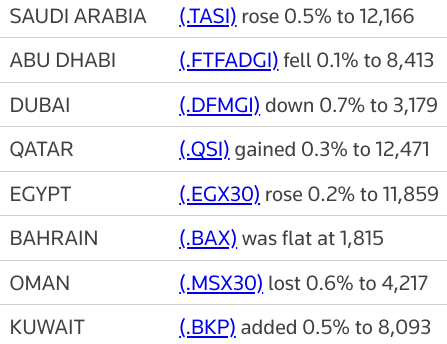

Stock markets in the Gulf ended mixed on Monday, with the Saudi index extending gains from the previous sessions when it reached its highest in over 15 years.

Saudi Arabia's benchmark index (.TASI) gained 0.5%, at its highest since July 2006, led by a 1.4% rise in the kingdom's biggest lender Saudi National Bank (1180.SE) and a 1.8% increase in Saudi Telecom Company (7010.SE).

Oil prices, a key catalyst for the Gulf's financial markets, were steady as investor bets that global supply will remain tight amid restraint by major producers were offset by a rise in Libyan output.

The Qatari index (.QSI) finished 0.3% higher, led by a 2.4% increase in Qatar National Bank (QNBK.QA).

Last week, the Gulf's biggest bank reported a 10% increase in annual net profit driven by loan growth. read more

However, Qatar Islamic Bank (QISB.QA) fell 1.2%, despite reporting a rise in annual profit.

Investors remain cautious while uncertainties remain around the developments in U.S. monetary policy, said Wael Makarem, senior market strategist at Exness.

"Markets in the region have also seen investors move to secure their profits after several increases in the last few days."

Dubai's main share index (.DFMGI) fell 0.7%, dragged down by a 2.3% fall in Emirates NBD Bank (ENBD.DU) and a 1.2% decrease in Emirates Integrated Telecommunications (DU.DU).

Three fuel trucks exploded, killing three people, and a fire broke out near Abu Dhabi airport on Monday in what Yemen's Iran-aligned Houthi group said was an attack deep inside the United Arab Emirates. read more

The Houthi movement, which is battling a Saudi-led coalition that includes the UAE, has frequently launched cross-border missile and drone attacks on Saudi Arabia, but has claimed few such attacks on the UAE, mostly denied by Emirati authorities.

The Abu Dhabi stock market index (.FTFADGI) eased 0.1%, giving up early gains after the news of the explosion and fire. The stock market index had gained as much as 0.3% in early trade.

Outside the Gulf, Egypt's blue-chip index (.EGX30) added 0.2%, ending two sessions of losses, helped by a 0.4% gain in top lender Commercial International Bank Egypt (COMI.CA).

No comments:

Post a Comment