"The upward trend in GRE debt/GDP that has been in evidence since 2014 could resume as GREs help to drive national economic agendas, aiming at job creation, diversification and the energy transition," the report said.

However, increased focus on privatisation and asset sales could mitigate this trend over time, Fitch noted.

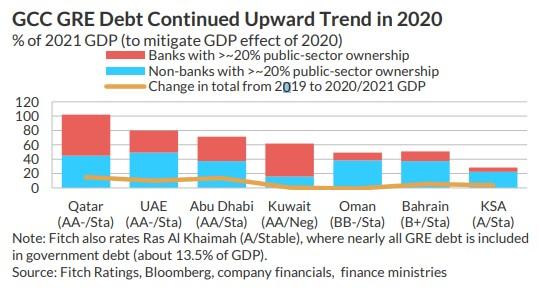

Aggregate GCC non-bank GRE debt hit 37 percent of GDP in 2020 (an increase of 7pp over 2019), driven in part by declines in nominal GDP on lower oil prices and Covid-19-induced recessions. The ratio is 32 percent in relation to forecast 2021 GDP.

Aggregate debt of GCC government-related banks rose to 24 percent of GDP in 2020. However, potential contingent liabilities from banks are larger. For instance in Qatar, sector assets reached above 300 percent.

No comments:

Post a Comment