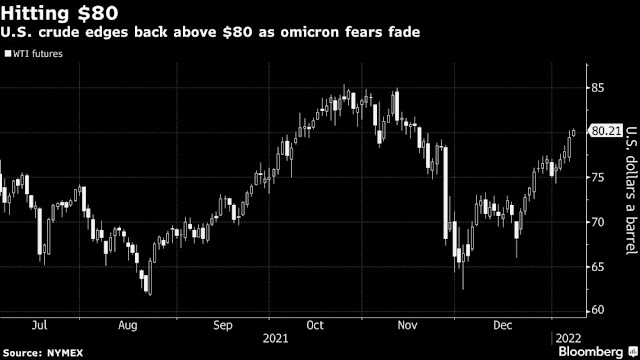

Oil has started off 2022 with a bang.

A market that was supposed to suffer a ballooning surplus instead surpassed $80 a barrel last week as global demand shrugs off the omicron variant, while a host of supply constraints hit producers from Canada to Russia.

With investment banks calling for higher prices, and options contracts invoking the prospect of crude spiraling above $100, the commodity is threatening to intensify the inflationary pain felt by major consumers.

Such a rally would be bad news for fuel-hungry countries. It would also be a big blow to U.S. President Joe Biden, who invested a lot of time and effort in jawboning prices lower and orchestrating a global release of strategic petroleum reserves.

“The bullish sentiment has regained the narrative,’’ said Michael Tran, a commodities strategist at RBC Capital Markets. “With improving demand, tightening inventories, and questions of OPEC’s ability to ramp further, the directional arrows of progress point to further optimism.’’

Movements in the price of oil are felt more keenly and quickly than any other commodity because it passes almost immediately into the cost of end-products like gasoline, diesel and jet fuel. This month there were riots across Kazakhstan after the government there allowed the price of liquefied petroleum gas — a key road fuel — to surge.

No comments:

Post a Comment