikh Sabah Al-Khaled Al-Sabah sought to appease all political groupings, many declined posts due to persistent parliamentary pressure on ministers and a lack of support for the changes required to help the government balance its books.

Other appointments include:

- Defense Minister and deputy PM: Sheikh Hamad Jaber Al-Ali Al-Sabah

- Interior Minister and deputy PM: Sheikh Ahmad Al-Mansour Al-Sabah

- Foreign Minister: Sheikh Ahmad Nasser Al-Mohammed Al-Sabah

- Health Minister: Khaled Al-Saeed

- Minister of state for municipality affairs and minister of communications: Rana Al-Fares

Brent nears $80 as market shrugs off Omicron | Reuters

Brent nears $80 as market shrugs off Omicron | Reuters

Oil prices extended gains on Tuesday, with Brent crude trading near $80 a barrel despite the rapid spread of the Omicron coronavirus variant, supported by supply outages and expectations that U.S. inventories fell last week.

Brent crude rose by 55 cents, or 0.7%, to $79.15 a barrel by 1410 GMT, after hitting a session high of $79.85. U.S. West Texas Intermediate (WTI) crude rose 73 cents, or 1%, to $76.30, after rising to $76.92.

Both contracts traded at their highest in a month.

"Support comes as well from high aggregated production disruptions in Ecuador, Libya and Nigeria and the expectation of another large drop in U.S. crude inventories," said UBS oil analyst Giovanni Staunovo.

Oil prices extended gains on Tuesday, with Brent crude trading near $80 a barrel despite the rapid spread of the Omicron coronavirus variant, supported by supply outages and expectations that U.S. inventories fell last week.

Brent crude rose by 55 cents, or 0.7%, to $79.15 a barrel by 1410 GMT, after hitting a session high of $79.85. U.S. West Texas Intermediate (WTI) crude rose 73 cents, or 1%, to $76.30, after rising to $76.92.

Both contracts traded at their highest in a month.

"Support comes as well from high aggregated production disruptions in Ecuador, Libya and Nigeria and the expectation of another large drop in U.S. crude inventories," said UBS oil analyst Giovanni Staunovo.

#Iran sees Azadegan oilfield development completed by 2023 | Reuters

Iran sees Azadegan oilfield development completed by 2023 | Reuters

The development of Iran's largest oilfield, Azadegan, is to be completed by mid-2023 with a total production of 320,000 barrels per day (bpd), the Iranian Oil Ministry said on Tuesday.

The report came as indirect talks between Iran and the United States on salvaging the 2015 Iran nuclear deal resumed on Monday with Tehran focused on lifting sanctions to allow it to sell oil without hindrance and collect its revenue. read more

"With the completion of the development project of this field, #crude_oil production will reach 320,000 barrels per day from the field," said Mohsen Khojastehmehr, CEO of the National Iranian Oil Co. (NIOC), according to the ministry's Twitter account.

In July 2020, a unit of state-run NIOC signed a deal with the local company Petropars to raise output capacity to 320,000 bpd from 140,000 bpd within 30 months at the Azadegan field, Iran's largest, which is shared with its neighbour Iraq, according to state media.

The United States under Donald Trump's presidency withdrew from the nuclear deal in 2018 and reimposed sanctions, slashing Iran's vital crude oil exports and chasing away foreign energy companies from potential Iranian oil projects.

The development of Iran's largest oilfield, Azadegan, is to be completed by mid-2023 with a total production of 320,000 barrels per day (bpd), the Iranian Oil Ministry said on Tuesday.

The report came as indirect talks between Iran and the United States on salvaging the 2015 Iran nuclear deal resumed on Monday with Tehran focused on lifting sanctions to allow it to sell oil without hindrance and collect its revenue. read more

"With the completion of the development project of this field, #crude_oil production will reach 320,000 barrels per day from the field," said Mohsen Khojastehmehr, CEO of the National Iranian Oil Co. (NIOC), according to the ministry's Twitter account.

In July 2020, a unit of state-run NIOC signed a deal with the local company Petropars to raise output capacity to 320,000 bpd from 140,000 bpd within 30 months at the Azadegan field, Iran's largest, which is shared with its neighbour Iraq, according to state media.

The United States under Donald Trump's presidency withdrew from the nuclear deal in 2018 and reimposed sanctions, slashing Iran's vital crude oil exports and chasing away foreign energy companies from potential Iranian oil projects.

Brent near $80 as market shrugs off Omicron | Reuters

Brent near $80 as market shrugs off Omicron | Reuters

Oil prices extended gains on Tuesday, with Brent crude trading near $80 a barrel despite the rapid spread of the Omicron coronavirus variant, supported by supply outages and expectations that U.S. inventories fell last week.

Brent crude rose by $1.04, or 1.3%, to $79.64 a barrel by 1119 GMT. U.S. West Texas Intermediate (WTI) crude rose $1.15, or 1.5%, to $76.72.

Both contracts traded at their highest in a month.

"Support comes as well from high aggregated production disruptions in Ecuador, Libya and Nigeria and the expectation of another large drop in U.S. crude inventories," said UBS oil analyst Giovanni Staunovo.

Oil prices extended gains on Tuesday, with Brent crude trading near $80 a barrel despite the rapid spread of the Omicron coronavirus variant, supported by supply outages and expectations that U.S. inventories fell last week.

Brent crude rose by $1.04, or 1.3%, to $79.64 a barrel by 1119 GMT. U.S. West Texas Intermediate (WTI) crude rose $1.15, or 1.5%, to $76.72.

Both contracts traded at their highest in a month.

"Support comes as well from high aggregated production disruptions in Ecuador, Libya and Nigeria and the expectation of another large drop in U.S. crude inventories," said UBS oil analyst Giovanni Staunovo.

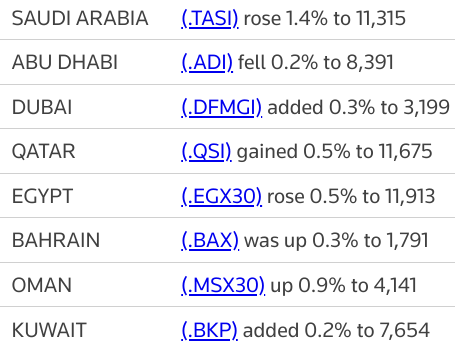

Most Gulf bourses close higher as Omicron worries ease | Reuters

Most Gulf bourses close higher as Omicron worries ease | Reuters

Most stock markets in the Gulf ended higher on Tuesday, with the Saudi index outperforming the region amid diminished concern over the economic impact of the Omicron variant of COVID-19.

Saudi Arabia's benchmark index (.TASI) advanced 1.4%, buoyed by a 2.9% rise in Al Rajhi Bank (1120.SE) and a 1.7% increase in petrochemical maker Saudi Basic Industries Corp (2010.SE).

The market was supported by rising oil prices and retreating concerns around the possible effects of the Omicron variant on the global economy, said Wael Makarem, senior market strategist at Exness.

"However, the market remains exposed to new price corrections if oil prices return to the downside."

Oil prices, a key catalyst for the Gulf's financial markets, extended gains, with Brent crude trading near $80 a barrel as the market shrugged off Omicron worries, supported by supply outages and expectations that U.S. inventories fell last week.

Meanwhile, Saudi Arabia delayed the launch of a major development strategy for the city of Riyadh up to 2030 until next year due to some "incomplete elements", the state news agency SPA reported. read more

Dubai's main share index (.DFMGI) gained 0.3%, supported by a 1.2% leap in blue-chip developer Emaar Properties (EMAR.DU) and a 0.4% rise in sharia-compliant lender Dubai Islamic Bank (DISB.DU).

The United Arab Emirates has approved emergency use of Sinopharm's protein-based COVID-19 vaccine and it will be available to the public as a booster dose starting in January 2022, the health ministry said. read more

The Qatari benchmark (.QSI) added 0.5%, ending two sessions of losses, with the Gulf's biggest lender Qatar National Bank (QNBK.QA) closing 1% higher.

In Abu Dhabi, the index (.ADI) fell 0.2%, pressured by a 0.9% fall in the country's largest lender First Abu Dhabi Bank (FAB.AD).

Outside the Gulf, Egypt's blue-chip index (.EGX30) finished 0.5% higher, led by a 4.6% jump in Abu Qir Fertilizers and Chemical Industries (ABUK.CA).

Most stock markets in the Gulf ended higher on Tuesday, with the Saudi index outperforming the region amid diminished concern over the economic impact of the Omicron variant of COVID-19.

Saudi Arabia's benchmark index (.TASI) advanced 1.4%, buoyed by a 2.9% rise in Al Rajhi Bank (1120.SE) and a 1.7% increase in petrochemical maker Saudi Basic Industries Corp (2010.SE).

The market was supported by rising oil prices and retreating concerns around the possible effects of the Omicron variant on the global economy, said Wael Makarem, senior market strategist at Exness.

"However, the market remains exposed to new price corrections if oil prices return to the downside."

Oil prices, a key catalyst for the Gulf's financial markets, extended gains, with Brent crude trading near $80 a barrel as the market shrugged off Omicron worries, supported by supply outages and expectations that U.S. inventories fell last week.

Meanwhile, Saudi Arabia delayed the launch of a major development strategy for the city of Riyadh up to 2030 until next year due to some "incomplete elements", the state news agency SPA reported. read more

Dubai's main share index (.DFMGI) gained 0.3%, supported by a 1.2% leap in blue-chip developer Emaar Properties (EMAR.DU) and a 0.4% rise in sharia-compliant lender Dubai Islamic Bank (DISB.DU).

The United Arab Emirates has approved emergency use of Sinopharm's protein-based COVID-19 vaccine and it will be available to the public as a booster dose starting in January 2022, the health ministry said. read more

The Qatari benchmark (.QSI) added 0.5%, ending two sessions of losses, with the Gulf's biggest lender Qatar National Bank (QNBK.QA) closing 1% higher.

In Abu Dhabi, the index (.ADI) fell 0.2%, pressured by a 0.9% fall in the country's largest lender First Abu Dhabi Bank (FAB.AD).

Outside the Gulf, Egypt's blue-chip index (.EGX30) finished 0.5% higher, led by a 4.6% jump in Abu Qir Fertilizers and Chemical Industries (ABUK.CA).

Fraying #Saudi-#UAE Ties Put U.S. Objectives at Risk - Bloomberg @ghoshworld

Fraying Saudi-UAE Ties Put U.S. Objectives at Risk - Bloomberg

By tradition, the communiqué at the end of every Gulf Cooperation Council summit meeting is a bromide about friendship among the member states — Saudi Arabia, the United Arab Emirates, Kuwait, Qatar, Oman and Bahrain. The joint declaration is usually long on promise but short on any real purpose beyond concealing discord.

Even by that low standard, the document released at the end of the latest gathering of Gulf leaders in Riyadh on Dec. 14 was the wispiest of fig leaves. The usual invocation of unity did little to hide the growing rivalry between the group’s two most important members, Saudi Arabia and the UAE.

For me, the widening divergence of economic, security and foreign-policy interests between the kingdom and the confederation of emirates was one of the most important stories of 2021. How the contest plays out will have a large bearing not only on the affairs of the Arabian Peninsula but on the geopolitics of the wider Middle East. In particular, it poses a challenge for the U.S., which has long relied on the friendship between the two states as a bulwark against Iran.More from

Some of the differences between Saudi Arabia and the UAE stem from economic choices made by their leaders, others from contrasting security calculations and still others from ideological considerations. These haven’t yet added up to open antagonism between them, certainly nothing in the nature of the naked hostility they jointly directed at Qatar during a three-year economic embargo that ended at the start of 2021.

By tradition, the communiqué at the end of every Gulf Cooperation Council summit meeting is a bromide about friendship among the member states — Saudi Arabia, the United Arab Emirates, Kuwait, Qatar, Oman and Bahrain. The joint declaration is usually long on promise but short on any real purpose beyond concealing discord.

Even by that low standard, the document released at the end of the latest gathering of Gulf leaders in Riyadh on Dec. 14 was the wispiest of fig leaves. The usual invocation of unity did little to hide the growing rivalry between the group’s two most important members, Saudi Arabia and the UAE.

For me, the widening divergence of economic, security and foreign-policy interests between the kingdom and the confederation of emirates was one of the most important stories of 2021. How the contest plays out will have a large bearing not only on the affairs of the Arabian Peninsula but on the geopolitics of the wider Middle East. In particular, it poses a challenge for the U.S., which has long relied on the friendship between the two states as a bulwark against Iran.More from

Some of the differences between Saudi Arabia and the UAE stem from economic choices made by their leaders, others from contrasting security calculations and still others from ideological considerations. These haven’t yet added up to open antagonism between them, certainly nothing in the nature of the naked hostility they jointly directed at Qatar during a three-year economic embargo that ended at the start of 2021.

#SaudiArabia to finalise Riyadh 2030 strategy next year - state media | Reuters

Saudi Arabia to finalise Riyadh 2030 strategy next year - state media | Reuters

Saudi Arabia has delayed the launch of a major development strategy for the city of Riyadh up to 2030 until next year due to some "incomplete elements", the state news agency SPA reported on Tuesday.

SPA said the development strategy for the capital is to be "finalised" in 2022.

Saudi Arabia is investing $220 billion to transform Riyadh into a global city by 2030, and expects to attract a similar amount of investment from the private sector, the head of the royal commission for the capital told Reuters in January. read more

The Gulf kingdom plans to double the population and economy of its capital city, currently home to some 7 million people, in the next decade.

Saudi Arabia, the world's top oil exporter, is seeking to diversify its economy away from crude revenues by creating new industries and investment opportunities.

Saudi Crown Prince Mohammed bin Salman wants the kingdom's capital to become one of the world's biggest 10 cities under his economic reform strategy.

Saudi Arabia has delayed the launch of a major development strategy for the city of Riyadh up to 2030 until next year due to some "incomplete elements", the state news agency SPA reported on Tuesday.

SPA said the development strategy for the capital is to be "finalised" in 2022.

Saudi Arabia is investing $220 billion to transform Riyadh into a global city by 2030, and expects to attract a similar amount of investment from the private sector, the head of the royal commission for the capital told Reuters in January. read more

The Gulf kingdom plans to double the population and economy of its capital city, currently home to some 7 million people, in the next decade.

Saudi Arabia, the world's top oil exporter, is seeking to diversify its economy away from crude revenues by creating new industries and investment opportunities.

Saudi Crown Prince Mohammed bin Salman wants the kingdom's capital to become one of the world's biggest 10 cities under his economic reform strategy.

Most Gulf bourses track oil prices, Asian shares higher | Reuters

Most Gulf bourses track oil prices, Asian shares higher | Reuters

Most stock markets in the Gulf rose in early trade on Tuesday, tracking gains in oil prices and Asian shares as some investors grew less fearful about economic damage from the Omicron variant of COVID-19.

Saudi Arabia's benchmark index (.TASI) gained 0.6%, with Al Rajhi Bank (1120.SE) rising 1% and oil behemoth Saudi Aramco (2222.SE) adding 0.6%.

Oil prices, a key catalyst for the Gulf's financial markets, extended gains with prices trading near the previous day's one-month high on hopes that the Omicron variant will have a limited impact on fuel demand.

Meanwhile, Saudi Arabia delayed the launch of a major development strategy for the city of Riyadh up to 2030 until next year due to some "incomplete elements", the state news agency SPA reported. read more

The kingdom is investing $220 billion to transform Riyadh into a global city by 2030, and expects to attract a similar amount of investment from the private sector, Reuters reported in January, citing the head of the royal commission for the capital. read more

Dubai's main share index (.DFMGI) rose 0.3%, supported by a 0.8% rise in blue-chip developer Emaar Properties (EMAR.DU).

The United Arab Emirates has approved the emergency use of Sinopharm's protein-based COVID-19 vaccine and it will be available to the public as a booster dose starting January 2022, the health ministry said. read more

The Qatari index (.QSI) edged 0.2% higher, on course to end two sessions of losses, with Qatar Fuel gaining 0.9%.

In Abu Dhabi, the index (.ADI) fell 0.4%, hit by a 0.8% fall in the country's largest lender First Abu Dhabi Bank (FAB.AD).

Most stock markets in the Gulf rose in early trade on Tuesday, tracking gains in oil prices and Asian shares as some investors grew less fearful about economic damage from the Omicron variant of COVID-19.

Saudi Arabia's benchmark index (.TASI) gained 0.6%, with Al Rajhi Bank (1120.SE) rising 1% and oil behemoth Saudi Aramco (2222.SE) adding 0.6%.

Oil prices, a key catalyst for the Gulf's financial markets, extended gains with prices trading near the previous day's one-month high on hopes that the Omicron variant will have a limited impact on fuel demand.

Meanwhile, Saudi Arabia delayed the launch of a major development strategy for the city of Riyadh up to 2030 until next year due to some "incomplete elements", the state news agency SPA reported. read more

The kingdom is investing $220 billion to transform Riyadh into a global city by 2030, and expects to attract a similar amount of investment from the private sector, Reuters reported in January, citing the head of the royal commission for the capital. read more

Dubai's main share index (.DFMGI) rose 0.3%, supported by a 0.8% rise in blue-chip developer Emaar Properties (EMAR.DU).

The United Arab Emirates has approved the emergency use of Sinopharm's protein-based COVID-19 vaccine and it will be available to the public as a booster dose starting January 2022, the health ministry said. read more

The Qatari index (.QSI) edged 0.2% higher, on course to end two sessions of losses, with Qatar Fuel gaining 0.9%.

In Abu Dhabi, the index (.ADI) fell 0.4%, hit by a 0.8% fall in the country's largest lender First Abu Dhabi Bank (FAB.AD).

Where Does Gold Come From in Africa? Suspected Smuggling to #Dubai Rings Alarms - Bloomberg video

Where Does Gold Come From in Africa? Suspected Smuggling to Dubai Rings Alarms - Bloomberg

In the moon-like landscape of northern Sudan, informal gold miners toil with spades and pickaxes to extract their prize from shallow pits that pockmark the terrain.

Mining ore in the sweltering heat of the Nubian desert is the first stage of an illicit network that has exploded in the past 18 months following a pandemic-induced spike in the gold price. African governments desperate to recoup lost revenue are looking to Dubai to help stop the trade.

Interviews with government officials across Africa reveal smuggling operations that span at least nine countries and involve tons of gold spirited over borders. That’s a cause for international concern because the funds from contraband minerals dealing in Africa fuel conflict, finance criminal and terrorist networks, undermine democracy and facilitate money laundering, according to the Organisation for Economic Cooperation and Development.

While it’s impossible to say precisely how much is lost to smugglers each year, United Nations trade data for 2020 show a discrepancy of at least $4 billion between the United Arab Emirates’ declared gold imports from Africa and what African countries say they exported to the UAE.

In the moon-like landscape of northern Sudan, informal gold miners toil with spades and pickaxes to extract their prize from shallow pits that pockmark the terrain.

Mining ore in the sweltering heat of the Nubian desert is the first stage of an illicit network that has exploded in the past 18 months following a pandemic-induced spike in the gold price. African governments desperate to recoup lost revenue are looking to Dubai to help stop the trade.

Interviews with government officials across Africa reveal smuggling operations that span at least nine countries and involve tons of gold spirited over borders. That’s a cause for international concern because the funds from contraband minerals dealing in Africa fuel conflict, finance criminal and terrorist networks, undermine democracy and facilitate money laundering, according to the Organisation for Economic Cooperation and Development.

While it’s impossible to say precisely how much is lost to smugglers each year, United Nations trade data for 2020 show a discrepancy of at least $4 billion between the United Arab Emirates’ declared gold imports from Africa and what African countries say they exported to the UAE.

Oil prices climb as worries over fuel demand recede | Reuters

Oil prices climb as worries over fuel demand recede | Reuters

Oil prices extended gains on Tuesday with prices trading near the previous day's one-month high on hopes that the Omicron coronavirus variant will have a limited impact on fuel demand.

Brent crude rose 7 cents, or 0.1%, to $78.67 a barrel, by 0728 GMT. U.S. West Texas Intermediate (WTI) crude rose 17 cents, or 0.2%, to $75.74 a barrel, gaining for a fifth straight session.

"Worries regarding Omicron are easing across the globe, resulting in some optimism over demand ... Prices are expected to trade with positive bias," said Abhishek Chauhan, head of commodities at Swastika Investmart Ltd.

England will not get any new COVID-19 restrictions before the end of 2021, British health minister Sajid Javid said on Monday, as the government awaits more evidence on whether the health service can cope with high infection rates. read more

Oil prices extended gains on Tuesday with prices trading near the previous day's one-month high on hopes that the Omicron coronavirus variant will have a limited impact on fuel demand.

Brent crude rose 7 cents, or 0.1%, to $78.67 a barrel, by 0728 GMT. U.S. West Texas Intermediate (WTI) crude rose 17 cents, or 0.2%, to $75.74 a barrel, gaining for a fifth straight session.

"Worries regarding Omicron are easing across the globe, resulting in some optimism over demand ... Prices are expected to trade with positive bias," said Abhishek Chauhan, head of commodities at Swastika Investmart Ltd.

England will not get any new COVID-19 restrictions before the end of 2021, British health minister Sajid Javid said on Monday, as the government awaits more evidence on whether the health service can cope with high infection rates. read more

Monday, 27 December 2021

Oil prices rise to highest level in a month as Omicron concern eases | Reuters

Oil prices rise to highest level in a month as Omicron concern eases | Reuters

Oil prices rose more than 2% on Monday to the highest level since late November on hopes that the Omicron coronavirus variant will have a limited impact on global demand in 2022, even as surging cases caused flight cancellations.

Global benchmark Brent crude rose $2.46, or 3.2%, to settle at $78.60 a barrel. U.S. West Texas Intermediate (WTI) crude rose $1.78, or 2.4%, to settle at $75.57 a barrel. The U.S. market was closed on Friday for a holiday.

Both benchmarks rose on Monday to the highest since Nov. 26. On that day, oil plunged by more than 10% when reports of a new variant first appeared. The benchmarks gained last week after early data suggested that Omicron could cause a milder level of illness.

"Though Omicron is spreading faster than any COVID-19 variant yet, a relatively relieving news is that most people infected with Omicron are showing mild symptoms, at least so far," said Leona Liu, analyst at Singapore-based DailyFX.

Oil prices rose more than 2% on Monday to the highest level since late November on hopes that the Omicron coronavirus variant will have a limited impact on global demand in 2022, even as surging cases caused flight cancellations.

Global benchmark Brent crude rose $2.46, or 3.2%, to settle at $78.60 a barrel. U.S. West Texas Intermediate (WTI) crude rose $1.78, or 2.4%, to settle at $75.57 a barrel. The U.S. market was closed on Friday for a holiday.

Both benchmarks rose on Monday to the highest since Nov. 26. On that day, oil plunged by more than 10% when reports of a new variant first appeared. The benchmarks gained last week after early data suggested that Omicron could cause a milder level of illness.

"Though Omicron is spreading faster than any COVID-19 variant yet, a relatively relieving news is that most people infected with Omicron are showing mild symptoms, at least so far," said Leona Liu, analyst at Singapore-based DailyFX.

Most Gulf bourses fall as Omicron worries weigh | Reuters

Most Gulf bourses fall as Omicron worries weigh | Reuters

Most Gulf stock markets ended lower on Monday, with investor sentiment hit by uncertainty over the economic impact of the Omicron coronavirus variant.

The spread of the Omicron variant is becoming an increasing concern despite reports of it having a less serious impact on health than previous variants, said Farah Mourad, senior market analyst at XTB MENA.

Saudi Arabia's benchmark index (.TASI) dipped by 0.1%, with Al Rajhi Bank (1120.SE) losing 0.7% and Riyad Bank (1010.SE) declining 1.5%.