Solely aggregation of news articles, with no opinions expressed by this service since 2009 launch on this platform. Copyright to all articles remains with the original publisher and HEADLINES ARE CLICKABLE to access the whole article at source. (Subscription by email is recommended,with real-time updates on LinkedIn and Twitter.)

Search This Blog

Monday, 31 January 2022

Oil posts biggest monthly gain in a year on tight supply, political tensions | Reuters

Oil posts biggest monthly gain in a year on tight supply, political tensions | Reuters

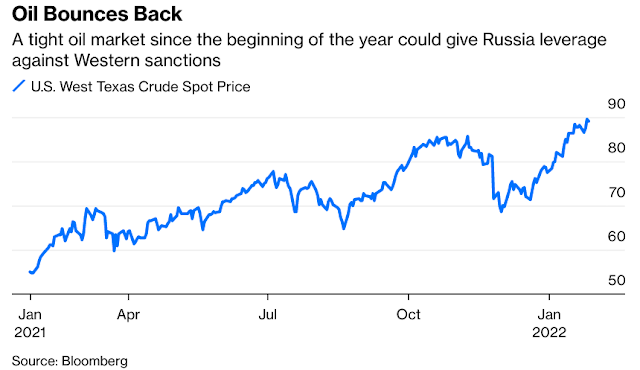

Oil prices rose on Monday to end January with their biggest monthly gain in a year, boosted by a supply shortage and political tensions in Eastern Europe and the Middle East.

The most-active Brent contract, for April delivery , traded 74 cents higher, or 0.8%, to settle at $89.26 per barrel. The front-month contract, for March delivery , which expired at the end of the session, rose $1.18, or 1.3%, to finish at $91.21.

U.S. West Texas Intermediate crude rose $1.33, or 1.5%, to close at $88.15 a barrel.

The benchmarks recorded their highest levels since October 2014 on Friday, at $91.70 and $88.84, respectively, and their sixth straight weekly gain. They gained by about 17% this month, the most since February 2021.

Oil prices rose on Monday to end January with their biggest monthly gain in a year, boosted by a supply shortage and political tensions in Eastern Europe and the Middle East.

The most-active Brent contract, for April delivery , traded 74 cents higher, or 0.8%, to settle at $89.26 per barrel. The front-month contract, for March delivery , which expired at the end of the session, rose $1.18, or 1.3%, to finish at $91.21.

U.S. West Texas Intermediate crude rose $1.33, or 1.5%, to close at $88.15 a barrel.

The benchmarks recorded their highest levels since October 2014 on Friday, at $91.70 and $88.84, respectively, and their sixth straight weekly gain. They gained by about 17% this month, the most since February 2021.

Oil on track for biggest monthly gain in a year on supply constraints, political tensions | Reuters

Oil on track for biggest monthly gain in a year on supply constraints, political tensions | Reuters

Oil prices were on track for their biggest monthly gain in almost a year on Monday, boosted by a supply shortage and political tensions in Eastern Europe and the Middle East.

The most-active Brent contract, for April delivery , was trading 83 cents higher at $89.35 per barrel by 1:16 p.m. EST (1816 GMT). The front-month contract for March delivery , rose $1.20 to $91.23 a barrel but was set to expire later in the day.

U.S. West Texas Intermediate crude rose $1.11, or 1.3%, to $87.93 a barrel.

The benchmarks recorded their highest levels since October 2014 on Friday, at $91.70 and $88.84, respectively, and their sixth straight weekly gain. They were headed for gains of about 17% this month, the most since February 2021.

Oil prices were on track for their biggest monthly gain in almost a year on Monday, boosted by a supply shortage and political tensions in Eastern Europe and the Middle East.

The most-active Brent contract, for April delivery , was trading 83 cents higher at $89.35 per barrel by 1:16 p.m. EST (1816 GMT). The front-month contract for March delivery , rose $1.20 to $91.23 a barrel but was set to expire later in the day.

U.S. West Texas Intermediate crude rose $1.11, or 1.3%, to $87.93 a barrel.

The benchmarks recorded their highest levels since October 2014 on Friday, at $91.70 and $88.84, respectively, and their sixth straight weekly gain. They were headed for gains of about 17% this month, the most since February 2021.

#UAE bank ADCB quarterly net profit up 44%, beats forecasts | Reuters

UAE bank ADCB quarterly net profit up 44%, beats forecasts | Reuters

Abu Dhabi Commercial Bank (ADCB.AD), UAE's third-biggest lender, beat expectations with a 44% rise in fourth-quarter net profit, boosted by higher net fee and commission income on cards and loans.

Banks in the United Arab Emirates are seeing a swift recovery in earnings as the economy recovers from the worst of the pandemic, oil prices have surged and the world fair Expo has boosted tourism.

ADCB's recorded a net profit of 1.448 billion dirhams ($394 million) in the October-December quarter, up from 1.007 billion dirhams in the same period in 2020.

The net profit beat analysts expectations as EFG Hermes had predicted 1.33 billion dirhams and Arqaam Capital had 1.16 billion dirhams.

Abu Dhabi Commercial Bank (ADCB.AD), UAE's third-biggest lender, beat expectations with a 44% rise in fourth-quarter net profit, boosted by higher net fee and commission income on cards and loans.

Banks in the United Arab Emirates are seeing a swift recovery in earnings as the economy recovers from the worst of the pandemic, oil prices have surged and the world fair Expo has boosted tourism.

ADCB's recorded a net profit of 1.448 billion dirhams ($394 million) in the October-December quarter, up from 1.007 billion dirhams in the same period in 2020.

The net profit beat analysts expectations as EFG Hermes had predicted 1.33 billion dirhams and Arqaam Capital had 1.16 billion dirhams.

The #UAE Is Set to Levy Corporate Tax: Here’s What Analysts Say - Bloomberg

The UAE Is Set to Levy Corporate Tax: Here’s What Analysts Say - Bloomberg

The United Arab Emirates plans to introduce a 9% federal tax on corporate earnings for the first time next year, in its latest step toward dismantling a levy-free regime that helped make it a magnet for businesses from across the world.

Mohamed Abu Basha, head of macroeconomic research at investment bank EFG Hermes:

The United Arab Emirates plans to introduce a 9% federal tax on corporate earnings for the first time next year, in its latest step toward dismantling a levy-free regime that helped make it a magnet for businesses from across the world.

Mohamed Abu Basha, head of macroeconomic research at investment bank EFG Hermes:

- “The implementation comes as UAE aligns itself with the new global standards, in particular the transition to a global minimum tax, as well as the government’s noticeable intentions to prepare for a life beyond oil.”

- “In terms of its impact on attracting investment, I don’t think it will much affect UAE’s ability to attract investments. First, companies in free zones will continue to enjoy their tax benefits, hence are shielded from the decision. Second, most other Gulf countries already impose a corporate income tax on multinational operating in the economy, including 20% in Saudi, 15% in Oman and 10% Qatar.”

- “The tax will hit some sectors harder than others.”

- “Telecoms and companies in the services industry already pay fees, some as high at 20% as in the case of hotela. For some firms, a 9% tax will take them from profitability to loss, reducing investor appetite and lowering the share price. Many will be looking to see whether the royalties or fees might get changed too.”

- “This was the logical next step although it came much earlier than many of us had expected.”

- “There is quite a bit of detail that needs to come out still but for large companies operating in the UAE, corporate taxes were expected and now they know the rate.”

- “The issue I see is implementation for SME. What’s to stop business owners from loading up the salaries to avoid paying the tax. Usually many of those businesses are controlled by few shareholders.”

- “While the news was a surprise, there is little evidence to suggest that corporate tax rates have any type of meaningful impact on equity markets. Counterintuitive to conventional expectations, a study suggests that the S&P 500 index had higher average returns on every occasion of an increase in corporate taxes in the US.”

- “Foreign taxes paid will be credited against any payable UAE corporate tax meaning there will be no double taxation. Moreover, since the implications only commence from June 2023, companies do have some time to readjust to the new tax regime.”

- “It was just a matter of time before the UAE imposed corporate tax in line with some other GCC countries,”

- “The levels announced of 9% base are quite reasonable in international standards.”

- “I’m glad to see that SMEs and small business will most likely be exempt from the corporate tax burden,”

- “Business and financial institutions will have to start accounting for a corporate tax that will touch their net earnings. Hence, a leaner workforce alongside more efficient operations may come into place to compensate for the tax impact on profitability.”

- “The challenge for the UAE is to remain competitive, regionally and globally, despite the new corporate tax regime.”

- “The UAE as a country is attractive for investors because of the favorable tax regime.”

- “The upcoming regulatory changes might cause concern for businesses operating here. Even so, with huge investment in infrastructure and changes in immigration policy, this is a natural progression for the growth of the country in line with best practices globally.”

Oil steady as geopolitical risks offset by OPEC+ supply plans | Reuters

Oil steady as geopolitical risks offset by OPEC+ supply plans | Reuters

Oil prices were steady on Monday, with Eastern Europe and Middle East political issues offsetting expectations that major producers will release more supply to a thirsty market.

Brent crude was up 91 cents, or 1%, to $90.94 a barrel by 1500 GMT. The front-month contract for March delivery expires later in the day.

However the most-active Brent contract, for April delivery , was unchanged at $88.53. U.S. West Texas Intermediate crude rose 7 cents, or 0.1%, to $86.89 a barrel.

The benchmarks on Friday recorded their highest levels since October 2014 at $91.70 and $88.84 respectively and their sixth straight weekly gain. They are on track for a monthly gain of about 17%, the most since last February.

Oil prices were steady on Monday, with Eastern Europe and Middle East political issues offsetting expectations that major producers will release more supply to a thirsty market.

Brent crude was up 91 cents, or 1%, to $90.94 a barrel by 1500 GMT. The front-month contract for March delivery expires later in the day.

However the most-active Brent contract, for April delivery , was unchanged at $88.53. U.S. West Texas Intermediate crude rose 7 cents, or 0.1%, to $86.89 a barrel.

The benchmarks on Friday recorded their highest levels since October 2014 at $91.70 and $88.84 respectively and their sixth straight weekly gain. They are on track for a monthly gain of about 17%, the most since last February.

Geopolitical tensions hit #UAE stocks, oil supports #Saudi shares | Reuters

Geopolitical tensions hit UAE stocks, oil supports Saudi shares | Reuters

Stocks in the United Arab Emirates(UAE) dropped on Monday following four days of consecutive gains after another attack by Yemen's Iran-aligned Houthi movement on the Gulf state, while rising oil prices supported Saudi Arabian shares.

The UAE said on Monday it intercepted a ballistic missile fired by the Houthis, the third such attack on the U.S.-allied Gulf state in the last two weeks. read more

Oil rose on Monday as a supply shortage and political tensions in Eastern Europe and the Middle East put prices on track for their biggest monthly gain in almost a year.

"Markets in Dubai and Abu Dhabi dropped a little in reaction to the recent developments. In contrast, the Saudi market was supported by the strong oil prices and could see additional increases," said Wael Makarem, Senior Market Strategist at Exness.

The Abu Dhabi index (.FTFADGI) ended 0.7% down, though the index was up 2.5% for the month. Market heavyweight First Abu Dhabi Bank (FAB.AD) declined 2.7%.

In Dubai, the index (.DFMGI) slipped 0.5%, reducing its monthly gain to 0.2%.

Emirates NBD Bank (ENBD.DU) weighed the most on index, falling 3.6%.

Dubai Investments (DINV.DU), however, surged 7%. After the market close, the investment company reported a more than 78% increase in its full-year profit to 619.5 million dirhams ($168.68 million).

Saudi Arabia's benchmark index (.TASI) closed 0.1% higher to log a monthly gain of about 9%.

Alinma Bank (1150.SE) and Saudi National Bank (1180.SE) increased 3.3% and 1.1% respectively.

The Qatari index (.QSI) closed flat as Qatar National Bank (QNBK.QA) lost 0.7% and Mesaieed Petrochemical Holdings (MPHC.QA) rose 2.3%.

In Egypt, the blue-chip index (.EGX30) snapped its six-session losing streak, gaining 0.3%. Talat Mostafa Group (TMGH.CA) increased 8.6% and Telecom Egypt (ETEL.CA) added 3.5%.

Stocks in the United Arab Emirates(UAE) dropped on Monday following four days of consecutive gains after another attack by Yemen's Iran-aligned Houthi movement on the Gulf state, while rising oil prices supported Saudi Arabian shares.

The UAE said on Monday it intercepted a ballistic missile fired by the Houthis, the third such attack on the U.S.-allied Gulf state in the last two weeks. read more

Oil rose on Monday as a supply shortage and political tensions in Eastern Europe and the Middle East put prices on track for their biggest monthly gain in almost a year.

"Markets in Dubai and Abu Dhabi dropped a little in reaction to the recent developments. In contrast, the Saudi market was supported by the strong oil prices and could see additional increases," said Wael Makarem, Senior Market Strategist at Exness.

The Abu Dhabi index (.FTFADGI) ended 0.7% down, though the index was up 2.5% for the month. Market heavyweight First Abu Dhabi Bank (FAB.AD) declined 2.7%.

In Dubai, the index (.DFMGI) slipped 0.5%, reducing its monthly gain to 0.2%.

Emirates NBD Bank (ENBD.DU) weighed the most on index, falling 3.6%.

Dubai Investments (DINV.DU), however, surged 7%. After the market close, the investment company reported a more than 78% increase in its full-year profit to 619.5 million dirhams ($168.68 million).

Saudi Arabia's benchmark index (.TASI) closed 0.1% higher to log a monthly gain of about 9%.

Alinma Bank (1150.SE) and Saudi National Bank (1180.SE) increased 3.3% and 1.1% respectively.

The Qatari index (.QSI) closed flat as Qatar National Bank (QNBK.QA) lost 0.7% and Mesaieed Petrochemical Holdings (MPHC.QA) rose 2.3%.

In Egypt, the blue-chip index (.EGX30) snapped its six-session losing streak, gaining 0.3%. Talat Mostafa Group (TMGH.CA) increased 8.6% and Telecom Egypt (ETEL.CA) added 3.5%.

Boeing to sign #Qatar freighter deal on Monday - U.S. officials | Reuters

Boeing to sign Qatar freighter deal on Monday - U.S. officials | Reuters

Boeing Co (BA.N) looks set to sign a provisional order from Qatar Airways for a new freighter version of its 777X passenger jet on Monday, in a Washington ceremony coinciding with a visit by the Gulf state's ruling emir, U.S. officials said.

Reuters reported last week that the U.S. planemaker was in advanced negotiations with the Gulf carrier for around 34 of the planned twin-engined freighters in a deal provisionally estimated to be worth $14 billion at list prices. read more

Qatar Airways has publicly said it is interested in buying up to 50 jets, with the larger figure expected to include additional options that could lead to later top-up purchases.

The deal, which could be subject to a formal launch of the freighter project, is expected to be signed at a White House ceremony at 12:30 pm local (1630 GMT), the officials said.

Boeing declined to comment.

Qatar Airways, which has declined to comment on Boeing freighter negotiations, could not immediately be reached.

Boeing Co (BA.N) looks set to sign a provisional order from Qatar Airways for a new freighter version of its 777X passenger jet on Monday, in a Washington ceremony coinciding with a visit by the Gulf state's ruling emir, U.S. officials said.

Reuters reported last week that the U.S. planemaker was in advanced negotiations with the Gulf carrier for around 34 of the planned twin-engined freighters in a deal provisionally estimated to be worth $14 billion at list prices. read more

Qatar Airways has publicly said it is interested in buying up to 50 jets, with the larger figure expected to include additional options that could lead to later top-up purchases.

The deal, which could be subject to a formal launch of the freighter project, is expected to be signed at a White House ceremony at 12:30 pm local (1630 GMT), the officials said.

Boeing declined to comment.

Qatar Airways, which has declined to comment on Boeing freighter negotiations, could not immediately be reached.

#UAE to launch first federal corporate tax on business profits from June 2023 | Reuters

UAE to launch first federal corporate tax on business profits from June 2023 | Reuters

The United Arab Emirates (UAE) on Monday said it would introduce a federal corporate tax on business profits for the first time starting from June 1, 2023, although it kept the rate low, at 9 percent, to maintain its attractiveness for businesses.

The Gulf Arab oil exporter, a magnet for the globe's ultra-rich, has long benefited from its tax-free status to carve out a role as an international commercial, energy and tourism hub.

Much of this tax-free regime, including no personal income tax, remains. But the Finance Ministry said it was launching corporate tax to align with international efforts to combat tax avoidance, as well as to address challenges arising from the digitalisation of the global economy.

The new tax will be levied on all corporations and commercial activities in the country, except for the "extraction of natural resources" which will remain subject to taxation at the emirate level.

The United Arab Emirates (UAE) on Monday said it would introduce a federal corporate tax on business profits for the first time starting from June 1, 2023, although it kept the rate low, at 9 percent, to maintain its attractiveness for businesses.

The Gulf Arab oil exporter, a magnet for the globe's ultra-rich, has long benefited from its tax-free status to carve out a role as an international commercial, energy and tourism hub.

Much of this tax-free regime, including no personal income tax, remains. But the Finance Ministry said it was launching corporate tax to align with international efforts to combat tax avoidance, as well as to address challenges arising from the digitalisation of the global economy.

The new tax will be levied on all corporations and commercial activities in the country, except for the "extraction of natural resources" which will remain subject to taxation at the emirate level.

Oil rises on geopolitical risks, supply shortage | Reuters

Oil rises on geopolitical risks, supply shortage | Reuters

Oil rose on Monday as a supply shortage and political tensions in Eastern Europe and the Middle East put prices on track for their biggest monthly gain in almost a year.

Brent crude had risen 87 cents, or 1%, to $90.90 a barrel by 1228 GMT. The front-month contract for March delivery expires later in the day. The most-active Brent contract, for April delivery , was trading at $89.03, up 51 cents, or 0.6%.

U.S. West Texas Intermediate crude rose 47 cents, or 0.5%, to $87.29 a barrel.

The benchmarks recorded their highest levels since October 2014 on Friday, $91.70 and $88.84, respectively, and their sixth straight weekly gain. They were headed for about 17% gains this month, the most since February 2021.

Oil rose on Monday as a supply shortage and political tensions in Eastern Europe and the Middle East put prices on track for their biggest monthly gain in almost a year.

Brent crude had risen 87 cents, or 1%, to $90.90 a barrel by 1228 GMT. The front-month contract for March delivery expires later in the day. The most-active Brent contract, for April delivery , was trading at $89.03, up 51 cents, or 0.6%.

U.S. West Texas Intermediate crude rose 47 cents, or 0.5%, to $87.29 a barrel.

The benchmarks recorded their highest levels since October 2014 on Friday, $91.70 and $88.84, respectively, and their sixth straight weekly gain. They were headed for about 17% gains this month, the most since February 2021.

#Oman starts raising $3.5 bln loan that could go up to $4 bln - source | Reuters

Oman starts raising $3.5 bln loan that could go up to $4 bln - source | Reuters

Oman has started raising a $3.5 billion seven-year loan underwritten by seven regional and local banks that will help refinance a loan it took out last year, a source with direct knowledge of the deal told Reuters.

The finance ministry loan could go up to $4 billion, the source said, as the Gulf oil producer seeks to refinance the $2.2 billion loan taken out early last year.

The banks underwriting the loan include First Abu Dhabi Bank, Mashreq Bank, Abu Dhabi Commercial Bank, Gulf International Bank, Bank ABC and two Omani banks, according to the source and a report by Refintiv's IFR.

The Oman government did not respond to a request for comment.

Oman has started raising a $3.5 billion seven-year loan underwritten by seven regional and local banks that will help refinance a loan it took out last year, a source with direct knowledge of the deal told Reuters.

The finance ministry loan could go up to $4 billion, the source said, as the Gulf oil producer seeks to refinance the $2.2 billion loan taken out early last year.

The banks underwriting the loan include First Abu Dhabi Bank, Mashreq Bank, Abu Dhabi Commercial Bank, Gulf International Bank, Bank ABC and two Omani banks, according to the source and a report by Refintiv's IFR.

The Oman government did not respond to a request for comment.

Citigroup Expects Record Gulf IPO Year With Hiring Spree Across Region - Bloomberg

Citigroup Expects Record Gulf IPO Year With Hiring Spree Across Region - Bloomberg

Citigroup Inc. is boosting its presence in the Gulf region as it expects activity including initial public offerings to reach a new historic high.

“2021 was a record year, but I actually believe 2022 will be even better,” Miguel Azevedo, Citi’s head of investment banking for the Middle East and North Africa, said in an interview with Bloomberg TV on Monday. “We are adding resources all across the region. We are basically in Saudi Arabia and in Dubai and we are adding on both of those.”

The Middle East saw a boom in IPOs last year, with Abu Dhabi joining the rush as governments in the region seek to diversify their economies away from oil and reinvigorate their capital markets. Dubai is seeking to close the gap with Abu Dhabi and Riyadh this year with a clutch of planned privatizations, starting with its main utility.

Lured by the region’s deep pools of capital, Wall Street banks from Citigroup to JPMorgan Chase & Co. and Goldman Sachs Group Inc. are seizing on the opportunity to capture market share, expanding teams on the ground in the hope of winning advisory roles.

Citigroup Inc. is boosting its presence in the Gulf region as it expects activity including initial public offerings to reach a new historic high.

“2021 was a record year, but I actually believe 2022 will be even better,” Miguel Azevedo, Citi’s head of investment banking for the Middle East and North Africa, said in an interview with Bloomberg TV on Monday. “We are adding resources all across the region. We are basically in Saudi Arabia and in Dubai and we are adding on both of those.”

The Middle East saw a boom in IPOs last year, with Abu Dhabi joining the rush as governments in the region seek to diversify their economies away from oil and reinvigorate their capital markets. Dubai is seeking to close the gap with Abu Dhabi and Riyadh this year with a clutch of planned privatizations, starting with its main utility.

Lured by the region’s deep pools of capital, Wall Street banks from Citigroup to JPMorgan Chase & Co. and Goldman Sachs Group Inc. are seizing on the opportunity to capture market share, expanding teams on the ground in the hope of winning advisory roles.

#Kuwait Credit Bank weighs issue of 1 bln dinars of bonds amid liquidity crunch | Reuters

Kuwait Credit Bank weighs issue of 1 bln dinars of bonds amid liquidity crunch | Reuters

Kuwait Credit Bank, a state-owned lender that provides interest-free home loans, is in talks with banks and Oliver Wyman about issuing a possible 1 billion dinars ($3.30 billion) of bonds, its director general said.

No decision has been made and KCB is also considering issuing sukuk or taking bank loans to fund a longstanding lack of liquidity amid ballooning demand for its interest-free 70,000-dinar home loans, Salah al-Mudhaf told Reuters.

He said KCB needs 16 billion dinars to finance home loans through 2035. Kuwait's parliament last week approved a measure to provide KCB with 300 million dinars from the Kuwait Fund for Arab Economic Development to boost its capital and to reschedule 500 million dinars in bonds owed to KFAD.

Kuwait's government guarantees housing for its citizens, who number roughly 1.47 million and make up about a third of the population, providing free land and the KCB financing.

Kuwait Credit Bank, a state-owned lender that provides interest-free home loans, is in talks with banks and Oliver Wyman about issuing a possible 1 billion dinars ($3.30 billion) of bonds, its director general said.

No decision has been made and KCB is also considering issuing sukuk or taking bank loans to fund a longstanding lack of liquidity amid ballooning demand for its interest-free 70,000-dinar home loans, Salah al-Mudhaf told Reuters.

He said KCB needs 16 billion dinars to finance home loans through 2035. Kuwait's parliament last week approved a measure to provide KCB with 300 million dinars from the Kuwait Fund for Arab Economic Development to boost its capital and to reschedule 500 million dinars in bonds owed to KFAD.

Kuwait's government guarantees housing for its citizens, who number roughly 1.47 million and make up about a third of the population, providing free land and the KCB financing.

Oil Prices Punch Higher at the Week’s Open on Demand Outlook: Brent Crude, WTI - Bloomberg

Oil Prices Punch Higher at the Week’s Open on Demand Outlook: Brent Crude, WTI - Bloomberg

| PRICES |

|---|

|

Most Gulf markets fall in early trade; #Saudi rises | Reuters

Most Gulf markets fall in early trade; Saudi rises | Reuters

Most major indexes in the Gulf fell in early trade on Monday, with the Dubai index declining the most after United Arab Emirates intercepted another attack by the Houthis, the third attack since the beginning of this year.

The UAE defence ministry said the latest missile attack was intercepted and its debris fell on an uninhabited area. It did not say whether it was aimed at Abu Dhabi or Dubai. read more

Dubai's main share index (.DFMGI) fell as much as 1.2%, with most of the stocks in negative territory, with the country's top lender Emirates NBD Bank (ENBD.DU) dropping 4% and blue-chip developer Emaar Properties (EMAR.DU) losing 0.4%.

The Abu Dhabi index (.FTFADGI) eased 0.2%, snapping its four consecutive session of winning streak, led by a 0.2% decrease in heavyweight First Abu Dhabi Bank (FAB.AD).

In Qatar, the benchmark index (.QSI) was down 0.1% as it extended the loss from the previous session, pressured by financial stocks, with Commercial Bank (COMB.QA) declining 2.9% and Qatar Islamic Bank decreasing 0.9%.

Saudi Arabia's benchmark index (.TASI), however, bucked the trend, with stocks edging up 0.1%, as Al Rajhi Bank (1120.SE) gained 0.5%, and Alinma Bank (1150.SE) advanced 0.9%.

Most major indexes in the Gulf fell in early trade on Monday, with the Dubai index declining the most after United Arab Emirates intercepted another attack by the Houthis, the third attack since the beginning of this year.

The UAE defence ministry said the latest missile attack was intercepted and its debris fell on an uninhabited area. It did not say whether it was aimed at Abu Dhabi or Dubai. read more

Dubai's main share index (.DFMGI) fell as much as 1.2%, with most of the stocks in negative territory, with the country's top lender Emirates NBD Bank (ENBD.DU) dropping 4% and blue-chip developer Emaar Properties (EMAR.DU) losing 0.4%.

The Abu Dhabi index (.FTFADGI) eased 0.2%, snapping its four consecutive session of winning streak, led by a 0.2% decrease in heavyweight First Abu Dhabi Bank (FAB.AD).

In Qatar, the benchmark index (.QSI) was down 0.1% as it extended the loss from the previous session, pressured by financial stocks, with Commercial Bank (COMB.QA) declining 2.9% and Qatar Islamic Bank decreasing 0.9%.

Saudi Arabia's benchmark index (.TASI), however, bucked the trend, with stocks edging up 0.1%, as Al Rajhi Bank (1120.SE) gained 0.5%, and Alinma Bank (1150.SE) advanced 0.9%.

Sunday, 30 January 2022

More #Saudi IPOs Price at Top of Range as Demand for Deals Surges - Bloomberg

More Saudi IPOs Price at Top of Range as Demand for Deals Surges - Bloomberg

Two companies in Saudi Arabia set final offering pricing for their IPOs at the top end of a range on Sunday, underscoring the booming demand for share sales in the kingdom.

Elm Co., a digital security firm owned by Saudi Arabia’s sovereign wealth fund, is expected to raise $820 million, while Scientific & Medical Equipment House Co. may garner $83 million.

Share sales in Saudi Arabia have seen huge investor demand in the past year, with most IPOs getting priced at the top of offering ranges and then the shares surging on their trading debut. The Saudi benchmark index has jumped about 9% this year, extending its 2021 gains of 30%.

The pipeline for IPOs in the kingdom is “deeper than ever,” the stock exchange’s Chief Executive Officer Khalid al Hussan said in an interview in December. He said “it will be even better” in 2022, adding that technology, health care and education companies are among the newcomers to the market.

Saudi Arabia’s economy, the biggest in the Middle East, has been boosted by the surge in oil prices to over $85 a barrel and the government easing coronavirus lockdowns. Some of the biggest IPOs last year included offerings by ACWA Power, Solutions by STC and Saudi Tadawul Group.

And for Goldman Sachs Group Inc. the kingdom will remain the busiest of the Middle East’s stock markets, even as the United Arab Emirates pushes more companies to go public.

Sunday IPO pricing:

Two companies in Saudi Arabia set final offering pricing for their IPOs at the top end of a range on Sunday, underscoring the booming demand for share sales in the kingdom.

Elm Co., a digital security firm owned by Saudi Arabia’s sovereign wealth fund, is expected to raise $820 million, while Scientific & Medical Equipment House Co. may garner $83 million.

Share sales in Saudi Arabia have seen huge investor demand in the past year, with most IPOs getting priced at the top of offering ranges and then the shares surging on their trading debut. The Saudi benchmark index has jumped about 9% this year, extending its 2021 gains of 30%.

The pipeline for IPOs in the kingdom is “deeper than ever,” the stock exchange’s Chief Executive Officer Khalid al Hussan said in an interview in December. He said “it will be even better” in 2022, adding that technology, health care and education companies are among the newcomers to the market.

Saudi Arabia’s economy, the biggest in the Middle East, has been boosted by the surge in oil prices to over $85 a barrel and the government easing coronavirus lockdowns. Some of the biggest IPOs last year included offerings by ACWA Power, Solutions by STC and Saudi Tadawul Group.

And for Goldman Sachs Group Inc. the kingdom will remain the busiest of the Middle East’s stock markets, even as the United Arab Emirates pushes more companies to go public.

Sunday IPO pricing:

- Elm will sell shares at 128 riyals apiece after institutional book-building

- It marketed shares at: 113 riyals to 128 riyals

- Scientific & Medical Equipment will sell shares at 52 riyals apiece after institutional book-building

- It marketed shares at: 45 riyals to 52 riyals

#Saudi shares hover near multi-year highs; #Qatar falls | Reuters

Saudi shares hover near multi-year highs; Qatar falls | Reuters

Stock markets in the Gulf ended mixed on Sunday, with the Saudi index hovering near a 15-year high amid rising oil prices as geopolitical turmoil exacerbated concerns over tight energy supply.

Saudi Arabia's benchmark index (.TASI) gained 0.7%, with petrochemical maker Saudi Basic Industries Corp (2010.SE) rising 1.5% and oil giant Saudi Aramco (2222.SE) closing 0.7% higher.

The kingdom's energy index (.TENI) was up 0.6%.

Separately, Saudi Arabian digital security firm Elm, owned by the kingdom's sovereign wealth fund, is set to raise 3.07 billion riyals ($818.27 million) after pricing its initial public offering at the top of its indicative price range. read more

The country's bourse operator Tadawul said in December it had 50 applications from companies for IPOs this year and is considering whether to allow blank-cheque companies, known as SPACs, to list. read more

In Qatar, the index (.QSI) fell 0.1%, hit by a 1.8% fall in sharia-compliant lender Masraf Al Rayan (MARK.QA) following a decline in its annual profit.

Outside the Gulf, Egypt's blue-chip index (.EGX30) lost 0.4%, extending losses for a fourth session, pressured by a 3.2% fall in Talaat Mostafa Holding (TMGH.CA).

Stock markets in the Gulf ended mixed on Sunday, with the Saudi index hovering near a 15-year high amid rising oil prices as geopolitical turmoil exacerbated concerns over tight energy supply.

Saudi Arabia's benchmark index (.TASI) gained 0.7%, with petrochemical maker Saudi Basic Industries Corp (2010.SE) rising 1.5% and oil giant Saudi Aramco (2222.SE) closing 0.7% higher.

The kingdom's energy index (.TENI) was up 0.6%.

Separately, Saudi Arabian digital security firm Elm, owned by the kingdom's sovereign wealth fund, is set to raise 3.07 billion riyals ($818.27 million) after pricing its initial public offering at the top of its indicative price range. read more

The country's bourse operator Tadawul said in December it had 50 applications from companies for IPOs this year and is considering whether to allow blank-cheque companies, known as SPACs, to list. read more

In Qatar, the index (.QSI) fell 0.1%, hit by a 1.8% fall in sharia-compliant lender Masraf Al Rayan (MARK.QA) following a decline in its annual profit.

Outside the Gulf, Egypt's blue-chip index (.EGX30) lost 0.4%, extending losses for a fourth session, pressured by a 3.2% fall in Talaat Mostafa Holding (TMGH.CA).

OPEC+ Is Being Way Too Optimistic About Its Supply Targets - Bloomberg

OPEC+ Is Being Way Too Optimistic About Its Supply Targets - Bloomberg

As a new month comes into sight, so too does another meeting of the OPEC+ group of oil producers, who are seeking to balance the oil market by gradually adding back the supply they removed almost two years ago in response to the first wave of Covid-19.

With one or two notable exceptions — the November gathering that saw the group refuse customers’ requests for a bigger-than-planned output increase being the most obvious — the virtual get-togethers have become almost routine, with the biggest surprises they have generated being their brevity.

Don’t get me wrong, I’m all in favor of a few unexciting meetings.

The group is expected to agree to add another 400,000 barrels a day to supply in March — they already have a similar increase agreed for February — but are likely to fall even further behind their target when it comes to actual production. They’ve been struggling to keep pace with their plans to increase supply since first adopting them. Actual increases have lagged behind the target in three of the five months so far.

With one or two notable exceptions — the November gathering that saw the group refuse customers’ requests for a bigger-than-planned output increase being the most obvious — the virtual get-togethers have become almost routine, with the biggest surprises they have generated being their brevity.

Don’t get me wrong, I’m all in favor of a few unexciting meetings.

The group is expected to agree to add another 400,000 barrels a day to supply in March — they already have a similar increase agreed for February — but are likely to fall even further behind their target when it comes to actual production. They’ve been struggling to keep pace with their plans to increase supply since first adopting them. Actual increases have lagged behind the target in three of the five months so far.

#Saudi Wealth Fund Rakes In $5 Billion as Demand For Stocks Booms - Bloomberg

Saudi Wealth Fund Rakes In $5 Billion as Demand For Stocks Booms - Bloomberg

Saudi Arabia’s plan to sell off stakes in local companies held by its sovereign wealth fund is already paying dividends -- it’s set to rake in about $5 billion over three months.

The Public Investment Fund is set to raise $820 million from selling a stake in digital security firm Elm Co. next month after pricing the share sale at the top of the pricing range. That’s in addition to the $3.2 billion it raised from selling shares in Saudi Telecom Co., the largest secondary offering in the Europe, Middle East and Africa region last year. It also raised $1 billion from selling a stake in the Saudi stock exchange in December.

Share sales in Saudi Arabia have seen huge investor demand, with most IPOs getting priced at the top of offering ranges and surging on their trading debut. The Saudi benchmark index has jumped about 9% this year, extending its 2021 gains of 30%.

Proceeds from the share sales will be a welcome boost for the PIF, which is planning to invest about $40 billion into the Saudi economy this year as it looks to drive Crown Prince Mohammed Bin Salman’s plan to diversify the country’s economy away from oil by investing in areas like entertainment and tourism that barely existed in the kingdom before 2016.

The sales also mark a shift in strategy. For decades a sleepy holding company for government stakes in local firms, its looking to recycle its capital, selling off shares in companies it has held for years to invest in new firms. It still holds almost $140 billion of Saudi equities, including large stakes in Saudi National Bank, Saudi Arabian Mining Co., and Saudi Electricity Co.

At the same time, the PIF is planning to plow deeper into global equity markets this year by investing about $10 billion more into listed stocks.

Saudi Arabia’s plan to sell off stakes in local companies held by its sovereign wealth fund is already paying dividends -- it’s set to rake in about $5 billion over three months.

The Public Investment Fund is set to raise $820 million from selling a stake in digital security firm Elm Co. next month after pricing the share sale at the top of the pricing range. That’s in addition to the $3.2 billion it raised from selling shares in Saudi Telecom Co., the largest secondary offering in the Europe, Middle East and Africa region last year. It also raised $1 billion from selling a stake in the Saudi stock exchange in December.

Share sales in Saudi Arabia have seen huge investor demand, with most IPOs getting priced at the top of offering ranges and surging on their trading debut. The Saudi benchmark index has jumped about 9% this year, extending its 2021 gains of 30%.

Proceeds from the share sales will be a welcome boost for the PIF, which is planning to invest about $40 billion into the Saudi economy this year as it looks to drive Crown Prince Mohammed Bin Salman’s plan to diversify the country’s economy away from oil by investing in areas like entertainment and tourism that barely existed in the kingdom before 2016.

The sales also mark a shift in strategy. For decades a sleepy holding company for government stakes in local firms, its looking to recycle its capital, selling off shares in companies it has held for years to invest in new firms. It still holds almost $140 billion of Saudi equities, including large stakes in Saudi National Bank, Saudi Arabian Mining Co., and Saudi Electricity Co.

At the same time, the PIF is planning to plow deeper into global equity markets this year by investing about $10 billion more into listed stocks.

Healthy 2021 bank results reinforce #UAE’s economic recovery | Banking – Gulf News

Healthy 2021 bank results reinforce UAE’s economic recovery | Banking – Gulf News

Financial results of top UAE banks for full year 2021 points to sustained economic recovery supported by key financial sector indicators such as improved credit quality, higher margins, greater profitability and high levels of liquidity that will support future credit growth.

Key financials of banks such as First Abu Dhabi Bank (FAB), Emirates NBD (ENBD) and Dubai Islamic Bank (DIB) showed these institutions maintained strong profitability, high credit quality and improving margins amid challenging economic conditions posed by the pandemic and low interest rate environment.

FAB, UAE’s largest bank reported a full year 2021 Group net profit of Dh12.5 Billion, up 19 per cent on year-on-year and posted an overall credit growth of 6 per cent year on year indicating improved credit offtake.

Financial results of top UAE banks for full year 2021 points to sustained economic recovery supported by key financial sector indicators such as improved credit quality, higher margins, greater profitability and high levels of liquidity that will support future credit growth.

Key financials of banks such as First Abu Dhabi Bank (FAB), Emirates NBD (ENBD) and Dubai Islamic Bank (DIB) showed these institutions maintained strong profitability, high credit quality and improving margins amid challenging economic conditions posed by the pandemic and low interest rate environment.

FAB, UAE’s largest bank reported a full year 2021 Group net profit of Dh12.5 Billion, up 19 per cent on year-on-year and posted an overall credit growth of 6 per cent year on year indicating improved credit offtake.

#Kuwait’s Jazeera Air Approves $3.4 Billion Airbus Aircraft Order - Bloomberg

Kuwait’s Jazeera Air Approves $3.4 Billion Airbus Aircraft Order - Bloomberg

Jazeera Airways’s board approved a deal to purchase of 28 narrow-body planes from Airbus SE as the Kuwaiti carrier’s expands its network to include long-haul routes.

The value of the agreement is $3.4 billion and comprises 20 A320neos and eight A321neos, according to a statement. The companies had signed the pact at the Dubai Airshow in November.

Jazeera, whose board also approved an agreement to buy two CFM spare engines in a $32.2 million deal, said deliveries of the Airbus aircraft will be determined at a later stage. The carrier already operates an all-Airbus fleet of original-generation A320s and eight A320neos.

The airline, which laid off about 500 employees in 2020, is in recovery mode after the coronavirus pandemic grounded flights, rehiring staff who want to rejoin. Jazeera’s third-quarter earnings wiped out first-half losses, while cash reserves are at an all-time high.

The shares have jumped 15% this year, extending its 2021 gains of 80%.

Jazeera Airways’s board approved a deal to purchase of 28 narrow-body planes from Airbus SE as the Kuwaiti carrier’s expands its network to include long-haul routes.

The value of the agreement is $3.4 billion and comprises 20 A320neos and eight A321neos, according to a statement. The companies had signed the pact at the Dubai Airshow in November.

Jazeera, whose board also approved an agreement to buy two CFM spare engines in a $32.2 million deal, said deliveries of the Airbus aircraft will be determined at a later stage. The carrier already operates an all-Airbus fleet of original-generation A320s and eight A320neos.

The airline, which laid off about 500 employees in 2020, is in recovery mode after the coronavirus pandemic grounded flights, rehiring staff who want to rejoin. Jazeera’s third-quarter earnings wiped out first-half losses, while cash reserves are at an all-time high.

The shares have jumped 15% this year, extending its 2021 gains of 80%.

#Saudi digital security firm Elm set to raise $818 mln in IPO | Reuters

Saudi digital security firm Elm set to raise $818 mln in IPO | Reuters

Saudi Arabian digital security firm Elm is set to raise 3.07 billion riyals ($818 million) after pricing its initial public offering at the top of its indicative price range.

Elm, owned by the kingdom's sovereign wealth fund, said on Sunday it priced the deal at 128 riyals a share, against an indicative price of 113 to 128 riyals per share. It is selling 24 million shares in the deal.

Fully owned by the Public Investment Fund, the company provides secure e-business services and information technology, as well as project support services and government project outsourcing in Saudi Arabia, according to its website.

Saudi Arabia has had a surge in IPOs since it listed oil giant Saudi Aramco (2222.SE) in a record $29.4 billion listing in 2019.

The country's bourse operator Tadawul, which also listed last year, said in December it had 50 applications from companies for IPOs this year and is considering whether to allow blank-cheque companies, known as SPACs, to list.

Saudi Arabian digital security firm Elm is set to raise 3.07 billion riyals ($818 million) after pricing its initial public offering at the top of its indicative price range.

Elm, owned by the kingdom's sovereign wealth fund, said on Sunday it priced the deal at 128 riyals a share, against an indicative price of 113 to 128 riyals per share. It is selling 24 million shares in the deal.

Fully owned by the Public Investment Fund, the company provides secure e-business services and information technology, as well as project support services and government project outsourcing in Saudi Arabia, according to its website.

Saudi Arabia has had a surge in IPOs since it listed oil giant Saudi Aramco (2222.SE) in a record $29.4 billion listing in 2019.

The country's bourse operator Tadawul, which also listed last year, said in December it had 50 applications from companies for IPOs this year and is considering whether to allow blank-cheque companies, known as SPACs, to list.

Saturday, 29 January 2022

Billionaire Gilinski Bids for Colombia Companies Set to Open - Bloomberg

Billionaire Gilinski Bids for Colombia Companies Set to Open - Bloomberg

Billionaire banker Jaime Gilinski’s bids to increase his holdings in two Colombian companies are expected to open in the coming week after gaining regulatory approval, according to a person with direct knowledge of the process.

Gilinski is offering to buy as much as $1.1 billion of shares in foodmaker Grupo Nutresa SA and buy up to $289 million in financial conglomerate Grupo de Inversiones Suramericana. These follow a $1.9 billion investment that closed earlier this month, making him the second-largest shareholder of both companies.

The latest public acquisition offers will be published on Monday and the stocks, which have been frozen while regulators evaluated the proposals, will start trading on Tuesday, according to the person, who asked not to be named as the details have not been made public. The offers will close on Feb. 28 as shareholders decide on his bids, the person said.

Gilinski, one of the country’s richest men with an estimate net worth of $4.4 billion, shook Colombia’s capital markets with his first offer for Nutresa back in November. He followed it with an offer for Sura weeks later.

In the latest bids, he’s offering $9.88 a share for as much as 6.25% of Sura. On Nutresa, he’s teaming up with the Abu Dhabi royal family for a $10.48 a share offer for between 18.3% to 22.88% of the company.

If successful, Gilinski would be a step closer to taking control of Colombia’s most influential business alliance, known as Grupo Empresarial Antioqueno or GEA. In addition to Sura and Nutresa, the GEA also includes the conglomerate Grupo Argos SA, cement and energy producers and the country’s largest bank.

Billionaire banker Jaime Gilinski’s bids to increase his holdings in two Colombian companies are expected to open in the coming week after gaining regulatory approval, according to a person with direct knowledge of the process.

Gilinski is offering to buy as much as $1.1 billion of shares in foodmaker Grupo Nutresa SA and buy up to $289 million in financial conglomerate Grupo de Inversiones Suramericana. These follow a $1.9 billion investment that closed earlier this month, making him the second-largest shareholder of both companies.

The latest public acquisition offers will be published on Monday and the stocks, which have been frozen while regulators evaluated the proposals, will start trading on Tuesday, according to the person, who asked not to be named as the details have not been made public. The offers will close on Feb. 28 as shareholders decide on his bids, the person said.

Gilinski, one of the country’s richest men with an estimate net worth of $4.4 billion, shook Colombia’s capital markets with his first offer for Nutresa back in November. He followed it with an offer for Sura weeks later.

In the latest bids, he’s offering $9.88 a share for as much as 6.25% of Sura. On Nutresa, he’s teaming up with the Abu Dhabi royal family for a $10.48 a share offer for between 18.3% to 22.88% of the company.

If successful, Gilinski would be a step closer to taking control of Colombia’s most influential business alliance, known as Grupo Empresarial Antioqueno or GEA. In addition to Sura and Nutresa, the GEA also includes the conglomerate Grupo Argos SA, cement and energy producers and the country’s largest bank.

Boeing (BA) Set to Launch Its First New Jet in Nearly Five Years With #Qatar Deal - Bloomberg

Boeing (BA) Set to Launch Its First New Jet in Nearly Five Years With Qatar Deal - Bloomberg

Boeing Co. is preparing to launch the 777X freighter, its first new jet model in nearly five years, with a 50-plane commitment from Qatar Airways, people familiar with the matter said.

The announcement is set to coincide with a meeting between Qatar’s ruling emir, Sheikh Tamim bin Hamad Al Thani, and U.S. President Joe Biden in Washington, D.C., on Jan. 31, said the people, who asked not to be identified discussing the plans. The potential multibillion-dollar deal would help showcase trade relations between the two nations and could be unveiled at the White House, though the location is still being finalized, the people said.

The Gulf carrier is expected to place a firm order for about 15 of the aircraft, the freighter version of Boeing’s largest twin-engine jet. A combination of options and conversions of existing orders would make up the rest of its commitment, the people said. A Qatar representative declined to comment on its plans. Reuters previously reported Boeing-Qatar talks around the state visit.

The deal comes as Qatar Airways Chief Executive Officer Akbar Al Baker spars with Airbus SE over potential flaws with a passenger version of its A350 airliners. The European planemaker last year unveiled a freighter version of the A350-1000 to challenge Boeing’s decades of dominance of the cargo-jet market.

Wrangling with regulators has delayed the commercial debut of the first passenger 777X by at least three years to late 2023. It’s unusual for a planemaker to sell a freighter variant before the passenger version has hit the market. Boeing’s move reflects the strong market for cargo jets as e-commerce booms, as well as the struggle it faces selling 400-seat planes in a depressed travel market.

Boeing Co. is preparing to launch the 777X freighter, its first new jet model in nearly five years, with a 50-plane commitment from Qatar Airways, people familiar with the matter said.

The announcement is set to coincide with a meeting between Qatar’s ruling emir, Sheikh Tamim bin Hamad Al Thani, and U.S. President Joe Biden in Washington, D.C., on Jan. 31, said the people, who asked not to be identified discussing the plans. The potential multibillion-dollar deal would help showcase trade relations between the two nations and could be unveiled at the White House, though the location is still being finalized, the people said.

The Gulf carrier is expected to place a firm order for about 15 of the aircraft, the freighter version of Boeing’s largest twin-engine jet. A combination of options and conversions of existing orders would make up the rest of its commitment, the people said. A Qatar representative declined to comment on its plans. Reuters previously reported Boeing-Qatar talks around the state visit.

The deal comes as Qatar Airways Chief Executive Officer Akbar Al Baker spars with Airbus SE over potential flaws with a passenger version of its A350 airliners. The European planemaker last year unveiled a freighter version of the A350-1000 to challenge Boeing’s decades of dominance of the cargo-jet market.

Wrangling with regulators has delayed the commercial debut of the first passenger 777X by at least three years to late 2023. It’s unusual for a planemaker to sell a freighter variant before the passenger version has hit the market. Boeing’s move reflects the strong market for cargo jets as e-commerce booms, as well as the struggle it faces selling 400-seat planes in a depressed travel market.

Friday, 28 January 2022

Oil hits 7-year peak on political risks, supply crunch | Reuters

Oil hits 7-year peak on political risks, supply crunch | Reuters

Oil prices rose to a more than seven-year peak on Friday and recorded their sixth straight weekly gain as geopolitical turmoil exacerbated concerns over tight energy supply.

On a weekly basis, the benchmark contracts notched their longest run of gains since October.

Brent futures rose 69 cents to settle at $90.03 a barrel, after hitting $91.70, the highest level since October 2014.

U.S. crude closed 21 cents higher at $86.82 per barrel, after hitting a seven-year peak of $88.84 during the session.

Tight oil supplies pushed the six-month market structure for Brent into steep backwardation of $6.92 a barrel, the widest since 2013. Backwardation exists when contracts for near-term delivery of oil are priced higher than those for later months, encouraging traders to release oil from storage to sell it promptly.

Oil prices rose to a more than seven-year peak on Friday and recorded their sixth straight weekly gain as geopolitical turmoil exacerbated concerns over tight energy supply.

On a weekly basis, the benchmark contracts notched their longest run of gains since October.

Brent futures rose 69 cents to settle at $90.03 a barrel, after hitting $91.70, the highest level since October 2014.

U.S. crude closed 21 cents higher at $86.82 per barrel, after hitting a seven-year peak of $88.84 during the session.

Tight oil supplies pushed the six-month market structure for Brent into steep backwardation of $6.92 a barrel, the widest since 2013. Backwardation exists when contracts for near-term delivery of oil are priced higher than those for later months, encouraging traders to release oil from storage to sell it promptly.

Oil hits fresh 7-year highs on supply concerns | Reuters

Oil hits fresh 7-year highs on supply concerns | Reuters

Oil prices reached seven-year highs on Friday as geopolitical tensions continue to raise supply concerns.

Brent crude futures were up $1.91, or 2.1%, at $91.25 a barrel by 1436 GMT, having hit $91.41 on Friday for their highest since October 2014.

U.S. West Texas Intermediate (WTI) crude futures rose $1.83, or 2.11%, to $88.44 a barrel. WTI also reached a fresh seven-year high of $88.76 earlier in Friday's session.

Both Brent and WTI are on track for their six-weekly gain in what would be the longest run of weekly gains since October.

Oil prices reached seven-year highs on Friday as geopolitical tensions continue to raise supply concerns.

Brent crude futures were up $1.91, or 2.1%, at $91.25 a barrel by 1436 GMT, having hit $91.41 on Friday for their highest since October 2014.

U.S. West Texas Intermediate (WTI) crude futures rose $1.83, or 2.11%, to $88.44 a barrel. WTI also reached a fresh seven-year high of $88.76 earlier in Friday's session.

Both Brent and WTI are on track for their six-weekly gain in what would be the longest run of weekly gains since October.

Property, Telecom shares lead #UAE higher, both indexes post weekly gain | Reuters

Property, Telecom shares lead UAE higher, both indexes post weekly gain | Reuters

Stock markets in the United Arab Emirates extended gains from previous sessions on Friday, with Dubai's index bolstered by rise in property stocks and telecom gains boosted Abu Dhabi.

"UAE's stock markets were inching up. Dubai was recovering from this month's corrections as investors return while Abu Dhabi is supported by the resilient oil prices and receding risks," said Wael Makarem, Senior Market Strategist – MENA at Exness.

Dubai's main share index (.DFMGI) rose 1%, bolstered by its property stocks, as blue-chip developer Emaar Properties (EMAR.DU) jumped 2.1% and Telecoms Operator Emirates Integrated Telecommunications (DU.DU) advanced 1.2%.

Emaar Properties listed unit Emaar Development (EMAARDEV.DU) was also up 2.4%.

Dubai index also posted a weekly gain of 0.3%.

In Abu Dhabi, the index (.FTFADGI) added 0.4%, extending gains for a fourth consecutive session, buoyed by a 1.3% hike in Emirates Telecommunications Group (Etisalat) (ETISALAT.AD).

Post Market close, Etisalat Group said it acquired 100% shareholding of online groceries marketplace elGrocer in an acquisition value not exceeding 38 million dirhams ($10.35 million).

Abu Dhabi index closed 0.7% higher on a weekly basis.

The UAE moved to a Saturday-Sunday weekend from the start of 2022, to better align with the global market.

Stock markets in the United Arab Emirates extended gains from previous sessions on Friday, with Dubai's index bolstered by rise in property stocks and telecom gains boosted Abu Dhabi.

"UAE's stock markets were inching up. Dubai was recovering from this month's corrections as investors return while Abu Dhabi is supported by the resilient oil prices and receding risks," said Wael Makarem, Senior Market Strategist – MENA at Exness.

Dubai's main share index (.DFMGI) rose 1%, bolstered by its property stocks, as blue-chip developer Emaar Properties (EMAR.DU) jumped 2.1% and Telecoms Operator Emirates Integrated Telecommunications (DU.DU) advanced 1.2%.

Emaar Properties listed unit Emaar Development (EMAARDEV.DU) was also up 2.4%.

Dubai index also posted a weekly gain of 0.3%.

In Abu Dhabi, the index (.FTFADGI) added 0.4%, extending gains for a fourth consecutive session, buoyed by a 1.3% hike in Emirates Telecommunications Group (Etisalat) (ETISALAT.AD).

Post Market close, Etisalat Group said it acquired 100% shareholding of online groceries marketplace elGrocer in an acquisition value not exceeding 38 million dirhams ($10.35 million).

Abu Dhabi index closed 0.7% higher on a weekly basis.

The UAE moved to a Saturday-Sunday weekend from the start of 2022, to better align with the global market.

#Russia May Use Oil Weapon Responding to #Ukraine Sanctions - Bloomberg @OSullivanMeghan

Russia May Use Oil Weapon Responding to Ukraine Sanctions - Bloomberg

Russian military action in Ukraine could trigger an energy crisis even more serious than the one already hitting Europe. As has been pointed out, should the West hit Russia with severe new sanctions, President Vladimir Putin could cut off natural gas exports, leaving the continent shivering through midwinter. Yet there is another potential weapon of Russia’s that’s been less discussed and might be very effective: An ability to disrupt global oil markets, which would directly hit U.S. consumers.

There’s no doubt that Russia’s influence over natural gas exports to Europe gives Putin reason to believe he might avoid harsh punishment should he invade Ukraine or undertake major efforts to destabilize the Kyiv government. Despite talk from U.S. President Joe Biden’s administration about finding the Europeans supplies from elsewhere, there simply is not enough uncommitted natural gas in the global system that could be redirected to Europe at a reasonable price. Piped natural gas can only flow where existing infrastructure takes it.

There are also constraints on liquified natural gas, which can be more easily redirected with container ships: As of 2020, 60% of this LNG trade was governed by medium- and long -term contracts. Even if Europe was successful in bringing existing spot-market LNG trade its way, it would mean paying extremely high prices in a bidding war with Asian and other customers.

That said, cutting the gas supply has some notable downsides for Putin. First, it would forever damage Russia’s relationship with the Europeans. They would no longer be able to argue, as they have to U.S. officials wringing their hands about their dependence on Russian gas, that Gazprom PSJC, the state-owned behemoth, “has been a reliable supplier for decades.” Even after this particular crisis, there would be no returning to the status quo. As European Union climate chief Frans Timmermans told EU energy and environment ministers last week, “If we really want to stop long-term making Putin very rich, we have to invest in renewables and we need to do it quickly.”

Russian military action in Ukraine could trigger an energy crisis even more serious than the one already hitting Europe. As has been pointed out, should the West hit Russia with severe new sanctions, President Vladimir Putin could cut off natural gas exports, leaving the continent shivering through midwinter. Yet there is another potential weapon of Russia’s that’s been less discussed and might be very effective: An ability to disrupt global oil markets, which would directly hit U.S. consumers.

There’s no doubt that Russia’s influence over natural gas exports to Europe gives Putin reason to believe he might avoid harsh punishment should he invade Ukraine or undertake major efforts to destabilize the Kyiv government. Despite talk from U.S. President Joe Biden’s administration about finding the Europeans supplies from elsewhere, there simply is not enough uncommitted natural gas in the global system that could be redirected to Europe at a reasonable price. Piped natural gas can only flow where existing infrastructure takes it.

There are also constraints on liquified natural gas, which can be more easily redirected with container ships: As of 2020, 60% of this LNG trade was governed by medium- and long -term contracts. Even if Europe was successful in bringing existing spot-market LNG trade its way, it would mean paying extremely high prices in a bidding war with Asian and other customers.

That said, cutting the gas supply has some notable downsides for Putin. First, it would forever damage Russia’s relationship with the Europeans. They would no longer be able to argue, as they have to U.S. officials wringing their hands about their dependence on Russian gas, that Gazprom PSJC, the state-owned behemoth, “has been a reliable supplier for decades.” Even after this particular crisis, there would be no returning to the status quo. As European Union climate chief Frans Timmermans told EU energy and environment ministers last week, “If we really want to stop long-term making Putin very rich, we have to invest in renewables and we need to do it quickly.”

Baly: Three-Month-Old Startup Scores Largest Funding in #Iraq’s History - Bloomberg

Baly: Three-Month-Old Startup Scores Largest Funding in Iraq’s History - Bloomberg

A three-month old startup co-founded by a McKinsey & Co. alumnus said it completed what could be the largest funding round ever in Iraq’s nascent technology sector.

Baly, which describes itself as Iraq’s first super-app and is backed by German tech incubator Rocket Internet SE, offers ride-hailing in Baghdad and is in the process of adding new services like food and grocery delivery. It raised $10.5 million in seed funding from Kingsway Capital, MSA Capital, Global Founders Capital, Vostok Ventures, Majid Al Futtaim and March Holding.

The funds will be used to expand the app across the country and bankroll the introduction of other offerings including food delivery, according to a statement.

Home to 40 million people and boasting smartphone penetration of over 90% among those aged 17-40, Iraq is ripe for a digital shake-up, said Baly’s managing director, Matteo Mantovani.

After previously working for nearly three years at McKinsey in the United Arab Emirates, Mantovani co-founded the company with Munqith Alazzawi, whose previous stints included time as a consultant at Rocket Internet, according to their LinkedIn accounts.

“With a young, urbanized population, it is the perfect place to revolutionize the economy through digital services,” Mantovani said.

In the Middle East, the bulk of startup activity centers on the UAE, Egypt and Saudi Arabia. Iraq rarely sees any venture capital deals but there are some signs of a small sector developing.

E-commerce firm Miswag has raised nearly $3 million since 2019 and a number of investors began a new company called Iraq Ventures Partners last year.

A three-month old startup co-founded by a McKinsey & Co. alumnus said it completed what could be the largest funding round ever in Iraq’s nascent technology sector.

Baly, which describes itself as Iraq’s first super-app and is backed by German tech incubator Rocket Internet SE, offers ride-hailing in Baghdad and is in the process of adding new services like food and grocery delivery. It raised $10.5 million in seed funding from Kingsway Capital, MSA Capital, Global Founders Capital, Vostok Ventures, Majid Al Futtaim and March Holding.

The funds will be used to expand the app across the country and bankroll the introduction of other offerings including food delivery, according to a statement.

Home to 40 million people and boasting smartphone penetration of over 90% among those aged 17-40, Iraq is ripe for a digital shake-up, said Baly’s managing director, Matteo Mantovani.

After previously working for nearly three years at McKinsey in the United Arab Emirates, Mantovani co-founded the company with Munqith Alazzawi, whose previous stints included time as a consultant at Rocket Internet, according to their LinkedIn accounts.

“With a young, urbanized population, it is the perfect place to revolutionize the economy through digital services,” Mantovani said.

In the Middle East, the bulk of startup activity centers on the UAE, Egypt and Saudi Arabia. Iraq rarely sees any venture capital deals but there are some signs of a small sector developing.

E-commerce firm Miswag has raised nearly $3 million since 2019 and a number of investors began a new company called Iraq Ventures Partners last year.

Oil heads for sixth weekly gain amid supply concerns | Reuters

Oil heads for sixth weekly gain amid supply concerns | Reuters

Oil prices rose on Friday, set for their sixth weekly gain, amid concerns of tight supplies as major producers continue their policy of limited output increases amid rising fuel demand.

Brent crude futures climbed 57 cents, or 0.6%, to $89.91 a barrel at 0734 GMT, after falling 62 cents during the previous day. However, prices did reach $91.04 earlier in that session, the highest since October 2014.

U.S. West Texas Intermediate (WTI) crude futures rose 54 cents, or 0.6%, to $87.15 a barrel, having declined 74 cents on Thursday. WTI also reached a seven-year high of $88.54 earlier in the session.

Both Brent and WTI are set to rise for a sixth week, the longest weekly streak since October, when Brent prices climbed for seven weeks while WTI gained for nine.

Oil prices rose on Friday, set for their sixth weekly gain, amid concerns of tight supplies as major producers continue their policy of limited output increases amid rising fuel demand.

Brent crude futures climbed 57 cents, or 0.6%, to $89.91 a barrel at 0734 GMT, after falling 62 cents during the previous day. However, prices did reach $91.04 earlier in that session, the highest since October 2014.

U.S. West Texas Intermediate (WTI) crude futures rose 54 cents, or 0.6%, to $87.15 a barrel, having declined 74 cents on Thursday. WTI also reached a seven-year high of $88.54 earlier in the session.

Both Brent and WTI are set to rise for a sixth week, the longest weekly streak since October, when Brent prices climbed for seven weeks while WTI gained for nine.

Thursday, 27 January 2022

Oil falls from seven-year high as Russia tensions offset Fed tightening | Reuters

Oil falls from seven-year high as Russia tensions offset Fed tightening | Reuters

Oil prices fell on Thursday after Brent crude hit a seven-year high above $90 a barrel, as the market balanced concerns about tight worldwide supply with expectations the U.S. Federal Reserve will soon tighten monetary policy.

Global benchmark Brent fell 62 cents to settle at $89.34 a barrel, while U.S. crude closed 74 cents lower at $86.61 a barrel in a volatile session with both contracts see-sawing between positive and negative territory.

Prices had surged on Wednesday, with Brent climbing above $90 a barrel for the first time in seven years amid tensions between Russia and the West. Threats to the United Arab Emirates from Yemen's Houthi movement had added to oil market jitters.

Russia, the world's second-largest oil producer, and the West have been at loggerheads over Ukraine, fanning fears that energy supplies to Europe could be disrupted, although concerns are focused on gas supplies rather than crude.

Oil prices fell on Thursday after Brent crude hit a seven-year high above $90 a barrel, as the market balanced concerns about tight worldwide supply with expectations the U.S. Federal Reserve will soon tighten monetary policy.

Global benchmark Brent fell 62 cents to settle at $89.34 a barrel, while U.S. crude closed 74 cents lower at $86.61 a barrel in a volatile session with both contracts see-sawing between positive and negative territory.

Prices had surged on Wednesday, with Brent climbing above $90 a barrel for the first time in seven years amid tensions between Russia and the West. Threats to the United Arab Emirates from Yemen's Houthi movement had added to oil market jitters.

Russia, the world's second-largest oil producer, and the West have been at loggerheads over Ukraine, fanning fears that energy supplies to Europe could be disrupted, although concerns are focused on gas supplies rather than crude.

Aramco CEO says energy transition "not going smoothly" | Reuters

Aramco CEO says energy transition "not going smoothly" | Reuters

Saudi Aramco Chief Executive Amin Nasser said on Thursday that investment in oil and gas was needed to run alongside new energy investments until the latter can realistically support rising consumption.

"We all agree that to move towards a sustainable energy future a smooth energy transition is absolutely essential but we must also consider the complexities and challenges to get there," he told the B20 conference in Indonesia via video link.

"We have to acknowledge that the current transition is not going smoothly," he said.

Nasser has said Aramco aims to achieve net zero emissions from its operations by 2050 while also building hydrocarbon capacity and expanding its maximum sustained production capacity to 13 million barrels per day.

Saudi Aramco Chief Executive Amin Nasser said on Thursday that investment in oil and gas was needed to run alongside new energy investments until the latter can realistically support rising consumption.

"We all agree that to move towards a sustainable energy future a smooth energy transition is absolutely essential but we must also consider the complexities and challenges to get there," he told the B20 conference in Indonesia via video link.

"We have to acknowledge that the current transition is not going smoothly," he said.

Nasser has said Aramco aims to achieve net zero emissions from its operations by 2050 while also building hydrocarbon capacity and expanding its maximum sustained production capacity to 13 million barrels per day.

Most Gulf bourses rebound on rising oil prices | Reuters

Most Gulf bourses rebound on rising oil prices | Reuters

Most major stock markets in the Gulf rebounded on Thursday, as oil prices touched seven-year highs on fears of disruption to energy supplies due to escalating tensions between Russia and Ukraine.

Brent crude furtures were up 89 cents, or 1%, at $90.85 a barrel by 1217 GMT, while U.S. West Texas Intermediate (WTI) crude futures were up 87 cents, or 1%, at $88.22.

Crude prices are a key catalyst for the Gulf's financial markets.

Dubai's main share index (.DFMGI) gained 0.5%, helped by a 1.5% jump in Emirates NBD Bank (ENBD.DU), after the top regional lender reported a 34% rise in annual profit on Wednesday. read more

Shares in Dubai, however, might experience more corrections like they did earlier this month in the absence of a clear catalyst and global risk appetite souring on a hawkish U.S. Federal Reserve, said Farah Mourad, a senior market analyst at XTB MENA.

Abu Dhabi's index (.FTFADGI) edged up 0.2%, after falling as much as 1.6% during the session. Heavyweight First Abu Dhabi Bank (FAB.AD) pulled back from a 4% fall to close flat.

The bank proposed a lower dividend this year, but its full-year net profit rose about 19% to 12.53 billion dirhams ($3.41 billion).

"Its proposed dividend of 0.70 dirhams per share was lower than the 0.74 dirhams paid out in 2020," an analyst said.

The Qatar index (.QSI) ended 0.2% higher. Qatar Islamic Bank (QISB.QA) added 1%, while Industries Qatar (IQCD.QA) rose 0.7%.

Saudi Arabia's benchmark index (.TASI) ended flat in a volatile session. Al Rajhi Bank (1120.SE) fell 0.7%, while Saudi National Bank (1180.SE) gained 1.4%.

Most major stock markets in the Gulf rebounded on Thursday, as oil prices touched seven-year highs on fears of disruption to energy supplies due to escalating tensions between Russia and Ukraine.

Brent crude furtures were up 89 cents, or 1%, at $90.85 a barrel by 1217 GMT, while U.S. West Texas Intermediate (WTI) crude futures were up 87 cents, or 1%, at $88.22.

Crude prices are a key catalyst for the Gulf's financial markets.

Dubai's main share index (.DFMGI) gained 0.5%, helped by a 1.5% jump in Emirates NBD Bank (ENBD.DU), after the top regional lender reported a 34% rise in annual profit on Wednesday. read more

Shares in Dubai, however, might experience more corrections like they did earlier this month in the absence of a clear catalyst and global risk appetite souring on a hawkish U.S. Federal Reserve, said Farah Mourad, a senior market analyst at XTB MENA.

Abu Dhabi's index (.FTFADGI) edged up 0.2%, after falling as much as 1.6% during the session. Heavyweight First Abu Dhabi Bank (FAB.AD) pulled back from a 4% fall to close flat.

The bank proposed a lower dividend this year, but its full-year net profit rose about 19% to 12.53 billion dirhams ($3.41 billion).

"Its proposed dividend of 0.70 dirhams per share was lower than the 0.74 dirhams paid out in 2020," an analyst said.

The Qatar index (.QSI) ended 0.2% higher. Qatar Islamic Bank (QISB.QA) added 1%, while Industries Qatar (IQCD.QA) rose 0.7%.

Saudi Arabia's benchmark index (.TASI) ended flat in a volatile session. Al Rajhi Bank (1120.SE) fell 0.7%, while Saudi National Bank (1180.SE) gained 1.4%.

Analysis: Oil market faces rocky road as shock absorbers wear thin | Reuters

Analysis: Oil market faces rocky road as shock absorbers wear thin | Reuters

An increase in oil output by producer nations cashing in on expensive crude has depleted the cushion of spare capacity that protects the market from sudden shocks and raised the risk of price spikes or even fuel shortages.

Some analysts have said that by the middle of the year unused capacity could be as depleted as in 2008 when international oil futures hit their all-time record above $147 a barrel.

Typically, the biggest producers, including Saudi Arabia and the United Arab Emirates, have capacity that they can draw on relatively quickly to add extra oil and calm price volatility should war or a natural disaster cause a sudden drop in supply.

Without that flexibility, consumers could be exposed to price shocks and fuel shortages.

Some analysts have said that by the middle of the year unused capacity could be as depleted as in 2008 when international oil futures hit their all-time record above $147 a barrel.

Typically, the biggest producers, including Saudi Arabia and the United Arab Emirates, have capacity that they can draw on relatively quickly to add extra oil and calm price volatility should war or a natural disaster cause a sudden drop in supply.

Without that flexibility, consumers could be exposed to price shocks and fuel shortages.

#Kuwait Rating Cut at Fitch on Continuing Political Constraints - Bloomberg @ShajiShaji1

Kuwait Rating Cut at Fitch on Continuing Political Constraints - Bloomberg

Kuwait was downgraded by Fitch Ratings, which cited ongoing political constraints on decision-making in the oil-rich nation.

The credit rating was cut one level to AA-, the fourth-highest investment-grade level at Fitch, according to a statement on Thursday. Constraints on decision-making has hindered “addressing structural challenges related to heavy oil dependence, a generous welfare state and a large public sector,” Fitch said.

Years of political tensions have stymied efforts to diversify the economy of Kuwait, home to about 8.5% of the world’s oil reserves, and promote foreign investment. The government has been unable to borrow since its debut Eurobond in 2017, forcing it to rely on its General Reserve Fund instead.