Most Gulf stock markets ended lower on Monday, with investor sentiment hit by uncertainty over the economic impact of the Omicron coronavirus variant.

The spread of the Omicron variant is becoming an increasing concern despite reports of it having a less serious impact on health than previous variants, said Farah Mourad, senior market analyst at XTB MENA.

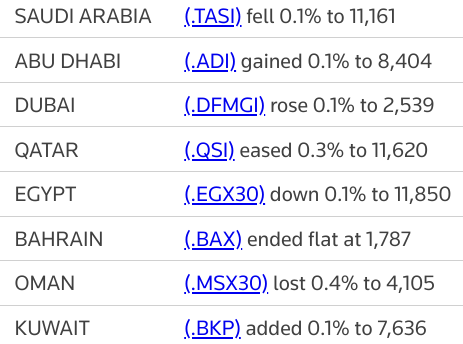

Saudi Arabia's benchmark index (.TASI) dipped by 0.1%, with Al Rajhi Bank (1120.SE) losing 0.7% and Riyad Bank (1010.SE) declining 1.5%.

Saudi health authorities advised citizens and residents last week to avoid all unnecessary foreign travel. The kingdom reported its first Omicron case on Dec. 1.

Crude oil prices, a key catalyst for the Gulf's financial markets, fell after U.S. airlines called off thousands of flights over the Christmas holidays amid surging COVID-19 cases.

The Qatari index (.QSI) dropped 0.3%, while Oman's benchmark (.MSX30) settled 0.4% down.

Omani authorities require foreign travellers aged 18 or older to have received at least two COVID-19 vaccine doses to enter the sultanate, the state news agency reported on Sunday. read more

Dubai's main share index (.DFMGI) advanced 0.9%, boosted by a 1.5% gain in blue-chip developer Emaar Properties (EMAR.DU) and a 1.3% increase in sharia-compliant lender Dubai Islamic Bank (DISB.DU).

Investors are returning to the market gradually after last week's price corrections and the main index could record some increases in the coming days if traders move to buy the dip, said Mourad.

The Abu Dhabi index (.ADI) reversed early losses to close 0.1% higher, helped by a 0.3% rise in telecoms company Etisalat (ETISALAT.AD).

Separately, the UAE government has told some of its biggest business families that it plans to remove their monopolies on the sale of imported goods, Reuters reported on Sunday, citing the Financial Times. read more

Over the past year, the UAE, a growing economic rival of Saudi Arabia, has taken measures to make its economy more attractive to foreign investors and talent.

Outside the Gulf, Egypt's blue-chip index (.EGX30) eased by 0.1%, snapping four sessions of gains, hit by a 1.8% fall in tobacco monopoly Eastern Company (EAST.CA).

No comments:

Post a Comment